Key Insights

The South American functional beverage market, including energy drinks, sports drinks, fortified juices, dairy and dairy alternatives, and functional/fortified water, represents a significant investment opportunity. Driven by heightened health awareness, increased disposable incomes, and a preference for convenient, nutritious beverages, the market is poised for substantial growth. The projected CAGR of 8.8% signifies sustained expansion, propelled by rising concerns over lifestyle diseases and the growing popularity of fitness and sports. Key distribution channels include supermarkets, hypermarkets, pharmacies, health stores, and convenience stores, with online retail emerging as a channel with considerable growth potential. Leading global companies like Monster Beverage Corporation, PepsiCo, and Coca-Cola are strategically positioned to leverage this trend, while regional and niche brands contribute to market diversity. Brazil and Argentina lead the South American market due to their large populations and developed beverage industries. The "Rest of South America" segment also offers promising growth prospects, fueled by increasing urbanization and evolving consumer preferences. Despite challenges such as fluctuating raw material prices and intense competition, the long-term outlook for the South American functional beverage market remains positive, driven by continuous innovation and evolving consumer demand for functional and convenient beverage solutions.

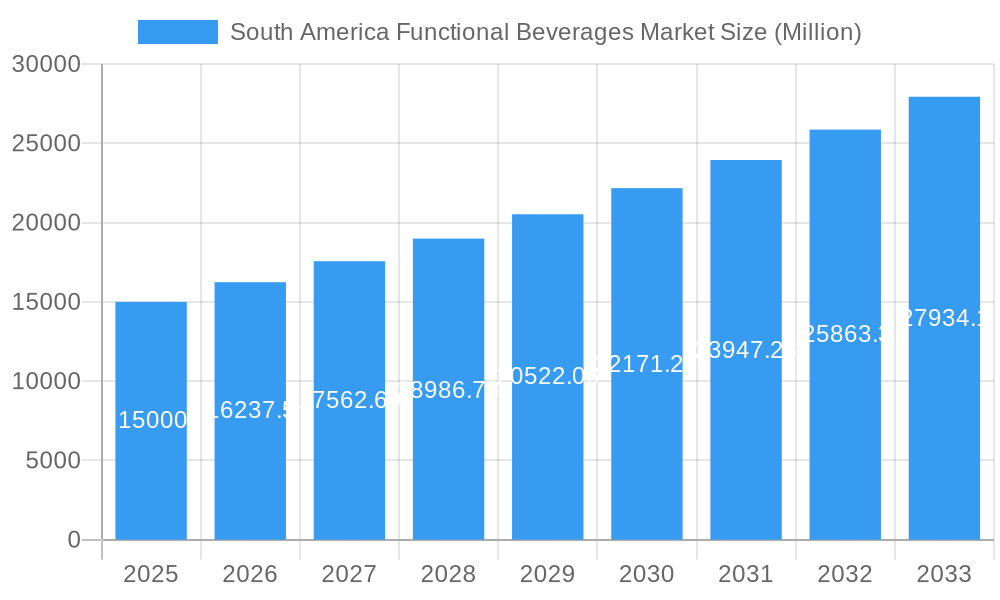

South America Functional Beverages Market Market Size (In Billion)

Market segmentation highlights crucial insights. Energy and sports drinks are expected to hold the largest market share due to their established presence and association with active lifestyles. However, fortified juices and dairy/dairy alternatives are experiencing robust growth, reflecting a consumer shift towards healthier choices. Functional/fortified water is also gaining traction as consumers prioritize hydration with added health benefits. Distribution channel analysis underscores the importance of varied retail strategies, with supermarkets and hypermarkets offering broad reach, while pharmacies and health stores cater to health-conscious consumers. Online retail is rapidly expanding, providing enhanced convenience and access to a wider product selection. The competitive landscape features a blend of global leaders and regional players, indicating significant investment potential and opportunities for smaller brands to establish themselves through specialized offerings and a regional focus. The forecast period of 2025-2033 is anticipated to witness considerable expansion, with opportunities for increased market penetration and product diversification.

South America Functional Beverages Market Company Market Share

This comprehensive report provides an in-depth analysis of the South America Functional Beverages Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed study period spanning 2019-2033 (Base Year: 2024, Forecast Period: 2025-2033), this report unveils the market's dynamics, trends, and future potential. The market is projected to reach 8982.7 million by 2033, exhibiting a CAGR of 8.8% during the forecast period.

South America Functional Beverages Market Dynamics & Concentration

The South American functional beverages market is characterized by a moderately concentrated landscape, with key players such as Monster Beverage Corporation, PepsiCo Inc, Danone SA, Keurig Dr Pepper Inc, Red Bull GmbH, The Coca-Cola Company, XL Energy Drink Corp, Fonterra Co-operative Group holding significant market share. Market concentration is influenced by factors such as brand recognition, distribution networks, and marketing strategies. The market share of the top five players is estimated at xx%.

Innovation is a key driver, with companies constantly introducing new products with enhanced functionalities, flavors, and health benefits. Regulatory frameworks regarding labeling, ingredients, and health claims play a crucial role. The presence of substitute products, such as juices and traditional beverages, exerts competitive pressure. Consumer trends towards health and wellness are fueling demand for functional beverages. Mergers and acquisitions (M&A) activity has been moderate, with approximately xx M&A deals recorded between 2019 and 2024. This activity is anticipated to increase as larger players seek to expand their market presence.

South America Functional Beverages Market Industry Trends & Analysis

The South American functional beverage market is experiencing robust growth, driven primarily by increasing health consciousness among consumers and the rising disposable incomes across various segments of the population. The market's expansion is further propelled by technological advancements in product formulation, packaging, and distribution. Consumer preferences are shifting towards natural, low-sugar, and functional products. The market is witnessing increased competition, with both established players and new entrants vying for market share. This competitive landscape is stimulating innovation and product diversification. Specific growth drivers include the rising prevalence of lifestyle diseases, increasing demand for convenience, and growing adoption of online retail channels. Market penetration of functional beverages remains relatively low in some regions, presenting substantial growth opportunities.

Leading Markets & Segments in South America Functional Beverages Market

Brazil is currently the dominant market for functional beverages in South America, accounting for approximately xx% of the total market value. This dominance is attributed to factors such as a large and growing population, rising disposable incomes, and a favorable regulatory environment. Other key markets include Mexico, Argentina, and Colombia.

Dominant Segments by Type: Energy drinks represent the largest segment, followed by sports drinks and fortified juices. The dairy and dairy alternative drinks segment is experiencing rapid growth due to increasing consumer preference for healthier options. The functional/fortified water category is witnessing a gradual increase in demand.

Dominant Segments by Distribution Channel: Supermarkets/hypermarkets constitute the leading distribution channel, followed by convenience stores and pharmacies/health stores. Online retail is steadily gaining traction, although it still accounts for a relatively smaller share of total sales.

Key Drivers by Region:

- Brazil: Robust economic growth, high consumer spending, and a strong distribution infrastructure.

- Mexico: Growing middle class, increasing health consciousness, and a large young population.

- Argentina: High demand for energy drinks and sports drinks, coupled with a well-developed retail sector.

- Colombia: Rising disposable incomes and increasing popularity of functional beverages among health-conscious consumers.

The dominance of specific segments and regions is a reflection of varied socio-economic factors, consumer preferences, and regulatory frameworks.

South America Functional Beverages Market Product Developments

Recent product innovations have focused on incorporating natural ingredients, reducing sugar content, and enhancing functional properties. Companies are also leveraging advanced packaging technologies to extend shelf life and improve product appeal. These developments are driven by the growing consumer demand for healthier and more convenient functional beverages. Technological advancements in product formulation, such as the inclusion of probiotics and adaptogens, are creating unique competitive advantages. The development of functional beverages aligned with emerging consumer preferences, such as plant-based options, is expected to further drive market growth.

Key Drivers of South America Functional Beverages Market Growth

The South American functional beverage market is propelled by several key factors:

- Rising Health Consciousness: Consumers are increasingly aware of the health benefits of functional beverages, leading to higher demand for products that enhance physical performance, boost immunity, and improve overall wellbeing.

- Growing Disposable Incomes: Increasing disposable incomes across the region are enabling consumers to spend more on premium and functional beverages.

- Favorable Regulatory Environment: Supportive regulatory frameworks are encouraging investment and innovation in the functional beverage sector. (Specific examples would be included here in a full report.)

Challenges in the South America Functional Beverages Market Market

Several factors pose challenges to the market's growth:

- Fluctuating Raw Material Prices: The cost of raw materials can significantly impact the profitability of functional beverage producers.

- Stringent Regulatory Requirements: Compliance with labeling and health claims regulations can be demanding.

- Intense Competition: The market is highly competitive, with numerous players vying for market share. This competition intensifies price pressures and necessitates continuous innovation.

Emerging Opportunities in South America Functional Beverages Market

Significant opportunities exist for growth in the South American functional beverages market. These include expansion into untapped markets, the development of innovative products catering to specific consumer segments, strategic partnerships with local distributors, and the leveraging of e-commerce platforms to reach broader consumer bases. Technological advancements in product formulation and packaging will continue to create new opportunities for growth.

Leading Players in the South America Functional Beverages Market Sector

- Monster Beverage Corporation

- PepsiCo Inc

- Danone SA

- Keurig Dr Pepper Inc

- Red Bull GmbH

- The Coca-Cola Company

- XL Energy Drink Corp

- Fonterra Co-operative Group

Key Milestones in South America Functional Beverages Market Industry

- March 2021: Red Bull launched a new summer limited edition in Brazil, highlighting the importance of seasonal product variations.

- August 2022: Urbe Cafe entered the Brazilian market with a cold brew launch, signifying a growing interest in alternative energy drink options.

- November 2022: BioZen expanded its product line in Brazil with kefir drinks, showcasing the burgeoning interest in gut health and low-sugar products.

Strategic Outlook for South America Functional Beverages Market Market

The South American functional beverages market holds immense long-term growth potential. Strategic opportunities include focusing on niche segments, expanding distribution channels, and investing in research and development to create innovative products. Companies that effectively address consumer health concerns and adapt to evolving market trends are well-positioned to capitalize on the opportunities in this dynamic market. The market's future growth will be largely driven by consumer demand for healthier options, increasing disposable incomes, and continued innovation within the industry.

South America Functional Beverages Market Segmentation

-

1. Type

- 1.1. Energy Drinks

- 1.2. Sports Drinks

- 1.3. Fortified Juices

- 1.4. Dairy and Dairy Alternative Drinks

- 1.5. Functional/Fortified Water

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Pharmacies/Health Stores

- 2.3. Convenience Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Functional Beverages Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Functional Beverages Market Regional Market Share

Geographic Coverage of South America Functional Beverages Market

South America Functional Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumer Inclination Toward Low-sugar/Sugar-free Beverages; Expenditure on Advertisement and Promotional Activities

- 3.3. Market Restrains

- 3.3.1. Concerns Over Health Issues Associated with Functional Beverages

- 3.4. Market Trends

- 3.4.1. Augmented Expenditure on Advertisement and Promotional Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Functional Beverages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Energy Drinks

- 5.1.2. Sports Drinks

- 5.1.3. Fortified Juices

- 5.1.4. Dairy and Dairy Alternative Drinks

- 5.1.5. Functional/Fortified Water

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Pharmacies/Health Stores

- 5.2.3. Convenience Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Functional Beverages Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Energy Drinks

- 6.1.2. Sports Drinks

- 6.1.3. Fortified Juices

- 6.1.4. Dairy and Dairy Alternative Drinks

- 6.1.5. Functional/Fortified Water

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Pharmacies/Health Stores

- 6.2.3. Convenience Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Functional Beverages Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Energy Drinks

- 7.1.2. Sports Drinks

- 7.1.3. Fortified Juices

- 7.1.4. Dairy and Dairy Alternative Drinks

- 7.1.5. Functional/Fortified Water

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Pharmacies/Health Stores

- 7.2.3. Convenience Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Functional Beverages Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Energy Drinks

- 8.1.2. Sports Drinks

- 8.1.3. Fortified Juices

- 8.1.4. Dairy and Dairy Alternative Drinks

- 8.1.5. Functional/Fortified Water

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Pharmacies/Health Stores

- 8.2.3. Convenience Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Monster Beverage Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 PepsiCo Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Danone SA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Keurig Dr Pepper Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Red Bull GmbH

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 The Coca-Cola Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 XL Energy Drink Corp *List Not Exhaustive

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Fonterra Co-operative Group

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Monster Beverage Corporation

List of Figures

- Figure 1: South America Functional Beverages Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America Functional Beverages Market Share (%) by Company 2025

List of Tables

- Table 1: South America Functional Beverages Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: South America Functional Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Functional Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: South America Functional Beverages Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: South America Functional Beverages Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: South America Functional Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Functional Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: South America Functional Beverages Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: South America Functional Beverages Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: South America Functional Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Functional Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: South America Functional Beverages Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: South America Functional Beverages Market Revenue million Forecast, by Type 2020 & 2033

- Table 14: South America Functional Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Functional Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: South America Functional Beverages Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Functional Beverages Market?

The projected CAGR is approximately 8.8%.

2. Which companies are prominent players in the South America Functional Beverages Market?

Key companies in the market include Monster Beverage Corporation, PepsiCo Inc, Danone SA, Keurig Dr Pepper Inc, Red Bull GmbH, The Coca-Cola Company, XL Energy Drink Corp *List Not Exhaustive, Fonterra Co-operative Group.

3. What are the main segments of the South America Functional Beverages Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8982.7 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Inclination Toward Low-sugar/Sugar-free Beverages; Expenditure on Advertisement and Promotional Activities.

6. What are the notable trends driving market growth?

Augmented Expenditure on Advertisement and Promotional Activities.

7. Are there any restraints impacting market growth?

Concerns Over Health Issues Associated with Functional Beverages.

8. Can you provide examples of recent developments in the market?

November 2022: BioZen launched its kefir drinks in Brazil. The company initially launched kombucha in the market and is expanding its presence in the low-sugar and gut health-proclaiming drinks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Functional Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Functional Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Functional Beverages Market?

To stay informed about further developments, trends, and reports in the South America Functional Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence