Key Insights

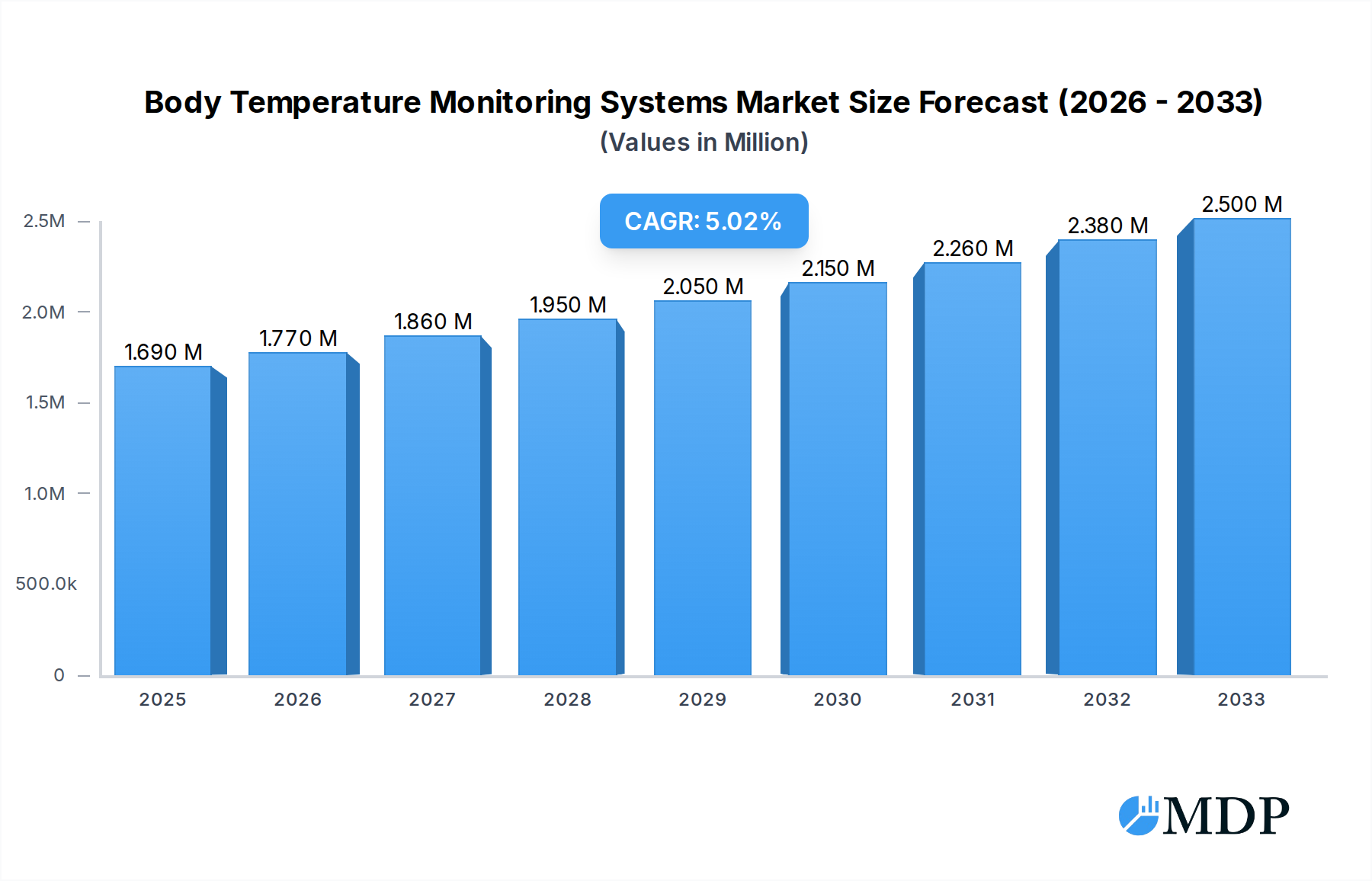

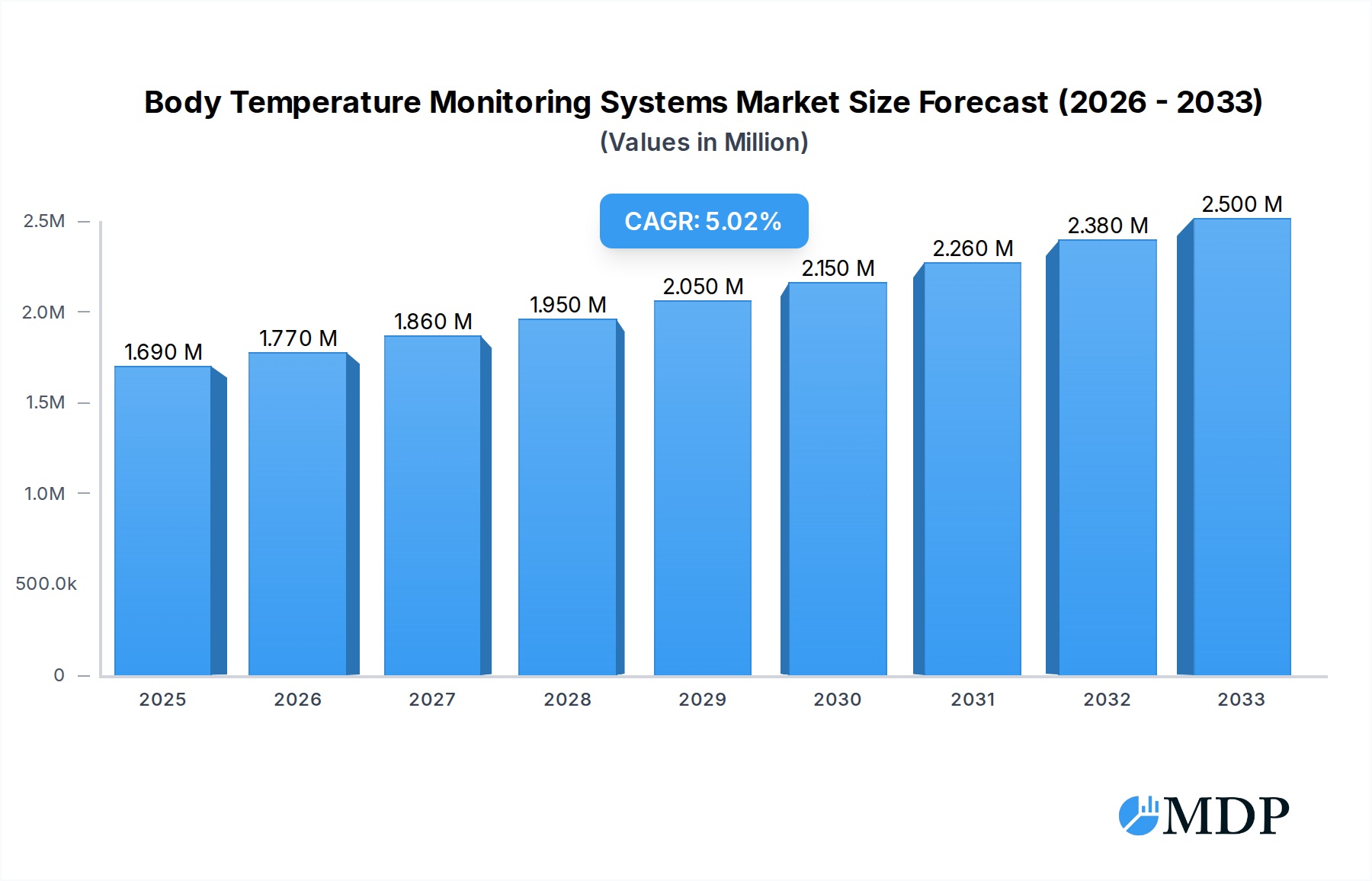

The global Body Temperature Monitoring Systems market is poised for significant expansion, projected to reach $1.69 Million by 2025 with a robust Compound Annual Growth Rate (CAGR) of 5.04% through 2033. This growth is primarily fueled by increasing awareness of fever as a critical health indicator, the rising prevalence of infectious diseases, and a growing demand for accurate and convenient temperature monitoring solutions across healthcare settings and households. Technological advancements are a key driver, leading to the development of more sophisticated and user-friendly devices such as non-contact infrared thermometers and smart wearable sensors. The shift towards preventative healthcare and the growing geriatric population, who are more susceptible to temperature fluctuations, further bolster market prospects. The market is characterized by a diverse range of product segments, including digital thermometers, infrared ear thermometers, and non-contact infrared thermometers, catering to various application needs like oral, rectal, and ear measurements.

Body Temperature Monitoring Systems Market Market Size (In Million)

The market's trajectory is further supported by the expanding reach of healthcare services into remote areas and the increasing adoption of telehealth platforms, which necessitate reliable remote patient monitoring capabilities. Hospitals and clinics represent a substantial end-user segment, driven by the need for efficient patient management and infection control protocols. While the market exhibits strong growth potential, certain factors might present challenges. Stringent regulatory approvals for new medical devices, the initial cost of advanced monitoring systems, and the availability of less expensive traditional thermometers could pose restraints. However, the enduring demand for accurate health diagnostics, coupled with continuous innovation, is expected to outweigh these challenges, ensuring sustained market vitality and a broadening adoption of advanced body temperature monitoring systems worldwide.

Body Temperature Monitoring Systems Market Company Market Share

Body Temperature Monitoring Systems Market: Comprehensive Forecast & Strategic Analysis (2019-2033)

Unlock critical insights into the burgeoning Body Temperature Monitoring Systems market. This in-depth report provides a data-driven analysis of market dynamics, technological advancements, regulatory landscapes, and competitive strategies from 2019 to 2033, with a base year of 2025. Discover key growth drivers, emerging trends, and pivotal opportunities shaping the future of temperature monitoring for healthcare professionals and consumers. Forecasted to reach over $5,000 Million by 2033, with a robust CAGR of 8.5%, this report is essential for understanding the trajectory of digital thermometers, infrared thermometers, and thermal scanners across hospitals, clinics, and home care settings.

Body Temperature Monitoring Systems Market Dynamics & Concentration

The global Body Temperature Monitoring Systems market is characterized by moderate concentration, driven by increasing demand for accurate and accessible temperature measurement solutions. Innovation remains a key driver, with continuous development in non-contact technologies and smart connectivity features. Regulatory frameworks, such as those set by the FDA and CE, play a crucial role in market entry and product approval, ensuring device safety and efficacy. While product substitutes exist, particularly in basic temperature assessment, advanced monitoring systems offer superior accuracy and data integration. End-user trends are shifting towards remote patient monitoring (RPM) and home-based healthcare, bolstering the demand for connected devices. Mergers and acquisitions (M&A) activities, with an estimated 25 deals in the historical period, indicate a consolidation phase where larger players are acquiring innovative startups to expand their portfolios and market reach. The market share of key players is projected to see shifts due to these strategic moves.

Body Temperature Monitoring Systems Market Industry Trends & Analysis

The Body Temperature Monitoring Systems market is experiencing robust growth, fueled by several intertwined industry trends and analytical insights. A primary growth driver is the escalating prevalence of infectious diseases and chronic conditions that necessitate regular temperature monitoring. The COVID-19 pandemic significantly accelerated the adoption of non-contact infrared thermometers for public health screening and at-home use, embedding temperature monitoring as a routine health practice. Technological disruptions are at the forefront, with advancements in sensor technology leading to more accurate, faster, and user-friendly devices. The integration of IoT and AI capabilities is transforming traditional thermometers into smart devices that can wirelessly transmit data, enabling seamless integration with electronic health records (EHRs) and remote patient monitoring platforms. This connectivity is crucial for healthcare providers to track patient vitals effectively, particularly in an era of telemedicine and decentralized healthcare. Consumer preferences are evolving towards convenience, accuracy, and hygiene. Non-contact thermometers, for instance, are favored for their ability to prevent cross-contamination and offer a comfortable user experience. The demand for digital thermometers with fast reading times and clear displays is also high, especially among the elderly and parents of young children. Competitive dynamics within the market are intense, with established players like Omron Corporation and Cardinal Health Inc. investing heavily in R&D to maintain their market position. New entrants, often leveraging innovative technologies, are also challenging the status quo. The market penetration of advanced temperature monitoring devices is expected to increase from approximately 35% in the historical period to an estimated 60% by the end of the forecast period, indicating a significant shift towards sophisticated solutions. The projected Compound Annual Growth Rate (CAGR) for the Body Temperature Monitoring Systems market stands at a healthy 8.5% for the forecast period (2025–2033), underscoring its substantial growth potential. This sustained growth is attributed to the ongoing need for reliable health monitoring, coupled with the increasing affordability and accessibility of advanced technological solutions. The market’s trajectory is further supported by rising healthcare expenditure globally and a growing awareness among the general population about the importance of proactive health management.

Leading Markets & Segments in Body Temperature Monitoring Systems Market

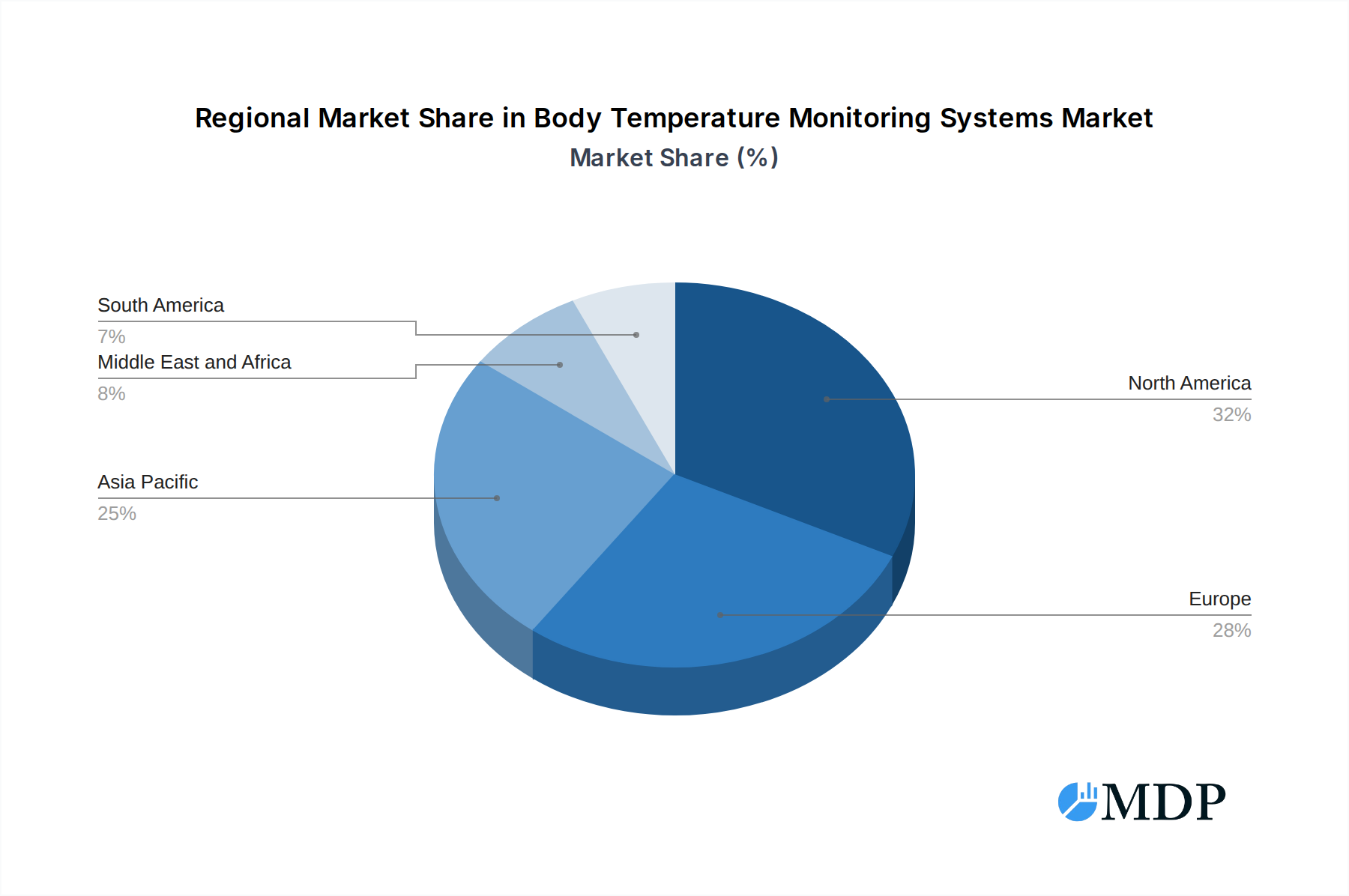

The Body Temperature Monitoring Systems market is dominated by North America, driven by high healthcare expenditure, advanced technological adoption, and a strong emphasis on preventive healthcare. Within North America, the United States represents the largest country-specific market, influenced by its robust healthcare infrastructure, widespread availability of advanced medical devices, and significant investment in R&D.

Product Segment Dominance:

- Non-Contact Infrared Thermometers are experiencing unparalleled growth, accounting for a significant market share.

- Key Drivers:

- Enhanced hygiene and infection control, especially post-pandemic.

- Speed and convenience of readings without physical contact.

- Technological advancements leading to increased accuracy and broader temperature detection ranges.

- Growing use in public spaces, airports, and workplaces for mass screening.

- Key Drivers:

- Contact Products, particularly Digital Thermometers and IR Temporal Artery Thermometers, remain crucial segments.

- Digital Thermometers: High demand in household settings and clinics due to affordability and reliability.

- IR Temporal Artery Thermometers: Valued for their accuracy and ease of use, particularly for infants and children.

Application Segment Dominance:

- Ear (Tympanic) and Temporal Artery applications are leading in terms of market share.

- Key Drivers:

- Non-invasive nature and quick, accurate readings.

- Ease of use for healthcare professionals and parents.

- Preference for measuring core body temperature from these sites.

- Key Drivers:

End User Segment Dominance:

- Hospitals represent the largest end-user segment.

- Key Drivers:

- High volume of patient monitoring requirements.

- Need for reliable and accurate devices for diagnosis and treatment.

- Integration with hospital information systems and remote patient monitoring.

- Key Drivers:

- Clinics follow closely, with increasing adoption of advanced temperature monitoring solutions to enhance patient care and efficiency.

The market's expansion is further propelled by economic policies supporting healthcare innovation and the continuous development of robust healthcare infrastructure in key regions. The increasing acceptance of home-based healthcare solutions is also contributing to the growth of the consumer segment within these leading markets.

Body Temperature Monitoring Systems Market Product Developments

Product development in the Body Temperature Monitoring Systems market is focused on enhancing accuracy, speed, and connectivity. Innovations are leading to more sophisticated non-contact infrared thermometers with wider scanning capabilities and improved environmental temperature compensation. Digital thermometers are incorporating faster reading times and Bluetooth connectivity for seamless data syncing with mobile applications. The integration of AI-powered analytics for trend identification and early disease detection is a significant trend. These advancements provide competitive advantages by offering superior user experience, improved clinical decision-making support, and greater patient engagement. The market fit is being optimized through user-friendly designs and features tailored to specific end-user needs, from pediatric care to industrial screening.

Key Drivers of Body Temperature Monitoring Systems Market Growth

The growth of the Body Temperature Monitoring Systems market is propelled by several key factors. Technologically, the increasing demand for non-contact thermometers, driven by hygiene concerns and convenience, alongside advancements in infrared sensor technology, is a major catalyst. The growing prevalence of chronic diseases and infectious outbreaks, such as the recent pandemic, necessitates continuous and accurate temperature monitoring. Economically, rising healthcare expenditure globally and increasing disposable incomes in emerging economies are expanding market access. Regulatory support for remote patient monitoring and digital health solutions also plays a vital role, encouraging the development and adoption of connected temperature monitoring devices.

Challenges in the Body Temperature Monitoring Systems Market Market

Despite robust growth, the Body Temperature Monitoring Systems market faces several challenges. Stringent regulatory approvals for medical devices can be a significant hurdle, leading to extended development timelines and increased costs, particularly for novel technologies. The market is also susceptible to supply chain disruptions, as witnessed during global health crises, which can impact the availability of raw materials and components. Intense competition from numerous manufacturers, including both established brands and emerging players, can lead to price erosion and pressure on profit margins. Furthermore, educating consumers about the proper use and benefits of advanced temperature monitoring devices, especially in home settings, remains an ongoing challenge for market penetration and widespread adoption.

Emerging Opportunities in Body Temperature Monitoring Systems Market

Emerging opportunities in the Body Temperature Monitoring Systems market are largely driven by technological breakthroughs and strategic market expansion. The continued growth of the remote patient monitoring (RPM) sector presents a significant avenue for smart, connected thermometers that can transmit data wirelessly to healthcare providers, facilitating proactive care and reducing hospital readmissions. Advancements in AI and machine learning offer the potential for predictive diagnostics based on temperature trends, creating value-added services. Strategic partnerships between technology providers and healthcare institutions are expected to accelerate the integration of these systems into broader healthcare ecosystems. Furthermore, the expanding healthcare infrastructure and increasing health awareness in developing economies present substantial untapped market potential for both contact and non-contact temperature monitoring devices.

Leading Players in the Body Temperature Monitoring Systems Market Sector

- American Diagnostic Corporation Limited

- Hartmann AG

- Easywell Biomedicals Inc

- Terumo Corporation

- Cardinal Health Inc

- 3M Company

- Omron Corporation

- Hicks Thermometers India Limited

- Helen of Troy Limited (Kaz USA Inc )

- A&D Medical Technologies Sarl

- Briggs Healthcare

- Baxter International Inc

- Midas Investment Company Limited (Microlife Corporation)

Key Milestones in Body Temperature Monitoring Systems Market Industry

- December 2022: Singapore-based health tech company SmartFuture launched a new software development kit for remote patient monitoring. The software kit can connect with over 400 regulated wireless medical devices from around 40 brands, including Omron, Abbott, Roche, and Viacom. This includes devices that capture temperature thermometers and other devices and send readings via a cloud database. This new offering adds to its portfolio of health technology solutions, including an RPM platform, which consists of a mobile app, web portal, wireless medical devices, and EMR integrations.

- August 2022: Exergen Corporation reported that NIDEK Medical signed an agreement to distribute the temporal artery line consisting of the TAT-5000, TAT-2000, and TAT-2000C Temporal Artery Thermometers and accessories in India.

Strategic Outlook for Body Temperature Monitoring Systems Market Market

The strategic outlook for the Body Temperature Monitoring Systems market is exceptionally positive, driven by sustained demand and ongoing technological innovation. Growth accelerators include the increasing integration of these systems into broader digital health ecosystems, particularly within remote patient monitoring and telehealth platforms. The market will see continued product development focused on enhancing accuracy, speed, and user-friendliness, alongside the integration of advanced features like AI-driven analytics for early disease detection. Strategic opportunities lie in expanding market reach in emerging economies, forging partnerships with healthcare providers to facilitate seamless data integration, and capitalizing on the growing consumer demand for accessible and reliable health monitoring solutions for home use. The focus on preventative healthcare and the ongoing need for efficient infection control will continue to be key strategic imperatives.

Body Temperature Monitoring Systems Market Segmentation

-

1. Product

-

1.1. Contact

- 1.1.1. Digital Thermometers

- 1.1.2. Infrared Ear Thermometers

- 1.1.3. IR Temporal Artery Thermometers

- 1.1.4. Mercury Thermometers

- 1.1.5. Disposable Thermometers

- 1.1.6. Other Contact Products

-

1.2. Non-Contact

- 1.2.1. Non-contact Infrared Thermometers

- 1.2.2. Thermal Scanners

-

1.1. Contact

-

2. Application

- 2.1. Oral Cavity

- 2.2. Rectum

- 2.3. Ear

- 2.4. Other Applications

-

3. End Users

- 3.1. Hospitals

- 3.2. Clinics

Body Temperature Monitoring Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Body Temperature Monitoring Systems Market Regional Market Share

Geographic Coverage of Body Temperature Monitoring Systems Market

Body Temperature Monitoring Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Prevalence of Infectious Diseases Such as Swine Flu

- 3.2.2 Ebola Virus

- 3.2.3 and Others; Increasing Pediatric Population; Increasing Demand for Disposable and Digital Thermometers

- 3.3. Market Restrains

- 3.3.1. Issues Related to Rectal Thermometers; Concerns about the Use of Infrared Thermometers

- 3.4. Market Trends

- 3.4.1. Oral Cavity Segment is Expected to Witness Significant Growth Over the Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Body Temperature Monitoring Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Contact

- 5.1.1.1. Digital Thermometers

- 5.1.1.2. Infrared Ear Thermometers

- 5.1.1.3. IR Temporal Artery Thermometers

- 5.1.1.4. Mercury Thermometers

- 5.1.1.5. Disposable Thermometers

- 5.1.1.6. Other Contact Products

- 5.1.2. Non-Contact

- 5.1.2.1. Non-contact Infrared Thermometers

- 5.1.2.2. Thermal Scanners

- 5.1.1. Contact

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Oral Cavity

- 5.2.2. Rectum

- 5.2.3. Ear

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Body Temperature Monitoring Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Contact

- 6.1.1.1. Digital Thermometers

- 6.1.1.2. Infrared Ear Thermometers

- 6.1.1.3. IR Temporal Artery Thermometers

- 6.1.1.4. Mercury Thermometers

- 6.1.1.5. Disposable Thermometers

- 6.1.1.6. Other Contact Products

- 6.1.2. Non-Contact

- 6.1.2.1. Non-contact Infrared Thermometers

- 6.1.2.2. Thermal Scanners

- 6.1.1. Contact

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Oral Cavity

- 6.2.2. Rectum

- 6.2.3. Ear

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End Users

- 6.3.1. Hospitals

- 6.3.2. Clinics

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Body Temperature Monitoring Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Contact

- 7.1.1.1. Digital Thermometers

- 7.1.1.2. Infrared Ear Thermometers

- 7.1.1.3. IR Temporal Artery Thermometers

- 7.1.1.4. Mercury Thermometers

- 7.1.1.5. Disposable Thermometers

- 7.1.1.6. Other Contact Products

- 7.1.2. Non-Contact

- 7.1.2.1. Non-contact Infrared Thermometers

- 7.1.2.2. Thermal Scanners

- 7.1.1. Contact

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Oral Cavity

- 7.2.2. Rectum

- 7.2.3. Ear

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End Users

- 7.3.1. Hospitals

- 7.3.2. Clinics

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Body Temperature Monitoring Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Contact

- 8.1.1.1. Digital Thermometers

- 8.1.1.2. Infrared Ear Thermometers

- 8.1.1.3. IR Temporal Artery Thermometers

- 8.1.1.4. Mercury Thermometers

- 8.1.1.5. Disposable Thermometers

- 8.1.1.6. Other Contact Products

- 8.1.2. Non-Contact

- 8.1.2.1. Non-contact Infrared Thermometers

- 8.1.2.2. Thermal Scanners

- 8.1.1. Contact

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Oral Cavity

- 8.2.2. Rectum

- 8.2.3. Ear

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End Users

- 8.3.1. Hospitals

- 8.3.2. Clinics

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Body Temperature Monitoring Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Contact

- 9.1.1.1. Digital Thermometers

- 9.1.1.2. Infrared Ear Thermometers

- 9.1.1.3. IR Temporal Artery Thermometers

- 9.1.1.4. Mercury Thermometers

- 9.1.1.5. Disposable Thermometers

- 9.1.1.6. Other Contact Products

- 9.1.2. Non-Contact

- 9.1.2.1. Non-contact Infrared Thermometers

- 9.1.2.2. Thermal Scanners

- 9.1.1. Contact

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Oral Cavity

- 9.2.2. Rectum

- 9.2.3. Ear

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End Users

- 9.3.1. Hospitals

- 9.3.2. Clinics

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Body Temperature Monitoring Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Contact

- 10.1.1.1. Digital Thermometers

- 10.1.1.2. Infrared Ear Thermometers

- 10.1.1.3. IR Temporal Artery Thermometers

- 10.1.1.4. Mercury Thermometers

- 10.1.1.5. Disposable Thermometers

- 10.1.1.6. Other Contact Products

- 10.1.2. Non-Contact

- 10.1.2.1. Non-contact Infrared Thermometers

- 10.1.2.2. Thermal Scanners

- 10.1.1. Contact

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Oral Cavity

- 10.2.2. Rectum

- 10.2.3. Ear

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End Users

- 10.3.1. Hospitals

- 10.3.2. Clinics

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 American Diagnostic Corporation Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hartmann AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Easywell Biomedicals Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Terumo Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cardinal Health Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3M Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Omron Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hicks Thermometers India Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Helen of Troy Limited (Kaz USA Inc )

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 A&D Medical Technologies Sarl

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Briggs Healthcare

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Baxter International Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Midas Investment Company Limited (Microlife Corporation)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 American Diagnostic Corporation Limited

List of Figures

- Figure 1: Global Body Temperature Monitoring Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Body Temperature Monitoring Systems Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Body Temperature Monitoring Systems Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Body Temperature Monitoring Systems Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Body Temperature Monitoring Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Body Temperature Monitoring Systems Market Revenue (Million), by End Users 2025 & 2033

- Figure 7: North America Body Temperature Monitoring Systems Market Revenue Share (%), by End Users 2025 & 2033

- Figure 8: North America Body Temperature Monitoring Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Body Temperature Monitoring Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Body Temperature Monitoring Systems Market Revenue (Million), by Product 2025 & 2033

- Figure 11: Europe Body Temperature Monitoring Systems Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe Body Temperature Monitoring Systems Market Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Body Temperature Monitoring Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Body Temperature Monitoring Systems Market Revenue (Million), by End Users 2025 & 2033

- Figure 15: Europe Body Temperature Monitoring Systems Market Revenue Share (%), by End Users 2025 & 2033

- Figure 16: Europe Body Temperature Monitoring Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Body Temperature Monitoring Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Body Temperature Monitoring Systems Market Revenue (Million), by Product 2025 & 2033

- Figure 19: Asia Pacific Body Temperature Monitoring Systems Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Asia Pacific Body Temperature Monitoring Systems Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Body Temperature Monitoring Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Body Temperature Monitoring Systems Market Revenue (Million), by End Users 2025 & 2033

- Figure 23: Asia Pacific Body Temperature Monitoring Systems Market Revenue Share (%), by End Users 2025 & 2033

- Figure 24: Asia Pacific Body Temperature Monitoring Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Body Temperature Monitoring Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Body Temperature Monitoring Systems Market Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East and Africa Body Temperature Monitoring Systems Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Body Temperature Monitoring Systems Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Body Temperature Monitoring Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Body Temperature Monitoring Systems Market Revenue (Million), by End Users 2025 & 2033

- Figure 31: Middle East and Africa Body Temperature Monitoring Systems Market Revenue Share (%), by End Users 2025 & 2033

- Figure 32: Middle East and Africa Body Temperature Monitoring Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Body Temperature Monitoring Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Body Temperature Monitoring Systems Market Revenue (Million), by Product 2025 & 2033

- Figure 35: South America Body Temperature Monitoring Systems Market Revenue Share (%), by Product 2025 & 2033

- Figure 36: South America Body Temperature Monitoring Systems Market Revenue (Million), by Application 2025 & 2033

- Figure 37: South America Body Temperature Monitoring Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Body Temperature Monitoring Systems Market Revenue (Million), by End Users 2025 & 2033

- Figure 39: South America Body Temperature Monitoring Systems Market Revenue Share (%), by End Users 2025 & 2033

- Figure 40: South America Body Temperature Monitoring Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Body Temperature Monitoring Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 4: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 8: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Product 2020 & 2033

- Table 13: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 15: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Product 2020 & 2033

- Table 23: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 25: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Product 2020 & 2033

- Table 33: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 35: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Product 2020 & 2033

- Table 40: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 42: Global Body Temperature Monitoring Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Body Temperature Monitoring Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Body Temperature Monitoring Systems Market?

The projected CAGR is approximately 5.04%.

2. Which companies are prominent players in the Body Temperature Monitoring Systems Market?

Key companies in the market include American Diagnostic Corporation Limited, Hartmann AG, Easywell Biomedicals Inc, Terumo Corporation, Cardinal Health Inc, 3M Company, Omron Corporation, Hicks Thermometers India Limited, Helen of Troy Limited (Kaz USA Inc ), A&D Medical Technologies Sarl, Briggs Healthcare, Baxter International Inc, Midas Investment Company Limited (Microlife Corporation).

3. What are the main segments of the Body Temperature Monitoring Systems Market?

The market segments include Product, Application, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Infectious Diseases Such as Swine Flu. Ebola Virus. and Others; Increasing Pediatric Population; Increasing Demand for Disposable and Digital Thermometers.

6. What are the notable trends driving market growth?

Oral Cavity Segment is Expected to Witness Significant Growth Over the Forecast Period..

7. Are there any restraints impacting market growth?

Issues Related to Rectal Thermometers; Concerns about the Use of Infrared Thermometers.

8. Can you provide examples of recent developments in the market?

December 2022: Singapore-based health tech company SmartFuture launched a new software development kit for remote patient monitoring. The software kit can connect with over 400 regulated wireless medical devices from around 40 brands, including Omron, Abbott, Roche, and Viacom. This includes devices that capture temperature thermometers and other devices and send readings via a cloud database. This new offering adds to its portfolio of health technology solutions, including an RPM platform, which consists of a mobile app, web portal, wireless medical devices, and EMR integrations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Body Temperature Monitoring Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Body Temperature Monitoring Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Body Temperature Monitoring Systems Market?

To stay informed about further developments, trends, and reports in the Body Temperature Monitoring Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence