Key Insights

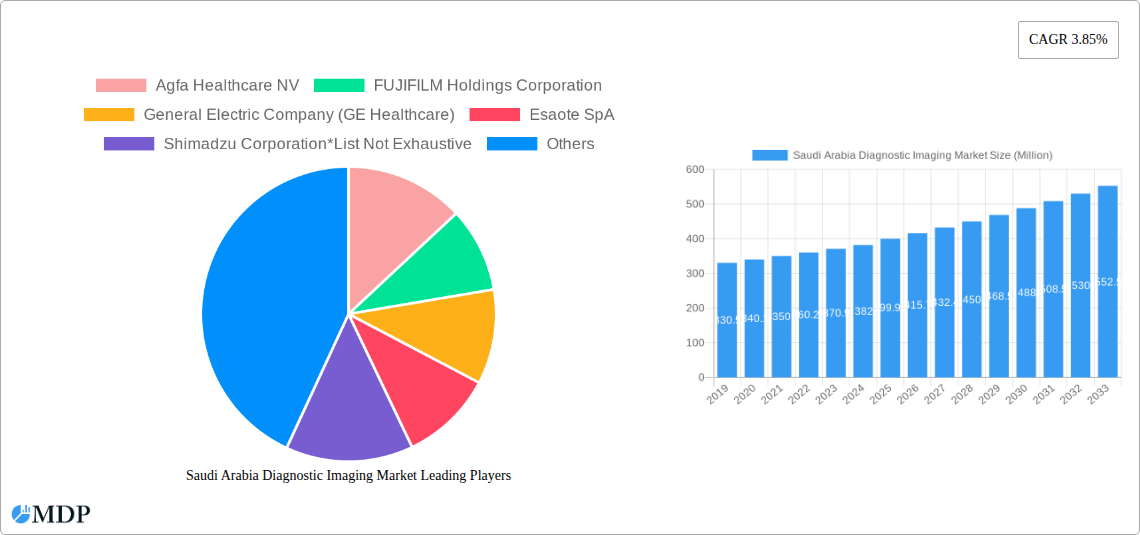

The Saudi Arabia Diagnostic Imaging Market is poised for significant growth, projected to reach 399.92 Million by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 3.85% through 2033. This robust expansion is fueled by a confluence of factors, including the increasing prevalence of chronic diseases, a growing aging population, and substantial government investments in healthcare infrastructure and advanced medical technologies. The demand for sophisticated diagnostic imaging modalities like MRI and Computed Tomography (CT) is particularly strong, driven by their critical role in early disease detection and personalized treatment planning. Furthermore, the growing emphasis on preventive healthcare and the rising patient awareness regarding the benefits of early diagnosis are acting as key accelerators for market growth. The integration of artificial intelligence (AI) and machine learning in diagnostic imaging is also a notable trend, promising enhanced accuracy and efficiency in image interpretation and workflow management.

Saudi Arabia Diagnostic Imaging Market Market Size (In Million)

The market is segmented across various modalities including MRI, Computed Tomography, Ultrasound, X-Ray, Nuclear Imaging, Fluoroscopy, and Mammography, catering to a wide array of applications such as Cardiology, Oncology, Neurology, Orthopedics, and Gastroenterology. Hospitals and dedicated Diagnostic Centers represent the primary end-users, reflecting the increasing utilization of advanced imaging services within these healthcare settings. While the market demonstrates a positive growth trajectory, certain factors could present challenges. These might include the high initial cost of advanced imaging equipment and the need for skilled radiographers and technicians to operate and interpret complex systems. However, the proactive approach of the Saudi government in promoting medical tourism and its Vision 2030 initiatives aimed at transforming the healthcare sector are expected to overcome these potential restraints, ensuring a dynamic and expanding diagnostic imaging landscape.

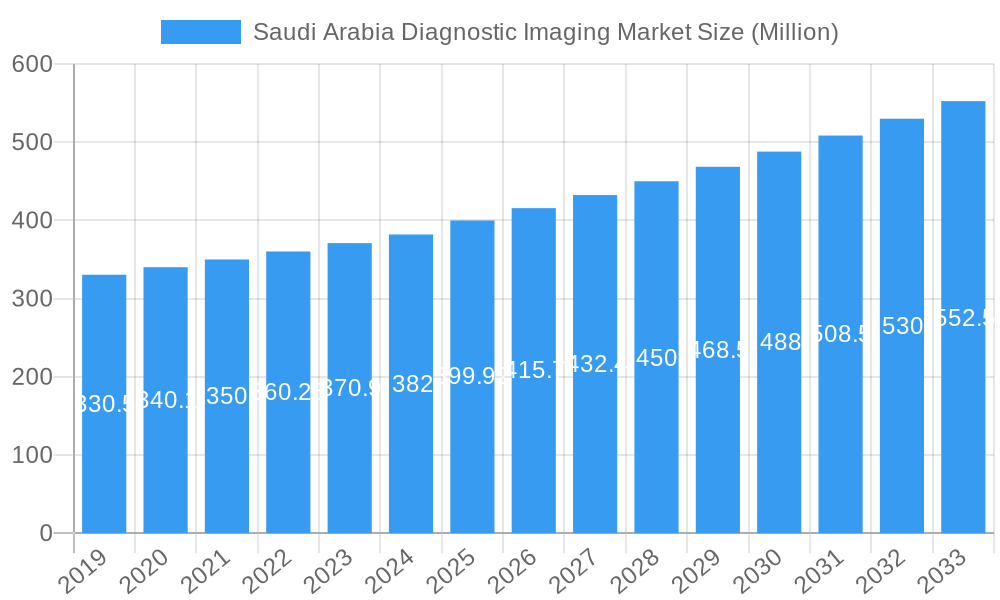

Saudi Arabia Diagnostic Imaging Market Company Market Share

Saudi Arabia Diagnostic Imaging Market: Market Dynamics & Concentration

The Saudi Arabia Diagnostic Imaging Market is characterized by a dynamic landscape driven by increasing healthcare expenditure, a growing focus on early disease detection, and significant government initiatives aimed at enhancing medical infrastructure. Market concentration is moderately fragmented, with major global players holding substantial shares while a growing number of local entities are emerging. Innovation drivers include the demand for advanced imaging technologies like Artificial Intelligence (AI)-powered diagnostics, portable imaging solutions, and higher resolution modalities. Regulatory frameworks, while evolving, are becoming more conducive to market growth, focusing on patient safety and technological adoption. Product substitutes are limited in diagnostic imaging, but advancements in non-imaging diagnostic methods could pose a long-term threat. End-user trends are shifting towards outpatient settings and specialized diagnostic centers, driven by convenience and cost-effectiveness. Mergers and acquisitions (M&A) activities are expected to increase as larger players seek to consolidate their market position and expand their product portfolios. The market's estimated value is projected to reach over $500 Million by 2033, with a notable CAGR of XX% during the forecast period. Key M&A deals observed in the historical period (2019-2024) were driven by the acquisition of innovative technologies and market access, with approximately XX significant M&A transactions recorded.

Saudi Arabia Diagnostic Imaging Market Industry Trends & Analysis

The Saudi Arabia Diagnostic Imaging Market is poised for robust expansion, fueled by a confluence of favorable industry trends. The Kingdom's Vision 2030 plan emphasizes a significant transformation of its healthcare sector, prioritizing the development of state-of-the-art medical facilities and the adoption of cutting-edge technologies. This translates into a surging demand for advanced diagnostic imaging equipment, including MRI, CT scanners, and ultrasound devices. The increasing prevalence of chronic diseases, such as cardiovascular conditions, neurological disorders, and cancer, further propels the market, necessitating accurate and early diagnosis through sophisticated imaging modalities.

Technological disruptions are playing a pivotal role in shaping market dynamics. The integration of Artificial Intelligence (AI) and machine learning in diagnostic imaging is revolutionizing image interpretation, enhancing diagnostic accuracy, and optimizing workflow efficiency. Furthermore, the advent of portable and point-of-care imaging devices is expanding access to diagnostic services, particularly in remote areas and for patient comfort. Advancements in modalities like digital radiography and advanced ultrasound probes are offering higher resolution images and improved patient safety.

Consumer preferences are increasingly gravitating towards personalized medicine and preventative healthcare. This shift is driving the demand for advanced imaging techniques that can provide detailed insights into an individual's health status, enabling early intervention and tailored treatment plans. The growing health consciousness among the Saudi population, coupled with rising disposable incomes, contributes to a higher uptake of advanced diagnostic imaging services.

The competitive landscape is characterized by the presence of established global players and a growing number of local distributors and service providers. Intense competition is driving innovation and pushing companies to offer more cost-effective and technologically superior solutions. Strategic partnerships and collaborations between technology providers, healthcare institutions, and research organizations are becoming crucial for market penetration and growth. The market is estimated to have reached $250 Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. Market penetration for advanced diagnostic imaging services is also steadily increasing, reflecting the growing adoption of these technologies across the healthcare ecosystem.

Leading Markets & Segments in Saudi Arabia Diagnostic Imaging Market

The Saudi Arabia Diagnostic Imaging Market exhibits strong growth across various segments, with specific modalities, applications, and end-users demonstrating significant dominance. The Computed Tomography (CT) segment stands out as a leading modality, driven by its versatility in diagnosing a wide range of conditions, from trauma and vascular diseases to oncology and neurological disorders. The increasing investment in advanced CT scanners with lower radiation doses and higher resolution is further bolstering its market share. Complementing this, Magnetic Resonance Imaging (MRI) is also a high-growth segment, particularly for soft tissue imaging and neurological assessments, supported by advancements in superconductivity and faster scanning techniques.

In terms of applications, Cardiology and Oncology are the dominant segments, reflecting the high prevalence of cardiovascular diseases and cancer in the region. The demand for advanced cardiac imaging for precise diagnosis and monitoring of heart conditions, along with the critical role of imaging in cancer staging, treatment planning, and follow-up, fuels this segment's growth. Neurology also represents a significant application area, with the rising incidence of neurological disorders driving the need for sophisticated imaging solutions like MRI and PET scans.

The Hospital segment is the primary end-user, accounting for the largest market share. This is attributed to the comprehensive nature of hospital services, requiring a broad spectrum of diagnostic imaging equipment for patient care. The Saudi government's continuous investment in upgrading public and private hospital infrastructure, including the establishment of new medical cities and specialized treatment centers, further strengthens this segment. Diagnostic Centers are also emerging as crucial players, offering specialized imaging services and catering to the growing outpatient demand, thus contributing to increased market penetration and accessibility.

Key drivers for the dominance of these segments include:

- Economic Policies and Healthcare Investment: Saudi Arabia's Vision 2030 initiative has prioritized healthcare sector development, leading to substantial government and private investment in advanced medical infrastructure, including diagnostic imaging facilities.

- Infrastructure Development: The expansion of new hospitals, specialized clinics, and diagnostic centers across the Kingdom is creating a robust demand for a wide array of diagnostic imaging modalities.

- Disease Burden and Awareness: The rising prevalence of chronic diseases like cardiovascular conditions, cancer, and neurological disorders, coupled with increasing public awareness about early detection, directly fuels the demand for advanced diagnostic imaging applications.

- Technological Adoption: The continuous integration of AI, high-resolution imaging, and advanced software solutions by manufacturers makes these modalities more appealing and effective for clinical use.

- Skilled Workforce Development: Investments in training healthcare professionals to operate and interpret advanced imaging technologies ensure optimal utilization of these systems.

The market is estimated to have been valued at over $250 Million in 2025, with the forecast period extending to 2033. The market share of the leading segments is expected to grow consistently, reflecting the ongoing healthcare transformation in Saudi Arabia.

Saudi Arabia Diagnostic Imaging Market Product Developments

Product development in the Saudi Arabia Diagnostic Imaging Market is characterized by a relentless pursuit of enhanced diagnostic accuracy, patient comfort, and workflow efficiency. Innovations are focused on integrating Artificial Intelligence (AI) for image analysis, enabling faster and more precise diagnoses, particularly in oncology and neurology. The development of higher resolution imaging technologies, such as advanced MRI coils and CT detectors, allows for the visualization of finer anatomical details, crucial for early disease detection. Furthermore, the trend towards portable and compact imaging devices is expanding access to diagnostic services beyond traditional hospital settings. These developments offer a significant competitive advantage by addressing unmet clinical needs and improving the overall patient experience.

Key Drivers of Saudi Arabia Diagnostic Imaging Market Growth

The Saudi Arabia Diagnostic Imaging Market is propelled by several potent growth drivers. Foremost is the Kingdom's strategic Vision 2030, which mandates significant investment in healthcare infrastructure and technology. This commitment fosters the establishment of advanced medical facilities and the adoption of cutting-edge diagnostic equipment. The escalating burden of chronic diseases, including cardiovascular ailments, cancer, and neurological disorders, necessitates precise and early detection, directly increasing the demand for sophisticated imaging solutions. Technological advancements, such as AI-driven image analysis and higher resolution modalities, are enhancing diagnostic capabilities and patient outcomes, further fueling market expansion. Finally, increasing health consciousness among the population and rising disposable incomes are contributing to a greater willingness to invest in preventive healthcare and advanced diagnostics.

Challenges in the Saudi Arabia Diagnostic Imaging Market Market

Despite its promising growth trajectory, the Saudi Arabia Diagnostic Imaging Market faces certain challenges. High initial capital investment for advanced imaging equipment, including MRI and CT scanners, can be a significant barrier for smaller healthcare providers. Stringent regulatory approvals and compliance requirements, though essential for patient safety, can lead to longer product launch timelines. A shortage of highly skilled radiologists and imaging technicians trained in operating and interpreting advanced technologies can impact the optimal utilization of these systems. Furthermore, maintaining a consistent supply chain for consumables and spare parts for sophisticated equipment can pose logistical hurdles. Competitive pressures from both global and regional players also necessitate continuous innovation and cost-effective solutions.

Emerging Opportunities in Saudi Arabia Diagnostic Imaging Market

The Saudi Arabia Diagnostic Imaging Market presents compelling opportunities for long-term growth. The ongoing digital transformation of healthcare, particularly the integration of AI and cloud-based imaging solutions, offers immense potential for improved diagnostics and remote patient monitoring. The increasing demand for specialized imaging services in areas like women's health (mammography, gynecological ultrasound) and orthopedic diagnostics presents niche market expansion avenues. Strategic partnerships between global technology providers and local healthcare institutions can facilitate technology transfer and market penetration. Furthermore, the growing focus on preventative healthcare and wellness programs will drive demand for routine screening and early detection imaging, creating sustained market growth opportunities.

Leading Players in the Saudi Arabia Diagnostic Imaging Market Sector

- Agfa Healthcare NV

- FUJIFILM Holdings Corporation

- General Electric Company (GE Healthcare)

- Esaote SpA

- Shimadzu Corporation

- Fonar Corporation

- Canon Medical Systems Corporation

- Siemens Healthineers

- Stryker Corporation

- Koninklijke Philips N V

Key Milestones in Saudi Arabia Diagnostic Imaging Market Industry

- October 2022: Saudi Arabian company AZDEF launched an MRI safety awareness campaign that began with the Advanced Safety Training Seminar, held in Dubai in partnership with the Dubai Health Authority (DHA). This initiative aims to enhance safety protocols and understanding of MRI technology, positively impacting user practices and indirectly supporting market adoption.

- January 2022: Saudi Arabia's Sanad Charitable Association launched a childhood cancer awareness campaign, "Sanad for Our Children." By informing families about symptom detection, this campaign indirectly promotes early diagnosis, potentially increasing the demand for diagnostic imaging services in pediatric oncology.

Strategic Outlook for Saudi Arabia Diagnostic Imaging Market Market

The strategic outlook for the Saudi Arabia Diagnostic Imaging Market is highly optimistic, driven by a sustained commitment to healthcare modernization and technological advancement. Growth accelerators include the continued implementation of Vision 2030, which promises substantial investments in cutting-edge medical infrastructure and the adoption of innovative diagnostic technologies. The increasing prevalence of chronic diseases and a growing emphasis on preventative healthcare will ensure a robust and continuous demand for advanced imaging solutions. Strategic opportunities lie in the expansion of AI-driven diagnostics, the development of portable imaging devices for broader access, and forging deeper collaborations between global manufacturers and local healthcare providers to tailor solutions to the specific needs of the Saudi market, ultimately driving market penetration and value creation.

Saudi Arabia Diagnostic Imaging Market Segmentation

-

1. Modality

- 1.1. MRI

- 1.2. Computed Tomography

- 1.3. Ultrasound

- 1.4. X-Ray

- 1.5. Nuclear Imaging

- 1.6. Fluoroscopy

- 1.7. Mammography

-

2. Application

- 2.1. Cardiology

- 2.2. Oncology

- 2.3. Neurology

- 2.4. Orthopedics

- 2.5. Gastroenterology

- 2.6. Gynecology

- 2.7. Other Applications

-

3. End User

- 3.1. Hospital

- 3.2. Diagnostic Centers

- 3.3. Other End Users

Saudi Arabia Diagnostic Imaging Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Diagnostic Imaging Market Regional Market Share

Geographic Coverage of Saudi Arabia Diagnostic Imaging Market

Saudi Arabia Diagnostic Imaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidence of Chronic Diseases; Increased Adoption of Advanced Technologies in Medical Imaging

- 3.3. Market Restrains

- 3.3.1. High Cost of Diagnostic Imaging Equipment

- 3.4. Market Trends

- 3.4.1. Oncology is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Diagnostic Imaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Modality

- 5.1.1. MRI

- 5.1.2. Computed Tomography

- 5.1.3. Ultrasound

- 5.1.4. X-Ray

- 5.1.5. Nuclear Imaging

- 5.1.6. Fluoroscopy

- 5.1.7. Mammography

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Oncology

- 5.2.3. Neurology

- 5.2.4. Orthopedics

- 5.2.5. Gastroenterology

- 5.2.6. Gynecology

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospital

- 5.3.2. Diagnostic Centers

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Modality

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Agfa Healthcare NV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FUJIFILM Holdings Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Electric Company (GE Healthcare)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Esaote SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shimadzu Corporation*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fonar Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canon Medical Systems Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Siemens Healthineers

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stryker Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Koninklijke Philips N V

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Agfa Healthcare NV

List of Figures

- Figure 1: Saudi Arabia Diagnostic Imaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Diagnostic Imaging Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Diagnostic Imaging Market Revenue Million Forecast, by Modality 2020 & 2033

- Table 2: Saudi Arabia Diagnostic Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Saudi Arabia Diagnostic Imaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Saudi Arabia Diagnostic Imaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Diagnostic Imaging Market Revenue Million Forecast, by Modality 2020 & 2033

- Table 6: Saudi Arabia Diagnostic Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Saudi Arabia Diagnostic Imaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Saudi Arabia Diagnostic Imaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Diagnostic Imaging Market?

The projected CAGR is approximately 3.85%.

2. Which companies are prominent players in the Saudi Arabia Diagnostic Imaging Market?

Key companies in the market include Agfa Healthcare NV, FUJIFILM Holdings Corporation, General Electric Company (GE Healthcare), Esaote SpA, Shimadzu Corporation*List Not Exhaustive, Fonar Corporation, Canon Medical Systems Corporation, Siemens Healthineers, Stryker Corporation, Koninklijke Philips N V.

3. What are the main segments of the Saudi Arabia Diagnostic Imaging Market?

The market segments include Modality, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 399.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidence of Chronic Diseases; Increased Adoption of Advanced Technologies in Medical Imaging.

6. What are the notable trends driving market growth?

Oncology is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Diagnostic Imaging Equipment.

8. Can you provide examples of recent developments in the market?

October 2022: Saudi Arabian company AZDEF launched an MRI safety awareness campaign that began with the Advanced Safety Training Seminar, which was held in Dubai in partnership with the Dubai Health Authority (DHA).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Diagnostic Imaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Diagnostic Imaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Diagnostic Imaging Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Diagnostic Imaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence