Key Insights

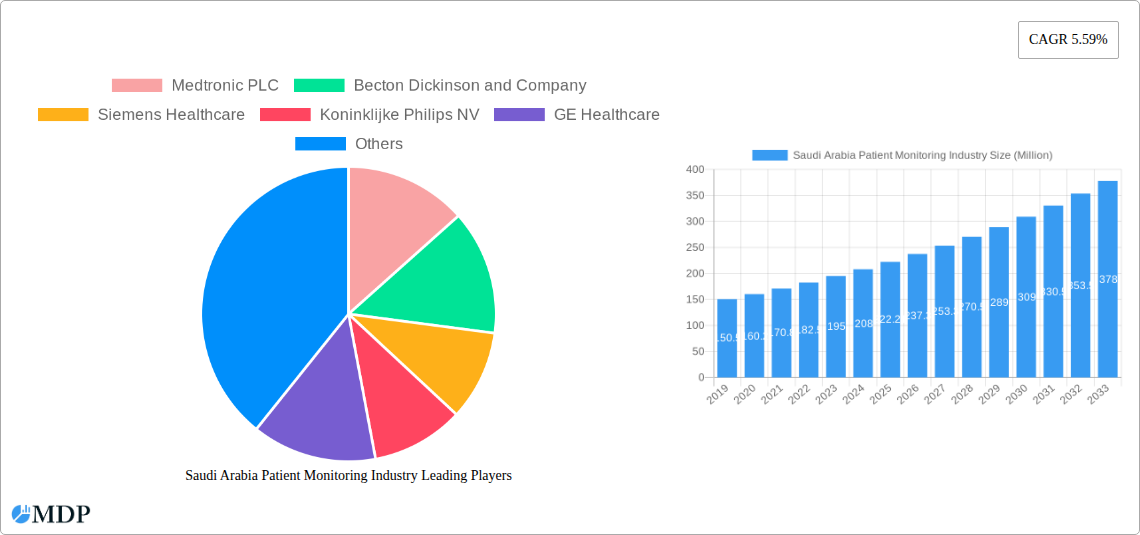

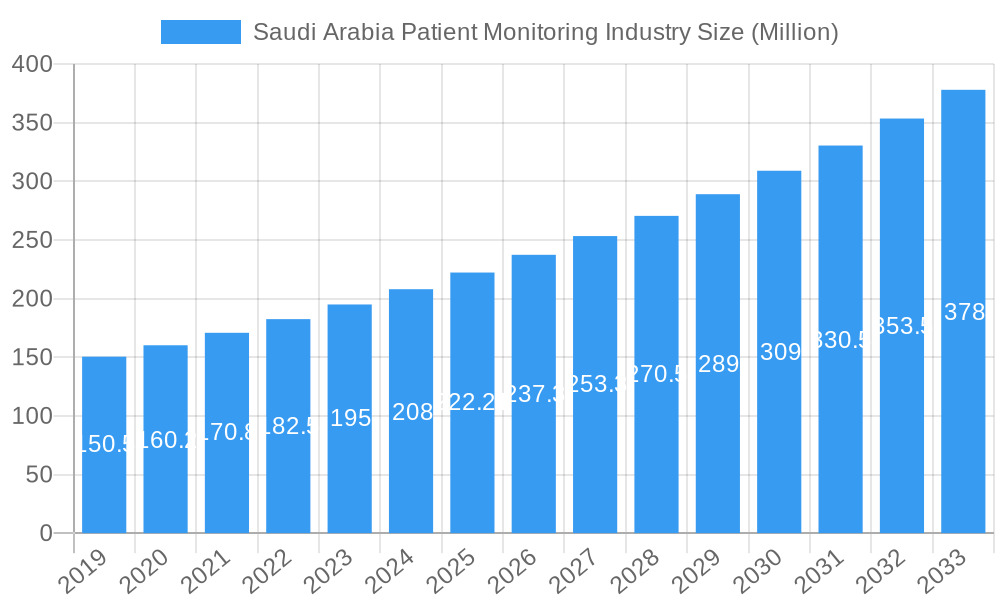

The Saudi Arabia patient monitoring market is poised for substantial growth, projected to reach USD 222.21 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.59% through 2033. This expansion is primarily driven by the increasing prevalence of chronic diseases such as cardiovascular and respiratory conditions, necessitating continuous and sophisticated patient monitoring. The Saudi government's significant investment in healthcare infrastructure, including the establishment of advanced medical facilities and the implementation of e-health initiatives, further fuels market expansion. The drive towards value-based healthcare and the growing demand for remote patient monitoring solutions to manage chronic conditions effectively are key trends shaping the market. Furthermore, the increasing adoption of wearable devices and AI-powered diagnostic tools is set to revolutionize patient care and data analysis, creating new avenues for market players. The region's commitment to Vision 2030, which emphasizes the modernization of its healthcare system, acts as a strong catalyst for the adoption of advanced patient monitoring technologies.

Saudi Arabia Patient Monitoring Industry Market Size (In Million)

The patient monitoring market in Saudi Arabia encompasses a diverse range of device types, with Hemodynamic, Neuromonitoring, Cardiac, and Respiratory monitoring devices expected to witness significant adoption, driven by the high disease burden in these areas. The application segment is also broad, with Cardiology and Respiratory applications leading the demand, followed closely by Neurology and Fetal and Neonatal monitoring. The shift towards home healthcare is a notable trend, with an increasing number of patients opting for remote monitoring solutions to manage their health outside traditional hospital settings. This transition is supported by advancements in telemedicine and connectivity. Key end-users include hospitals, which will continue to be major adopters, but also a growing segment of home healthcare providers and specialized clinics. The competitive landscape features established global players like Medtronic PLC, Siemens Healthcare, and Koninklijke Philips NV, alongside emerging local entities, all striving to capture market share through innovation and strategic partnerships within the evolving Saudi Arabian healthcare ecosystem.

Saudi Arabia Patient Monitoring Industry Company Market Share

Gain unparalleled insights into the rapidly evolving Saudi Arabia Patient Monitoring Industry. This comprehensive report delves into market dynamics, key trends, leading players, and future opportunities within this critical sector. Discover the market size, growth projections, and the strategic landscape shaping the adoption of advanced patient monitoring solutions across hospitals, home healthcare settings, and beyond. Essential for stakeholders seeking to capitalize on the Kingdom's healthcare transformation.

Saudi Arabia Patient Monitoring Industry Market Dynamics & Concentration

The Saudi Arabia Patient Monitoring Industry exhibits a moderate to high market concentration, with major multinational players like Medtronic PLC, Becton Dickinson and Company, Siemens Healthcare, Koninklijke Philips NV, GE Healthcare, Baxter International Inc, Dragerwerk AG, and Abbott Laboratories holding significant market share. Innovation drivers are primarily fueled by the Saudi Vision 2030, which emphasizes healthcare sector modernization, increased investment in medical technology, and a growing demand for advanced diagnostic and monitoring solutions. The regulatory framework, while evolving, is increasingly supportive of technological adoption, with a focus on patient safety and data privacy. Product substitutes are limited for critical care monitoring, but advancements in consumer-grade wearables present indirect competition for less critical applications. End-user trends show a strong preference for integrated systems that offer real-time data, remote access, and predictive analytics. Mergers and acquisition (M&A) activities are expected to increase as larger players seek to consolidate their market position and acquire innovative technologies. For instance, recent M&A activities have focused on acquiring companies with expertise in AI-powered analytics for patient monitoring, reflecting a strategic shift towards data-driven healthcare. The market share distribution is currently estimated with leading companies holding a combined xx% of the market. M&A deal counts are projected to grow by xx% over the forecast period, indicating an active consolidation phase.

Saudi Arabia Patient Monitoring Industry Industry Trends & Analysis

The Saudi Arabia Patient Monitoring Industry is poised for substantial growth, driven by a confluence of factors propelling market expansion. The Kingdom's ambitious healthcare reforms under Vision 2030 are a primary growth driver, injecting significant capital into upgrading healthcare infrastructure and adopting cutting-edge medical technologies. This includes a strong emphasis on preventive care and the management of chronic diseases, creating a sustained demand for reliable patient monitoring systems. Technological disruptions, particularly in the realm of remote patient monitoring (RPM) and wearable devices, are revolutionizing how healthcare is delivered. The increasing internet penetration and the widespread adoption of smartphones further facilitate the seamless integration of these technologies. Consumer preferences are shifting towards personalized and proactive healthcare, with patients actively seeking solutions that empower them to manage their health from the comfort of their homes. This trend is directly fueling the demand for remote monitoring devices. Competitive dynamics are intensifying, characterized by strategic partnerships between technology providers and healthcare institutions, as well as product innovation focused on enhanced accuracy, user-friendliness, and data security. The market penetration of advanced patient monitoring solutions is expected to rise significantly, from an estimated xx% in the historical period to over xx% by the end of the forecast period. The Compound Annual Growth Rate (CAGR) for the Saudi Arabia Patient Monitoring Industry is projected to be a robust xx% during the forecast period of 2025–2033. This impressive growth is underpinned by the increasing prevalence of lifestyle-related diseases such as diabetes and cardiovascular conditions, necessitating continuous patient oversight. Furthermore, the growing aging population in Saudi Arabia also contributes to a higher demand for continuous health monitoring. The adoption of Artificial Intelligence (AI) and Machine Learning (ML) in patient monitoring platforms is a significant trend, enabling predictive analytics and early detection of critical events. The integration of IoMT (Internet of Medical Things) devices is further enhancing the connectivity and efficiency of patient monitoring systems, allowing for real-time data transmission and remote intervention.

Leading Markets & Segments in Saudi Arabia Patient Monitoring Industry

The Cardiology application segment stands out as a dominant force within the Saudi Arabia Patient Monitoring Industry. This is primarily driven by the high prevalence of cardiovascular diseases in the Kingdom, necessitating continuous and advanced monitoring solutions such as cardiac monitoring devices. The Hospitals end-user segment also holds a commanding position, reflecting the ongoing investments in upgrading hospital infrastructure and the critical need for comprehensive patient monitoring in acute care settings. Remote Monitoring Devices are rapidly emerging as a key growth segment, propelled by government initiatives promoting telehealth and home-based care.

- Dominant Application: Cardiology

- High prevalence of cardiovascular diseases necessitates continuous monitoring.

- Technological advancements in cardiac monitoring devices are enhancing diagnostic capabilities.

- Increasing demand for remote cardiac monitoring solutions for post-discharge patient management.

- Dominant End-user: Hospitals

- Significant investments in modernizing hospital infrastructure and ICU capabilities.

- Growing adoption of integrated patient monitoring systems for enhanced patient care.

- Need for real-time data for critical care decision-making.

- Rapidly Growing Segment: Remote Monitoring Devices

- Government push for telehealth and digital health initiatives.

- Rising adoption of home healthcare services.

- Technological advancements in wearable sensors and connectivity.

- Convenience and cost-effectiveness for patients with chronic conditions.

- Type of Device Dominance: While Cardiac Monitoring Devices currently lead due to the application landscape, Remote Monitoring Devices are experiencing the fastest growth. Respiratory Monitoring Devices also represent a significant and growing segment, particularly in light of public health concerns.

- Other Applications and End-users: While Cardiology leads, Neurology and Respiratory applications are also seeing increased attention due to the rise in related conditions. Home Healthcare is a rapidly expanding end-user segment, driven by the desire for patient comfort and the efficiency of remote care.

Saudi Arabia Patient Monitoring Industry Product Developments

Product developments in the Saudi Arabia Patient Monitoring Industry are characterized by a strong focus on wireless connectivity, AI-driven analytics, and miniaturization. Companies are launching innovative solutions designed for early detection of patient deterioration and continuous health monitoring, both within hospital settings and for remote care. For instance, GE Healthcare's launch of the wireless Portrait Mobile system exemplifies the trend towards portable and easily deployable monitoring devices. These advancements offer enhanced patient comfort, improved data accuracy, and streamlined workflows for clinicians, ultimately contributing to better patient outcomes and reduced healthcare costs. The competitive advantage lies in integrated platforms that seamlessly collect, analyze, and transmit patient data, enabling proactive interventions.

Key Drivers of Saudi Arabia Patient Monitoring Industry Growth

The growth of the Saudi Arabia Patient Monitoring Industry is propelled by several key drivers. Foremost is the Saudi Vision 2030 initiative, which prioritizes the modernization of healthcare infrastructure and the adoption of advanced medical technologies, leading to increased government spending on patient monitoring solutions. Technological advancements, particularly in the field of remote patient monitoring (RPM) and wearable devices, are revolutionizing healthcare delivery and expanding accessibility. The rising prevalence of chronic diseases, such as cardiovascular conditions and diabetes, necessitates continuous patient monitoring, creating sustained demand. Furthermore, supportive government regulations and policies encouraging the adoption of digital health solutions are creating a favorable market environment.

Challenges in the Saudi Arabia Patient Monitoring Industry Market

Despite robust growth, the Saudi Arabia Patient Monitoring Industry faces certain challenges. Regulatory hurdles, particularly concerning data privacy and cybersecurity for connected medical devices, can slow down adoption. Supply chain disruptions and the reliance on imported technologies can also impact product availability and cost. Furthermore, ensuring adequate training for healthcare professionals to effectively utilize complex monitoring systems is crucial for successful implementation. The high initial investment cost for advanced monitoring equipment can also be a barrier for some healthcare providers, especially smaller clinics.

Emerging Opportunities in Saudi Arabia Patient Monitoring Industry

Emerging opportunities in the Saudi Arabia Patient Monitoring Industry are centered around technological innovation and strategic market expansion. The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) into patient monitoring platforms presents a significant opportunity for predictive analytics and personalized medicine. Strategic partnerships between technology providers and healthcare institutions, as well as collaborations with pharmaceutical companies for drug efficacy monitoring, are poised to drive long-term growth. The expansion of remote patient monitoring services for chronic disease management and post-operative care, supported by government initiatives like the "hospitals at home" program, represents a substantial untapped market.

Leading Players in the Saudi Arabia Patient Monitoring Industry Sector

- Medtronic PLC

- Becton Dickinson and Company

- Siemens Healthcare

- Koninklijke Philips NV

- GE Healthcare

- Baxter International Inc

- Dragerwerk AG

- Abbott Laboratories

Key Milestones in Saudi Arabia Patient Monitoring Industry Industry

- June 2022: GE Healthcare launched a new wireless patient monitoring system called Portrait Mobile, designed to help clinicians detect early patient deterioration and constantly monitor patients' health during their stay at the hospital.

- May 2022: The 34.0 million residents of the Kingdom of Saudi Arabia gained access to Huma's market-leading technology platform "hospitals at home," a remote patient monitoring platform, through a 5-year agreement between Tamer and a top healthcare distribution organization in the Middle East. This initiative began by assisting diabetic and heart disease patients.

Strategic Outlook for Saudi Arabia Patient Monitoring Industry Market

The strategic outlook for the Saudi Arabia Patient Monitoring Industry remains highly positive, fueled by ongoing healthcare reforms and technological advancements. The market is expected to witness sustained growth driven by the increasing adoption of remote patient monitoring, AI-powered analytics, and integrated healthcare solutions. Strategic opportunities lie in expanding telehealth services, particularly for chronic disease management, and developing user-friendly, data-secure monitoring platforms. Collaborations between government bodies, healthcare providers, and technology companies will be crucial in unlocking the full potential of this dynamic market and driving better patient outcomes across the Kingdom. The focus will be on creating a robust ecosystem that supports continuous innovation and seamless integration of patient monitoring technologies.

Saudi Arabia Patient Monitoring Industry Segmentation

-

1. Type of Device

- 1.1. Hemodynamic Monitoring Devices

- 1.2. Neuromonitoring Devices

- 1.3. Cardiac Monitoring Devices

- 1.4. Respiratory Monitoring Devices

- 1.5. Remote Monitoring Devices

- 1.6. Other Types of Devices

-

2. Application

- 2.1. Cardiology

- 2.2. Neurology

- 2.3. Respiratory

- 2.4. Fetal and Neonatal

- 2.5. Weight Management and Fitness Monitoring

- 2.6. Other Applications

-

3. End-users

- 3.1. Home Healthcare

- 3.2. Hospitals

- 3.3. Other End Users

Saudi Arabia Patient Monitoring Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Patient Monitoring Industry Regional Market Share

Geographic Coverage of Saudi Arabia Patient Monitoring Industry

Saudi Arabia Patient Monitoring Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidences of Chronic Diseases; Growth in Geriatric Population; Growing Preference for Home and Remote Monitoring

- 3.3. Market Restrains

- 3.3.1. High Cost of Technology

- 3.4. Market Trends

- 3.4.1. Cardiology Segment is Expected to Witness Considerable Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Patient Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Hemodynamic Monitoring Devices

- 5.1.2. Neuromonitoring Devices

- 5.1.3. Cardiac Monitoring Devices

- 5.1.4. Respiratory Monitoring Devices

- 5.1.5. Remote Monitoring Devices

- 5.1.6. Other Types of Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Neurology

- 5.2.3. Respiratory

- 5.2.4. Fetal and Neonatal

- 5.2.5. Weight Management and Fitness Monitoring

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-users

- 5.3.1. Home Healthcare

- 5.3.2. Hospitals

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Medtronic PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Becton Dickinson and Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koninklijke Philips NV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GE Healthcare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Baxter International Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dragerwerk AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Abbott Laboratories

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Medtronic PLC

List of Figures

- Figure 1: Saudi Arabia Patient Monitoring Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Patient Monitoring Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 2: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 3: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by End-users 2020 & 2033

- Table 6: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by End-users 2020 & 2033

- Table 7: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 10: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 11: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by End-users 2020 & 2033

- Table 14: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by End-users 2020 & 2033

- Table 15: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Patient Monitoring Industry?

The projected CAGR is approximately 5.59%.

2. Which companies are prominent players in the Saudi Arabia Patient Monitoring Industry?

Key companies in the market include Medtronic PLC, Becton Dickinson and Company, Siemens Healthcare, Koninklijke Philips NV, GE Healthcare, Baxter International Inc, Dragerwerk AG, Abbott Laboratories.

3. What are the main segments of the Saudi Arabia Patient Monitoring Industry?

The market segments include Type of Device, Application, End-users.

4. Can you provide details about the market size?

The market size is estimated to be USD 222.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidences of Chronic Diseases; Growth in Geriatric Population; Growing Preference for Home and Remote Monitoring.

6. What are the notable trends driving market growth?

Cardiology Segment is Expected to Witness Considerable Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Technology.

8. Can you provide examples of recent developments in the market?

June 2022 : GE Healthcare launched a new wireless patient monitoring system called Portrait Mobile. The new device has been designed to help clinicians detect early patient deterioration and constantly monitor patients' health during their stay at the hospital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Patient Monitoring Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Patient Monitoring Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Patient Monitoring Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Patient Monitoring Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence