Key Insights

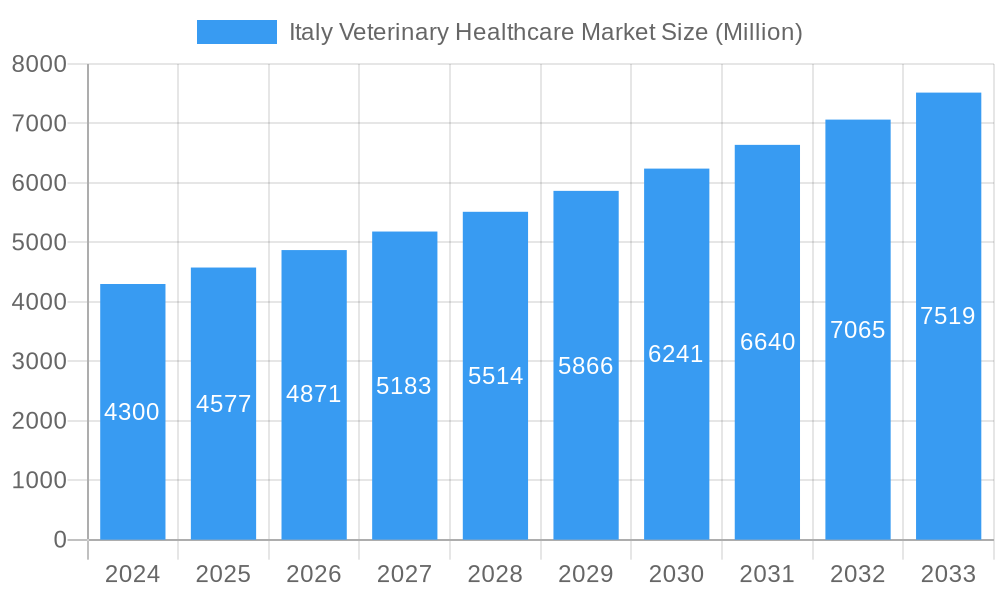

The Italian veterinary healthcare market is poised for significant expansion, driven by increasing pet ownership, rising disposable incomes, and a growing awareness of animal welfare among the populace. Forecasted to reach approximately USD 4.3 billion in 2024, the market is projected to experience a healthy Compound Annual Growth Rate (CAGR) of 6.4% through 2033. This robust growth is underpinned by advancements in veterinary medicine, leading to the development of more sophisticated therapeutics and diagnostic tools. Key growth drivers include the rising demand for preventive healthcare in companion animals like dogs and cats, the need for effective treatments for livestock diseases to ensure food safety and security, and the continuous innovation in veterinary pharmaceuticals, including vaccines and anti-infectives. The market's expansion is further bolstered by the increasing adoption of advanced diagnostic technologies, such as molecular diagnostics and immunodiagnostic tests, which enable earlier and more accurate disease detection.

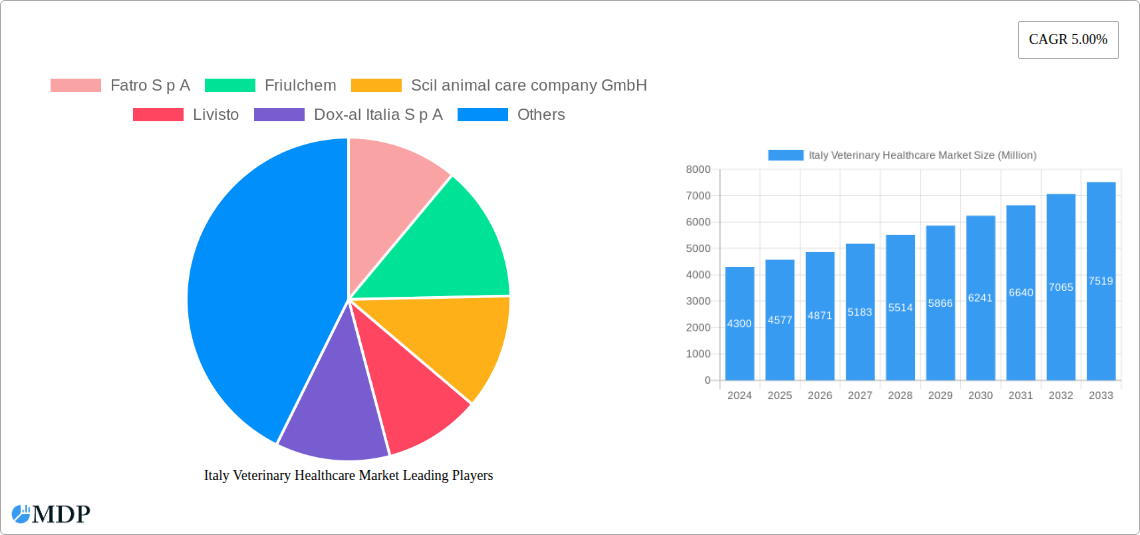

Italy Veterinary Healthcare Market Market Size (In Billion)

The Italian veterinary healthcare landscape is characterized by a dynamic interplay of product segments and animal types. Therapeutics, encompassing vaccines, parasiticides, anti-infectives, and medical feed additives, represent a substantial portion of the market, reflecting the ongoing need for disease prevention and treatment. Diagnostics, including immunodiagnostic tests and molecular diagnostics, are also gaining traction as the focus shifts towards proactive animal health management. While companion animals like dogs and cats are significant revenue generators due to increasing humanization of pets, the ruminant and poultry segments also present considerable opportunities, driven by the demands of the agricultural sector for healthy livestock. Key players in the market are actively investing in research and development to introduce innovative solutions, catering to the evolving needs of veterinarians and pet owners alike, and contributing to the overall positive market trajectory.

Italy Veterinary Healthcare Market Company Market Share

This comprehensive report offers an in-depth analysis of the Italy veterinary healthcare market, a rapidly expanding sector driven by increasing pet ownership, advancements in animal welfare, and robust demand for sophisticated veterinary products and services. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report provides unparalleled insights into market dynamics, industry trends, leading players, and future opportunities. Expected to reach over USD 5 billion by 2025, the Italian veterinary market presents significant opportunities for growth and innovation.

Italy Veterinary Healthcare Market Market Dynamics & Concentration

The Italy veterinary healthcare market exhibits moderate to high concentration, with a few key players dominating significant market shares. Innovation drivers are primarily fueled by the rising incidence of zoonotic diseases, increasing demand for advanced diagnostics and therapeutics for companion animals, and a growing awareness of preventive healthcare in livestock. The regulatory framework, overseen by the Italian Ministry of Health and the European Medicines Agency (EMA), plays a crucial role in ensuring product safety and efficacy, impacting market entry and product approvals. Product substitutes, while present in some basic therapeutic areas, are increasingly being outpaced by novel and specialized veterinary solutions. End-user trends are strongly influenced by the humanization of pets, leading to greater investment in their health and well-being, and a growing emphasis on food safety and animal welfare in the livestock sector. Mergers and acquisitions (M&A) activities are a significant factor shaping market concentration. For instance, Fatro S.p.A.'s acquisition of Quadrel in November 2022 underscores the strategic focus on consolidating market presence and expanding product portfolios, particularly in the companion animal segment. The market has witnessed over 5 significant M&A deals in the last five years, signaling ongoing consolidation and strategic realignments among key industry players.

Italy Veterinary Healthcare Market Industry Trends & Analysis

The Italy veterinary healthcare market is poised for substantial growth, projecting a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This expansion is propelled by a confluence of factors. The rising trend of pet ownership across Italy, coupled with an increasing willingness among pet owners to invest in high-quality veterinary care, is a primary growth driver. This "humanization of pets" phenomenon translates into higher demand for sophisticated diagnostic tools, advanced therapeutics, and preventive healthcare solutions, mirroring human healthcare trends. Technological disruptions are revolutionizing veterinary diagnostics and treatment. The advent of advanced diagnostic imaging techniques, alongside the development of molecular diagnostics and immunodiagnostic tests, allows for earlier and more accurate disease detection, leading to improved treatment outcomes. Medical feed additives are also gaining traction, particularly in the livestock sector, to enhance animal health, productivity, and reduce reliance on antibiotics. Consumer preferences are shifting towards minimally invasive procedures, personalized treatment plans, and an increased focus on chronic disease management in older pets. The competitive landscape is characterized by intense rivalry among global and local players, pushing for continuous innovation in product development and service offerings. Market penetration of advanced veterinary technologies is steadily increasing, indicating a mature market actively embracing innovation. The emphasis on One Health initiatives, recognizing the interconnectedness of human, animal, and environmental health, further fuels demand for integrated veterinary solutions and research.

Leading Markets & Segments in Italy Veterinary Healthcare Market

Within the Italy veterinary healthcare market, the Dogs and Cats segment emerges as the dominant force, driven by the enduring trend of pet humanization and a growing disposable income allocated to pet care. This segment commands a significant market share, estimated to be over 40% of the total market value.

- Product Segment Dominance:

- Therapeutics: This segment is the largest, with Vaccines and Parasiticides leading the sub-segments due to their essential role in preventive care and disease management for both companion and food-producing animals. The rising awareness of zoonotic diseases further bolsters the demand for effective vaccines. Anti-infectives remain crucial, though there's a growing trend towards more targeted and antibiotic-sparing treatments.

- Diagnostics: The Diagnostic Imaging sub-segment is experiencing robust growth, fueled by technological advancements and the increasing need for precise disease identification. Immunodiagnostic Tests are also highly prevalent due to their speed and accuracy in detecting various diseases.

- Animal Type Dominance:

- Dogs and Cats: As mentioned, this segment is the undisputed leader. The increasing prevalence of chronic diseases and age-related conditions in companion animals necessitates ongoing veterinary intervention and specialized treatments.

- Ruminants and Swine: These segments remain significant, particularly due to the importance of the Italian agricultural sector. Demand for Medical Feed Additives and Vaccines to ensure herd health and optimize productivity is substantial. Economic policies supporting sustainable farming practices indirectly contribute to the growth of these segments.

- Key Drivers of Dominance:

- Economic Policies: Government initiatives supporting the agricultural sector and animal welfare directly impact the demand for veterinary products in the ruminant and swine segments.

- Infrastructure: The widespread availability of veterinary clinics and advanced diagnostic facilities, especially in urban and semi-urban areas, facilitates higher market penetration for products and services catering to companion animals.

- Consumer Awareness: Increased consumer awareness regarding pet health and the economic benefits of healthy livestock are powerful drivers of market dominance.

Italy Veterinary Healthcare Market Product Developments

The Italy veterinary healthcare market is witnessing continuous innovation with a strong focus on developing advanced therapeutics and diagnostics. Key product developments include novel vaccines offering broader spectrum protection, highly targeted parasiticides with improved safety profiles, and next-generation anti-infectives to combat antimicrobial resistance. In diagnostics, the integration of artificial intelligence in diagnostic imaging and the development of rapid point-of-care immunodiagnostic tests are transforming disease detection and management. Furthermore, advancements in medical feed additives are focusing on improving gut health and immune function in livestock, thereby reducing the need for routine antibiotic use. These innovations are driven by a desire to enhance animal welfare, improve disease control, and ensure food safety, positioning the market for sustained growth and technological leadership.

Key Drivers of Italy Veterinary Healthcare Market Growth

Several pivotal factors are propelling the Italy veterinary healthcare market forward. The continuous rise in pet ownership across Italy, coupled with the escalating trend of pet humanization, is a primary driver, leading to increased expenditure on veterinary services and products. Technological advancements in veterinary diagnostics and therapeutics are creating more effective and less invasive treatment options, thereby boosting demand. A growing awareness among animal owners regarding preventive healthcare and the management of chronic diseases also contributes significantly. Furthermore, supportive regulatory frameworks and increasing government focus on animal welfare and food safety in the agricultural sector create a favorable environment for market expansion. Strategic investments in research and development by leading companies are consistently introducing innovative solutions to the market.

Challenges in the Italy Veterinary Healthcare Market Market

Despite its robust growth, the Italy veterinary healthcare market faces several challenges. Stringent regulatory hurdles for new product approvals can lead to extended market entry timelines and increased development costs. Supply chain disruptions, exacerbated by global events, can impact the availability and pricing of critical veterinary medicines and equipment. Intense competitive pressure from both established players and emerging niche companies can lead to pricing wars and pressure on profit margins. Additionally, the high cost of advanced veterinary treatments and diagnostics can sometimes be a barrier for a segment of the pet-owning population, leading to potential disparities in access to care. The ongoing concern regarding antimicrobial resistance also necessitates a shift towards alternative treatments and proactive disease prevention strategies, requiring significant investment and adaptation from market stakeholders.

Emerging Opportunities in Italy Veterinary Healthcare Market

The Italy veterinary healthcare market is rife with emerging opportunities for stakeholders. The growing demand for telemedicine and remote veterinary consultations presents a significant avenue for expanding service accessibility, particularly in rural areas. The increasing focus on personalized medicine and genomic testing for animals opens up new frontiers for tailored treatment plans and disease prediction. Furthermore, the development of novel biologics and immunotherapy approaches for treating complex diseases in animals offers substantial potential. Strategic partnerships between veterinary practices, research institutions, and technology providers can accelerate innovation and market penetration. The ongoing emphasis on sustainability in animal agriculture also creates opportunities for products and solutions that enhance animal welfare and reduce environmental impact, aligning with global trends and consumer preferences.

Leading Players in the Italy Veterinary Healthcare Market Sector

- Fatro S.p.A.

- Friulchem

- Scil animal care company GmbH

- Livisto

- Dox-al Italia S.p.A.

- Teknofarma s.r.l.

- Virbac

- Candioli Pharma

- Zoetis Inc.

Key Milestones in Italy Veterinary Healthcare Market Industry

- November 2022: Fatro acquired Quadrel, a strategic move aimed at emphasizing growth in the companion animal market. This initiative involved a EUR 7.6 million (USD 7.6 million) investment in 13 research centers focused on neglected tropical diseases, with the addition of QL-A02 significantly boosting Fatro's pet sector pipeline.

- April 2022: Vetoquinol launched Falpreva for veterinarians in five European markets, including Italy. Falpreva is a groundbreaking spot-on combination for cats designed to treat both internal and external parasite infestations and infections, including tapeworms, with the convenience of a single dose lasting up to three months.

Strategic Outlook for Italy Veterinary Healthcare Market Market

The strategic outlook for the Italy veterinary healthcare market is exceptionally positive, driven by several key growth accelerators. The increasing integration of digital technologies, including AI-powered diagnostics and telehealth platforms, will enhance efficiency and accessibility of veterinary care. Continued investment in research and development for novel therapeutics and vaccines, particularly those addressing emerging infectious diseases and chronic conditions, will be crucial. Strategic collaborations and mergers between companies will continue to consolidate the market and drive innovation. Furthermore, a growing emphasis on preventive healthcare and wellness programs for pets, alongside the development of sustainable solutions for livestock, will shape future market dynamics. The Italian market's strong inclination towards advanced solutions and its significant companion animal population position it as a prime region for continued expansion and leadership in the European veterinary landscape.

Italy Veterinary Healthcare Market Segmentation

-

1. Product

-

1.1. Therapeutics

- 1.1.1. Vaccines

- 1.1.2. Parasiticides

- 1.1.3. Anti-infectives

- 1.1.4. Medical Feed Additives

- 1.1.5. Other Therapeutics

-

1.2. Diagnostics

- 1.2.1. Immunodiagnostic Tests

- 1.2.2. Molecular Diagnostics

- 1.2.3. Diagnostic Imaging

- 1.2.4. Clinical Chemistry

- 1.2.5. Other Diagnostics

-

1.1. Therapeutics

-

2. Animal Type

- 2.1. Dogs and Cats

- 2.2. Horses

- 2.3. Ruminants

- 2.4. Swine

- 2.5. Poultry

- 2.6. Other Animals

Italy Veterinary Healthcare Market Segmentation By Geography

- 1. Italy

Italy Veterinary Healthcare Market Regional Market Share

Geographic Coverage of Italy Veterinary Healthcare Market

Italy Veterinary Healthcare Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advanced Technology Leading to Innovations in Animal Healthcare; Increasing Pet Ownership

- 3.3. Market Restrains

- 3.3.1. Lack of Veterinarians and Shortage of Skilled Farm Workers; Increasing Cost of Animal Testing and Veterinary Services

- 3.4. Market Trends

- 3.4.1. Vaccines Segment is Expected to Witness a Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Veterinary Healthcare Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Therapeutics

- 5.1.1.1. Vaccines

- 5.1.1.2. Parasiticides

- 5.1.1.3. Anti-infectives

- 5.1.1.4. Medical Feed Additives

- 5.1.1.5. Other Therapeutics

- 5.1.2. Diagnostics

- 5.1.2.1. Immunodiagnostic Tests

- 5.1.2.2. Molecular Diagnostics

- 5.1.2.3. Diagnostic Imaging

- 5.1.2.4. Clinical Chemistry

- 5.1.2.5. Other Diagnostics

- 5.1.1. Therapeutics

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dogs and Cats

- 5.2.2. Horses

- 5.2.3. Ruminants

- 5.2.4. Swine

- 5.2.5. Poultry

- 5.2.6. Other Animals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Fatro S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Friulchem

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Scil animal care company GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Livisto

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dox-al Italia S p A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teknofarma s r l

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Virbac

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Candioli Pharma

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zoetis Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Fatro S p A

List of Figures

- Figure 1: Italy Veterinary Healthcare Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Italy Veterinary Healthcare Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Veterinary Healthcare Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Italy Veterinary Healthcare Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 3: Italy Veterinary Healthcare Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Italy Veterinary Healthcare Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 5: Italy Veterinary Healthcare Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 6: Italy Veterinary Healthcare Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Veterinary Healthcare Market?

The projected CAGR is approximately 3.39%.

2. Which companies are prominent players in the Italy Veterinary Healthcare Market?

Key companies in the market include Fatro S p A, Friulchem, Scil animal care company GmbH, Livisto, Dox-al Italia S p A, Teknofarma s r l, Virbac, Candioli Pharma, Zoetis Inc.

3. What are the main segments of the Italy Veterinary Healthcare Market?

The market segments include Product, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Advanced Technology Leading to Innovations in Animal Healthcare; Increasing Pet Ownership.

6. What are the notable trends driving market growth?

Vaccines Segment is Expected to Witness a Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Veterinarians and Shortage of Skilled Farm Workers; Increasing Cost of Animal Testing and Veterinary Services.

8. Can you provide examples of recent developments in the market?

November 2022: Fatro acquired Quadrel with the aim of emphasizing growth in the companion animal market. This initiative provided EUR 7.6 million (USD 7.6 million) investment to 13 research centers specializing in neglected tropical diseases. The addition of QL-A02 helps boost Fatro's pipeline for the pet sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Veterinary Healthcare Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Veterinary Healthcare Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Veterinary Healthcare Market?

To stay informed about further developments, trends, and reports in the Italy Veterinary Healthcare Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence