Key Insights

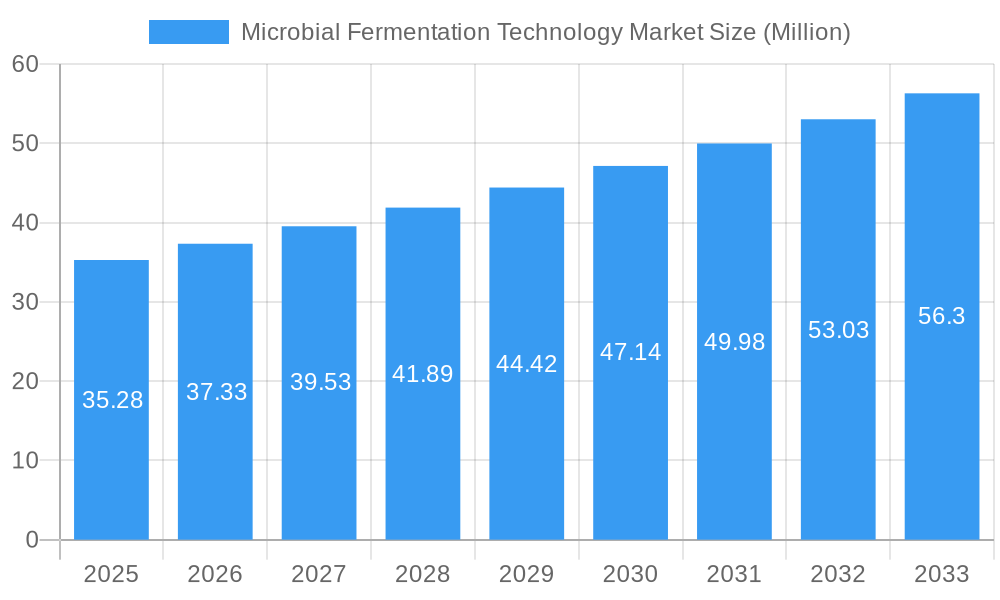

The global Microbial Fermentation Technology Market is poised for significant expansion, projected to reach $35.28 million by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 5.88% through 2033. This upward trajectory is primarily fueled by the escalating demand for biopharmaceuticals, including antibiotics, monoclonal antibodies, and recombinant proteins, driven by advancements in healthcare and the growing prevalence of chronic diseases. The increasing adoption of biosimilars, offering cost-effective alternatives to originator biologics, further propels market growth. Moreover, the expanding applications of enzymes in various industries, from food and beverages to biofuels and diagnostics, alongside the critical role of vaccines in global health initiatives, are substantial market drivers. The continuous innovation in fermentation techniques, leading to higher yields and improved efficiency, coupled with substantial investments in research and development by key players, are also instrumental in shaping a positive market outlook.

Microbial Fermentation Technology Market Market Size (In Million)

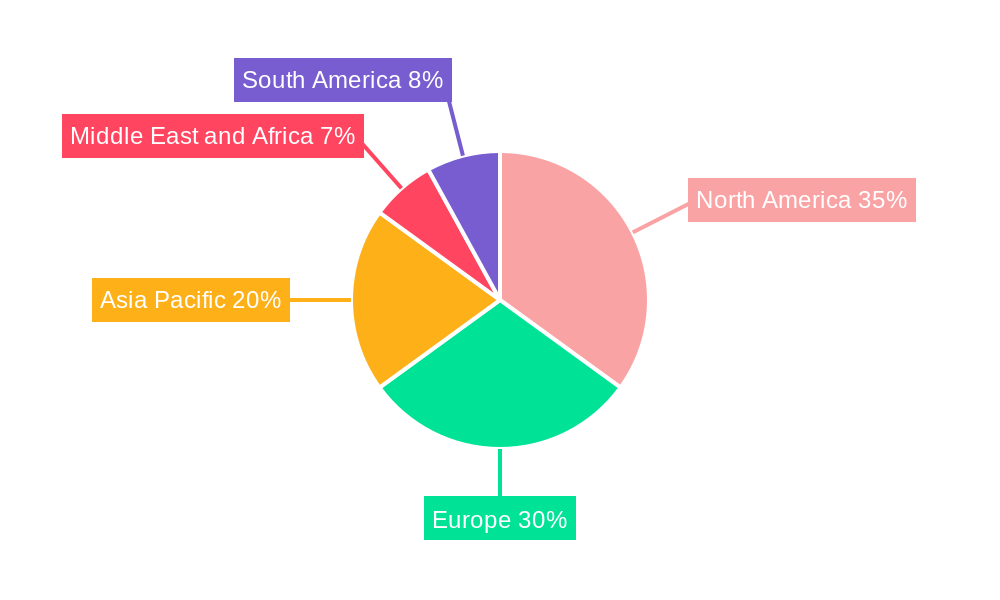

The market's expansion is further supported by the increasing outsourcing of manufacturing processes to Contract Development and Manufacturing Organizations (CDMOs) and Contract Research Organizations (CROs) by bio-pharmaceutical companies, enabling greater focus on core competencies. Academic and research institutes also play a pivotal role in driving innovation and exploring novel fermentation applications. While the market benefits from these drivers, potential restraints such as stringent regulatory hurdles for new product approvals, the high capital investment required for advanced fermentation facilities, and the complexity of scaling up bioprocesses may present challenges. Geographically, North America and Europe currently dominate the market due to established biopharmaceutical industries and significant R&D spending. However, the Asia Pacific region is expected to witness the fastest growth, driven by favorable government initiatives, a growing biotechnology sector, and increasing investments in the region.

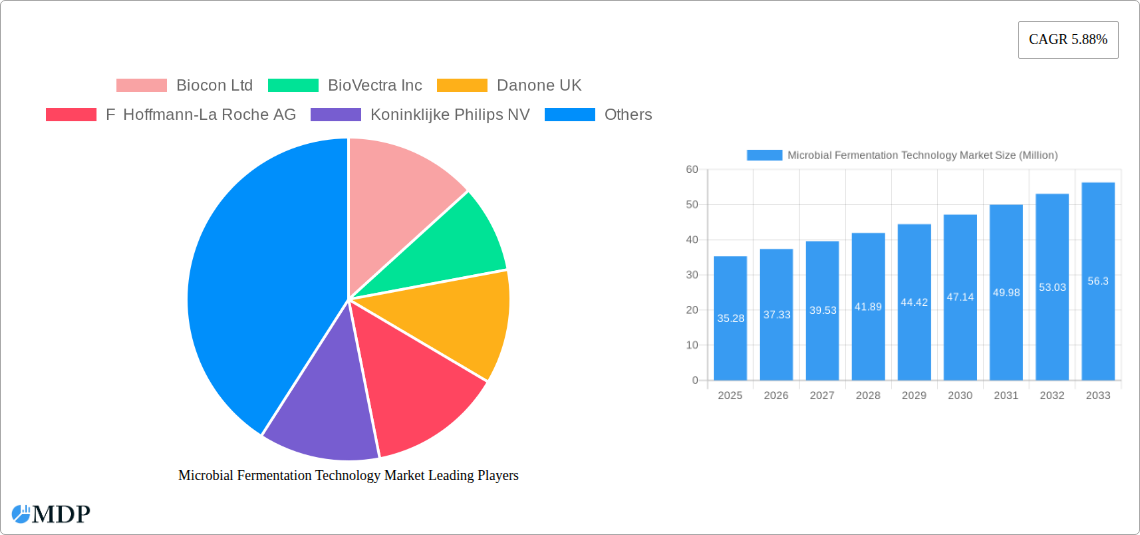

Microbial Fermentation Technology Market Company Market Share

This in-depth report provides a definitive analysis of the global Microbial Fermentation Technology Market, charting its trajectory from 2019 to 2033, with a focused outlook on the base year 2025 and the forecast period 2025–2033. Delve into the intricate dynamics, emerging trends, and strategic imperatives shaping this rapidly evolving sector. Our research offers actionable insights for stakeholders across bio-pharmaceutical companies, Contract Research Organizations (CROs), CMOs and CDMOs, and academic and research institutes. Explore key applications including Antibiotics, Monoclonal Antibodies, Recombinant Proteins, Biosimilars, Vaccines, Enzymes, and Small Molecules, understanding their market penetration and future potential.

Microbial Fermentation Technology Market Dynamics & Concentration

The Microbial Fermentation Technology Market is characterized by a dynamic interplay of innovation, stringent regulatory oversight, and a growing demand for bio-based products. Market concentration is moderate, with several key players holding significant market share, particularly in established segments like antibiotics and enzymes. However, the rise of novel applications such as monoclonal antibodies and biosimilars is fostering increased competition and driving innovation. Technological advancements in bioprocess optimization, genetic engineering, and downstream processing are key innovation drivers, enabling higher yields and purer products. Regulatory frameworks, including those from the FDA and EMA, play a crucial role in product approval and market access, influencing research and development priorities. Product substitutes, while present in some traditional applications, are increasingly being challenged by the superior efficacy and specificity offered by fermentation-derived products. End-user trends indicate a strong preference for scalable, cost-effective, and sustainable manufacturing solutions, pushing for greater adoption of advanced fermentation techniques. Mergers and acquisition (M&A) activities are observed as companies seek to expand their technological capabilities, product portfolios, and market reach. For instance, in the historical period 2019-2024, we observed an estimated 15-20 M&A deals aimed at consolidating market presence and acquiring specialized expertise. The market share of leading players in specific segments can range from 10% to 25%, reflecting a fragmented yet consolidating landscape.

Microbial Fermentation Technology Market Industry Trends & Analysis

The Microbial Fermentation Technology Market is poised for significant expansion, driven by a confluence of factors including increasing healthcare expenditure, a rising prevalence of chronic diseases, and a growing demand for sustainable biomanufacturing. The market penetration of microbial fermentation technologies is steadily increasing across diverse applications, from the production of life-saving pharmaceuticals to industrial enzymes and bio-based chemicals. A projected Compound Annual Growth Rate (CAGR) of 7.5% to 9.0% is anticipated during the forecast period 2025–2033, underscoring robust growth prospects. Technological disruptions, such as advancements in synthetic biology, CRISPR-based gene editing, and continuous bioprocessing, are revolutionizing fermentation efficiency, enabling the production of complex biomolecules with enhanced yields and reduced costs. Consumer preferences are shifting towards bio-derived and sustainable products, further fueling the adoption of fermentation technologies in sectors beyond pharmaceuticals, including food and beverage, agriculture, and materials science. Competitive dynamics are intensifying, with both established biopharmaceutical giants and agile biotechnology startups vying for market dominance. Key market growth drivers include the burgeoning demand for biologics, the expiration of patents for blockbuster drugs leading to increased production of biosimilars, and the global push for green chemistry and sustainable manufacturing practices. Furthermore, the development of novel microbial strains and optimized fermentation media are contributing to improved productivity and cost-effectiveness. The market is also witnessing a trend towards personalized medicine and the development of highly specific therapeutic proteins, which are often best produced through microbial fermentation. The increasing investment in research and development by both private and public entities further propels the industry forward.

Leading Markets & Segments in Microbial Fermentation Technology Market

The Microbial Fermentation Technology Market demonstrates varied regional dominance and segment growth. North America, particularly the United States, currently leads the market due to its robust bio-pharmaceutical infrastructure, significant R&D investments, and favorable regulatory environment. Key drivers for this dominance include strong government funding for biotechnology research and a high concentration of leading bio-pharmaceutical companies and Contract Research Organizations (CROs). Asia Pacific is emerging as a rapid growth region, driven by increasing healthcare expenditure, a growing manufacturing base, and supportive government policies aimed at fostering domestic biomanufacturing capabilities.

Within the Application segment, Monoclonal Antibodies and Recombinant Proteins are experiencing exponential growth. These high-value therapeutics are critical in treating a wide range of diseases, from cancer to autoimmune disorders. The increasing pipeline of biologics and the growing demand for targeted therapies are propelling the expansion of these segments.

- Monoclonal Antibodies: Driven by advancements in therapeutic antibody engineering and the rising incidence of chronic diseases, this segment is a major growth engine. Key drivers include the increasing prevalence of cancer and autoimmune diseases, and the ongoing development of novel therapeutic antibodies.

- Recombinant Proteins: Essential for various therapeutic and industrial applications, this segment benefits from advancements in protein expression systems and purification technologies. Economic policies favoring biotechnological innovation and strong demand from the healthcare sector contribute to its growth.

- Biosimilars: As patents for blockbuster biologic drugs expire, the demand for cost-effective biosimilars is surging, presenting a significant growth opportunity.

In terms of End User, Bio-pharmaceutical Companies represent the largest and most influential segment. Their extensive R&D pipelines, significant manufacturing capacities, and substantial market reach make them primary adopters and drivers of microbial fermentation technologies.

- Bio-pharmaceutical Companies: Their continuous innovation and need for scalable, efficient production of complex biologics make them the backbone of the market. Infrastructure development for advanced biomanufacturing facilities is a key factor here.

- CMOs and CDMOs: Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) are increasingly crucial, offering specialized expertise and manufacturing capacity to a growing number of biotech firms.

Microbial Fermentation Technology Market Product Developments

Product developments in the Microbial Fermentation Technology Market are primarily focused on enhancing process efficiency, improving product yield and purity, and enabling the production of novel biomolecules. Innovations include the development of genetically engineered microbial strains with superior production capabilities, advanced bioreactor designs for optimized control and scalability, and sophisticated downstream processing techniques for efficient product recovery. These advancements cater to the growing demand for biologics, such as monoclonal antibodies and recombinant proteins, and also support the production of biosimilars and vaccines. The competitive advantage lies in achieving lower production costs, higher quality products, and faster time-to-market, crucial for stakeholders in the bio-pharmaceutical and CMO/CDMO sectors.

Key Drivers of Microbial Fermentation Technology Market Growth

The Microbial Fermentation Technology Market is propelled by a multi-faceted growth trajectory. Technological advancements in areas like synthetic biology, metabolic engineering, and continuous bioprocessing are central, enabling higher yields and more complex molecule production. Economic factors, including increasing global healthcare expenditure and the growing demand for cost-effective biologics and biosimilars, are significant drivers. Furthermore, regulatory support for biomanufacturing and the increasing focus on sustainable production methods are creating a favorable environment for market expansion. For example, government initiatives promoting domestic biopharmaceutical production in emerging economies are a key economic driver.

Challenges in the Microbial Fermentation Technology Market Market

Despite its promising growth, the Microbial Fermentation Technology Market faces several challenges. Regulatory hurdles for new product approvals and stringent compliance requirements can impede market entry and increase development costs. Supply chain complexities for specialized raw materials and equipment can lead to production delays and cost escalations. Intense competitive pressures and the need for continuous innovation to stay ahead of technological advancements also pose significant challenges. Furthermore, the high capital investment required for setting up and maintaining state-of-the-art fermentation facilities can be a barrier for smaller players. The potential for process failures and the need for robust quality control systems also add to operational challenges.

Emerging Opportunities in Microbial Fermentation Technology Market

Emerging opportunities within the Microbial Fermentation Technology Market are abundant and poised to drive long-term growth. Technological breakthroughs in areas such as AI-driven process optimization and advanced cell-free protein synthesis are opening new avenues for product development and manufacturing efficiency. Strategic partnerships between technology providers, biopharmaceutical companies, and academic institutions are fostering collaborative innovation and accelerating the translation of research into commercial applications. Market expansion into underdeveloped regions and the burgeoning demand for bio-based alternatives in sectors like food, agriculture, and sustainable materials present substantial growth potential. The increasing focus on personalized medicine and the development of novel therapeutic modalities, such as gene therapies, also offer significant future opportunities for microbial fermentation technologies.

Leading Players in the Microbial Fermentation Technology Market Sector

- Biocon Ltd

- BioVectra Inc

- Danone UK

- F Hoffmann-La Roche AG

- Koninklijke Philips NV

- Lonza

- Novozymes AS

- TerraVia Holdings Inc

- BIOZEEN

- Abbvie Inc

Key Milestones in Microbial Fermentation Technology Market Industry

- March 2024: Novel Bio partnered with Culture Biosciences to accelerate the development of scalable fermentation processes for their NBx Platform, focusing on plasmid DNA production for genetic medicines.

- June 2024: Danone, Michelin, DMC Biotechnologies, and Crédit Agricole Centre France established the Biotech Open Platform to enhance advanced fermentation process development, with a focus on scaling precision fermentation for bio-based materials.

Strategic Outlook for Microbial Fermentation Technology Market Market

The strategic outlook for the Microbial Fermentation Technology Market is exceptionally bright, driven by an increasing reliance on biotechnological solutions across diverse industries. Future growth accelerators include the continued expansion of the biologics market, the persistent demand for sustainable and bio-based products, and advancements in precision fermentation techniques. Companies are expected to invest heavily in R&D to develop novel microbial strains, optimize fermentation processes, and enhance downstream purification methods. Strategic collaborations and partnerships will be crucial for leveraging specialized expertise and accessing new markets. The market is likely to witness increased consolidation as larger players acquire innovative startups to bolster their technological portfolios and expand their service offerings, further solidifying the market's trajectory towards advanced and sustainable biomanufacturing.

Microbial Fermentation Technology Market Segmentation

-

1. Application

- 1.1. Antibiotics

- 1.2. Monoclonal Antibodies

- 1.3. Recombinant Proteins

- 1.4. Biosimilars

- 1.5. Vaccines

- 1.6. Enzymes

- 1.7. Small Molecules

- 1.8. Other Applications

-

2. End User

- 2.1. Bio-pharmaceutical Companies

- 2.2. Contract Research Organizations (CROs)

- 2.3. CMOs and CDMOs

- 2.4. Academic and Research Institutes

Microbial Fermentation Technology Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Microbial Fermentation Technology Market Regional Market Share

Geographic Coverage of Microbial Fermentation Technology Market

Microbial Fermentation Technology Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Biotech-based Drugs; Rising Research and Development Activities to Produce Novel Biological Drugs; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Biotech-based Drugs; Rising Research and Development Activities to Produce Novel Biological Drugs; Technological Advancements

- 3.4. Market Trends

- 3.4.1. The Bio-pharmaceutical Companies Segment Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Microbial Fermentation Technology Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Antibiotics

- 5.1.2. Monoclonal Antibodies

- 5.1.3. Recombinant Proteins

- 5.1.4. Biosimilars

- 5.1.5. Vaccines

- 5.1.6. Enzymes

- 5.1.7. Small Molecules

- 5.1.8. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Bio-pharmaceutical Companies

- 5.2.2. Contract Research Organizations (CROs)

- 5.2.3. CMOs and CDMOs

- 5.2.4. Academic and Research Institutes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Microbial Fermentation Technology Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Antibiotics

- 6.1.2. Monoclonal Antibodies

- 6.1.3. Recombinant Proteins

- 6.1.4. Biosimilars

- 6.1.5. Vaccines

- 6.1.6. Enzymes

- 6.1.7. Small Molecules

- 6.1.8. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Bio-pharmaceutical Companies

- 6.2.2. Contract Research Organizations (CROs)

- 6.2.3. CMOs and CDMOs

- 6.2.4. Academic and Research Institutes

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Microbial Fermentation Technology Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Antibiotics

- 7.1.2. Monoclonal Antibodies

- 7.1.3. Recombinant Proteins

- 7.1.4. Biosimilars

- 7.1.5. Vaccines

- 7.1.6. Enzymes

- 7.1.7. Small Molecules

- 7.1.8. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Bio-pharmaceutical Companies

- 7.2.2. Contract Research Organizations (CROs)

- 7.2.3. CMOs and CDMOs

- 7.2.4. Academic and Research Institutes

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Microbial Fermentation Technology Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Antibiotics

- 8.1.2. Monoclonal Antibodies

- 8.1.3. Recombinant Proteins

- 8.1.4. Biosimilars

- 8.1.5. Vaccines

- 8.1.6. Enzymes

- 8.1.7. Small Molecules

- 8.1.8. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Bio-pharmaceutical Companies

- 8.2.2. Contract Research Organizations (CROs)

- 8.2.3. CMOs and CDMOs

- 8.2.4. Academic and Research Institutes

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East and Africa Microbial Fermentation Technology Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Antibiotics

- 9.1.2. Monoclonal Antibodies

- 9.1.3. Recombinant Proteins

- 9.1.4. Biosimilars

- 9.1.5. Vaccines

- 9.1.6. Enzymes

- 9.1.7. Small Molecules

- 9.1.8. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Bio-pharmaceutical Companies

- 9.2.2. Contract Research Organizations (CROs)

- 9.2.3. CMOs and CDMOs

- 9.2.4. Academic and Research Institutes

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. South America Microbial Fermentation Technology Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Antibiotics

- 10.1.2. Monoclonal Antibodies

- 10.1.3. Recombinant Proteins

- 10.1.4. Biosimilars

- 10.1.5. Vaccines

- 10.1.6. Enzymes

- 10.1.7. Small Molecules

- 10.1.8. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Bio-pharmaceutical Companies

- 10.2.2. Contract Research Organizations (CROs)

- 10.2.3. CMOs and CDMOs

- 10.2.4. Academic and Research Institutes

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Biocon Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BioVectra Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Danone UK

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 F Hoffmann-La Roche AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Koninklijke Philips NV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lonza

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Novozymes AS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TerraVia Holdings Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BIOZEEN

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Abbvie Inc *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Biocon Ltd

List of Figures

- Figure 1: Global Microbial Fermentation Technology Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Microbial Fermentation Technology Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Microbial Fermentation Technology Market Revenue (Million), by Application 2025 & 2033

- Figure 4: North America Microbial Fermentation Technology Market Volume (Billion), by Application 2025 & 2033

- Figure 5: North America Microbial Fermentation Technology Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Microbial Fermentation Technology Market Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Microbial Fermentation Technology Market Revenue (Million), by End User 2025 & 2033

- Figure 8: North America Microbial Fermentation Technology Market Volume (Billion), by End User 2025 & 2033

- Figure 9: North America Microbial Fermentation Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Microbial Fermentation Technology Market Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Microbial Fermentation Technology Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Microbial Fermentation Technology Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Microbial Fermentation Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Microbial Fermentation Technology Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Microbial Fermentation Technology Market Revenue (Million), by Application 2025 & 2033

- Figure 16: Europe Microbial Fermentation Technology Market Volume (Billion), by Application 2025 & 2033

- Figure 17: Europe Microbial Fermentation Technology Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Microbial Fermentation Technology Market Volume Share (%), by Application 2025 & 2033

- Figure 19: Europe Microbial Fermentation Technology Market Revenue (Million), by End User 2025 & 2033

- Figure 20: Europe Microbial Fermentation Technology Market Volume (Billion), by End User 2025 & 2033

- Figure 21: Europe Microbial Fermentation Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Microbial Fermentation Technology Market Volume Share (%), by End User 2025 & 2033

- Figure 23: Europe Microbial Fermentation Technology Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Microbial Fermentation Technology Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Microbial Fermentation Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Microbial Fermentation Technology Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Microbial Fermentation Technology Market Revenue (Million), by Application 2025 & 2033

- Figure 28: Asia Pacific Microbial Fermentation Technology Market Volume (Billion), by Application 2025 & 2033

- Figure 29: Asia Pacific Microbial Fermentation Technology Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Microbial Fermentation Technology Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Asia Pacific Microbial Fermentation Technology Market Revenue (Million), by End User 2025 & 2033

- Figure 32: Asia Pacific Microbial Fermentation Technology Market Volume (Billion), by End User 2025 & 2033

- Figure 33: Asia Pacific Microbial Fermentation Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 34: Asia Pacific Microbial Fermentation Technology Market Volume Share (%), by End User 2025 & 2033

- Figure 35: Asia Pacific Microbial Fermentation Technology Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Microbial Fermentation Technology Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Microbial Fermentation Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Microbial Fermentation Technology Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Microbial Fermentation Technology Market Revenue (Million), by Application 2025 & 2033

- Figure 40: Middle East and Africa Microbial Fermentation Technology Market Volume (Billion), by Application 2025 & 2033

- Figure 41: Middle East and Africa Microbial Fermentation Technology Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East and Africa Microbial Fermentation Technology Market Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East and Africa Microbial Fermentation Technology Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Middle East and Africa Microbial Fermentation Technology Market Volume (Billion), by End User 2025 & 2033

- Figure 45: Middle East and Africa Microbial Fermentation Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Middle East and Africa Microbial Fermentation Technology Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Middle East and Africa Microbial Fermentation Technology Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Microbial Fermentation Technology Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East and Africa Microbial Fermentation Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Microbial Fermentation Technology Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Microbial Fermentation Technology Market Revenue (Million), by Application 2025 & 2033

- Figure 52: South America Microbial Fermentation Technology Market Volume (Billion), by Application 2025 & 2033

- Figure 53: South America Microbial Fermentation Technology Market Revenue Share (%), by Application 2025 & 2033

- Figure 54: South America Microbial Fermentation Technology Market Volume Share (%), by Application 2025 & 2033

- Figure 55: South America Microbial Fermentation Technology Market Revenue (Million), by End User 2025 & 2033

- Figure 56: South America Microbial Fermentation Technology Market Volume (Billion), by End User 2025 & 2033

- Figure 57: South America Microbial Fermentation Technology Market Revenue Share (%), by End User 2025 & 2033

- Figure 58: South America Microbial Fermentation Technology Market Volume Share (%), by End User 2025 & 2033

- Figure 59: South America Microbial Fermentation Technology Market Revenue (Million), by Country 2025 & 2033

- Figure 60: South America Microbial Fermentation Technology Market Volume (Billion), by Country 2025 & 2033

- Figure 61: South America Microbial Fermentation Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Microbial Fermentation Technology Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Microbial Fermentation Technology Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Microbial Fermentation Technology Market Volume Billion Forecast, by Application 2020 & 2033

- Table 3: Global Microbial Fermentation Technology Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Microbial Fermentation Technology Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Global Microbial Fermentation Technology Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Microbial Fermentation Technology Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Microbial Fermentation Technology Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Microbial Fermentation Technology Market Volume Billion Forecast, by Application 2020 & 2033

- Table 9: Global Microbial Fermentation Technology Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global Microbial Fermentation Technology Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Global Microbial Fermentation Technology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Microbial Fermentation Technology Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global Microbial Fermentation Technology Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Microbial Fermentation Technology Market Volume Billion Forecast, by Application 2020 & 2033

- Table 21: Global Microbial Fermentation Technology Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global Microbial Fermentation Technology Market Volume Billion Forecast, by End User 2020 & 2033

- Table 23: Global Microbial Fermentation Technology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Microbial Fermentation Technology Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Germany Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: France Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Italy Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Spain Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Global Microbial Fermentation Technology Market Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Microbial Fermentation Technology Market Volume Billion Forecast, by Application 2020 & 2033

- Table 39: Global Microbial Fermentation Technology Market Revenue Million Forecast, by End User 2020 & 2033

- Table 40: Global Microbial Fermentation Technology Market Volume Billion Forecast, by End User 2020 & 2033

- Table 41: Global Microbial Fermentation Technology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Microbial Fermentation Technology Market Volume Billion Forecast, by Country 2020 & 2033

- Table 43: China Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: China Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Japan Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: India Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Australia Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Australia Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: South Korea Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: South Korea Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Global Microbial Fermentation Technology Market Revenue Million Forecast, by Application 2020 & 2033

- Table 56: Global Microbial Fermentation Technology Market Volume Billion Forecast, by Application 2020 & 2033

- Table 57: Global Microbial Fermentation Technology Market Revenue Million Forecast, by End User 2020 & 2033

- Table 58: Global Microbial Fermentation Technology Market Volume Billion Forecast, by End User 2020 & 2033

- Table 59: Global Microbial Fermentation Technology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Microbial Fermentation Technology Market Volume Billion Forecast, by Country 2020 & 2033

- Table 61: GCC Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: GCC Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: South Africa Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Global Microbial Fermentation Technology Market Revenue Million Forecast, by Application 2020 & 2033

- Table 68: Global Microbial Fermentation Technology Market Volume Billion Forecast, by Application 2020 & 2033

- Table 69: Global Microbial Fermentation Technology Market Revenue Million Forecast, by End User 2020 & 2033

- Table 70: Global Microbial Fermentation Technology Market Volume Billion Forecast, by End User 2020 & 2033

- Table 71: Global Microbial Fermentation Technology Market Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Microbial Fermentation Technology Market Volume Billion Forecast, by Country 2020 & 2033

- Table 73: Brazil Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Argentina Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Microbial Fermentation Technology Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Microbial Fermentation Technology Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Microbial Fermentation Technology Market?

The projected CAGR is approximately 5.88%.

2. Which companies are prominent players in the Microbial Fermentation Technology Market?

Key companies in the market include Biocon Ltd, BioVectra Inc, Danone UK, F Hoffmann-La Roche AG, Koninklijke Philips NV, Lonza, Novozymes AS, TerraVia Holdings Inc, BIOZEEN, Abbvie Inc *List Not Exhaustive.

3. What are the main segments of the Microbial Fermentation Technology Market?

The market segments include Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Biotech-based Drugs; Rising Research and Development Activities to Produce Novel Biological Drugs; Technological Advancements.

6. What are the notable trends driving market growth?

The Bio-pharmaceutical Companies Segment Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Demand for Biotech-based Drugs; Rising Research and Development Activities to Produce Novel Biological Drugs; Technological Advancements.

8. Can you provide examples of recent developments in the market?

March 2024: Novel Bio, a frontrunner in advanced biomanufacturing technologies for plasmid DNA utilized in genetic medicines, partnered with Culture Biosciences. This collaboration aims to expedite the development of scalable fermentation processes for Novel Bio's proprietary NBx Platform, which is dedicated to plasmid DNA production.June 2024: French industrial giants Danone and Michelin, alongside American startup DMC Biotechnologies and Crédit Agricole Centre France, partnered to establish the Biotech Open Platform. This initiative aims to enhance the development of advanced fermentation processes, with a particular focus on scaling up precision fermentation. Precision fermentation stands out as a groundbreaking biotechnological method for producing bio-based materials and ingredients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Microbial Fermentation Technology Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Microbial Fermentation Technology Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Microbial Fermentation Technology Market?

To stay informed about further developments, trends, and reports in the Microbial Fermentation Technology Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence