Key Insights

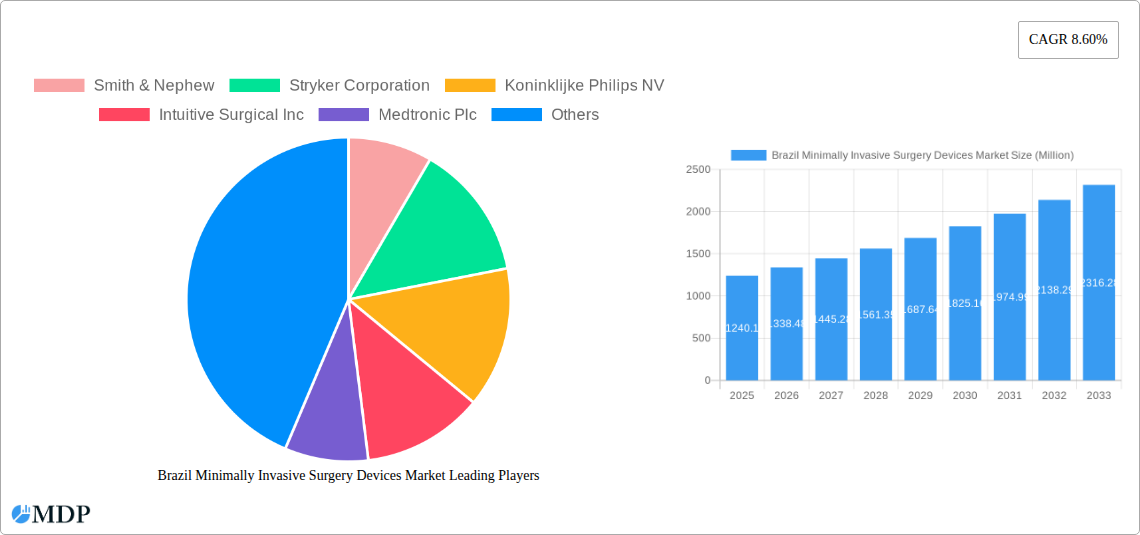

The Brazilian Minimally Invasive Surgery (MIS) Devices Market is poised for robust expansion, projected to reach an estimated $1240.1 million in 2025, with a compelling Compound Annual Growth Rate (CAGR) of 7.98% through 2033. This significant growth is propelled by a confluence of factors, primarily the increasing adoption of advanced surgical techniques driven by a growing preference for less invasive procedures. Key drivers include the rising prevalence of chronic diseases, particularly in the cardiovascular and gastrointestinal segments, necessitating more effective and less traumatic interventions. Furthermore, favorable reimbursement policies and government initiatives aimed at improving healthcare infrastructure in Brazil are significantly contributing to the market's upward trajectory. Technological advancements in handheld instruments, guiding devices, and sophisticated electrosurgical and endoscopic tools are further fueling demand, enabling surgeons to perform complex procedures with greater precision and reduced patient recovery times.

Brazil Minimally Invasive Surgery Devices Market Market Size (In Billion)

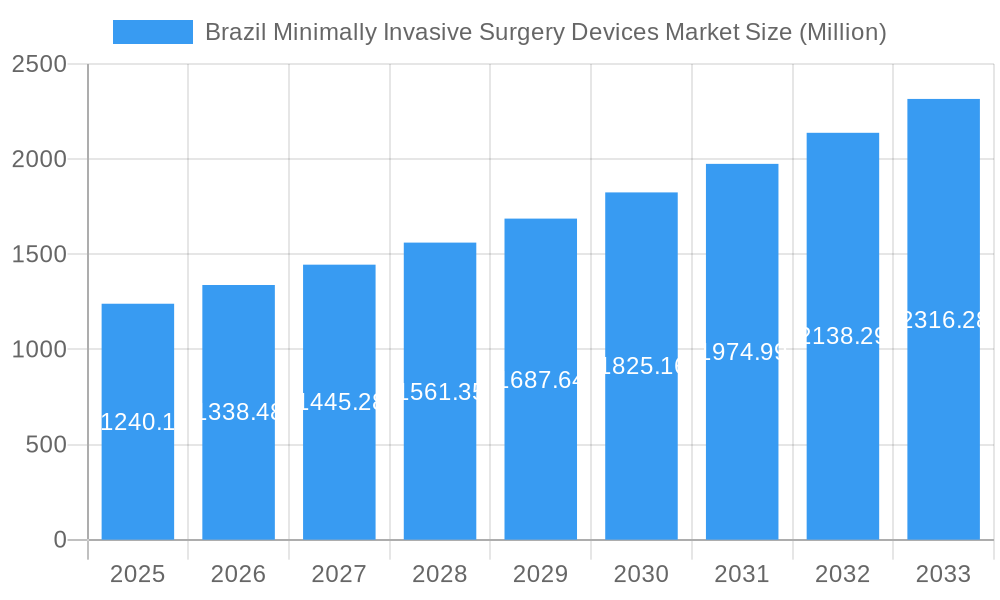

The MIS Devices Market in Brazil is characterized by a dynamic competitive landscape and evolving product segmentation. The "Monitoring and Visualization Devices" segment is expected to witness substantial growth due to the increasing integration of AI and advanced imaging technologies in surgical suites. The "Aesthetic" application segment, while smaller, is demonstrating rapid growth as cosmetic surgery gains wider acceptance. Major global players like Medtronic Plc, Stryker Corporation, and Intuitive Surgical Inc. are actively investing in research and development to introduce innovative products and expand their market presence in Brazil. However, the market also faces restraints such as the high cost of advanced MIS devices, the need for specialized training for healthcare professionals, and the presence of established traditional surgical methods. Nevertheless, the overall outlook remains strongly positive, driven by the undeniable benefits of MIS in terms of patient outcomes and healthcare cost-efficiency.

Brazil Minimally Invasive Surgery Devices Market Company Market Share

This comprehensive report delves into the burgeoning Brazil Minimally Invasive Surgery (MIS) Devices Market, offering an in-depth analysis of its trajectory from 2019 to 2033. With a base year of 2025, the estimated market size is projected to reach over $XXX million in 2025, driven by an anticipated Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This report is an indispensable resource for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the competitive landscape of minimally invasive surgical instruments, laparoscopic surgery devices, and endoscopic surgery equipment in Brazil. We meticulously examine Smith & Nephew, Stryker Corporation, Koninklijke Philips NV, Intuitive Surgical Inc, Medtronic Plc, Siemens Healthineers, GE Healthcare, Zimmer Biomet, Olympus Corporation, and Abbott Laboratories, alongside key market segments including Handheld Instruments, Guiding Devices, Electrosurgical Devices, Endoscopic and Laproscopic Devices, Monitoring and Visualization Devices, Ablation and Laser Based Devices, and Others. Applications spanning Aesthetic, Cardiovascular, Gastrointestinal, Gynecological, Orthopedic, Urological, and Other Applications are thoroughly explored.

Brazil Minimally Invasive Surgery Devices Market Market Dynamics & Concentration

The Brazil Minimally Invasive Surgery Devices Market is characterized by a moderate to high level of concentration, with a few key players dominating a significant portion of the market share. Innovation remains a crucial driver, propelled by continuous advancements in medical technology, miniaturization, and enhanced imaging capabilities. The regulatory framework, particularly the approval processes by Agência Nacional de Vigilância Sanitária (ANVISA), plays a pivotal role in market entry and product adoption. While direct product substitutes for highly specialized MIS devices are limited, the availability of open surgery alternatives can influence market penetration. End-user trends are shifting towards less invasive procedures due to patient preference for faster recovery times, reduced scarring, and lower complication rates. This demand fuels the adoption of advanced surgical robotics, energy-based devices, and advanced visualization systems. Mergers and acquisitions (M&A) activities are expected to continue as companies seek to expand their product portfolios, gain market share, and enhance their technological capabilities. Over the historical period of 2019–2024, we observed XX M&A deals impacting the competitive landscape.

Brazil Minimally Invasive Surgery Devices Market Industry Trends & Analysis

The Brazil Minimally Invasive Surgery Devices Market is experiencing robust growth, driven by an escalating demand for advanced surgical solutions that offer enhanced patient outcomes and reduced healthcare costs. The increasing prevalence of chronic diseases and the growing aging population are significant contributors to the rising number of surgical procedures, many of which are increasingly being performed using minimally invasive techniques. Technological disruptions are at the forefront, with the integration of artificial intelligence (AI) and machine learning (ML) in surgical planning and execution, alongside the widespread adoption of 3D visualization, haptic feedback, and robotic-assisted surgery. These advancements are not only improving surgical precision but also enabling surgeons to perform more complex procedures with greater ease and safety. Consumer preferences are strongly leaning towards procedures that minimize patient trauma and shorten hospital stays, directly fueling the market for MIS devices. The competitive dynamics are characterized by intense R&D investments, strategic collaborations, and a focus on product differentiation. The market penetration of advanced laparoscopic instruments and endoscopic devices is steadily increasing as healthcare providers recognize their long-term economic and clinical benefits. The overall market is projected to reach over $XXX million by 2025, with a projected CAGR of xx% during the forecast period.

Leading Markets & Segments in Brazil Minimally Invasive Surgery Devices Market

Within the Brazil Minimally Invasive Surgery Devices Market, the Endoscopic and Laproscopic Devices segment is poised to dominate, driven by their extensive application across a wide range of surgical specialties. This segment's leadership is underpinned by the inherent advantages of these devices, including smaller incisions, reduced blood loss, and faster recovery times. The Orthopedic and Gastrointestinal application segments are expected to exhibit the highest growth rates.

Products Dominance:

- Endoscopic and Laproscopic Devices: These remain the cornerstone of MIS, encompassing a vast array of instruments used in abdominal, thoracic, and joint surgeries. Their versatility and continuous innovation in areas like flexible endoscopy and single-port laparoscopy contribute to their market leadership.

- Monitoring and Visualization Devices: The increasing complexity of MIS procedures necessitates advanced imaging and real-time monitoring. High-definition cameras, augmented reality integration, and AI-powered image analysis are critical for surgical success and drive demand in this segment.

- Handheld Instruments: While traditional, these instruments are continuously being refined for better ergonomics, precision, and compatibility with advanced robotic systems, ensuring their continued relevance.

- Electrosurgical Devices: Essential for cutting and coagulation, these devices are witnessing innovation in energy delivery for more precise tissue manipulation and reduced collateral damage.

- Guiding Devices: Including catheters, guidewires, and trocars, these are fundamental for accessing surgical sites and are seeing advancements in material science for improved maneuverability and patient safety.

- Ablation and Laser Based Devices: Growing in popularity for targeted tissue destruction in oncology and cardiology, these devices offer a precise and less invasive approach.

- Others: This category encompasses emerging technologies and niche applications that contribute to the overall market diversification.

Application Dominance:

- Orthopedic: The rising incidence of sports injuries, degenerative joint diseases, and the growing preference for less invasive joint replacement procedures are significant growth catalysts. Advancements in arthroscopic surgical techniques and specialized instruments for joint repair and reconstruction are key drivers.

- Gastrointestinal: Procedures such as bariatric surgery, colectomies, and appendectomies are increasingly performed laparoscopically, leading to substantial demand for related MIS devices. The prevalence of gastrointestinal disorders and the aging population contribute to this trend.

- Urological: MIS techniques are widely adopted for procedures like prostatectomy, nephrectomy, and stone removal, offering improved outcomes and reduced patient morbidity.

- Gynecological: Laparoscopic hysterectomies, myomectomies, and procedures for treating endometriosis are common, driving demand for specialized gynecological MIS instruments.

- Cardiovascular: While still evolving, minimally invasive approaches for valve repair and replacement, as well as cardiac ablation, are gaining traction and contributing to market growth.

- Aesthetic: Minimally invasive cosmetic procedures, such as liposuction and facial rejuvenation, utilize specialized MIS devices, contributing to a growing segment.

- Other Applications: This includes procedures in neurosurgery, pulmonology, and other specialties adopting MIS techniques.

Brazil Minimally Invasive Surgery Devices Market Product Developments

Recent product developments in the Brazil MIS Devices Market are centered on enhancing precision, miniaturization, and surgeon ergonomics. Innovations include the introduction of advanced robotic surgical systems with improved dexterity and tactile feedback, as well as the development of smaller, more flexible endoscopes for accessing confined anatomical spaces. The integration of AI for real-time image analysis and surgical guidance is a significant trend, promising to improve diagnostic accuracy and procedural efficiency. Furthermore, the market is witnessing advancements in energy-based devices offering more controlled tissue ablation and coagulation, and the development of disposable MIS instruments to reduce the risk of surgical site infections and sterilization complexities.

Key Drivers of Brazil Minimally Invasive Surgery Devices Market Growth

Several key factors are propelling the growth of the Brazil Minimally Invasive Surgery Devices Market. Firstly, the increasing patient preference for less invasive procedures due to faster recovery, reduced pain, and minimal scarring is a major catalyst. Secondly, the rising prevalence of chronic diseases and the expanding aging population are leading to a higher volume of surgical interventions, with MIS techniques becoming the preferred approach. Thirdly, continuous technological advancements, including the development of surgical robotics, improved imaging technologies, and smarter instrumentation, are expanding the scope of MIS procedures. Finally, supportive government initiatives and increasing healthcare expenditure are further bolstering market expansion, encouraging the adoption of advanced medical technologies.

Challenges in the Brazil Minimally Invasive Surgery Devices Market Market

Despite the promising growth, the Brazil MIS Devices Market faces certain challenges. High initial investment costs for advanced MIS equipment, particularly surgical robots, can be a significant barrier for smaller healthcare facilities. The need for specialized training and skilled personnel to operate complex MIS systems also presents a hurdle. Furthermore, navigating Brazil's complex regulatory landscape for medical device approvals can be time-consuming and costly. Supply chain disruptions and the reliance on imported components can also impact product availability and pricing.

Emerging Opportunities in Brazil Minimally Invasive Surgery Devices Market

The Brazil MIS Devices Market presents several exciting emerging opportunities. The expanding middle class and increasing disposable incomes are leading to greater access to advanced healthcare services, including MIS procedures. The growing focus on preventative healthcare and early disease detection will likely increase the demand for diagnostic and therapeutic MIS interventions. Strategic partnerships between local distributors and global manufacturers, along with increased investment in research and development tailored to the Brazilian healthcare context, will further drive market growth. The development of more affordable and accessible MIS solutions for a wider range of procedures also represents a significant untapped market potential.

Leading Players in the Brazil Minimally Invasive Surgery Devices Market Sector

- Smith & Nephew

- Stryker Corporation

- Koninklijke Philips NV

- Intuitive Surgical Inc

- Medtronic Plc

- Siemens Healthineers

- GE Healthcare

- Zimmer Biomet

- Olympus Corporation

- Abbott Laboratories

Key Milestones in Brazil Minimally Invasive Surgery Devices Market Industry

- June 2022: GC Aesthetics, Inc., a privately-held medical technology company offering women's healthcare aesthetic and reconstructive solutions, announced its expansion goals for the Brazilian market. The company planned to commercialize all GC Aesthetics products and solutions in Brazil.

- January 2022: Spinologics Inc. and Importek launched Cervision, an upper-extremity patient positioning device for cervical spine surgery, in Brazil.

- Early January 2022: Cervision was approved by the Brazilian medical device regulatory body Agência Nacional de Vigilância Sanitária (ANVISA).

Strategic Outlook for Brazil Minimally Invasive Surgery Devices Market Market

The strategic outlook for the Brazil Minimally Invasive Surgery Devices Market is exceptionally positive. Future growth will be accelerated by a continued focus on technological innovation, particularly in robotic surgery and AI-driven solutions. Increased adoption of MIS across a wider spectrum of applications, driven by favorable patient outcomes and cost-effectiveness, will be paramount. Strategic collaborations between international manufacturers and Brazilian healthcare providers, coupled with localized manufacturing and distribution initiatives, will further solidify market presence. The development of comprehensive training programs to address the skill gap and government incentives for adopting advanced medical technologies will act as significant growth accelerators.

Brazil Minimally Invasive Surgery Devices Market Segmentation

-

1. Products

- 1.1. Handheld Instruments

- 1.2. Guiding Devices

- 1.3. Electrosurgical Devices

- 1.4. Endoscopic and Laproscopic Devices

- 1.5. Monitoring and Visualization Devices

- 1.6. Ablation and Laser Based Devices

- 1.7. Others

-

2. Application

- 2.1. Aesthetic

- 2.2. Cardiovascular

- 2.3. Gastrointestinal

- 2.4. Gynecological

- 2.5. Orthopedic

- 2.6. Urological

- 2.7. Other Applications

Brazil Minimally Invasive Surgery Devices Market Segmentation By Geography

- 1. Brazil

Brazil Minimally Invasive Surgery Devices Market Regional Market Share

Geographic Coverage of Brazil Minimally Invasive Surgery Devices Market

Brazil Minimally Invasive Surgery Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Acceptance Rate of Minimally-invasive Surgeries over Traditional Surgeries; Increasing Prevalence of Lifestyle-related and Chronic Disorders; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Lack of Experienced Professionals; Uncertain Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Aesthetics Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Minimally Invasive Surgery Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Handheld Instruments

- 5.1.2. Guiding Devices

- 5.1.3. Electrosurgical Devices

- 5.1.4. Endoscopic and Laproscopic Devices

- 5.1.5. Monitoring and Visualization Devices

- 5.1.6. Ablation and Laser Based Devices

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Aesthetic

- 5.2.2. Cardiovascular

- 5.2.3. Gastrointestinal

- 5.2.4. Gynecological

- 5.2.5. Orthopedic

- 5.2.6. Urological

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Smith & Nephew

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stryker Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Koninklijke Philips NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Intuitive Surgical Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens Healthineers

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GE Healthcare

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zimmer Biomet

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Olympus Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Abbott Laboratories

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Smith & Nephew

List of Figures

- Figure 1: Brazil Minimally Invasive Surgery Devices Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Brazil Minimally Invasive Surgery Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Products 2020 & 2033

- Table 2: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Products 2020 & 2033

- Table 3: Brazil Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Application 2020 & 2033

- Table 5: Brazil Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Region 2020 & 2033

- Table 7: Brazil Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Products 2020 & 2033

- Table 8: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Products 2020 & 2033

- Table 9: Brazil Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Application 2020 & 2033

- Table 11: Brazil Minimally Invasive Surgery Devices Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Brazil Minimally Invasive Surgery Devices Market Volume K units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Minimally Invasive Surgery Devices Market?

The projected CAGR is approximately 9.7%.

2. Which companies are prominent players in the Brazil Minimally Invasive Surgery Devices Market?

Key companies in the market include Smith & Nephew, Stryker Corporation, Koninklijke Philips NV, Intuitive Surgical Inc, Medtronic Plc, Siemens Healthineers, GE Healthcare, Zimmer Biomet, Olympus Corporation, Abbott Laboratories.

3. What are the main segments of the Brazil Minimally Invasive Surgery Devices Market?

The market segments include Products, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Higher Acceptance Rate of Minimally-invasive Surgeries over Traditional Surgeries; Increasing Prevalence of Lifestyle-related and Chronic Disorders; Technological Advancements.

6. What are the notable trends driving market growth?

Aesthetics Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Experienced Professionals; Uncertain Regulatory Framework.

8. Can you provide examples of recent developments in the market?

In June 2022, GC Aesthetics, Inc., a privately-held medical technology company offering women's healthcare aesthetic and reconstructive solutions, announced its expansion goals for the Brazilian market. The company planned to commercialize all GC Aesthetics products and solutions in Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Minimally Invasive Surgery Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Minimally Invasive Surgery Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Minimally Invasive Surgery Devices Market?

To stay informed about further developments, trends, and reports in the Brazil Minimally Invasive Surgery Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence