Key Insights

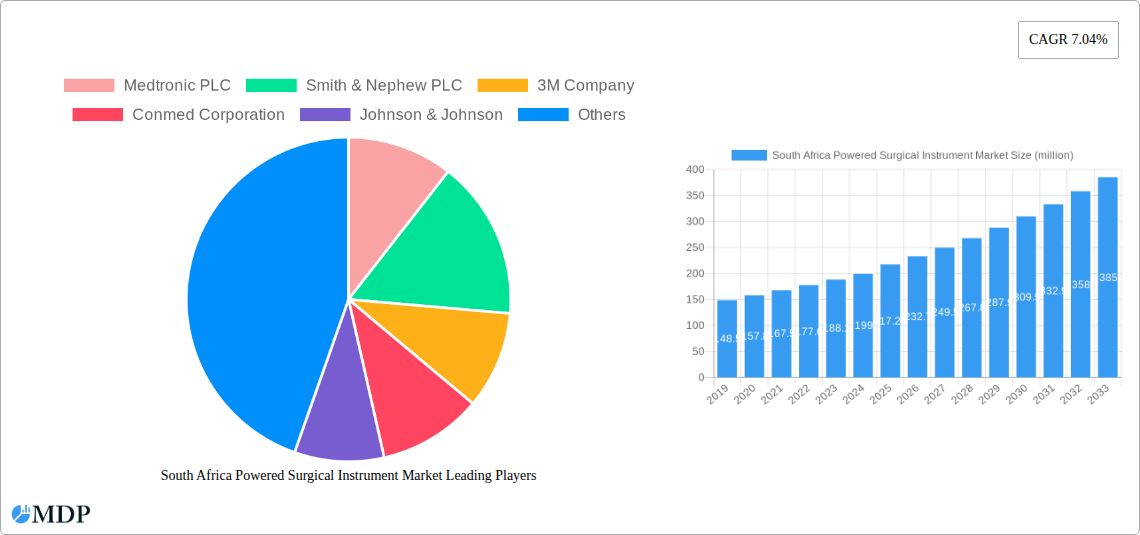

The South African Powered Surgical Instrument Market is poised for robust expansion, projected to reach an estimated $217.21 million in 2025. This growth is driven by several key factors that are reshaping the healthcare landscape across the nation. A significant catalyst is the increasing adoption of minimally invasive surgical techniques, which necessitate the use of advanced powered instruments for greater precision and patient recovery. This trend is further amplified by the rising prevalence of chronic diseases requiring surgical intervention, such as orthopedic conditions, gynecological issues, and cardiological ailments, all of which benefit from the enhanced capabilities offered by powered surgical tools. Additionally, a growing focus on improving healthcare infrastructure and accessibility, particularly in underserved regions, coupled with government initiatives to upgrade medical facilities, is directly contributing to the demand for these sophisticated instruments. The market's overall trajectory is characterized by a healthy compound annual growth rate (CAGR) of 7.04%, indicating sustained investment and innovation within the sector.

South Africa Powered Surgical Instrument Market Market Size (In Million)

Further fueling this growth is the continuous technological evolution in powered surgical instruments, leading to the development of more ergonomic, efficient, and versatile devices. Segments like handheld and laparoscopic devices are expected to witness significant uptake due to their widespread application in various surgical specialties, including gynecology, urology, cardiology, orthopedic, and neurology. While the market benefits from these drivers, it also faces certain restraints, such as the high initial cost of advanced powered surgical systems and the need for specialized training for healthcare professionals to operate them effectively. However, the long-term outlook remains exceptionally positive, with ongoing research and development efforts focused on reducing costs and improving user-friendliness. The expanding healthcare sector in South Africa, coupled with an increasing patient pool seeking advanced surgical solutions, solidifies the strong growth prospects for the powered surgical instrument market over the forecast period.

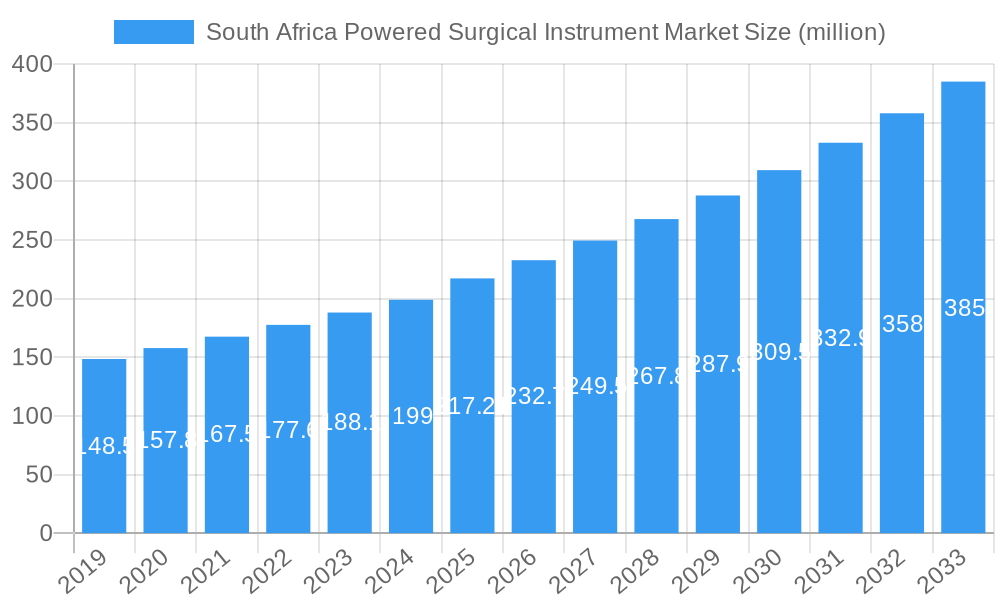

South Africa Powered Surgical Instrument Market Company Market Share

Unveiling the South Africa Powered Surgical Instrument Market: A Comprehensive Analysis (2019-2033)

This in-depth report offers a definitive analysis of the South Africa powered surgical instrument market, projecting its trajectory from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this study provides critical insights for industry stakeholders, including manufacturers, healthcare providers, investors, and policymakers. The market is segmented by product type, including Handheld Devices, Laproscopic Devices, Electrosurgical Devices, Wound-closure Devices, and Other Products, and by application areas such as Gynecology and Urology, Cardiology, Orthopedic, Neurology, and Other Applications. The report delves into the competitive landscape, featuring key players like Medtronic PLC, Smith & Nephew PLC, 3M Company, Conmed Corporation, Johnson & Johnson, Boston Scientific Corporation, B Braun SE, and Olympus Corporation. Discover critical market dynamics, evolving industry trends, leading segments, product innovations, growth drivers, challenges, emerging opportunities, and strategic outlooks within the dynamic South African healthcare sector. This report is designed for immediate use without further modification, offering actionable intelligence and robust market data. The market is estimated to be valued at approximately XX million in 2025.

South Africa Powered Surgical Instrument Market Market Dynamics & Concentration

The South Africa powered surgical instrument market is characterized by a moderate to high concentration, with established global players holding significant market share. Innovation drivers are primarily centered around minimally invasive surgical techniques, advancements in energy-based devices, and the increasing demand for precision and patient safety. Regulatory frameworks, while evolving, aim to ensure the efficacy and safety of these sophisticated medical devices, impacting market entry and product approvals. Product substitutes, though limited in direct replacement for powered instruments, can include traditional surgical tools and evolving non-powered technologies. End-user trends indicate a growing preference for procedures that reduce patient trauma, shorten recovery times, and improve surgical outcomes. Mergers and acquisitions (M&A) activities, though not extensively detailed in terms of volume for this specific market, are crucial for consolidating market presence, expanding product portfolios, and gaining access to new technologies. Key players are actively engaged in R&D to introduce next-generation powered surgical instruments, contributing to market growth. The market's M&A deal count is anticipated to be around X in the forecast period, with an estimated XX million value for significant transactions.

South Africa Powered Surgical Instrument Market Industry Trends & Analysis

The South Africa powered surgical instrument market is poised for substantial growth, driven by a confluence of factors. A significant catalyst is the increasing prevalence of chronic diseases and the rising demand for advanced surgical interventions across various medical specialties. The growing adoption of minimally invasive surgery (MIS) techniques is a primary market driver, as powered surgical instruments are indispensable for such procedures, offering enhanced precision, reduced patient trauma, and faster recovery times. Technological disruptions, including the integration of artificial intelligence (AI) for enhanced instrument control and real-time surgical guidance, are beginning to shape the market. Furthermore, advancements in energy delivery technologies, such as bipolar and ultrasonic energy devices, are offering surgeons greater control and improved hemostasis, leading to better patient outcomes. Consumer preferences are increasingly leaning towards procedures that minimize scarring and hospital stays, directly benefiting the market for sophisticated surgical instruments. The competitive dynamics are intense, with key global players investing heavily in research and development to maintain their market leadership and introduce innovative solutions. The market penetration of powered surgical instruments is steadily increasing as healthcare infrastructure improves and more healthcare facilities adopt advanced medical technologies. The estimated Compound Annual Growth Rate (CAGR) for the South Africa powered surgical instrument market is projected to be XX% during the forecast period of 2025–2033. The market size is expected to reach approximately XX million by 2033, up from an estimated XX million in 2025.

Leading Markets & Segments in South Africa Powered Surgical Instrument Market

Within the South Africa powered surgical instrument market, the Handheld Devices segment is projected to lead due to their widespread application in various surgical procedures and their versatility. This segment's dominance is fueled by its essential role in both open and minimally invasive surgeries, offering surgeons a fundamental tool for tissue manipulation, dissection, and resection. The Orthopedic application segment is also a significant contributor, driven by the increasing incidence of orthopedic conditions such as osteoarthritis and sports-related injuries, necessitating advanced surgical solutions. Economic policies aimed at improving healthcare access and affordability, coupled with ongoing infrastructure development in the healthcare sector, further bolster the growth of these leading segments.

Product Segments:

- Handheld Devices: This segment's dominance is underpinned by its broad utility across multiple surgical disciplines and its continuous innovation in terms of ergonomics, power delivery, and integrated functionalities.

- Laproscopic Devices: Growth is propelled by the expanding adoption of minimally invasive surgery (MIS), leading to reduced patient recovery times and hospital stays.

- Electrosurgical Devices: These are critical for hemostasis and tissue ablation, finding extensive use in various complex surgeries.

- Wound-closure Devices: Advancements in powered suturing and stapling devices contribute to their increasing market share.

- Other Products: This category includes specialized instruments for niche surgical areas, also experiencing growth.

Application Segments:

- Orthopedic: High demand due to the aging population and rising rates of musculoskeletal disorders.

- Gynecology and Urology: Significant utilization in minimally invasive procedures for treating a range of conditions.

- Cardiology: Essential for cardiac surgeries, with ongoing advancements in devices for complex procedures.

- Neurology: Critical for delicate neurosurgical interventions, where precision is paramount.

- Other Applications: Encompasses general surgery, gastroenterology, and ENT, all contributing to market expansion.

The estimated market value for the Handheld Devices segment is XX million in 2025, while the Orthopedic application segment is valued at XX million in the same year.

South Africa Powered Surgical Instrument Market Product Developments

Product developments in the South Africa powered surgical instrument market are increasingly focused on enhancing precision, safety, and user experience. Innovations are geared towards creating devices with advanced energy control, ergonomic designs, and integrated imaging capabilities. For instance, next-generation electrosurgical devices offer improved tissue sealing and reduced thermal spread, minimizing collateral damage. Laparoscopic instruments are becoming more miniaturized and articulated, allowing for greater dexterity in confined spaces. These advancements are crucial for expanding the scope of minimally invasive procedures and improving patient outcomes, thereby providing a significant competitive advantage to manufacturers who invest in cutting-edge technology that aligns with evolving surgical demands. The market is witnessing a growing emphasis on multi-functional devices that can perform a variety of tasks, streamlining surgical workflows.

Key Drivers of South Africa Powered Surgical Instrument Market Growth

The growth of the South Africa powered surgical instrument market is propelled by several key factors. The rising prevalence of chronic diseases and an aging population are increasing the demand for surgical interventions. Advancements in surgical techniques, particularly the widespread adoption of minimally invasive surgery (MIS), necessitate the use of sophisticated powered instruments for enhanced precision and patient safety. Technological innovations, such as improved energy delivery systems and intelligent instrument design, are expanding the application spectrum of these devices. Furthermore, government initiatives aimed at modernizing healthcare infrastructure and improving access to quality medical care play a crucial role. Economic growth and increased healthcare expenditure also contribute to greater adoption of advanced medical technologies.

Challenges in the South Africa Powered Surgical Instrument Market Market

Despite robust growth prospects, the South Africa powered surgical instrument market faces several challenges. High procurement costs of advanced powered surgical instruments can be a significant barrier for smaller healthcare facilities and public hospitals with limited budgets. Stringent regulatory approval processes for new medical devices can lead to extended market entry timelines. Ensuring consistent product availability and efficient supply chain management across the country, particularly in remote areas, can be complex. Moreover, the need for specialized training for surgeons and support staff to effectively utilize these sophisticated instruments presents an ongoing challenge. Competitive pressures from established global players and the emergence of newer technologies also require constant innovation and adaptation. The estimated impact of these challenges on market growth is approximately X% annually.

Emerging Opportunities in South Africa Powered Surgical Instrument Market

Emerging opportunities in the South Africa powered surgical instrument market lie in the increasing demand for specialized surgical procedures and the expansion of healthcare infrastructure. The growing focus on telehealth and remote surgical assistance presents opportunities for the development of connected and intelligent powered instruments. Strategic partnerships between local healthcare providers and global manufacturers can facilitate technology transfer and market penetration. Furthermore, the increasing investment in medical research and development within South Africa offers potential for localized innovation and tailored product development. The burgeoning private healthcare sector also represents a significant avenue for growth, as these facilities are often early adopters of advanced medical technologies, driving market expansion and the introduction of next-generation powered surgical instruments.

Leading Players in the South Africa Powered Surgical Instrument Market Sector

The South Africa powered surgical instrument market is characterized by the presence of several leading global players who are instrumental in driving innovation and market growth. These companies bring a wealth of expertise, advanced technologies, and extensive product portfolios to the South African healthcare landscape. Their continuous investment in research and development ensures the availability of cutting-edge surgical solutions.

- Medtronic PLC

- Smith & Nephew PLC

- 3M Company

- Conmed Corporation

- Johnson & Johnson

- Boston Scientific Corporation

- B Braun SE

- Olympus Corporation

Key Milestones in South Africa Powered Surgical Instrument Market Industry

- September 2022: Olympus Corporation launched THUNDERBEAT Open Fine Jaw Type X surgical energy devices for open surgery. With a new thermal shield, the THUNDERBEAT Open Fine Jaw Type X surgical energy device is designed to support safer procedures, enhancing patient safety and surgical outcomes in open procedures.

- April 2022: The Netcare Property Holdings Joint Venture opened a 400-bed multi-specialty hospital. The new Netcare Alberton Hospital is a purpose-built facility to provide better care to patients, signifying increased investment in advanced healthcare infrastructure and services, which will likely drive demand for sophisticated surgical instruments.

Strategic Outlook for South Africa Powered Surgical Instrument Market Market

The strategic outlook for the South Africa powered surgical instrument market is highly optimistic, driven by a sustained demand for advanced surgical solutions and a commitment to improving healthcare outcomes. Key growth accelerators include the continued embrace of minimally invasive surgical techniques, the development of smarter and more intuitive powered instruments, and the expansion of healthcare access in underserved regions. Manufacturers are likely to focus on product differentiation through technological innovation, particularly in areas like AI integration for surgical guidance and robotics. Strategic collaborations with local healthcare institutions and distributors will be crucial for market penetration and localized support. Furthermore, government policies that encourage investment in healthcare technology and training will undoubtedly foster a more dynamic and growth-oriented market environment, ensuring continued expansion and the widespread adoption of these critical surgical tools. The market is projected to reach an estimated value of XX million by 2033.

South Africa Powered Surgical Instrument Market Segmentation

-

1. Product

- 1.1. Handheld Devices

- 1.2. Laproscopic Devices

- 1.3. Electrosurgical Devices

- 1.4. Wound-closure Devices

- 1.5. Other Products

-

2. Application

- 2.1. Gynecology and Urology

- 2.2. Cardiology

- 2.3. Orthopedic

- 2.4. Neurology

- 2.5. Other Applications

South Africa Powered Surgical Instrument Market Segmentation By Geography

- 1. South Africa

South Africa Powered Surgical Instrument Market Regional Market Share

Geographic Coverage of South Africa Powered Surgical Instrument Market

South Africa Powered Surgical Instrument Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Minimally Invasive Surgeries (MIS) is gaining momentum in South Africa

- 3.2.2 as these procedures offer benefits such as shorter recovery times

- 3.2.3 less postoperative pain

- 3.2.4 and reduced hospital stays. Powered surgical instruments play a crucial role in enabling these precise

- 3.2.5 minimally invasive procedures.

- 3.3. Market Restrains

- 3.3.1 The high cost of advanced powered surgical instruments is a significant challenge

- 3.3.2 particularly in the public healthcare sector in South Africa. While private hospitals may be able to afford the latest surgical technologies

- 3.3.3 public hospitals with limited budgets may face difficulties in adopting these high-cost devices.

- 3.4. Market Trends

- 3.4.1 There is a growing trend toward battery-powered and cordless surgical instruments

- 3.4.2 which offer greater mobility

- 3.4.3 ease of use

- 3.4.4 and improved surgical precision. These instruments eliminate the need for cumbersome cords

- 3.4.5 providing surgeons with more flexibility during operations.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Powered Surgical Instrument Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Handheld Devices

- 5.1.2. Laproscopic Devices

- 5.1.3. Electrosurgical Devices

- 5.1.4. Wound-closure Devices

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gynecology and Urology

- 5.2.2. Cardiology

- 5.2.3. Orthopedic

- 5.2.4. Neurology

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Medtronic PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Smith & Nephew PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 3M Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Conmed Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson & Johnson

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Boston Scientific Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 B Braun SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Olympus Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Medtronic PLC

List of Figures

- Figure 1: South Africa Powered Surgical Instrument Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South Africa Powered Surgical Instrument Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Powered Surgical Instrument Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: South Africa Powered Surgical Instrument Market Volume K Units Forecast, by Product 2020 & 2033

- Table 3: South Africa Powered Surgical Instrument Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: South Africa Powered Surgical Instrument Market Volume K Units Forecast, by Application 2020 & 2033

- Table 5: South Africa Powered Surgical Instrument Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: South Africa Powered Surgical Instrument Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: South Africa Powered Surgical Instrument Market Revenue million Forecast, by Product 2020 & 2033

- Table 8: South Africa Powered Surgical Instrument Market Volume K Units Forecast, by Product 2020 & 2033

- Table 9: South Africa Powered Surgical Instrument Market Revenue million Forecast, by Application 2020 & 2033

- Table 10: South Africa Powered Surgical Instrument Market Volume K Units Forecast, by Application 2020 & 2033

- Table 11: South Africa Powered Surgical Instrument Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: South Africa Powered Surgical Instrument Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Powered Surgical Instrument Market?

The projected CAGR is approximately 7.04%.

2. Which companies are prominent players in the South Africa Powered Surgical Instrument Market?

Key companies in the market include Medtronic PLC, Smith & Nephew PLC, 3M Company, Conmed Corporation, Johnson & Johnson, Boston Scientific Corporation, B Braun SE, Olympus Corporation.

3. What are the main segments of the South Africa Powered Surgical Instrument Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 217.21 million as of 2022.

5. What are some drivers contributing to market growth?

Minimally Invasive Surgeries (MIS) is gaining momentum in South Africa. as these procedures offer benefits such as shorter recovery times. less postoperative pain. and reduced hospital stays. Powered surgical instruments play a crucial role in enabling these precise. minimally invasive procedures..

6. What are the notable trends driving market growth?

There is a growing trend toward battery-powered and cordless surgical instruments. which offer greater mobility. ease of use. and improved surgical precision. These instruments eliminate the need for cumbersome cords. providing surgeons with more flexibility during operations..

7. Are there any restraints impacting market growth?

The high cost of advanced powered surgical instruments is a significant challenge. particularly in the public healthcare sector in South Africa. While private hospitals may be able to afford the latest surgical technologies. public hospitals with limited budgets may face difficulties in adopting these high-cost devices..

8. Can you provide examples of recent developments in the market?

In September 2022, Olympus Corporation launched THUNDERBEAT Open Fine Jaw Type X surgical energy devices for open surgery. With a new thermal shield, the THUNDERBEAT Open Fine Jaw Type X surgical energy device is designed to support safer procedures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Powered Surgical Instrument Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Powered Surgical Instrument Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Powered Surgical Instrument Market?

To stay informed about further developments, trends, and reports in the South Africa Powered Surgical Instrument Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence