Key Insights

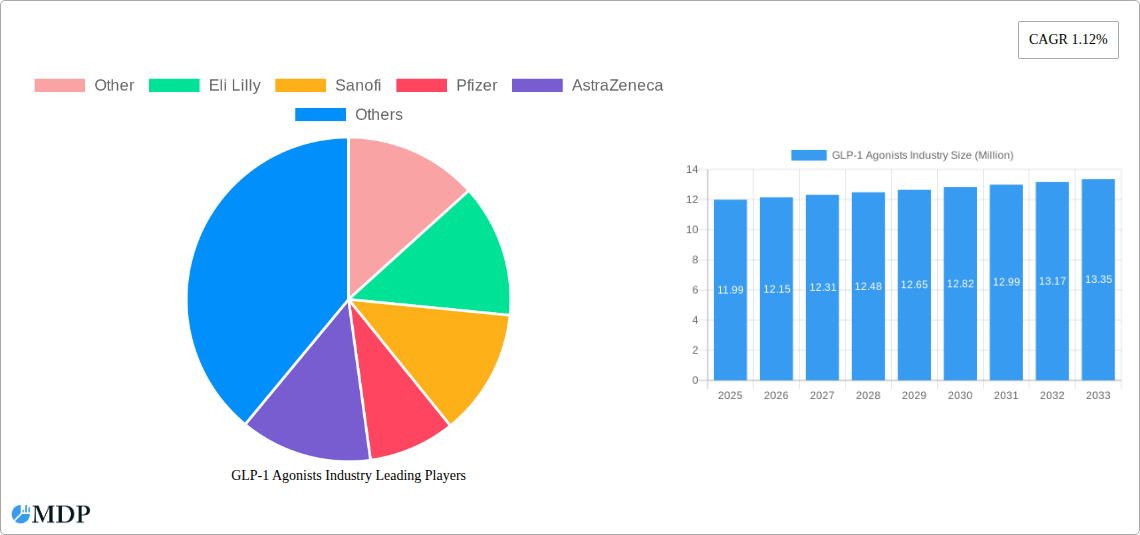

The GLP-1 Agonists market is experiencing significant growth, projected to reach $11.99 Million by 2025. This robust expansion is underpinned by a CAGR of 1.12% during the study period of 2019-2033. The primary drivers fueling this market include the escalating prevalence of type 2 diabetes globally, a growing awareness of the therapeutic benefits of GLP-1 agonists beyond glycemic control, such as weight management and cardiovascular risk reduction, and continuous innovation in drug development leading to more effective and patient-friendly formulations. Emerging trends such as the development of oral GLP-1 agonists and combination therapies are further poised to accelerate market penetration. The increasing demand for advanced treatment options for chronic metabolic diseases, coupled with favorable reimbursement policies in developed regions, are key factors contributing to this optimistic outlook.

GLP-1 Agonists Industry Market Size (In Million)

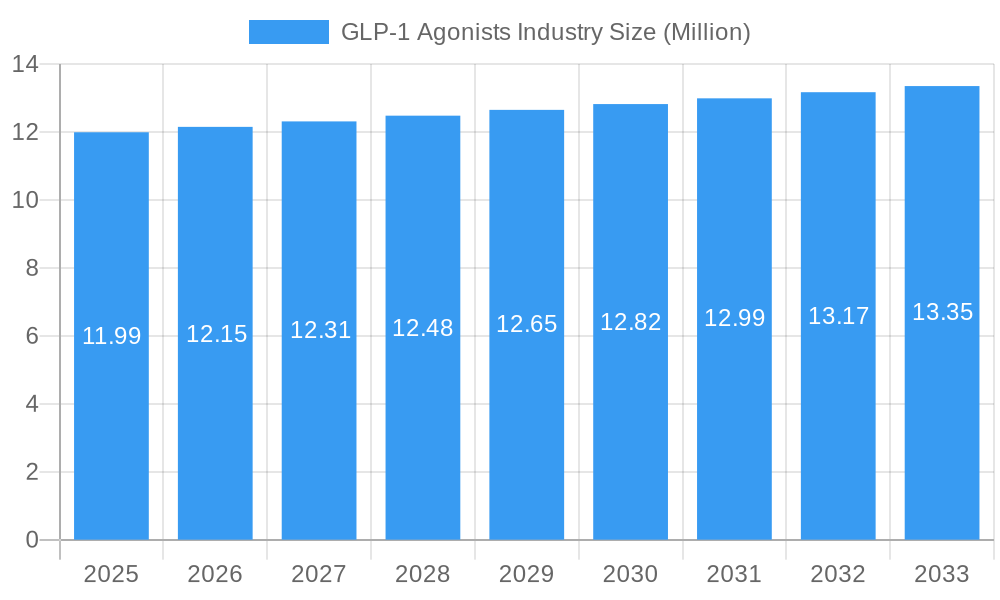

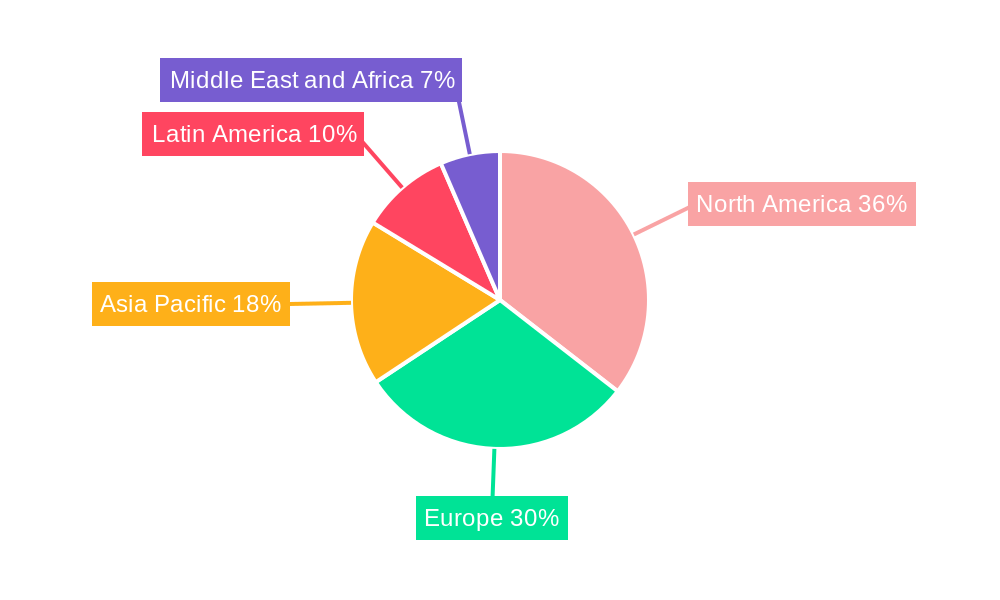

Despite the promising growth trajectory, the market faces certain restraints, including the high cost of these novel therapies, potential side effects that may limit patient adherence, and the need for robust clinical evidence to support broader off-label use. However, the market is characterized by intense competition among major pharmaceutical players like Novo Nordisk, Eli Lilly, Sanofi, and AstraZeneca, who are actively investing in research and development to launch next-generation GLP-1 agonists. The market segmentation by drugs includes leading molecules such as Semaglutide, Dulaglutide, Liraglutide, Exenatide, and Lixisenatide, with Semaglutide currently dominating due to its superior efficacy and versatility. Geographically, North America and Europe are leading markets, driven by high healthcare expenditure and a well-established regulatory framework, while the Asia Pacific region presents significant untapped potential for future growth.

GLP-1 Agonists Industry Company Market Share

Unlocking the Future of Diabetes and Obesity Management: GLP-1 Agonists Industry Market Report (2019-2033)

This comprehensive report offers an in-depth analysis of the GLP-1 agonists market, a rapidly expanding sector revolutionizing the treatment of type 2 diabetes and obesity. Covering the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033), this research provides critical insights for pharmaceutical companies, investors, healthcare providers, and policymakers navigating this dynamic landscape. Our analysis delves into key market drivers, emerging trends, leading drug segments like Semaglutide, Liraglutide, Dulaglutide, Exenatide, and Lixisenatide, and the strategic moves of industry giants such as Novo Nordisk, Eli Lilly, Sanofi, Pfizer, AstraZeneca, and Boehringer Ingelheim. Discover the pivotal industry developments, including the NHS approval of Wegovy (semaglutide) in March 2023 for obesity management and the FDA's approval of Eli Lilly's Mounjaro (tirzepatide) in May 2022 for type 2 diabetes. This report is your essential guide to understanding market concentration, innovation, regulatory frameworks, and the future trajectory of GLP-1 agonists.

GLP-1 Agonists Industry Market Dynamics & Concentration

The GLP-1 agonists market is characterized by moderate to high concentration, with a few dominant players holding significant market share. Novo Nordisk and Eli Lilly are at the forefront, driven by their groundbreaking drugs like Semaglutide (Ozempic, Rybelsus, Wegovy) and Tirzepatide (Mounjaro), respectively. Innovation remains the primary driver, with ongoing research focused on improving efficacy, durability, administration routes, and expanding indications for GLP-1 agonists beyond diabetes and obesity. Regulatory frameworks play a crucial role, influencing drug approvals, market access, and pricing. The stringent approval processes by bodies like the FDA and EMA are critical hurdles, but also ensure product safety and efficacy. Product substitutes exist in the form of other anti-diabetic medications (SGLT2 inhibitors, DPP-4 inhibitors) and weight-loss therapies, yet GLP-1 agonists often offer superior outcomes for specific patient profiles. End-user trends are heavily influenced by increasing global prevalence of type 2 diabetes and obesity, growing awareness of GLP-1 agonists' benefits, and a rising demand for effective weight management solutions. Merger and acquisition (M&A) activities have been relatively limited but are expected to increase as smaller biotech firms with promising pipeline assets become acquisition targets for larger pharmaceutical companies seeking to bolster their portfolios. We estimate the current M&A deal count to be in the range of 5-10 significant transactions annually, with a projected increase of 15-20% over the forecast period.

GLP-1 Agonists Industry Industry Trends & Analysis

The GLP-1 agonists industry is experiencing an unprecedented surge in growth, driven by a confluence of factors that are reshaping therapeutic landscapes for metabolic diseases. The CAGR (Compound Annual Growth Rate) for this market is projected to be robust, estimated at 18-22% throughout the forecast period of 2025-2033. This exponential growth is primarily fueled by the escalating global prevalence of type 2 diabetes and obesity, two chronic conditions that represent significant unmet medical needs. The increasing patient pool, coupled with a growing demand for effective and well-tolerated treatment options, is creating a fertile ground for GLP-1 agonists.

Technological disruptions are at the core of this market's evolution. Advancements in drug discovery and development have led to the creation of more potent and durable GLP-1 receptor agonists, including dual agonists that target multiple incretin pathways. The development of oral formulations, such as Novo Nordisk's Rybelsus, has significantly improved patient convenience and adherence, further driving market penetration. This shift from injectable to oral therapies represents a major technological leap, broadening the appeal of GLP-1 agonists to a wider patient demographic.

Consumer preferences are also shifting dramatically. Patients are increasingly seeking treatments that offer not only glycemic control but also significant weight loss and cardiovascular benefits. GLP-1 agonists have demonstrated remarkable efficacy in these areas, positioning them as frontline therapies for many individuals. The growing awareness of these multifaceted benefits, amplified by positive patient testimonials and media attention, is accelerating adoption rates. This heightened patient demand is a powerful market penetration driver, pushing the penetration rate of GLP-1 agonists in relevant patient populations from approximately 10-15% currently to an estimated 30-40% by 2033.

The competitive dynamics within the GLP-1 agonists market are intense. Key players are investing heavily in research and development to bring next-generation therapies to market and expand existing drug indications. This includes exploring the use of GLP-1 agonists for conditions such as non-alcoholic steatohepatitis (NASH), cardiovascular disease, and sleep apnea. The race to secure regulatory approvals for new indications and formulations, alongside strategic partnerships and acquisitions, defines the competitive landscape. The market is moving towards a scenario where GLP-1 agonists are no longer just diabetes medications but comprehensive metabolic health solutions, a trend that will continue to fuel growth and innovation.

Leading Markets & Segments in GLP-1 Agonists Industry

The global GLP-1 agonists market is experiencing remarkable growth, with North America currently leading in terms of market share and revenue. The United States, in particular, stands out due to its high prevalence of type 2 diabetes and obesity, a robust healthcare infrastructure, significant R&D investment, and a favorable regulatory environment that encourages the adoption of innovative therapies. Economic policies promoting access to advanced treatments and a strong emphasis on patient outcomes further solidify North America's dominant position.

Within the drug segments, Semaglutide has emerged as the leading molecule, driving substantial market growth. Its dual applications in type 2 diabetes management (Ozempic, Rybelsus) and obesity treatment (Wegovy) have propelled it to the forefront. The success of Semaglutide is attributed to its high efficacy in glycemic control and significant weight loss potential, coupled with the convenience of both injectable and oral formulations. Following closely, Liraglutide continues to hold a significant market share, particularly for its established role in diabetes management and weight loss with Victoza and Saxenda respectively.

- Key Drivers for Dominance in North America:

- High Prevalence of Type 2 Diabetes and Obesity: A large and growing patient population creates substantial demand for effective treatments.

- Advanced Healthcare Infrastructure and Access: Well-established healthcare systems and insurance coverage facilitate patient access to high-cost, innovative therapies.

- Significant R&D Investment: Leading pharmaceutical companies actively invest in research and development within the region, fostering innovation and pipeline advancements.

- Favorable Regulatory Environment: The FDA's streamlined approval processes for innovative drugs, coupled with market exclusivity, incentivize development and commercialization.

- Reimbursement Policies: Generally favorable reimbursement policies for novel diabetes and obesity medications contribute to market accessibility.

While North America currently leads, the Asia-Pacific region is anticipated to witness the fastest growth rate in the coming years. This expansion is driven by increasing healthcare expenditure, rising disposable incomes, improving access to advanced medical treatments, and a rapidly growing obese and diabetic population in countries like China and India.

GLP-1 Agonists Industry Product Developments

Product developments in the GLP-1 agonists industry are characterized by a strong focus on enhancing patient outcomes and convenience. Innovations are centered on increasing potency, extending duration of action, and developing novel administration methods. The introduction of dual and triple agonists, targeting multiple metabolic pathways simultaneously, represents a significant stride in therapeutic efficacy. Furthermore, the successful development of oral formulations like Semaglutide's Rybelsus has transformed patient adherence and broadened market accessibility. These advancements not only improve glycemic control and facilitate substantial weight loss but also demonstrate cardiovascular benefits, positioning GLP-1 agonists as comprehensive cardiometabolic solutions. The ongoing pursuit of new indications, such as NASH and sleep apnea, further underscores the evolving therapeutic potential and market fit of these agents.

Key Drivers of GLP-1 Agonists Industry Growth

The GLP-1 agonists industry is propelled by a robust set of growth drivers. The escalating global prevalence of type 2 diabetes and obesity remains the primary catalyst, creating a vast patient pool with significant unmet needs. Technological advancements in drug discovery and development, leading to more effective and convenient therapies like oral formulations and dual agonists, are accelerating market penetration. Furthermore, the demonstrated cardiovascular benefits associated with GLP-1 agonists are expanding their therapeutic role beyond glycemic control and weight management, attracting a broader patient and prescriber base. Regulatory bodies are also increasingly recognizing the importance of these agents, with evolving guidelines often favoring treatments that offer comprehensive metabolic benefits.

Challenges in the GLP-1 Agonists Industry Market

Despite the immense growth potential, the GLP-1 agonists market faces several challenges. High treatment costs present a significant barrier to access for many patients and healthcare systems globally, impacting market penetration. Regulatory hurdles for new indications and formulations, while necessary for safety, can prolong development timelines and increase R&D expenses. Supply chain disruptions, as seen during periods of high demand, can lead to stockouts and patient dissatisfaction. Furthermore, intense competition from other therapeutic classes and the ongoing development of novel treatments necessitate continuous innovation and differentiation. The potential for adverse events, though generally manageable, can also influence prescribing patterns and patient uptake.

Emerging Opportunities in GLP-1 Agonists Industry

Several catalysts are driving long-term growth in the GLP-1 agonists industry. The expansion of indications beyond diabetes and obesity, such as non-alcoholic steatohepatitis (NASH), cardiovascular disease prevention, and even neurological disorders, represents a significant untapped market. Technological breakthroughs in drug delivery systems, including longer-acting injectables and advanced oral formulations, will further enhance patient convenience and adherence. Strategic partnerships between pharmaceutical giants and smaller biotech firms specializing in novel drug targets or delivery technologies are creating synergistic opportunities. Market expansion into emerging economies, where the burden of metabolic diseases is rapidly increasing, offers substantial growth potential with tailored market access strategies.

Leading Players in the GLP-1 Agonists Industry Sector

- Other

- Eli Lilly

- Sanofi

- Pfizer

- AstraZeneca

- NovoNordisk

- Novo Nordisk

- Boehringer Ingelheim

Key Milestones in GLP-1 Agonists Industry Industry

- March 2023: NHS approved Wegovy, a weight loss injection known as semaglutide. Wegovy mimics the hormone glucagon-like peptide-1 (GLP-1) and suppresses appetite. The NHS is set to offer Wegovy, a weight loss injection known as semaglutide, to thousands of people living with obesity in England. This milestone significantly boosted the market for obesity treatments and highlighted the therapeutic potential of GLP-1 agonists beyond diabetes.

- May 2022: The US Food and Drug Administration (FDA approved Eli Lilly and Company's Mounjaro (tirzepatide) injection as an adjunct to diet and exercise. It is to enhance glycemic control in adult patients with type 2 diabetes. A single molecule, Mounjaro is a once-weekly glucose-dependent insulinotropic polypeptide (GIP) and glucagon-like peptide-1 (GLP-1) receptor agonist. This approval marked a significant advancement in dual-agonist therapy, offering enhanced glycemic control and a novel therapeutic option for type 2 diabetes patients.

Strategic Outlook for GLP-1 Agonists Industry Market

The strategic outlook for the GLP-1 agonists market remains exceptionally strong, driven by sustained innovation and expanding therapeutic utility. Future growth will be fueled by the development of next-generation agonists with improved efficacy profiles, enhanced safety, and novel mechanisms of action, including triple and quadruple agonists. Strategic focus will be on securing expanded indications, particularly for cardiovascular risk reduction, NASH, and other metabolic disorders. Investment in advanced drug delivery technologies and personalized medicine approaches will be crucial for maintaining competitive advantage. Furthermore, efforts to address affordability and improve market access in both developed and emerging economies will be paramount for maximizing market penetration and long-term sustainability, ensuring GLP-1 agonists remain at the forefront of cardiometabolic disease management.

GLP-1 Agonists Industry Segmentation

-

1. Drugs

- 1.1. Dulaglutide

- 1.2. Exenatide

- 1.3. Liraglutide

- 1.4. Lixisenatide

- 1.5. Semaglutide

GLP-1 Agonists Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. Spain

- 2.3. Italy

- 2.4. France

- 2.5. United Kingdom

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. Japan

- 3.2. China

- 3.3. Australia

- 3.4. India

- 3.5. South Korea

- 3.6. Malaysia

- 3.7. Indonesia

- 3.8. Thailand

- 3.9. Philippines

- 3.10. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Oman

- 5.4. Egypt

- 5.5. Iran

- 5.6. Rest of Middle East and Africa

GLP-1 Agonists Industry Regional Market Share

Geographic Coverage of GLP-1 Agonists Industry

GLP-1 Agonists Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Dulaglutide Segment Occupied the Highest Market Share in the Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GLP-1 Agonists Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drugs

- 5.1.1. Dulaglutide

- 5.1.2. Exenatide

- 5.1.3. Liraglutide

- 5.1.4. Lixisenatide

- 5.1.5. Semaglutide

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Drugs

- 6. North America GLP-1 Agonists Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drugs

- 6.1.1. Dulaglutide

- 6.1.2. Exenatide

- 6.1.3. Liraglutide

- 6.1.4. Lixisenatide

- 6.1.5. Semaglutide

- 6.1. Market Analysis, Insights and Forecast - by Drugs

- 7. Europe GLP-1 Agonists Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drugs

- 7.1.1. Dulaglutide

- 7.1.2. Exenatide

- 7.1.3. Liraglutide

- 7.1.4. Lixisenatide

- 7.1.5. Semaglutide

- 7.1. Market Analysis, Insights and Forecast - by Drugs

- 8. Asia Pacific GLP-1 Agonists Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drugs

- 8.1.1. Dulaglutide

- 8.1.2. Exenatide

- 8.1.3. Liraglutide

- 8.1.4. Lixisenatide

- 8.1.5. Semaglutide

- 8.1. Market Analysis, Insights and Forecast - by Drugs

- 9. Latin America GLP-1 Agonists Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drugs

- 9.1.1. Dulaglutide

- 9.1.2. Exenatide

- 9.1.3. Liraglutide

- 9.1.4. Lixisenatide

- 9.1.5. Semaglutide

- 9.1. Market Analysis, Insights and Forecast - by Drugs

- 10. Middle East and Africa GLP-1 Agonists Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drugs

- 10.1.1. Dulaglutide

- 10.1.2. Exenatide

- 10.1.3. Liraglutide

- 10.1.4. Lixisenatide

- 10.1.5. Semaglutide

- 10.1. Market Analysis, Insights and Forecast - by Drugs

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Other

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eli Lilly

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sanofi

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pfizer

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AstraZeneca

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NovoNordisk

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Novo Nordisk

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boehringer Ingelheim

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Other

List of Figures

- Figure 1: Global GLP-1 Agonists Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global GLP-1 Agonists Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America GLP-1 Agonists Industry Revenue (Million), by Drugs 2025 & 2033

- Figure 4: North America GLP-1 Agonists Industry Volume (K Unit), by Drugs 2025 & 2033

- Figure 5: North America GLP-1 Agonists Industry Revenue Share (%), by Drugs 2025 & 2033

- Figure 6: North America GLP-1 Agonists Industry Volume Share (%), by Drugs 2025 & 2033

- Figure 7: North America GLP-1 Agonists Industry Revenue (Million), by Country 2025 & 2033

- Figure 8: North America GLP-1 Agonists Industry Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America GLP-1 Agonists Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America GLP-1 Agonists Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe GLP-1 Agonists Industry Revenue (Million), by Drugs 2025 & 2033

- Figure 12: Europe GLP-1 Agonists Industry Volume (K Unit), by Drugs 2025 & 2033

- Figure 13: Europe GLP-1 Agonists Industry Revenue Share (%), by Drugs 2025 & 2033

- Figure 14: Europe GLP-1 Agonists Industry Volume Share (%), by Drugs 2025 & 2033

- Figure 15: Europe GLP-1 Agonists Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe GLP-1 Agonists Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe GLP-1 Agonists Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe GLP-1 Agonists Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific GLP-1 Agonists Industry Revenue (Million), by Drugs 2025 & 2033

- Figure 20: Asia Pacific GLP-1 Agonists Industry Volume (K Unit), by Drugs 2025 & 2033

- Figure 21: Asia Pacific GLP-1 Agonists Industry Revenue Share (%), by Drugs 2025 & 2033

- Figure 22: Asia Pacific GLP-1 Agonists Industry Volume Share (%), by Drugs 2025 & 2033

- Figure 23: Asia Pacific GLP-1 Agonists Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific GLP-1 Agonists Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific GLP-1 Agonists Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific GLP-1 Agonists Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Latin America GLP-1 Agonists Industry Revenue (Million), by Drugs 2025 & 2033

- Figure 28: Latin America GLP-1 Agonists Industry Volume (K Unit), by Drugs 2025 & 2033

- Figure 29: Latin America GLP-1 Agonists Industry Revenue Share (%), by Drugs 2025 & 2033

- Figure 30: Latin America GLP-1 Agonists Industry Volume Share (%), by Drugs 2025 & 2033

- Figure 31: Latin America GLP-1 Agonists Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Latin America GLP-1 Agonists Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Latin America GLP-1 Agonists Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America GLP-1 Agonists Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa GLP-1 Agonists Industry Revenue (Million), by Drugs 2025 & 2033

- Figure 36: Middle East and Africa GLP-1 Agonists Industry Volume (K Unit), by Drugs 2025 & 2033

- Figure 37: Middle East and Africa GLP-1 Agonists Industry Revenue Share (%), by Drugs 2025 & 2033

- Figure 38: Middle East and Africa GLP-1 Agonists Industry Volume Share (%), by Drugs 2025 & 2033

- Figure 39: Middle East and Africa GLP-1 Agonists Industry Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa GLP-1 Agonists Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: Middle East and Africa GLP-1 Agonists Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa GLP-1 Agonists Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GLP-1 Agonists Industry Revenue Million Forecast, by Drugs 2020 & 2033

- Table 2: Global GLP-1 Agonists Industry Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 3: Global GLP-1 Agonists Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global GLP-1 Agonists Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global GLP-1 Agonists Industry Revenue Million Forecast, by Drugs 2020 & 2033

- Table 6: Global GLP-1 Agonists Industry Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 7: Global GLP-1 Agonists Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global GLP-1 Agonists Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global GLP-1 Agonists Industry Revenue Million Forecast, by Drugs 2020 & 2033

- Table 16: Global GLP-1 Agonists Industry Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 17: Global GLP-1 Agonists Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global GLP-1 Agonists Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Germany GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Spain GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Italy GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: France GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: France GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Russia GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Global GLP-1 Agonists Industry Revenue Million Forecast, by Drugs 2020 & 2033

- Table 34: Global GLP-1 Agonists Industry Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 35: Global GLP-1 Agonists Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global GLP-1 Agonists Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Japan GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Japan GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: China GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: China GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Australia GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Australia GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: India GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: India GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: South Korea GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: South Korea GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Malaysia GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Malaysia GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Indonesia GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Indonesia GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Thailand GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Thailand GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Philippines GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Philippines GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Rest of Asia Pacific GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia Pacific GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Global GLP-1 Agonists Industry Revenue Million Forecast, by Drugs 2020 & 2033

- Table 58: Global GLP-1 Agonists Industry Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 59: Global GLP-1 Agonists Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global GLP-1 Agonists Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Brazil GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Brazil GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Mexico GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Mexico GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Latin America GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Latin America GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global GLP-1 Agonists Industry Revenue Million Forecast, by Drugs 2020 & 2033

- Table 68: Global GLP-1 Agonists Industry Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 69: Global GLP-1 Agonists Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global GLP-1 Agonists Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: South Africa GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: South Africa GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Saudi Arabia GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Saudi Arabia GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Oman GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Oman GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Egypt GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Egypt GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: Iran GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Iran GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East and Africa GLP-1 Agonists Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East and Africa GLP-1 Agonists Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GLP-1 Agonists Industry?

The projected CAGR is approximately 1.12%.

2. Which companies are prominent players in the GLP-1 Agonists Industry?

Key companies in the market include Other, Eli Lilly, Sanofi, Pfizer, AstraZeneca, NovoNordisk, Novo Nordisk, Boehringer Ingelheim.

3. What are the main segments of the GLP-1 Agonists Industry?

The market segments include Drugs.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.99 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Dulaglutide Segment Occupied the Highest Market Share in the Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

March 2023: NHS approved Wegovy, a weight loss injection known as semaglutide. Wegovy mimics the hormone glucagon-like peptide-1 (GLP-1) and suppresses appetite. The NHS is set to offer Wegovy, a weight loss injection known as semaglutide, to thousands of people living with obesity in England.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GLP-1 Agonists Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GLP-1 Agonists Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GLP-1 Agonists Industry?

To stay informed about further developments, trends, and reports in the GLP-1 Agonists Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence