Key Insights

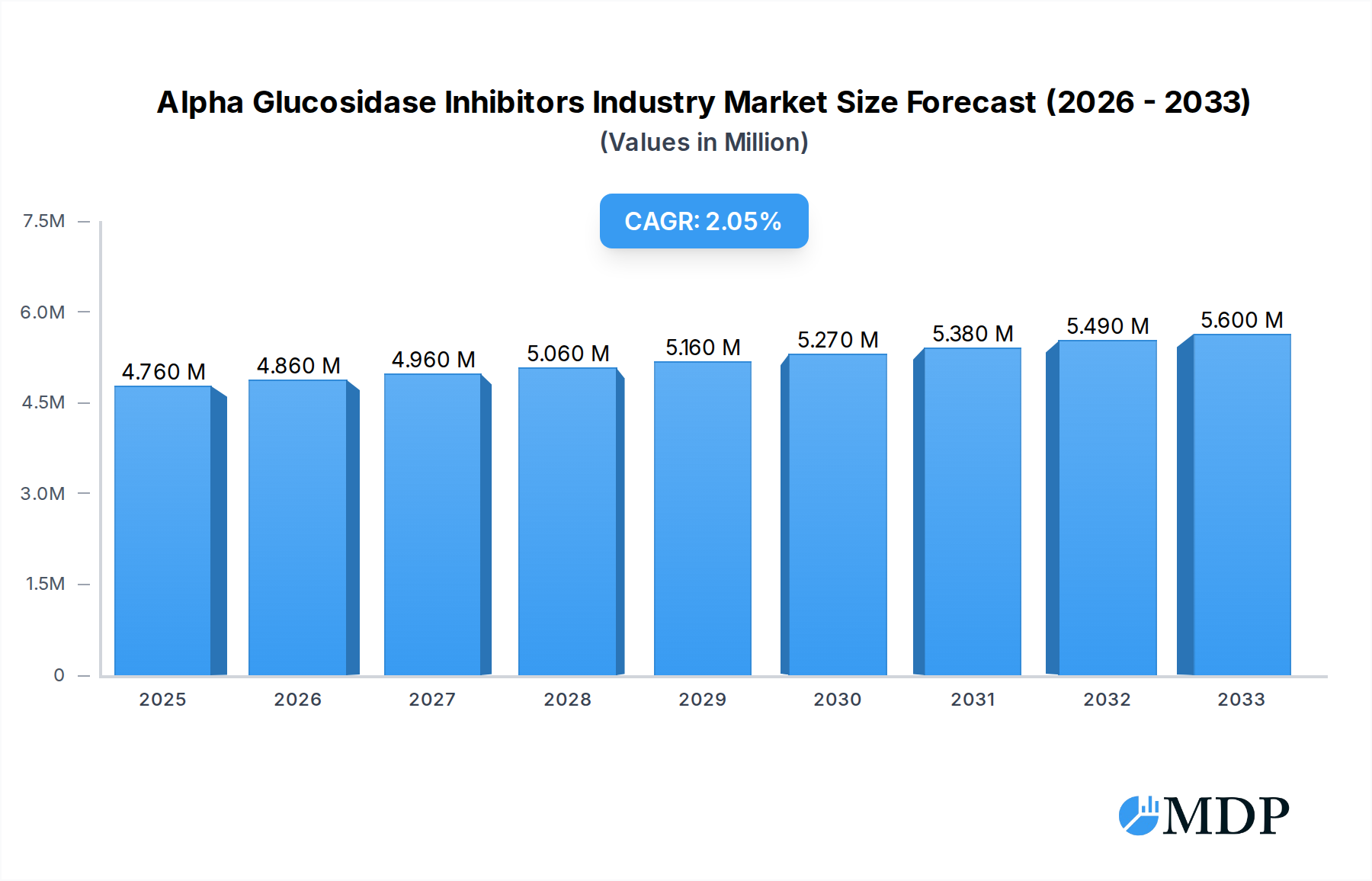

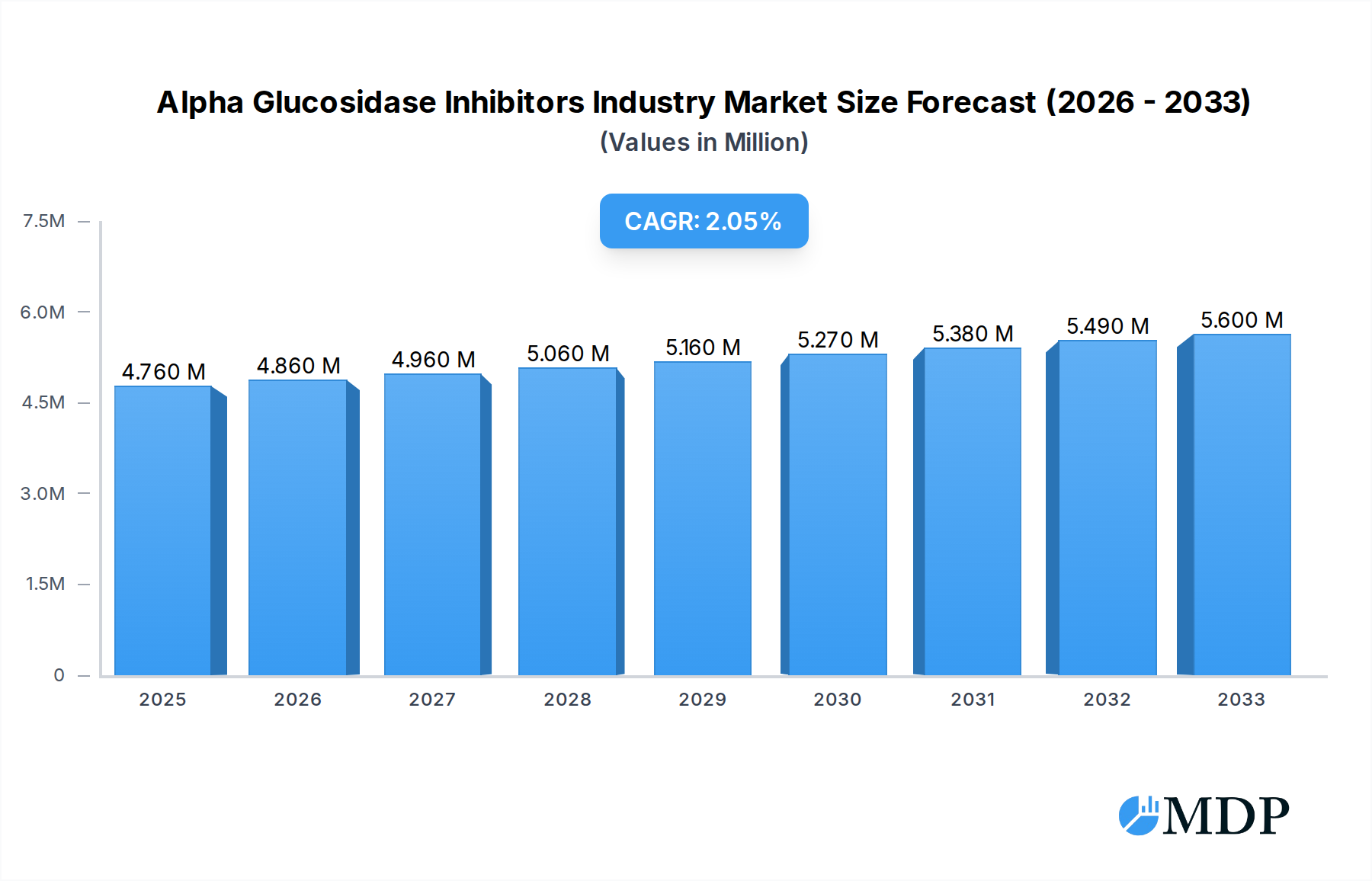

The global Alpha-Glucosidase Inhibitors market is poised for steady growth, currently valued at approximately $4.76 million with a projected Compound Annual Growth Rate (CAGR) of 2.17% over the forecast period of 2025-2033. This expansion is primarily fueled by the increasing global prevalence of type 2 diabetes, driven by lifestyle changes, sedentary habits, and an aging population. Alpha-glucosidase inhibitors play a crucial role in managing postprandial hyperglycemia by slowing down the digestion of carbohydrates, offering a valuable therapeutic option for a significant patient segment. The market's growth trajectory is further supported by rising healthcare expenditure and an increasing focus on chronic disease management. Key drivers for this market include the growing awareness of diabetes management, advancements in drug formulations offering improved efficacy and reduced side effects, and a strong pipeline of research and development activities aimed at enhancing existing therapies and exploring new applications. The aging global population is a significant factor, as the incidence of type 2 diabetes escalates with age. Furthermore, increasing disposable incomes in emerging economies contribute to better access to diabetes medications.

Alpha Glucosidase Inhibitors Industry Market Size (In Million)

Despite the positive outlook, the market faces certain restraints. The presence of alternative diabetes treatment options, including other oral antidiabetic drugs and insulin, poses a competitive challenge. Additionally, the side effects associated with alpha-glucosidase inhibitors, such as gastrointestinal discomfort, can sometimes limit patient adherence and physician preference. Regulatory hurdles and the cost of drug development and manufacturing also represent potential constraints. However, the market is actively witnessing key trends that are shaping its future. These include a growing emphasis on personalized medicine, where treatment is tailored to individual patient needs and metabolic profiles, and the development of combination therapies to achieve better glycemic control. Strategic collaborations and partnerships among leading pharmaceutical companies like Pfizer, Takeda, and Sun Pharma are expected to drive innovation and market penetration. The expanding geographical reach into emerging markets in Asia Pacific and Latin America, coupled with a growing focus on patient education and support programs, will further contribute to market expansion.

Alpha Glucosidase Inhibitors Industry Company Market Share

Alpha Glucosidase Inhibitors Market: Comprehensive Analysis and Future Projections (2019-2033)

This in-depth report provides an exhaustive analysis of the Alpha Glucosidase Inhibitors market, offering critical insights for pharmaceutical companies, investors, and healthcare stakeholders. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages high-traffic keywords such as diabetes treatment, anti-diabetic drugs, type 2 diabetes, oral hypoglycemic agents, and alpha-amylase inhibitors to maximize search visibility. Gain actionable intelligence on market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, and strategic outlooks. This report is your definitive guide to navigating the evolving landscape of alpha glucosidase inhibitors, essential for managing postprandial hyperglycemia.

Alpha Glucosidase Inhibitors Industry Market Dynamics & Concentration

The Alpha Glucosidase Inhibitors industry exhibits a moderate level of market concentration, with established pharmaceutical giants like Pfizer, Takeda, and Bayer holding significant market share due to their extensive product portfolios and global reach. Smaller, agile players such as Eris, Glenmark, Blue Cross, Sun Pharma, Unichem, Hexalag, and Torrent are actively contributing to market dynamics through focused innovation and regional penetration, particularly in emerging economies. The primary innovation driver within this sector is the continuous pursuit of improved efficacy, reduced side effects, and novel drug delivery systems to enhance patient compliance and therapeutic outcomes for type 2 diabetes management. Regulatory frameworks, such as those enforced by the FDA and EMA, play a crucial role in shaping market entry and product approval, influencing research and development priorities. Product substitutes, including other classes of oral hypoglycemic agents like DPP-4 inhibitors and SGLT2 inhibitors, pose a competitive challenge, necessitating ongoing differentiation and value proposition enhancement for alpha glucosidase inhibitors. End-user trends are increasingly driven by patient-centric approaches, demanding convenient dosing regimens and minimized gastrointestinal side effects. Mergers and acquisitions (M&A) activities, while not as prevalent as in some other pharmaceutical segments, offer strategic opportunities for consolidation and portfolio expansion, with an estimated xx M&A deal counts anticipated over the forecast period. The market is projected to reach a valuation of over xx Million by 2033.

Alpha Glucosidase Inhibitors Industry Industry Trends & Analysis

The Alpha Glucosidase Inhibitors industry is poised for significant expansion, driven by the global surge in type 2 diabetes prevalence and the increasing demand for effective oral antidiabetic medications. The market is expected to witness a robust Compound Annual Growth Rate (CAGR) of approximately xx% over the forecast period (2025-2033), propelling its valuation to an estimated xx Million by 2033. This growth is underpinned by several key trends. Firstly, a growing awareness among both healthcare professionals and patients regarding the benefits of alpha glucosidase inhibitors in managing postprandial hyperglycemia, thereby reducing the risk of diabetes-related complications. Secondly, advancements in pharmaceutical research and development are leading to the formulation of newer generation alpha glucosidase inhibitors with improved pharmacokinetic profiles and enhanced gastrointestinal tolerability, thereby broadening their appeal. Technological disruptions, such as the development of novel drug delivery systems and combination therapies, are also playing a pivotal role. For instance, the integration of alpha glucosidase inhibitors with other antidiabetic agents in single-pill formulations is enhancing patient convenience and adherence. Consumer preferences are shifting towards treatments that offer a favorable risk-benefit profile and minimal disruption to daily life. Consequently, manufacturers are investing in research to mitigate common side effects like bloating and diarrhea. Competitive dynamics are intensifying, with both established pharmaceutical giants and emerging players vying for market share. This competition is fostering innovation and driving down prices in some markets, making these essential medications more accessible. Market penetration for alpha glucosidase inhibitors, while significant, still holds considerable potential for growth, particularly in developing regions where diabetes rates are rapidly escalating. The increasing focus on personalized medicine and proactive diabetes management further accentuates the demand for targeted therapies like alpha glucosidase inhibitors. The global market size is projected to expand from approximately xx Million in 2025 to over xx Million by 2033.

Leading Markets & Segments in Alpha Glucosidase Inhibitors Industry

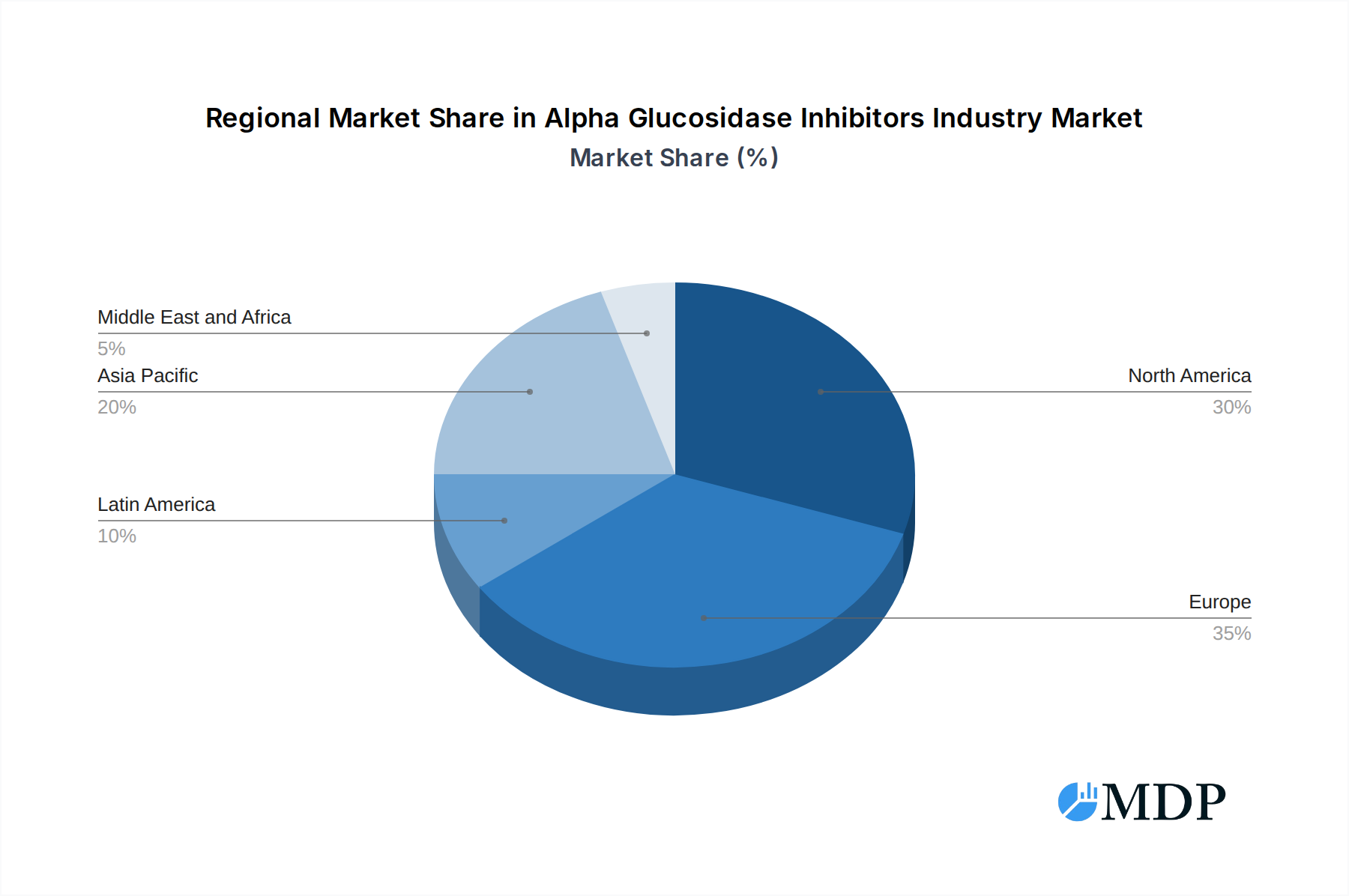

The Alpha Glucosidase Inhibitors market is characterized by a discernible geographical and segmental dominance. North America, particularly the United States, currently holds the position of the largest market for alpha glucosidase inhibitors, largely attributed to its high prevalence of type 2 diabetes, advanced healthcare infrastructure, robust research and development investments, and a well-established reimbursement system. Furthermore, the strong presence of leading pharmaceutical companies and a proactive approach to diabetes management contribute to its leading status.

Within the Alpha-glucosidase Inhibitors segment, the market is driven by a confluence of factors:

- Economic Policies: Favorable healthcare policies and government initiatives aimed at improving diabetes care access in developed nations significantly boost market demand.

- Healthcare Infrastructure: The availability of advanced diagnostic tools, well-equipped healthcare facilities, and a skilled workforce in regions like North America and Europe facilitate the widespread adoption and prescription of alpha glucosidase inhibitors.

- Growing Diabetes Prevalence: The alarming rise in type 2 diabetes cases globally, particularly in sedentary urban populations, serves as a primary growth catalyst. This necessitates the availability of effective therapeutic options like alpha glucosidase inhibitors.

- Technological Advancements: Continuous innovation in drug formulation and delivery systems, leading to improved efficacy and reduced side effects, enhances the attractiveness of these inhibitors for both patients and prescribers.

- Awareness and Education: Increased patient and physician awareness regarding the benefits of controlling postprandial hyperglycemia through alpha glucosidase inhibitors is a crucial driver.

Emerging markets, including Asia-Pacific (with a notable focus on India and China) and Latin America, are exhibiting rapid growth trajectories. This expansion is fueled by increasing diabetes rates, growing disposable incomes, improving healthcare access, and the introduction of cost-effective generic alternatives. The economic policies in these regions are gradually becoming more supportive of pharmaceutical innovation and accessibility. The increasing penetration of oral hypoglycemic agents, including alpha glucosidase inhibitors, in these regions presents a substantial opportunity for market players. The market is expected to see a strong performance in these regions, contributing significantly to the overall global market valuation of xx Million.

Alpha Glucosidase Inhibitors Industry Product Developments

Product development in the Alpha Glucosidase Inhibitors industry is focused on enhancing therapeutic efficacy and patient convenience. Innovations center around creating formulations with improved pharmacokinetic profiles, leading to more consistent glycemic control and reduced gastrointestinal side effects, which are common deterrents. For instance, advancements in drug formulation are exploring extended-release mechanisms to provide sustained therapeutic benefits throughout the day. Furthermore, the development of combination therapies, where alpha glucosidase inhibitors are co-formulated with other antidiabetic agents like metformin or DPP-4 inhibitors, offers a simplified treatment regimen and synergistic glycemic control, directly addressing patient demand for convenience and improved outcomes. These advancements aim to broaden the patient population suitable for alpha glucosidase inhibitor therapy and solidify their competitive advantage in the crowded diabetes treatment landscape. The market is projected to value xx Million by 2033.

Key Drivers of Alpha Glucosidase Inhibitors Industry Growth

The growth of the Alpha Glucosidase Inhibitors industry is propelled by several interconnected factors. The escalating global prevalence of type 2 diabetes, driven by sedentary lifestyles and aging populations, creates a sustained demand for effective glycemic control agents. Technological advancements in pharmaceutical research are leading to the development of novel alpha glucosidase inhibitors with improved tolerability and efficacy profiles, enhancing their market appeal. Increased patient and physician awareness regarding the benefits of controlling postprandial hyperglycemia, a key role of these inhibitors, further fuels demand. Favorable regulatory frameworks in key markets, coupled with the introduction of generic versions that improve affordability and accessibility, are also significant growth accelerators. The market is projected to reach xx Million by 2033.

Challenges in the Alpha Glucosidase Inhibitors Industry Market

The Alpha Glucosidase Inhibitors industry faces several significant challenges that could potentially impede its growth trajectory. The most prominent is the prevalent gastrointestinal side effects, such as bloating, flatulence, and diarrhea, which can lead to poor patient adherence and limit the therapeutic utility for a segment of the patient population. Furthermore, the development of new classes of antidiabetic drugs, including GLP-1 receptor agonists and SGLT2 inhibitors, offers alternative treatment options that may present a more favorable side-effect profile for some patients, thus intensifying competitive pressures. Stringent regulatory hurdles and the high cost associated with drug development and clinical trials can also pose barriers to market entry for new products. Supply chain disruptions and the genericization of existing molecules can impact profitability margins for manufacturers. The market is projected to reach xx Million by 2033.

Emerging Opportunities in Alpha Glucosidase Inhibitors Industry

Emerging opportunities within the Alpha Glucosidase Inhibitors industry are poised to drive long-term growth and market expansion. The increasing prevalence of diabetes in emerging economies presents a vast untapped market, where improved access to healthcare and growing awareness can significantly boost demand for effective oral antidiabetic agents. Technological breakthroughs in drug delivery systems, such as sustained-release formulations and personalized dosage regimens, offer the potential to mitigate side effects and enhance patient compliance, thereby broadening the therapeutic window for alpha glucosidase inhibitors. Strategic partnerships and collaborations between pharmaceutical companies, research institutions, and technology providers can accelerate the development of next-generation inhibitors with superior profiles. Furthermore, exploring the synergistic effects of alpha glucosidase inhibitors in combination therapies for managing metabolic syndrome and other related comorbidities could unlock new therapeutic avenues and market segments. The market is projected to reach xx Million by 2033.

Leading Players in the Alpha Glucosidase Inhibitors Industry Sector

- Pfizer

- Takeda

- Eris

- Glenmark

- Blue Cross

- Sun Pharma

- Unichem

- Hexalag

- Bayer

- Torrent

Key Milestones in Alpha Glucosidase Inhibitors Industry Industry

- January 2023: The Indian Drug pricing regulator National Pharmaceutical Pricing Authority (NPPA) fixed the retail price of 12 scheduled formulations under the Drugs (Prices Control) Order, 2013 (NLEM 2022). The retail price of one tablet of anti-diabetes combination drug Glimepiride, Voglibose & Metformin (extended-release) is fixed at INR 13.83 (USD 0.17), impacting affordability and accessibility in the Indian market.

- May 2022: The US FDA issued a revised draft guidance for the industry on generic acarbose, recommending in vitro comparative dissolution studies or one in vivo pilot bioequivalence study and one in vivo pivotal bioequivalence study with pharmacodynamic endpoints studies. This development impacts the regulatory pathway for generic acarbose approvals and fosters competition.

Strategic Outlook for Alpha Glucosidase Inhibitors Industry Market

The strategic outlook for the Alpha Glucosidase Inhibitors industry is characterized by a strong focus on innovation, market penetration, and patient-centricity. Future growth will be accelerated by the development of novel drug formulations that minimize gastrointestinal side effects and enhance patient compliance, thereby expanding the therapeutic utility of these agents. Strategic partnerships aimed at exploring combination therapies and addressing unmet needs in diabetes management will be crucial. Furthermore, targeted market expansion into emerging economies with high diabetes prevalence and improving healthcare infrastructure presents a significant opportunity for revenue growth. The industry's strategic imperative will be to leverage technological advancements to create differentiated products and solidify their position as essential components in the comprehensive management of type 2 diabetes, with the market projected to reach xx Million by 2033.

Alpha Glucosidase Inhibitors Industry Segmentation

- 1. Alpha-glucosidase Inhibitors

Alpha Glucosidase Inhibitors Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. France

- 2.2. Germany

- 2.3. Italy

- 2.4. Spain

- 2.5. United Kingdom

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Latin America

- 3.1. Mexico

- 3.2. Brazil

- 3.3. Rest of Latin America

-

4. Asia Pacific

- 4.1. Japan

- 4.2. South Korea

- 4.3. China

- 4.4. India

- 4.5. Australia

- 4.6. Vietnam

- 4.7. Malaysia

- 4.8. Indonesia

- 4.9. Philippines

- 4.10. Thailand

- 4.11. Rest of Asia Pacific

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Iran

- 5.3. Egypt

- 5.4. Oman

- 5.5. South Africa

- 5.6. Rest of Middle East and Africa

Alpha Glucosidase Inhibitors Industry Regional Market Share

Geographic Coverage of Alpha Glucosidase Inhibitors Industry

Alpha Glucosidase Inhibitors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Number of Kidney Cancer Cases; Increased R&D Expenditure of Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. ; High Cost Associated with Treatment; Preference for Generic Drugs

- 3.4. Market Trends

- 3.4.1. Rising diabetes prevalence globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Alpha Glucosidase Inhibitors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Latin America

- 5.2.4. Asia Pacific

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 6. North America Alpha Glucosidase Inhibitors Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 6.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 7. Europe Alpha Glucosidase Inhibitors Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 7.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 8. Latin America Alpha Glucosidase Inhibitors Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 8.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 9. Asia Pacific Alpha Glucosidase Inhibitors Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 9.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 10. Middle East and Africa Alpha Glucosidase Inhibitors Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 10.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Pfizer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Takeda

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eris

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Glenmark

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Blue Cross

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sun Pharma

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Unichem

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hexalag

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bayer

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Torrent

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Pfizer

List of Figures

- Figure 1: Global Alpha Glucosidase Inhibitors Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Alpha Glucosidase Inhibitors Industry Revenue (Million), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 3: North America Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 4: North America Alpha Glucosidase Inhibitors Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Alpha Glucosidase Inhibitors Industry Revenue (Million), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 7: Europe Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 8: Europe Alpha Glucosidase Inhibitors Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Latin America Alpha Glucosidase Inhibitors Industry Revenue (Million), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 11: Latin America Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 12: Latin America Alpha Glucosidase Inhibitors Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Latin America Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Alpha Glucosidase Inhibitors Industry Revenue (Million), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 15: Asia Pacific Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 16: Asia Pacific Alpha Glucosidase Inhibitors Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Asia Pacific Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Alpha Glucosidase Inhibitors Industry Revenue (Million), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 19: Middle East and Africa Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 20: Middle East and Africa Alpha Glucosidase Inhibitors Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Alpha-glucosidase Inhibitors 2020 & 2033

- Table 2: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Alpha-glucosidase Inhibitors 2020 & 2033

- Table 4: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Alpha-glucosidase Inhibitors 2020 & 2033

- Table 9: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: France Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Germany Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Alpha-glucosidase Inhibitors 2020 & 2033

- Table 18: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Mexico Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Brazil Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Latin America Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Alpha-glucosidase Inhibitors 2020 & 2033

- Table 23: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Japan Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: South Korea Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: China Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Australia Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Vietnam Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Malaysia Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Indonesia Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Philippines Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Thailand Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Asia Pacific Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Alpha-glucosidase Inhibitors 2020 & 2033

- Table 36: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Saudi Arabia Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Iran Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Egypt Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Oman Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: South Africa Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Alpha Glucosidase Inhibitors Industry?

The projected CAGR is approximately 2.17%.

2. Which companies are prominent players in the Alpha Glucosidase Inhibitors Industry?

Key companies in the market include Pfizer, Takeda, Eris, Glenmark, Blue Cross, Sun Pharma, Unichem, Hexalag, Bayer, Torrent.

3. What are the main segments of the Alpha Glucosidase Inhibitors Industry?

The market segments include Alpha-glucosidase Inhibitors.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.76 Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Number of Kidney Cancer Cases; Increased R&D Expenditure of Pharmaceutical Companies.

6. What are the notable trends driving market growth?

Rising diabetes prevalence globally.

7. Are there any restraints impacting market growth?

; High Cost Associated with Treatment; Preference for Generic Drugs.

8. Can you provide examples of recent developments in the market?

January 2023: The Indian Drug pricing regulator National Pharmaceutical Pricing Authority (NPPA) fixed the retail price of 12 scheduled formulations under the Drugs (Prices Control) Order, 2013 (NLEM 2022). The retail price of one tablet of anti-diabetes combination drug Glimepiride, Voglibose & Metformin (extended-release) is fixed at INR 13.83 (USD 0.17).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Alpha Glucosidase Inhibitors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Alpha Glucosidase Inhibitors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Alpha Glucosidase Inhibitors Industry?

To stay informed about further developments, trends, and reports in the Alpha Glucosidase Inhibitors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence