Key Insights

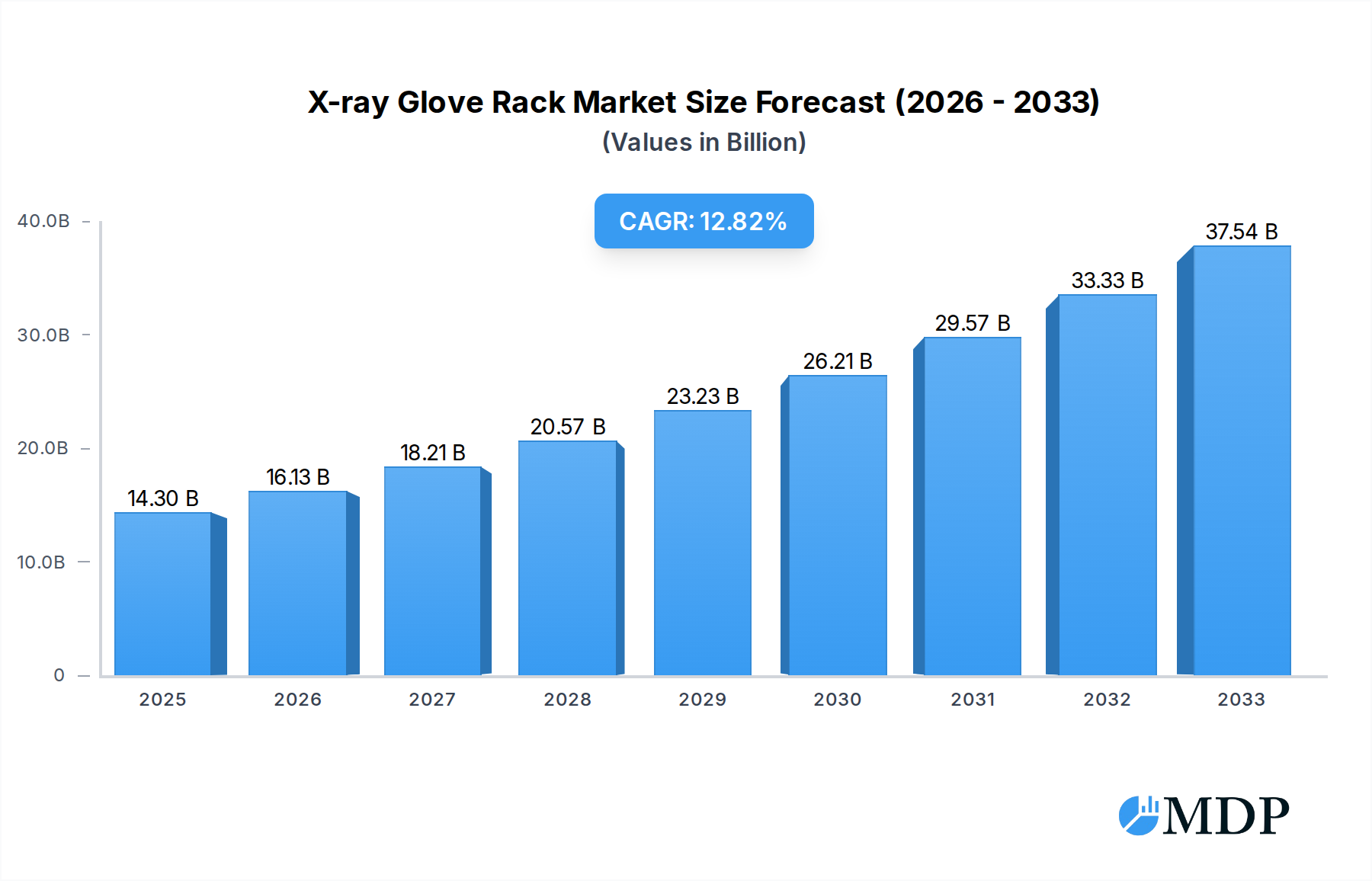

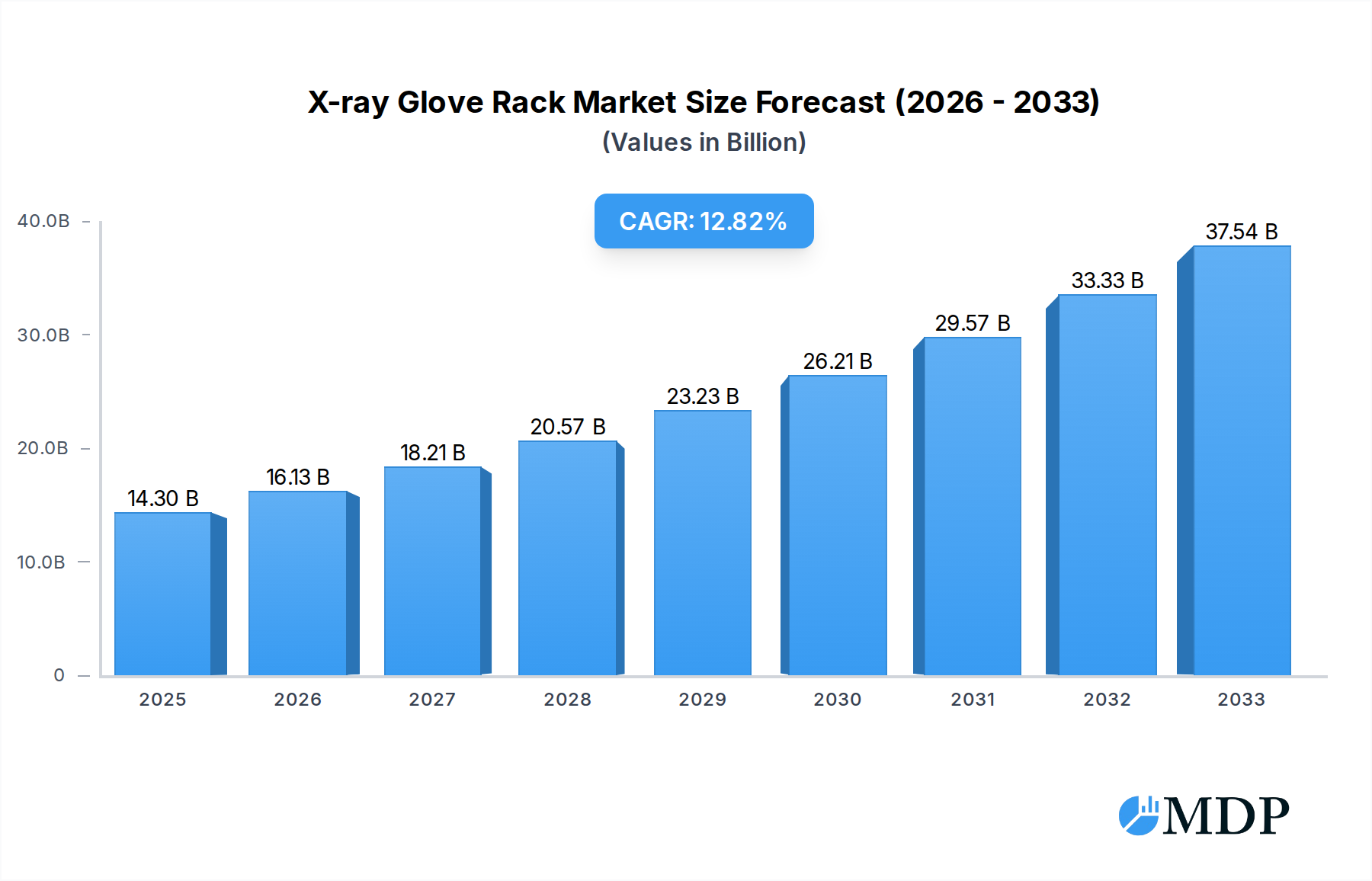

The global X-ray Glove Rack market is poised for significant expansion, projected to reach $14.3 billion in 2025. This robust growth is fueled by an estimated Compound Annual Growth Rate (CAGR) of 12.7% during the forecast period of 2025-2033. A primary driver for this upward trajectory is the increasing demand for advanced diagnostic imaging solutions across healthcare facilities, from large hospitals to specialized clinics. The growing awareness of radiation safety protocols and the need for efficient handling of sensitive medical supplies like X-ray gloves are also contributing factors. Furthermore, the continuous innovation in the design and material of these racks, focusing on durability, infection control, and ease of use, is enhancing their adoption. The market is segmented into applications within Hospitals and Clinics, and by product types including Fixed Type and Mobile Type racks, catering to diverse operational needs within the healthcare ecosystem.

X-ray Glove Rack Market Size (In Billion)

Several key trends are shaping the X-ray Glove Rack market landscape. The integration of antimicrobial materials in rack manufacturing is a significant development, addressing critical infection control concerns in clinical settings. The increasing adoption of mobile X-ray units also drives demand for portable and adaptable glove rack solutions, enhancing flexibility in diagnostic imaging procedures. While the market enjoys strong growth, certain restraints such as the high initial cost of sophisticated rack systems and the availability of alternative storage methods in smaller, less resourced facilities may present challenges. However, the persistent need for radiation protection and efficient workflow management in medical imaging departments worldwide is expected to outweigh these limitations, ensuring sustained market dynamism. Companies like Aktif X-ray, CAWO Solutions, and Phillips Safety Products are actively innovating to meet these evolving demands.

X-ray Glove Rack Company Market Share

This in-depth report provides a strategic analysis of the global X-ray Glove Rack market, forecasting its trajectory from 2019 to 2033, with a base year of 2025. The study offers actionable insights for industry stakeholders, including manufacturers, suppliers, distributors, and investors, on market dynamics, emerging trends, leading segments, and key players. The comprehensive coverage ensures no further modifications are required for immediate use.

X-ray Glove Rack Market Dynamics & Concentration

The X-ray Glove Rack market exhibits a moderate concentration, with leading players like Aktif X-ray, CAWO Solutions, Dr. Goos-Suprema, Phillips Safety Products, Podoblock, and Wolf X-Ray Corporation holding significant market share. In the historical period (2019-2024), market share distribution saw a variance of approximately 15-25% among the top three players, with a combined share of over 60%. Innovation drivers are primarily centered around material science for enhanced durability and sterility, along with ergonomic designs for improved user experience in hospital and clinic settings. Regulatory frameworks, particularly those concerning medical device safety and radiation protection, play a crucial role in shaping product development and market entry. Product substitutes, though limited in direct function, include general medical supply storage solutions that may indirectly impact demand. End-user trends indicate a growing preference for mobile type racks due to their flexibility in varied healthcare environments. Merger and acquisition (M&A) activities, while not extensive, have seen an average of 2-3 significant deals annually over the past five years, indicating consolidation and strategic expansion efforts.

X-ray Glove Rack Industry Trends & Analysis

The X-ray Glove Rack industry is poised for robust growth, driven by several key factors. The increasing global prevalence of diagnostic imaging procedures, fueled by aging populations and rising incidence of chronic diseases, directly translates to a higher demand for essential accessories like X-ray glove racks in hospitals and clinics. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is estimated at a healthy 7.5%. Technological disruptions are manifesting in the form of advanced antimicrobial coatings on glove racks, ensuring superior hygiene standards crucial in healthcare settings. Furthermore, the integration of smart features, such as inventory tracking for glove usage, is an emerging trend that enhances operational efficiency. Consumer preferences are leaning towards compact, wall-mounted fixed type racks for space optimization in smaller clinics, while larger hospitals are increasingly adopting mobile type racks for their versatility across different departments. Market penetration is currently at approximately 65% for essential facilities, with significant room for expansion in emerging economies. The competitive dynamics are characterized by a focus on product differentiation through material quality, design innovation, and competitive pricing strategies. The increasing investment in healthcare infrastructure globally is a significant catalyst, further bolstering market penetration and overall industry expansion. The ongoing advancements in radiology equipment necessitate compatible and efficient accessory solutions, ensuring a sustained demand for high-quality X-ray glove racks.

Leading Markets & Segments in X-ray Glove Rack

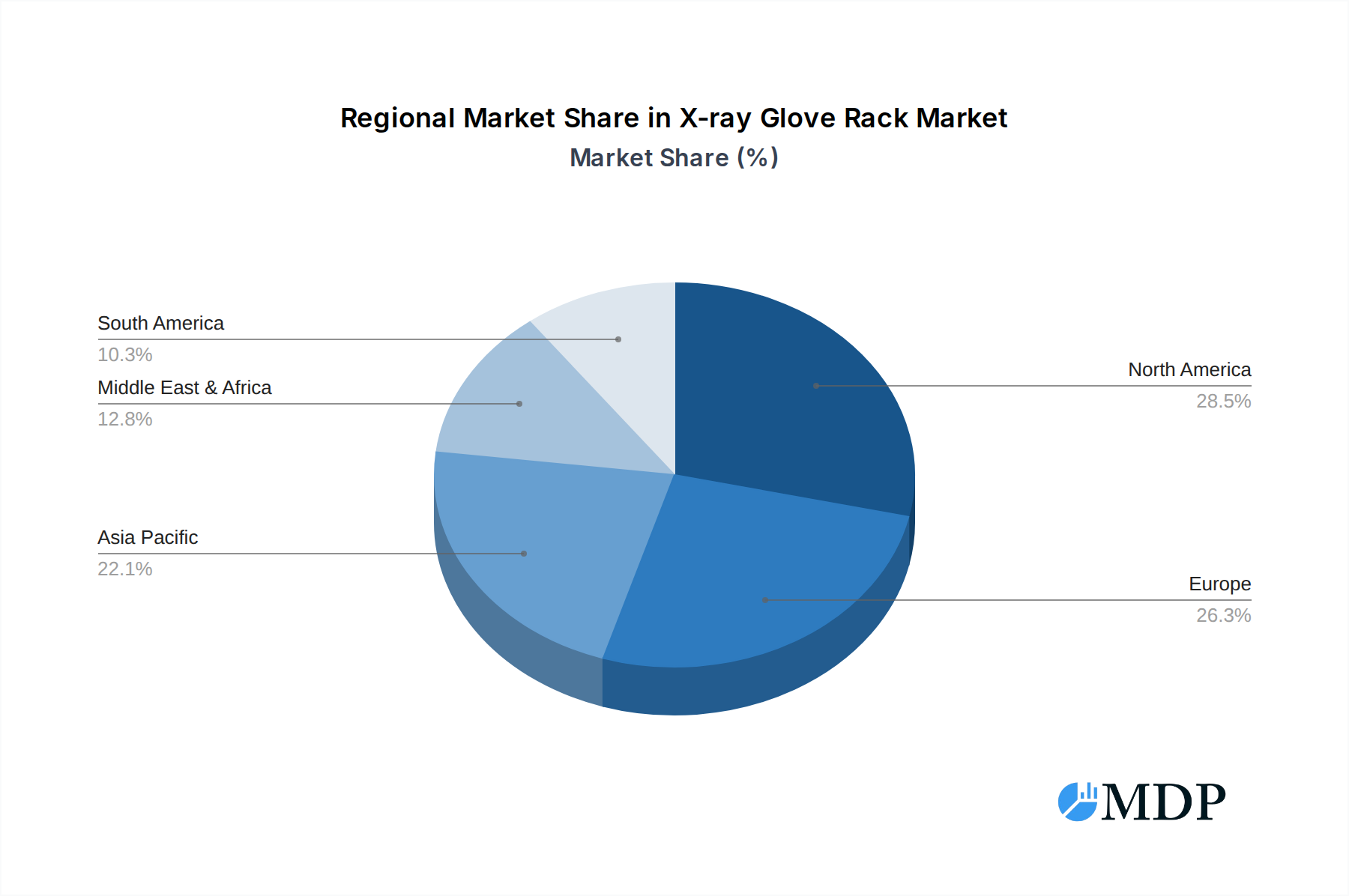

North America currently dominates the X-ray Glove Rack market, driven by advanced healthcare infrastructure, high adoption rates of diagnostic imaging technologies, and stringent quality standards. The United States, in particular, accounts for a substantial share of this regional dominance due to its extensive network of hospitals and specialized clinics. Within the Applications segment, Hospitals represent the largest market due to their high patient volumes and extensive use of X-ray procedures. The Clinic segment is also witnessing significant growth, particularly specialized radiology and diagnostic centers.

- Key Drivers of Dominance in North America:

- Robust Healthcare Expenditure: High per capita healthcare spending and government investments in medical infrastructure.

- Technological Advancements: Early adoption and integration of cutting-edge radiology equipment.

- Regulatory Compliance: Strict adherence to safety and hygiene standards by healthcare facilities.

- Aging Population: Increasing demand for diagnostic imaging services for age-related conditions.

In terms of Types, the Fixed Type X-ray Glove Rack is widely adopted in established healthcare facilities where space is a premium, offering a stable and accessible solution. However, the Mobile Type X-ray Glove Rack is gaining considerable traction due to its inherent flexibility. This mobility is invaluable in large hospital complexes, enabling healthcare professionals to easily transport and position glove racks where they are most needed, thus optimizing workflow and response times during urgent procedures.

- Detailed Dominance Analysis of Segments:

- Application: Hospital: This segment’s dominance is attributed to the sheer volume of X-ray procedures performed daily, requiring a consistent and organized supply of protective gloves. The need for specialized storage solutions that maintain sterility and accessibility is paramount.

- Application: Clinic: The growing number of specialized diagnostic clinics and outpatient centers contributes significantly to this segment. These facilities often prioritize space-saving and efficient storage solutions.

- Type: Fixed Type: Ideal for dedicated radiology rooms, these racks offer a permanent, secure, and easily accessible storage point. Their simplicity and durability make them a cost-effective solution for many healthcare providers.

- Type: Mobile Type: This segment's rise is fueled by the demand for adaptable workflows. The ability to move racks between imaging suites, patient wards, or emergency departments enhances operational efficiency and ensures gloves are always within reach, a critical factor in critical care scenarios.

The forecast period is expected to see continued growth in both segments, with mobile racks potentially exhibiting a higher growth rate due to increasing emphasis on flexible healthcare delivery models.

X-ray Glove Rack Product Developments

Recent product developments in the X-ray Glove Rack market focus on enhancing user safety, hygiene, and operational efficiency. Innovations include the introduction of racks made from antimicrobial-infused polymers, actively reducing the risk of cross-contamination. Some manufacturers are integrating modular designs, allowing for customizable configurations to accommodate varying glove sizes and quantities, thereby increasing versatility. Furthermore, lightweight yet robust materials are being employed to improve the portability of mobile units and the ease of installation for fixed units. These advancements are driven by the need to comply with evolving infection control protocols and optimize workflow in busy medical environments.

Key Drivers of X-ray Glove Rack Growth

The growth of the X-ray Glove Rack market is propelled by several interconnected factors. The escalating global demand for diagnostic imaging services, spurred by an aging population and the increasing incidence of medical conditions requiring X-ray examinations, is a primary driver. Technological advancements in radiology, leading to more sophisticated imaging equipment, indirectly create a need for high-quality, compatible accessories. Furthermore, a heightened awareness and stricter enforcement of infection control protocols in healthcare settings globally mandates the use of specialized storage solutions like X-ray glove racks to maintain glove sterility. Economic factors, including increased healthcare spending in both developed and developing nations, also contribute significantly by improving access to advanced medical equipment and infrastructure.

Challenges in the X-ray Glove Rack Market

Despite the positive growth trajectory, the X-ray Glove Rack market faces certain challenges. Intense competition among manufacturers, particularly in established markets, can lead to price wars and pressure on profit margins. While direct material costs are generally stable, fluctuations in raw material prices, such as stainless steel or high-grade plastics, can impact production costs. Supply chain disruptions, as witnessed in recent global events, can affect the availability and timely delivery of components, leading to production delays. Furthermore, the stringent regulatory approval processes for medical devices in certain regions can pose a hurdle for new entrants and product innovation, requiring significant investment in time and resources.

Emerging Opportunities in X-ray Glove Rack

Emerging opportunities in the X-ray Glove Rack market lie in the growing demand for customized solutions and the expansion into untapped emerging economies. The increasing adoption of telemedicine and remote diagnostic services may also create niche opportunities for specialized, portable glove rack solutions. Strategic partnerships between X-ray glove rack manufacturers and diagnostic equipment providers can lead to bundled product offerings, enhancing market reach. Furthermore, the development of "smart" glove racks with integrated inventory management features presents a significant opportunity to tap into the trend of digital transformation in healthcare, offering enhanced efficiency and data tracking capabilities for healthcare facilities.

Leading Players in the X-ray Glove Rack Sector

- Aktif X-ray

- CAWO Solutions

- Dr. Goos-Suprema

- Phillips Safety Products

- Podoblock

- Wolf X-Ray Corporation

- Allied X-Ray

- McKesson Medical-Surgical

Key Milestones in X-ray Glove Rack Industry

- 2019: Increased focus on antimicrobial materials in glove rack manufacturing.

- 2020: Introduction of more ergonomic and space-saving designs in response to clinic needs.

- 2021: Emergence of smart features for inventory tracking in advanced models.

- 2022: Enhanced supply chain resilience strategies implemented by major players.

- 2023: Growing demand for mobile type racks in diverse healthcare settings.

- 2024: Significant investment in research and development for sustainable material alternatives.

Strategic Outlook for X-ray Glove Rack Market

The strategic outlook for the X-ray Glove Rack market is overwhelmingly positive, driven by sustained demand from the healthcare sector and ongoing technological advancements. The market is expected to witness continued growth fueled by the increasing adoption of diagnostic imaging globally and a heightened emphasis on infection control. Key growth accelerators include the development of smart, connected glove rack solutions that integrate with existing hospital management systems, offering enhanced operational efficiency. Furthermore, strategic expansion into emerging markets, where healthcare infrastructure is rapidly developing, presents substantial opportunities. Manufacturers focusing on product innovation, particularly in areas of antimicrobial technology and sustainable materials, alongside robust supply chain management, will be best positioned to capitalize on future market potential.

X-ray Glove Rack Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

-

2. Types

- 2.1. Fixed Type

- 2.2. Mobile Type

X-ray Glove Rack Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

X-ray Glove Rack Regional Market Share

Geographic Coverage of X-ray Glove Rack

X-ray Glove Rack REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global X-ray Glove Rack Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Fixed Type

- 5.2.2. Mobile Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America X-ray Glove Rack Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Fixed Type

- 6.2.2. Mobile Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America X-ray Glove Rack Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Fixed Type

- 7.2.2. Mobile Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe X-ray Glove Rack Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Fixed Type

- 8.2.2. Mobile Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa X-ray Glove Rack Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Fixed Type

- 9.2.2. Mobile Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific X-ray Glove Rack Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Fixed Type

- 10.2.2. Mobile Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aktif X-ray

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CAWO Solutions

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dr. Goos-Suprema

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Phillips Safety Products

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Podoblock

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wolf X-Ray Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Allied X-Ray

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 McKesson Medical-Surgical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Aktif X-ray

List of Figures

- Figure 1: Global X-ray Glove Rack Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global X-ray Glove Rack Volume Breakdown (K, %) by Region 2025 & 2033

- Figure 3: North America X-ray Glove Rack Revenue (undefined), by Application 2025 & 2033

- Figure 4: North America X-ray Glove Rack Volume (K), by Application 2025 & 2033

- Figure 5: North America X-ray Glove Rack Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America X-ray Glove Rack Volume Share (%), by Application 2025 & 2033

- Figure 7: North America X-ray Glove Rack Revenue (undefined), by Types 2025 & 2033

- Figure 8: North America X-ray Glove Rack Volume (K), by Types 2025 & 2033

- Figure 9: North America X-ray Glove Rack Revenue Share (%), by Types 2025 & 2033

- Figure 10: North America X-ray Glove Rack Volume Share (%), by Types 2025 & 2033

- Figure 11: North America X-ray Glove Rack Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America X-ray Glove Rack Volume (K), by Country 2025 & 2033

- Figure 13: North America X-ray Glove Rack Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America X-ray Glove Rack Volume Share (%), by Country 2025 & 2033

- Figure 15: South America X-ray Glove Rack Revenue (undefined), by Application 2025 & 2033

- Figure 16: South America X-ray Glove Rack Volume (K), by Application 2025 & 2033

- Figure 17: South America X-ray Glove Rack Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America X-ray Glove Rack Volume Share (%), by Application 2025 & 2033

- Figure 19: South America X-ray Glove Rack Revenue (undefined), by Types 2025 & 2033

- Figure 20: South America X-ray Glove Rack Volume (K), by Types 2025 & 2033

- Figure 21: South America X-ray Glove Rack Revenue Share (%), by Types 2025 & 2033

- Figure 22: South America X-ray Glove Rack Volume Share (%), by Types 2025 & 2033

- Figure 23: South America X-ray Glove Rack Revenue (undefined), by Country 2025 & 2033

- Figure 24: South America X-ray Glove Rack Volume (K), by Country 2025 & 2033

- Figure 25: South America X-ray Glove Rack Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America X-ray Glove Rack Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe X-ray Glove Rack Revenue (undefined), by Application 2025 & 2033

- Figure 28: Europe X-ray Glove Rack Volume (K), by Application 2025 & 2033

- Figure 29: Europe X-ray Glove Rack Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe X-ray Glove Rack Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe X-ray Glove Rack Revenue (undefined), by Types 2025 & 2033

- Figure 32: Europe X-ray Glove Rack Volume (K), by Types 2025 & 2033

- Figure 33: Europe X-ray Glove Rack Revenue Share (%), by Types 2025 & 2033

- Figure 34: Europe X-ray Glove Rack Volume Share (%), by Types 2025 & 2033

- Figure 35: Europe X-ray Glove Rack Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe X-ray Glove Rack Volume (K), by Country 2025 & 2033

- Figure 37: Europe X-ray Glove Rack Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe X-ray Glove Rack Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa X-ray Glove Rack Revenue (undefined), by Application 2025 & 2033

- Figure 40: Middle East & Africa X-ray Glove Rack Volume (K), by Application 2025 & 2033

- Figure 41: Middle East & Africa X-ray Glove Rack Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East & Africa X-ray Glove Rack Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East & Africa X-ray Glove Rack Revenue (undefined), by Types 2025 & 2033

- Figure 44: Middle East & Africa X-ray Glove Rack Volume (K), by Types 2025 & 2033

- Figure 45: Middle East & Africa X-ray Glove Rack Revenue Share (%), by Types 2025 & 2033

- Figure 46: Middle East & Africa X-ray Glove Rack Volume Share (%), by Types 2025 & 2033

- Figure 47: Middle East & Africa X-ray Glove Rack Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East & Africa X-ray Glove Rack Volume (K), by Country 2025 & 2033

- Figure 49: Middle East & Africa X-ray Glove Rack Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa X-ray Glove Rack Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific X-ray Glove Rack Revenue (undefined), by Application 2025 & 2033

- Figure 52: Asia Pacific X-ray Glove Rack Volume (K), by Application 2025 & 2033

- Figure 53: Asia Pacific X-ray Glove Rack Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific X-ray Glove Rack Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific X-ray Glove Rack Revenue (undefined), by Types 2025 & 2033

- Figure 56: Asia Pacific X-ray Glove Rack Volume (K), by Types 2025 & 2033

- Figure 57: Asia Pacific X-ray Glove Rack Revenue Share (%), by Types 2025 & 2033

- Figure 58: Asia Pacific X-ray Glove Rack Volume Share (%), by Types 2025 & 2033

- Figure 59: Asia Pacific X-ray Glove Rack Revenue (undefined), by Country 2025 & 2033

- Figure 60: Asia Pacific X-ray Glove Rack Volume (K), by Country 2025 & 2033

- Figure 61: Asia Pacific X-ray Glove Rack Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific X-ray Glove Rack Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global X-ray Glove Rack Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global X-ray Glove Rack Volume K Forecast, by Application 2020 & 2033

- Table 3: Global X-ray Glove Rack Revenue undefined Forecast, by Types 2020 & 2033

- Table 4: Global X-ray Glove Rack Volume K Forecast, by Types 2020 & 2033

- Table 5: Global X-ray Glove Rack Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global X-ray Glove Rack Volume K Forecast, by Region 2020 & 2033

- Table 7: Global X-ray Glove Rack Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global X-ray Glove Rack Volume K Forecast, by Application 2020 & 2033

- Table 9: Global X-ray Glove Rack Revenue undefined Forecast, by Types 2020 & 2033

- Table 10: Global X-ray Glove Rack Volume K Forecast, by Types 2020 & 2033

- Table 11: Global X-ray Glove Rack Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global X-ray Glove Rack Volume K Forecast, by Country 2020 & 2033

- Table 13: United States X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 15: Canada X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 17: Mexico X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 19: Global X-ray Glove Rack Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global X-ray Glove Rack Volume K Forecast, by Application 2020 & 2033

- Table 21: Global X-ray Glove Rack Revenue undefined Forecast, by Types 2020 & 2033

- Table 22: Global X-ray Glove Rack Volume K Forecast, by Types 2020 & 2033

- Table 23: Global X-ray Glove Rack Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global X-ray Glove Rack Volume K Forecast, by Country 2020 & 2033

- Table 25: Brazil X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Brazil X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 27: Argentina X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Argentina X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 31: Global X-ray Glove Rack Revenue undefined Forecast, by Application 2020 & 2033

- Table 32: Global X-ray Glove Rack Volume K Forecast, by Application 2020 & 2033

- Table 33: Global X-ray Glove Rack Revenue undefined Forecast, by Types 2020 & 2033

- Table 34: Global X-ray Glove Rack Volume K Forecast, by Types 2020 & 2033

- Table 35: Global X-ray Glove Rack Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global X-ray Glove Rack Volume K Forecast, by Country 2020 & 2033

- Table 37: United Kingdom X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 39: Germany X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Germany X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 41: France X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: France X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 43: Italy X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Italy X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 45: Spain X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Spain X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 47: Russia X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Russia X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 49: Benelux X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Benelux X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 51: Nordics X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Nordics X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 55: Global X-ray Glove Rack Revenue undefined Forecast, by Application 2020 & 2033

- Table 56: Global X-ray Glove Rack Volume K Forecast, by Application 2020 & 2033

- Table 57: Global X-ray Glove Rack Revenue undefined Forecast, by Types 2020 & 2033

- Table 58: Global X-ray Glove Rack Volume K Forecast, by Types 2020 & 2033

- Table 59: Global X-ray Glove Rack Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global X-ray Glove Rack Volume K Forecast, by Country 2020 & 2033

- Table 61: Turkey X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Turkey X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 63: Israel X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Israel X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 65: GCC X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: GCC X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 67: North Africa X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: North Africa X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 69: South Africa X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: South Africa X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 73: Global X-ray Glove Rack Revenue undefined Forecast, by Application 2020 & 2033

- Table 74: Global X-ray Glove Rack Volume K Forecast, by Application 2020 & 2033

- Table 75: Global X-ray Glove Rack Revenue undefined Forecast, by Types 2020 & 2033

- Table 76: Global X-ray Glove Rack Volume K Forecast, by Types 2020 & 2033

- Table 77: Global X-ray Glove Rack Revenue undefined Forecast, by Country 2020 & 2033

- Table 78: Global X-ray Glove Rack Volume K Forecast, by Country 2020 & 2033

- Table 79: China X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: China X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 81: India X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: India X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 83: Japan X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: Japan X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 85: South Korea X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: South Korea X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 87: ASEAN X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: ASEAN X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 89: Oceania X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Oceania X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific X-ray Glove Rack Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific X-ray Glove Rack Volume (K) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the X-ray Glove Rack?

The projected CAGR is approximately 12.7%.

2. Which companies are prominent players in the X-ray Glove Rack?

Key companies in the market include Aktif X-ray, CAWO Solutions, Dr. Goos-Suprema, Phillips Safety Products, Podoblock, Wolf X-Ray Corporation, Allied X-Ray, McKesson Medical-Surgical.

3. What are the main segments of the X-ray Glove Rack?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "X-ray Glove Rack," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the X-ray Glove Rack report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the X-ray Glove Rack?

To stay informed about further developments, trends, and reports in the X-ray Glove Rack, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence