Key Insights

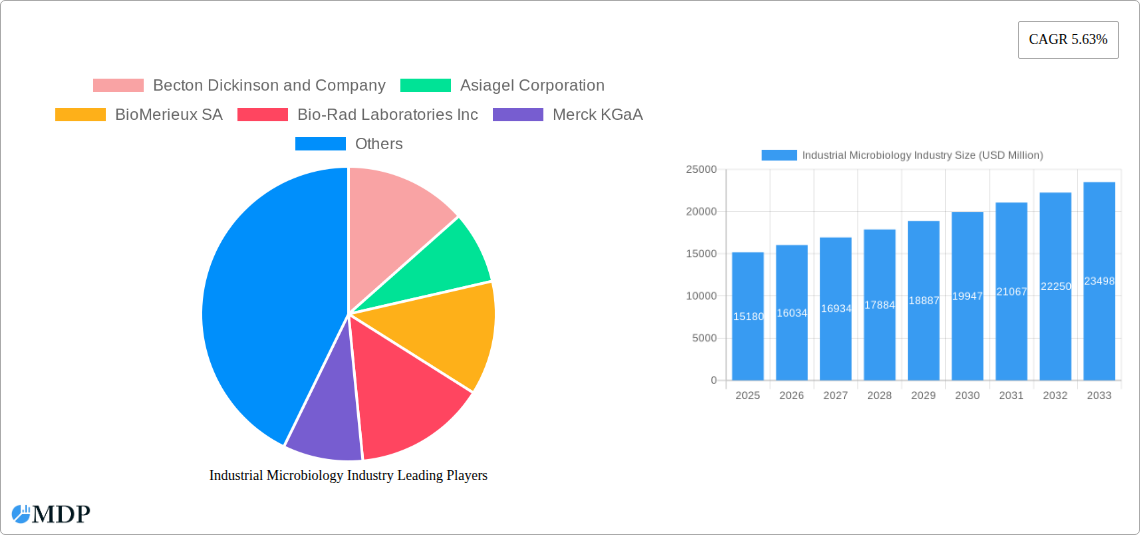

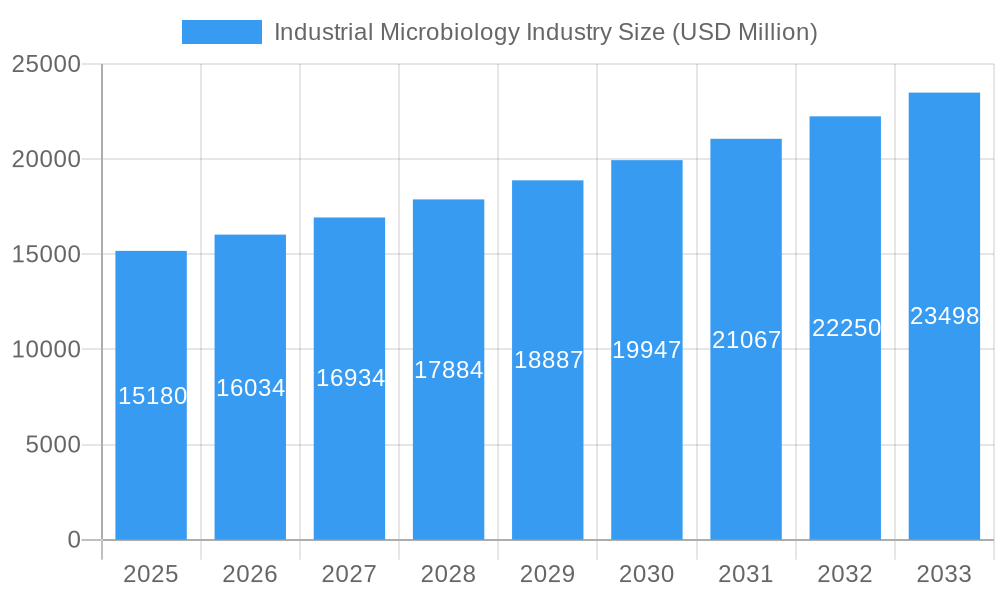

The global Industrial Microbiology market is projected to reach $15.18 billion in 2025, demonstrating robust growth with a Compound Annual Growth Rate (CAGR) of 5.63% through 2033. This expansion is fueled by an increasing demand for reliable and efficient microbial testing and analysis across a multitude of industries. Key drivers include the escalating need for stringent quality control and safety assurance in the food and beverage sector, driven by consumer expectations and regulatory mandates. Similarly, the pharmaceutical and biotechnology industries are heavily investing in microbial solutions for drug development, vaccine production, and bioprocessing, recognizing their critical role in ensuring product efficacy and patient safety. The agricultural sector's adoption of advanced microbial applications for crop protection, yield enhancement, and soil health management also contributes significantly to market momentum. Furthermore, growing environmental concerns are propelling the use of industrial microbiology in monitoring pollution, treating wastewater, and bioremediation efforts, opening up new avenues for market expansion.

Industrial Microbiology Industry Market Size (In Billion)

The market's trajectory is further shaped by key trends such as the continuous innovation in diagnostic technologies, leading to faster, more accurate, and cost-effective microbial detection methods. The integration of automation and artificial intelligence in laboratory workflows is streamlining operations and improving data analysis. Emerging applications in the cosmetic and personal care industry, focusing on microbial safety and the development of bio-based ingredients, are also contributing to market diversification. While the market exhibits strong growth potential, certain restraints, such as the high cost of advanced equipment and the need for skilled labor to operate sophisticated analytical instruments, may pose challenges. However, the pervasive need for microbial integrity and the ongoing advancements in scientific understanding and technological capabilities are expected to outweigh these limitations, paving the way for sustained market development.

Industrial Microbiology Industry Company Market Share

Industrial Microbiology Industry Market Analysis & Forecast 2019-2033: Unveiling Opportunities in a Billion-Dollar Sector

This comprehensive report offers an in-depth analysis of the Industrial Microbiology Industry, a dynamic and rapidly evolving sector projected to reach billions in value. We provide critical insights into market dynamics, growth drivers, emerging trends, and leading players from 2019 through 2033, with a base year of 2025. This report is essential for pharmaceutical and biotechnology companies, food and beverage manufacturers, agricultural enterprises, environmental agencies, and cosmetic brands seeking to understand and capitalize on the burgeoning industrial microbiology market. Our expert analysis covers market concentration, technological innovations, regulatory landscapes, and segment-specific performance, equipping stakeholders with actionable intelligence for strategic decision-making and investment in this high-growth industry.

Industrial Microbiology Industry Market Dynamics & Concentration

The Industrial Microbiology Industry exhibits a moderate market concentration, with several key players dominating specific niches while a broader landscape of specialized companies contributes to overall market activity. Innovation is a primary driver, fueled by advancements in genomics, high-throughput screening, and automation aimed at enhancing microbial detection, characterization, and application. Regulatory frameworks, particularly in the pharmaceutical and biotechnology industry and the food and beverage industry, mandate stringent quality control and safety standards, creating consistent demand for industrial microbiology solutions. Product substitutes are relatively limited in core applications, but advancements in alternative testing methods are continuously emerging. End-user trends are shifting towards faster, more sensitive, and data-driven insights, necessitating sophisticated equipment and systems, consumables, and reagents. Mergers and acquisition (M&A) activities are significant, reflecting a strategic consolidation of capabilities and market reach. For instance, in the historical period (2019-2024), there were approximately xx significant M&A deals valued at over xx billion, indicating a robust drive for expansion and synergistic integration among leading industrial microbiology companies.

- Key Dynamics:

- Innovation in rapid testing and molecular diagnostics.

- Increasing demand for contamination control and quality assurance.

- Stringent global regulatory compliance requirements.

- Growing adoption of AI and machine learning in microbial analysis.

- Market Share: Leading companies hold an estimated xx% of the market share in specific segments like diagnostic reagents and laboratory equipment.

- M&A Activities: Recent years have seen an average of xx M&A transactions annually, with deal values ranging from xx million to over xx billion.

Industrial Microbiology Industry Industry Trends & Analysis

The Industrial Microbiology Industry is poised for robust growth, driven by several interconnected trends and factors. A significant growth driver is the escalating demand for stringent quality control and safety measures across diverse sectors, particularly in the pharmaceutical and biotechnology industry and the food and beverage industry. As global populations expand and regulatory bodies impose stricter guidelines, the need for reliable microbial detection and monitoring solutions becomes paramount. This translates into a consistent demand for advanced equipment and systems, high-quality consumables, and precise reagents.

Technological disruptions are continuously reshaping the market landscape. The integration of omics technologies, such as metagenomics and transcriptomics, is enabling a deeper understanding of microbial communities and their functions, leading to novel applications in areas like bioprocessing and environmental remediation. Furthermore, the development of rapid microbial detection methods, including biosensors and molecular assays, significantly reduces testing times, allowing for quicker product release and enhanced operational efficiency. For instance, the launch of ultra-rapid screening kits for beverages underscores this trend.

Consumer preferences are also influencing market direction. Growing awareness regarding food safety, the demand for natural and sustainable products, and a preference for personalized cosmetics are all creating new avenues for industrial microbiology applications. In the agricultural industry, the focus is shifting towards precision agriculture and sustainable farming practices, where understanding soil and plant microbiomes plays a crucial role. The environmental industry benefits from the increasing need for wastewater treatment and bioremediation, relying heavily on microbial processes.

The competitive landscape is characterized by intense innovation and strategic collaborations. Companies are investing heavily in R&D to develop next-generation technologies that offer higher sensitivity, faster turnaround times, and improved cost-effectiveness. The Industrial Microbiology Industry is experiencing a compound annual growth rate (CAGR) of approximately xx% during the forecast period (2025–2033), with market penetration in emerging economies expected to accelerate significantly. The overall market size is projected to reach over xx billion by 2033.

Leading Markets & Segments in Industrial Microbiology Industry

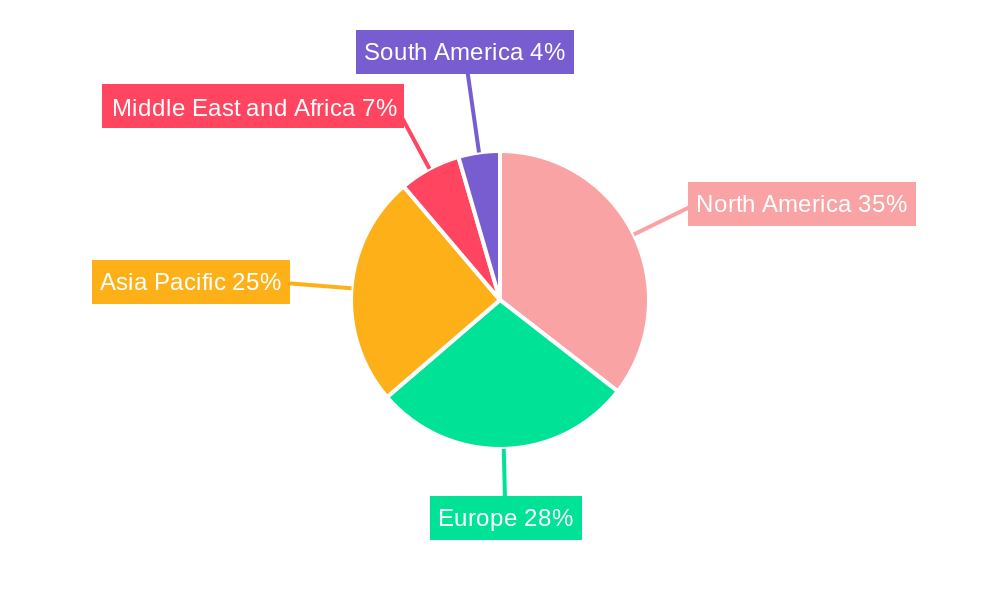

The Industrial Microbiology Industry presents a diverse range of market opportunities, with significant dominance observed across specific regions and application areas. North America currently leads the global market, driven by a well-established pharmaceutical and biotechnology industry, strong regulatory oversight, and substantial investment in R&D. Within North America, the United States stands out as a primary market due to its advanced healthcare infrastructure and a high concentration of leading biotechnology and pharmaceutical firms.

From a product type perspective, Equipment and Systems hold a substantial market share due to the significant capital investment required for advanced laboratory infrastructure and automated testing solutions. This segment is critical for comprehensive microbial analysis, encompassing incubators, centrifuges, microscopes, and automated sample preparation systems. Consumables, including culture media, petri dishes, and filtration devices, represent another significant segment, driven by the repetitive nature of microbial testing and the need for disposable materials in sterile environments. Reagents, particularly molecular biology kits and diagnostic assays, are experiencing rapid growth due to their role in highly specific and sensitive microbial identification and characterization.

In terms of application areas, the Pharmaceutical and Biotechnology Industry is the largest and fastest-growing segment. This is attributed to the critical need for microbial quality control throughout drug development, manufacturing, and post-market surveillance to ensure product safety and efficacy. The Food and Beverage Industry is the second-largest segment, where industrial microbiology plays a vital role in preventing contamination, ensuring product shelf-life, and adhering to stringent food safety regulations. The Environmental Industry is also a key growth area, with increasing focus on water quality testing, pollution monitoring, and bioremediation strategies.

- Dominant Region: North America, with the United States as the primary market driver.

- Key Product Segments:

- Equipment and Systems: High demand for advanced laboratory instrumentation.

- Consumables: Consistent demand for disposable lab materials.

- Reagents: Rapid growth driven by molecular diagnostics and assay development.

- Dominant Application Areas:

- Pharmaceutical and Biotechnology Industry: Largest segment due to stringent quality control needs.

- Food and Beverage Industry: Second-largest segment driven by food safety regulations.

- Environmental Industry: Growing due to increased focus on pollution control and remediation.

- Growth Drivers in Key Segments:

- Pharmaceutical/Biotech: Increasing R&D investments, new drug development, and stringent regulatory mandates.

- Food & Beverage: Growing consumer awareness of food safety, global food trade, and evolving regulatory landscapes.

- Environmental: Rising environmental concerns, government initiatives for pollution control, and demand for sustainable solutions.

Industrial Microbiology Industry Product Developments

Product developments in the Industrial Microbiology Industry are primarily focused on enhancing speed, accuracy, and user-friendliness. Innovations in rapid microbial detection kits, such as those offering results in under 30 minutes, are revolutionizing quality control processes, particularly in the food and beverage industry. The integration of advanced molecular techniques, like PCR and next-generation sequencing, is enabling more precise identification and characterization of microorganisms. Furthermore, the development of automated systems and AI-powered software is streamlining workflows, reducing manual intervention, and improving data analysis capabilities. These advancements provide competitive advantages by enabling faster market release, reducing operational costs, and enhancing overall product safety and quality for a range of industries including pharmaceuticals, agriculture, and cosmetics.

Key Drivers of Industrial Microbiology Industry Growth

The growth of the Industrial Microbiology Industry is propelled by a confluence of technological advancements, evolving economic factors, and stringent regulatory mandates. The increasing sophistication of genomic sequencing and bioinformatics allows for deeper insights into microbial communities, driving innovation in areas like bioprospecting and personalized medicine. Economically, a growing global demand for safe and high-quality products across the food and beverage industry and the pharmaceutical and biotechnology industry necessitates advanced microbial testing solutions. Regulatory bodies worldwide are continuously strengthening standards for product safety and environmental protection, thereby mandating the adoption of more sensitive and reliable microbial monitoring tools. For example, the Antimicrobial (AMR) Action Fund's investments underscore the critical need for novel therapies, indirectly boosting the demand for diagnostic and research tools in industrial microbiology.

Challenges in the Industrial Microbiology Industry Market

Despite its growth trajectory, the Industrial Microbiology Industry faces several challenges. High development costs for novel technologies and reagents can be a significant barrier to entry for smaller companies. The complex and often lengthy regulatory approval processes for new products, especially in the pharmaceutical and biotechnology industry, can slow down market penetration. Supply chain disruptions, as witnessed in recent global events, can impact the availability of critical raw materials and components for manufacturing equipment and systems and consumables. Furthermore, intense competition among established players and emerging startups puts pressure on pricing and profit margins, requiring continuous innovation to maintain market share. The cost of skilled labor for operating advanced industrial microbiology equipment and interpreting complex data also presents a consideration.

Emerging Opportunities in Industrial Microbiology Industry

The Industrial Microbiology Industry is ripe with emerging opportunities, primarily driven by technological breakthroughs and strategic market expansion. The growing understanding of the human microbiome is opening new frontiers in personalized medicine and the development of probiotics and prebiotics, significantly impacting the pharmaceutical and biotechnology industry. Advancements in synthetic biology and metabolic engineering offer exciting possibilities for industrial-scale production of biofuels, chemicals, and pharmaceuticals through microbial fermentation, benefiting the agricultural industry and beyond. The increasing global focus on sustainability and environmental protection is driving demand for microbial solutions in wastewater treatment, bioremediation, and waste valorization within the environmental industry. Furthermore, strategic partnerships between technology providers and end-user industries can accelerate the development and adoption of tailored industrial microbiology solutions, unlocking new revenue streams and market segments.

Leading Players in the Industrial Microbiology Industry Sector

- Becton Dickinson and Company

- Asiagel Corporation

- BioMerieux SA

- Bio-Rad Laboratories Inc

- Merck KGaA

- Thermo Fisher Scientific Inc

- Eppendorf AG

- Sartorius AG

- 3M Company

- Danaher Corporation

- Qiagen NV

- Agilent Technologies

Key Milestones in Industrial Microbiology Industry Industry

- April 2022: Adaptive Phage Therapeutics (APT) and Venatorx Pharmaceuticals both received funding from the Antimicrobial (AMR) Action Fund. The transactions are the Fund's first investments, and they represent a significant step toward the Fund's goal of bringing novel therapies to market for priority pathogens defined by the World Health Organization (WHO) and the United States Centers for Disease Control and Prevention (CDC). This signifies a growing focus on combating antimicrobial resistance, a key area for industrial microbiology applications.

- April 2022: Hygiena launched a new, ultra-rapid, microbial screening kit, RapiScreen Beverage Kit, that provides high-performance testing for low pH beverages using Innovate System. The kit provides quality control results in less than 30 minutes following a preliminary incubation period, allowing manufacturers to confirm product quality for quick release to market. This highlights the trend towards faster and more efficient testing solutions, particularly impactful for the food and beverage sector.

Strategic Outlook for Industrial Microbiology Industry Market

The strategic outlook for the Industrial Microbiology Industry is highly positive, with continued expansion anticipated through innovation and market penetration. Key growth accelerators include the increasing adoption of advanced analytical techniques such as AI and machine learning for microbial data interpretation, leading to more predictive and precise applications. The sustained global demand for biopharmaceuticals and novel therapeutics will continue to fuel growth in the pharmaceutical and biotechnology industry. Furthermore, the growing emphasis on sustainable practices in agriculture and environmental management presents significant opportunities for microbial solutions in areas like soil health, pest control, and pollution remediation. Strategic partnerships and collaborations between research institutions and industry players will be crucial for translating cutting-edge research into commercially viable products and services, solidifying the industrial microbiology market's billion-dollar potential.

Industrial Microbiology Industry Segmentation

-

1. Product Type

- 1.1. Equipment and Systems

- 1.2. Consumables

- 1.3. Reagents

-

2. Application Area

- 2.1. Food and Beverage Industry

- 2.2. Pharmaceutical and Biotechnology Industry

- 2.3. Agricultural Industry

- 2.4. Environmental Industry

- 2.5. Cosmetic or Personal Care Industry

- 2.6. Other Application Areas

Industrial Microbiology Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Industrial Microbiology Industry Regional Market Share

Geographic Coverage of Industrial Microbiology Industry

Industrial Microbiology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Industrial microbiology plays a crucial role in the fermentation processes for products such as bread

- 3.2.2 beer

- 3.2.3 wine

- 3.2.4 dairy

- 3.2.5 and probiotics. The growing demand for fermented and functional foods is fueling the industry

- 3.3. Market Restrains

- 3.3.1 The development of microbial technologies requires significant investment in research and development

- 3.3.2 which can be a barrier for smaller companies

- 3.4. Market Trends

- 3.4.1 The use of CRISPR and other genetic engineering technologies is enabling the development of custom microbes that are optimized for specific industrial processes

- 3.4.2 enhancing efficiency and reducing costs

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Microbiology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Equipment and Systems

- 5.1.2. Consumables

- 5.1.3. Reagents

- 5.2. Market Analysis, Insights and Forecast - by Application Area

- 5.2.1. Food and Beverage Industry

- 5.2.2. Pharmaceutical and Biotechnology Industry

- 5.2.3. Agricultural Industry

- 5.2.4. Environmental Industry

- 5.2.5. Cosmetic or Personal Care Industry

- 5.2.6. Other Application Areas

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Industrial Microbiology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Equipment and Systems

- 6.1.2. Consumables

- 6.1.3. Reagents

- 6.2. Market Analysis, Insights and Forecast - by Application Area

- 6.2.1. Food and Beverage Industry

- 6.2.2. Pharmaceutical and Biotechnology Industry

- 6.2.3. Agricultural Industry

- 6.2.4. Environmental Industry

- 6.2.5. Cosmetic or Personal Care Industry

- 6.2.6. Other Application Areas

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Industrial Microbiology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Equipment and Systems

- 7.1.2. Consumables

- 7.1.3. Reagents

- 7.2. Market Analysis, Insights and Forecast - by Application Area

- 7.2.1. Food and Beverage Industry

- 7.2.2. Pharmaceutical and Biotechnology Industry

- 7.2.3. Agricultural Industry

- 7.2.4. Environmental Industry

- 7.2.5. Cosmetic or Personal Care Industry

- 7.2.6. Other Application Areas

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Industrial Microbiology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Equipment and Systems

- 8.1.2. Consumables

- 8.1.3. Reagents

- 8.2. Market Analysis, Insights and Forecast - by Application Area

- 8.2.1. Food and Beverage Industry

- 8.2.2. Pharmaceutical and Biotechnology Industry

- 8.2.3. Agricultural Industry

- 8.2.4. Environmental Industry

- 8.2.5. Cosmetic or Personal Care Industry

- 8.2.6. Other Application Areas

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Industrial Microbiology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Equipment and Systems

- 9.1.2. Consumables

- 9.1.3. Reagents

- 9.2. Market Analysis, Insights and Forecast - by Application Area

- 9.2.1. Food and Beverage Industry

- 9.2.2. Pharmaceutical and Biotechnology Industry

- 9.2.3. Agricultural Industry

- 9.2.4. Environmental Industry

- 9.2.5. Cosmetic or Personal Care Industry

- 9.2.6. Other Application Areas

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Industrial Microbiology Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Equipment and Systems

- 10.1.2. Consumables

- 10.1.3. Reagents

- 10.2. Market Analysis, Insights and Forecast - by Application Area

- 10.2.1. Food and Beverage Industry

- 10.2.2. Pharmaceutical and Biotechnology Industry

- 10.2.3. Agricultural Industry

- 10.2.4. Environmental Industry

- 10.2.5. Cosmetic or Personal Care Industry

- 10.2.6. Other Application Areas

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Asiagel Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BioMerieux SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bio-Rad Laboratories Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Merck KGaA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Thermo Fisher Scientific Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Eppendorf AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sartorius AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 3M Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Danaher Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Qiagen NV

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Agilent Technologies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Industrial Microbiology Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Industrial Microbiology Industry Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Industrial Microbiology Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 4: North America Industrial Microbiology Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 5: North America Industrial Microbiology Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Industrial Microbiology Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Industrial Microbiology Industry Revenue (undefined), by Application Area 2025 & 2033

- Figure 8: North America Industrial Microbiology Industry Volume (K Units), by Application Area 2025 & 2033

- Figure 9: North America Industrial Microbiology Industry Revenue Share (%), by Application Area 2025 & 2033

- Figure 10: North America Industrial Microbiology Industry Volume Share (%), by Application Area 2025 & 2033

- Figure 11: North America Industrial Microbiology Industry Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Industrial Microbiology Industry Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Industrial Microbiology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Industrial Microbiology Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Industrial Microbiology Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 16: Europe Industrial Microbiology Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 17: Europe Industrial Microbiology Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Industrial Microbiology Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Industrial Microbiology Industry Revenue (undefined), by Application Area 2025 & 2033

- Figure 20: Europe Industrial Microbiology Industry Volume (K Units), by Application Area 2025 & 2033

- Figure 21: Europe Industrial Microbiology Industry Revenue Share (%), by Application Area 2025 & 2033

- Figure 22: Europe Industrial Microbiology Industry Volume Share (%), by Application Area 2025 & 2033

- Figure 23: Europe Industrial Microbiology Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Industrial Microbiology Industry Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe Industrial Microbiology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Industrial Microbiology Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Industrial Microbiology Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Industrial Microbiology Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Industrial Microbiology Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Industrial Microbiology Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Industrial Microbiology Industry Revenue (undefined), by Application Area 2025 & 2033

- Figure 32: Asia Pacific Industrial Microbiology Industry Volume (K Units), by Application Area 2025 & 2033

- Figure 33: Asia Pacific Industrial Microbiology Industry Revenue Share (%), by Application Area 2025 & 2033

- Figure 34: Asia Pacific Industrial Microbiology Industry Volume Share (%), by Application Area 2025 & 2033

- Figure 35: Asia Pacific Industrial Microbiology Industry Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Industrial Microbiology Industry Volume (K Units), by Country 2025 & 2033

- Figure 37: Asia Pacific Industrial Microbiology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Industrial Microbiology Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Industrial Microbiology Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 40: Middle East and Africa Industrial Microbiology Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 41: Middle East and Africa Industrial Microbiology Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Middle East and Africa Industrial Microbiology Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Middle East and Africa Industrial Microbiology Industry Revenue (undefined), by Application Area 2025 & 2033

- Figure 44: Middle East and Africa Industrial Microbiology Industry Volume (K Units), by Application Area 2025 & 2033

- Figure 45: Middle East and Africa Industrial Microbiology Industry Revenue Share (%), by Application Area 2025 & 2033

- Figure 46: Middle East and Africa Industrial Microbiology Industry Volume Share (%), by Application Area 2025 & 2033

- Figure 47: Middle East and Africa Industrial Microbiology Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East and Africa Industrial Microbiology Industry Volume (K Units), by Country 2025 & 2033

- Figure 49: Middle East and Africa Industrial Microbiology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Industrial Microbiology Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Industrial Microbiology Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 52: South America Industrial Microbiology Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 53: South America Industrial Microbiology Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: South America Industrial Microbiology Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: South America Industrial Microbiology Industry Revenue (undefined), by Application Area 2025 & 2033

- Figure 56: South America Industrial Microbiology Industry Volume (K Units), by Application Area 2025 & 2033

- Figure 57: South America Industrial Microbiology Industry Revenue Share (%), by Application Area 2025 & 2033

- Figure 58: South America Industrial Microbiology Industry Volume Share (%), by Application Area 2025 & 2033

- Figure 59: South America Industrial Microbiology Industry Revenue (undefined), by Country 2025 & 2033

- Figure 60: South America Industrial Microbiology Industry Volume (K Units), by Country 2025 & 2033

- Figure 61: South America Industrial Microbiology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Industrial Microbiology Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Microbiology Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Industrial Microbiology Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Global Industrial Microbiology Industry Revenue undefined Forecast, by Application Area 2020 & 2033

- Table 4: Global Industrial Microbiology Industry Volume K Units Forecast, by Application Area 2020 & 2033

- Table 5: Global Industrial Microbiology Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Industrial Microbiology Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Industrial Microbiology Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: Global Industrial Microbiology Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Global Industrial Microbiology Industry Revenue undefined Forecast, by Application Area 2020 & 2033

- Table 10: Global Industrial Microbiology Industry Volume K Units Forecast, by Application Area 2020 & 2033

- Table 11: Global Industrial Microbiology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Industrial Microbiology Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Global Industrial Microbiology Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 20: Global Industrial Microbiology Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 21: Global Industrial Microbiology Industry Revenue undefined Forecast, by Application Area 2020 & 2033

- Table 22: Global Industrial Microbiology Industry Volume K Units Forecast, by Application Area 2020 & 2033

- Table 23: Global Industrial Microbiology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Industrial Microbiology Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Germany Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Germany Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: France Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: France Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Italy Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Italy Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: Spain Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Spain Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Global Industrial Microbiology Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 38: Global Industrial Microbiology Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 39: Global Industrial Microbiology Industry Revenue undefined Forecast, by Application Area 2020 & 2033

- Table 40: Global Industrial Microbiology Industry Volume K Units Forecast, by Application Area 2020 & 2033

- Table 41: Global Industrial Microbiology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Industrial Microbiology Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 43: China Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: China Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Japan Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Japan Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: India Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: India Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Australia Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Australia Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: South Korea Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: South Korea Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Global Industrial Microbiology Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 56: Global Industrial Microbiology Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 57: Global Industrial Microbiology Industry Revenue undefined Forecast, by Application Area 2020 & 2033

- Table 58: Global Industrial Microbiology Industry Volume K Units Forecast, by Application Area 2020 & 2033

- Table 59: Global Industrial Microbiology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Industrial Microbiology Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 61: GCC Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: GCC Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: South Africa Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: South Africa Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: Global Industrial Microbiology Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 68: Global Industrial Microbiology Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 69: Global Industrial Microbiology Industry Revenue undefined Forecast, by Application Area 2020 & 2033

- Table 70: Global Industrial Microbiology Industry Volume K Units Forecast, by Application Area 2020 & 2033

- Table 71: Global Industrial Microbiology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 72: Global Industrial Microbiology Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 73: Brazil Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Brazil Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 75: Argentina Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Argentina Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Industrial Microbiology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Industrial Microbiology Industry Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Microbiology Industry?

The projected CAGR is approximately 5.63%.

2. Which companies are prominent players in the Industrial Microbiology Industry?

Key companies in the market include Becton Dickinson and Company, Asiagel Corporation, BioMerieux SA, Bio-Rad Laboratories Inc, Merck KGaA, Thermo Fisher Scientific Inc, Eppendorf AG, Sartorius AG, 3M Company, Danaher Corporation, Qiagen NV, Agilent Technologies.

3. What are the main segments of the Industrial Microbiology Industry?

The market segments include Product Type, Application Area.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Industrial microbiology plays a crucial role in the fermentation processes for products such as bread. beer. wine. dairy. and probiotics. The growing demand for fermented and functional foods is fueling the industry.

6. What are the notable trends driving market growth?

The use of CRISPR and other genetic engineering technologies is enabling the development of custom microbes that are optimized for specific industrial processes. enhancing efficiency and reducing costs.

7. Are there any restraints impacting market growth?

The development of microbial technologies requires significant investment in research and development. which can be a barrier for smaller companies.

8. Can you provide examples of recent developments in the market?

In April 2022, Adaptive Phage Therapeutics (APT) and Venatorx Pharmaceuticals both received funding from the Antimicrobial (AMR) Action Fund. The transactions are the Fund's first investments, and they represent a significant step toward the Fund's goal of bringing novel therapies to market for priority pathogens defined by the World Health Organization (WHO) and the United States Centers for Disease Control and Prevention (CDC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Microbiology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Microbiology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Microbiology Industry?

To stay informed about further developments, trends, and reports in the Industrial Microbiology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence