Key Insights

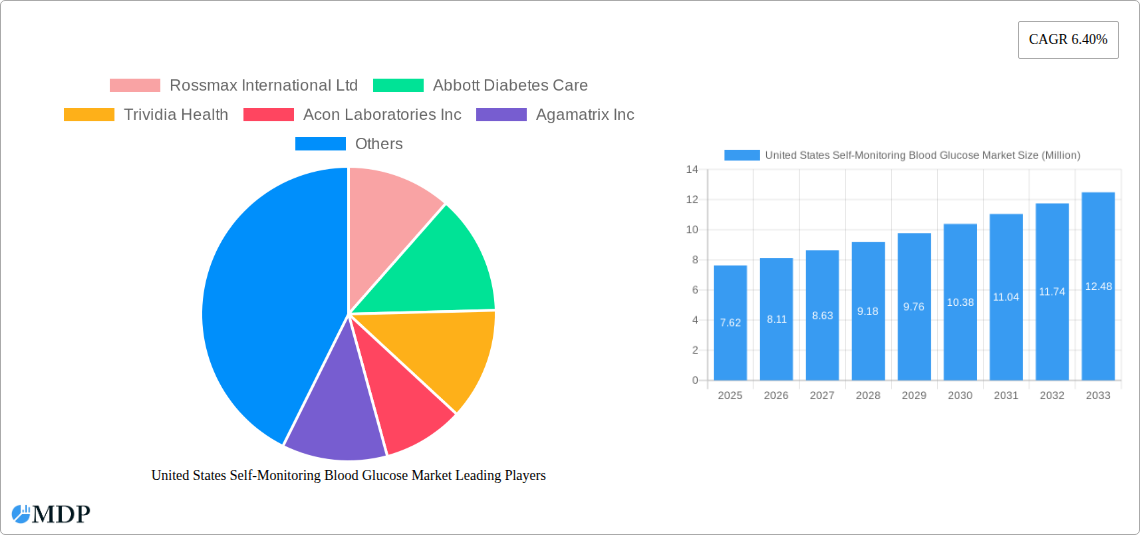

The United States Self-Monitoring Blood Glucose (SMBG) Market is poised for significant expansion, with a current estimated market size of approximately $7.62 billion. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 6.40%, indicating a healthy and sustained upward trajectory. The primary drivers fueling this market surge include the escalating prevalence of diabetes, a growing awareness among patients regarding proactive glucose management, and continuous technological advancements in SMBG devices. The increasing demand for user-friendly, accurate, and connected glucose monitoring solutions is also a key influencer. Innovations such as smaller, less painful lancets and highly precise test strips are enhancing the patient experience and encouraging consistent self-monitoring, thereby contributing to the overall market value.

United States Self-Monitoring Blood Glucose Market Market Size (In Million)

The SMBG market in the United States is segmented into key components: Glucometer Devices, Test Strips, and Lancets. Each segment plays a vital role in the comprehensive management of diabetes. The market is expected to witness consistent growth across all these segments, driven by an aging population, rising healthcare expenditure, and government initiatives promoting diabetes care. While the market benefits from strong growth drivers, potential restraints include the increasing adoption of continuous glucose monitoring (CGM) systems, which, though a parallel technology, could influence the long-term growth trajectory of traditional SMBG. However, the established affordability and accessibility of SMBG devices ensure their continued relevance, particularly for specific patient demographics and in certain healthcare settings. Companies like Abbott Diabetes Care, Roche Holding AG, and Ascensia Diabetes Care are at the forefront of innovation, driving competition and market development.

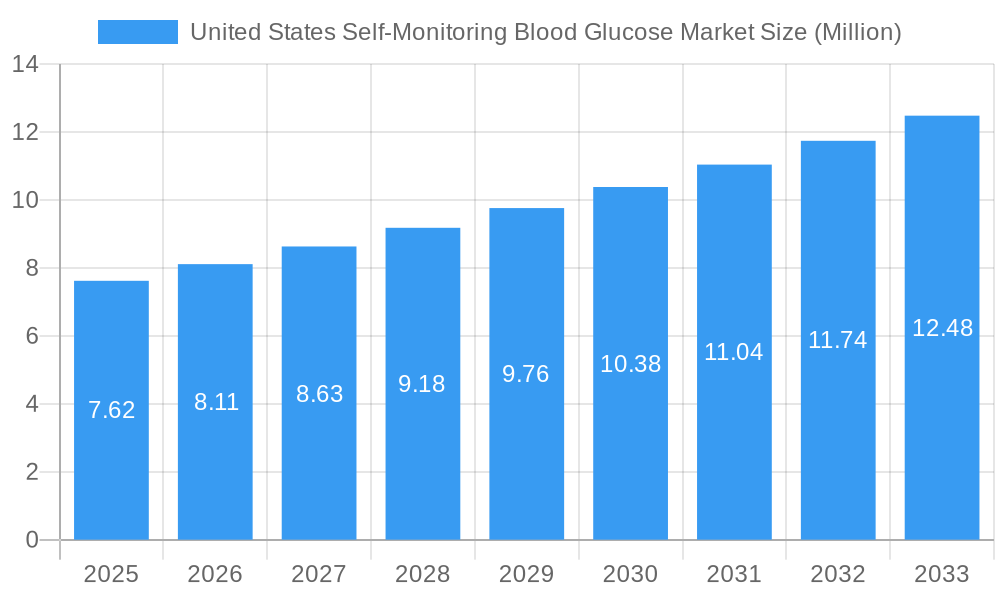

United States Self-Monitoring Blood Glucose Market Company Market Share

This in-depth report provides a definitive analysis of the United States Self-Monitoring Blood Glucose (SMBG) Market, offering critical insights into market dynamics, key trends, and future growth projections from 2019–2033. With a base year of 2025, the report meticulously details the estimated year of 2025 and a comprehensive forecast period of 2025–2033, building upon the historical period of 2019–2024. Discover the competitive landscape, innovative product developments, and strategic opportunities shaping the SMBG devices market and diabetes management solutions in the US. High-traffic keywords such as blood glucose meters, test strips, diabetes monitoring, glycemic control, and point-of-care diagnostics are seamlessly integrated to maximize search visibility and attract industry stakeholders, including manufacturers, distributors, healthcare providers, and investors.

United States Self-Monitoring Blood Glucose Market Market Dynamics & Concentration

The United States Self-Monitoring Blood Glucose Market is characterized by a moderate to high concentration, with a few key players dominating a significant portion of the market share. Innovation remains a primary driver, fueled by the continuous demand for more accurate, user-friendly, and connected SMBG devices. Regulatory frameworks, while stringent, are evolving to accommodate advancements in digital health and data integration, impacting product approvals and market access. Product substitutes, such as continuous glucose monitoring (CGM) systems, are increasingly competing with traditional SMBG devices, necessitating ongoing innovation in performance and cost-effectiveness. End-user trends indicate a growing preference for integrated digital solutions that offer seamless data syncing and personalized insights for diabetes management. Mergers and acquisitions (M&A) activities have been a consistent feature, as larger companies seek to consolidate market presence, acquire innovative technologies, and expand their product portfolios. For instance, recent M&A activities in the broader diabetes care sector signal a trend towards consolidation, with an estimated XX M&A deals occurring within the past two years, significantly impacting market concentration and competitive dynamics.

- Market Concentration: Moderately to highly concentrated, with key players holding substantial market share.

- Innovation Drivers: Demand for enhanced accuracy, user-friendliness, connectivity, and data integration.

- Regulatory Frameworks: Evolving FDA approvals and increasing focus on data privacy and security.

- Product Substitutes: Growing competition from Continuous Glucose Monitoring (CGM) systems.

- End-User Trends: Preference for connected devices, mobile apps, and personalized diabetes management.

- M&A Activities: Strategic acquisitions and partnerships to gain market share and technological advancements.

United States Self-Monitoring Blood Glucose Market Industry Trends & Analysis

The United States Self-Monitoring Blood Glucose Market is poised for robust growth, driven by an increasing prevalence of diabetes, an aging population, and a heightened awareness of proactive health management. The market is experiencing significant technological disruptions, with the integration of Bluetooth connectivity, mobile applications, and artificial intelligence (AI) transforming the way individuals monitor their glucose levels. These advancements are leading to more personalized diabetes care, enabling users to track trends, share data with healthcare providers, and receive actionable insights for better glycemic control. Consumer preferences are shifting towards non-invasive or minimally invasive monitoring solutions, coupled with a demand for aesthetically pleasing and easy-to-use devices. The competitive landscape is dynamic, characterized by intense rivalry among established players and the emergence of innovative startups. Key market growth drivers include the rising incidence of type 1 and type 2 diabetes in the US, a growing demand for home-based healthcare solutions, and favorable reimbursement policies for diabetes management technologies. The market penetration of advanced SMBG devices is steadily increasing, as consumers become more educated about the benefits of regular and accurate glucose monitoring. The overall market is projected to exhibit a Compound Annual Growth Rate (CAGR) of approximately XX% over the forecast period. This growth is further bolstered by government initiatives promoting diabetes awareness and early detection programs. The increasing adoption of smart devices and wearable technology is also contributing to the demand for connected SMBG solutions, fostering a more integrated approach to diabetes self-management. The focus on preventative healthcare and the desire to reduce long-term complications associated with diabetes are also significant factors driving market expansion.

Leading Markets & Segments in United States Self-Monitoring Blood Glucose Market

The United States Self-Monitoring Blood Glucose Market is segmented into key components: Glucometer Devices, Test Strips, and Lancets. Within these segments, Test Strips currently hold the largest market share by value and volume, driven by the recurring need for replenishment by individuals using blood glucose meters. The high consumption rate of test strips directly correlates with the growing number of people managing diabetes.

- Glucometer Devices: This segment encompasses a wide range of blood glucose meters, from basic models to advanced smart devices with connectivity features. The demand is influenced by technological advancements, brand loyalty, and the availability of integrated digital platforms. The market penetration of newer, connected glucometers is steadily increasing, offering improved user experience and data management capabilities.

- Test Strips: As the most frequently purchased consumable, test strips represent the largest revenue stream within the SMBG market. The market is characterized by fierce competition, leading to price sensitivity and a focus on accuracy and reliability. Innovations in strip technology, such as faster blood absorption and wider operating temperature ranges, are key differentiators.

- Lancets: While a smaller segment, lancets are essential for blood sample collection. The trend towards less painful and more comfortable lancing devices is driving innovation in this area. Features like adjustable depth settings and safety mechanisms are becoming standard.

Dominance Analysis:

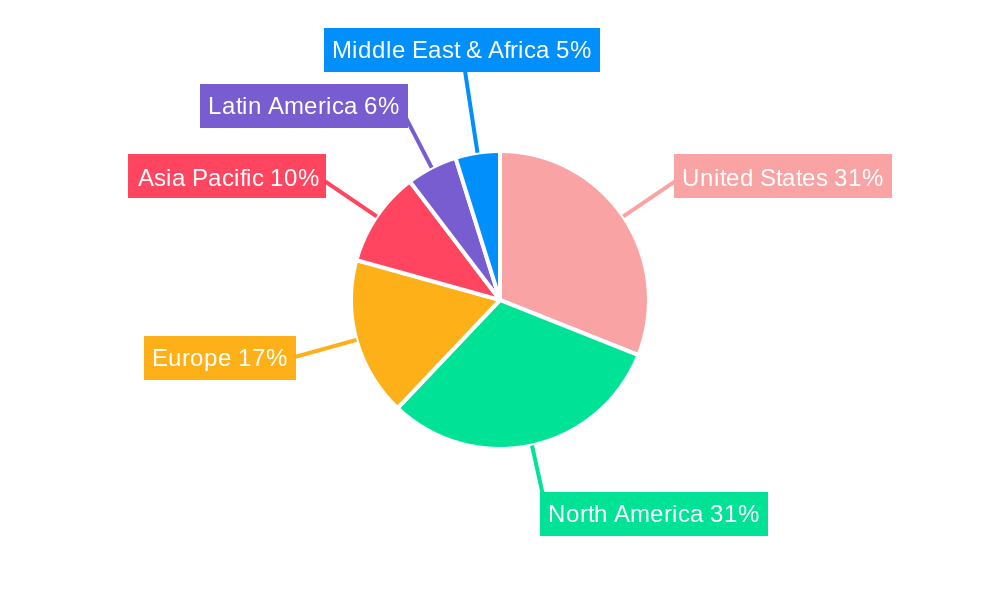

The United States stands as the dominant country within the North American SMBG market, owing to its large population, high prevalence of diabetes, and advanced healthcare infrastructure. Government policies encouraging early diagnosis and management of chronic diseases, coupled with robust reimbursement schemes for diabetes care products, further solidify the US's leading position. The economic stability of the region also supports consistent investment in research and development of innovative SMBG technologies.

- Key Drivers for Dominance (United States):

- High incidence of diabetes and pre-diabetes.

- Advanced healthcare infrastructure and accessibility.

- Favorable reimbursement policies for diabetes management.

- Strong consumer awareness and adoption of health technologies.

- Significant R&D investment by leading medical device companies.

United States Self-Monitoring Blood Glucose Market Product Developments

Product developments in the United States Self-Monitoring Blood Glucose Market are intensely focused on enhancing user experience and integrating smart technology. Innovations aim to provide more accurate readings, reduced pain, and seamless data connectivity. Companies are actively developing Bluetooth-enabled glucometers that synchronize with mobile applications, offering real-time data analysis, trend tracking, and personalized feedback for better glycemic control. Furthermore, advancements in strip technology are leading to faster testing times and the ability to function reliably in a wider range of environmental conditions. The integration of AI-powered insights within these platforms is also a growing trend, helping users make more informed decisions about their diabetes management. These developments are crucial for maintaining competitive advantage and meeting the evolving needs of individuals managing diabetes.

Key Drivers of United States Self-Monitoring Blood Glucose Market Growth

The United States Self-Monitoring Blood Glucose Market is propelled by several key drivers. The escalating prevalence of diabetes, driven by an aging population and lifestyle factors, creates a continuously growing patient base requiring regular glucose monitoring. Technological advancements, particularly in digital health and connectivity, are transforming SMBG devices into integrated health management tools. Government initiatives and awareness campaigns focused on diabetes prevention and management further stimulate market growth. Economic factors, including increasing disposable incomes and expanding health insurance coverage, also contribute to greater accessibility and adoption of SMBG products.

- Growing Diabetes Prevalence: A significant and expanding patient population necessitates consistent monitoring.

- Technological Innovation: Development of connected devices, apps, and AI for enhanced data analysis and user experience.

- Government Initiatives & Awareness: Public health campaigns and support for diabetes management.

- Economic Factors: Rising disposable incomes and improved health insurance coverage.

Challenges in the United States Self-Monitoring Blood Glucose Market Market

Despite its growth, the United States Self-Monitoring Blood Glucose Market faces several challenges. The increasing competition from Continuous Glucose Monitoring (CGM) systems presents a significant threat, as CGM offers real-time, comprehensive data with less frequent finger pricks. Regulatory hurdles and the time-consuming approval processes for new devices and software updates can slow down market entry for innovators. Supply chain disruptions, particularly in the wake of global events, can impact the availability and cost of essential components like test strips. Furthermore, pricing pressures from payers and the need to demonstrate cost-effectiveness to healthcare providers can limit market adoption and profitability.

- Competition from CGM: Growing preference for continuous monitoring solutions.

- Regulatory Hurdles: Stringent approval processes and evolving compliance requirements.

- Supply Chain Disruptions: Challenges in sourcing raw materials and components.

- Pricing Pressures: Need to demonstrate cost-effectiveness and manage reimbursement complexities.

Emerging Opportunities in United States Self-Monitoring Blood Glucose Market

Emerging opportunities in the United States Self-Monitoring Blood Glucose Market lie in the continued integration of digital health ecosystems and the development of advanced analytics. The increasing adoption of telehealth platforms presents a significant opportunity for SMBG device manufacturers to offer integrated solutions for remote patient monitoring and virtual consultations. Strategic partnerships between device manufacturers, pharmaceutical companies, and digital health providers can create comprehensive diabetes management programs. Furthermore, the focus on personalized medicine and data-driven insights offers a ripe ground for developing AI-powered tools that can predict glycemic trends and offer proactive recommendations, thereby improving patient outcomes and reducing healthcare costs.

Leading Players in the United States Self-Monitoring Blood Glucose Market Sector

- Rossmax International Ltd

- Abbott Diabetes Care

- Trividia Health

- Acon Laboratories Inc

- Agamatrix Inc

- Bionime Corporation

- LifeScan

- Roche Holding AG

- Ascensia Diabetes Care

- Arkray Inc

Key Milestones in United States Self-Monitoring Blood Glucose Market Industry

- January, 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published Improved Glycemic Control Using a Bluetooth Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Evidence From Over 144,000 People With Diabetes, detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes-one of the largest combined blood glucose meter and mobile diabetes app datasets ever published.

- January 20, 2022: Roche announced the launch of the COBAS pulse system in selected countries accepting the CE mark. The COBAS pulse system marks Roche Diagnostics' newest generation of connected point-of-care solutions for professional blood glucose management. The COBAS pulse system combines the form factor of a high-performance blood glucose meter with simple usability and expanded digital capabilities like those of a smartphone. Following first commercial availability under the CE mark in select markets, Roche plans to seek CE IVDR and FDA clearance for the Cobas Pulse System in other global markets.

Strategic Outlook for United States Self-Monitoring Blood Glucose Market Market

The strategic outlook for the United States Self-Monitoring Blood Glucose Market is characterized by a strong emphasis on innovation, integration, and patient-centricity. Companies are expected to accelerate the development of connected SMBG devices that seamlessly integrate with broader digital health platforms, including electronic health records (EHRs) and telehealth services. The focus will shift towards providing comprehensive data analytics and AI-driven insights to empower both patients and healthcare providers in proactive diabetes management. Strategic partnerships and collaborations will be crucial for expanding market reach and offering holistic care solutions. Furthermore, there will be a continued drive towards developing more affordable and accessible monitoring options to cater to diverse patient populations and healthcare settings, ensuring sustained market growth and improved patient outcomes.

United States Self-Monitoring Blood Glucose Market Segmentation

-

1. Component (Value and Volume, 2017 - 2028)

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

United States Self-Monitoring Blood Glucose Market Segmentation By Geography

- 1. United States

United States Self-Monitoring Blood Glucose Market Regional Market Share

Geographic Coverage of United States Self-Monitoring Blood Glucose Market

United States Self-Monitoring Blood Glucose Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in the United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Self-Monitoring Blood Glucose Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component (Value and Volume, 2017 - 2028)

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Component (Value and Volume, 2017 - 2028)

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rossmax International Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Abbott Diabetes Care

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trividia Health

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Acon Laboratories Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Agamatrix Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bionime Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LifeScan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Other Company Share Analyse

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Roche Holding AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ascensia Diabetes Care

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Arkray Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Rossmax International Ltd

List of Figures

- Figure 1: United States Self-Monitoring Blood Glucose Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Self-Monitoring Blood Glucose Market Share (%) by Company 2025

List of Tables

- Table 1: United States Self-Monitoring Blood Glucose Market Revenue Million Forecast, by Component (Value and Volume, 2017 - 2028) 2020 & 2033

- Table 2: United States Self-Monitoring Blood Glucose Market Volume K Unit Forecast, by Component (Value and Volume, 2017 - 2028) 2020 & 2033

- Table 3: United States Self-Monitoring Blood Glucose Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Self-Monitoring Blood Glucose Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: United States Self-Monitoring Blood Glucose Market Revenue Million Forecast, by Component (Value and Volume, 2017 - 2028) 2020 & 2033

- Table 6: United States Self-Monitoring Blood Glucose Market Volume K Unit Forecast, by Component (Value and Volume, 2017 - 2028) 2020 & 2033

- Table 7: United States Self-Monitoring Blood Glucose Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: United States Self-Monitoring Blood Glucose Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Self-Monitoring Blood Glucose Market?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the United States Self-Monitoring Blood Glucose Market?

Key companies in the market include Rossmax International Ltd, Abbott Diabetes Care, Trividia Health, Acon Laboratories Inc, Agamatrix Inc, Bionime Corporation, LifeScan, Other Company Share Analyse, Roche Holding AG, Ascensia Diabetes Care, Arkray Inc .

3. What are the main segments of the United States Self-Monitoring Blood Glucose Market?

The market segments include Component (Value and Volume, 2017 - 2028).

4. Can you provide details about the market size?

The market size is estimated to be USD 7.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in the United States.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

January, 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published Improved Glycemic Control Using a Bluetooth Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Evidence From Over 144,000 People With Diabetes, detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes-one of the largest combined blood glucose meter and mobile diabetes app datasets ever published.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Self-Monitoring Blood Glucose Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Self-Monitoring Blood Glucose Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Self-Monitoring Blood Glucose Market?

To stay informed about further developments, trends, and reports in the United States Self-Monitoring Blood Glucose Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence