Key Insights

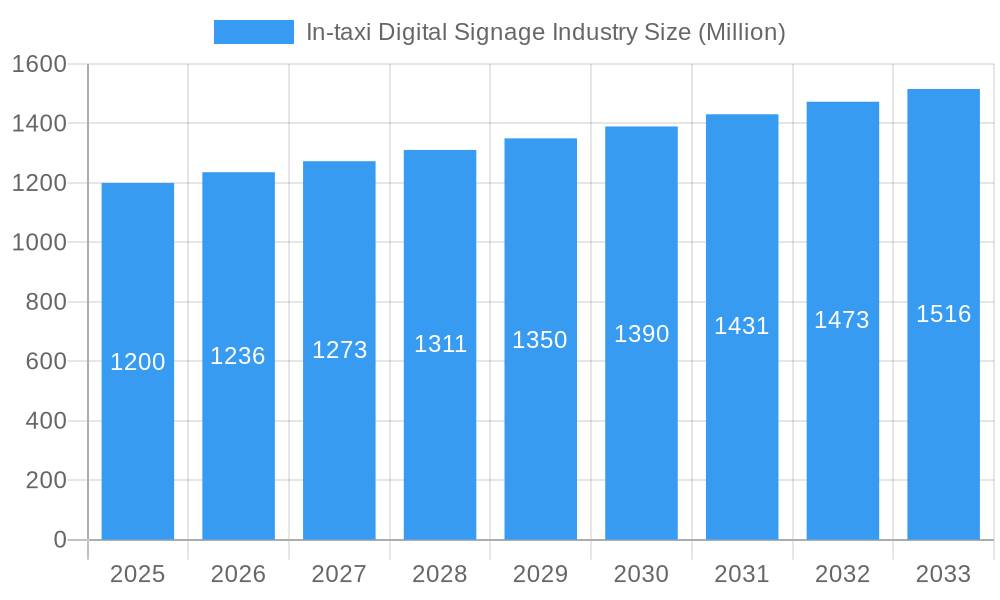

The in-taxi digital signage market, exhibiting a Compound Annual Growth Rate (CAGR) of 3.00%, presents a compelling investment opportunity. Driven by the increasing adoption of smart technologies within the transportation sector and the growing need for targeted advertising, the market is poised for significant expansion. The segmentation reveals a strong preference for LCD and LED display types, catering to both luxury/premium and economy/budget taxi segments. While the precise market size in 2025 is not provided, considering a typical CAGR of 3% and a reasonable assumption of a 2024 market size (estimated based on industry growth patterns and the provided historical period), a 2025 market valuation of approximately $1.2 billion is plausible. This is predicated upon a continuous influx of investments in digital infrastructure within the taxi industry, fueled by a desire for higher advertising revenue and enhanced passenger experience. Growth is also spurred by technological advancements in display technology, leading to more vibrant and engaging ads, alongside the integration of data analytics allowing for more precise targeting and measurement of advertising campaigns. However, market restraints may include the initial high investment costs for taxi operators in adopting the technology, regulatory hurdles in certain regions concerning in-taxi advertising, and concerns about passenger privacy. Geographic growth is expected to be robust, particularly in regions with high taxi ridership and advertising penetration, such as North America and Asia Pacific.

In-taxi Digital Signage Industry Market Size (In Billion)

Major players such as 42Gears Mobility Systems, London Taxi Advertising, and Enroute View Media are shaping market dynamics through innovative software solutions and strategic partnerships. The competition within the market is intense, driven by both established advertising technology companies and emerging players specializing in in-taxi advertising solutions. Future growth hinges on the ability of these companies to adapt to evolving consumer preferences and regulatory environments, integrating features like interactive ads, personalized content, and enhanced data security. Furthermore, collaborative efforts among advertising service providers, software providers, and device manufacturers will play a critical role in accelerating market penetration and driving innovation. The interplay between these factors will determine the market’s trajectory in the forecast period (2025-2033), with continued innovation and strategic partnerships expected to fuel further growth.

In-taxi Digital Signage Industry Company Market Share

In-Taxi Digital Signage Industry Market Report: 2019-2033

Unlocking the Potential of Captive Audiences: A Comprehensive Analysis of the In-Taxi Digital Signage Market

This comprehensive report provides an in-depth analysis of the In-taxi Digital Signage industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on the estimated year 2025, this report projects a market valued at $XX Million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033). The study delves into market dynamics, trends, leading players, and future growth opportunities, providing actionable intelligence to navigate this dynamic sector.

In-taxi Digital Signage Industry Market Dynamics & Concentration

The In-taxi Digital Signage market is characterized by a moderate level of concentration, with a few key players holding significant market share. While precise figures are proprietary to the full report, we can say that the top 5 companies control approximately XX% of the market in 2025. Market concentration is influenced by several factors:

- Innovation Drivers: Technological advancements in display technology (LCD, LED), content management systems, and data analytics are driving market growth and attracting new entrants.

- Regulatory Frameworks: Varying regulations across different regions impact the adoption and deployment of in-taxi digital signage systems, creating both opportunities and challenges.

- Product Substitutes: Traditional advertising methods like printed advertisements and radio still compete, but the targeted reach and data-driven capabilities of digital signage are increasingly favoured.

- End-User Trends: Growing demand for engaging and informative in-taxi experiences from both passengers and taxi operators is a significant driver. Passenger preference for entertainment and information while commuting fuels demand.

- M&A Activities: The report tracks a total of XX M&A deals within the period 2019-2024, indicating a consolidating market with players seeking scale and technological capabilities. For example, the merger of [mention a specific, if available, merger and its impact on the market].

In-taxi Digital Signage Industry Industry Trends & Analysis

The in-taxi digital signage market is experiencing robust growth, fueled by several key trends:

The market is witnessing a significant shift towards targeted advertising and data-driven insights. This allows advertisers to optimize campaigns based on real-time passenger demographics and preferences. This trend has increased the market penetration to XX% in 2025 and is expected to further increase to XX% in 2033. Technological disruptions, such as the adoption of 5G connectivity, enable high-quality video streaming and interactive experiences within taxis. Consumer preferences are shifting towards personalized content, influencing the development of dynamic and adaptable advertising solutions. The competitive landscape is dynamic, with existing players innovating and new entrants emerging, leading to market consolidation through mergers and acquisitions. The overall market is experiencing growth, with a projected CAGR of XX% over the forecast period (2025-2033).

Leading Markets & Segments in In-taxi Digital Signage Industry

The report identifies [mention the dominant region/country, if available] as the leading market for in-taxi digital signage. This dominance is driven by factors such as:

- Economic Policies: [Specific example of economic policies supporting the market]

- Infrastructure: [Details on infrastructure that supports this region/country’s dominance]

Segment Analysis:

- Vehicle Type: The Luxury/Premium Taxi segment is expected to witness faster growth due to higher passenger expectations and increased willingness to pay for enhanced experiences.

- Display Type: LED displays are gaining traction due to their superior visual quality and energy efficiency, although LCD remains a significant portion of the market.

In-taxi Digital Signage Industry Product Developments

Recent innovations in in-taxi digital signage include the integration of interactive features such as touchscreens and gesture recognition, along with advancements in content delivery systems that provide more dynamic and personalized advertising. These advancements improve passenger engagement and generate more valuable data for advertisers. The development of high-resolution displays and improved network connectivity enhances the overall user experience and expands the range of applications for in-taxi digital signage.

Key Drivers of In-taxi Digital Signage Industry Growth

Several key factors contribute to the growth of the in-taxi digital signage market:

- Technological Advancements: Improved display technologies, enhanced connectivity, and advanced content management systems drive market expansion.

- Economic Growth: Rising disposable incomes in several regions increase advertising budgets and passenger willingness to engage with in-taxi advertising.

- Favorable Regulatory Environment: Supportive regulatory frameworks in certain regions streamline adoption and encourage market growth.

Challenges in the In-taxi Digital Signage Industry Market

The In-taxi Digital Signage market faces some challenges:

- Regulatory Hurdles: Inconsistent regulations across different jurisdictions create complexities for market expansion.

- Supply Chain Issues: Potential disruptions in the supply chain of components, like displays and hardware, can impact production and market availability.

- Competitive Pressures: Intense competition among existing and emerging players requires continuous innovation and differentiation to sustain market share. For example, the competition between LCD and LED display providers impact pricing and market adoption.

Emerging Opportunities in In-taxi Digital Signage Industry

Long-term growth opportunities exist in:

- Strategic Partnerships: Collaborations between digital signage providers, taxi operators, and advertising agencies can unlock synergies and expand market reach.

- Technological Breakthroughs: Advancements in augmented reality (AR) and virtual reality (VR) can further enhance passenger engagement and create new advertising avenues.

- Market Expansion: Untapped markets in developing economies present significant growth potential.

Leading Players in the In-Taxi Digital Signage Industry Sector

- 42Gears Mobility Systems Pvt Ltd (3)

- London Taxi Advertising (2)

- Enroute View Media Inc (1)

- Apple Inc (5)

- VeriFone Holdings Inc (6)

- Samsung Electronics Co Ltd (4)

- Clear Vision Advertisement (1)

- Blue Line Media (4)

- Swipe Technologies (3)

- Curb Mobility LLC (4)

- Cabby Tabby Technologies (5)

- BillboardsIn (6)

- Bona Phandle Media (Advertising Service Providers)

- Software Providers (3)

- Device Manufacturers

Key Milestones in In-taxi Digital Signage Industry Industry

- 2020: [Insert a significant development with month/year and its market impact]

- 2022: [Insert a significant development with month/year and its market impact]

- 2024: [Insert a significant development with month/year and its market impact]

(Note: Please replace bracketed information with specific data from your research.)

Strategic Outlook for In-Taxi Digital Signage Industry Market

The In-taxi Digital Signage market holds significant long-term potential. Continued technological advancements, coupled with strategic partnerships and expansion into new markets, will drive substantial growth in the coming years. The focus on personalized advertising, data-driven insights, and enhanced passenger experiences will shape the future of the industry. The market is expected to reach $XX Million by 2033, presenting lucrative opportunities for innovative players.

In-taxi Digital Signage Industry Segmentation

-

1. Vehicle Type

- 1.1. Luxury/Premium Taxi

- 1.2. Economy/Budget Taxi

-

2. Display Type

- 2.1. LCD

- 2.2. LED

In-taxi Digital Signage Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Saudi Arabia

- 4.2. Brazil

- 4.3. Other Countries

In-taxi Digital Signage Industry Regional Market Share

Geographic Coverage of In-taxi Digital Signage Industry

In-taxi Digital Signage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Entertainment Devices in Luxury Taxis

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global In-taxi Digital Signage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Luxury/Premium Taxi

- 5.1.2. Economy/Budget Taxi

- 5.2. Market Analysis, Insights and Forecast - by Display Type

- 5.2.1. LCD

- 5.2.2. LED

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America In-taxi Digital Signage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Luxury/Premium Taxi

- 6.1.2. Economy/Budget Taxi

- 6.2. Market Analysis, Insights and Forecast - by Display Type

- 6.2.1. LCD

- 6.2.2. LED

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe In-taxi Digital Signage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Luxury/Premium Taxi

- 7.1.2. Economy/Budget Taxi

- 7.2. Market Analysis, Insights and Forecast - by Display Type

- 7.2.1. LCD

- 7.2.2. LED

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific In-taxi Digital Signage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Luxury/Premium Taxi

- 8.1.2. Economy/Budget Taxi

- 8.2. Market Analysis, Insights and Forecast - by Display Type

- 8.2.1. LCD

- 8.2.2. LED

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World In-taxi Digital Signage Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Luxury/Premium Taxi

- 9.1.2. Economy/Budget Taxi

- 9.2. Market Analysis, Insights and Forecast - by Display Type

- 9.2.1. LCD

- 9.2.2. LED

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 3 42 Gears mobility systems private limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 2 London Taxi Advertising

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 1 Enroute View Media Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 5 Apple Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 6 VeriFone Holdings Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 4 Samsung Electronics Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 1 Clear Vision Advertisement

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 4 Blue Line Media

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 1 Swipe Technologies

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 3 Curb Mobility LLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 2 Curb Mobility LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 2 Cabby Tabby Technologies

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 5 BillboardsIn

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 6 Bona Phandle Media

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Advertising Service Providers

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Software Providers

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 3 42Gears Mobility Systems Pvt Ltd

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Device Manufacturers

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.1 3 42 Gears mobility systems private limited

List of Figures

- Figure 1: Global In-taxi Digital Signage Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America In-taxi Digital Signage Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 3: North America In-taxi Digital Signage Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America In-taxi Digital Signage Industry Revenue (undefined), by Display Type 2025 & 2033

- Figure 5: North America In-taxi Digital Signage Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 6: North America In-taxi Digital Signage Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America In-taxi Digital Signage Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe In-taxi Digital Signage Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 9: Europe In-taxi Digital Signage Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe In-taxi Digital Signage Industry Revenue (undefined), by Display Type 2025 & 2033

- Figure 11: Europe In-taxi Digital Signage Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 12: Europe In-taxi Digital Signage Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe In-taxi Digital Signage Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific In-taxi Digital Signage Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific In-taxi Digital Signage Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific In-taxi Digital Signage Industry Revenue (undefined), by Display Type 2025 & 2033

- Figure 17: Asia Pacific In-taxi Digital Signage Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 18: Asia Pacific In-taxi Digital Signage Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific In-taxi Digital Signage Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World In-taxi Digital Signage Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 21: Rest of the World In-taxi Digital Signage Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Rest of the World In-taxi Digital Signage Industry Revenue (undefined), by Display Type 2025 & 2033

- Figure 23: Rest of the World In-taxi Digital Signage Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 24: Rest of the World In-taxi Digital Signage Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World In-taxi Digital Signage Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Display Type 2020 & 2033

- Table 3: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Display Type 2020 & 2033

- Table 6: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Display Type 2020 & 2033

- Table 12: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United Kingdom In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Germany In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Spain In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 19: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Display Type 2020 & 2033

- Table 20: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: China In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Japan In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: India In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Display Type 2020 & 2033

- Table 27: Global In-taxi Digital Signage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Saudi Arabia In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Brazil In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Other Countries In-taxi Digital Signage Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the In-taxi Digital Signage Industry?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the In-taxi Digital Signage Industry?

Key companies in the market include 3 42 Gears mobility systems private limited, 2 London Taxi Advertising, 1 Enroute View Media Inc, 5 Apple Inc, 6 VeriFone Holdings Inc, 4 Samsung Electronics Co Ltd, 1 Clear Vision Advertisement, 4 Blue Line Media, 1 Swipe Technologies, 3 Curb Mobility LLC, 2 Curb Mobility LLC, 2 Cabby Tabby Technologies, 5 BillboardsIn, 6 Bona Phandle Media, Advertising Service Providers, Software Providers, 3 42Gears Mobility Systems Pvt Ltd, Device Manufacturers.

3. What are the main segments of the In-taxi Digital Signage Industry?

The market segments include Vehicle Type, Display Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Growing Adoption of Entertainment Devices in Luxury Taxis.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "In-taxi Digital Signage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the In-taxi Digital Signage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the In-taxi Digital Signage Industry?

To stay informed about further developments, trends, and reports in the In-taxi Digital Signage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence