Key Insights

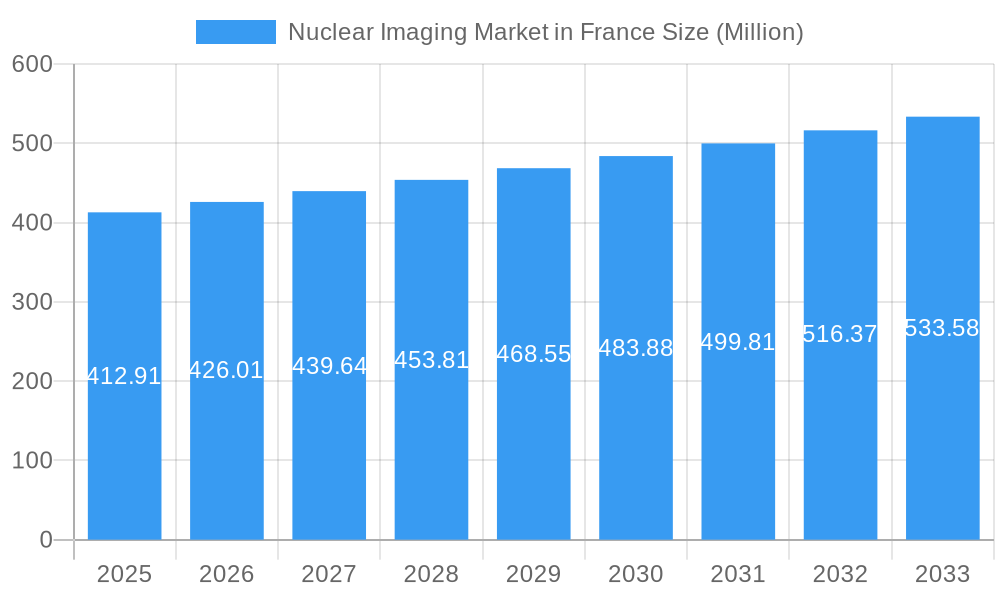

The French Nuclear Imaging Market is poised for steady expansion, driven by increasing demand for advanced diagnostic solutions and a growing prevalence of chronic diseases. With an estimated market size of 412.91 Million in 2025, the market is projected to witness a Compound Annual Growth Rate (CAGR) of 3.21% through 2033. This growth is underpinned by significant advancements in radioisotope technology, particularly in SPECT and PET imaging, which offer unparalleled insights into disease progression and treatment efficacy. The increasing adoption of SPECT radioisotopes like Technetium-99m for various applications such as cardiology, neurology, and thyroid imaging, alongside the rising use of PET radioisotopes, especially Fluorodeoxyglucose (FDG) in oncology, are key contributors to market expansion. France's well-established healthcare infrastructure, coupled with a proactive approach to adopting cutting-edge medical technologies, positions it as a crucial market within the European landscape.

Nuclear Imaging Market in France Market Size (In Million)

Key market drivers include the escalating burden of oncological, neurological, and cardiovascular diseases, necessitating more accurate and earlier diagnostic interventions. Technological innovations in imaging equipment, including enhanced detector sensitivity and faster scan times, are further fueling market growth. The market is segmented into Equipment, comprising diagnostic radioisotopes for SPECT and PET, and Applications, covering SPECT imaging in cardiology, neurology, thyroid, and other areas, as well as PET imaging in oncology and other fields. Leading global players such as Siemens Healthineers, GE Healthcare, and Bracco Group are actively investing in research and development, introducing novel radiopharmaceuticals and imaging systems. However, the market faces certain restraints, including the high cost of advanced imaging equipment and radiopharmaceuticals, coupled with stringent regulatory frameworks for radioisotope production and handling. Despite these challenges, the robust pipeline of new radiotracers and the expanding reimbursement landscape are expected to sustain a positive growth trajectory for the French nuclear imaging market.

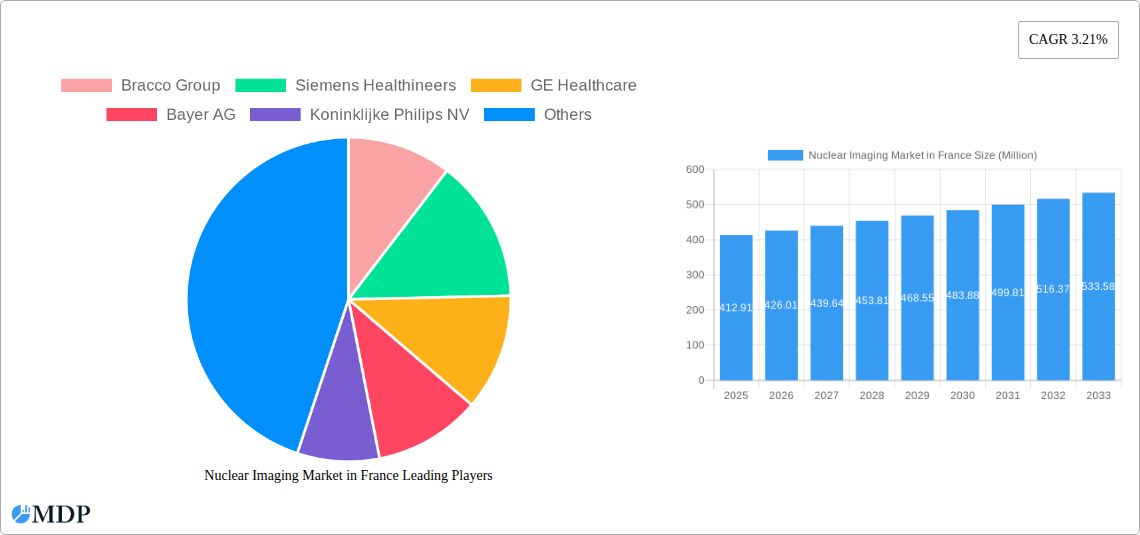

Nuclear Imaging Market in France Company Market Share

Unveiling the French Nuclear Imaging Market: A Comprehensive Analysis of Growth, Innovation, and Strategic Opportunities (2019-2033)

Dive deep into the dynamic French nuclear imaging market with this in-depth report. Explore the evolving landscape, from cutting-edge equipment and vital diagnostic radioisotopes to critical applications in oncology, cardiology, and neurology. This report provides actionable insights for stakeholders, including device manufacturers, pharmaceutical companies, research institutions, and investors, navigating the intricate growth trajectory driven by technological advancements, favorable regulatory environments, and increasing healthcare expenditure. The study encompasses the historical period from 2019-2024, the base year of 2025, and projects future trends through 2033, offering a complete understanding of market evolution. Discover key market drivers, emergent opportunities, prevailing challenges, and the strategic imperatives for sustained growth within France's burgeoning nuclear medicine sector.

Nuclear Imaging Market in France Market Dynamics & Concentration

The French nuclear imaging market is characterized by a moderate to high concentration, with key players like Siemens Healthineers, GE Healthcare, and Philips NV holding significant market share. Innovation remains a primary driver, fueled by continuous advancements in detector technology, radiopharmaceutical development, and artificial intelligence integration for enhanced image analysis. Regulatory frameworks, overseen by authorities like the Agence nationale de sécurité du médicament et des produits de santé (ANSM), are crucial in ensuring product safety and efficacy, influencing market entry and product development strategies. While product substitutes exist in other diagnostic modalities, the unique functional information provided by nuclear imaging, particularly for metabolic and molecular processes, limits their direct replacement. End-user trends indicate a growing demand for minimally invasive diagnostic procedures, improved patient outcomes, and cost-effectiveness, pushing for more efficient and accessible nuclear medicine solutions. Mergers and acquisitions (M&A) activity, while not rampant, has been strategic, aiming to consolidate portfolios, expand technological capabilities, and enhance market reach. For instance, recent consolidations within the radiopharmaceutical sector have aimed to secure supply chains and broaden therapeutic offerings. The market is witnessing an increasing adoption of hybrid imaging systems, such as PET/CT and SPECT/CT, underscoring the demand for integrated diagnostic capabilities.

Nuclear Imaging Market in France Industry Trends & Analysis

The French nuclear imaging market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025-2033. This upward trajectory is underpinned by several converging trends. A significant market driver is the increasing prevalence of chronic diseases, particularly cancer, cardiovascular disorders, and neurological conditions, which necessitate advanced diagnostic tools for early detection, staging, and treatment monitoring. Nuclear imaging, with its ability to visualize physiological processes at a molecular level, plays a pivotal role in managing these diseases. Technological disruptions are a constant feature, with ongoing innovation in SPECT and PET radioisotope development leading to agents with higher specificity and sensitivity, thereby improving diagnostic accuracy. Furthermore, advancements in imaging hardware, including the development of more compact, cost-effective, and higher-resolution scanners, are expanding the accessibility of nuclear medicine procedures. Consumer preferences are increasingly aligned with personalized medicine, where nuclear imaging aids in tailoring treatment strategies based on individual patient molecular profiles. The competitive dynamics within the market are shaped by established global players and emerging local innovators, fostering a climate of continuous improvement and product differentiation. The market penetration of advanced nuclear imaging techniques is steadily rising, driven by increased awareness among healthcare professionals and patients regarding their diagnostic benefits. The integration of artificial intelligence (AI) in image reconstruction, analysis, and workflow optimization is another transformative trend, promising to enhance efficiency and diagnostic precision, thereby contributing significantly to market expansion. The growing emphasis on preventative healthcare and early disease detection further fuels the demand for sophisticated diagnostic imaging solutions.

Leading Markets & Segments in Nuclear Imaging Market in France

Within the French nuclear imaging market, the SPECT Applications segment demonstrates significant dominance, particularly driven by its established use in Cardiology and Neurology.

- Cardiology: SPECT imaging remains a cornerstone for diagnosing and managing a wide range of cardiovascular diseases, including myocardial perfusion imaging to assess blood flow to the heart muscle. Factors contributing to its strong presence include the availability of well-established radiotracers, a robust body of clinical evidence supporting its efficacy, and its relative cost-effectiveness compared to PET in certain diagnostic scenarios. The increasing incidence of heart disease in France, coupled with an aging population, continues to bolster demand for SPECT cardiology applications.

- Neurology: SPECT applications in neurology are crucial for evaluating conditions such as Alzheimer's disease, Parkinson's disease, and epilepsy. Its ability to assess regional cerebral blood flow and neurotransmitter activity provides invaluable insights for diagnosis and treatment planning. The growing understanding of neurodegenerative diseases and the demand for accurate diagnostic tools contribute to the sustained importance of SPECT in this domain.

- Equipment: The Equipment segment, encompassing SPECT and PET scanners, is a major market contributor. The continuous upgrade cycle of existing infrastructure and the increasing adoption of hybrid imaging systems like SPECT/CT are key drivers. Investments in advanced SPECT systems with improved resolution and faster scan times are also fueling growth.

- Diagnostic Radioisotope - SPECT Radioisotopes: The availability and development of SPECT radioisotopes are intrinsically linked to the demand for SPECT applications. Radiotracers like Technetium-99m (Tc-99m) remain widely used, and ongoing research into novel SPECT tracers is further strengthening this segment.

- PET Applications - Oncology: While SPECT holds a strong position, PET Applications are experiencing rapid growth, with Oncology being the primary driver. PET scans, particularly using Fluorodeoxyglucose (FDG), are indispensable for cancer detection, staging, response assessment to therapy, and recurrence monitoring. The increasing focus on precision oncology and the development of targeted PET tracers are propelling the PET oncology segment forward.

- Other SPECT Applications & Other PET Applications: These segments, while smaller, represent growing areas of application, including thyroid disorders, inflammation, and infection imaging for SPECT, and an expanding range of molecular targets for PET.

The overall dominance is a testament to the established clinical utility of SPECT in key specialties, while the rapid expansion of PET, especially in oncology, signifies a significant shift towards molecular imaging for a broader spectrum of diseases.

Nuclear Imaging Market in France Product Developments

Product development in the French nuclear imaging market is highly focused on enhancing diagnostic accuracy, improving patient comfort, and increasing workflow efficiency. Innovations in detector technology for SPECT and PET scanners are yielding higher resolution images with reduced scan times, enabling earlier and more precise diagnoses. The development of novel radiotracers with greater target specificity is a critical area of research, leading to improved visualization of specific cellular processes and molecular targets, particularly in oncology and neurology. The integration of artificial intelligence (AI) into imaging hardware and software is transforming image reconstruction, noise reduction, and quantitative analysis, offering significant competitive advantages to manufacturers. Furthermore, there is a growing trend towards developing more compact and cost-effective imaging systems, which aim to expand accessibility to nuclear medicine diagnostics in a wider range of healthcare settings.

Key Drivers of Nuclear Imaging Market in France Growth

Several key factors are propelling the growth of the nuclear imaging market in France. Technologically, advancements in scanner hardware, including PET/CT and SPECT/CT hybrid systems, offer superior diagnostic capabilities by combining anatomical and functional information. The development of novel radiotracers, especially for PET imaging in oncology and neurology, is expanding the scope of molecular diagnostics. Economically, increasing healthcare expenditure, an aging population, and a rising prevalence of chronic diseases like cancer and cardiovascular disorders are driving the demand for advanced diagnostic tools. Regulatory support for the adoption of new imaging technologies and radiopharmaceuticals, coupled with government initiatives focused on improving cancer care and diagnostic accessibility, also plays a crucial role. The growing awareness among healthcare professionals and patients about the benefits of nuclear imaging for early disease detection and personalized treatment planning is a significant behavioral driver.

Challenges in the Nuclear Imaging Market in France Market

Despite its growth potential, the French nuclear imaging market faces several challenges. High acquisition and maintenance costs associated with advanced nuclear imaging equipment and radiopharmaceuticals can be a significant barrier to widespread adoption, particularly for smaller healthcare facilities. Stringent regulatory approval processes for new radiotracers and imaging devices can lead to extended market entry timelines. The availability and reliable supply of certain radioisotopes, which have short half-lives and require specialized production and distribution networks, can pose logistical challenges. Furthermore, the shortage of trained nuclear medicine physicians, technologists, and radiopharmacists in France can limit the capacity to utilize existing and new imaging technologies effectively. Finally, competition from alternative diagnostic modalities, such as advanced MRI and CT technologies, necessitates continuous innovation and demonstration of the unique value proposition of nuclear imaging.

Emerging Opportunities in Nuclear Imaging Market in France

Emerging opportunities in the French nuclear imaging market are primarily driven by technological breakthroughs and strategic collaborations. The expanding repertoire of novel PET and SPECT radiotracers targeting specific molecular pathways in various diseases, beyond oncology, presents a significant growth avenue. The increasing application of artificial intelligence and machine learning in image analysis and workflow optimization holds immense potential to enhance diagnostic accuracy, reduce interpretation times, and improve operational efficiency. Strategic partnerships between equipment manufacturers, radiopharmaceutical companies, and academic research institutions are fostering innovation and accelerating the development of next-generation nuclear medicine solutions. Furthermore, the growing interest in theranostics, the combination of diagnostic imaging with targeted radionuclide therapy, offers a promising future for personalized cancer treatment. The expansion of nuclear imaging services into smaller hospitals and specialized clinics, facilitated by more compact and cost-effective imaging systems, also represents a significant market expansion opportunity.

Leading Players in the Nuclear Imaging Market in France Sector

- Bracco Group

- Siemens Healthineers

- GE Healthcare

- Bayer AG

- Koninklijke Philips NV

- Mirion Technologies (Capintec)

- Canon Medical Systems Corporation

- Novartis AG (Advanced Accelerator Applications)

- Curium

- Fujifilm Holdings Corporation

Key Milestones in Nuclear Imaging Market in France Industry

- May 2022: Nuclear medicine physicians at the Baclesse Cancer Center in Caen, France, developed an Artificial Intelligence algorithm designed to enhance image quality in PET scanners, signaling a significant step forward in AI integration for improved diagnostic precision.

- January 2021: Koninklijke Philips N.V. and Rennes University Hospital entered into a pivotal 5-year innovation and technology partnership. This collaboration aims to advance diagnostic and interventional imaging, patient monitoring, and management, underscoring a commitment to cutting-edge healthcare solutions in France.

Strategic Outlook for Nuclear Imaging Market in France Market

The strategic outlook for the French nuclear imaging market is one of sustained growth and innovation. Key accelerators include the continued development and adoption of advanced radiotracers that enable earlier and more precise disease detection, particularly in oncology, neurology, and cardiology. The integration of artificial intelligence and machine learning across the entire nuclear medicine workflow, from image acquisition to analysis and reporting, will be crucial for enhancing efficiency and diagnostic accuracy. Strategic partnerships between technology providers, healthcare institutions, and pharmaceutical companies will drive the development and commercialization of novel imaging agents and theranostic applications. Furthermore, a focus on expanding access to nuclear imaging technologies in regional and smaller healthcare facilities through more compact and cost-effective solutions will unlock new market segments. The market is expected to witness a gradual shift towards hybrid imaging modalities and personalized medicine approaches, further solidifying the indispensable role of nuclear imaging in modern healthcare.

Nuclear Imaging Market in France Segmentation

-

1. Product

- 1.1. Equipment

-

1.2. Diagnostic Radioisotope

- 1.2.1. SPECT Radioisotopes

- 1.2.2. PET Radioisotopes

-

2. Application

-

2.1. SPECT Applications

- 2.1.1. Cardiology

- 2.1.2. Neurology

- 2.1.3. Thyroid

- 2.1.4. Other SPECT Applications

-

2.2. PET Applications

- 2.2.1. Oncology

- 2.2.2. Other PET Applications

-

2.1. SPECT Applications

Nuclear Imaging Market in France Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

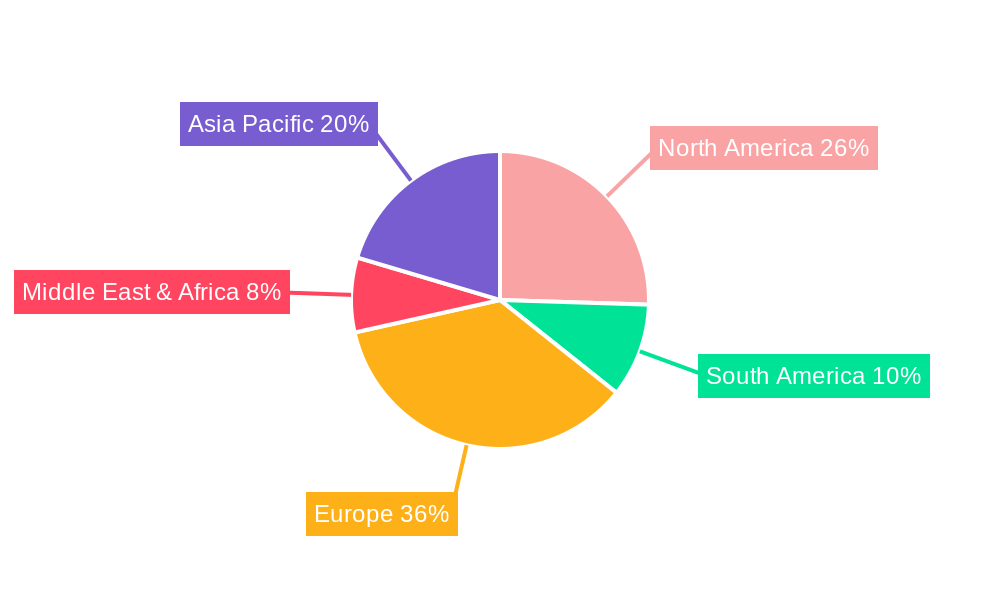

Nuclear Imaging Market in France Regional Market Share

Geographic Coverage of Nuclear Imaging Market in France

Nuclear Imaging Market in France REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Cancer and Cardiac Disorders; Technological Advancements in Nuclear Imaging

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations

- 3.4. Market Trends

- 3.4.1. PET Radioisotopes are Expected to Witness Strong Growth in Future

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nuclear Imaging Market in France Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Equipment

- 5.1.2. Diagnostic Radioisotope

- 5.1.2.1. SPECT Radioisotopes

- 5.1.2.2. PET Radioisotopes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. SPECT Applications

- 5.2.1.1. Cardiology

- 5.2.1.2. Neurology

- 5.2.1.3. Thyroid

- 5.2.1.4. Other SPECT Applications

- 5.2.2. PET Applications

- 5.2.2.1. Oncology

- 5.2.2.2. Other PET Applications

- 5.2.1. SPECT Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Nuclear Imaging Market in France Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Equipment

- 6.1.2. Diagnostic Radioisotope

- 6.1.2.1. SPECT Radioisotopes

- 6.1.2.2. PET Radioisotopes

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. SPECT Applications

- 6.2.1.1. Cardiology

- 6.2.1.2. Neurology

- 6.2.1.3. Thyroid

- 6.2.1.4. Other SPECT Applications

- 6.2.2. PET Applications

- 6.2.2.1. Oncology

- 6.2.2.2. Other PET Applications

- 6.2.1. SPECT Applications

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Nuclear Imaging Market in France Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Equipment

- 7.1.2. Diagnostic Radioisotope

- 7.1.2.1. SPECT Radioisotopes

- 7.1.2.2. PET Radioisotopes

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. SPECT Applications

- 7.2.1.1. Cardiology

- 7.2.1.2. Neurology

- 7.2.1.3. Thyroid

- 7.2.1.4. Other SPECT Applications

- 7.2.2. PET Applications

- 7.2.2.1. Oncology

- 7.2.2.2. Other PET Applications

- 7.2.1. SPECT Applications

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Nuclear Imaging Market in France Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Equipment

- 8.1.2. Diagnostic Radioisotope

- 8.1.2.1. SPECT Radioisotopes

- 8.1.2.2. PET Radioisotopes

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. SPECT Applications

- 8.2.1.1. Cardiology

- 8.2.1.2. Neurology

- 8.2.1.3. Thyroid

- 8.2.1.4. Other SPECT Applications

- 8.2.2. PET Applications

- 8.2.2.1. Oncology

- 8.2.2.2. Other PET Applications

- 8.2.1. SPECT Applications

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Nuclear Imaging Market in France Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Equipment

- 9.1.2. Diagnostic Radioisotope

- 9.1.2.1. SPECT Radioisotopes

- 9.1.2.2. PET Radioisotopes

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. SPECT Applications

- 9.2.1.1. Cardiology

- 9.2.1.2. Neurology

- 9.2.1.3. Thyroid

- 9.2.1.4. Other SPECT Applications

- 9.2.2. PET Applications

- 9.2.2.1. Oncology

- 9.2.2.2. Other PET Applications

- 9.2.1. SPECT Applications

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Nuclear Imaging Market in France Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Equipment

- 10.1.2. Diagnostic Radioisotope

- 10.1.2.1. SPECT Radioisotopes

- 10.1.2.2. PET Radioisotopes

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. SPECT Applications

- 10.2.1.1. Cardiology

- 10.2.1.2. Neurology

- 10.2.1.3. Thyroid

- 10.2.1.4. Other SPECT Applications

- 10.2.2. PET Applications

- 10.2.2.1. Oncology

- 10.2.2.2. Other PET Applications

- 10.2.1. SPECT Applications

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bracco Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Siemens Healthineers

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GE Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bayer AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Koninklijke Philips NV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mirion technologies (capintec)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Canon Medical Systems Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NOVARTIS AG (ADVANCED ACCELERATOR APPLICATIONS)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Curium

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fujifilm Holdings Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bracco Group

List of Figures

- Figure 1: Global Nuclear Imaging Market in France Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Nuclear Imaging Market in France Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Nuclear Imaging Market in France Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Nuclear Imaging Market in France Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Nuclear Imaging Market in France Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Nuclear Imaging Market in France Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Nuclear Imaging Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Nuclear Imaging Market in France Revenue (Million), by Product 2025 & 2033

- Figure 9: South America Nuclear Imaging Market in France Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America Nuclear Imaging Market in France Revenue (Million), by Application 2025 & 2033

- Figure 11: South America Nuclear Imaging Market in France Revenue Share (%), by Application 2025 & 2033

- Figure 12: South America Nuclear Imaging Market in France Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Nuclear Imaging Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Nuclear Imaging Market in France Revenue (Million), by Product 2025 & 2033

- Figure 15: Europe Nuclear Imaging Market in France Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Nuclear Imaging Market in France Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Nuclear Imaging Market in France Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Nuclear Imaging Market in France Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Nuclear Imaging Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Nuclear Imaging Market in France Revenue (Million), by Product 2025 & 2033

- Figure 21: Middle East & Africa Nuclear Imaging Market in France Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa Nuclear Imaging Market in France Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East & Africa Nuclear Imaging Market in France Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East & Africa Nuclear Imaging Market in France Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Nuclear Imaging Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Nuclear Imaging Market in France Revenue (Million), by Product 2025 & 2033

- Figure 27: Asia Pacific Nuclear Imaging Market in France Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific Nuclear Imaging Market in France Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Pacific Nuclear Imaging Market in France Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Nuclear Imaging Market in France Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Nuclear Imaging Market in France Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nuclear Imaging Market in France Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Nuclear Imaging Market in France Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Nuclear Imaging Market in France Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Nuclear Imaging Market in France Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global Nuclear Imaging Market in France Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Nuclear Imaging Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Nuclear Imaging Market in France Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global Nuclear Imaging Market in France Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Nuclear Imaging Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Nuclear Imaging Market in France Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global Nuclear Imaging Market in France Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Nuclear Imaging Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Nuclear Imaging Market in France Revenue Million Forecast, by Product 2020 & 2033

- Table 29: Global Nuclear Imaging Market in France Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Nuclear Imaging Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Nuclear Imaging Market in France Revenue Million Forecast, by Product 2020 & 2033

- Table 38: Global Nuclear Imaging Market in France Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global Nuclear Imaging Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Nuclear Imaging Market in France Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nuclear Imaging Market in France?

The projected CAGR is approximately 3.21%.

2. Which companies are prominent players in the Nuclear Imaging Market in France?

Key companies in the market include Bracco Group, Siemens Healthineers, GE Healthcare, Bayer AG, Koninklijke Philips NV, Mirion technologies (capintec), Canon Medical Systems Corporation, NOVARTIS AG (ADVANCED ACCELERATOR APPLICATIONS), Curium, Fujifilm Holdings Corporation.

3. What are the main segments of the Nuclear Imaging Market in France?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 412.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Cancer and Cardiac Disorders; Technological Advancements in Nuclear Imaging.

6. What are the notable trends driving market growth?

PET Radioisotopes are Expected to Witness Strong Growth in Future.

7. Are there any restraints impacting market growth?

Stringent Regulations.

8. Can you provide examples of recent developments in the market?

In May 2022, Nuclear medicine physicians at the Baclesse Cancer Center in Caen, France developed an Artificial Intelligence algorithm that can be used in PET scanners to improve image quality.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nuclear Imaging Market in France," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nuclear Imaging Market in France report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nuclear Imaging Market in France?

To stay informed about further developments, trends, and reports in the Nuclear Imaging Market in France, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence