Key Insights

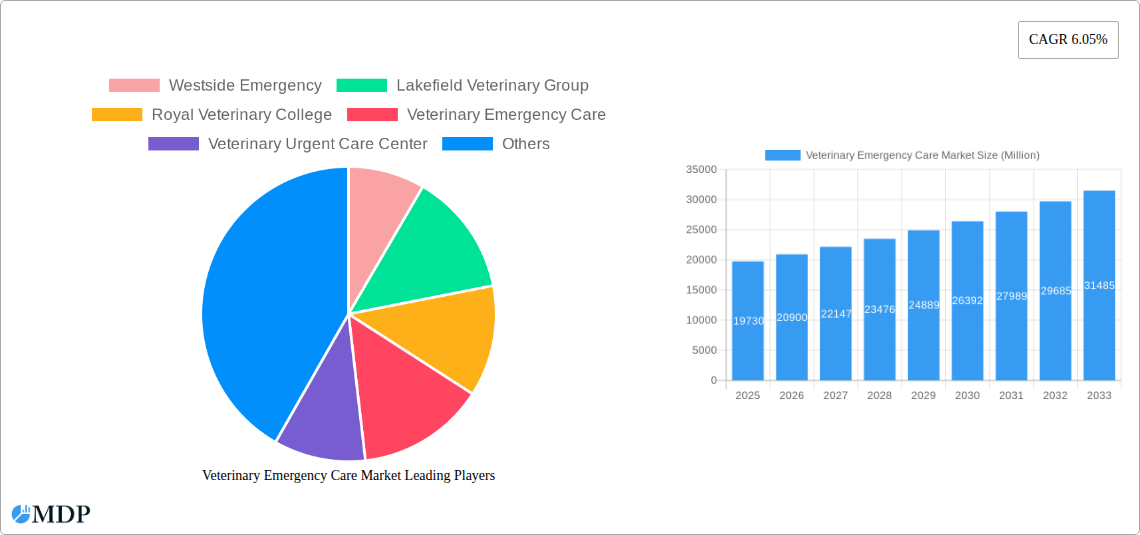

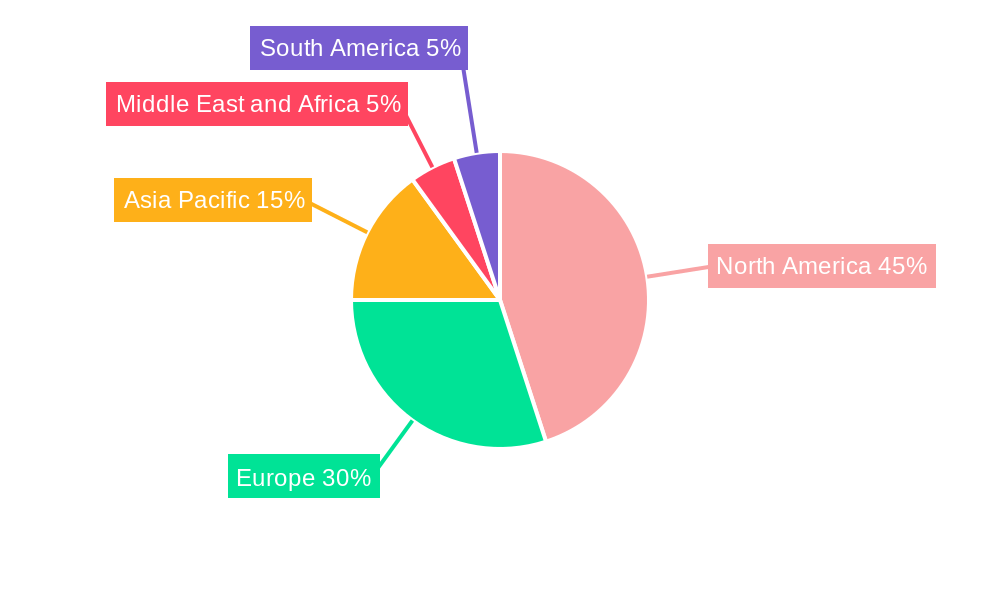

The global veterinary emergency care market is experiencing robust growth, projected to reach \$19.73 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.05% from 2025 to 2033. This expansion is fueled by several key factors. Increasing pet ownership worldwide, coupled with rising pet humanization—treating pets as family members—drives demand for advanced and readily available emergency veterinary services. Simultaneously, an aging pet population requires more frequent and specialized care, contributing significantly to market growth. Technological advancements, such as improved diagnostic imaging techniques and minimally invasive surgical procedures, further enhance the quality of emergency veterinary care, attracting more clients and boosting market value. The market is segmented by animal type (companion animals dominating, followed by livestock) and application (accidental ingestion, respiratory distress, gastrointestinal diseases being prevalent). North America currently holds a significant market share due to high pet ownership rates and well-established veterinary infrastructure; however, rapidly developing economies in Asia-Pacific are poised for substantial growth in the coming years, driven by increasing disposable incomes and awareness of pet healthcare. The competitive landscape includes both large multinational veterinary chains and smaller, specialized emergency clinics, all striving to provide timely and effective care to animals in need. Challenges include the high cost of specialized equipment and personnel, and ensuring access to emergency care in underserved rural areas.

Veterinary Emergency Care Market Market Size (In Billion)

The market's trajectory indicates a consistent upward trend through 2033. Continued investment in veterinary technology, expanding access to veterinary emergency services in emerging markets, and increased public awareness of pet health insurance all contribute to a positive outlook. However, factors like economic downturns and variations in pet ownership rates could influence market growth. Specific strategies for market players include developing specialized emergency services for niche animal populations, adopting telemedicine technologies to improve accessibility, and focusing on strategic partnerships to expand their geographic reach. Further segmentation analysis by specific emergency procedures, alongside detailed regional breakdowns, would offer a more granular understanding of market opportunities.

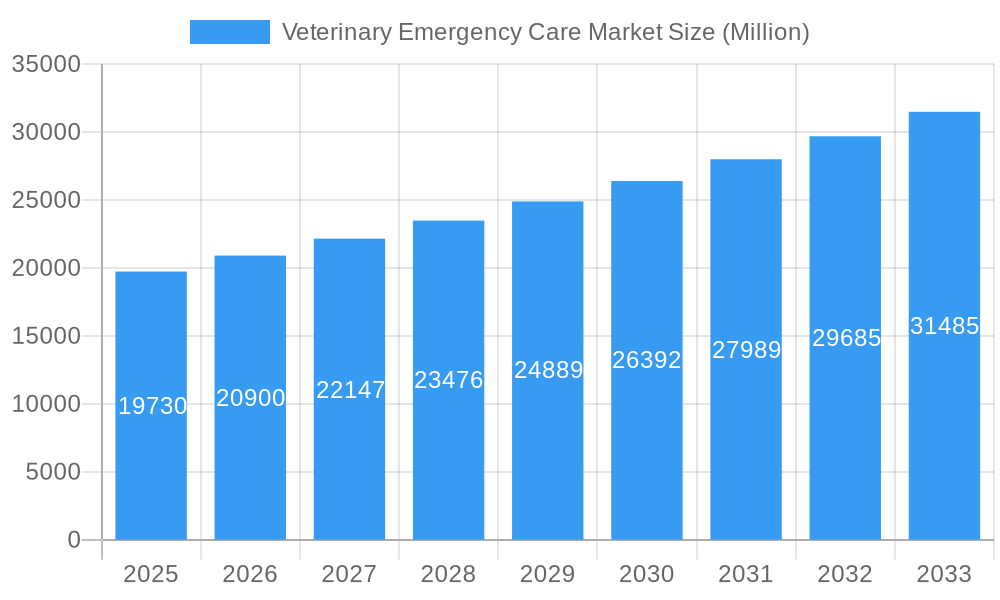

Veterinary Emergency Care Market Company Market Share

Veterinary Emergency Care Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Veterinary Emergency Care Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this rapidly evolving sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a robust understanding of historical trends, current market dynamics, and future growth projections. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This report meticulously examines market segmentation by animal type (companion animals, livestock) and application (accidental ingestion, respiratory distress, gastrointestinal disease, seizures, accidents, and other applications).

Veterinary Emergency Care Market Dynamics & Concentration

The Veterinary Emergency Care market is characterized by a moderately concentrated landscape, with a few large players and numerous smaller, regional providers. Market share is primarily distributed among established veterinary hospitals and specialized emergency care centers. While precise market share figures for individual companies remain proprietary, analysis suggests that larger multi-location practices hold a significant advantage due to economies of scale and broader geographic reach. The market is experiencing increasing consolidation through mergers and acquisitions (M&A) activity, with an estimated xx M&A deals occurring between 2019 and 2024. This trend is driven by the desire to expand service areas, enhance service offerings, and gain a competitive edge in a fragmented market.

Several factors influence market concentration. Firstly, increasing regulatory scrutiny and compliance costs act as barriers to entry for smaller players, favoring larger, more established entities. Secondly, technological advancements, such as advanced diagnostic imaging and treatment modalities, require significant capital investment, leading to consolidation among players who can afford these upgrades. Thirdly, consumer preferences are shifting towards more specialized and comprehensive care, leading to an increase in the number of specialized veterinary emergency facilities. Lastly, product substitution is limited due to the specialized nature of emergency veterinary services; however, competition is growing from telehealth options for non-emergency consultations.

- Innovation Drivers: Technological advancements in diagnostic tools, treatment protocols, and patient monitoring systems.

- Regulatory Frameworks: Increasing regulatory scrutiny regarding animal welfare, facility standards, and licensing requirements.

- Product Substitutes: Limited direct substitutes; however, competition exists from alternative care options like telehealth for less critical situations.

- End-User Trends: Growing pet ownership and increasing humanization of pets drive demand for improved veterinary care, including emergency services.

- M&A Activities: A noticeable increase in M&A activity driven by expansion strategies and market consolidation.

Veterinary Emergency Care Market Industry Trends & Analysis

The Veterinary Emergency Care market is experiencing significant growth, driven by several key factors. The increasing pet ownership rate globally, coupled with the rising humanization of pets, is a major contributor to this expansion. Pet owners are increasingly willing to invest in high-quality emergency care for their animals, fueling demand. Technological advancements, such as improved diagnostic imaging techniques and minimally invasive surgical procedures, have enhanced treatment options and improved patient outcomes. This has also increased the attractiveness of emergency veterinary services for pet owners and the profitability of these services for providers.

Furthermore, the expansion of 24/7 emergency veterinary care facilities in underserved areas is significantly contributing to market growth. This expansion is largely driven by a growing demand and the inconvenience and potential risk associated with transporting animals long distances for emergency care. A notable trend is the integration of telehealth consultations with in-person emergency services. This allows for quicker preliminary assessments and efficient triage of cases, optimizing the use of resources and improving patient care. The market penetration of 24/7 emergency services in urban areas is already high, approximately xx%, but still has significant potential for growth in rural communities and underserved areas. This growth is anticipated to continue at a CAGR of xx% during the forecast period (2025-2033). Competitive dynamics remain intense with existing players focusing on service expansion and technological upgrades to enhance their offerings and attract customers.

Leading Markets & Segments in Veterinary Emergency Care Market

The North American region, particularly the United States, currently dominates the Veterinary Emergency Care market. This dominance is attributed to factors such as high pet ownership rates, advanced veterinary infrastructure, and increased consumer spending on pet healthcare. The companion animal segment constitutes the most significant portion of the market, followed by other companion animals like livestock. Among applications, accidental ingestions, respiratory distress, and gastrointestinal diseases represent the largest share of cases needing emergency care.

Key Drivers in North America:

- High pet ownership rates and increasing humanization of pets.

- Advanced veterinary infrastructure and technological capabilities.

- High disposable income and willingness to invest in pet healthcare.

- Well-established regulatory frameworks for animal welfare.

Dominance Analysis: The concentration of specialized emergency veterinary facilities and the high disposable incomes in North America contribute to its market leadership. While other regions show growth potential, the established infrastructure and consumer behavior in North America currently ensure its dominant position. The companion animal segment's dominance stems from high pet ownership and strong emotional bonds between owners and their animals, resulting in greater willingness to invest in urgent care. Accidents, respiratory issues, and gastrointestinal problems frequently require immediate veterinary attention, thus dominating the application-based segmentation.

Veterinary Emergency Care Market Product Developments

Recent product innovations in veterinary emergency care focus on enhancing diagnostic capabilities and treatment efficacy. Advanced imaging technologies like MRI and CT scans, coupled with minimally invasive surgical techniques, are becoming increasingly prevalent. Telemedicine platforms are integrating with traditional emergency services, enabling remote consultations and monitoring. These advancements contribute to faster diagnoses, more precise treatment plans, and improved patient outcomes. The market fit of these innovations is strong, driven by the increasing demand for faster, more accurate, and less invasive procedures.

Key Drivers of Veterinary Emergency Care Market Growth

Several factors contribute to the growth of the veterinary emergency care market. First, the rising number of pet owners globally, fueled by changing lifestyles and urbanization, creates increased demand. Second, the humanization of pets leads owners to prioritize their animals' health and wellbeing, including emergency care. Third, technological advancements in diagnostic tools and treatment methods enable better outcomes and increased demand for advanced care. Finally, the increasing number of specialized veterinary emergency facilities and 24/7 services further expands accessibility and market demand.

Challenges in the Veterinary Emergency Care Market

The Veterinary Emergency Care market faces several challenges. The high cost of specialized equipment and staffing creates operational pressures, potentially impacting affordability and accessibility for some pet owners. Regulatory complexities and licensing requirements increase the barriers to entry for new players and operational costs for incumbents. The increasing availability of telehealth services presents competitive pressures on traditional in-person emergency veterinary services, forcing existing providers to adapt.

Emerging Opportunities in Veterinary Emergency Care Market

The expanding telehealth segment offers significant opportunities for growth through remote monitoring and virtual consultations. Strategic partnerships between emergency veterinary clinics and primary care providers streamline referral pathways and improve access to care. Geographic expansion into underserved areas, particularly in developing countries with rising pet ownership, presents considerable market potential. The integration of Artificial Intelligence (AI) and machine learning in diagnostics and treatment protocols presents additional opportunities to enhance the efficiency and accuracy of veterinary emergency services.

Leading Players in the Veterinary Emergency Care Market Sector

- Westside Emergency

- Lakefield Veterinary Group

- Royal Veterinary College

- Veterinary Emergency Care

- Veterinary Urgent Care Center

- Elizabeth Street Veterinary Clinic

- Animal Emergency Service

- Emergency Veterinary Care Centers (EVCC)

- VES Hospital Pte Ltd

- The Animal Medical Center

Key Milestones in Veterinary Emergency Care Market Industry

September 2023: Erie Canal Animal Hospital launched an urgent care service, expanding access to treatment for common illnesses requiring 24-hour hospitalization (diarrhea, ear infections, vomiting, lameness). This signifies a trend towards specialized, accessible urgent care.

August 2023: Veterinary Emergency & Specialty Hospital opened a new 24/7 animal emergency care service in West Springfield, USA, addressing a critical gap in local urgent care access. This highlights the ongoing expansion of emergency services to meet growing demand.

Strategic Outlook for Veterinary Emergency Care Market

The Veterinary Emergency Care market is poised for sustained growth, driven by increasing pet ownership, technological advancements, and expanding access to specialized services. Strategic opportunities lie in leveraging telehealth, forming strategic partnerships, and expanding into underserved markets. Innovation in diagnostic tools and treatment protocols will be key for maintaining a competitive edge, while operational efficiencies and strategic acquisitions will help larger players consolidate their market share.

Veterinary Emergency Care Market Segmentation

-

1. Animal

-

1.1. Companion Animals

- 1.1.1. Dogs

- 1.1.2. Cats

- 1.1.3. Other Companion Animals

-

1.2. Livestock Animals

- 1.2.1. Poultry

- 1.2.2. Cattle

- 1.2.3. Sheep

- 1.2.4. Other Livestock Animals

-

1.1. Companion Animals

-

2. Application

- 2.1. Accidental Ingestion

- 2.2. Respiratory Distress

- 2.3. Gastrointestinal Disease

- 2.4. Seizures

- 2.5. Accidents

- 2.6. Other Applications

Veterinary Emergency Care Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Veterinary Emergency Care Market Regional Market Share

Geographic Coverage of Veterinary Emergency Care Market

Veterinary Emergency Care Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Pet Ownership; Development of Infrastructure to Facilitate Emergency Care

- 3.3. Market Restrains

- 3.3.1. High Out-of-Pocket Cost Associated with the Treatment

- 3.4. Market Trends

- 3.4.1. The Segment for Dogs is Expected to Hold a Significant Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary Emergency Care Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal

- 5.1.1. Companion Animals

- 5.1.1.1. Dogs

- 5.1.1.2. Cats

- 5.1.1.3. Other Companion Animals

- 5.1.2. Livestock Animals

- 5.1.2.1. Poultry

- 5.1.2.2. Cattle

- 5.1.2.3. Sheep

- 5.1.2.4. Other Livestock Animals

- 5.1.1. Companion Animals

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Accidental Ingestion

- 5.2.2. Respiratory Distress

- 5.2.3. Gastrointestinal Disease

- 5.2.4. Seizures

- 5.2.5. Accidents

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Animal

- 6. North America Veterinary Emergency Care Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal

- 6.1.1. Companion Animals

- 6.1.1.1. Dogs

- 6.1.1.2. Cats

- 6.1.1.3. Other Companion Animals

- 6.1.2. Livestock Animals

- 6.1.2.1. Poultry

- 6.1.2.2. Cattle

- 6.1.2.3. Sheep

- 6.1.2.4. Other Livestock Animals

- 6.1.1. Companion Animals

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Accidental Ingestion

- 6.2.2. Respiratory Distress

- 6.2.3. Gastrointestinal Disease

- 6.2.4. Seizures

- 6.2.5. Accidents

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Animal

- 7. Europe Veterinary Emergency Care Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal

- 7.1.1. Companion Animals

- 7.1.1.1. Dogs

- 7.1.1.2. Cats

- 7.1.1.3. Other Companion Animals

- 7.1.2. Livestock Animals

- 7.1.2.1. Poultry

- 7.1.2.2. Cattle

- 7.1.2.3. Sheep

- 7.1.2.4. Other Livestock Animals

- 7.1.1. Companion Animals

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Accidental Ingestion

- 7.2.2. Respiratory Distress

- 7.2.3. Gastrointestinal Disease

- 7.2.4. Seizures

- 7.2.5. Accidents

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Animal

- 8. Asia Pacific Veterinary Emergency Care Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal

- 8.1.1. Companion Animals

- 8.1.1.1. Dogs

- 8.1.1.2. Cats

- 8.1.1.3. Other Companion Animals

- 8.1.2. Livestock Animals

- 8.1.2.1. Poultry

- 8.1.2.2. Cattle

- 8.1.2.3. Sheep

- 8.1.2.4. Other Livestock Animals

- 8.1.1. Companion Animals

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Accidental Ingestion

- 8.2.2. Respiratory Distress

- 8.2.3. Gastrointestinal Disease

- 8.2.4. Seizures

- 8.2.5. Accidents

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Animal

- 9. Middle East and Africa Veterinary Emergency Care Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal

- 9.1.1. Companion Animals

- 9.1.1.1. Dogs

- 9.1.1.2. Cats

- 9.1.1.3. Other Companion Animals

- 9.1.2. Livestock Animals

- 9.1.2.1. Poultry

- 9.1.2.2. Cattle

- 9.1.2.3. Sheep

- 9.1.2.4. Other Livestock Animals

- 9.1.1. Companion Animals

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Accidental Ingestion

- 9.2.2. Respiratory Distress

- 9.2.3. Gastrointestinal Disease

- 9.2.4. Seizures

- 9.2.5. Accidents

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Animal

- 10. South America Veterinary Emergency Care Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal

- 10.1.1. Companion Animals

- 10.1.1.1. Dogs

- 10.1.1.2. Cats

- 10.1.1.3. Other Companion Animals

- 10.1.2. Livestock Animals

- 10.1.2.1. Poultry

- 10.1.2.2. Cattle

- 10.1.2.3. Sheep

- 10.1.2.4. Other Livestock Animals

- 10.1.1. Companion Animals

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Accidental Ingestion

- 10.2.2. Respiratory Distress

- 10.2.3. Gastrointestinal Disease

- 10.2.4. Seizures

- 10.2.5. Accidents

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Animal

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Westside Emergency

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lakefield Veterinary Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Royal Veterinary College

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Veterinary Emergency Care

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Veterinary Urgent Care Center

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Elizabeth Street Veterinary Clinic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Animal Emergency Service

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Emergency Veterinary Care Centers (EVCC)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 VES Hospital Pte Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Animal Medical Center

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Westside Emergency

List of Figures

- Figure 1: Global Veterinary Emergency Care Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Veterinary Emergency Care Market Revenue (Million), by Animal 2025 & 2033

- Figure 3: North America Veterinary Emergency Care Market Revenue Share (%), by Animal 2025 & 2033

- Figure 4: North America Veterinary Emergency Care Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Veterinary Emergency Care Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Veterinary Emergency Care Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Veterinary Emergency Care Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Veterinary Emergency Care Market Revenue (Million), by Animal 2025 & 2033

- Figure 9: Europe Veterinary Emergency Care Market Revenue Share (%), by Animal 2025 & 2033

- Figure 10: Europe Veterinary Emergency Care Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Veterinary Emergency Care Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Veterinary Emergency Care Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Veterinary Emergency Care Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Veterinary Emergency Care Market Revenue (Million), by Animal 2025 & 2033

- Figure 15: Asia Pacific Veterinary Emergency Care Market Revenue Share (%), by Animal 2025 & 2033

- Figure 16: Asia Pacific Veterinary Emergency Care Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Veterinary Emergency Care Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Veterinary Emergency Care Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Veterinary Emergency Care Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Veterinary Emergency Care Market Revenue (Million), by Animal 2025 & 2033

- Figure 21: Middle East and Africa Veterinary Emergency Care Market Revenue Share (%), by Animal 2025 & 2033

- Figure 22: Middle East and Africa Veterinary Emergency Care Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East and Africa Veterinary Emergency Care Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East and Africa Veterinary Emergency Care Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Veterinary Emergency Care Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Veterinary Emergency Care Market Revenue (Million), by Animal 2025 & 2033

- Figure 27: South America Veterinary Emergency Care Market Revenue Share (%), by Animal 2025 & 2033

- Figure 28: South America Veterinary Emergency Care Market Revenue (Million), by Application 2025 & 2033

- Figure 29: South America Veterinary Emergency Care Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Veterinary Emergency Care Market Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Veterinary Emergency Care Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Veterinary Emergency Care Market Revenue Million Forecast, by Animal 2020 & 2033

- Table 2: Global Veterinary Emergency Care Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Veterinary Emergency Care Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Veterinary Emergency Care Market Revenue Million Forecast, by Animal 2020 & 2033

- Table 5: Global Veterinary Emergency Care Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Veterinary Emergency Care Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Veterinary Emergency Care Market Revenue Million Forecast, by Animal 2020 & 2033

- Table 11: Global Veterinary Emergency Care Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Veterinary Emergency Care Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Veterinary Emergency Care Market Revenue Million Forecast, by Animal 2020 & 2033

- Table 20: Global Veterinary Emergency Care Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Veterinary Emergency Care Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Veterinary Emergency Care Market Revenue Million Forecast, by Animal 2020 & 2033

- Table 29: Global Veterinary Emergency Care Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Veterinary Emergency Care Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: GCC Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Veterinary Emergency Care Market Revenue Million Forecast, by Animal 2020 & 2033

- Table 35: Global Veterinary Emergency Care Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Veterinary Emergency Care Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Veterinary Emergency Care Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Emergency Care Market?

The projected CAGR is approximately 6.05%.

2. Which companies are prominent players in the Veterinary Emergency Care Market?

Key companies in the market include Westside Emergency, Lakefield Veterinary Group, Royal Veterinary College, Veterinary Emergency Care, Veterinary Urgent Care Center, Elizabeth Street Veterinary Clinic, Animal Emergency Service, Emergency Veterinary Care Centers (EVCC), VES Hospital Pte Ltd, The Animal Medical Center.

3. What are the main segments of the Veterinary Emergency Care Market?

The market segments include Animal, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Pet Ownership; Development of Infrastructure to Facilitate Emergency Care.

6. What are the notable trends driving market growth?

The Segment for Dogs is Expected to Hold a Significant Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

High Out-of-Pocket Cost Associated with the Treatment.

8. Can you provide examples of recent developments in the market?

September 2023: Erie Canal Animal Hospital launched an urgent care service to address the increasing demand for veterinary emergency care. The treatment under this facility is expected to cover selective illnesses that require 24-hour hospitalization, such as diarrhea, ear infection, vomiting, and lameness.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary Emergency Care Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary Emergency Care Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary Emergency Care Market?

To stay informed about further developments, trends, and reports in the Veterinary Emergency Care Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence