Key Insights

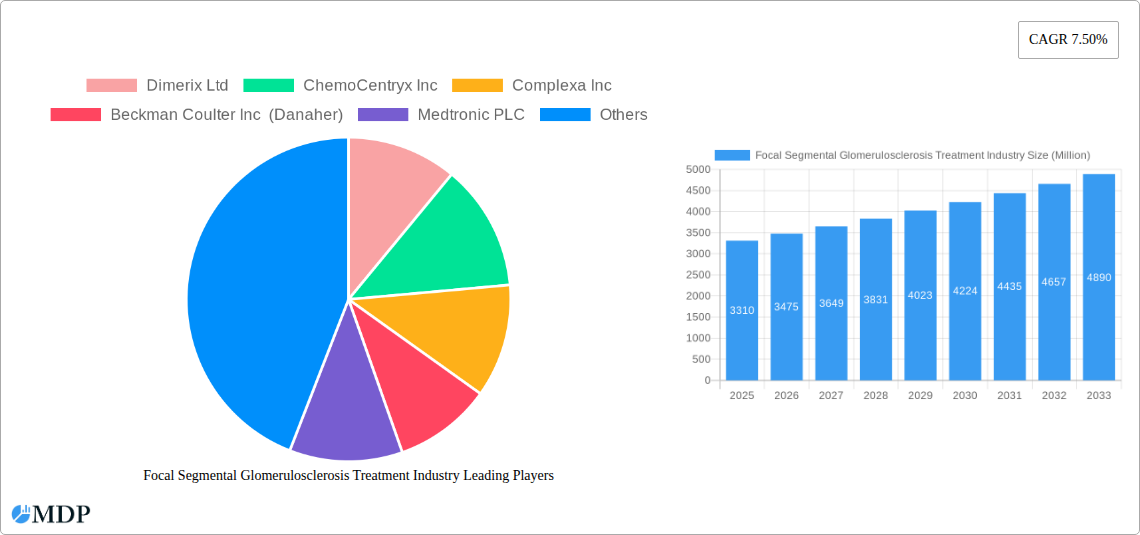

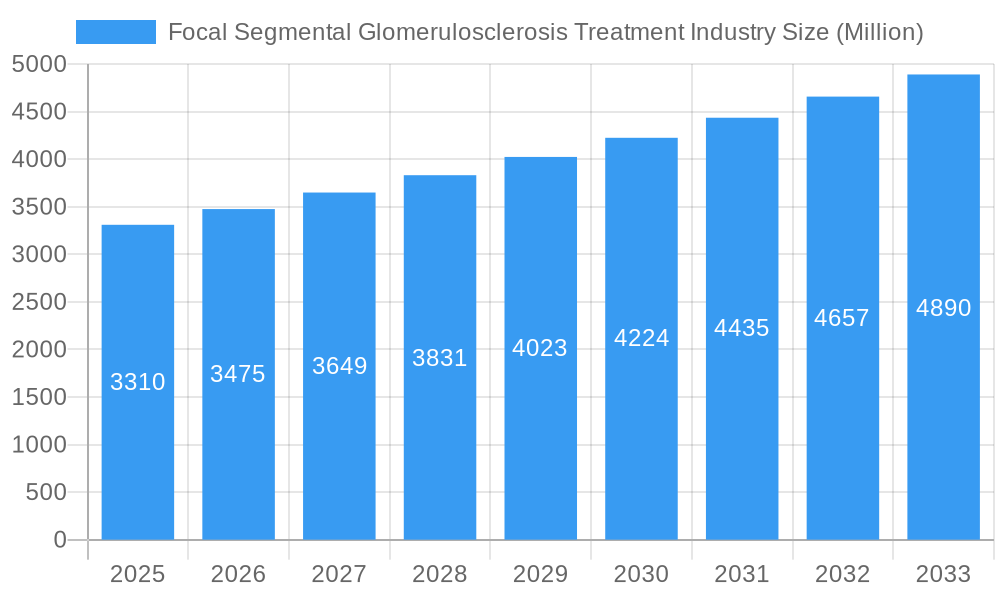

The Focal Segmental Glomerulosclerosis (FSGS) Treatment Market is poised for significant expansion, projected to reach approximately USD 3.31 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5% through 2033. This growth trajectory is primarily fueled by the increasing prevalence of both primary and secondary FSGS, driven by factors such as rising rates of obesity, hypertension, and genetic predispositions contributing to kidney damage. Advancements in diagnostic tools, leading to earlier and more accurate detection of FSGS, are also playing a crucial role in market expansion. Furthermore, ongoing research and development into novel therapeutic strategies, including targeted drug therapies and innovative treatment protocols beyond traditional dialysis and transplantation, are expected to unlock new market opportunities and improve patient outcomes. The emphasis on personalized medicine and a deeper understanding of the underlying mechanisms of FSGS are pushing the development of more effective and less invasive treatment options, thereby stimulating market demand.

Focal Segmental Glomerulosclerosis Treatment Industry Market Size (In Billion)

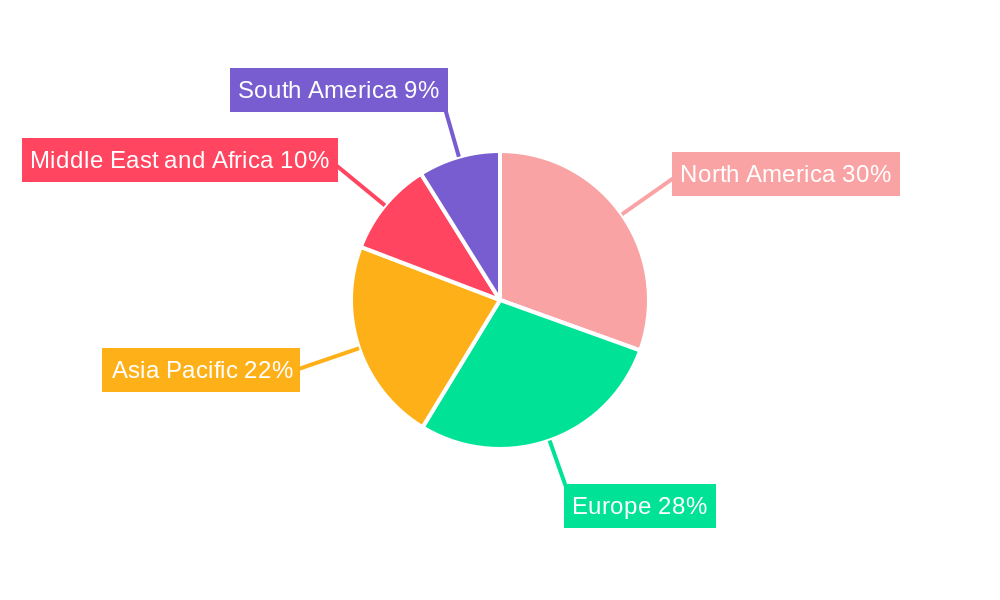

The market is witnessing substantial growth across its key segments. The "Disease Management" segment, encompassing diagnosis and treatment, is particularly dynamic. Within diagnostics, kidney biopsy remains a gold standard, complemented by increasingly sophisticated blood and urine tests like creatinine levels for monitoring kidney function. In treatment, while drug therapy continues to evolve with new pharmacological agents targeting specific pathways involved in FSGS pathogenesis, the demand for dialysis and kidney transplantation, though critical, highlights the unmet need for more effective disease-modifying treatments. Geographically, North America and Europe currently lead the market due to advanced healthcare infrastructure, high healthcare spending, and early adoption of new technologies. However, the Asia Pacific region presents a significant growth opportunity owing to its large patient pool, increasing healthcare expenditure, and growing awareness about kidney diseases.

Focal Segmental Glomerulosclerosis Treatment Industry Company Market Share

Here is an SEO-optimized, engaging report description for the Focal Segmental Glomerulosclerosis Treatment Industry, designed for maximum visibility and to attract industry stakeholders without requiring further modification.

This in-depth report provides a definitive analysis of the global Focal Segmental Glomerulosclerosis (FSGS) treatment market, offering critical insights for pharmaceutical companies, biotech innovators, healthcare providers, investors, and policymakers. Spanning the historical period of 2019–2024 and projecting growth through 2033, this report delves into the intricate market dynamics, emerging trends, competitive landscape, and strategic opportunities within this crucial therapeutic area. With an estimated market size projected to reach billions by the base year of 2025 and a significant CAGR during the forecast period (2025–2033), understanding the drivers, challenges, and future trajectory of FSGS treatment is paramount for stakeholders seeking to capitalize on market growth and address unmet patient needs. This report leverages high-traffic keywords such as "FSGS treatment market," "focal segmental glomerulosclerosis diagnosis," "kidney biopsy for FSGS," "drug therapy for FSGS," "dialysis for kidney disease," "kidney transplant market," and "rare kidney disease treatment" to ensure maximum search visibility.

Focal Segmental Glomerulosclerosis Treatment Industry Market Dynamics & Concentration

The Focal Segmental Glomerulosclerosis (FSGS) treatment market is characterized by a moderate to high level of concentration, with a few key players holding significant market share, estimated to be around 60-70% based on recent analyses. Innovation drivers are primarily fueled by the increasing understanding of FSGS pathogenesis, leading to the development of targeted therapies and precision medicine approaches. Regulatory frameworks, including those from the FDA and EMA, play a crucial role in approving novel treatments and ensuring patient safety, with an estimated 5-8 new drug approvals anticipated within the forecast period. Product substitutes, while limited for advanced stages of FSGS, include symptomatic treatments and supportive care modalities. End-user trends are shifting towards early diagnosis and proactive management, driven by increased patient awareness and the availability of advanced diagnostic tools. Merger and acquisition (M&A) activities are moderately active, with an estimated 3-5 significant deals annually, as larger pharmaceutical companies seek to acquire promising pipeline assets and expand their rare disease portfolios.

- Market Concentration: Dominated by a few key pharmaceutical and biotechnology firms.

- Innovation Drivers: Advancements in understanding disease mechanisms, genetic research, and drug delivery systems.

- Regulatory Frameworks: Stringent approval processes for novel FSGS treatments, influencing market entry and R&D investment.

- Product Substitutes: Supportive care, immunosuppressants, and lifestyle modifications for early-stage management.

- End-User Trends: Growing demand for disease-modifying therapies and personalized treatment plans.

- M&A Activities: Strategic acquisitions and partnerships to strengthen R&D pipelines and market presence.

Focal Segmental Glomerulosclerosis Treatment Industry Industry Trends & Analysis

The Focal Segmental Glomerulosclerosis (FSGS) treatment industry is experiencing a period of significant transformation, driven by escalating healthcare investments, a growing prevalence of rare kidney diseases, and a robust pipeline of innovative therapeutic candidates. The global market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8-10% during the forecast period (2025–2033), reaching a valuation of several billion dollars. Market penetration for advanced therapies is steadily increasing, particularly in developed economies where access to specialized healthcare and diagnostic services is widespread. Technological disruptions, such as advancements in gene therapy, targeted drug delivery systems, and improved diagnostic imaging, are revolutionizing the way FSGS is managed. Consumer preferences are evolving towards more patient-centric care models that emphasize quality of life and long-term disease management rather than just symptom alleviation. Competitive dynamics are intensifying, with an increasing number of biopharmaceutical companies investing heavily in R&D to develop novel treatments for both primary and secondary FSGS. The focus is shifting from broad immunosuppression to more specific pathways implicated in glomerular injury, leading to the development of precision medicines. Patient advocacy groups are also playing a more prominent role in driving research funding and demanding faster access to novel therapies. The economic burden of FSGS, including costs associated with dialysis and kidney transplantation, further underscores the urgent need for effective and curative treatments, creating a substantial market opportunity for innovative solutions.

Leading Markets & Segments in Focal Segmental Glomerulosclerosis Treatment Industry

The global Focal Segmental Glomerulosclerosis (FSGS) treatment market is segmented by disease type and disease management.

Disease Type:

- Primary FSGS: This segment represents a significant portion of the market, driven by idiopathic cases and the continuous search for targeted therapies. Economic policies supporting rare disease research and development are crucial drivers for this segment, particularly in North America and Europe. The market penetration of advanced therapies for primary FSGS is expected to grow substantially as new drugs gain regulatory approval.

- Secondary FSGS: This segment, often linked to other underlying conditions like obesity, viral infections, or genetic predispositions, presents a substantial market due to its broader patient population base. The increasing incidence of conditions contributing to secondary FSGS, such as hypertension and diabetes, fuels market growth. Infrastructure development in healthcare systems worldwide, enabling better identification and management of these contributing factors, further bolsters this segment.

Disease Management:

- Diagnosis:

- Kidney Biopsy: Remains the gold standard for definitive FSGS diagnosis, driving demand for diagnostic pathology services and specialized equipment. Infrastructure in diagnostic centers and skilled nephropathologists are key drivers.

- Creatinine Test: A fundamental diagnostic tool, contributing to the high market penetration of routine blood tests for kidney function assessment.

- Other Diagnoses: Includes a range of serological tests, genetic screenings, and imaging techniques that aid in identifying the underlying cause and specific subtype of FSGS. Technological advancements in these areas are crucial for market expansion.

- Treatment:

- Drug Therapy: This segment is experiencing the most dynamic growth, with a strong focus on novel immunosuppressants, antiproteinuric agents, and emerging precision medicines. Regulatory approvals and the success of clinical trials are significant drivers. The market is projected to see a substantial increase in the adoption of targeted drug therapies, moving away from generic immunosuppression.

- Dialysis: While a critical supportive treatment for end-stage renal disease (ESRD) caused by FSGS, the growth in this segment is tempered by the increasing emphasis on disease modification and kidney transplantation. The expansion of dialysis centers in emerging economies is a key driver.

- Kidney Transplant: Represents the ultimate therapeutic goal for many FSGS patients, driving demand for transplant services, immunosuppressive drugs post-transplant, and related healthcare infrastructure. Government initiatives promoting organ donation and transplant accessibility are vital for this segment's growth.

Focal Segmental Glomerulosclerosis Treatment Industry Product Developments

Product development in the FSGS treatment landscape is rapidly advancing, focusing on targeted therapies that address specific pathogenic mechanisms. Innovations include novel small molecules designed to inhibit key inflammatory pathways, gene therapies aimed at correcting genetic defects, and improved drug delivery systems for enhanced efficacy and reduced side effects. Companies are leveraging precision medicine approaches, tailoring treatments based on a patient's genetic profile and disease subtype. The competitive advantage lies in demonstrating superior efficacy, improved safety profiles, and the ability to slow or reverse kidney damage, thereby delaying or avoiding the need for dialysis or transplantation.

Key Drivers of Focal Segmental Glomerulosclerosis Treatment Industry Growth

Several factors are propelling the growth of the Focal Segmental Glomerulosclerosis (FSGS) treatment market. Increased awareness and early diagnosis of rare kidney diseases, coupled with advancements in medical research and understanding of FSGS pathophysiology, are major contributors. The robust pipeline of novel drug candidates, particularly in areas like targeted therapies and precision medicine, offers significant promise. Furthermore, favorable regulatory pathways for orphan drugs and supportive government initiatives for rare disease research are accelerating development and market access. The rising global healthcare expenditure and the increasing prevalence of conditions that contribute to secondary FSGS, such as diabetes and hypertension, also contribute to market expansion.

Challenges in the Focal Segmental Glomerulosclerosis Treatment Industry Market

Despite the promising outlook, the FSGS treatment market faces several challenges. The complexity of FSGS and its heterogeneity can make it difficult to develop universally effective treatments, leading to high failure rates in clinical trials. Stringent regulatory hurdles and the lengthy approval processes for new drugs can impede market entry. The high cost of novel therapies, particularly orphan drugs, presents a significant barrier to accessibility for many patients and healthcare systems. Supply chain disruptions and manufacturing complexities for advanced biologics can also pose challenges. Moreover, limited physician awareness of the latest treatment guidelines and diagnostic advancements can affect the timely and appropriate management of FSGS patients.

Emerging Opportunities in Focal Segmental Glomerulosclerosis Treatment Industry

The FSGS treatment industry is ripe with emerging opportunities. The development of precision medicine approaches, utilizing genetic sequencing and biomarkers to stratify patients and predict treatment response, is a significant growth catalyst. Strategic partnerships and collaborations between pharmaceutical companies, academic institutions, and patient advocacy groups are fostering innovation and accelerating clinical development. Market expansion into emerging economies, where the prevalence of kidney diseases is rising and healthcare infrastructure is improving, presents a substantial untapped potential. Furthermore, the ongoing research into the underlying mechanisms of FSGS is expected to uncover new therapeutic targets and novel treatment modalities, including regenerative medicine and gene editing technologies.

Leading Players in the Focal Segmental Glomerulosclerosis Treatment Industry Sector

- Dimerix Ltd

- ChemoCentryx Inc

- Complexa Inc

- Beckman Coulter Inc (Danaher)

- Medtronic PLC

- Variant Pharmaceuticals Inc

- B Braun Melsungen AG

- Retrophin Inc

- Baxter International Inc

- Pfizer Inc

Key Milestones in Focal Segmental Glomerulosclerosis Treatment Industry Industry

- February 2022: Goldfinch Bio announced positive preliminary data from a phase 2 clinical trial evaluating gfb-887 as a precision medicine for patients with focal segmental glomerulosclerosis (FSGS).

- September 2021: Vifor Pharma and Travere Therapeutics inked a collaboration and licensing partnership to commercialize sparsentan in Europe, Australia, and New Zealand. The drug is being made to treat FSGS and IgAN, which are both rare, progressive kidney diseases that lead to end-stage kidney disease more often than other diseases.

Strategic Outlook for Focal Segmental Glomerulosclerosis Treatment Industry Market

The strategic outlook for the Focal Segmental Glomerulosclerosis (FSGS) treatment market is overwhelmingly positive, driven by unmet medical needs and significant therapeutic innovation. Future growth accelerators include the continued development and regulatory approval of targeted therapies and precision medicines that offer improved efficacy and safety profiles. Strategic investments in rare disease R&D, coupled with collaborations to expedite clinical trials and market access, will be crucial. Furthermore, expanding diagnostic capabilities, particularly in underdeveloped regions, will drive early identification and treatment initiation. The increasing emphasis on patient-centric care and the integration of digital health solutions for remote monitoring and management will also shape the market's future, promising better outcomes and an enhanced patient journey.

Focal Segmental Glomerulosclerosis Treatment Industry Segmentation

-

1. Disease Type

- 1.1. Primary FSGS

- 1.2. Secondary FSGS

-

2. Disease Management

-

2.1. Diagnosis

- 2.1.1. Kidney Biopsy

- 2.1.2. Creatinine Test

- 2.1.3. Other Diagnoses

-

2.2. Treatment

- 2.2.1. Drug Therapy

- 2.2.2. Dialysis

- 2.2.3. Kidney Transplant

-

2.1. Diagnosis

Focal Segmental Glomerulosclerosis Treatment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Focal Segmental Glomerulosclerosis Treatment Industry Regional Market Share

Geographic Coverage of Focal Segmental Glomerulosclerosis Treatment Industry

Focal Segmental Glomerulosclerosis Treatment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Focal Segmental Glomerulosclerosis (FSGS); High Focus on Developing New Treatment Options4.2.3

- 3.3. Market Restrains

- 3.3.1. High Cost of Dialysis and Kidney Transplant

- 3.4. Market Trends

- 3.4.1. Primary FSGS Segment is Expected to Witness High Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Focal Segmental Glomerulosclerosis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 5.1.1. Primary FSGS

- 5.1.2. Secondary FSGS

- 5.2. Market Analysis, Insights and Forecast - by Disease Management

- 5.2.1. Diagnosis

- 5.2.1.1. Kidney Biopsy

- 5.2.1.2. Creatinine Test

- 5.2.1.3. Other Diagnoses

- 5.2.2. Treatment

- 5.2.2.1. Drug Therapy

- 5.2.2.2. Dialysis

- 5.2.2.3. Kidney Transplant

- 5.2.1. Diagnosis

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 6. North America Focal Segmental Glomerulosclerosis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Disease Type

- 6.1.1. Primary FSGS

- 6.1.2. Secondary FSGS

- 6.2. Market Analysis, Insights and Forecast - by Disease Management

- 6.2.1. Diagnosis

- 6.2.1.1. Kidney Biopsy

- 6.2.1.2. Creatinine Test

- 6.2.1.3. Other Diagnoses

- 6.2.2. Treatment

- 6.2.2.1. Drug Therapy

- 6.2.2.2. Dialysis

- 6.2.2.3. Kidney Transplant

- 6.2.1. Diagnosis

- 6.1. Market Analysis, Insights and Forecast - by Disease Type

- 7. Europe Focal Segmental Glomerulosclerosis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Disease Type

- 7.1.1. Primary FSGS

- 7.1.2. Secondary FSGS

- 7.2. Market Analysis, Insights and Forecast - by Disease Management

- 7.2.1. Diagnosis

- 7.2.1.1. Kidney Biopsy

- 7.2.1.2. Creatinine Test

- 7.2.1.3. Other Diagnoses

- 7.2.2. Treatment

- 7.2.2.1. Drug Therapy

- 7.2.2.2. Dialysis

- 7.2.2.3. Kidney Transplant

- 7.2.1. Diagnosis

- 7.1. Market Analysis, Insights and Forecast - by Disease Type

- 8. Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Disease Type

- 8.1.1. Primary FSGS

- 8.1.2. Secondary FSGS

- 8.2. Market Analysis, Insights and Forecast - by Disease Management

- 8.2.1. Diagnosis

- 8.2.1.1. Kidney Biopsy

- 8.2.1.2. Creatinine Test

- 8.2.1.3. Other Diagnoses

- 8.2.2. Treatment

- 8.2.2.1. Drug Therapy

- 8.2.2.2. Dialysis

- 8.2.2.3. Kidney Transplant

- 8.2.1. Diagnosis

- 8.1. Market Analysis, Insights and Forecast - by Disease Type

- 9. Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Disease Type

- 9.1.1. Primary FSGS

- 9.1.2. Secondary FSGS

- 9.2. Market Analysis, Insights and Forecast - by Disease Management

- 9.2.1. Diagnosis

- 9.2.1.1. Kidney Biopsy

- 9.2.1.2. Creatinine Test

- 9.2.1.3. Other Diagnoses

- 9.2.2. Treatment

- 9.2.2.1. Drug Therapy

- 9.2.2.2. Dialysis

- 9.2.2.3. Kidney Transplant

- 9.2.1. Diagnosis

- 9.1. Market Analysis, Insights and Forecast - by Disease Type

- 10. South America Focal Segmental Glomerulosclerosis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Disease Type

- 10.1.1. Primary FSGS

- 10.1.2. Secondary FSGS

- 10.2. Market Analysis, Insights and Forecast - by Disease Management

- 10.2.1. Diagnosis

- 10.2.1.1. Kidney Biopsy

- 10.2.1.2. Creatinine Test

- 10.2.1.3. Other Diagnoses

- 10.2.2. Treatment

- 10.2.2.1. Drug Therapy

- 10.2.2.2. Dialysis

- 10.2.2.3. Kidney Transplant

- 10.2.1. Diagnosis

- 10.1. Market Analysis, Insights and Forecast - by Disease Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dimerix Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ChemoCentryx Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Complexa Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Beckman Coulter Inc (Danaher)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Medtronic PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Variant Pharmaceuticals Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 B Braun Melsungen AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Retrophin Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baxter International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pfizer Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dimerix Ltd

List of Figures

- Figure 1: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 4: North America Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Type 2025 & 2033

- Figure 5: North America Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 6: North America Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Type 2025 & 2033

- Figure 7: North America Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Management 2025 & 2033

- Figure 8: North America Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Management 2025 & 2033

- Figure 9: North America Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Management 2025 & 2033

- Figure 10: North America Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Management 2025 & 2033

- Figure 11: North America Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 16: Europe Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Type 2025 & 2033

- Figure 17: Europe Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 18: Europe Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Type 2025 & 2033

- Figure 19: Europe Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Management 2025 & 2033

- Figure 20: Europe Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Management 2025 & 2033

- Figure 21: Europe Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Management 2025 & 2033

- Figure 22: Europe Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Management 2025 & 2033

- Figure 23: Europe Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 28: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Type 2025 & 2033

- Figure 29: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 30: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Type 2025 & 2033

- Figure 31: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Management 2025 & 2033

- Figure 32: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Management 2025 & 2033

- Figure 33: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Management 2025 & 2033

- Figure 34: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Management 2025 & 2033

- Figure 35: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 40: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Type 2025 & 2033

- Figure 41: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 42: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Type 2025 & 2033

- Figure 43: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Management 2025 & 2033

- Figure 44: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Management 2025 & 2033

- Figure 45: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Management 2025 & 2033

- Figure 46: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Management 2025 & 2033

- Figure 47: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 52: South America Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Type 2025 & 2033

- Figure 53: South America Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 54: South America Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Type 2025 & 2033

- Figure 55: South America Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Management 2025 & 2033

- Figure 56: South America Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Management 2025 & 2033

- Figure 57: South America Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Management 2025 & 2033

- Figure 58: South America Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Management 2025 & 2033

- Figure 59: South America Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 60: South America Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 2: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 3: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Management 2020 & 2033

- Table 4: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Management 2020 & 2033

- Table 5: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 8: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 9: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Management 2020 & 2033

- Table 10: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Management 2020 & 2033

- Table 11: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 20: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 21: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Management 2020 & 2033

- Table 22: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Management 2020 & 2033

- Table 23: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Germany Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: France Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Italy Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Spain Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 38: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 39: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Management 2020 & 2033

- Table 40: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Management 2020 & 2033

- Table 41: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: China Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Japan Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: India Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Australia Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: South Korea Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 56: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 57: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Management 2020 & 2033

- Table 58: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Management 2020 & 2033

- Table 59: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: GCC Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: South Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 68: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 69: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Management 2020 & 2033

- Table 70: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Management 2020 & 2033

- Table 71: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 72: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Brazil Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Argentina Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Focal Segmental Glomerulosclerosis Treatment Industry?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Focal Segmental Glomerulosclerosis Treatment Industry?

Key companies in the market include Dimerix Ltd, ChemoCentryx Inc, Complexa Inc, Beckman Coulter Inc (Danaher), Medtronic PLC, Variant Pharmaceuticals Inc , B Braun Melsungen AG, Retrophin Inc, Baxter International Inc, Pfizer Inc.

3. What are the main segments of the Focal Segmental Glomerulosclerosis Treatment Industry?

The market segments include Disease Type, Disease Management.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Focal Segmental Glomerulosclerosis (FSGS); High Focus on Developing New Treatment Options4.2.3.

6. What are the notable trends driving market growth?

Primary FSGS Segment is Expected to Witness High Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Dialysis and Kidney Transplant.

8. Can you provide examples of recent developments in the market?

February 2022: Goldfinch Bio announced positive preliminary data from a phase 2 clinical trial evaluating gfb-887 as a precision medicine for patients with focal segmental glomerulosclerosis (FSGS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Focal Segmental Glomerulosclerosis Treatment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Focal Segmental Glomerulosclerosis Treatment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Focal Segmental Glomerulosclerosis Treatment Industry?

To stay informed about further developments, trends, and reports in the Focal Segmental Glomerulosclerosis Treatment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence