Key Insights

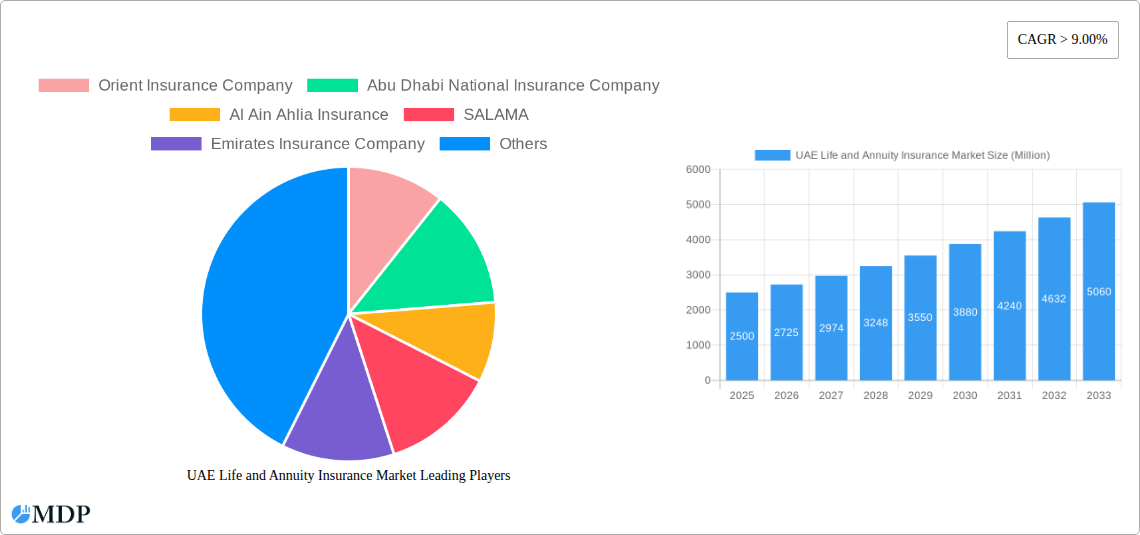

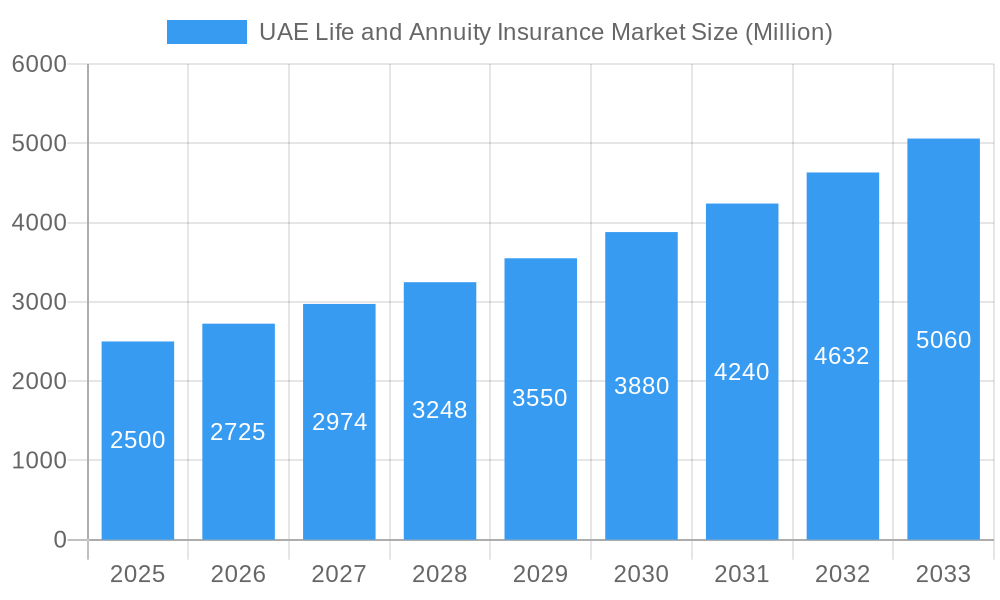

The United Arab Emirates (UAE) Life and Annuity Insurance market is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 7.4% from 2025 to 2033. The current market size stands at an estimated $3.92 billion. Key growth catalysts include a growing young and working-age demographic, increasing demand for life insurance and retirement solutions, and supportive government initiatives promoting financial inclusion and long-term savings. Heightened awareness of financial security and the need for protection against life's uncertainties are also driving higher adoption rates. The market is evolving with a strong trend towards digital distribution channels and innovative product development, improving accessibility and meeting diverse customer needs. Competitive dynamics among established entities such as Orient Insurance Company, Abu Dhabi National Insurance Company, and Emirates Insurance Company, coupled with new entrants, are fostering innovation and enhancing service delivery.

UAE Life and Annuity Insurance Market Market Size (In Billion)

Despite a positive outlook, market participants face regulatory complexities and compliance demands, which can influence market entry strategies. Economic volatility and geopolitical factors may also impact consumer spending on insurance products. The market is segmented by product type (life insurance, annuities), distribution channels (online, agents, brokers), and customer demographics (age, income). Notwithstanding these challenges, sustained economic development and increasing insurance penetration in the UAE ensure a robust long-term trajectory. Insurers are actively pursuing product diversification, technological integration, and strategic alliances to solidify their competitive positions.

UAE Life and Annuity Insurance Market Company Market Share

UAE Life and Annuity Insurance Market Report: 2019-2033 Forecast

Unlocking Growth in the Thriving UAE Insurance Sector: A Comprehensive Market Analysis

This comprehensive report provides an in-depth analysis of the UAE life and annuity insurance market, offering invaluable insights for industry stakeholders, investors, and strategic planners. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a detailed view of historical trends (2019-2024) and future projections, encompassing market size, segmentation, and competitive landscape. Discover key growth drivers, emerging opportunities, and potential challenges within this dynamic market. The report also highlights recent significant M&A activity, regulatory changes, and technological advancements that are shaping the future of the UAE life and annuity insurance sector. The estimated market value in 2025 is projected at xx Million.

UAE Life and Annuity Insurance Market Dynamics & Concentration

The UAE life and annuity insurance market exhibits a moderately concentrated landscape, with several dominant players vying for market share. Market concentration is influenced by factors such as regulatory frameworks, the prevalence of innovative product offerings, and the dynamic nature of mergers and acquisitions (M&A) activity. The historical period (2019-2024) witnessed xx M&A deals, contributing to market consolidation. Key drivers of innovation include the increasing adoption of Insurtech solutions and the demand for tailored, digital-first insurance products. The regulatory environment plays a crucial role in shaping market dynamics, influencing product development, distribution channels, and solvency requirements. Product substitutes, such as investment vehicles and alternative risk management strategies, also impact market competition. End-user trends, such as a growing awareness of long-term financial security, are driving demand for life and annuity products.

- Market Share (2024): Orient Insurance Company: xx%; Abu Dhabi National Insurance Company: xx%; Emirates Insurance Company: xx%; Others: xx%. (Note: These are predicted values).

- M&A Deal Count (2019-2024): xx

- Key Regulatory Factors: Solvency regulations, product approval processes, and consumer protection laws.

UAE Life and Annuity Insurance Market Industry Trends & Analysis

The UAE life and annuity insurance market is characterized by robust growth, driven by factors such as a burgeoning population, rising disposable incomes, and increasing awareness of financial planning. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was estimated at xx%. Technological advancements, particularly in areas such as digital distribution channels, data analytics, and artificial intelligence, are transforming the insurance landscape. Consumer preferences are shifting towards personalized products, seamless digital experiences, and value-added services. Intense competition among both established players and new entrants fosters innovation and improves the customer experience. Market penetration is currently estimated at xx% in 2025, with significant potential for future growth.

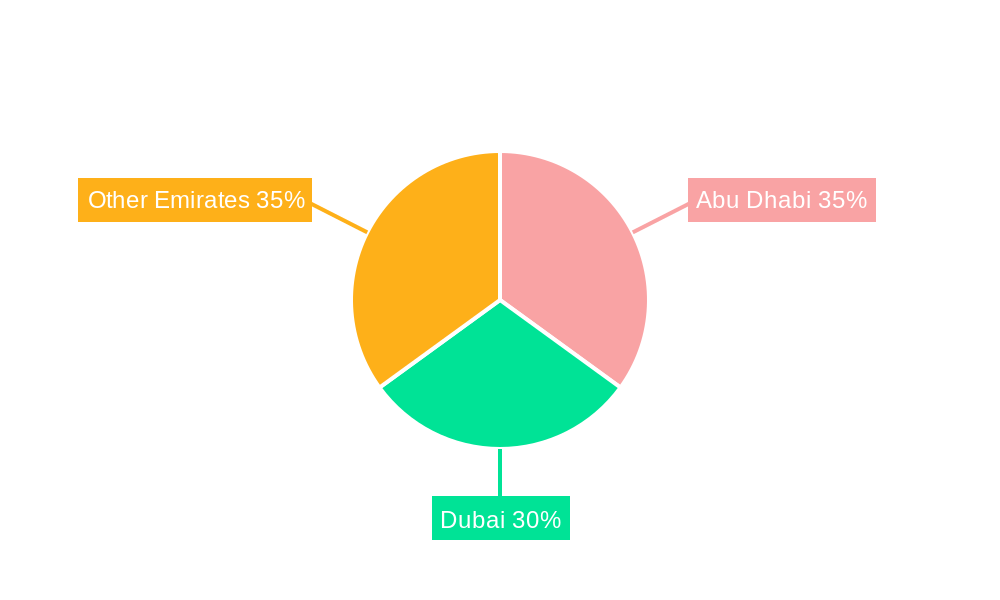

Leading Markets & Segments in UAE Life and Annuity Insurance Market

The UAE's life and annuity insurance market is primarily driven by the strong economic performance and robust infrastructure development. Key growth drivers across various segments include:

- Economic Policies: Government initiatives to encourage financial inclusion and long-term investment.

- Infrastructure Development: Expansion of healthcare and retirement facilities, supporting the demand for related insurance products.

- Demographic Trends: A young and growing population fuels demand for life insurance and retirement planning products.

- Government Regulations: Initiatives promoting financial literacy and consumer awareness of insurance products.

Dominance Analysis: The market is dominated by xx, due to its strong distribution network, brand recognition, and diversified product portfolio. However, other players are actively expanding their market share through innovative product launches and strategic partnerships.

UAE Life and Annuity Insurance Market Product Developments

Recent product developments reflect an industry-wide focus on digitalization and personalization. Insurers are incorporating technology to streamline customer onboarding, personalize product offerings, and enhance customer engagement through mobile apps and online portals. These developments emphasize convenience, accessibility, and seamless user experience, enhancing market fit and competitiveness.

Key Drivers of UAE Life and Annuity Insurance Market Growth

The UAE life and annuity insurance market is experiencing sustained growth due to a confluence of factors. Firstly, the government's focus on financial inclusion and economic diversification is creating a supportive environment for insurance expansion. Secondly, rising affluence and increased awareness of financial security among the population are driving demand for insurance products. Thirdly, technological advancements are enabling efficient distribution channels and personalized offerings. The strong regulatory framework also contributes to investor confidence and stable market growth.

Challenges in the UAE Life and Annuity Insurance Market

The UAE life and annuity insurance market faces certain challenges. These include increasing competition from both established and new market entrants, the need to adapt to changing consumer preferences, and the need to manage risks associated with technological disruptions. Regulatory compliance and managing operational costs also pose significant challenges.

Emerging Opportunities in UAE Life and Annuity Insurance Market

Significant opportunities exist for growth in the UAE life and annuity insurance market. Further technological advancements, strategic partnerships with fintech companies, and expanding into underserved segments hold substantial potential. The focus on digitalization and personalized insurance solutions will unlock new avenues for market penetration and growth.

Leading Players in the UAE Life and Annuity Insurance Market Sector

- Orient Insurance Company

- Abu Dhabi National Insurance Company

- Al Ain Ahlia Insurance

- SALAMA

- Emirates Insurance Company

- Dubai Insurance Company

- Union Insurance Company

- Dubai National Insurance & Reinsurance PSC

- AXA Green Crescent Insurance

- Oman Insurance Company

- (List Not Exhaustive)

Key Milestones in UAE Life and Annuity Insurance Market Industry

- May 2023: Oman Insurance Company P.S.C. ('Sukoon') completed the acquisition of 93.0432% of Arabian Scandinavian Insurance Company P.S.C. (ASCANA), significantly altering the market landscape.

- September 2022: The U.A.E. Central Bank and Sama signed a preliminary deal to jointly supervise the insurance sector, enhancing regulatory cooperation and potentially streamlining operations.

Strategic Outlook for UAE Life and Annuity Insurance Market

The UAE life and annuity insurance market is poised for continued growth driven by favorable demographics, economic expansion, and technological innovation. Strategic opportunities lie in leveraging digital technologies to enhance customer experiences, developing innovative product offerings catering to evolving consumer needs, and building strategic alliances to expand market reach. The market's future trajectory suggests significant potential for long-term expansion and profitability for well-positioned players.

UAE Life and Annuity Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Individual Insurance

- 1.2. Annuity Insurance

- 1.3. Endowment Insurance

- 1.4. Whole Life Insurance

- 1.5. Other Insurance Types

UAE Life and Annuity Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Life and Annuity Insurance Market Regional Market Share

Geographic Coverage of UAE Life and Annuity Insurance Market

UAE Life and Annuity Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Awareness of Insurance; Expanding Distribution Channels

- 3.3. Market Restrains

- 3.3.1. Increased Awareness of Insurance; Expanding Distribution Channels

- 3.4. Market Trends

- 3.4.1. COVID-19 Impact Driving the Market to New Flexible Business Models

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Life and Annuity Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Individual Insurance

- 5.1.2. Annuity Insurance

- 5.1.3. Endowment Insurance

- 5.1.4. Whole Life Insurance

- 5.1.5. Other Insurance Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. North America UAE Life and Annuity Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6.1.1. Individual Insurance

- 6.1.2. Annuity Insurance

- 6.1.3. Endowment Insurance

- 6.1.4. Whole Life Insurance

- 6.1.5. Other Insurance Types

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7. South America UAE Life and Annuity Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7.1.1. Individual Insurance

- 7.1.2. Annuity Insurance

- 7.1.3. Endowment Insurance

- 7.1.4. Whole Life Insurance

- 7.1.5. Other Insurance Types

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8. Europe UAE Life and Annuity Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8.1.1. Individual Insurance

- 8.1.2. Annuity Insurance

- 8.1.3. Endowment Insurance

- 8.1.4. Whole Life Insurance

- 8.1.5. Other Insurance Types

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9. Middle East & Africa UAE Life and Annuity Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9.1.1. Individual Insurance

- 9.1.2. Annuity Insurance

- 9.1.3. Endowment Insurance

- 9.1.4. Whole Life Insurance

- 9.1.5. Other Insurance Types

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10. Asia Pacific UAE Life and Annuity Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10.1.1. Individual Insurance

- 10.1.2. Annuity Insurance

- 10.1.3. Endowment Insurance

- 10.1.4. Whole Life Insurance

- 10.1.5. Other Insurance Types

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Orient Insurance Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Abu Dhabi National Insurance Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Al Ain Ahlia Insurance

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SALAMA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Emirates Insurance Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dubai Insurance Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Union Insurance Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dubai National Insurance & Reinsurance PSC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AXA Green Crescent Insurance

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oman Insurance Company**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Orient Insurance Company

List of Figures

- Figure 1: Global UAE Life and Annuity Insurance Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UAE Life and Annuity Insurance Market Revenue (billion), by Insurance Type 2025 & 2033

- Figure 3: North America UAE Life and Annuity Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 4: North America UAE Life and Annuity Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America UAE Life and Annuity Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UAE Life and Annuity Insurance Market Revenue (billion), by Insurance Type 2025 & 2033

- Figure 7: South America UAE Life and Annuity Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 8: South America UAE Life and Annuity Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 9: South America UAE Life and Annuity Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UAE Life and Annuity Insurance Market Revenue (billion), by Insurance Type 2025 & 2033

- Figure 11: Europe UAE Life and Annuity Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 12: Europe UAE Life and Annuity Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe UAE Life and Annuity Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UAE Life and Annuity Insurance Market Revenue (billion), by Insurance Type 2025 & 2033

- Figure 15: Middle East & Africa UAE Life and Annuity Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 16: Middle East & Africa UAE Life and Annuity Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa UAE Life and Annuity Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UAE Life and Annuity Insurance Market Revenue (billion), by Insurance Type 2025 & 2033

- Figure 19: Asia Pacific UAE Life and Annuity Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 20: Asia Pacific UAE Life and Annuity Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific UAE Life and Annuity Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 2: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 4: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 9: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 14: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 25: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 33: Global UAE Life and Annuity Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UAE Life and Annuity Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Life and Annuity Insurance Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the UAE Life and Annuity Insurance Market?

Key companies in the market include Orient Insurance Company, Abu Dhabi National Insurance Company, Al Ain Ahlia Insurance, SALAMA, Emirates Insurance Company, Dubai Insurance Company, Union Insurance Company, Dubai National Insurance & Reinsurance PSC, AXA Green Crescent Insurance, Oman Insurance Company**List Not Exhaustive.

3. What are the main segments of the UAE Life and Annuity Insurance Market?

The market segments include Insurance Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Awareness of Insurance; Expanding Distribution Channels.

6. What are the notable trends driving market growth?

COVID-19 Impact Driving the Market to New Flexible Business Models.

7. Are there any restraints impacting market growth?

Increased Awareness of Insurance; Expanding Distribution Channels.

8. Can you provide examples of recent developments in the market?

May 2023: Oman Insurance Company P.S.C. ('Sukoon') completed the acquisition of 93.0432% of the share capital of Arabian Scandinavian Insurance Company P.S.C. (ASCANA) by way of the special deal through Dubai Clear. Sukoon signed a share purchase agreement in December 2022 to acquire a majority stake of more than 93% in the DFM-listed takaful insurer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Life and Annuity Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Life and Annuity Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Life and Annuity Insurance Market?

To stay informed about further developments, trends, and reports in the UAE Life and Annuity Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence