Key Insights

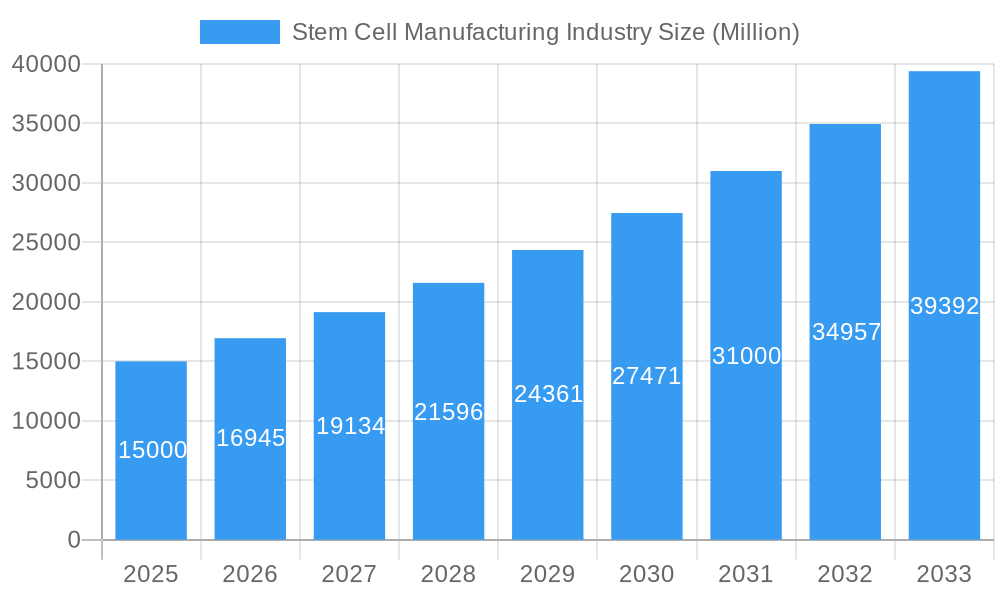

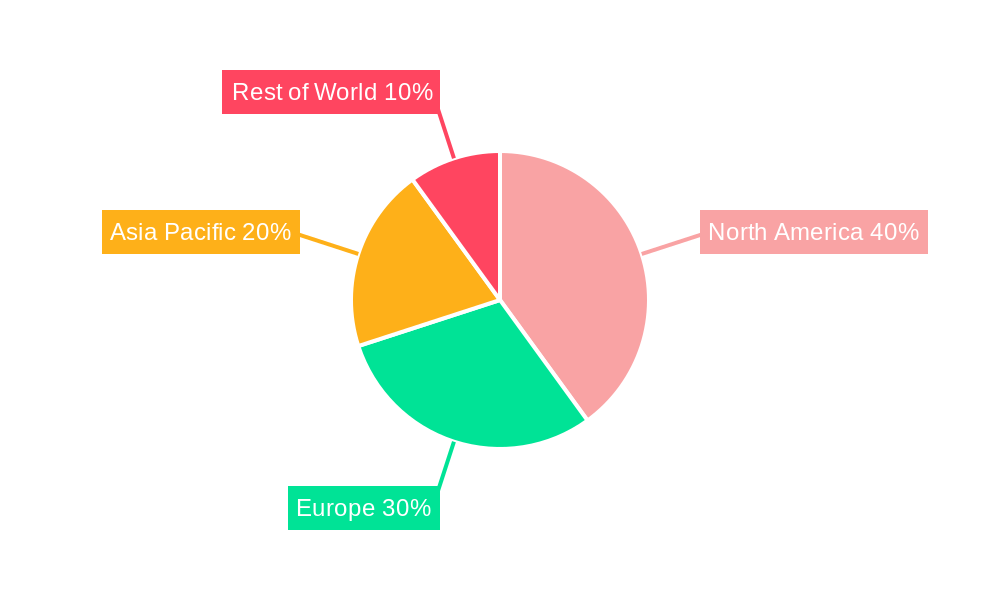

The global stem cell manufacturing market is poised for significant expansion, driven by escalating demand for stem cell-based therapies and advanced research initiatives. A projected compound annual growth rate (CAGR) of 11.5% from a base year of 2024 underscores the dynamic growth trajectory. This expansion is primarily fueled by breakthroughs in regenerative medicine, accelerated drug discovery pipelines, and the widening therapeutic applications of stem cells for numerous diseases. Key growth accelerators include the increasing incidence of chronic conditions necessitating novel treatment paradigms, substantial investments in research and development (R&D), and growing adoption of stem cell therapies by both medical professionals and patients. The market is segmented by stem cell type (embryonic, induced pluripotent, adult), product categories (media, reagents, bioreactors), services (cell culture, cryopreservation), application areas (therapy, drug discovery, banking, regenerative medicine), and end-user segments (pharmaceutical firms, cell banks, research institutions). While North America and Europe currently dominate due to established regulatory frameworks and robust research infrastructure, the Asia-Pacific region is anticipated to experience the most rapid growth, propelled by rising healthcare expenditures and a concentrated focus on biopharmaceutical manufacturing within emerging economies. The competitive landscape features a dynamic interplay between large multinational corporations and specialized biotechnology enterprises vying for market leadership.

Stem Cell Manufacturing Industry Market Size (In Billion)

Despite this promising outlook, the market confronts certain restraints. Substantial R&D investments, stringent regulatory pathways for stem cell products, and ethical considerations surrounding stem cell utilization present potential challenges to market expansion. However, ongoing technological advancements in stem cell isolation, culture, and manipulation are expected to effectively mitigate these obstacles, fostering continued market growth. A strategic shift towards developing safer, more efficient, and cost-effective stem cell manufacturing processes is underway, aiming to enhance the accessibility and affordability of these transformative therapies. The successful commercialization of novel stem cell-based products and the cultivation of synergistic collaborations among academia, industry, and regulatory bodies will further invigorate market expansion, presenting a substantial and evolving opportunity for stakeholders throughout the forecast period.

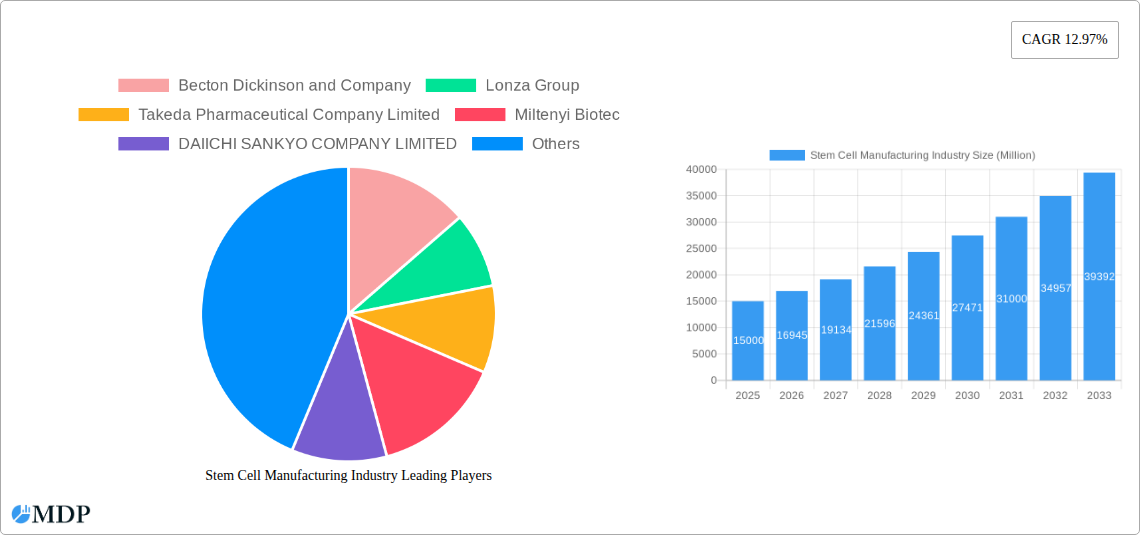

Stem Cell Manufacturing Industry Company Market Share

Global Stem Cell Manufacturing Market Analysis: 2024-2033

This comprehensive report delivers an in-depth analysis of the global stem cell manufacturing market, providing critical insights for stakeholders across the entire value chain. Covering market dynamics, leading participants, emerging trends, and future prospects, this report serves as an indispensable resource for navigating this rapidly evolving sector. The analysis spans the period from 2024 to 2033, with a specific focus on estimated market figures. The market size is projected to reach $16.23 billion by 2033.

Stem Cell Manufacturing Industry Market Dynamics & Concentration

The stem cell manufacturing industry is characterized by a moderately concentrated market structure, with several large multinational corporations holding significant market share. The top 10 players account for approximately xx% of the global market in 2025, with Becton Dickinson and Company, Lonza Group, and Thermo Fisher Scientific among the leading companies. Market concentration is influenced by factors such as high barriers to entry (requiring substantial capital investment and regulatory approvals), technological complexities, and the specialized nature of the products and services.

Innovation is a critical driver, with ongoing R&D efforts focused on improving stem cell culture techniques, developing novel bioreactors, and enhancing the efficiency of downstream processing. Stringent regulatory frameworks, particularly in relation to GMP compliance and clinical trials, significantly impact market dynamics. While limited, substitutability exists with certain traditional therapeutic approaches. However, the unique capabilities of stem cell-based therapies create a distinct market niche. End-user trends, such as increasing demand for personalized medicine and regenerative therapies, are fuelling market growth.

M&A activities have played a notable role in shaping the industry landscape, with an estimated xx number of mergers and acquisitions recorded between 2019 and 2024. These activities often involve larger companies acquiring smaller, specialized firms to expand their product portfolios and technological capabilities. The majority of these mergers and acquisitions have focused on expanding production capacity, broadening product offerings, and gaining access to innovative technologies. Future projections suggest continued consolidation within the industry driven by competition and technological development.

Stem Cell Manufacturing Industry Industry Trends & Analysis

The stem cell manufacturing industry is experiencing robust growth, driven by several key factors. The global market is projected to witness a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033. This growth is fueled by several factors including increasing prevalence of chronic diseases requiring regenerative therapies, the growing adoption of stem cell-based therapies and drug discovery, and significant investments in R&D.

Technological advancements, such as the development of automated cell culture systems and advanced bioreactor technologies, are streamlining manufacturing processes and improving product quality and consistency. Market penetration of advanced technologies is steadily growing, with adoption rates particularly high among large pharmaceutical and biotechnology companies. Consumer preferences are shifting toward personalized medicine, with a growing emphasis on tailored therapeutic approaches based on individual genetic profiles. Competitive dynamics are intensifying, with companies vying for market share through innovation, strategic partnerships, and capacity expansion.

Leading Markets & Segments in Stem Cell Manufacturing Industry

North America currently dominates the global stem cell manufacturing market, owing to strong regulatory support, high adoption rates of advanced therapies, and robust investment in research and development. However, Asia-Pacific is projected to experience significant growth in the coming years, driven by increasing healthcare expenditure, a growing understanding of regenerative therapies, and regulatory changes supportive of stem cell-based innovation. The embryonic stem cell line segment is expected to maintain a significant market share, reflecting the versatility of these cells for various applications.

- Key Drivers of Regional Dominance:

- North America: Strong regulatory framework, high healthcare expenditure, well-established research infrastructure, and strong presence of major market players.

- Europe: Growing acceptance of regenerative therapies, robust government funding for research, and increasing awareness of stem cell applications.

- Asia-Pacific: Rapidly developing healthcare infrastructure, rising disposable incomes, and a large pool of patients.

Within the product segment, bioreactors hold a significant share. Services such as cell culture, cryopreservation, and quality control are also integral. The largest application market segment for stem cell manufacturing currently is regenerative medicine which is expected to retain its strong dominance, but drug discovery and development are emerging as significant drivers of industry growth.

Stem Cell Manufacturing Industry Product Developments

Recent years have witnessed significant advancements in stem cell manufacturing technology. Innovations include the development of automated cell culture systems, closed-system bioreactors minimizing contamination risk, and improved purification and cryopreservation techniques. These advancements are enhancing product quality, consistency, and scalability. Products are increasingly tailored to specific applications, leading to the development of specialized culture media, purification reagents, and bioprocessing solutions. Competitive advantages stem from superior efficiency, reduced manufacturing costs, and improved product efficacy.

Key Drivers of Stem Cell Manufacturing Industry Growth

Several factors are propelling the growth of the stem cell manufacturing industry. Technological advancements, such as automation and improved bioprocessing techniques, are enhancing manufacturing efficiency and reducing costs. Favorable regulatory environments in certain regions are promoting the adoption of stem cell-based therapies. Growing investments in R&D, fueled by both public and private sectors, are further stimulating innovation and market expansion. Increased funding for stem cell research coupled with an expanding pipeline of clinical trials are driving significant growth.

Challenges in the Stem Cell Manufacturing Industry Market

The stem cell manufacturing industry faces several hurdles. Stringent regulatory requirements for manufacturing and clinical trials create high barriers to entry and extend timelines for product development. Supply chain disruptions can impact the availability of essential reagents and materials. Intense competition among established players and emerging companies creates pricing pressures. The overall cost of manufacturing and delivering stem-cell based therapies remains high, limiting their accessibility for a broad patient base. There is also potential for high failure rates during the clinical trials phase.

Emerging Opportunities in Stem Cell Manufacturing Industry

The stem cell manufacturing industry presents numerous long-term growth opportunities. Technological breakthroughs, such as gene editing and induced pluripotent stem cell (iPSC) technology, are expanding the therapeutic potential of stem cells. Strategic partnerships between research institutions, biotech companies, and pharmaceutical giants are accelerating product development and commercialization. Market expansion into emerging economies with significant unmet healthcare needs is another significant driver. Advancements in 3D cell culture and bioprinting technologies pave the way for large scale manufacturing of stem cell based products, creating significant opportunities.

Leading Players in the Stem Cell Manufacturing Industry Sector

- Becton Dickinson and Company

- Lonza Group

- Takeda Pharmaceutical Company Limited

- Miltenyi Biotec

- DAIICHI SANKYO COMPANY LIMITED

- AbbVie Inc

- Pluristem Therapeutics Inc

- Sartorius

- Merck Group

- Fujifilm Holdings Corporation (Cellular Dynamics)

- Thermo Fisher Scientific

- Stemcell Technologies

- Corning Incorporated

Key Milestones in Stem Cell Manufacturing Industry Industry

- August 2022: Applied StemCell, Inc. expands its cGMP facility, adding capacity for cell banking and product manufacturing. This significantly increases the industry's capacity for compliant manufacturing of cell and gene products.

- January 2022: Cellino Biotech secures USD 80 Million in Series A funding, accelerating the development of autonomous human cell foundries. This milestone indicates significant investor confidence and technological progress in the sector.

Strategic Outlook for Stem Cell Manufacturing Industry Market

The stem cell manufacturing industry is poised for continued expansion, driven by technological advancements, favorable regulatory landscapes, and the growing demand for personalized and regenerative therapies. Strategic opportunities lie in focusing on innovative bioprocessing technologies, expanding into niche therapeutic areas, and establishing strategic partnerships to broaden market reach and accelerate commercialization efforts. The future of the industry will be shaped by companies adept at navigating regulatory hurdles, adopting advanced technologies, and effectively addressing the unmet clinical needs of a wide range of patient populations.

Stem Cell Manufacturing Industry Segmentation

-

1. Type

-

1.1. Product

- 1.1.1. Culture Media

- 1.1.2. Consumables

- 1.1.3. Instruments

- 1.1.4. Stem Cell Lines

- 1.2. Services

-

1.1. Product

-

2. Application

- 2.1. Stem Cell Therapy

- 2.2. Drug Discovery and Development

- 2.3. Stem Cell Banking

-

3. End User

- 3.1. Pharmaceutical and Biotechnology Companies

- 3.2. Cell Banks and Tissue Banks

- 3.3. Other End Users

Stem Cell Manufacturing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Stem Cell Manufacturing Industry Regional Market Share

Geographic Coverage of Stem Cell Manufacturing Industry

Stem Cell Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements in Stem Cell Manufacturing and Preservation; Growing Public Awareness About the Therapeutic Potency of Stem Cell Products; Growing Public-Private Investments and Funding in Stem Cell-based Research

- 3.3. Market Restrains

- 3.3.1. High Operational Costs Associated with Stem Cell Manufacturing and Banking

- 3.4. Market Trends

- 3.4.1. Stem Cell Banking Segment is Likely to Witness a Significant Growth in the Stem Cell Manufacturing Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Stem Cell Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Product

- 5.1.1.1. Culture Media

- 5.1.1.2. Consumables

- 5.1.1.3. Instruments

- 5.1.1.4. Stem Cell Lines

- 5.1.2. Services

- 5.1.1. Product

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Stem Cell Therapy

- 5.2.2. Drug Discovery and Development

- 5.2.3. Stem Cell Banking

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceutical and Biotechnology Companies

- 5.3.2. Cell Banks and Tissue Banks

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Stem Cell Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Product

- 6.1.1.1. Culture Media

- 6.1.1.2. Consumables

- 6.1.1.3. Instruments

- 6.1.1.4. Stem Cell Lines

- 6.1.2. Services

- 6.1.1. Product

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Stem Cell Therapy

- 6.2.2. Drug Discovery and Development

- 6.2.3. Stem Cell Banking

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pharmaceutical and Biotechnology Companies

- 6.3.2. Cell Banks and Tissue Banks

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Stem Cell Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Product

- 7.1.1.1. Culture Media

- 7.1.1.2. Consumables

- 7.1.1.3. Instruments

- 7.1.1.4. Stem Cell Lines

- 7.1.2. Services

- 7.1.1. Product

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Stem Cell Therapy

- 7.2.2. Drug Discovery and Development

- 7.2.3. Stem Cell Banking

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pharmaceutical and Biotechnology Companies

- 7.3.2. Cell Banks and Tissue Banks

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Stem Cell Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Product

- 8.1.1.1. Culture Media

- 8.1.1.2. Consumables

- 8.1.1.3. Instruments

- 8.1.1.4. Stem Cell Lines

- 8.1.2. Services

- 8.1.1. Product

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Stem Cell Therapy

- 8.2.2. Drug Discovery and Development

- 8.2.3. Stem Cell Banking

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pharmaceutical and Biotechnology Companies

- 8.3.2. Cell Banks and Tissue Banks

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Stem Cell Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Product

- 9.1.1.1. Culture Media

- 9.1.1.2. Consumables

- 9.1.1.3. Instruments

- 9.1.1.4. Stem Cell Lines

- 9.1.2. Services

- 9.1.1. Product

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Stem Cell Therapy

- 9.2.2. Drug Discovery and Development

- 9.2.3. Stem Cell Banking

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pharmaceutical and Biotechnology Companies

- 9.3.2. Cell Banks and Tissue Banks

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Stem Cell Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Product

- 10.1.1.1. Culture Media

- 10.1.1.2. Consumables

- 10.1.1.3. Instruments

- 10.1.1.4. Stem Cell Lines

- 10.1.2. Services

- 10.1.1. Product

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Stem Cell Therapy

- 10.2.2. Drug Discovery and Development

- 10.2.3. Stem Cell Banking

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pharmaceutical and Biotechnology Companies

- 10.3.2. Cell Banks and Tissue Banks

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lonza Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Takeda Pharmaceutical Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Miltenyi Biotec

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DAIICHI SANKYO COMPANY LIMITED

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AbbVie Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pluristem Therapeutics Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sartorius

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Merck Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fujifilm Holdings Corporation (Cellular Dynamics)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Thermo Fisher Scientific

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Stemcell Technologies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Corning Incorporated

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Stem Cell Manufacturing Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Stem Cell Manufacturing Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Stem Cell Manufacturing Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Stem Cell Manufacturing Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Stem Cell Manufacturing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Stem Cell Manufacturing Industry Revenue (billion), by End User 2025 & 2033

- Figure 7: North America Stem Cell Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Stem Cell Manufacturing Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Stem Cell Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Stem Cell Manufacturing Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Stem Cell Manufacturing Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Stem Cell Manufacturing Industry Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Stem Cell Manufacturing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Stem Cell Manufacturing Industry Revenue (billion), by End User 2025 & 2033

- Figure 15: Europe Stem Cell Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Stem Cell Manufacturing Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Stem Cell Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Stem Cell Manufacturing Industry Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Stem Cell Manufacturing Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Stem Cell Manufacturing Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Stem Cell Manufacturing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Stem Cell Manufacturing Industry Revenue (billion), by End User 2025 & 2033

- Figure 23: Asia Pacific Stem Cell Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Stem Cell Manufacturing Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Stem Cell Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Stem Cell Manufacturing Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Stem Cell Manufacturing Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Stem Cell Manufacturing Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Stem Cell Manufacturing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Stem Cell Manufacturing Industry Revenue (billion), by End User 2025 & 2033

- Figure 31: Middle East and Africa Stem Cell Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Stem Cell Manufacturing Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Stem Cell Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Stem Cell Manufacturing Industry Revenue (billion), by Type 2025 & 2033

- Figure 35: South America Stem Cell Manufacturing Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Stem Cell Manufacturing Industry Revenue (billion), by Application 2025 & 2033

- Figure 37: South America Stem Cell Manufacturing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Stem Cell Manufacturing Industry Revenue (billion), by End User 2025 & 2033

- Figure 39: South America Stem Cell Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Stem Cell Manufacturing Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Stem Cell Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 25: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 35: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 40: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 42: Global Stem Cell Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Stem Cell Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Stem Cell Manufacturing Industry?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Stem Cell Manufacturing Industry?

Key companies in the market include Becton Dickinson and Company, Lonza Group, Takeda Pharmaceutical Company Limited, Miltenyi Biotec, DAIICHI SANKYO COMPANY LIMITED, AbbVie Inc, Pluristem Therapeutics Inc, Sartorius, Merck Group, Fujifilm Holdings Corporation (Cellular Dynamics), Thermo Fisher Scientific, Stemcell Technologies, Corning Incorporated.

3. What are the main segments of the Stem Cell Manufacturing Industry?

The market segments include Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.23 billion as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements in Stem Cell Manufacturing and Preservation; Growing Public Awareness About the Therapeutic Potency of Stem Cell Products; Growing Public-Private Investments and Funding in Stem Cell-based Research.

6. What are the notable trends driving market growth?

Stem Cell Banking Segment is Likely to Witness a Significant Growth in the Stem Cell Manufacturing Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Operational Costs Associated with Stem Cell Manufacturing and Banking.

8. Can you provide examples of recent developments in the market?

In August 2022, Applied StemCell, Inc. (ASC), a cell and gene therapy CRO/CDMO focused on supporting the research community and biotechnology industry for their needs in developing and manufacturing cell and gene products, expanded its Current Good Manufacturing (cGMP) facility. ASC has successfully carried out cell banking and product manufacturing projects in its current cGMP suite and is now set on building 4 additional cGMP cleanrooms, cryo-storage space, process development, and QC/QA space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Stem Cell Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Stem Cell Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Stem Cell Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Stem Cell Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence