Key Insights

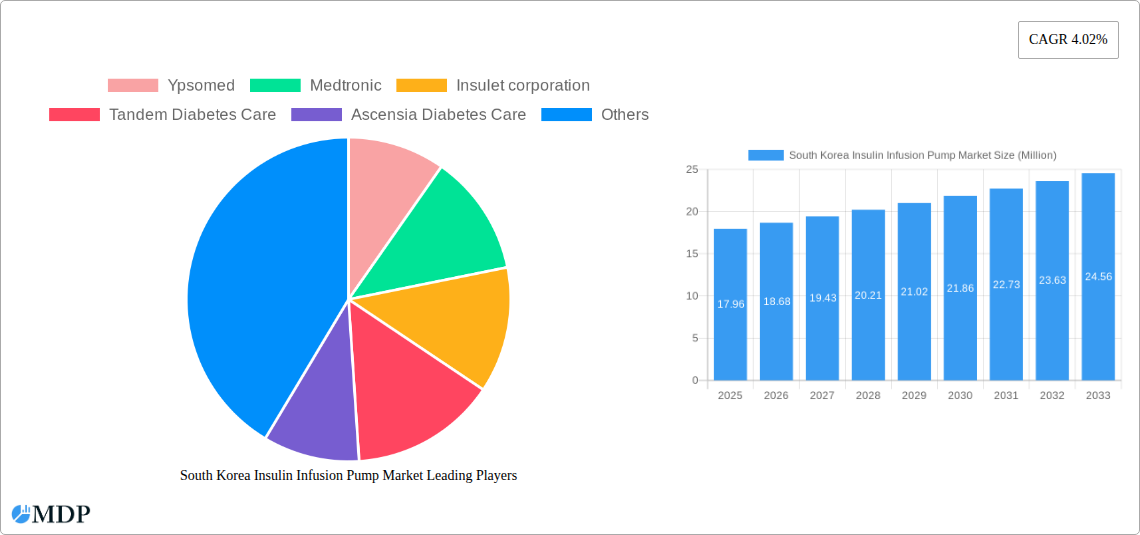

The South Korean insulin infusion pump market is projected for robust growth, estimated at USD 17.96 million in 2025, with a Compound Annual Growth Rate (CAGR) of 4.02% anticipated over the forecast period from 2025 to 2033. This sustained expansion is primarily driven by the increasing prevalence of diabetes in South Korea, a growing awareness of advanced diabetes management solutions, and supportive government initiatives aimed at improving healthcare accessibility. The market is experiencing a significant trend towards technologically advanced insulin pumps, including smart pumps with integrated continuous glucose monitoring (CGM) capabilities and automated insulin delivery systems. These innovations offer enhanced convenience, improved glycemic control, and a better quality of life for individuals with diabetes, thereby fueling demand. Key players like Ypsomed, Medtronic, Insulet Corporation, Tandem Diabetes Care, and Ascensia Diabetes Care are actively investing in research and development to launch next-generation devices, further stimulating market dynamism. The integration of telehealth and remote monitoring features is also a growing trend, allowing for more personalized and proactive diabetes care.

South Korea Insulin Infusion Pump Market Market Size (In Million)

Despite the positive outlook, certain restraints may temper the market's trajectory. High upfront costs associated with insulin infusion pump devices and ongoing expenses for consumables such as infusion sets and reservoirs can pose a financial barrier for some patients, particularly in a price-sensitive market. Furthermore, a lack of widespread insurance coverage for these devices and limited clinician training on their optimal use can hinder broader adoption. However, the increasing burden of diabetes and the clear clinical benefits of insulin pump therapy are expected to outweigh these challenges, driving sustained market penetration. The market is segmented into Insulin Pump Devices, Infusion Sets, and Reservoirs, with the Insulin Pump Device segment likely holding the largest share due to its central role in therapy. The growing adoption of patch pumps and hybrid closed-loop systems is a significant trend that will continue to shape the competitive landscape.

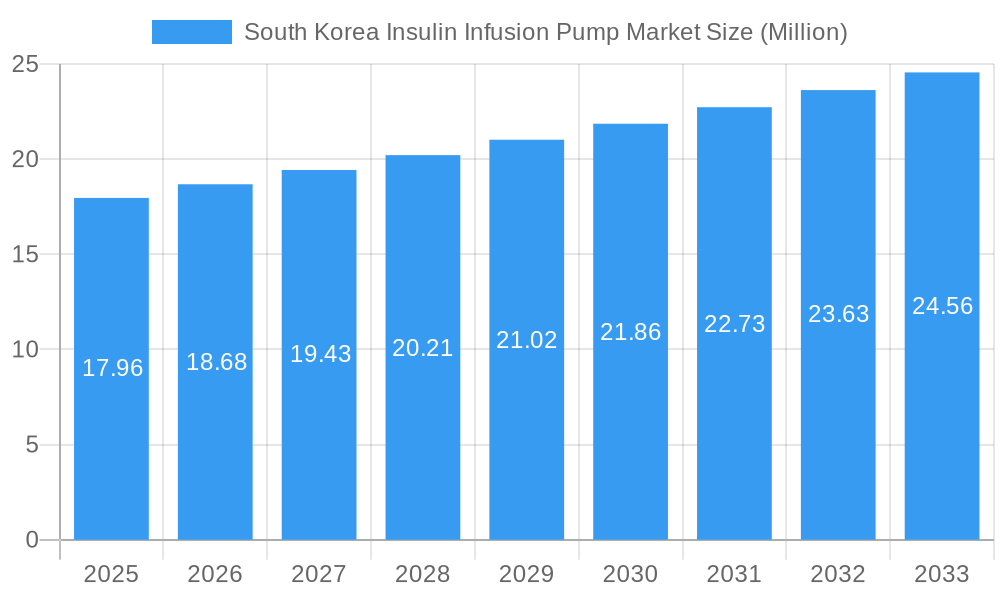

South Korea Insulin Infusion Pump Market Company Market Share

Here's the SEO-optimized, engaging report description for the South Korea Insulin Infusion Pump Market:

Report Title: South Korea Insulin Infusion Pump Market: Growth, Trends, and Forecast 2025-2033

Report Description:

Dive deep into the burgeoning South Korea insulin infusion pump market with our comprehensive report, meticulously crafted to provide unparalleled insights for industry stakeholders. This in-depth analysis covers the period from 2019 to 2033, with a detailed focus on the base year of 2025 and a robust forecast extending to 2033. We explore the critical drivers shaping this dynamic sector, including technological advancements in insulin pump devices, the growing adoption of smart insulin pumps, and increasing demand for sophisticated infusion sets and reservoirs. With high-traffic keywords like "South Korea insulin pump market," "diabetes technology South Korea," "insulin delivery devices," "Medtronic EOFlow acquisition," and "Tandem Diabetes Care innovations," this report ensures maximum search visibility. Understand the market concentration, key industry trends, leading market segments, product developments, growth drivers, challenges, emerging opportunities, and the strategies of leading players like Ypsomed, Medtronic, Insulet Corporation, Tandem Diabetes Care, and Ascensia Diabetes Care. Uncover actionable intelligence on the strategic importance of the insulin pump device segment, the evolving landscape of infusion sets, and the critical role of reservoirs in patient care. This report is essential for manufacturers, suppliers, investors, and healthcare providers seeking to capitalize on the significant growth potential of the South Korean diabetes management market.

South Korea Insulin Infusion Pump Market Market Dynamics & Concentration

The South Korea insulin infusion pump market is characterized by a moderate level of concentration, with key players actively vying for market share through product innovation and strategic acquisitions. The primary drivers of market growth include the increasing prevalence of diabetes, a growing awareness of advanced diabetes management solutions, and supportive government initiatives aimed at improving patient outcomes. Regulatory frameworks, while generally conducive to innovation, require adherence to stringent quality and safety standards, influencing product development timelines and market entry strategies. Product substitutes, such as traditional insulin pens and syringes, still hold a significant presence, but the convenience, accuracy, and improved glycemic control offered by insulin pumps are gradually shifting patient preferences. End-user trends highlight a strong demand for user-friendly, connected devices that integrate seamlessly with continuous glucose monitoring (CGM) systems, enabling a more personalized and proactive approach to diabetes management. Mergers and acquisitions (M&A) are playing a crucial role in shaping the competitive landscape. A notable development includes Medtronic's agreement to acquire EOFlow for approximately USD 738 Million in May 2023, signaling a strategic move to bolster its position in the tubeless insulin pump segment. This acquisition is anticipated to intensify competition with Insulet Corporation and Tandem Diabetes Care, both of whom have made significant strides in the patch pump and integrated pump technologies, respectively. The market is expected to witness further consolidation as companies seek to expand their product portfolios and geographical reach. The M&A deal count is projected to increase as companies look to acquire innovative technologies and gain access to new patient populations.

South Korea Insulin Infusion Pump Market Industry Trends & Analysis

The South Korea insulin infusion pump market is poised for significant expansion, driven by a confluence of escalating diabetes prevalence, rapid technological advancements, and a growing patient preference for sophisticated, automated insulin delivery systems. The market's growth trajectory is further bolstered by increased healthcare expenditure and government focus on chronic disease management, making insulin infusion pumps an increasingly vital component of diabetes care. A key trend is the surging demand for smart insulin pumps that offer advanced features such as closed-loop systems, predictive algorithms, and seamless integration with continuous glucose monitoring (CGM) devices. This technological evolution allows for more precise insulin delivery, leading to better glycemic control and an improved quality of life for individuals living with diabetes. The compound annual growth rate (CAGR) is expected to be robust, fueled by these innovations and a rising market penetration rate as awareness and accessibility improve.

Consumer preferences are shifting towards user-friendly, discreet, and personalized insulin delivery solutions. The emergence of tubeless and patch insulin pumps has been particularly impactful, offering enhanced convenience and mobility compared to traditional tethered systems. Companies like Insulet Corporation have already gained substantial market share with their tubeless offerings, compelling competitors to innovate in this space. Medtronic's proposed acquisition of EOFlow, a South Korean patch pump manufacturer, underscores the strategic importance of this segment. This move aims to strengthen Medtronic's competitive standing against Insulet and Tandem Diabetes Care, which itself has strategically expanded its portfolio by acquiring patch pump maker AMF Medical.

The competitive dynamics within the market are intensifying. Leading global players are investing heavily in research and development to introduce next-generation insulin pumps that offer enhanced functionalities, improved accuracy, and greater patient comfort. The integration of artificial intelligence (AI) and machine learning (ML) in insulin pump algorithms is another significant trend, enabling more adaptive and personalized insulin therapy. The forecast period from 2025 to 2033 is anticipated to witness a rapid adoption of these advanced technologies, further solidifying the market's growth. Economic factors, including the disposable income of the population and insurance coverage for advanced diabetes devices, also play a pivotal role in determining market penetration. As South Korea's economy continues to grow, so too does the affordability and accessibility of these life-changing technologies. The increasing number of diabetes-related complications and the associated healthcare costs also act as a significant incentive for adopting preventive and well-managed treatment modalities like insulin infusion pumps.

Leading Markets & Segments in South Korea Insulin Infusion Pump Market

The South Korea insulin infusion pump market is experiencing dynamic growth across its key segments, with a notable dominance driven by technological adoption and evolving patient needs. Within the broader Insulin Infusion Pump category, the Insulin Pump Device segment stands out as the primary revenue generator and growth catalyst. This dominance is fueled by continuous innovation in pump technology, including the development of more sophisticated, user-friendly, and connected devices. The increasing prevalence of type 1 and type 2 diabetes in South Korea, coupled with a growing awareness among patients and healthcare professionals about the benefits of advanced insulin delivery systems for better glycemic control, directly propels the demand for these devices.

- Key Drivers for Insulin Pump Device Dominance:

- Technological Advancements: The introduction of closed-loop systems, predictive insulin delivery algorithms, and seamless integration with continuous glucose monitoring (CGM) systems are significant differentiators.

- Patient Convenience and Quality of Life: Tubeless and patch pump designs are gaining traction, offering greater freedom of movement and discreet wearability.

- Improved Glycemic Control: Evidence showcasing superior HbA1c reduction and decreased incidence of hypoglycemia with pump therapy contributes to higher adoption rates.

- Government and Payer Support: Increasing recognition of the long-term cost-effectiveness of pump therapy in preventing diabetes-related complications may lead to broader reimbursement policies.

The Infusion Set segment, while secondary to the pump device, is intrinsically linked and experiences robust growth due to the recurring nature of its replacement. The effectiveness and patient comfort associated with an infusion set directly influence user satisfaction and adherence to pump therapy. Innovations in infusion set materials, insertion techniques, and tubing design are crucial for maintaining market share and customer loyalty. The demand for infusion sets is directly proportional to the installed base of insulin pump devices.

- Key Drivers for Infusion Set Growth:

- Replacement Cycles: Standard replacement schedules for infusion sets ensure consistent demand.

- Material Innovations: Development of hypoallergenic and more flexible materials enhances patient comfort and reduces site complications.

- Design Simplicity: Ease of insertion and connection with the pump device is a crucial factor for end-users.

- Compatibility: A wide range of compatible infusion sets for various pump models expands market reach.

The Reservoir segment, also known as insulin cartridges or vials, represents the consumable component of the insulin infusion pump system. Its market growth is directly tied to the overall insulin pump usage. As the adoption of insulin infusion pumps increases, so does the demand for reservoirs. The development of larger capacity reservoirs and improved insulin stability within these reservoirs are ongoing areas of innovation.

- Key Drivers for Reservoir Growth:

- Increased Pump Usage: Direct correlation with the number of active insulin pump users.

- Insulin Volume Requirements: Patients requiring higher daily insulin doses will necessitate more frequent reservoir replacements.

- Product Reliability and Safety: Ensuring the integrity of insulin storage and delivery from the reservoir is paramount.

Overall, the South Korean market exhibits a strong preference for integrated solutions, pushing innovation across all segments to enhance user experience and therapeutic outcomes. The strategic importance of the Insulin Pump Device segment, driven by cutting-edge technology and patient-centric designs, continues to be the primary engine of market expansion.

South Korea Insulin Infusion Pump Market Product Developments

Product developments in the South Korea insulin infusion pump market are rapidly advancing, focusing on enhanced user experience, improved therapeutic outcomes, and seamless connectivity. Innovations are largely driven by the integration of artificial intelligence (AI) and machine learning (ML) algorithms into pump functionalities, enabling more personalized and predictive insulin delivery. The trend towards tubeless and patch pumps continues, offering greater discreetness and freedom of movement. Furthermore, advancements in continuous glucose monitoring (CGM) integration are creating more sophisticated hybrid closed-loop systems, which automatically adjust insulin delivery based on real-time glucose readings. These developments aim to minimize the burden of diabetes management, reduce the incidence of hypo- and hyperglycemia, and ultimately improve the overall quality of life for individuals living with diabetes in South Korea.

Key Drivers of South Korea Insulin Infusion Pump Market Growth

The South Korea insulin infusion pump market's growth is propelled by several interconnected factors. Firstly, the rising incidence of diabetes, fueled by lifestyle changes and an aging population, creates a larger patient pool requiring advanced management solutions. Secondly, increasing patient awareness and a growing demand for convenient, technologically advanced diabetes management tools are driving adoption of insulin pumps over traditional methods. Technological innovation, particularly in the development of smart insulin pumps, closed-loop systems, and user-friendly designs like patch pumps, is a significant catalyst. Government initiatives and healthcare policies that promote better chronic disease management and potentially expand reimbursement for advanced diabetes technologies also play a crucial role. Furthermore, the proactive approach of leading companies in introducing cutting-edge products and expanding market access ensures continuous growth.

Challenges in the South Korea Insulin Infusion Pump Market Market

Despite the promising growth, the South Korea insulin infusion pump market faces several challenges. High initial costs of insulin pumps and associated consumables can be a significant barrier to adoption for a substantial portion of the population, particularly for those with limited insurance coverage or lower disposable income. Navigating the complex regulatory approval processes for new devices and software updates can also be time-consuming and resource-intensive for manufacturers. Fierce competition among established global players and emerging local innovators necessitates continuous investment in R&D and marketing, impacting profit margins. Moreover, ensuring adequate training and support for both healthcare professionals and patients on the proper use and maintenance of these sophisticated devices is crucial to maximize efficacy and patient satisfaction, yet can be a logistical hurdle.

Emerging Opportunities in South Korea Insulin Infusion Pump Market

Emerging opportunities in the South Korea insulin infusion pump market are centered around technological advancements and market expansion strategies. The increasing demand for integrated diabetes management systems, combining insulin pumps with advanced CGM and digital health platforms, presents a significant avenue for growth. Companies that can offer comprehensive solutions that provide real-time data insights and predictive analytics will be well-positioned. The development and adoption of more affordable and accessible insulin pump technologies, including potentially simpler patch pump designs or improved disposable options, could unlock new market segments. Strategic partnerships between pump manufacturers, CGM providers, and local healthcare institutions are also key to expanding reach and improving patient education. Furthermore, exploring untapped patient demographics and geographical regions within South Korea could reveal substantial growth potential.

Leading Players in the South Korea Insulin Infusion Pump Market Sector

- Ypsomed

- Medtronic

- Insulet Corporation

- Tandem Diabetes Care

- Ascensia Diabetes Care

Key Milestones in South Korea Insulin Infusion Pump Market Industry

- May 2023: Medtronic agreed to buy EOFlow, a company based in South Korea that makes a tubeless, disposable insulin pump on a patch. The company will offer a public tender to acquire all of EOFlow's outstanding public shares for 971 billion South Korean won (USD 738 million). This acquisition is poised to significantly impact market dynamics, enhancing Medtronic's competitive position against rivals like Insulet and Tandem Diabetes Care in the tubeless pump arena.

- May 2023: Tandem Diabetes Care plotted the late 2023 launch of a slimmed-down insulin pump with Dexcom and Abbott CGM integrations, indicating a continued focus on user convenience and enhanced connectivity with leading continuous glucose monitoring technologies.

Strategic Outlook for South Korea Insulin Infusion Pump Market Market

The strategic outlook for the South Korea insulin infusion pump market is exceptionally bright, driven by sustained innovation and increasing adoption of advanced diabetes management solutions. The market is set to benefit from the continued evolution of smart insulin pumps, particularly those incorporating sophisticated AI-driven algorithms for personalized insulin delivery and seamless integration with CGM devices. The ongoing consolidation, exemplified by Medtronic's acquisition of EOFlow, signals a trend towards companies strengthening their portfolios and expanding their market reach, particularly in the highly competitive tubeless and patch pump segments. Future growth will also be accelerated by a greater emphasis on patient-centric designs, affordability, and enhanced user education, making these life-changing technologies accessible to a broader patient population. Strategic partnerships and a focus on creating comprehensive diabetes management ecosystems will be crucial for long-term success and market leadership.

South Korea Insulin Infusion Pump Market Segmentation

-

1. Insulin Infusion Pump

- 1.1. Insulin Pump Device

- 1.2. Infusion Set

- 1.3. Reservoir

South Korea Insulin Infusion Pump Market Segmentation By Geography

- 1. South Korea

South Korea Insulin Infusion Pump Market Regional Market Share

Geographic Coverage of South Korea Insulin Infusion Pump Market

South Korea Insulin Infusion Pump Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications of Cryosurgery; Technological Advancements in Cryotherapy Equipment; Rising Preference for Minimally Invasive Techniques

- 3.3. Market Restrains

- 3.3.1. Hazardous Effects of Cryogenic Gases; Complexity of the Cryotherapy Mechanisms

- 3.4. Market Trends

- 3.4.1. Insulin Pump is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Insulin Infusion Pump Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 5.1.1. Insulin Pump Device

- 5.1.2. Infusion Set

- 5.1.3. Reservoir

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ypsomed

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medtronic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Insulet corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tandem Diabetes Care

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ascensia Diabetes Care

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Ypsomed

List of Figures

- Figure 1: South Korea Insulin Infusion Pump Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Insulin Infusion Pump Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Insulin Infusion Pump Market Revenue Million Forecast, by Insulin Infusion Pump 2020 & 2033

- Table 2: South Korea Insulin Infusion Pump Market Volume K Unit Forecast, by Insulin Infusion Pump 2020 & 2033

- Table 3: South Korea Insulin Infusion Pump Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South Korea Insulin Infusion Pump Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: South Korea Insulin Infusion Pump Market Revenue Million Forecast, by Insulin Infusion Pump 2020 & 2033

- Table 6: South Korea Insulin Infusion Pump Market Volume K Unit Forecast, by Insulin Infusion Pump 2020 & 2033

- Table 7: South Korea Insulin Infusion Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: South Korea Insulin Infusion Pump Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Insulin Infusion Pump Market?

The projected CAGR is approximately 4.02%.

2. Which companies are prominent players in the South Korea Insulin Infusion Pump Market?

Key companies in the market include Ypsomed, Medtronic, Insulet corporation, Tandem Diabetes Care, Ascensia Diabetes Care.

3. What are the main segments of the South Korea Insulin Infusion Pump Market?

The market segments include Insulin Infusion Pump.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications of Cryosurgery; Technological Advancements in Cryotherapy Equipment; Rising Preference for Minimally Invasive Techniques.

6. What are the notable trends driving market growth?

Insulin Pump is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Hazardous Effects of Cryogenic Gases; Complexity of the Cryotherapy Mechanisms.

8. Can you provide examples of recent developments in the market?

May 2023: Medtronic agreed to buy EOFlow, a company based in South Korea that makes a tubeless, disposable insulin pump on a patch. The company will offer a public tender to acquire all of EOFlow's outstanding public shares for 971 billion South Korean won (USD 738 million). The purchase will likely allow Medtronic to compete with Insulet, which has gained market share with its tubeless insulin pumps, and Tandem Diabetes Care, which agreed to buy patch pump maker AMF Medical last year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Insulin Infusion Pump Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Insulin Infusion Pump Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Insulin Infusion Pump Market?

To stay informed about further developments, trends, and reports in the South Korea Insulin Infusion Pump Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence