Key Insights

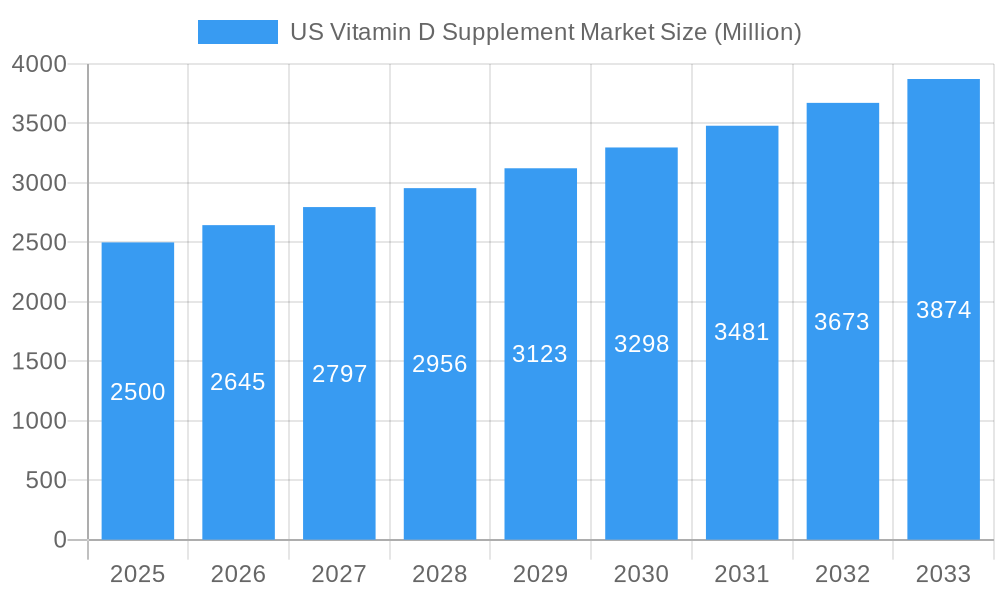

The U.S. Vitamin D supplement market is projected for substantial growth, forecast at a CAGR of 5.3%. The market was valued at $1.56 billion in the 2025 base year and is expected to reach significant future value. This expansion is driven by heightened public awareness of Vitamin D's essential role in bone health, immune function, and overall wellness. Increased incidence of Vitamin D deficiency, particularly in aging populations and individuals with limited sun exposure, is a key demand driver. Furthermore, rising disposable incomes, a growing health-conscious consumer base, and the proliferation of accessible online retail channels are supporting market growth. Leading companies like GNC, Nature's Bounty, and Abbott Laboratories are focusing on product innovation, developing specialized formulations (e.g., pediatric liquid drops, high-potency options for seniors) and enhanced bioavailability to secure market share. While challenges such as concerns regarding excessive supplementation and regulatory oversight exist, the long-term market outlook remains optimistic. Segmentation by product type (Vitamin D2, Vitamin D3) and distribution channel (supermarkets, pharmacies, online) presents varied growth opportunities. A strong emphasis on preventative healthcare and the integration of Vitamin D into personalized wellness plans are anticipated to significantly contribute to market expansion through 2033.

US Vitamin D Supplement Market Market Size (In Billion)

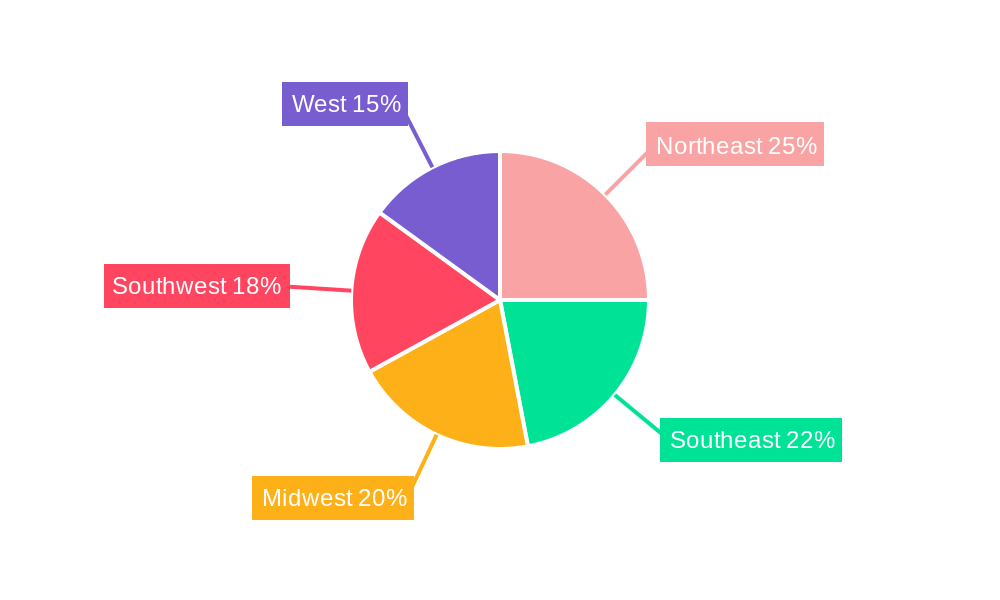

Regional analysis within the U.S. indicates varied market penetration. While precise regional market share data is limited, states with higher proportions of elderly residents and regions experiencing less sunlight (e.g., the Northeast) are likely to show higher per capita consumption. Conversely, sunnier regions may demonstrate lower consumption rates. Future growth is expected to be fueled by strategic collaborations between supplement manufacturers and healthcare providers, advancements in personalized nutrition guidance, and an intensified focus on preventive health strategies. Ongoing development and marketing of advanced Vitamin D formulations, emphasizing superior absorption and efficacy, are critical for sustaining market momentum. The competitive environment will continue to be shaped by established market players and the emergence of specialized brands.

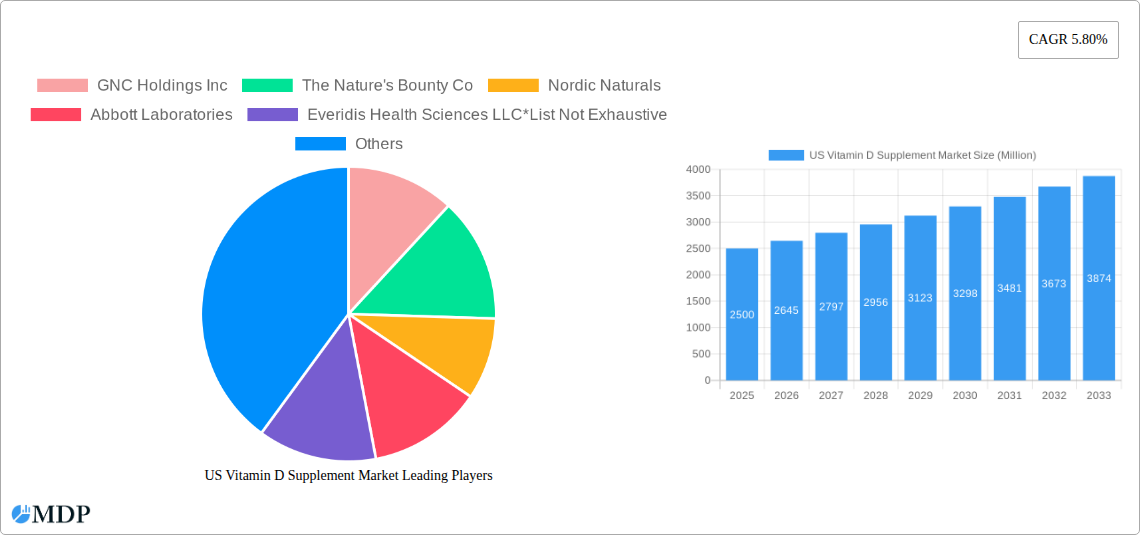

US Vitamin D Supplement Market Company Market Share

US Vitamin D Supplement Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the US Vitamin D Supplement Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. It delves into market dynamics, competitive landscapes, and emerging trends, empowering businesses to navigate the complexities of this rapidly evolving market. The report projects a market value of xx Million by 2033, presenting a compelling growth opportunity.

US Vitamin D Supplement Market Market Dynamics & Concentration

The US Vitamin D supplement market exhibits a moderately concentrated landscape, with several key players commanding significant market share. Market concentration is influenced by factors including brand recognition, distribution networks, and R&D capabilities. Innovation is a key driver, with companies constantly seeking to improve formulations, delivery methods, and efficacy. Regulatory frameworks, including FDA guidelines on labeling and safety, significantly shape market practices. The market also witnesses competition from alternative sources of Vitamin D, such as sunlight exposure and fortified foods. End-user trends, such as increased health consciousness and preventative healthcare practices, are fueling market growth. The market has witnessed several M&A activities in recent years, although the exact number is unavailable (xx) during the historical period.

- Market Share: Major players, including GNC Holdings Inc, The Nature's Bounty Co, and Abbott Laboratories, hold significant shares, while smaller niche players focus on specialized formulations.

- M&A Activity: The number of M&A deals in the period 2019-2024 is estimated at xx. These activities have shaped market consolidation and competitive dynamics.

- Innovation Drivers: Consumer demand for enhanced bioavailability, convenient formats (e.g., gummies, liquids), and functional blends is driving innovation.

- Regulatory Framework: Strict FDA regulations regarding labeling, purity, and efficacy play a significant role in market operations.

US Vitamin D Supplement Market Industry Trends & Analysis

The US Vitamin D supplement market is experiencing robust growth, driven by factors such as increasing awareness of Vitamin D's importance for bone health, immunity, and overall well-being. Technological advancements in formulation and delivery systems are enhancing product appeal and efficacy. Consumer preferences are shifting towards natural and organic supplements, influencing product development strategies. Competitive dynamics are characterized by intense competition among established players and emerging brands. The CAGR for the market during the forecast period (2025-2033) is estimated at xx%, with market penetration steadily increasing. Increased online sales channels and health and wellness initiatives further accelerate market expansion. Technological disruptions, such as personalized nutrition solutions and advanced analytical testing, are shaping the future of the market.

Leading Markets & Segments in US Vitamin D Supplement Market

The US Vitamin D supplement market is broadly segmented by type (Vitamin D2 and Vitamin D3) and distribution channel (supermarkets/hypermarkets, pharmacies/health stores, online stores, and other channels). While precise market share data for each segment isn't available, trends suggest that:

- By Type: Vitamin D3 holds a larger market share due to its superior bioavailability compared to Vitamin D2.

- By Distribution Channel: Pharmacies and health stores currently dominate, though online channels are rapidly growing in popularity. Supermarkets and hypermarkets provide wide accessibility to mass market options.

Key Drivers by Segment:

- Pharmacies/Health Stores: High consumer trust in these channels, expert advice availability, and targeted marketing.

- Online Stores: Convenience, wider selection, competitive pricing, and targeted advertising campaigns.

- Supermarkets/Hypermarkets: Accessibility, impulse purchasing opportunities, and competitive pricing.

The dominance of specific segments is influenced by factors like consumer purchasing behavior, access to healthcare, and marketing efforts. The increasing preference for online purchasing is likely to change the market dynamics in the coming years.

US Vitamin D Supplement Market Product Developments

Recent product innovations focus on enhanced absorption rates, improved taste and texture (e.g., gummies and liquids), and combination supplements incorporating Vitamin D with other nutrients. These developments cater to consumer preferences for convenience and enhanced efficacy. Technological advancements, such as liposomal delivery systems, improve bioavailability. This trend is likely to continue, with an emphasis on personalized nutrition solutions tailored to individual needs. The competitive advantage lies in offering superior formulations, improved delivery systems, and compelling value propositions.

Key Drivers of US Vitamin D Supplement Market Growth

The US Vitamin D supplement market is propelled by several key factors:

- Rising Prevalence of Vitamin D Deficiency: A significant portion of the US population suffers from Vitamin D deficiency, necessitating supplementation.

- Increased Health Awareness: Growing awareness of Vitamin D's role in overall health and well-being fuels demand.

- Favorable Regulatory Environment: The FDA's regulatory framework ensures supplement safety and quality, fostering consumer confidence.

- Technological Advancements: Innovations in formulation and delivery systems improve product effectiveness and consumer acceptance.

Challenges in the US Vitamin D Supplement Market Market

The market faces challenges such as:

- Stringent Regulatory Compliance: Meeting FDA regulations adds cost and complexity to product development and manufacturing.

- Supply Chain Disruptions: Global events and geopolitical instability can disrupt supply chains, impacting product availability and cost.

- Competitive Intensity: Intense competition among established and emerging players necessitates continuous innovation and efficient marketing.

- Consumer Concerns about Safety and Efficacy: Concerns about the quality and effectiveness of supplements require ongoing efforts to build consumer trust.

These factors, if not managed effectively, could impede market growth.

Emerging Opportunities in US Vitamin D Supplement Market

The market offers substantial opportunities for long-term growth:

- Personalized Nutrition: Tailoring supplements to individual needs based on genetic testing and lifestyle factors.

- Functional Foods & Beverages: Integrating Vitamin D into functional foods and beverages for enhanced convenience and consumer acceptance.

- Strategic Partnerships: Collaborations between supplement companies and healthcare providers to promote product usage.

- Market Expansion: Targeting underserved segments and geographic regions.

Leading Players in the US Vitamin D Supplement Market Sector

- GNC Holdings Inc

- The Nature's Bounty Co

- Nordic Naturals

- Abbott Laboratories

- Everidis Health Sciences LLC

- Amway

- GSK Plc

- Nurishable

- Otsuka Holdings Co Ltd

- Pfizer Inc

Key Milestones in US Vitamin D Supplement Market Industry

- January 2021: The Orlando Magic and Amway's Nutrilite Men's and Women's Packs announced a multi-year partnership, boosting brand visibility and market penetration.

- October 2021: MegaFood (Otsuka Holdings Co. Ltd) launched new multivitamins containing Vitamin D, expanding product offerings and market reach.

- September 2022: Nurishable relaunched its three-in-one supplement, combining Vitamin D3 with other key nutrients for increased convenience and cost savings, stimulating market innovation.

Strategic Outlook for US Vitamin D Supplement Market Market

The US Vitamin D supplement market is poised for continued growth, driven by increasing health consciousness, technological advancements, and evolving consumer preferences. Strategic opportunities lie in developing innovative product formulations, expanding distribution channels, and leveraging personalized nutrition strategies. Focusing on enhancing product efficacy, building strong brands, and targeting underserved markets will be crucial for achieving long-term success. The market presents a lucrative landscape for companies that can successfully adapt to changing consumer demands and technological disruptions.

US Vitamin D Supplement Market Segmentation

-

1. Type

- 1.1. Vitamin D2

- 1.2. Vitamin D3

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets,

- 2.2. Pharmacies/Health Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

US Vitamin D Supplement Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Vitamin D Supplement Market Regional Market Share

Geographic Coverage of US Vitamin D Supplement Market

US Vitamin D Supplement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Consumer Awareness Regarding Benefits of Vitamin D Supplements.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Vitamin D Supplement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vitamin D2

- 5.1.2. Vitamin D3

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets,

- 5.2.2. Pharmacies/Health Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Vitamin D Supplement Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Vitamin D2

- 6.1.2. Vitamin D3

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/ Hypermarkets,

- 6.2.2. Pharmacies/Health Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Vitamin D Supplement Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Vitamin D2

- 7.1.2. Vitamin D3

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/ Hypermarkets,

- 7.2.2. Pharmacies/Health Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Vitamin D Supplement Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Vitamin D2

- 8.1.2. Vitamin D3

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/ Hypermarkets,

- 8.2.2. Pharmacies/Health Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Vitamin D Supplement Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Vitamin D2

- 9.1.2. Vitamin D3

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/ Hypermarkets,

- 9.2.2. Pharmacies/Health Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Vitamin D Supplement Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Vitamin D2

- 10.1.2. Vitamin D3

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/ Hypermarkets,

- 10.2.2. Pharmacies/Health Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GNC Holdings Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Nature's Bounty Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nordic Naturals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abbott Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Everidis Health Sciences LLC*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Amway

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GSK Plc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nurishable

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Otsuka Holdings Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pfizer Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 GNC Holdings Inc

List of Figures

- Figure 1: Global US Vitamin D Supplement Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Vitamin D Supplement Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America US Vitamin D Supplement Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America US Vitamin D Supplement Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America US Vitamin D Supplement Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America US Vitamin D Supplement Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America US Vitamin D Supplement Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Vitamin D Supplement Market Revenue (billion), by Type 2025 & 2033

- Figure 9: South America US Vitamin D Supplement Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America US Vitamin D Supplement Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America US Vitamin D Supplement Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America US Vitamin D Supplement Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America US Vitamin D Supplement Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Vitamin D Supplement Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe US Vitamin D Supplement Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe US Vitamin D Supplement Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe US Vitamin D Supplement Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe US Vitamin D Supplement Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe US Vitamin D Supplement Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Vitamin D Supplement Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East & Africa US Vitamin D Supplement Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa US Vitamin D Supplement Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa US Vitamin D Supplement Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa US Vitamin D Supplement Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Vitamin D Supplement Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Vitamin D Supplement Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Asia Pacific US Vitamin D Supplement Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific US Vitamin D Supplement Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific US Vitamin D Supplement Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific US Vitamin D Supplement Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific US Vitamin D Supplement Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Vitamin D Supplement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global US Vitamin D Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global US Vitamin D Supplement Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global US Vitamin D Supplement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global US Vitamin D Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global US Vitamin D Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global US Vitamin D Supplement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global US Vitamin D Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global US Vitamin D Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global US Vitamin D Supplement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global US Vitamin D Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global US Vitamin D Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global US Vitamin D Supplement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global US Vitamin D Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global US Vitamin D Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global US Vitamin D Supplement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global US Vitamin D Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global US Vitamin D Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Vitamin D Supplement Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Vitamin D Supplement Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the US Vitamin D Supplement Market?

Key companies in the market include GNC Holdings Inc, The Nature's Bounty Co, Nordic Naturals, Abbott Laboratories, Everidis Health Sciences LLC*List Not Exhaustive, Amway, GSK Plc, Nurishable, Otsuka Holdings Co Ltd, Pfizer Inc.

3. What are the main segments of the US Vitamin D Supplement Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Consumer Awareness Regarding Benefits of Vitamin D Supplements..

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Nurishable relaunched All New Three-in-One Supplement. Instead of taking three individual vitamins, Nurishable Triple Play combines zinc 50 mg, vitamin D3 10,000 iu, and vitamin c 500 mg all in one capsule for extreme convenience and cost savings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Vitamin D Supplement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Vitamin D Supplement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Vitamin D Supplement Market?

To stay informed about further developments, trends, and reports in the US Vitamin D Supplement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence