Key Insights

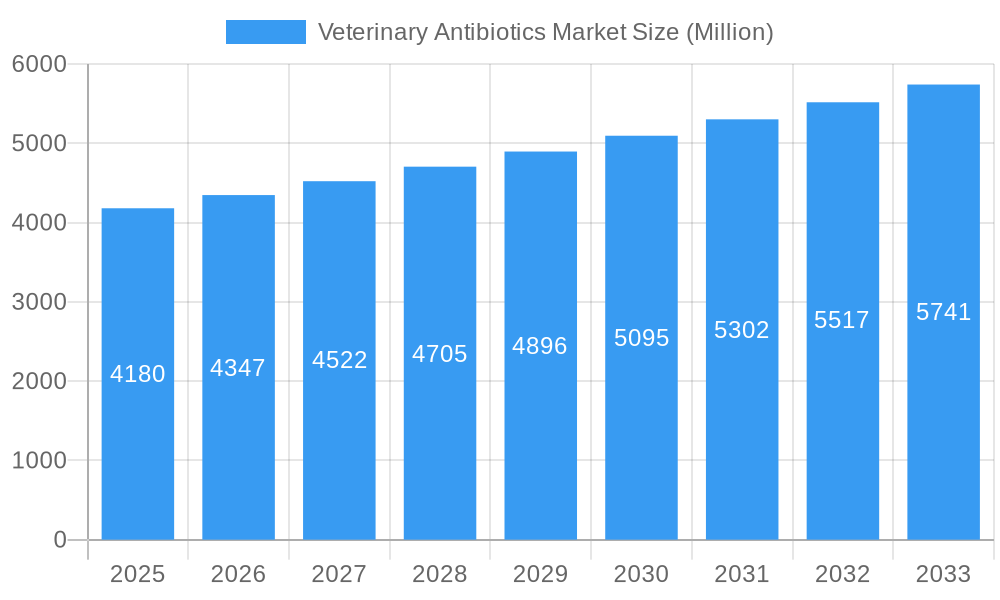

The global Veterinary Antibiotics Market is poised for significant expansion, projected to reach an estimated $4.18 billion in 2025. This growth is underpinned by a steady Compound Annual Growth Rate (CAGR) of 4% throughout the forecast period of 2025-2033. A primary driver for this upward trajectory is the escalating global demand for animal protein, necessitating healthier livestock and companion animals to meet consumption needs. Advances in veterinary medicine, coupled with increased awareness among pet owners and livestock farmers regarding animal welfare and disease prevention, are further bolstering market demand. The rise in companion animal ownership worldwide also contributes substantially, as owners invest more in the health and longevity of their pets, leading to greater utilization of veterinary antibiotics for treating infections and preventing disease outbreaks.

Veterinary Antibiotics Market Market Size (In Billion)

The market's robust growth is further fueled by emerging economies where the livestock industry is rapidly modernizing, adopting more sophisticated animal healthcare practices. Key trends include the development of novel antibiotic formulations with improved efficacy and reduced resistance potential, as well as a growing emphasis on prudent antibiotic use to combat antimicrobial resistance (AMR). While the market benefits from increasing adoption of advanced veterinary pharmaceuticals, restraints such as stringent regulatory approvals and the growing concern over AMR could moderate the pace of expansion. Nevertheless, the overall outlook remains highly positive, driven by innovation and the indispensable role of veterinary antibiotics in safeguarding animal health and ensuring a sustainable food supply chain. The market is segmented across various animal types, drug classes, and dosage forms, with poultry and cattle dominating the animal type segment, and tetracyclines and penicillin being key drug classes. Oral solutions and injections are the most prevalent dosage forms, reflecting the diverse treatment needs within veterinary medicine.

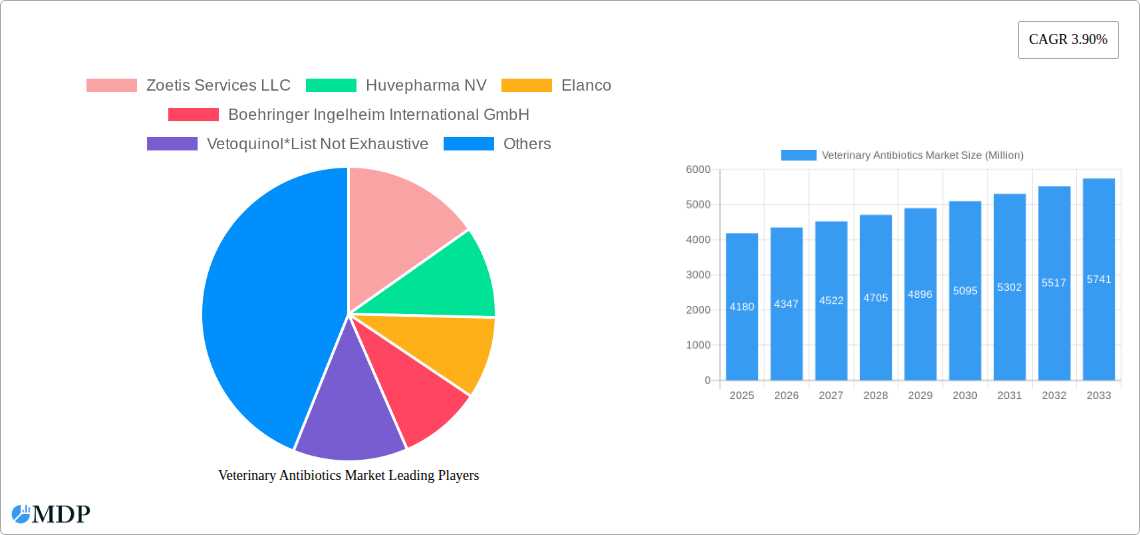

Veterinary Antibiotics Market Company Market Share

Veterinary Antibiotics Market: Comprehensive Global Analysis and Growth Forecast (2019-2033)

This in-depth report offers a definitive analysis of the global veterinary antibiotics market, projecting its growth from 2019 to 2033. Covering a robust historical period of 2019–2024, a base year of 2025, and an estimated year of 2025, this study provides critical insights into the market's trajectory. The forecast period of 2025–2033 will reveal an estimated market size of $XX billion with a Compound Annual Growth Rate (CAGR) of XX%. Delve into the intricacies of animal health pharmaceuticals, livestock antibiotics, and companion animal medications to understand market dynamics, key trends, and emerging opportunities within this vital sector. This report is essential for stakeholders seeking to navigate the evolving landscape of veterinary pharmaceuticals, from poultry and swine antibiotics to cattle and sheep medications, and the growing demand for companion animal treatments.

Veterinary Antibiotics Market Market Dynamics & Concentration

The veterinary antibiotics market is characterized by a moderate level of concentration, with a few key players like Zoetis Services LLC, Huvepharma NV, Elanco, and Boehringer Ingelheim International GmbH holding significant market share. Innovation remains a primary driver, fueled by the increasing demand for effective disease prevention and treatment in food-producing animals and the rising pet ownership globally. Regulatory frameworks, though varying by region, are becoming more stringent, emphasizing responsible antibiotic use and the reduction of antimicrobial resistance. Product substitutes, such as vaccines and alternative therapies, are gaining traction but have yet to significantly displace the core role of antibiotics. End-user trends are leaning towards specialized formulations and targeted therapies, driven by both economic considerations for farmers and enhanced treatment efficacy for veterinarians. Mergers and acquisitions (M&A) activities, such as XX M&A deals observed between 2019-2024, play a crucial role in market consolidation and portfolio expansion, with companies like Merck & Co Inc and Virbac actively participating in strategic acquisitions.

- Market Share Dominance: Top players collectively hold an estimated XX% market share.

- M&A Activity: An average of XX M&A deals per year within the historical period.

- Innovation Focus: Development of novel antibiotic formulations and combination therapies.

- Regulatory Landscape: Increasing emphasis on judicious antibiotic use and stewardship programs.

Veterinary Antibiotics Market Industry Trends & Analysis

The global veterinary antibiotics market is poised for significant expansion, driven by a confluence of factors that underscore the growing importance of animal health worldwide. The increasing global demand for animal protein, coupled with a rising population, necessitates enhanced productivity and health management in livestock farming. This directly fuels the demand for effective antibiotics for livestock, crucial for preventing and treating diseases that could impact production yields. Concurrently, the burgeoning pet care industry, characterized by increased humanization of pets and higher disposable incomes, is a powerful growth engine. Owners are increasingly willing to invest in comprehensive veterinary care, including advanced treatments for their companion animals, thereby bolstering the market for companion animal antibiotics. Technological advancements are revolutionizing the sector, with the development of more targeted and efficient drug delivery systems, such as oral antibiotic powders and injectable veterinary antibiotics, enhancing treatment efficacy and reducing administration challenges. Furthermore, the growing awareness among veterinarians and farmers about the economic implications of animal diseases—ranging from mortality to reduced growth rates—acts as a substantial market penetration driver. The competitive landscape is intensifying, with established players continually innovating and new entrants seeking to capture market share through specialized product offerings. The projected CAGR of XX% for the forecast period 2025–2033 reflects these robust growth drivers and the sustained demand for essential veterinary pharmaceutical solutions. The market penetration for key veterinary antibiotic classes is expected to deepen across all animal types.

Leading Markets & Segments in Veterinary Antibiotics Market

The veterinary antibiotics market is segmented by Animal Type, Drug Class, and Dosage Form, with significant regional variations and segment dominance.

Animal Type Dominance:

- Poultry: This segment is a dominant force due to the high volume of production and the susceptibility of birds to respiratory and gastrointestinal infections. Economic policies promoting large-scale poultry farming and the need for rapid disease control contribute to the strong demand for poultry antibiotics.

- Pigs: Swine farming, another major contributor to global protein supply, exhibits significant demand for antibiotics for pigs to manage common diseases like pneumonia and diarrhea. Infrastructure development in emerging economies supporting advanced swine husbandry practices further fuels this segment.

- Cattle: The beef and dairy industries drive substantial demand for cattle antibiotics, particularly for treating mastitis, respiratory diseases, and foot rot. Growing consumer preference for meat and dairy products in developing nations enhances the market penetration of these treatments.

- Companion Animals: This segment is experiencing exponential growth driven by increasing pet ownership, humanization of pets, and higher spending on veterinary care. The development of specialized antibiotics for dogs and cats addressing a wide range of infections, from dental to dermatological, is a key growth accelerator.

Drug Class Dominance:

- Tetracyclines: These broad-spectrum antibiotics remain a cornerstone in veterinary medicine due to their efficacy against a wide range of bacterial infections and their cost-effectiveness, making them crucial in livestock antibiotic formulations.

- Penicillin: While some resistance issues exist, penicillin-based antibiotics continue to be widely used for various bacterial infections in multiple animal species, particularly in swine and cattle antibiotic treatments.

- Macrolides: With growing concerns over resistance to other classes, macrolides are gaining prominence for their effectiveness against respiratory infections in various animal types. Their use in poultry and companion animal antibiotics is notable.

Dosage Form Dominance:

- Injections: This dosage form remains critical for rapid systemic treatment and severe infections, especially in large animals and critically ill pets. The development of injectable veterinary antibiotics with improved pharmacokinetics is a key trend.

- Oral Solutions: Widely used for ease of administration in drinking water or feed, particularly for flock or herd treatments in poultry and swine. The convenience of oral antibiotic powders and solutions makes them a preferred choice in extensive farming operations.

Veterinary Antibiotics Market Product Developments

Recent product developments in the veterinary antibiotics market highlight a trend towards targeted therapies and improved drug delivery. The launch of Cladaxxa by Krka in July 2022 exemplifies innovation in companion animal care, offering a comprehensive treatment for various infections in dogs and cats. Similarly, Virbac's introduction of Tulissin 25 and Tulissin 100 in July 2021 showcases advancements in injectable solutions for cattle and swine, focusing on efficient disease management. These developments underscore the industry's commitment to creating efficacious and user-friendly veterinary pharmaceutical products that address specific needs within different animal populations and disease profiles, thereby enhancing competitive advantage.

Key Drivers of Veterinary Antibiotics Market Growth

The veterinary antibiotics market is propelled by several key drivers. The increasing global demand for animal protein, driven by a growing human population, necessitates healthier livestock and thus higher consumption of veterinary pharmaceuticals. Furthermore, the escalating trend of pet humanization and increased disposable income translates to greater spending on companion animal healthcare, including advanced antibiotic treatments. Technological advancements in drug formulation and delivery systems are leading to more effective and convenient animal health medications. Regulatory bodies' increasing focus on animal welfare and disease prevention also mandates the use of appropriate antimicrobial agents. The economic imperative for farmers to minimize losses due to disease outbreaks ensures consistent demand for reliable veterinary antibiotics.

Challenges in the Veterinary Antibiotics Market Market

Despite robust growth, the veterinary antibiotics market faces significant challenges. The escalating issue of antimicrobial resistance (AMR) is a primary concern, leading to increased regulatory scrutiny and restrictions on the use of certain antibiotics, impacting the market for livestock antibiotics. Stringent regulatory approval processes for new veterinary drug products can be lengthy and costly, hindering innovation. Supply chain disruptions, exacerbated by global events, can affect the availability and pricing of raw materials for animal health pharmaceuticals. Moreover, the development of cost-effective alternative therapies, while still nascent, poses a potential long-term threat to traditional antibiotic markets.

Emerging Opportunities in Veterinary Antibiotics Market

The veterinary antibiotics market presents numerous emerging opportunities. The development of novel antimicrobial agents and combination therapies that circumvent existing resistance mechanisms is a significant avenue. Advancements in diagnostics and precision medicine allow for more targeted antibiotic use, improving efficacy and reducing unnecessary prescriptions of animal health medications. The growing demand for antibiotic alternatives, such as probiotics and bacteriophages, offers a parallel growth trajectory within the broader animal health pharmaceutical sector. Furthermore, expanding into emerging markets with a growing livestock industry and increasing pet ownership represents a substantial opportunity for market expansion and increased penetration of veterinary antibiotic formulations.

Leading Players in the Veterinary Antibiotics Market Sector

- Zoetis Services LLC

- Huvepharma NV

- Elanco

- Boehringer Ingelheim International GmbH

- Vetoquinol

- Merck & Co Inc

- Ceva

- Dechra Pharmaceuticals PLC

- Phibro Animal Health Corporation

- Virbac

Key Milestones in Veterinary Antibiotics Market Industry

- July 2022: Krka launched Cladaxxa, a significant development in the companion animal antibiotics segment, offering treatment for respiratory, digestive, urinary, skin, and dental infections in dogs and cats.

- July 2021: Virbac announced the launch of Tulissin 25 and Tulissin 100, injectable solutions aimed at improving the management of infections in cattle and swine, impacting the livestock antibiotic market.

Strategic Outlook for Veterinary Antibiotics Market Market

The strategic outlook for the veterinary antibiotics market is characterized by sustained growth driven by innovation and evolving market demands. Companies are focusing on research and development of novel veterinary pharmaceuticals, particularly those addressing antimicrobial resistance and targeting specific animal health needs. The increasing emphasis on antibiotic stewardship programs presents an opportunity for companies to offer integrated solutions, including diagnostics and supportive therapies alongside their animal health medication portfolios. Strategic partnerships and collaborations, especially for market access and product distribution in emerging economies, will be crucial. The continued rise in pet ownership globally and the imperative to maintain efficient food production will ensure a strong and evolving market for veterinary antibiotic formulations.

Veterinary Antibiotics Market Segmentation

-

1. Animal Type

- 1.1. Poultry

- 1.2. Pigs

- 1.3. Cattle

- 1.4. Sheep & Goats

- 1.5. Companion Animals

- 1.6. Other Animal Types

-

2. Drug Class

- 2.1. Tetracyclines

- 2.2. Penicillin

- 2.3. Sulfonamides

- 2.4. Macrolides

- 2.5. Other Drug Classes

-

3. Dosage Form

- 3.1. Oral Powder

- 3.2. Oral Solutions

- 3.3. Injections

- 3.4. Other Dosage Forms

Veterinary Antibiotics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

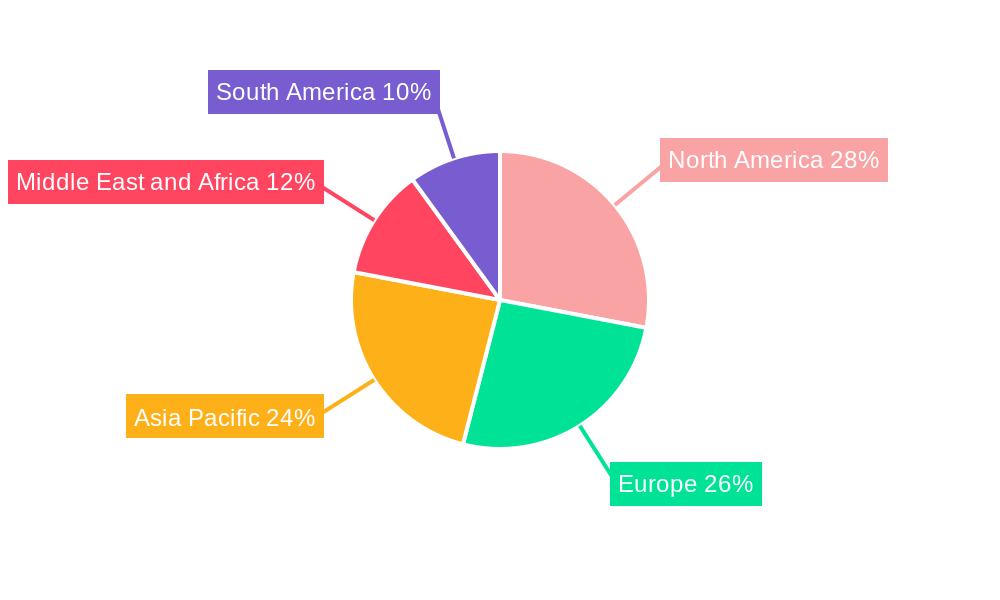

Veterinary Antibiotics Market Regional Market Share

Geographic Coverage of Veterinary Antibiotics Market

Veterinary Antibiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Pet & Livestock Ownership; Increasing Incidence of Livestock Diseases; Rising Focus On Animal-Only Antibiotics

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations and Increasing Antibiotic Resistance Among Food-Producing Animals; Scarcity of Veterinarians and Skilled Farm Workers

- 3.4. Market Trends

- 3.4.1. Penicillin Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Poultry

- 5.1.2. Pigs

- 5.1.3. Cattle

- 5.1.4. Sheep & Goats

- 5.1.5. Companion Animals

- 5.1.6. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Drug Class

- 5.2.1. Tetracyclines

- 5.2.2. Penicillin

- 5.2.3. Sulfonamides

- 5.2.4. Macrolides

- 5.2.5. Other Drug Classes

- 5.3. Market Analysis, Insights and Forecast - by Dosage Form

- 5.3.1. Oral Powder

- 5.3.2. Oral Solutions

- 5.3.3. Injections

- 5.3.4. Other Dosage Forms

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. North America Veterinary Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Poultry

- 6.1.2. Pigs

- 6.1.3. Cattle

- 6.1.4. Sheep & Goats

- 6.1.5. Companion Animals

- 6.1.6. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Drug Class

- 6.2.1. Tetracyclines

- 6.2.2. Penicillin

- 6.2.3. Sulfonamides

- 6.2.4. Macrolides

- 6.2.5. Other Drug Classes

- 6.3. Market Analysis, Insights and Forecast - by Dosage Form

- 6.3.1. Oral Powder

- 6.3.2. Oral Solutions

- 6.3.3. Injections

- 6.3.4. Other Dosage Forms

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. Europe Veterinary Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Poultry

- 7.1.2. Pigs

- 7.1.3. Cattle

- 7.1.4. Sheep & Goats

- 7.1.5. Companion Animals

- 7.1.6. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Drug Class

- 7.2.1. Tetracyclines

- 7.2.2. Penicillin

- 7.2.3. Sulfonamides

- 7.2.4. Macrolides

- 7.2.5. Other Drug Classes

- 7.3. Market Analysis, Insights and Forecast - by Dosage Form

- 7.3.1. Oral Powder

- 7.3.2. Oral Solutions

- 7.3.3. Injections

- 7.3.4. Other Dosage Forms

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Asia Pacific Veterinary Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Poultry

- 8.1.2. Pigs

- 8.1.3. Cattle

- 8.1.4. Sheep & Goats

- 8.1.5. Companion Animals

- 8.1.6. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Drug Class

- 8.2.1. Tetracyclines

- 8.2.2. Penicillin

- 8.2.3. Sulfonamides

- 8.2.4. Macrolides

- 8.2.5. Other Drug Classes

- 8.3. Market Analysis, Insights and Forecast - by Dosage Form

- 8.3.1. Oral Powder

- 8.3.2. Oral Solutions

- 8.3.3. Injections

- 8.3.4. Other Dosage Forms

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Middle East and Africa Veterinary Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Poultry

- 9.1.2. Pigs

- 9.1.3. Cattle

- 9.1.4. Sheep & Goats

- 9.1.5. Companion Animals

- 9.1.6. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Drug Class

- 9.2.1. Tetracyclines

- 9.2.2. Penicillin

- 9.2.3. Sulfonamides

- 9.2.4. Macrolides

- 9.2.5. Other Drug Classes

- 9.3. Market Analysis, Insights and Forecast - by Dosage Form

- 9.3.1. Oral Powder

- 9.3.2. Oral Solutions

- 9.3.3. Injections

- 9.3.4. Other Dosage Forms

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. South America Veterinary Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Poultry

- 10.1.2. Pigs

- 10.1.3. Cattle

- 10.1.4. Sheep & Goats

- 10.1.5. Companion Animals

- 10.1.6. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Drug Class

- 10.2.1. Tetracyclines

- 10.2.2. Penicillin

- 10.2.3. Sulfonamides

- 10.2.4. Macrolides

- 10.2.5. Other Drug Classes

- 10.3. Market Analysis, Insights and Forecast - by Dosage Form

- 10.3.1. Oral Powder

- 10.3.2. Oral Solutions

- 10.3.3. Injections

- 10.3.4. Other Dosage Forms

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zoetis Services LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Huvepharma NV

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Elanco

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Boehringer Ingelheim International GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vetoquinol*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Merck & Co Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ceva

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dechra Pharmaceuticals PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Phibro Animal Health Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Virbac

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Zoetis Services LLC

List of Figures

- Figure 1: Global Veterinary Antibiotics Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Veterinary Antibiotics Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 3: North America Veterinary Antibiotics Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 4: North America Veterinary Antibiotics Market Revenue (undefined), by Drug Class 2025 & 2033

- Figure 5: North America Veterinary Antibiotics Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 6: North America Veterinary Antibiotics Market Revenue (undefined), by Dosage Form 2025 & 2033

- Figure 7: North America Veterinary Antibiotics Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 8: North America Veterinary Antibiotics Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Veterinary Antibiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Veterinary Antibiotics Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 11: Europe Veterinary Antibiotics Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: Europe Veterinary Antibiotics Market Revenue (undefined), by Drug Class 2025 & 2033

- Figure 13: Europe Veterinary Antibiotics Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 14: Europe Veterinary Antibiotics Market Revenue (undefined), by Dosage Form 2025 & 2033

- Figure 15: Europe Veterinary Antibiotics Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 16: Europe Veterinary Antibiotics Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Veterinary Antibiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Veterinary Antibiotics Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 19: Asia Pacific Veterinary Antibiotics Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 20: Asia Pacific Veterinary Antibiotics Market Revenue (undefined), by Drug Class 2025 & 2033

- Figure 21: Asia Pacific Veterinary Antibiotics Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 22: Asia Pacific Veterinary Antibiotics Market Revenue (undefined), by Dosage Form 2025 & 2033

- Figure 23: Asia Pacific Veterinary Antibiotics Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 24: Asia Pacific Veterinary Antibiotics Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Veterinary Antibiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Veterinary Antibiotics Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 27: Middle East and Africa Veterinary Antibiotics Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 28: Middle East and Africa Veterinary Antibiotics Market Revenue (undefined), by Drug Class 2025 & 2033

- Figure 29: Middle East and Africa Veterinary Antibiotics Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 30: Middle East and Africa Veterinary Antibiotics Market Revenue (undefined), by Dosage Form 2025 & 2033

- Figure 31: Middle East and Africa Veterinary Antibiotics Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 32: Middle East and Africa Veterinary Antibiotics Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Veterinary Antibiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Veterinary Antibiotics Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 35: South America Veterinary Antibiotics Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 36: South America Veterinary Antibiotics Market Revenue (undefined), by Drug Class 2025 & 2033

- Figure 37: South America Veterinary Antibiotics Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 38: South America Veterinary Antibiotics Market Revenue (undefined), by Dosage Form 2025 & 2033

- Figure 39: South America Veterinary Antibiotics Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 40: South America Veterinary Antibiotics Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Veterinary Antibiotics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 2: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 3: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Dosage Form 2020 & 2033

- Table 4: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 6: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 7: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Dosage Form 2020 & 2033

- Table 8: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 13: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 14: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Dosage Form 2020 & 2033

- Table 15: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 23: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 24: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Dosage Form 2020 & 2033

- Table 25: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 33: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 34: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Dosage Form 2020 & 2033

- Table 35: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 40: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 41: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Dosage Form 2020 & 2033

- Table 42: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Antibiotics Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Veterinary Antibiotics Market?

Key companies in the market include Zoetis Services LLC, Huvepharma NV, Elanco, Boehringer Ingelheim International GmbH, Vetoquinol*List Not Exhaustive, Merck & Co Inc, Ceva, Dechra Pharmaceuticals PLC, Phibro Animal Health Corporation, Virbac.

3. What are the main segments of the Veterinary Antibiotics Market?

The market segments include Animal Type, Drug Class, Dosage Form.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Pet & Livestock Ownership; Increasing Incidence of Livestock Diseases; Rising Focus On Animal-Only Antibiotics.

6. What are the notable trends driving market growth?

Penicillin Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulations and Increasing Antibiotic Resistance Among Food-Producing Animals; Scarcity of Veterinarians and Skilled Farm Workers.

8. Can you provide examples of recent developments in the market?

In July 2022, Krka launched Cladaxxa which helps to treat respiratory, digestive, urinary, skin, and dental infections in dogs and cats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary Antibiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary Antibiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary Antibiotics Market?

To stay informed about further developments, trends, and reports in the Veterinary Antibiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence