Key Insights

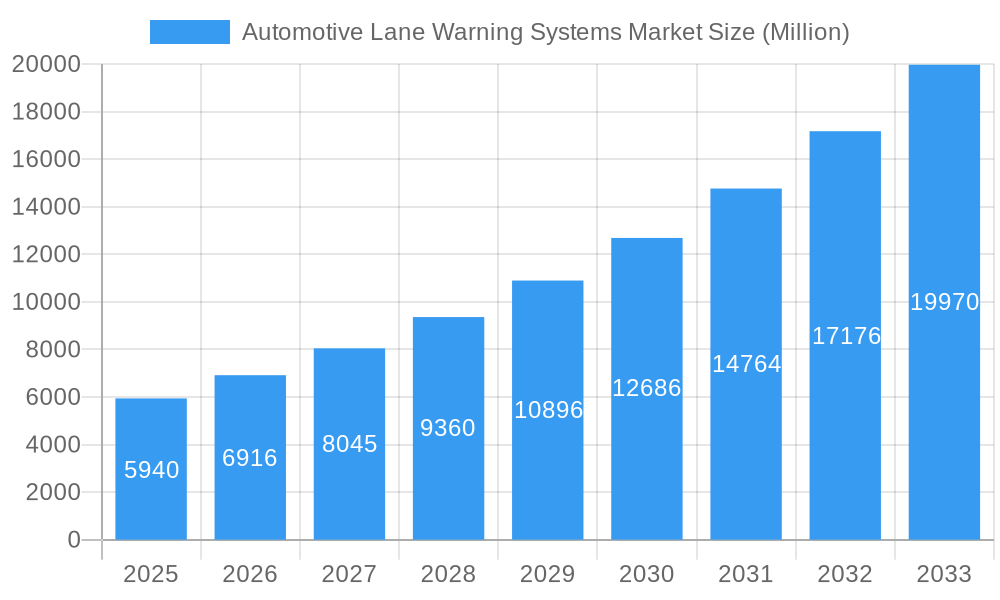

The global Automotive Lane Warning Systems market is experiencing robust growth, projected to reach a market size of $5.94 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 16.60% from 2025 to 2033. This expansion is driven by several key factors. Increasing road accidents due to lane departure and driver distraction are prompting stringent government regulations mandating advanced driver-assistance systems (ADAS) like lane warning systems in new vehicles. Furthermore, the rising adoption of autonomous driving technologies and increasing consumer preference for enhanced vehicle safety features are significantly contributing to market growth. Technological advancements, such as the integration of more sophisticated sensor technologies (like video, laser, and infrared sensors), are leading to more accurate and reliable lane keeping assistance. The market is segmented by vehicle type (passenger cars, light commercial vehicles, heavy commercial vehicles), function type (lane departure warning, lane keeping assist), sensor type, and sales channel (OEM, aftermarket). Passenger cars currently dominate the market, owing to high vehicle production volume, but the light and heavy commercial vehicle segments are anticipated to show significant growth fueled by the implementation of safety regulations in the commercial transportation sector.

Automotive Lane Warning Systems Market Market Size (In Billion)

The geographic distribution of the market reveals strong growth across all regions, with North America and Europe currently holding significant market share due to established automotive industries and high consumer adoption rates of advanced safety features. However, the Asia-Pacific region, particularly China and India, is poised for rapid expansion due to increasing vehicle production, rising disposable incomes, and improving infrastructure. The aftermarket segment is expected to experience considerable growth due to the retrofitting of lane warning systems in older vehicles. Key players such as The Bendix Corporation, Mobileye, and Bosch are investing heavily in research and development to improve the technology and expand their market presence. Competition is intense, focused on innovation in sensor technology, system integration, and cost-effectiveness. The ongoing development of more affordable and effective lane warning systems will further drive market penetration and growth throughout the forecast period.

Automotive Lane Warning Systems Market Company Market Share

Automotive Lane Warning Systems Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Automotive Lane Warning Systems Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth opportunities. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

Automotive Lane Warning Systems Market Dynamics & Concentration

The Automotive Lane Warning Systems market is characterized by a moderately concentrated landscape, with key players such as The Bendix Corporation, Mobileye, Nissan Motor Co Ltd, Volkswagen AG, Hitachi Ltd, Continental AG, Robert Bosch GmbH, Delphi Technologies, DENSO Corporation, Iteris Inc, and ZF TRW holding significant market share. However, the market also witnesses the emergence of smaller, innovative companies. Market concentration is influenced by factors such as technological advancements, economies of scale, and M&A activities. The number of M&A deals in the sector has shown an upward trend in recent years, reaching approximately xx deals in 2024, indicating a consolidation phase. This trend is driven by the need to expand product portfolios, enhance technological capabilities, and secure a larger market share.

- Innovation Drivers: Continuous advancements in sensor technology (video, laser, infrared), artificial intelligence, and machine learning are driving innovation and creating more sophisticated lane warning systems.

- Regulatory Frameworks: Stringent safety regulations worldwide are mandating the adoption of lane warning systems, particularly in new vehicles. This is a key growth driver.

- Product Substitutes: While no direct substitutes exist, advancements in autonomous driving technologies could potentially reduce the market's dependence on standalone lane warning systems in the long term.

- End-User Trends: Growing consumer demand for enhanced safety features and advanced driver-assistance systems (ADAS) is fueling market growth. The rising adoption of ADAS across various vehicle segments further boosts market expansion.

- M&A Activities: Strategic mergers and acquisitions are reshaping the competitive landscape, leading to increased market concentration and technological integration.

Automotive Lane Warning Systems Market Industry Trends & Analysis

The Automotive Lane Warning Systems market is experiencing robust growth, driven by several factors. The compound annual growth rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%, significantly higher than the historical CAGR (2019-2024) of xx%. This accelerated growth is attributed to technological advancements in sensor technology, increasing penetration of ADAS in vehicles, and supportive government regulations.

Market penetration is also steadily increasing, particularly in developed economies where safety standards are high and consumer awareness is considerable. The market is witnessing a shift toward more sophisticated systems that integrate multiple sensor technologies and provide enhanced functionalities. Consumer preferences are moving towards systems that offer seamless integration with other ADAS features and deliver a more user-friendly experience. This is driving demand for advanced features like lane keeping assist, which actively corrects steering to prevent lane departures, compared to the basic lane departure warning systems. The competitive dynamics are shaping up with established players investing heavily in R&D to innovate and enhance their product offerings.

Leading Markets & Segments in Automotive Lane Warning Systems Market

The Passenger Cars segment currently commands the largest share in the Automotive Lane Warning Systems market. This dominance is attributed to high global vehicle production volumes and a steadily increasing consumer preference for advanced safety features that enhance driving experience and mitigate risks. However, the Light Commercial Vehicles (LCV) segment is anticipated to experience a more robust growth trajectory in the coming years. This surge is fueled by increasingly stringent governmental regulations mandating advanced driver-assistance systems (ADAS) and a heightened awareness of safety concerns within the commercial transportation sector, where operational efficiency and driver well-being are paramount.

- Dominant Regions: North America continues to lead the global market, benefiting from early adoption of ADAS and strong regulatory frameworks. This is closely followed by Europe, which prioritizes stringent safety standards, and the rapidly expanding Asia Pacific region. The Asia Pacific market is witnessing significant growth due to escalating vehicle production, increasing disposable incomes, and a growing consciousness regarding road safety among consumers.

- Key Growth Drivers by Region:

- North America: Driven by a combination of strict federal and state safety mandates, a high level of consumer disposable income allowing for premium safety options, and a historical propensity for early adoption of cutting-edge automotive technologies.

- Europe: Characterized by a strong emphasis on achieving the highest possible vehicle safety standards, supported by robust regulatory bodies and a keen consumer interest in technologies that contribute to accident prevention.

- Asia Pacific: Experiencing rapid economic development, leading to substantial increases in vehicle production and sales. Rising consumer spending power, coupled with an increasing awareness of the benefits of safety features, are pivotal growth catalysts.

- Vehicle Type Segmentation:

- Passenger Cars: Remain the largest segment due to their sheer volume of sales and the increasing demand from consumers for integrated safety technologies that offer peace of mind.

- Light Commercial Vehicles (LCVs): This segment is poised for substantial growth, driven by stricter safety legislation for commercial fleets and a growing recognition of the need to protect drivers and cargo.

- Heavy Commercial Vehicles (HCVs): The adoption of ADAS, including lane warning systems, is accelerating in heavy-duty vehicles. This is primarily to enhance driver safety, reduce fatigue on long-haul routes, and improve overall operational efficiency and accident prevention.

- Function Type Evolution:

- Lane Departure Warning Systems (LDWS): Currently hold a significant market share due to their established presence and widespread integration across a broad spectrum of vehicle models, offering a foundational level of lane safety.

- Lane Keeping Systems (LKS): Are experiencing a notable surge in adoption. These systems offer more advanced intervention capabilities compared to basic LDWS, actively steering the vehicle back into its lane, thereby providing a superior level of active safety.

- Sensor Technology Dominance:

- Video Sensors: Continue to dominate the market owing to their cost-effectiveness, relatively simple integration into existing vehicle architectures, and increasing sophistication in image processing capabilities.

- Laser Sensors: Are gaining traction, particularly for their enhanced accuracy in diverse and challenging environmental conditions such as low light or fog, offering a more robust sensing solution.

- Infrared Sensors: Occupy a niche market, primarily employed in specialized applications where detection in extreme darkness or through certain obscurants is critical.

- Sales Channel Landscape:

- Original Equipment Manufacturer (OEM): This channel remains dominant as lane warning systems are increasingly integrated as standard or optional equipment directly by vehicle manufacturers during the production process.

- Aftermarket: Presents significant growth potential as an increasing number of vehicle owners seek to retrofit their existing vehicles with advanced safety features, driven by post-purchase awareness and regulatory changes.

Automotive Lane Warning Systems Market Product Developments

Recent years have witnessed significant advancements in Automotive Lane Warning Systems. The integration of multiple sensor types (video, radar, lidar) for improved accuracy and reliability is a key trend. Furthermore, the fusion of these systems with other ADAS features, such as adaptive cruise control and automatic emergency braking, creates more comprehensive driver-assistance packages. The market is shifting toward systems offering more proactive interventions, such as lane keeping assist, that actively correct steering to prevent lane departures. This enhanced functionality enhances vehicle safety and increases consumer appeal.

Key Drivers of Automotive Lane Warning Systems Market Growth

Several factors are accelerating the growth of the Automotive Lane Warning Systems market. Firstly, increasing government regulations mandating the adoption of these systems in new vehicles are driving demand. Secondly, advancements in sensor technology are leading to more accurate and reliable systems at reduced costs. Thirdly, growing consumer awareness regarding vehicle safety and the increasing demand for advanced driver-assistance systems (ADAS) is significantly contributing to market expansion. Finally, the continuous innovation in AI and machine learning is facilitating further enhancements in system functionalities.

Challenges in the Automotive Lane Warning Systems Market Market

Despite the significant growth potential, the market faces some challenges. High initial investment costs for advanced systems can be a barrier, particularly in developing economies. Supply chain disruptions impacting sensor component availability can hinder production and impact market growth. Intense competition among established players and the emergence of new entrants may lead to price pressures. Furthermore, regulatory hurdles and varying safety standards across different regions can complicate market expansion.

Emerging Opportunities in Automotive Lane Warning Systems Market

Several factors point to robust long-term growth for the Automotive Lane Warning Systems market. The continued integration of these systems with other ADAS features will enhance their value proposition. Strategic collaborations between automotive manufacturers and technology providers are expected to accelerate innovation. Expanding into emerging markets, where vehicle sales are growing rapidly, presents significant growth opportunities. Technological advancements, especially in areas like AI and machine learning, will lead to even more sophisticated and effective systems, further fueling market growth.

Leading Players in the Automotive Lane Warning Systems Market Sector

Key Milestones in Automotive Lane Warning Systems Market Industry

- October 2023: BMW's introduction of Active Lane Change in its 5 Series vehicles, utilizing eye-movement technology for lane changes. This signifies a leap in user-friendly ADAS features.

- September 2023: Hyundai Motor India launched the Venue with SmartSense ADAS, making advanced safety features accessible at a more affordable price point. This has a significant impact on market expansion, especially in developing economies.

- January 2022: Bosch supplied its Lane Departure Warning System (LDWS) to BYD's Qin Pro DM, increasing the adoption of LDWS in the Chinese market, a significant market.

Strategic Outlook for Automotive Lane Warning Systems Market Market

The Automotive Lane Warning Systems market is poised for sustained growth, driven by technological advancements, stringent safety regulations, and increasing consumer demand. Future market potential is significant, particularly in emerging markets and the expansion of the commercial vehicle segment. Strategic opportunities lie in the development of innovative systems integrating multiple sensors and enhanced functionalities, as well as strategic partnerships and collaborations to accelerate innovation and market penetration. The focus will continue to be on offering more advanced and user-friendly systems at competitive prices.

Automotive Lane Warning Systems Market Segmentation

-

1. Function Type

- 1.1. Lane Departure Warning System

- 1.2. Lane Keeping System

-

2. Sensor Type

- 2.1. Video Sensors

- 2.2. Laser Sensors

- 2.3. Infrared Sensors

-

3. Sales Channel

- 3.1. OEM

- 3.2. Aftermarket

-

4. Vehicle Type

- 4.1. Passenger Cars

- 4.2. Light Commercial Vehicles

- 4.3. Heavy Commercial Vehicles

Automotive Lane Warning Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Automotive Lane Warning Systems Market Regional Market Share

Geographic Coverage of Automotive Lane Warning Systems Market

Automotive Lane Warning Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Safety Awareness is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Concerns is Anticipated to Restrain the Market Growth

- 3.4. Market Trends

- 3.4.1. The Passenger Cars Segment is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Lane Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function Type

- 5.1.1. Lane Departure Warning System

- 5.1.2. Lane Keeping System

- 5.2. Market Analysis, Insights and Forecast - by Sensor Type

- 5.2.1. Video Sensors

- 5.2.2. Laser Sensors

- 5.2.3. Infrared Sensors

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Passenger Cars

- 5.4.2. Light Commercial Vehicles

- 5.4.3. Heavy Commercial Vehicles

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. South America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Function Type

- 6. North America Automotive Lane Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function Type

- 6.1.1. Lane Departure Warning System

- 6.1.2. Lane Keeping System

- 6.2. Market Analysis, Insights and Forecast - by Sensor Type

- 6.2.1. Video Sensors

- 6.2.2. Laser Sensors

- 6.2.3. Infrared Sensors

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. OEM

- 6.3.2. Aftermarket

- 6.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.4.1. Passenger Cars

- 6.4.2. Light Commercial Vehicles

- 6.4.3. Heavy Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Function Type

- 7. Europe Automotive Lane Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function Type

- 7.1.1. Lane Departure Warning System

- 7.1.2. Lane Keeping System

- 7.2. Market Analysis, Insights and Forecast - by Sensor Type

- 7.2.1. Video Sensors

- 7.2.2. Laser Sensors

- 7.2.3. Infrared Sensors

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. OEM

- 7.3.2. Aftermarket

- 7.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.4.1. Passenger Cars

- 7.4.2. Light Commercial Vehicles

- 7.4.3. Heavy Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Function Type

- 8. Asia Pacific Automotive Lane Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function Type

- 8.1.1. Lane Departure Warning System

- 8.1.2. Lane Keeping System

- 8.2. Market Analysis, Insights and Forecast - by Sensor Type

- 8.2.1. Video Sensors

- 8.2.2. Laser Sensors

- 8.2.3. Infrared Sensors

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel

- 8.3.1. OEM

- 8.3.2. Aftermarket

- 8.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.4.1. Passenger Cars

- 8.4.2. Light Commercial Vehicles

- 8.4.3. Heavy Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Function Type

- 9. South America Automotive Lane Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function Type

- 9.1.1. Lane Departure Warning System

- 9.1.2. Lane Keeping System

- 9.2. Market Analysis, Insights and Forecast - by Sensor Type

- 9.2.1. Video Sensors

- 9.2.2. Laser Sensors

- 9.2.3. Infrared Sensors

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel

- 9.3.1. OEM

- 9.3.2. Aftermarket

- 9.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.4.1. Passenger Cars

- 9.4.2. Light Commercial Vehicles

- 9.4.3. Heavy Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Function Type

- 10. Middle East and Africa Automotive Lane Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Function Type

- 10.1.1. Lane Departure Warning System

- 10.1.2. Lane Keeping System

- 10.2. Market Analysis, Insights and Forecast - by Sensor Type

- 10.2.1. Video Sensors

- 10.2.2. Laser Sensors

- 10.2.3. Infrared Sensors

- 10.3. Market Analysis, Insights and Forecast - by Sales Channel

- 10.3.1. OEM

- 10.3.2. Aftermarket

- 10.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.4.1. Passenger Cars

- 10.4.2. Light Commercial Vehicles

- 10.4.3. Heavy Commercial Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Function Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Bendix Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mobileye

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nissan Motor Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Volkswagen AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hitachi Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Continental AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Robert Bosch GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Delphi Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DENSO Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Iteris Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ZF TRW*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 The Bendix Corporation

List of Figures

- Figure 1: Global Automotive Lane Warning Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Lane Warning Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 3: North America Automotive Lane Warning Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 4: North America Automotive Lane Warning Systems Market Revenue (Million), by Sensor Type 2025 & 2033

- Figure 5: North America Automotive Lane Warning Systems Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 6: North America Automotive Lane Warning Systems Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 7: North America Automotive Lane Warning Systems Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 8: North America Automotive Lane Warning Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: North America Automotive Lane Warning Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: North America Automotive Lane Warning Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Automotive Lane Warning Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Automotive Lane Warning Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 13: Europe Automotive Lane Warning Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 14: Europe Automotive Lane Warning Systems Market Revenue (Million), by Sensor Type 2025 & 2033

- Figure 15: Europe Automotive Lane Warning Systems Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 16: Europe Automotive Lane Warning Systems Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 17: Europe Automotive Lane Warning Systems Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 18: Europe Automotive Lane Warning Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Europe Automotive Lane Warning Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Europe Automotive Lane Warning Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Automotive Lane Warning Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Automotive Lane Warning Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Lane Warning Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Lane Warning Systems Market Revenue (Million), by Sensor Type 2025 & 2033

- Figure 25: Asia Pacific Automotive Lane Warning Systems Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 26: Asia Pacific Automotive Lane Warning Systems Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 27: Asia Pacific Automotive Lane Warning Systems Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 28: Asia Pacific Automotive Lane Warning Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: Asia Pacific Automotive Lane Warning Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Asia Pacific Automotive Lane Warning Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Automotive Lane Warning Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Automotive Lane Warning Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 33: South America Automotive Lane Warning Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 34: South America Automotive Lane Warning Systems Market Revenue (Million), by Sensor Type 2025 & 2033

- Figure 35: South America Automotive Lane Warning Systems Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 36: South America Automotive Lane Warning Systems Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 37: South America Automotive Lane Warning Systems Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 38: South America Automotive Lane Warning Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 39: South America Automotive Lane Warning Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 40: South America Automotive Lane Warning Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Automotive Lane Warning Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Automotive Lane Warning Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 43: Middle East and Africa Automotive Lane Warning Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 44: Middle East and Africa Automotive Lane Warning Systems Market Revenue (Million), by Sensor Type 2025 & 2033

- Figure 45: Middle East and Africa Automotive Lane Warning Systems Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 46: Middle East and Africa Automotive Lane Warning Systems Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 47: Middle East and Africa Automotive Lane Warning Systems Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 48: Middle East and Africa Automotive Lane Warning Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 49: Middle East and Africa Automotive Lane Warning Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 50: Middle East and Africa Automotive Lane Warning Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East and Africa Automotive Lane Warning Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 2: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Sensor Type 2020 & 2033

- Table 3: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 4: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 7: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Sensor Type 2020 & 2033

- Table 8: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 9: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 10: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 15: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Sensor Type 2020 & 2033

- Table 16: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 17: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Germany Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Russia Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 26: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Sensor Type 2020 & 2033

- Table 27: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 28: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 29: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: India Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: China Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Japan Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Asia Pacific Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 35: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Sensor Type 2020 & 2033

- Table 36: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 37: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 38: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 39: Brazil Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Argentina Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of South America Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 43: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Sensor Type 2020 & 2033

- Table 44: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 45: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 46: Global Automotive Lane Warning Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 47: United Arab Emirates Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Saudi Arabia Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Rest of Middle East and Africa Automotive Lane Warning Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Lane Warning Systems Market?

The projected CAGR is approximately 16.60%.

2. Which companies are prominent players in the Automotive Lane Warning Systems Market?

Key companies in the market include The Bendix Corporation, Mobileye, Nissan Motor Co Ltd, Volkswagen AG, Hitachi Ltd, Continental AG, Robert Bosch GmbH, Delphi Technologies, DENSO Corporation, Iteris Inc, ZF TRW*List Not Exhaustive.

3. What are the main segments of the Automotive Lane Warning Systems Market?

The market segments include Function Type, Sensor Type, Sales Channel, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Safety Awareness is Driving the Market Growth.

6. What are the notable trends driving market growth?

The Passenger Cars Segment is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Cybersecurity Concerns is Anticipated to Restrain the Market Growth.

8. Can you provide examples of recent developments in the market?

October 2023: BMW was set to release its latest 5 Series vehicles equipped with an innovative advanced driver assistance system (ADAS) feature known as Active Lane Change. This cutting-edge technology enables lane changes through eye movement, and it eliminates the traditional requirement of using the turn signal to confirm lane changes, offering a more intuitive and streamlined driving experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Lane Warning Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Lane Warning Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Lane Warning Systems Market?

To stay informed about further developments, trends, and reports in the Automotive Lane Warning Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence