Key Insights

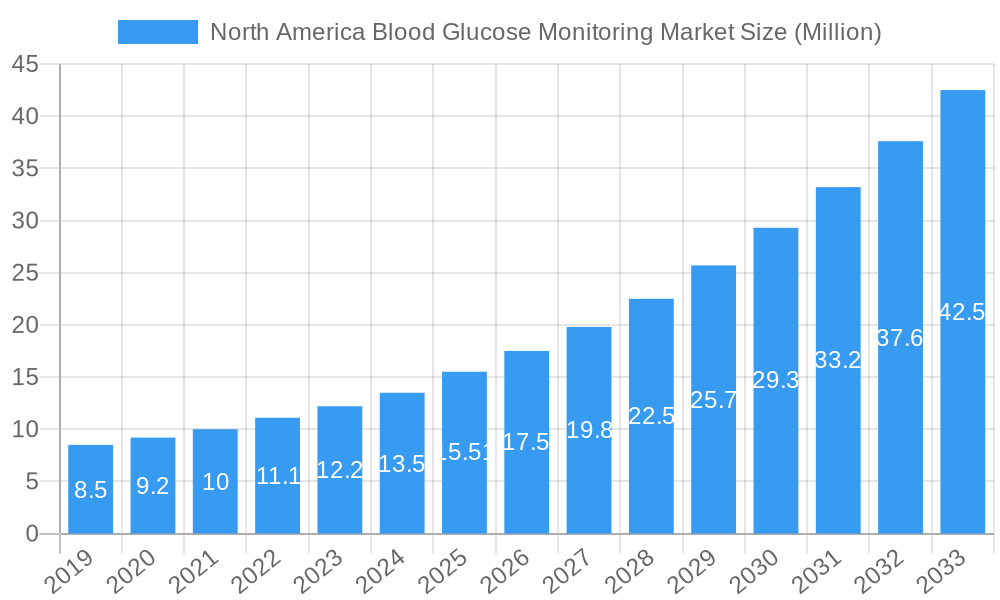

The North America Blood Glucose Monitoring Market is poised for robust expansion, projected to reach $15.51 million by 2025 and grow at a significant Compound Annual Growth Rate (CAGR) of 13.13% throughout the forecast period of 2025-2033. This substantial growth is primarily fueled by the increasing prevalence of diabetes across the region, coupled with a growing awareness among individuals regarding proactive health management. The rising adoption of advanced blood glucose monitoring devices, including continuous glucose monitoring (CGM) systems, is a key driver. These technologies offer greater convenience, improved accuracy, and real-time data, empowering patients and healthcare providers to make more informed treatment decisions. Furthermore, supportive government initiatives aimed at diabetes prevention and management, alongside an aging population susceptible to chronic diseases, are contributing to the market's upward trajectory. The shift towards home-based self-monitoring further amplifies this trend, driven by a desire for personalized healthcare and reduced hospital visits.

North America Blood Glucose Monitoring Market Market Size (In Million)

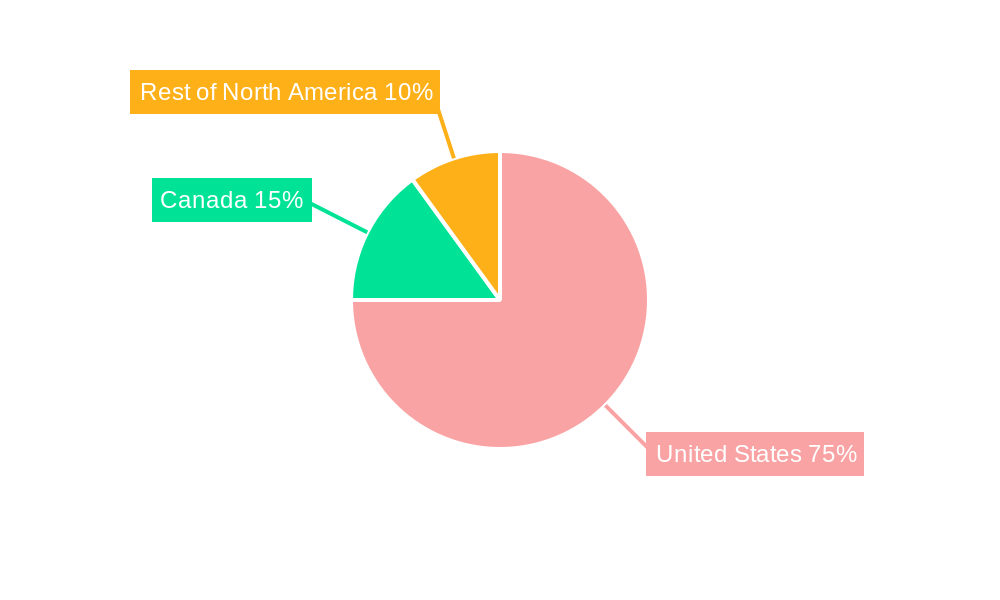

The market landscape is characterized by a dynamic segmentation across device types and end-users. Within devices, the demand for both self-monitoring blood glucose (SMBG) devices, encompassing glucometers, test strips, and lancets, and continuous glucose monitoring (CGM) systems, including sensors and durables, is expected to witness considerable growth. While SMBG devices remain a foundational segment due to their affordability and widespread use, CGM systems are rapidly gaining traction owing to their advanced features and the increasing preference for integrated diabetes management solutions. End-users are predominantly categorized into hospitals/clinics and home/personal settings. The home/personal segment is experiencing accelerated growth, reflecting the increasing independence of patients in managing their diabetes. Geographically, the United States currently dominates the North American market, with Canada and the Rest of North America also demonstrating significant potential. Key companies operating in this space are actively investing in research and development to innovate and expand their product portfolios, further stimulating market competition and consumer choice.

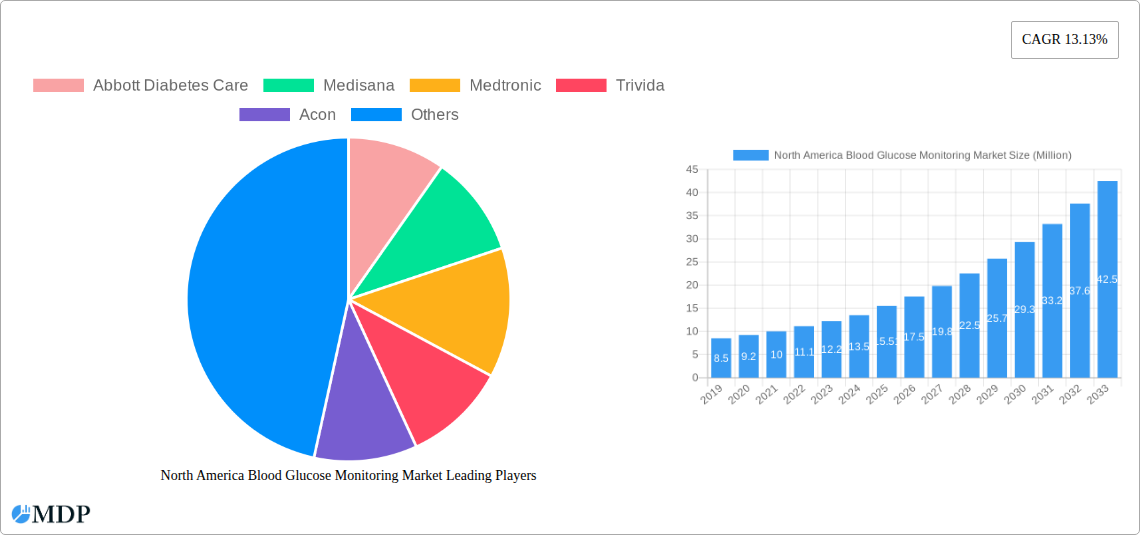

North America Blood Glucose Monitoring Market Company Market Share

North America Blood Glucose Monitoring Market: Dominance, Innovation, and Future Growth (2019-2033)

This comprehensive report delves deep into the North America blood glucose monitoring market, a vital sector driven by an increasing prevalence of diabetes and advancements in healthcare technology. We analyze market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, and emerging opportunities from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033. Discover actionable insights into the strategies of key players like Abbott Diabetes Care, Medisana, Medtronic, Trivida, Acon, Rossmax, Agamatrix Inc, F Hoffmann-La Roche AG, Bionime Corporation, Johnson & Johnson, Arkray, Dexcom, and Ascensia Diabetes Care. This report is your definitive guide to navigating the evolving landscape of blood glucose meters, test strips, lancets, continuous glucose monitors (CGMs), sensors, and durables, catering to end-users in hospitals/clinics and home/personal settings across the United States, Canada, and the Rest of North America.

North America Blood Glucose Monitoring Market Market Dynamics & Concentration

The North America blood glucose monitoring market is characterized by a dynamic interplay of innovation, regulatory oversight, and evolving end-user preferences. Market concentration is moderately high, with a few dominant players holding significant market share, particularly in the continuous glucose monitoring (CGM) segment. Abbott Diabetes Care and Dexcom are at the forefront of innovation, consistently launching advanced CGM systems that are reshaping patient care. The regulatory framework, primarily driven by the U.S. Food and Drug Administration (FDA) and Health Canada, plays a crucial role in approving new devices and ensuring their safety and efficacy. This often leads to longer product development cycles but also ensures higher quality standards.

Product substitutes, while present in the form of traditional blood glucose meters and test strips, are increasingly being complemented and in some cases supplanted by CGM technologies due to their superior data insights and reduced invasiveness. End-user trends are shifting towards greater adoption of CGMs driven by a desire for more comprehensive diabetes management, improved quality of life, and integration with automated insulin delivery systems. Merger and acquisition (M&A) activities, though not extensively documented in public records for this specific market, are anticipated to play a role as larger companies seek to acquire innovative technologies and expand their market reach. The market witnessed approximately 2-3 significant M&A deals in the historical period (2019-2024) as companies strategically consolidated their portfolios.

North America Blood Glucose Monitoring Market Industry Trends & Analysis

The North America blood glucose monitoring market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period of 2025–2033. This significant growth is underpinned by several key trends and drivers. The escalating global and regional prevalence of diabetes, particularly type 2 diabetes, continues to be the primary demand generator. As of our base year, 2025, an estimated 37.3 million people in the United States are living with diabetes, and this number is projected to increase substantially, creating a perpetual demand for effective glucose monitoring solutions.

Technological disruptions are revolutionizing the market. The transition from traditional self-monitoring blood glucose (SMBG) devices to continuous glucose monitoring (CGM) systems is a defining trend. CGMs offer real-time glucose readings, trend arrows, and alerts, empowering individuals with diabetes to make more informed treatment decisions and proactively manage their glycemic control. This shift is further accelerated by the integration of CGMs with smart insulin pens and automated insulin delivery (AID) systems, creating a closed-loop ecosystem that significantly improves glycemic outcomes. Market penetration of CGM devices, which stood at around 20% in 2024, is expected to surge to over 40% by 2033, especially in the United States and Canada.

Consumer preferences are increasingly aligning with user-friendly, less invasive, and data-rich monitoring solutions. Patients are seeking devices that offer convenience, accuracy, and the ability to share data seamlessly with their healthcare providers. The growing awareness of the long-term complications associated with poorly controlled diabetes, such as cardiovascular disease, nephropathy, and retinopathy, is also driving demand for proactive and efficient monitoring tools. The competitive landscape is characterized by intense innovation, with companies investing heavily in research and development to enhance sensor accuracy, improve device longevity, and develop more intuitive software platforms. This competition fosters a dynamic environment where product launches and feature upgrades are frequent, pushing the boundaries of what is possible in diabetes management.

Leading Markets & Segments in North America Blood Glucose Monitoring Market

The United States stands as the dominant market within North America for blood glucose monitoring, driven by its large population, high diabetes prevalence, advanced healthcare infrastructure, and significant per capita healthcare spending. The country's robust reimbursement policies for diabetes management devices further bolster market growth. Economic policies in the US, such as Medicare and Medicaid coverage for essential diabetes supplies and devices, have a direct and substantial impact on market accessibility and adoption rates.

Within the device segment, Continuous Glucose Monitoring (CGM) systems are exhibiting the most rapid growth and are rapidly becoming the preferred choice for many individuals with diabetes. This dominance is fueled by several factors:

- Sensors: The demand for disposable CGM sensors is soaring due to their convenience and the continuous stream of data they provide. Innovations in sensor technology, such as improved accuracy, longer wear times, and enhanced biocompatibility, are key drivers. For instance, the recent FDA approval of modified Abbott CGM sensors for use in automated insulin delivery systems highlights the growing integration and reliance on advanced sensor technology.

- Durables: The reusable transmitter components of CGM systems also contribute to market value, though the recurring purchase of sensors represents the primary revenue stream for CGM manufacturers.

The Home/Personal end-user segment is the largest and fastest-growing segment. This is attributed to:

- Patient Empowerment: Individuals with diabetes are increasingly taking an active role in managing their condition from the comfort of their homes.

- Convenience and Accessibility: Home-based monitoring eliminates the need for frequent clinic visits solely for glucose checks, offering significant convenience.

- Technological Advancements: The development of user-friendly, connected devices facilitates self-management and remote monitoring by healthcare providers.

While Self-monitoring Blood Glucose Devices (Glucometer Devices, Test Strips, Lancets) still represent a substantial portion of the market, their growth rate is slower compared to CGMs. However, they remain crucial for certain patient populations and as backup monitoring tools. The market for test strips, in particular, continues to be driven by the sheer volume of daily tests required by individuals with diabetes.

Canada represents another significant market, characterized by a universal healthcare system that provides coverage for essential diabetes monitoring supplies, albeit with variations in reimbursement policies across provinces. The market benefits from a growing awareness of diabetes management and increasing adoption of advanced technologies. The Rest of North America, encompassing smaller markets, contributes to the overall regional demand, with trends largely mirroring those in the US and Canada, influenced by local healthcare policies and patient demographics.

North America Blood Glucose Monitoring Market Product Developments

Product development in the North America blood glucose monitoring market is intensely focused on enhancing accuracy, user experience, and connectivity. The recent FDA approval for modified Abbott CGM sensors for use in automated insulin delivery systems exemplifies the trend towards integrating CGMs into comprehensive diabetes management ecosystems. Similarly, Dexcom's G7 CGM, approved for individuals with all types of diabetes aged two and older, signifies a push towards more accessible and advanced CGM technology suitable for a broader patient demographic. These developments highlight a move towards smaller, more discreet, and intelligent devices that provide actionable insights and facilitate proactive diabetes management, improving patient outcomes and quality of life.

Key Drivers of North America Blood Glucose Monitoring Market Growth

The North America blood glucose monitoring market is propelled by a confluence of powerful drivers. The escalating global and regional prevalence of diabetes, particularly type 2 diabetes, due to sedentary lifestyles and poor dietary habits, creates a sustained and growing demand for effective monitoring solutions. Technological advancements, especially the rapid evolution of Continuous Glucose Monitoring (CGM) systems, are revolutionizing diabetes care, offering real-time data and trend analysis that empowers patients and clinicians. The increasing awareness among patients and healthcare providers about the benefits of proactive glucose management and the prevention of long-term complications is a significant driver. Furthermore, favorable reimbursement policies in countries like the United States and Canada for diabetes monitoring devices and supplies are crucial in driving adoption rates and improving market accessibility.

Challenges in the North America Blood Glucose Monitoring Market Market

Despite its strong growth trajectory, the North America blood glucose monitoring market faces several challenges. High cost of advanced technologies, particularly CGM systems, can be a barrier to access for a segment of the population, despite reimbursement efforts. Regulatory hurdles and lengthy approval processes for new devices, while ensuring safety, can slow down the introduction of innovative products. Interoperability issues between different devices and software platforms can create fragmentation in data management. Competition from established players and emerging startups necessitates continuous innovation and competitive pricing strategies. Moreover, data security and privacy concerns associated with connected health devices need to be meticulously addressed to maintain user trust.

Emerging Opportunities in North America Blood Glucose Monitoring Market

The North America blood glucose monitoring market is ripe with emerging opportunities. The increasing integration of Artificial Intelligence (AI) and machine learning into glucose monitoring platforms promises personalized insights and predictive analytics for better diabetes management. The expansion of connected health ecosystems, including integration with wearable devices, smartphones, and electronic health records (EHRs), offers enhanced convenience and comprehensive health tracking. The development of non-invasive or minimally invasive glucose monitoring technologies remains a highly sought-after advancement that could revolutionize the market. Furthermore, strategic partnerships between device manufacturers, pharmaceutical companies, and healthcare providers can unlock new avenues for market expansion and improved patient care models.

Leading Players in the North America Blood Glucose Monitoring Market Sector

- Abbott Diabetes Care

- Medisana

- Medtronic

- Trivida

- Acon

- Rossmax

- Agamatrix Inc

- F Hoffmann-La Roche AG

- Bionime Corporation

- Johnson & Johnson

- Arkray

- Dexcom

- Ascensia Diabetes Care

Key Milestones in North America Blood Glucose Monitoring Market Industry

- March 2023: Modified Abbott CGM sensors scored FDA nod for use in automated insulin delivery systems, enhancing the integration of CGMs into closed-loop diabetes management solutions.

- December 2022: Dexcom announced FDA approval for their next-generation product, the Dexcom G7 CGM, which is approved for people with all types of diabetes from ages two years and older, broadening access to advanced CGM technology.

Strategic Outlook for North America Blood Glucose Monitoring Market Market

The strategic outlook for the North America blood glucose monitoring market is exceptionally promising, driven by ongoing technological innovation and a growing global emphasis on proactive diabetes management. Key growth accelerators include the continued development and adoption of continuous glucose monitoring (CGM) systems, enhanced integration with automated insulin delivery (AID) systems, and the increasing use of data analytics and AI to provide personalized insights. Market players are expected to focus on enhancing user experience, improving device accuracy and longevity, and ensuring seamless connectivity with other digital health platforms. Strategic collaborations and potential acquisitions will continue to shape the competitive landscape as companies strive to offer comprehensive and integrated diabetes care solutions. The persistent rise in diabetes prevalence, coupled with advancements in digital health, ensures a robust and expanding market for the foreseeable future.

North America Blood Glucose Monitoring Market Segmentation

-

1. Device

-

1.1. Self-monitoring Blood Glucose Devices

- 1.1.1. Glucometer Devices

- 1.1.2. Test Strips

- 1.1.3. Lancets

-

1.2. Continuous Glucose Monitoring

- 1.2.1. Sensors

- 1.2.2. Durables

-

1.1. Self-monitoring Blood Glucose Devices

-

2. End User

- 2.1. Hospital/Clinics

- 2.2. Home/Personal

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Blood Glucose Monitoring Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Blood Glucose Monitoring Market Regional Market Share

Geographic Coverage of North America Blood Glucose Monitoring Market

North America Blood Glucose Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Continuous Glucose Monitoring Holds Highest Market Share in the North American Blood Glucose Monitoring Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Self-monitoring Blood Glucose Devices

- 5.1.1.1. Glucometer Devices

- 5.1.1.2. Test Strips

- 5.1.1.3. Lancets

- 5.1.2. Continuous Glucose Monitoring

- 5.1.2.1. Sensors

- 5.1.2.2. Durables

- 5.1.1. Self-monitoring Blood Glucose Devices

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospital/Clinics

- 5.2.2. Home/Personal

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. United States North America Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Self-monitoring Blood Glucose Devices

- 6.1.1.1. Glucometer Devices

- 6.1.1.2. Test Strips

- 6.1.1.3. Lancets

- 6.1.2. Continuous Glucose Monitoring

- 6.1.2.1. Sensors

- 6.1.2.2. Durables

- 6.1.1. Self-monitoring Blood Glucose Devices

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospital/Clinics

- 6.2.2. Home/Personal

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. Canada North America Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Self-monitoring Blood Glucose Devices

- 7.1.1.1. Glucometer Devices

- 7.1.1.2. Test Strips

- 7.1.1.3. Lancets

- 7.1.2. Continuous Glucose Monitoring

- 7.1.2.1. Sensors

- 7.1.2.2. Durables

- 7.1.1. Self-monitoring Blood Glucose Devices

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospital/Clinics

- 7.2.2. Home/Personal

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Rest of North America North America Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Self-monitoring Blood Glucose Devices

- 8.1.1.1. Glucometer Devices

- 8.1.1.2. Test Strips

- 8.1.1.3. Lancets

- 8.1.2. Continuous Glucose Monitoring

- 8.1.2.1. Sensors

- 8.1.2.2. Durables

- 8.1.1. Self-monitoring Blood Glucose Devices

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospital/Clinics

- 8.2.2. Home/Personal

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Abbott Diabetes Care

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Medisana

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Medtronic

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Trivida

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Acon

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Rossmax*List Not Exhaustive 7 2 Company Share Analysi

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Agamatrix Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 F Hoffmann-La Roche AG

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Bionime Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Johnson & Johnson

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Arkray

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Dexcom

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Ascensia Diabetes Care

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.1 Abbott Diabetes Care

List of Figures

- Figure 1: North America Blood Glucose Monitoring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Blood Glucose Monitoring Market Share (%) by Company 2025

List of Tables

- Table 1: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Device 2020 & 2033

- Table 2: North America Blood Glucose Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Device 2020 & 2033

- Table 6: North America Blood Glucose Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 7: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Device 2020 & 2033

- Table 10: North America Blood Glucose Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 11: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Device 2020 & 2033

- Table 14: North America Blood Glucose Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Blood Glucose Monitoring Market?

The projected CAGR is approximately 13.13%.

2. Which companies are prominent players in the North America Blood Glucose Monitoring Market?

Key companies in the market include Abbott Diabetes Care, Medisana, Medtronic, Trivida, Acon, Rossmax*List Not Exhaustive 7 2 Company Share Analysi, Agamatrix Inc, F Hoffmann-La Roche AG, Bionime Corporation, Johnson & Johnson, Arkray, Dexcom, Ascensia Diabetes Care.

3. What are the main segments of the North America Blood Glucose Monitoring Market?

The market segments include Device, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Continuous Glucose Monitoring Holds Highest Market Share in the North American Blood Glucose Monitoring Market..

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

March 2023: Modified Abbott CGM sensors scored FDA nod for use in automated insulin delivery systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Blood Glucose Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Blood Glucose Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Blood Glucose Monitoring Market?

To stay informed about further developments, trends, and reports in the North America Blood Glucose Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence