Key Insights

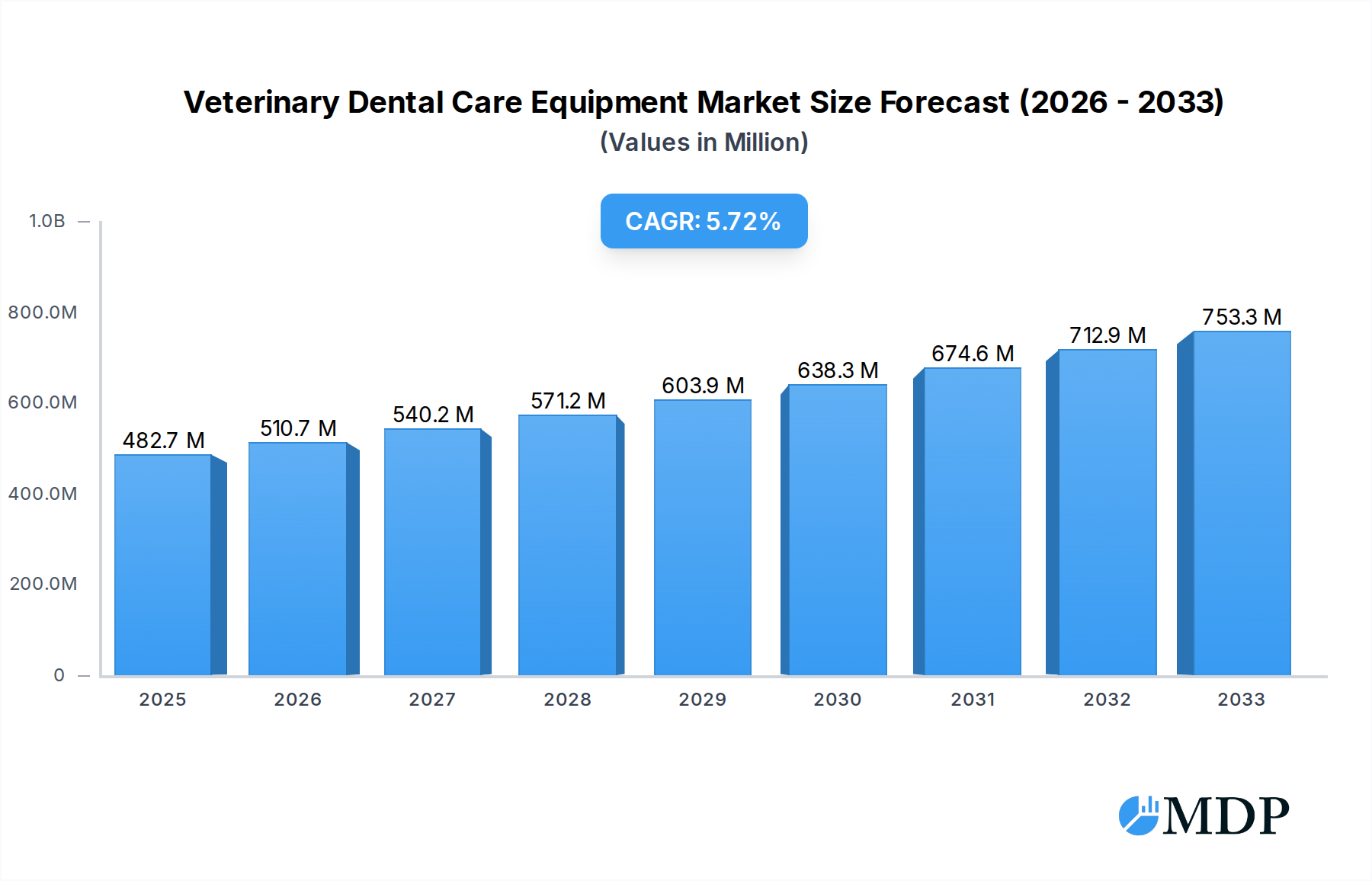

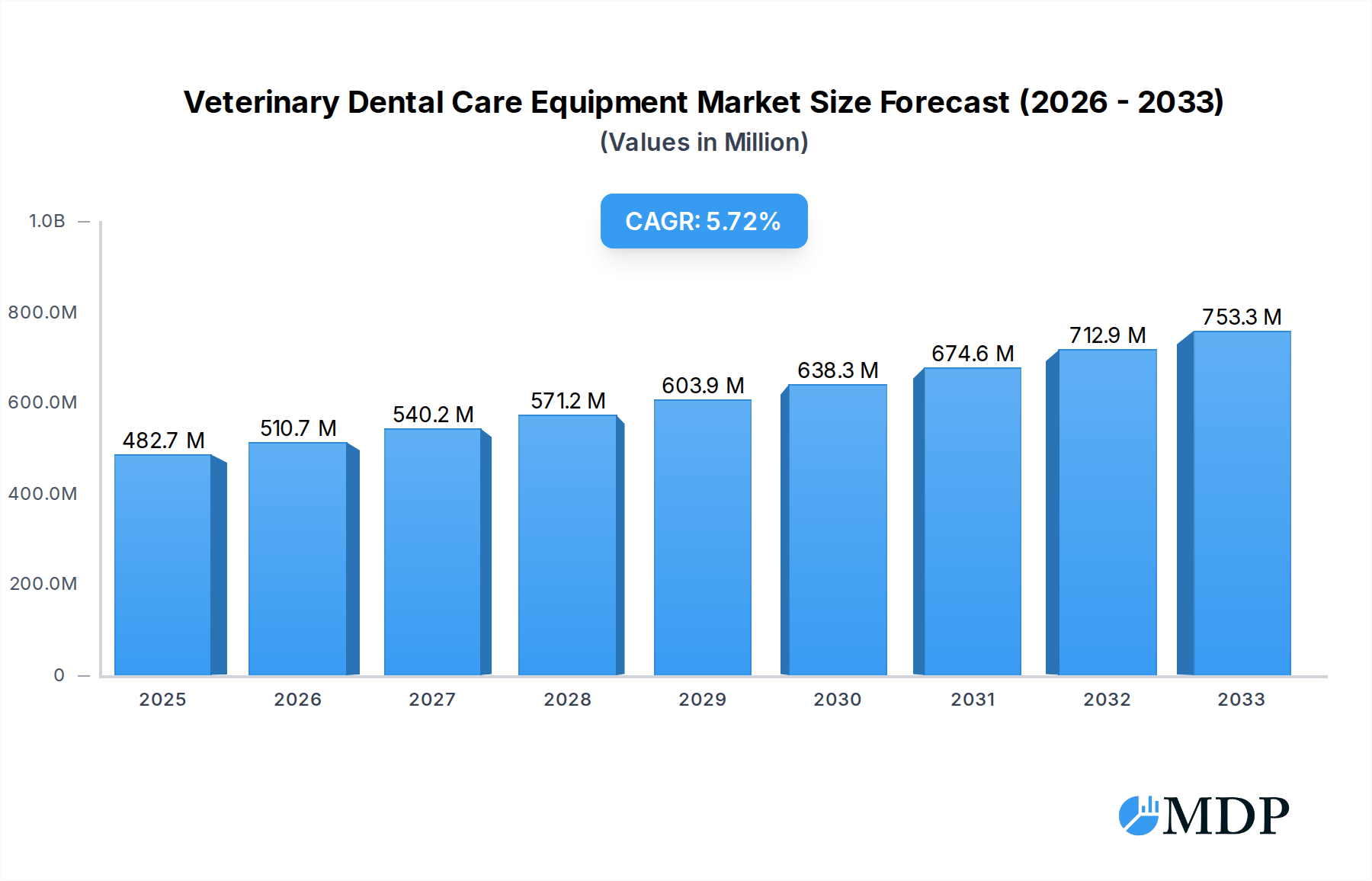

The global Veterinary Dental Care Equipment market is poised for robust expansion, projected to reach an estimated USD 482.67 million in 2025. This growth is underpinned by a steady Compound Annual Growth Rate (CAGR) of 5.8% from 2019 to 2033, indicating sustained demand for advanced oral care solutions for animals. A significant driver for this market is the increasing pet humanization trend, leading owners to invest more in comprehensive healthcare, including specialized dental procedures. This rising awareness of animal dental health, coupled with advancements in veterinary technology and an expanding range of innovative dental equipment, contributes to the market's upward trajectory. Furthermore, the growing number of veterinary hospitals and clinics globally, equipped to handle complex dental treatments, further fuels market demand. The market is segmented into Veterinary Hospitals and Veterinary Clinics for applications, and Dental Supplies, Prophy Products, and Others for product types, catering to a diverse set of needs within the veterinary sector.

Veterinary Dental Care Equipment Market Size (In Million)

The market's growth trajectory is also influenced by a confluence of evolving veterinary practices and a proactive approach to preventative animal healthcare. As veterinary professionals increasingly emphasize the importance of regular dental check-ups and treatments to prevent serious health issues, the demand for specialized equipment, ranging from dental X-ray machines and ultrasonic scalers to polishing units and extraction tools, is on the rise. Key industry players are actively engaged in research and development to introduce more sophisticated and user-friendly dental equipment, further stimulating market penetration. While the market demonstrates strong potential, factors such as the initial cost of advanced equipment and the availability of skilled veterinary dentists in certain regions may present moderate challenges. However, the overarching trend towards enhanced animal welfare and the recognition of oral health as a critical component of overall well-being are expected to overcome these hurdles, ensuring continued market vitality throughout the forecast period.

Veterinary Dental Care Equipment Company Market Share

Here's an SEO-optimized and engaging report description for Veterinary Dental Care Equipment, designed for immediate use without modification.

Report Description: Global Veterinary Dental Care Equipment Market – Forecast to 2033

This comprehensive report delivers an in-depth analysis of the global Veterinary Dental Care Equipment market, projecting significant growth from USD xx million in the Base Year of 2025 to USD xx million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the Forecast Period (2025–2033). Spanning the Study Period (2019–2033), with a detailed look at the Historical Period (2019–2024) and Estimated Year (2025), this report is an indispensable resource for veterinary professionals, equipment manufacturers, distributors, and investors seeking to capitalize on the expanding animal health sector. We dissect market dynamics, identify key trends, analyze leading segments and regions, and highlight crucial product developments, growth drivers, challenges, and emerging opportunities. Understand the competitive landscape, key player strategies, and pivotal milestones shaping the future of veterinary dental care.

Veterinary Dental Care Equipment Market Dynamics & Concentration

The Veterinary Dental Care Equipment market demonstrates a moderate to high concentration, driven by a blend of established players and innovative startups. Innovation is a primary driver, with continuous advancements in digital imaging, minimally invasive surgical tools, and advanced anesthetic monitoring significantly influencing market direction. Regulatory frameworks, while generally supportive of animal welfare, present a landscape that necessitates stringent adherence to safety and efficacy standards for all veterinary dental devices. Product substitutes, such as advancements in preventative care and specialized veterinary diets, indirectly influence the demand for corrective dental equipment. End-user trends reveal a growing pet humanization phenomenon, leading to increased willingness among pet owners to invest in advanced veterinary services, including sophisticated dental procedures. Merger and acquisition (M&A) activities are notable, with larger corporations strategically acquiring innovative smaller firms to expand their product portfolios and market reach. For instance, the M&A deal count within the broader animal health equipment sector reached xx during the Historical Period (2019–2024), with a projected xx% of these deals involving dental-focused companies. The market share distribution shows the top 3–5 players holding approximately xx% of the global market.

Veterinary Dental Care Equipment Industry Trends & Analysis

The Veterinary Dental Care Equipment industry is experiencing robust growth, fueled by escalating pet ownership worldwide and a heightened awareness among pet owners regarding their animals' oral health. This growing consciousness translates into increased demand for diagnostic, therapeutic, and prophylactic dental solutions for companion animals. Technological disruptions are at the forefront, with the integration of artificial intelligence (AI) in dental imaging for enhanced diagnostics and the development of advanced ultrasonic scalers and high-speed drills designed for improved precision and patient comfort. The market penetration of advanced veterinary dental technologies is expected to surge from an estimated xx% in 2025 to xx% by 2033. Consumer preferences are shifting towards less invasive and more effective treatment options, driving innovation in areas like dental laser therapy and specialized veterinary dental instruments. Competitive dynamics are characterized by intense product development and strategic partnerships aimed at capturing market share. The CAGR for the Veterinary Dental Care Equipment market is projected at a healthy xx% over the Forecast Period (2025–2033), indicating sustained upward momentum. Key growth drivers include the rising incidence of periodontal disease in pets, the increasing number of veterinary practices offering specialized dental services, and government initiatives promoting animal welfare. Furthermore, advancements in dental implantology and prosthetics for animals are opening new avenues for market expansion. The increasing veterinary expenditure per pet, which stood at approximately USD xx million globally in 2024, is a direct indicator of the market's potential.

Leading Markets & Segments in Veterinary Dental Care Equipment

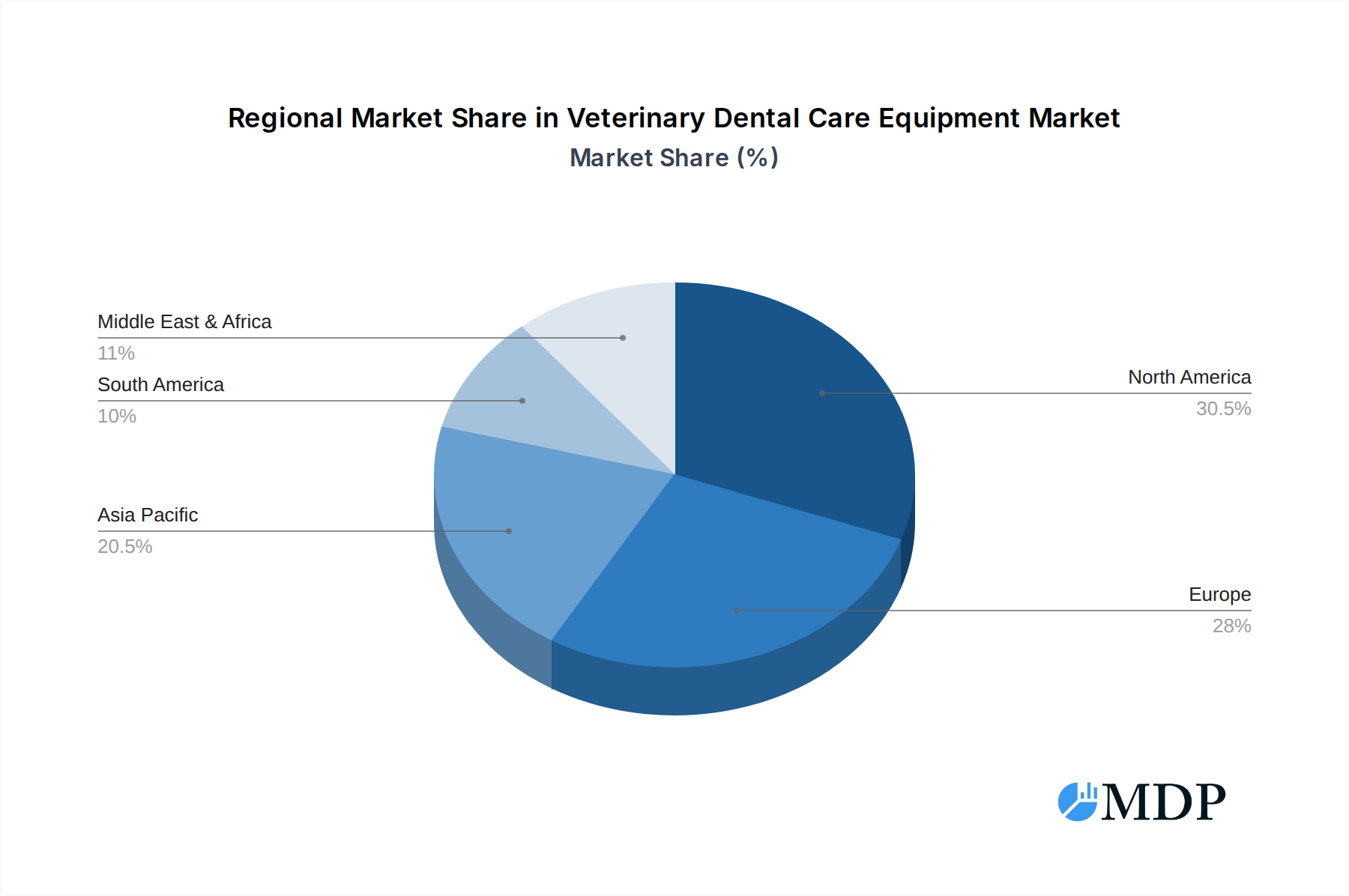

The North America region is currently the dominant market for Veterinary Dental Care Equipment, driven by high pet ownership rates, advanced veterinary infrastructure, and a strong economic capacity for pet healthcare spending. Within this region, the United States leads in terms of market value, accounting for an estimated xx% of the global market share. The primary application driving this dominance is Veterinary Hospitals, followed closely by Veterinary Clinics. These settings represent the core environments where advanced dental procedures are performed.

Key drivers of dominance in this segment include:

- Economic Policies: Favorable reimbursement structures and insurance options for pet healthcare in North America encourage owners to seek advanced treatments.

- Infrastructure: A well-developed network of specialized veterinary facilities equipped with the latest technology supports the adoption of high-end dental equipment.

- Technological Adoption: Early and widespread adoption of digital dental radiography, intraoral cameras, and ultrasonic scaling units in veterinary practices.

The dominant product type within the market is Dental Supplies, which encompasses a broad range of consumables and instruments essential for daily dental procedures. However, the Prophy Products segment is experiencing rapid growth, reflecting the increasing emphasis on preventative dental care. The "Others" category, which includes advanced diagnostic imaging systems, dental lasers, and specialized surgical tools, is also a significant contributor to market value and exhibits strong growth potential. The Application: Veterinary Clinics segment is expected to witness a higher CAGR of xx% compared to Veterinary Hospitals, indicating a trend towards decentralization of specialized dental services.

Veterinary Dental Care Equipment Product Developments

Product innovation in veterinary dental care equipment is rapidly advancing. Manufacturers are focusing on developing more portable and user-friendly digital radiography systems, enhancing the accuracy and speed of ultrasonic scalers, and introducing specialized instruments for complex oral surgeries. The integration of AI in imaging analysis promises to improve diagnostic capabilities, while advancements in materials science are leading to more durable and biocompatible dental implants and prosthetics. These developments cater to a growing demand for minimally invasive procedures, improved patient outcomes, and increased efficiency for veterinary professionals, thereby offering a significant competitive advantage to early adopters.

Key Drivers of Veterinary Dental Care Equipment Growth

Several key factors are propelling the growth of the Veterinary Dental Care Equipment market. Technological advancements, such as the development of AI-powered diagnostic tools and more efficient surgical instruments, are significantly enhancing the quality and scope of veterinary dental care. The economic imperative is also strong, with increasing disposable incomes globally allowing pet owners to invest more in their pets' health, leading to higher demand for advanced dental procedures. Furthermore, evolving regulatory frameworks that prioritize animal welfare are indirectly encouraging the adoption of better dental equipment to meet higher standards of care. The rising prevalence of dental diseases in pets, estimated to affect over xx% of adult dogs and cats, also acts as a powerful catalyst for market expansion.

Challenges in the Veterinary Dental Care Equipment Market

Despite robust growth, the Veterinary Dental Care Equipment market faces several challenges. Stringent regulatory hurdles in certain regions can slow down the approval and adoption of new technologies. High initial investment costs for advanced dental equipment can be a barrier for smaller veterinary practices, impacting market penetration. Supply chain disruptions, as observed during recent global events, can affect the availability and pricing of essential components and finished products. Additionally, a shortage of highly trained veterinary dental professionals can limit the uptake of complex equipment and procedures. The competitive pressure from established players and emerging technologies also necessitates continuous innovation and strategic market positioning. These challenges, collectively, are estimated to restrain the market growth by approximately xx% annually.

Emerging Opportunities in Veterinary Dental Care Equipment

Emerging opportunities in the Veterinary Dental Care Equipment market are largely driven by technological breakthroughs and strategic market expansion. The growing demand for integrated dental suites that combine diagnostic, surgical, and prophylactic equipment presents a significant opportunity for comprehensive solution providers. Furthermore, the development of more affordable and accessible dental care solutions for emerging markets, particularly in Asia-Pacific and Latin America, where pet ownership is rapidly increasing, offers substantial growth potential. Strategic partnerships between equipment manufacturers and veterinary educational institutions can foster greater adoption of advanced techniques and technologies. The increasing focus on preventive veterinary medicine and the development of home dental care solutions also present ancillary growth avenues.

Leading Players in the Veterinary Dental Care Equipment Sector

- MAI Animal Health

- iM3

- Dispomed

- Midmark Corporation

- Henry Schein

- Cislak Manufacturing, Inc.

- Acteon Group

- J&J Instruments Inc.

- Integra LifeSciences Corporation

- Eickemeyer

Key Milestones in Veterinary Dental Care Equipment Industry

- 2019: Introduction of AI-assisted dental imaging software for enhanced diagnostic accuracy.

- 2020: Launch of ultra-compact, portable digital dental X-ray units, increasing accessibility for mobile veterinary services.

- 2021: Significant advancements in biocompatible materials for veterinary dental implants, improving success rates.

- 2022: Increased investment in research and development for non-invasive periodontal disease treatments.

- 2023: Emergence of cloud-based platforms for veterinary dental record management and remote consultation.

- 2024: Strategic acquisitions by major animal health corporations to expand their veterinary dental portfolios.

- 2025 (Estimated): Projected widespread adoption of 3D printing for custom veterinary dental prosthetics.

- 2026: Anticipated introduction of advanced dental lasers with enhanced therapeutic capabilities.

- 2027: Expected growth in the market for specialized dental equipment for exotic pets.

- 2028: Development of integrated AI diagnostic systems for comprehensive dental health assessments.

- 2029: Increased focus on sustainable and eco-friendly materials in dental equipment manufacturing.

- 2030: Potential for robotic-assisted dental surgery in specialized veterinary centers.

- 2031: Expansion of dental equipment offerings for tele-veterinary services.

- 2032: Advancements in pain management technologies for veterinary dental procedures.

- 2033: Projected maturity of the digital veterinary dental imaging market with continued incremental improvements.

Strategic Outlook for Veterinary Dental Care Equipment Market

The strategic outlook for the Veterinary Dental Care Equipment market remains exceptionally positive. Growth accelerators include the continued humanization of pets, leading to increased demand for premium veterinary services, and ongoing technological innovation that offers more effective, efficient, and less invasive dental solutions. The market will likely witness further consolidation as larger companies seek to acquire innovative smaller players, alongside strategic partnerships aimed at expanding global reach and product integration. A key focus for future growth will be on developing user-friendly, cost-effective solutions that cater to a wider range of veterinary practices and emerging markets, ensuring broader access to advanced animal dental care.

Veterinary Dental Care Equipment Segmentation

-

1. Application

- 1.1. Veterinary Hospitals

- 1.2. Veterinary Clinics

-

2. Type

- 2.1. Dental Supplies

- 2.2. Prophy Products

- 2.3. Others

Veterinary Dental Care Equipment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Veterinary Dental Care Equipment Regional Market Share

Geographic Coverage of Veterinary Dental Care Equipment

Veterinary Dental Care Equipment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary Dental Care Equipment Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Veterinary Hospitals

- 5.1.2. Veterinary Clinics

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Dental Supplies

- 5.2.2. Prophy Products

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Veterinary Dental Care Equipment Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Veterinary Hospitals

- 6.1.2. Veterinary Clinics

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Dental Supplies

- 6.2.2. Prophy Products

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Veterinary Dental Care Equipment Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Veterinary Hospitals

- 7.1.2. Veterinary Clinics

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Dental Supplies

- 7.2.2. Prophy Products

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Veterinary Dental Care Equipment Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Veterinary Hospitals

- 8.1.2. Veterinary Clinics

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Dental Supplies

- 8.2.2. Prophy Products

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Veterinary Dental Care Equipment Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Veterinary Hospitals

- 9.1.2. Veterinary Clinics

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Dental Supplies

- 9.2.2. Prophy Products

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Veterinary Dental Care Equipment Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Veterinary Hospitals

- 10.1.2. Veterinary Clinics

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Dental Supplies

- 10.2.2. Prophy Products

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MAI Animal Health

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 iM3

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dispomed

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Midmark Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Henry Schein

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cislak Manufacturing Inc.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Acteon Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 J&J Instruments Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Integra LifeSciences Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eickemeyer

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 MAI Animal Health

List of Figures

- Figure 1: Global Veterinary Dental Care Equipment Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Veterinary Dental Care Equipment Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Veterinary Dental Care Equipment Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Veterinary Dental Care Equipment Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Veterinary Dental Care Equipment Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Veterinary Dental Care Equipment Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Veterinary Dental Care Equipment Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Veterinary Dental Care Equipment Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Veterinary Dental Care Equipment Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Veterinary Dental Care Equipment Revenue (undefined), by Type 2025 & 2033

- Figure 11: South America Veterinary Dental Care Equipment Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Veterinary Dental Care Equipment Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Veterinary Dental Care Equipment Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Veterinary Dental Care Equipment Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Veterinary Dental Care Equipment Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Veterinary Dental Care Equipment Revenue (undefined), by Type 2025 & 2033

- Figure 17: Europe Veterinary Dental Care Equipment Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Veterinary Dental Care Equipment Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Veterinary Dental Care Equipment Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Veterinary Dental Care Equipment Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Veterinary Dental Care Equipment Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Veterinary Dental Care Equipment Revenue (undefined), by Type 2025 & 2033

- Figure 23: Middle East & Africa Veterinary Dental Care Equipment Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Veterinary Dental Care Equipment Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Veterinary Dental Care Equipment Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Veterinary Dental Care Equipment Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Veterinary Dental Care Equipment Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Veterinary Dental Care Equipment Revenue (undefined), by Type 2025 & 2033

- Figure 29: Asia Pacific Veterinary Dental Care Equipment Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Veterinary Dental Care Equipment Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Veterinary Dental Care Equipment Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Type 2020 & 2033

- Table 39: Global Veterinary Dental Care Equipment Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Veterinary Dental Care Equipment Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Dental Care Equipment?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Veterinary Dental Care Equipment?

Key companies in the market include MAI Animal Health, iM3, Dispomed, Midmark Corporation, Henry Schein, Cislak Manufacturing, Inc., Acteon Group, J&J Instruments Inc., Integra LifeSciences Corporation, Eickemeyer.

3. What are the main segments of the Veterinary Dental Care Equipment?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary Dental Care Equipment," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary Dental Care Equipment report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary Dental Care Equipment?

To stay informed about further developments, trends, and reports in the Veterinary Dental Care Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence