Key Insights

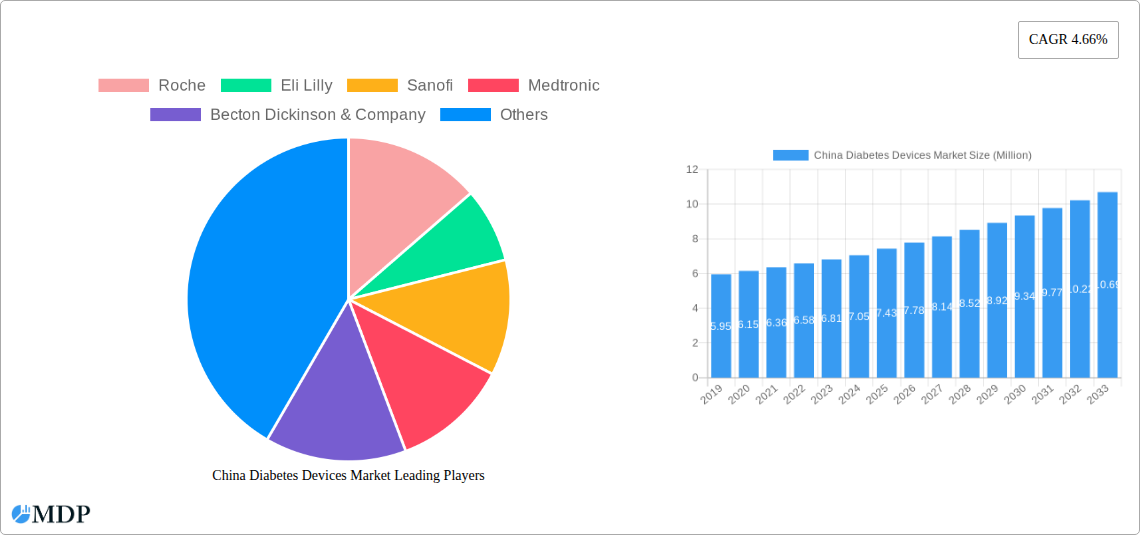

The China Diabetes Devices Market is poised for significant expansion, projected to reach $7.43 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 4.66% through 2033. This dynamic growth is primarily fueled by a confluence of escalating diabetes prevalence, increasing health consciousness among the population, and a growing demand for advanced and user-friendly monitoring and management solutions. Key drivers include the rising incidence of type 1 and type 2 diabetes, advancements in technology leading to more accurate and convenient devices, and supportive government initiatives aimed at improving chronic disease management. The market encompasses a diverse range of segments, from Self-monitoring Blood Glucose Devices and Continuous Glucose Monitoring systems to a comprehensive suite of Insulin Delivery Devices, including insulin pumps, syringes, disposable pens, and cartridges for reusable pens. This comprehensive product offering caters to the varied needs of diabetic patients in China, from basic glucose tracking to sophisticated insulin therapy.

China Diabetes Devices Market Market Size (In Million)

The market's trajectory is further shaped by emerging trends such as the widespread adoption of connected devices that enable seamless data sharing with healthcare providers, promoting more personalized and proactive diabetes care. The integration of artificial intelligence and machine learning in diabetes management platforms is also gaining traction, offering predictive analytics and enhanced treatment recommendations. However, certain restraints, such as the high cost of some advanced devices and the need for greater patient and healthcare professional education regarding their optimal use, could temper growth in specific sub-segments. Despite these challenges, the sheer scale of the Chinese population and the ongoing efforts to enhance healthcare accessibility and affordability create a fertile ground for sustained market development. Key players like Roche, Eli Lilly, Sanofi, Medtronic, and Abbott are actively investing in research and development to introduce innovative solutions, further stimulating competition and market evolution.

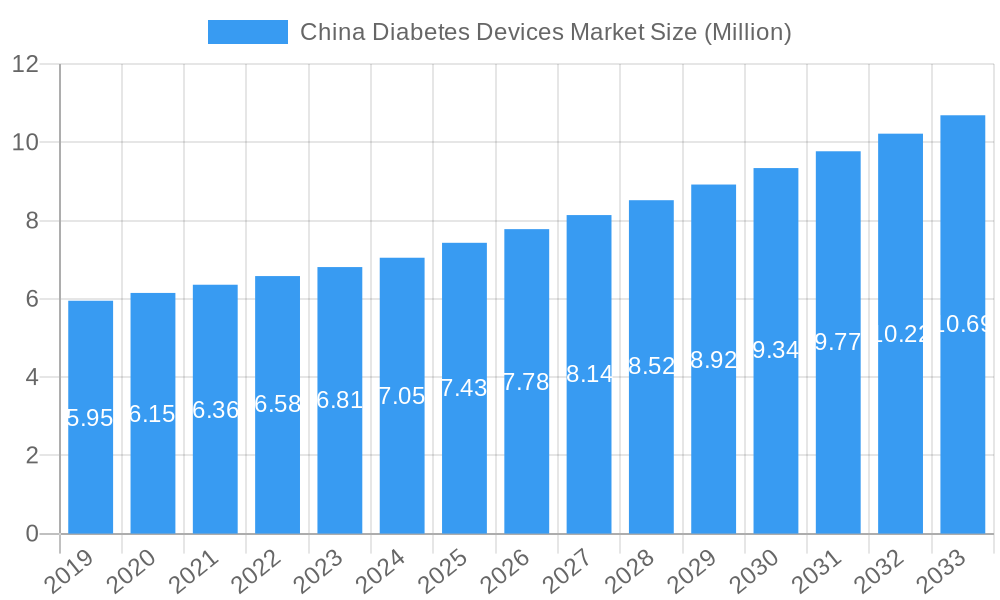

China Diabetes Devices Market Company Market Share

China Diabetes Devices Market: A Comprehensive Analysis 2019-2033

Unlock the immense potential of the China diabetes devices market with our in-depth report. This comprehensive analysis, covering the historical period of 2019-2024 and extending through a forecast period of 2025-2033, provides critical insights into market dynamics, industry trends, leading players, and future opportunities. Driven by an increasing diabetes prevalence, growing health awareness, and supportive government initiatives, the Chinese market for diabetes management solutions is experiencing robust growth. Our report meticulously dissects the market into key segments including self-monitoring blood glucose devices, continuous glucose monitoring, and various insulin delivery devices such as insulin pumps, syringes, and pens. We examine the competitive landscape featuring global giants like Roche, Eli Lilly, Sanofi, Medtronic, Becton Dickinson & Company, ARKRAY Inc, Abbott, ACON Laboratories Inc, Novo Nordisk, Bionime Corporation, Johnson & Johnson, Ascensia Diabetes Care, and domestic leaders like SinoCare and Rossmax International Ltd. This report is your essential guide to navigating the burgeoning Chinese diabetes market, understanding innovation drivers, and identifying strategic investments in diabetes care technology.

China Diabetes Devices Market Market Dynamics & Concentration

The China diabetes devices market exhibits a moderate to high concentration, with a blend of established multinational corporations and rapidly growing domestic players vying for market share. Innovation remains a primary driver, fueled by the escalating prevalence of diabetes across the nation and a burgeoning middle class with increased disposable income and a greater focus on preventative healthcare. Regulatory frameworks, overseen by the National Medical Products Administration (NMPA), are evolving to ensure product safety and efficacy, influencing market entry and product approval timelines. Product substitutes exist, particularly between traditional blood glucose meters and newer continuous glucose monitoring (CGM) systems, as well as between different types of insulin delivery devices. End-user trends are shifting towards more convenient, less invasive, and digitally integrated solutions. M&A activities are present, indicating a consolidation phase and strategic acquisitions aimed at expanding product portfolios and market reach. Key M&A deal counts are estimated at XX for the historical period, with increasing activity anticipated. Market share distribution shows leading players holding significant portions, with domestic brands making substantial inroads, particularly in the SMBG segment.

China Diabetes Devices Market Industry Trends & Analysis

The China diabetes devices market is poised for substantial expansion, driven by a confluence of factors including a rapidly aging population, increasingly sedentary lifestyles, and a growing awareness of diabetes management. The CAGR for the diabetes devices market in China is projected to be robust, estimated at xx% during the forecast period. Market penetration for advanced diabetes technologies, such as continuous glucose monitoring (CGM), is steadily increasing, albeit from a lower base compared to developed markets. Technological disruptions are playing a pivotal role, with the integration of artificial intelligence (AI) and the Internet of Things (IoT) in diabetes devices promising enhanced patient outcomes and personalized treatment. Consumer preferences are increasingly leaning towards user-friendly, connected devices that offer real-time data and seamless integration with mobile applications for better diabetes management. This shift is creating significant demand for smart insulin pens, connected glucose meters, and sophisticated insulin pumps. The competitive dynamics are intensifying, with both global players and local manufacturers investing heavily in research and development to capture this lucrative market. The increasing focus on remote patient monitoring and telehealth solutions further amplifies the growth trajectory for these devices. Economic policies supporting the healthcare sector and initiatives aimed at improving access to chronic disease management are also acting as significant tailwinds for the market.

Leading Markets & Segments in China Diabetes Devices Market

Within the China diabetes devices market, the Monitoring Devices segment is currently dominant, with a significant portion attributed to Self-monitoring Blood Glucose (SMBG) Devices. This dominance is largely driven by their affordability, widespread availability, and established usage patterns among the vast diabetic population in China. Economic policies promoting accessible healthcare and the sheer volume of individuals diagnosed with diabetes, many of whom rely on traditional blood glucose monitoring, contribute to this segment's stronghold. However, the Continuous Glucose Monitoring (CGM) segment is exhibiting the most rapid growth, driven by technological advancements, increasing physician recommendations, and a growing patient demand for more comprehensive and real-time glucose insights.

The Management Devices segment, particularly Insulin Delivery Devices, represents another critical area of growth. Within this, Insulin Pumps are gaining traction among patients requiring intensive insulin therapy, reflecting a global trend towards automated insulin delivery systems. Insulin Syringes and Insulin Disposable Pens remain prevalent due to their established infrastructure and cost-effectiveness, serving a large segment of the market. The emerging adoption of Insulin Cartridges in Reusable Pens and the niche but growing interest in Insulin Jet Injectors highlight the evolving preferences for convenience and less invasive delivery methods. Government initiatives focused on improving diabetes care infrastructure and increasing access to advanced medical technologies are key drivers across both monitoring and management device segments. The sheer size of the Chinese population, coupled with rising diabetes rates, ensures continued high demand across all these sub-segments.

China Diabetes Devices Market Product Developments

Recent product developments in the China diabetes devices market are characterized by a strong emphasis on connectivity, accuracy, and user convenience. Innovations in continuous glucose monitoring (CGM) systems are offering real-time glucose readings with improved sensor longevity and reduced calibration requirements. The development of smart insulin delivery devices, such as Bluetooth-enabled insulin pens and sophisticated insulin pumps with hybrid closed-loop systems, is revolutionizing diabetes management by providing automated insulin adjustments and reducing the burden on patients. These advancements aim to provide greater control over glycemic fluctuations, minimize the risk of complications, and improve the overall quality of life for individuals living with diabetes. The integration of mobile applications and cloud-based platforms further enhances data sharing and facilitates remote patient monitoring, creating a more connected and personalized diabetes care ecosystem.

Key Drivers of China Diabetes Devices Market Growth

The China diabetes devices market is propelled by several key drivers. Firstly, the escalating prevalence of diabetes in China, driven by demographic shifts and lifestyle changes, creates a vast and continuously expanding patient pool. Secondly, technological advancements in glucose monitoring and insulin delivery systems are offering more accurate, convenient, and user-friendly solutions, driving adoption of newer technologies. Thirdly, government initiatives aimed at improving healthcare infrastructure and increasing access to chronic disease management tools are significantly boosting market growth. Finally, a growing health-conscious population and increasing disposable incomes are enabling greater investment in personal health and well-being, including advanced diabetes management devices.

Challenges in the China Diabetes Devices Market Market

Despite its significant growth potential, the China diabetes devices market faces several challenges. Regulatory hurdles and lengthy approval processes for new medical devices can impede market entry and product launches. Supply chain disruptions and logistics complexities, especially in a market as vast as China, can impact product availability and cost. Intense competition from both domestic and international players, leading to price pressures, is another significant challenge. Furthermore, lack of widespread awareness and understanding of advanced diabetes technologies among certain patient demographics and healthcare professionals can slow down adoption. The affordability of premium devices for a substantial portion of the population also remains a barrier.

Emerging Opportunities in China Diabetes Devices Market

Emerging opportunities in the China diabetes devices market are substantial and multifaceted. The increasing adoption of digital health solutions and telemedicine presents a significant avenue for growth in connected glucose meters and insulin delivery systems, enabling remote patient monitoring and personalized care. Strategic partnerships between global device manufacturers and local distributors or healthcare providers can unlock new market segments and accelerate product penetration. The growing focus on preventative healthcare and early diagnosis of diabetes creates a demand for screening and early intervention devices. Furthermore, the expansion of healthcare coverage and government support for chronic disease management are creating a favorable environment for innovative diabetes management technologies, including advanced CGM systems and automated insulin delivery solutions.

Leading Players in the China Diabetes Devices Market Sector

- Roche

- Eli Lilly

- Sanofi

- Medtronic

- Becton Dickinson & Company

- ARKRAY Inc

- Abbott

- ACON Laboratories Inc

- Novo Nordisk

- Bionime Corporation

- Johnson & Johnson

- SinoCare

- Rossmax International Ltd

- Ascensia Diabetes Care

Key Milestones in China Diabetes Devices Market Industry

- February 2023: Medtronic MiniMed's MiniMed670G BLE received China NMPA approval. This advanced insulin pump kit, transmitter kit, and glucose sensor integrates a hybrid closed-loop algorithm and electrochemical impedance spectroscopy technology for accurate sensor status monitoring, significantly enhancing diabetes management capabilities.

- June 2022: LifeScan's Real World Evidence, published in Diabetes Technology and Therapeutics (DTT), showcased improved glycemic control with the use of a Bluetooth-connected Blood Glucose Meter and a Mobile Diabetes Management Application. The OneTouch Reveal app paired with the OneTouch Verio Reflect meter via Bluetooth wireless technology exemplifies a pivotal tool for enhanced glycemic control.

Strategic Outlook for China Diabetes Devices Market Market

The strategic outlook for the China diabetes devices market is overwhelmingly positive, driven by a combination of demographic shifts, technological innovation, and increasing healthcare expenditure. Future growth will be accelerated by the continued expansion of digital health platforms, facilitating seamless data integration and remote patient monitoring, thereby enhancing treatment efficacy and patient convenience. Strategic investments in research and development for next-generation CGM systems and advanced insulin delivery devices, such as closed-loop systems, will be crucial for market leadership. Collaborations between international and domestic players will be key to navigating regulatory landscapes and expanding market reach. Furthermore, a sustained focus on improving accessibility and affordability of these devices will unlock further growth potential in this dynamic market.

China Diabetes Devices Market Segmentation

-

1. Monitoring Devices

- 1.1. Self-monitoring Blood Glucose Devices

- 1.2. Continuous Glucose Monitoring

-

2. Management Devices

-

2.1. Insulin Delivery Devices

- 2.1.1. Insulin Pump

- 2.1.2. Insulin Syringes

- 2.1.3. Insulin Disposable Pens

- 2.1.4. Insulin Cartridges in Reusable pens

- 2.1.5. Insulin Jet Injectors

-

2.1. Insulin Delivery Devices

China Diabetes Devices Market Segmentation By Geography

- 1. China

China Diabetes Devices Market Regional Market Share

Geographic Coverage of China Diabetes Devices Market

China Diabetes Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidence of Hematologic Cancer; Growing Demand for Personalized Therapy

- 3.3. Market Restrains

- 3.3.1. Unfavorable Reimbursement Scenario

- 3.4. Market Trends

- 3.4.1. Monitoring Devices Market is growing with the highest CAGR in forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Diabetes Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 5.1.1. Self-monitoring Blood Glucose Devices

- 5.1.2. Continuous Glucose Monitoring

- 5.2. Market Analysis, Insights and Forecast - by Management Devices

- 5.2.1. Insulin Delivery Devices

- 5.2.1.1. Insulin Pump

- 5.2.1.2. Insulin Syringes

- 5.2.1.3. Insulin Disposable Pens

- 5.2.1.4. Insulin Cartridges in Reusable pens

- 5.2.1.5. Insulin Jet Injectors

- 5.2.1. Insulin Delivery Devices

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Roche

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eli Lilly

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sanofi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Medtronic

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Becton Dickinson & Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ARKRAY Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abbott

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ACON Laboratories Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Novo Nordisk

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bionime Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Johnson & Johnson

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SinoCare

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Rossmax International Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Ascensia Diabetes Care

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Roche

List of Figures

- Figure 1: China Diabetes Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Diabetes Devices Market Share (%) by Company 2025

List of Tables

- Table 1: China Diabetes Devices Market Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 2: China Diabetes Devices Market Volume K Unit Forecast, by Monitoring Devices 2020 & 2033

- Table 3: China Diabetes Devices Market Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 4: China Diabetes Devices Market Volume K Unit Forecast, by Management Devices 2020 & 2033

- Table 5: China Diabetes Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China Diabetes Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: China Diabetes Devices Market Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 8: China Diabetes Devices Market Volume K Unit Forecast, by Monitoring Devices 2020 & 2033

- Table 9: China Diabetes Devices Market Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 10: China Diabetes Devices Market Volume K Unit Forecast, by Management Devices 2020 & 2033

- Table 11: China Diabetes Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: China Diabetes Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Diabetes Devices Market?

The projected CAGR is approximately 4.66%.

2. Which companies are prominent players in the China Diabetes Devices Market?

Key companies in the market include Roche, Eli Lilly, Sanofi, Medtronic, Becton Dickinson & Company, ARKRAY Inc, Abbott, ACON Laboratories Inc, Novo Nordisk, Bionime Corporation, Johnson & Johnson, SinoCare, Rossmax International Ltd , Ascensia Diabetes Care.

3. What are the main segments of the China Diabetes Devices Market?

The market segments include Monitoring Devices, Management Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidence of Hematologic Cancer; Growing Demand for Personalized Therapy.

6. What are the notable trends driving market growth?

Monitoring Devices Market is growing with the highest CAGR in forecast period.

7. Are there any restraints impacting market growth?

Unfavorable Reimbursement Scenario.

8. Can you provide examples of recent developments in the market?

February 2023: The MiniMed670G BLE, developed by Medtronic MiniMed, has received approval from the China NMPA. This advanced product includes an insulin pump kit, transmitter kit, and glucose sensor. It incorporates two key technologies: a hybrid closed-loop algorithm for auto mode and electrochemical impedance spectroscopy technology to monitor sensor status, ensuring accurate glucose readings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Diabetes Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Diabetes Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Diabetes Devices Market?

To stay informed about further developments, trends, and reports in the China Diabetes Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence