Key Insights

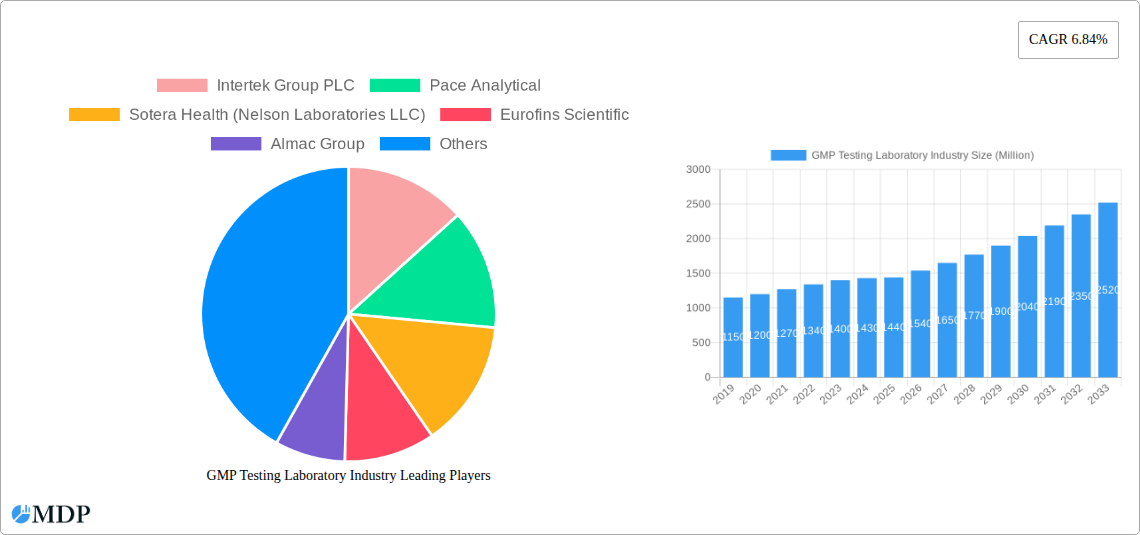

The GMP Testing Laboratory Industry is poised for significant expansion, with a current market size estimated at $1.44 billion in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 6.84% through 2033. This robust growth is primarily fueled by increasing regulatory stringency worldwide, demanding stringent adherence to Good Manufacturing Practices (GMP) for pharmaceuticals, biopharmaceuticals, and medical devices. The escalating complexity of drug development and the continuous launch of novel therapies necessitate sophisticated and reliable testing services to ensure product safety, efficacy, and quality. Furthermore, the growing emphasis on outsourcing by pharmaceutical and biopharmaceutical companies to specialized contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) is a major catalyst. These companies leverage the expertise and advanced infrastructure of GMP testing laboratories to accelerate product development timelines and reduce operational costs. The expanding global healthcare infrastructure and the increasing prevalence of chronic diseases also contribute to a higher demand for quality-assured pharmaceutical products, thereby driving the need for comprehensive GMP testing.

GMP Testing Laboratory Industry Market Size (In Billion)

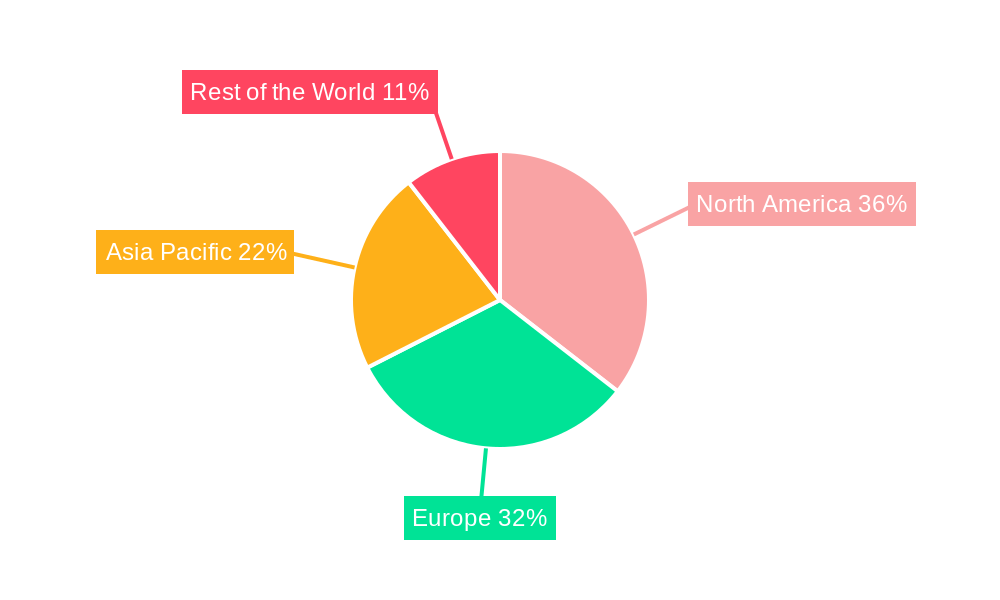

Key market segments within the GMP Testing Laboratory Industry include Product Validation Testing, Bioanalytical Services, and Packaging and Shelf-Life Testing, catering to a diverse range of end-users such as Pharmaceutical and Biopharmaceutical Companies and Medical Devices Companies. Geographically, North America and Europe currently represent dominant markets due to their well-established regulatory frameworks and high concentration of leading pharmaceutical and medical device manufacturers. However, the Asia Pacific region is expected to witness the fastest growth, driven by expanding manufacturing capabilities, increasing R&D investments, and a growing number of domestic and international companies establishing their presence. While the industry benefits from strong growth drivers, it also faces certain restraints, including the high cost of sophisticated analytical equipment and the shortage of skilled personnel in specialized testing areas. Nevertheless, ongoing technological advancements, such as the adoption of automation and artificial intelligence in laboratory operations, are expected to mitigate these challenges and further propel market expansion.

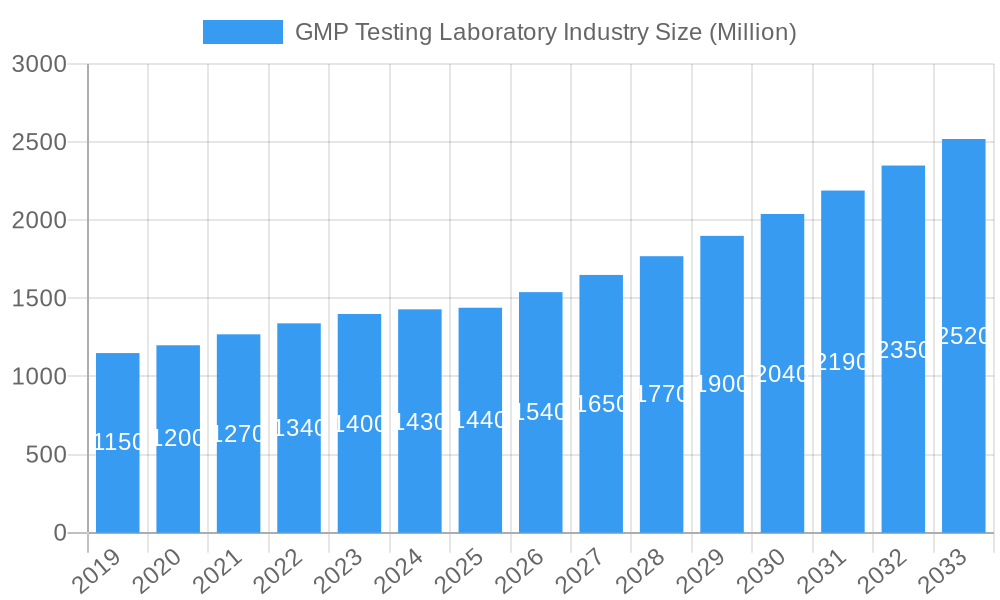

GMP Testing Laboratory Industry Company Market Share

GMP Testing Laboratory Industry: Comprehensive Market Analysis and Strategic Insights (2019–2033)

This in-depth report offers a definitive analysis of the global GMP Testing Laboratory Industry, providing critical insights for stakeholders across the pharmaceutical, biopharmaceutical, and medical device sectors. Delve into market dynamics, key trends, leading players, and future projections from 2019 to 2033, with a base year of 2025. Understand the forces shaping this vital industry, from regulatory evolution to technological advancements.

GMP Testing Laboratory Industry Market Dynamics & Concentration

The GMP Testing Laboratory Industry exhibits a moderate to high market concentration, with a few dominant players holding significant market share. Innovation drivers, such as the increasing complexity of drug development and stringent regulatory requirements, fuel the demand for advanced testing services. Regulatory frameworks, including those from the FDA, EMA, and other national health authorities, are paramount, dictating the standards and methodologies for GMP testing. Product substitutes are limited, as specialized GMP testing requires specific expertise and validated processes. End-user trends point towards an increasing reliance on outsourced testing due to the high capital investment and specialized talent required for in-house facilities. Mergers and Acquisitions (M&A) activities are prevalent as larger entities seek to expand their service portfolios and geographical reach. For instance, the acquisition of smaller, niche testing labs by established players is a common strategy to gain market share and new capabilities. We anticipate over 150 M&A deals within the forecast period. Key players like Eurofins Scientific and Intertek Group PLC command substantial market share, estimated at over 15% each.

GMP Testing Laboratory Industry Industry Trends & Analysis

The GMP Testing Laboratory Industry is experiencing robust growth, driven by several key factors. The increasing complexity of pharmaceutical and biopharmaceutical products, particularly in areas like biologics, cell and gene therapies, necessitates sophisticated and validated analytical testing. This fuels the demand for advanced bioanalytical services and product validation testing. The ever-evolving regulatory landscape, with stricter guidelines and increased enforcement, compels companies to invest more in comprehensive GMP compliance testing to ensure product safety and efficacy. Technological disruptions are also playing a significant role. The adoption of automation, artificial intelligence (AI) in data analysis, and advanced analytical instrumentation are enhancing efficiency, accuracy, and speed in testing processes. Consumer preferences for safer and more effective medicines and medical devices also indirectly drive the demand for rigorous GMP testing. The competitive dynamics within the industry are characterized by intense competition on service quality, turnaround times, and specialized expertise. Companies are increasingly differentiating themselves by offering end-to-end solutions, from early-stage development testing to post-market surveillance. The Compound Annual Growth Rate (CAGR) for the GMP Testing Laboratory Industry is projected to be XX% during the forecast period. Market penetration of specialized GMP testing services is expected to rise significantly, particularly in emerging economies as their pharmaceutical industries mature. The global market penetration rate is estimated to reach over 65% by 2033.

Leading Markets & Segments in GMP Testing Laboratory Industry

The Pharmaceutical and Biopharmaceutical Companies segment represents the dominant end-user in the GMP Testing Laboratory Industry. This dominance is attributed to the inherently high regulatory requirements and the critical need for product safety and efficacy in drug development and manufacturing. Key drivers for this segment's leadership include the escalating investment in R&D by pharmaceutical giants, the growing pipeline of complex biologics and biosimilars, and the increasing prevalence of chronic diseases globally, necessitating continuous drug development and, consequently, extensive testing.

Within the service types, Product Validation Testing and Bioanalytical Services are the leading segments. Product validation testing is crucial for ensuring that products meet all design specifications and regulatory requirements before market release. Bioanalytical services are indispensable for drug discovery and development, providing essential data on drug absorption, distribution, metabolism, and excretion (ADME).

- Key Drivers for Product Validation Testing Dominance:

- Stringent regulatory mandates for product quality and performance.

- Increased complexity of medical devices and combination products.

- Focus on patient safety and risk mitigation.

- Key Drivers for Bioanalytical Services Dominance:

- Growth of the biologics and biosimilar market.

- Advancements in biomarker discovery and validation.

- Requirement for robust pharmacokinetic and pharmacodynamic data.

Geographically, North America and Europe are the leading markets due to the well-established pharmaceutical and biotechnology industries, robust regulatory frameworks, and significant R&D expenditure. The increasing focus on outsourced testing services in these regions further solidifies their market leadership.

GMP Testing Laboratory Industry Product Developments

Recent product developments in the GMP Testing Laboratory Industry are characterized by advancements in analytical technologies and integrated service offerings. Innovations are focusing on enhancing throughput, improving sensitivity and specificity of tests, and enabling faster turnaround times. The integration of AI and machine learning for data analysis and predictive modeling is a significant trend, offering competitive advantages. Furthermore, the development of specialized testing solutions for emerging therapeutic areas like cell and gene therapy is a key focus. These advancements cater to the growing demand for more precise, efficient, and compliant testing methods, ensuring the quality and safety of novel pharmaceutical and medical device products.

Key Drivers of GMP Testing Laboratory Industry Growth

Several key factors are driving the substantial growth of the GMP Testing Laboratory Industry. Technological advancements in analytical instrumentation, automation, and data processing are enhancing the efficiency and accuracy of testing services, making them more accessible and cost-effective for clients. Increasing regulatory stringency globally, with stricter compliance requirements for product safety and efficacy, necessitates more comprehensive and robust GMP testing. The outsourcing trend among pharmaceutical and medical device companies, driven by the need to reduce capital expenditure and leverage specialized expertise, further fuels demand for contract testing laboratories. The growing pipeline of complex biologics, biosimilars, and advanced therapies, particularly in oncology and rare diseases, requires sophisticated and specialized testing methodologies, creating new market opportunities.

Challenges in the GMP Testing Laboratory Industry Market

Despite its robust growth, the GMP Testing Laboratory Industry faces several challenges. Strict and evolving regulatory compliance requires continuous adaptation and investment in updated methodologies and equipment, posing a significant financial and operational burden. Intense competition among numerous players leads to pricing pressures and the need for constant differentiation through service quality and specialization. Shortage of skilled personnel, particularly those with expertise in specialized analytical techniques and regulatory affairs, can hinder capacity expansion and service delivery. Supply chain disruptions for critical reagents and equipment can impact turnaround times and operational efficiency. The high capital investment required for state-of-the-art facilities and instrumentation also presents a barrier to entry for new players and can strain the resources of smaller laboratories.

Emerging Opportunities in GMP Testing Laboratory Industry

Emerging opportunities in the GMP Testing Laboratory Industry are primarily driven by rapid advancements in scientific research and therapeutic modalities. The burgeoning fields of cell and gene therapy, personalized medicine, and advanced biologics present significant demand for highly specialized and validated testing services. The increasing global focus on drug safety and supply chain integrity creates opportunities for expanded post-market surveillance testing and counterfeit detection services. Strategic partnerships between testing laboratories and drug developers, as well as the expansion of services into emerging economies with growing pharmaceutical sectors, represent significant growth catalysts. Furthermore, the development and adoption of novel analytical platforms, such as those leveraging AI for predictive analytics and omics technologies, will unlock new service offerings and competitive advantages.

Leading Players in the GMP Testing Laboratory Industry Sector

- Intertek Group PLC

- Pace Analytical

- Sotera Health (Nelson Laboratories LLC)

- Eurofins Scientific

- Almac Group

- Microchem Laboratory

- Sartorius AG

- North American Science Associates Inc

- Charles River Laboratories

- Laboratory Corporation of America Holdings (Covance Inc )

- PPD Inc

- Wuxi AppTec

Key Milestones in GMP Testing Laboratory Industry Industry

- April 2023: Thermo Fisher Scientific expanded its capabilities from development to commercial manufacturing in France. The early development hub includes a 430 sq m (4,600 sq ft) research and development facility for pre-clinical, non-GMP operations and expanded good manufacturing practices (GMP) facilities, indicating an industry shift towards integrated service offerings.

- February 2022: The analytical testing services laboratories of the Center for Breakthrough Medicines (CBM) were established to provide the most complete testing capabilities in the sector. These essential service provisions address expanding capacity requirements in the cell & gene therapy business, which is highly supply-constrained, highlighting the critical need for specialized testing in emerging therapeutic areas.

Strategic Outlook for GMP Testing Laboratory Industry Market

The strategic outlook for the GMP Testing Laboratory Industry remains highly positive, driven by sustained innovation and increasing global demand for safe and effective therapeutics. Growth accelerators include the continued expansion of the biologics and advanced therapy markets, necessitating sophisticated analytical and validation testing. Furthermore, the increasing emphasis on quality by design (QbD) and process analytical technology (PAT) by regulatory bodies will drive demand for advanced in-process testing and real-time monitoring solutions. Strategic opportunities lie in expanding service offerings to encompass the entire product lifecycle, from early-stage research and development to post-market surveillance. Investment in cutting-edge technologies, such as AI-driven data analytics and high-throughput screening platforms, will be crucial for maintaining competitive advantage. Partnerships and collaborations with pharmaceutical and biotechnology companies will also be instrumental in capitalizing on emerging therapeutic trends and market needs.

GMP Testing Laboratory Industry Segmentation

-

1. Service Type

- 1.1. Product Validation Testing

- 1.2. Bioanalytical Services

- 1.3. Packaging and Shelf-Life Testing

- 1.4. Other Service Types

-

2. End User

- 2.1. Pharmaceutical and Biopharmaceutical Companies

- 2.2. Medical Devices Company

GMP Testing Laboratory Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

GMP Testing Laboratory Industry Regional Market Share

Geographic Coverage of GMP Testing Laboratory Industry

GMP Testing Laboratory Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Pharmaceutical Industry; Increasing Drug and Devices Development

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Pharmaceutical and Biopharmaceutical Companies Segment Expected to Hold Significant Share in the GMP Testing Service Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GMP Testing Laboratory Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Product Validation Testing

- 5.1.2. Bioanalytical Services

- 5.1.3. Packaging and Shelf-Life Testing

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Pharmaceutical and Biopharmaceutical Companies

- 5.2.2. Medical Devices Company

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America GMP Testing Laboratory Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Product Validation Testing

- 6.1.2. Bioanalytical Services

- 6.1.3. Packaging and Shelf-Life Testing

- 6.1.4. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Pharmaceutical and Biopharmaceutical Companies

- 6.2.2. Medical Devices Company

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe GMP Testing Laboratory Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Product Validation Testing

- 7.1.2. Bioanalytical Services

- 7.1.3. Packaging and Shelf-Life Testing

- 7.1.4. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Pharmaceutical and Biopharmaceutical Companies

- 7.2.2. Medical Devices Company

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific GMP Testing Laboratory Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Product Validation Testing

- 8.1.2. Bioanalytical Services

- 8.1.3. Packaging and Shelf-Life Testing

- 8.1.4. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Pharmaceutical and Biopharmaceutical Companies

- 8.2.2. Medical Devices Company

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of the World GMP Testing Laboratory Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Product Validation Testing

- 9.1.2. Bioanalytical Services

- 9.1.3. Packaging and Shelf-Life Testing

- 9.1.4. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Pharmaceutical and Biopharmaceutical Companies

- 9.2.2. Medical Devices Company

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Intertek Group PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Pace Analytical

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sotera Health (Nelson Laboratories LLC)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Eurofins Scientific

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Almac Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Microchem Laboratory

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Sartorius AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 North American Science Associates Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Charles River Laboratories

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Laboratory Corporation of America Holdings (Covance Inc )

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 PPD Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Wuxi AppTec

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Intertek Group PLC

List of Figures

- Figure 1: Global GMP Testing Laboratory Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America GMP Testing Laboratory Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America GMP Testing Laboratory Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America GMP Testing Laboratory Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America GMP Testing Laboratory Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America GMP Testing Laboratory Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America GMP Testing Laboratory Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe GMP Testing Laboratory Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 9: Europe GMP Testing Laboratory Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe GMP Testing Laboratory Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe GMP Testing Laboratory Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe GMP Testing Laboratory Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe GMP Testing Laboratory Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific GMP Testing Laboratory Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Asia Pacific GMP Testing Laboratory Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Pacific GMP Testing Laboratory Industry Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific GMP Testing Laboratory Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific GMP Testing Laboratory Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific GMP Testing Laboratory Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World GMP Testing Laboratory Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Rest of the World GMP Testing Laboratory Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Rest of the World GMP Testing Laboratory Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Rest of the World GMP Testing Laboratory Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World GMP Testing Laboratory Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World GMP Testing Laboratory Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GMP Testing Laboratory Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global GMP Testing Laboratory Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global GMP Testing Laboratory Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global GMP Testing Laboratory Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global GMP Testing Laboratory Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global GMP Testing Laboratory Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global GMP Testing Laboratory Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: Global GMP Testing Laboratory Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global GMP Testing Laboratory Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global GMP Testing Laboratory Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 20: Global GMP Testing Laboratory Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 21: Global GMP Testing Laboratory Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific GMP Testing Laboratory Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global GMP Testing Laboratory Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 29: Global GMP Testing Laboratory Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global GMP Testing Laboratory Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GMP Testing Laboratory Industry?

The projected CAGR is approximately 6.84%.

2. Which companies are prominent players in the GMP Testing Laboratory Industry?

Key companies in the market include Intertek Group PLC, Pace Analytical, Sotera Health (Nelson Laboratories LLC), Eurofins Scientific, Almac Group, Microchem Laboratory, Sartorius AG, North American Science Associates Inc, Charles River Laboratories, Laboratory Corporation of America Holdings (Covance Inc ), PPD Inc, Wuxi AppTec.

3. What are the main segments of the GMP Testing Laboratory Industry?

The market segments include Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Pharmaceutical Industry; Increasing Drug and Devices Development.

6. What are the notable trends driving market growth?

Pharmaceutical and Biopharmaceutical Companies Segment Expected to Hold Significant Share in the GMP Testing Service Market.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

April 2023: Thermo Fisher Scientific expanded its capabilities from development to commercial manufacturing in France. The early development hub includes a 430 sq m (4,600 sq ft) research and development facility for pre-clinical, non-GMP operations and expanded good manufacturing practices (GMP) facilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GMP Testing Laboratory Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GMP Testing Laboratory Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GMP Testing Laboratory Industry?

To stay informed about further developments, trends, and reports in the GMP Testing Laboratory Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence