Key Insights

The global Ultraviolet Transilluminator Imaging Systems market is poised for significant expansion, projected to achieve a market size of $14.59 billion by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 8.02% from the base year 2025 to 2033. Key drivers include escalating demand for sophisticated imaging technologies in life sciences research, drug development, and molecular diagnostics. The pharmaceutical, biotechnology, and academic sectors are primary end-users, employing these systems for critical applications such as DNA/RNA visualization, protein gel electrophoresis, and quality assurance in molecular biology. Continued innovation in developing sensitive, user-friendly, and cost-effective imaging solutions is expected to further propel market development.

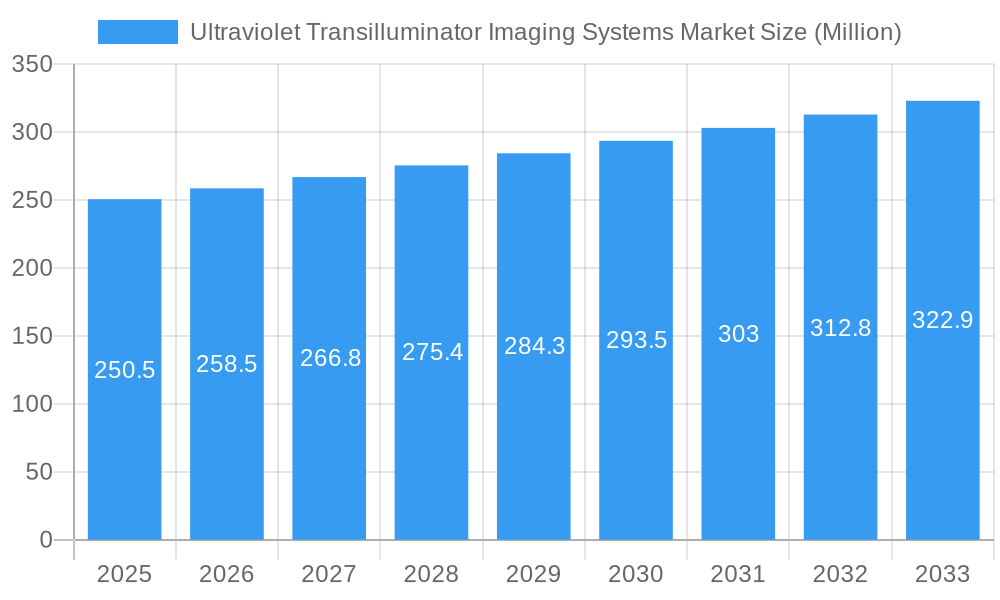

Ultraviolet Transilluminator Imaging Systems Market Market Size (In Billion)

Digital integration and advanced data analysis capabilities are shaping the market, meeting the increasing demand for reproducible scientific outcomes. While high initial investment and the availability of alternative imaging methods present some challenges, the expanding landscape of genetic research, personalized medicine, and molecular diagnostics will sustain strong market momentum. Prominent market participants, including Spectronics Corporation, Thermo Fisher Scientific, and Syngene (Synoptics Ltd), are actively contributing to market dynamics through strategic advancements and collaborations.

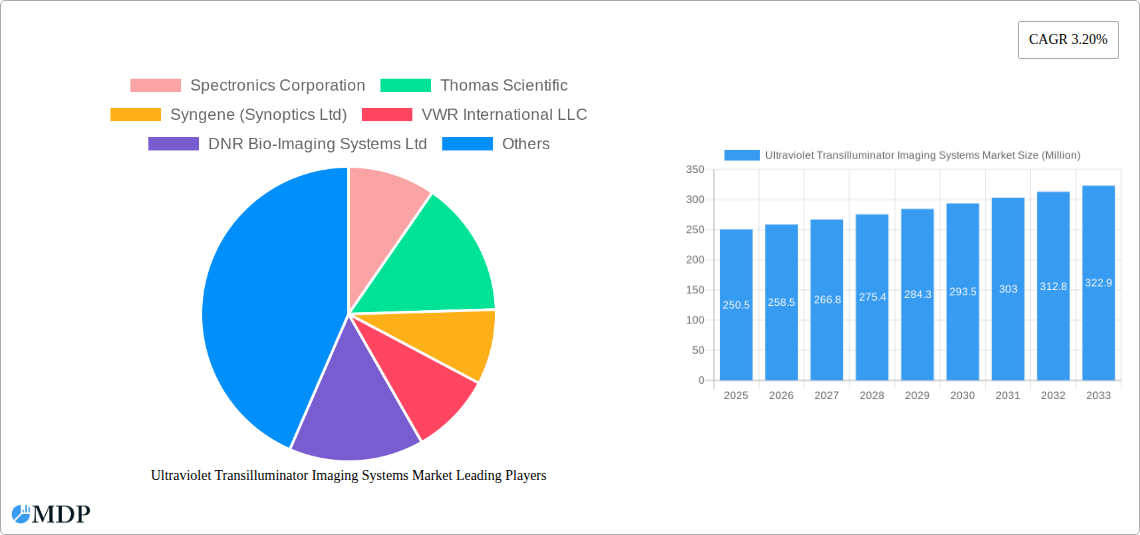

Ultraviolet Transilluminator Imaging Systems Market Company Market Share

Ultraviolet Transilluminator Imaging Systems Market: Comprehensive Analysis and Future Outlook (2019-2033)

The global Ultraviolet Transilluminator Imaging Systems market is poised for significant expansion, driven by advancements in life sciences research, molecular biology, and drug discovery. This report offers an in-depth analysis of the market dynamics, key trends, leading segments, and future growth prospects, providing actionable insights for industry stakeholders. The study period spans from 2019 to 2033, with the base and estimated year being 2025, and the forecast period from 2025 to 2033, covering historical data from 2019 to 2024.

Ultraviolet Transilluminator Imaging Systems Market Market Dynamics & Concentration

The Ultraviolet Transilluminator Imaging Systems market is characterized by a moderately concentrated landscape, with key players investing heavily in research and development to fuel innovation. Technological advancements in imaging resolution, portability, and data analysis capabilities are primary drivers. Regulatory frameworks surrounding laboratory equipment and safety standards also influence market entry and product design. Product substitutes, such as higher-resolution gel documentation systems or alternative detection methods, present a competitive challenge. End-user trends are leaning towards increased demand for automated, user-friendly systems that streamline workflows in pharmaceutical and biotechnology research. Merger and acquisition (M&A) activities, though not extensively high in recent years (estimated M&A deal count: xx), are likely to increase as companies seek to expand their product portfolios and market reach. Spectronics Corporation and Thermo Fisher Scientific hold significant market share, estimated at approximately 15% and 12% respectively, driven by their extensive product offerings and established distribution networks.

Ultraviolet Transilluminator Imaging Systems Market Industry Trends & Analysis

The global Ultraviolet Transilluminator Imaging Systems market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025-2033. This expansion is primarily fueled by the burgeoning life sciences sector, particularly in pharmaceutical and biotechnology companies, which are continuously investing in advanced research and development activities. The increasing prevalence of genetic research, molecular diagnostics, and protein analysis necessitates sophisticated imaging solutions for visualizing and quantifying results from techniques like gel electrophoresis and Western blotting. Technological disruptions, including the integration of artificial intelligence (AI) for enhanced image analysis and the development of more compact and portable transilluminator systems, are significantly shaping market trends. Consumer preferences are shifting towards systems offering higher sensitivity, improved resolution, and user-friendly interfaces that reduce experimental error and enhance productivity. Academic institutions also represent a substantial segment, driven by a continuous need for research equipment that supports cutting-edge scientific discoveries. The competitive dynamics within the market are intensifying, with companies focusing on developing innovative products that offer distinct advantages in terms of performance, cost-effectiveness, and application versatility. Market penetration for advanced ultraviolet transilluminator imaging systems is steadily increasing, as researchers recognize their value in accelerating discovery timelines. The market is also influenced by government funding initiatives for scientific research and the growing demand for personalized medicine, which relies heavily on precise molecular analysis. The global market size for Ultraviolet Transilluminator Imaging Systems was estimated at approximately $250 Million in 2025 and is projected to reach over $450 Million by 2033.

Leading Markets & Segments in Ultraviolet Transilluminator Imaging Systems Market

The Pharmaceutical and Biotechnology Companies segment stands as the dominant end-user in the Ultraviolet Transilluminator Imaging Systems market, driven by their substantial R&D expenditures and the critical role of these systems in drug discovery, development, and quality control processes. This segment is estimated to account for over 40% of the global market share.

- Key Drivers for Pharmaceutical and Biotechnology Companies Dominance:

- Accelerated Drug Discovery Timelines: Advanced transilluminator systems enable rapid visualization and analysis of experimental results, significantly shortening the R&D cycle for new therapeutics.

- High-Throughput Screening: The need for efficient screening of vast compound libraries necessitates reliable and high-performance imaging solutions.

- Quality Control and Assurance: Strict regulatory requirements in the pharmaceutical industry demand precise and reproducible data, which these systems provide for validation of biological assays and product consistency.

- Investment in Molecular Biology Research: The growing focus on genomics, proteomics, and metabolomics directly translates to increased demand for nucleic acid and protein visualization tools.

The Standalo type of ultraviolet transilluminator imaging systems holds a larger market share, estimated at around 65%, due to their robust features, higher power output, and suitability for dedicated laboratory environments where space is not a primary constraint. These systems offer superior illumination uniformity and greater control over imaging parameters, crucial for demanding research applications.

- Key Drivers for Standalone System Dominance:

- Superior Performance: Standalone units typically offer higher intensity UV sources and advanced optical configurations, leading to clearer and more sensitive detection of nucleic acids and proteins.

- Versatility in Applications: They are well-suited for a broad range of applications, including DNA/RNA gel electrophoresis, protein gel analysis, and fluorescence imaging.

- Durability and Longevity: Designed for continuous use in research settings, they often feature robust construction and longer operational lifespans.

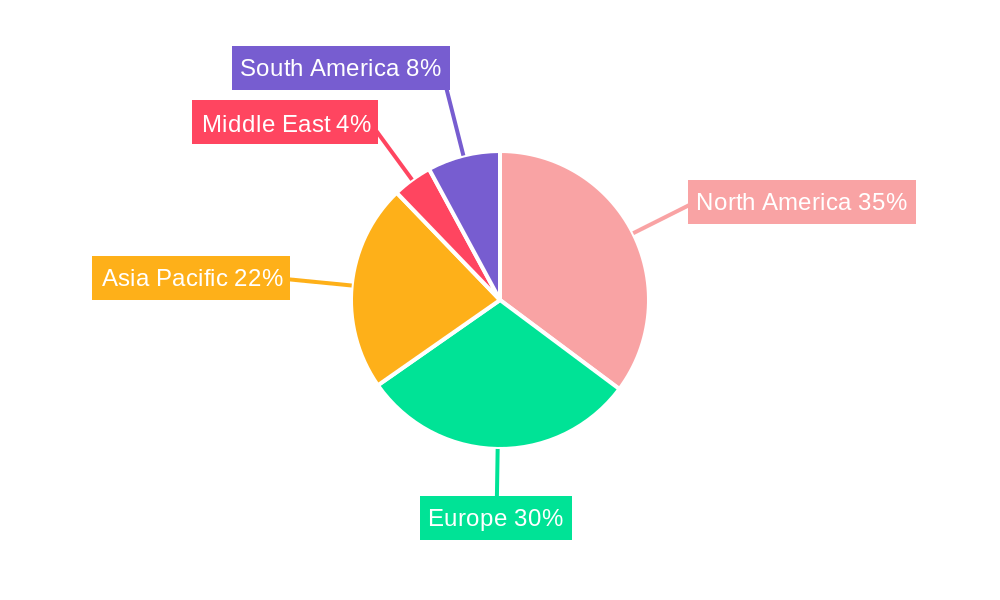

Geographically, North America is the leading market, contributing an estimated 35% to the global revenue. This dominance is attributed to the region's strong presence of leading pharmaceutical and biotechnology companies, extensive academic research infrastructure, and significant government funding for life sciences research. The United States, in particular, boasts a highly developed research ecosystem and a proactive adoption rate of new technologies.

- Key Drivers for North American Dominance:

- Concentration of Biopharmaceutical Hubs: Major research and development centers are located in regions like Boston, San Francisco, and San Diego.

- Robust Funding for Scientific Research: Significant investments from government agencies like the National Institutes of Health (NIH) and private foundations fuel innovation and equipment procurement.

- Early Adoption of Advanced Technologies: The region is a fast adopter of cutting-edge scientific instrumentation.

Ultraviolet Transilluminator Imaging Systems Market Product Developments

Product innovation in Ultraviolet Transilluminator Imaging Systems focuses on enhancing resolution, speed, and user experience. Manufacturers are developing systems with higher UV intensity for improved sensitivity, coupled with advanced imaging sensors and software for quantitative analysis. Integration of AI-powered image enhancement and automated data processing is a significant trend, enabling researchers to extract more meaningful insights faster. Developments also include more compact and portable designs, catering to the needs of field research and smaller laboratory setups. Competitive advantages lie in offering integrated solutions that combine transillumination, fluorescence, and chemiluminescence imaging capabilities within a single platform, maximizing laboratory space and cost-effectiveness.

Key Drivers of Ultraviolet Transilluminator Imaging Systems Market Growth

The growth of the Ultraviolet Transilluminator Imaging Systems market is propelled by several key factors. The escalating investments in life sciences research and development by pharmaceutical and biotechnology companies worldwide are a primary catalyst. Advancements in molecular biology techniques, such as PCR, gel electrophoresis, and Western blotting, directly correlate with the demand for high-performance imaging systems. Furthermore, the increasing focus on personalized medicine and genetic research necessitates precise visualization and quantification of biomolecules, driving the adoption of sophisticated transilluminator technology. Supportive government initiatives and grants aimed at advancing scientific research also contribute significantly to market expansion. The ongoing development of more sensitive, accurate, and user-friendly imaging systems by manufacturers further fuels market growth by catering to evolving research needs.

Challenges in the Ultraviolet Transilluminator Imaging Systems Market Market

Despite the robust growth, the Ultraviolet Transilluminator Imaging Systems market faces certain challenges. The high initial cost of advanced imaging systems can be a deterrent for smaller research institutions or laboratories with limited budgets, impacting market penetration in certain segments. Stringent regulatory compliance requirements for laboratory equipment, including safety standards and performance validation, can also pose a hurdle for new market entrants and necessitate significant investment in product development and certification. Intense competition among established players and emerging manufacturers leads to price pressures, potentially impacting profit margins. Furthermore, the rapid pace of technological evolution means that existing systems can become obsolete quickly, requiring continuous investment in upgrades or replacements, which can strain research budgets. Supply chain disruptions, as experienced in recent global events, can also impact the availability of components and the timely delivery of finished products.

Emerging Opportunities in Ultraviolet Transilluminator Imaging Systems Market

The Ultraviolet Transilluminator Imaging Systems market is ripe with emerging opportunities driven by technological advancements and evolving research landscapes. The increasing integration of AI and machine learning algorithms for automated image analysis and data interpretation presents a significant opportunity for enhanced workflow efficiency and deeper scientific insights. The growing demand for portable and miniaturized transilluminator systems, suitable for point-of-care diagnostics and field-based research, opens new market avenues. Furthermore, the expansion of proteomics and genomics research, particularly in areas like CRISPR gene editing and next-generation sequencing data validation, will continue to drive the need for high-sensitivity and high-resolution imaging solutions. Strategic partnerships between imaging system manufacturers and reagent or consumables providers can create bundled solutions, offering comprehensive workflows and capturing a larger market share. The increasing global focus on infectious disease research and vaccine development is also expected to boost demand for advanced imaging technologies.

Leading Players in the Ultraviolet Transilluminator Imaging Systems Market Sector

The following are the leading players in the Ultraviolet Transilluminator Imaging Systems Market sector: Spectronics Corporation Thomas Scientific Syngene (Synoptics Ltd) VWR International LLC DNR Bio-Imaging Systems Ltd Wealtech Corporation Cleaver Scientific Ltd Maestrogen Inc Thermo Fisher Scientific

Key Milestones in Ultraviolet Transilluminator Imaging Systems Market Industry

- 2019: Introduction of advanced LED-based transilluminators offering improved energy efficiency and longer lifespan by Spectronics Corporation.

- 2020: Syngene (Synoptics Ltd) launches a new series of compact, high-resolution transilluminators with integrated imaging software.

- 2021: Thermo Fisher Scientific expands its molecular imaging portfolio with enhanced sensitivity transilluminator systems for protein analysis.

- 2022: Cleaver Scientific Ltd introduces modular transilluminator designs allowing for flexible configurations and upgrades.

- 2023: DNR Bio-Imaging Systems Ltd showcases AI-powered image analysis capabilities for its transilluminator product line.

- 2024: VWR International LLC, through strategic partnerships, aims to offer bundled solutions integrating transilluminators with other lab equipment.

Strategic Outlook for Ultraviolet Transilluminator Imaging Systems Market Market

The strategic outlook for the Ultraviolet Transilluminator Imaging Systems market is strongly positive, characterized by continued innovation and expanding applications. Growth accelerators will include the development of multi-modal imaging systems capable of handling diverse fluorescent probes and applications, as well as increasing integration with cloud-based data management and analysis platforms. Companies that can offer cost-effective, high-performance solutions with advanced software capabilities will likely gain a competitive edge. Strategic focus on emerging markets, particularly in Asia-Pacific and Latin America, driven by expanding research infrastructure and growing biopharmaceutical sectors, will be crucial for long-term growth. The ongoing quest for novel therapeutics and diagnostics will continue to fuel demand for reliable and sophisticated imaging tools, solidifying the market's upward trajectory.

Ultraviolet Transilluminator Imaging Systems Market Segmentation

-

1. Type

- 1.1. Standalo

- 1.2. Portable

-

2. End User

- 2.1. Pharmaceutical and Biotechnology Companies

- 2.2. Academic Institutions

- 2.3. Other End Users

Ultraviolet Transilluminator Imaging Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. GCC

- 5.1. South Africa

- 5.2. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

Ultraviolet Transilluminator Imaging Systems Market Regional Market Share

Geographic Coverage of Ultraviolet Transilluminator Imaging Systems Market

Ultraviolet Transilluminator Imaging Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rapid Adoption in Pharmaceutical Industry; Rising Investments in the R&D; Advancement in Technology

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Maintenance

- 3.4. Market Trends

- 3.4.1. Portable Ultraviolet Transilluminator Imaging Systems Segment is Expected to Show Better Growth in the Forecast Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultraviolet Transilluminator Imaging Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Standalo

- 5.1.2. Portable

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Pharmaceutical and Biotechnology Companies

- 5.2.2. Academic Institutions

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East

- 5.3.5. GCC

- 5.3.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Ultraviolet Transilluminator Imaging Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Standalo

- 6.1.2. Portable

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Pharmaceutical and Biotechnology Companies

- 6.2.2. Academic Institutions

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Ultraviolet Transilluminator Imaging Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Standalo

- 7.1.2. Portable

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Pharmaceutical and Biotechnology Companies

- 7.2.2. Academic Institutions

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Ultraviolet Transilluminator Imaging Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Standalo

- 8.1.2. Portable

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Pharmaceutical and Biotechnology Companies

- 8.2.2. Academic Institutions

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East Ultraviolet Transilluminator Imaging Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Standalo

- 9.1.2. Portable

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Pharmaceutical and Biotechnology Companies

- 9.2.2. Academic Institutions

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. GCC Ultraviolet Transilluminator Imaging Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Standalo

- 10.1.2. Portable

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Pharmaceutical and Biotechnology Companies

- 10.2.2. Academic Institutions

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. South America Ultraviolet Transilluminator Imaging Systems Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Standalo

- 11.1.2. Portable

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Pharmaceutical and Biotechnology Companies

- 11.2.2. Academic Institutions

- 11.2.3. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Spectronics Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Thomas Scientific

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Syngene (Synoptics Ltd)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 VWR International LLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 DNR Bio-Imaging Systems Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Wealtech Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Cleaver Scientific Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Maestrogen Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Thermo Fisher Scientific

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Spectronics Corporation

List of Figures

- Figure 1: Global Ultraviolet Transilluminator Imaging Systems Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by End User 2025 & 2033

- Figure 5: North America Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by End User 2025 & 2033

- Figure 17: Asia Pacific Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by End User 2025 & 2033

- Figure 23: Middle East Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: GCC Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 27: GCC Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: GCC Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by End User 2025 & 2033

- Figure 29: GCC Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: GCC Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 31: GCC Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 33: South America Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: South America Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by End User 2025 & 2033

- Figure 35: South America Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by End User 2025 & 2033

- Figure 36: South America Ultraviolet Transilluminator Imaging Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 37: South America Ultraviolet Transilluminator Imaging Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by End User 2020 & 2033

- Table 21: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by End User 2020 & 2033

- Table 30: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by End User 2020 & 2033

- Table 33: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: South Africa Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 37: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by End User 2020 & 2033

- Table 38: Global Ultraviolet Transilluminator Imaging Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 39: Brazil Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Argentina Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of South America Ultraviolet Transilluminator Imaging Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultraviolet Transilluminator Imaging Systems Market?

The projected CAGR is approximately 8.02%.

2. Which companies are prominent players in the Ultraviolet Transilluminator Imaging Systems Market?

Key companies in the market include Spectronics Corporation, Thomas Scientific, Syngene (Synoptics Ltd), VWR International LLC, DNR Bio-Imaging Systems Ltd, Wealtech Corporation, Cleaver Scientific Ltd, Maestrogen Inc, Thermo Fisher Scientific.

3. What are the main segments of the Ultraviolet Transilluminator Imaging Systems Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.59 billion as of 2022.

5. What are some drivers contributing to market growth?

; Rapid Adoption in Pharmaceutical Industry; Rising Investments in the R&D; Advancement in Technology.

6. What are the notable trends driving market growth?

Portable Ultraviolet Transilluminator Imaging Systems Segment is Expected to Show Better Growth in the Forecast Years.

7. Are there any restraints impacting market growth?

; High Cost of Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultraviolet Transilluminator Imaging Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultraviolet Transilluminator Imaging Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultraviolet Transilluminator Imaging Systems Market?

To stay informed about further developments, trends, and reports in the Ultraviolet Transilluminator Imaging Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence