Key Insights

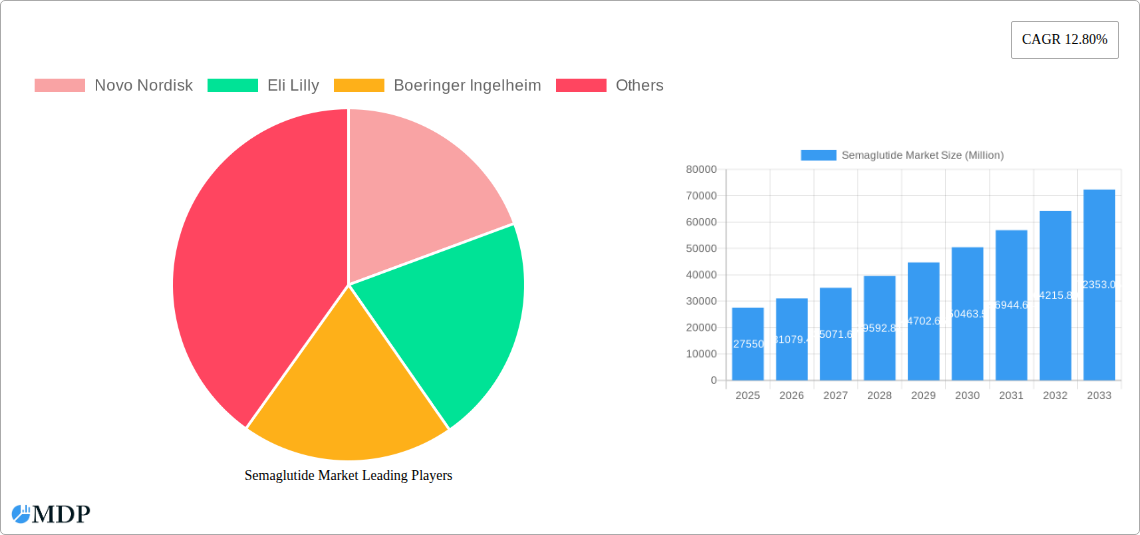

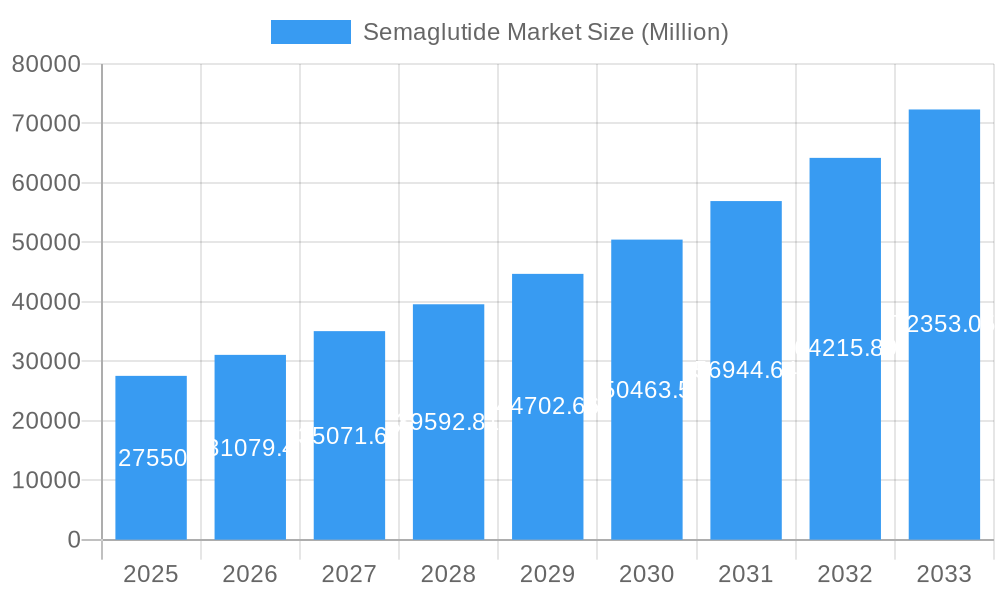

The global Semaglutide market is poised for substantial expansion, projected to reach \$27.55 billion with an impressive Compound Annual Growth Rate (CAGR) of 12.80% during the forecast period of 2025-2033. This robust growth is primarily fueled by the escalating prevalence of type 2 diabetes and obesity worldwide, coupled with a growing demand for effective weight management solutions. Key drivers include the sustained innovation and development of advanced semaglutide-based therapies, such as Wegovy, Rybelsus, and Ozempic, which have demonstrated significant efficacy in clinical trials and real-world applications. The increasing awareness among patients and healthcare providers about the benefits of GLP-1 receptor agonists for both glycemic control and weight reduction further underpins this market surge.

Semaglutide Market Market Size (In Billion)

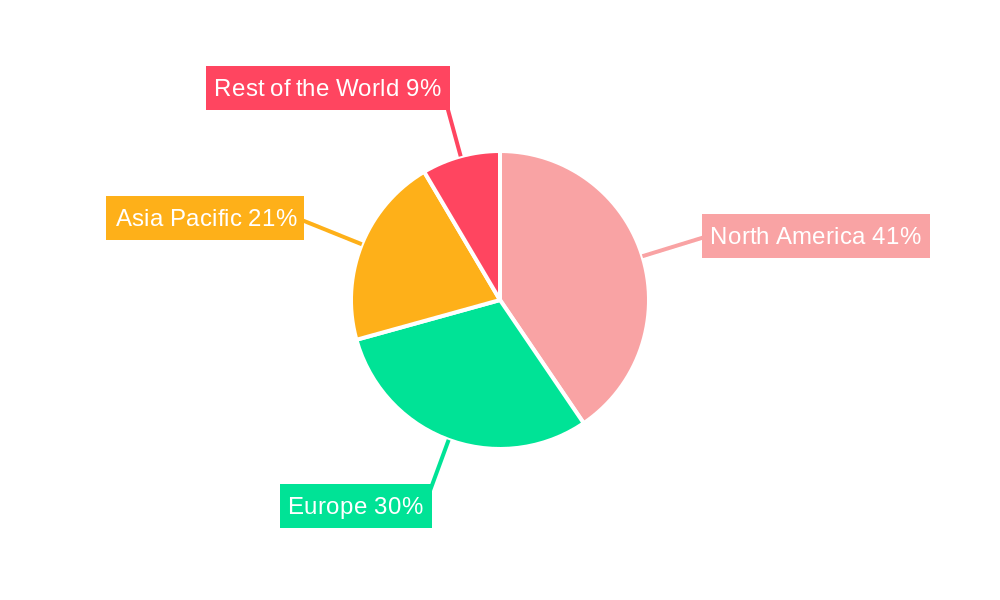

The market dynamics are further shaped by the competitive landscape dominated by major pharmaceutical players like Novo Nordisk, Eli Lilly, and Boeringer Ingelheim, who are actively investing in research and development to expand their product pipelines and geographical reach. Emerging trends indicate a shift towards personalized medicine and combination therapies to address the complex nature of metabolic disorders. While the market exhibits strong growth, potential restraints such as stringent regulatory approvals, high treatment costs, and the emergence of alternative therapeutic options could pose challenges. Geographically, North America, particularly the United States, is expected to lead the market due to high healthcare expenditure and early adoption of innovative treatments. Europe and the Asia Pacific region are also anticipated to witness significant growth, driven by increasing disease burden and improving healthcare infrastructure.

Semaglutide Market Company Market Share

Semaglutide Market Analysis: Comprehensive Report 2019-2033

This in-depth market research report provides a detailed analysis of the global Semaglutide market, offering critical insights for industry stakeholders. Covering the historical period of 2019-2024, the base year of 2025, and a forecast period extending to 2033, this report delves into market dynamics, trends, leading segments, product developments, growth drivers, challenges, opportunities, key players, and strategic outlook. With a focus on high-traffic keywords such as "Semaglutide market," "diabetes treatment," "weight loss drugs," "Novo Nordisk," "Eli Lilly," and "Ozempic," this report ensures maximum search visibility and caters to the information needs of pharmaceutical companies, healthcare providers, investors, and regulatory bodies.

Semaglutide Market Market Dynamics & Concentration

The Semaglutide market exhibits a highly concentrated structure, primarily dominated by a few key players with significant market share. Novo Nordisk, a leading innovator, holds a substantial portion of the market through its popular brands like Ozempic, Rybelsus, and Wegovy. Eli Lilly and Boehringer Ingelheim are also key competitors, actively investing in research and development to capture a larger market share. Innovation drivers are heavily focused on expanding therapeutic applications beyond type 2 diabetes and obesity, including cardiovascular risk reduction and other metabolic disorders. The regulatory framework, particularly from bodies like the FDA and EMA, plays a crucial role in approving new indications and ensuring drug safety and efficacy, which in turn influences market dynamics. Product substitutes, while limited for direct GLP-1 receptor agonists, include other therapeutic classes for diabetes and weight management. End-user trends highlight an increasing demand for effective and convenient treatment options for chronic conditions, with patient preference shifting towards injectable and oral formulations offering improved outcomes and reduced side effects. Mergers and acquisitions (M&A) activities are relatively moderate in this highly specialized market, with companies focusing on organic growth and strategic partnerships to enhance their product portfolios and market reach. The market share of leading players is estimated to be concentrated, with Novo Nordisk holding over 60% of the global Semaglutide market value in 2025. M&A deal counts have remained low, reflecting the established dominance of existing players.

Semaglutide Market Industry Trends & Analysis

The global Semaglutide market is experiencing unprecedented growth, propelled by a confluence of escalating healthcare needs and groundbreaking therapeutic advancements. The primary market growth driver stems from the surging global prevalence of type 2 diabetes and obesity, conditions that necessitate effective long-term management strategies. Semaglutide, as a potent glucagon-like peptide-1 (GLP-1) receptor agonist, has emerged as a transformative therapy, demonstrating superior efficacy in glycemic control and significant weight reduction. Technological disruptions are primarily centered around advancements in drug delivery systems, leading to the development of more convenient oral formulations alongside established injectable options, enhancing patient adherence and accessibility. Consumer preferences are increasingly aligning with therapies that offer comprehensive health benefits, such as the demonstrated cardiovascular risk reduction associated with Semaglutide. This broadened therapeutic utility is a significant market penetration accelerator. The competitive dynamics within the Semaglutide market are characterized by intense innovation and strategic maneuvering by key players. The market penetration of Semaglutide is projected to reach over 25% in the type 2 diabetes market and 15% in the obesity market by 2028. The Compound Annual Growth Rate (CAGR) for the Semaglutide market is estimated to be around 18% during the forecast period of 2025-2033. The expanding therapeutic indications, coupled with a growing understanding of the drug's multifaceted benefits, are expected to sustain this robust growth trajectory. Furthermore, advancements in manufacturing processes are crucial for meeting the escalating demand and ensuring the consistent availability of these life-changing medications. The market is also witnessing increased research into novel applications and potential synergies with other therapeutic modalities.

Leading Markets & Segments in Semaglutide Market

The Semaglutide market's dominance is intricately linked to its therapeutic applications and brand segmentation, with Wegovy, Rybelsus, and Ozempic standing as the leading contenders. Geographically, North America, particularly the United States, represents the largest and most dynamic market for Semaglutide. This is attributable to several factors, including a high prevalence of type 2 diabetes and obesity, advanced healthcare infrastructure, robust reimbursement policies, and significant patient and physician adoption of innovative treatments. Economic policies in the US favor the uptake of novel pharmaceuticals, supported by a well-established pharmaceutical market and a proactive regulatory environment.

- United States: A key driver of dominance is the substantial patient pool suffering from obesity and type 2 diabetes, coupled with a high per capita healthcare spending. The market penetration for Semaglutide in the US is significantly higher than in other regions due to strong insurance coverage and a proactive approach to chronic disease management.

- Europe: European markets, including Germany, the UK, and France, are also substantial contributors, driven by an aging population and increasing awareness of metabolic diseases. However, market access and reimbursement policies can vary significantly across European countries, influencing adoption rates.

- Asia Pacific: The Asia Pacific region, particularly China and Japan, presents a rapidly growing market. Factors such as a rising middle class, increasing urbanization, and a growing burden of lifestyle diseases are fueling demand. However, market development in this region is often characterized by diverse regulatory landscapes and varying levels of healthcare accessibility.

In terms of brand segmentation, Wegovy has emerged as a frontrunner in the obesity market, capitalizing on its proven efficacy in significant weight loss. Ozempic continues to hold a commanding position in the type 2 diabetes market, renowned for its glucose-lowering capabilities and cardiovascular benefits. Rybelsus, as the first oral GLP-1 receptor agonist, offers a convenient alternative, attracting a segment of patients who prefer non-injectable treatments. The demand for these brands is further amplified by ongoing clinical trials exploring new indications, such as non-alcoholic steatohepatitis (NASH) and renal disease, which are poised to expand their market reach and dominance.

Semaglutide Market Product Developments

The Semaglutide market is characterized by continuous product innovation aimed at enhancing patient convenience and expanding therapeutic applications. Key developments include the evolution from injectable formulations to the groundbreaking development of Rybelsus, the first oral GLP-1 receptor agonist, which significantly improves patient adherence and accessibility. Further advancements are anticipated in formulations with extended release profiles and combination therapies designed to address multiple co-morbidities. The competitive advantage of Semaglutide lies in its robust clinical data demonstrating superior efficacy in glycemic control and weight reduction, alongside proven cardiovascular benefits. These advancements are crucial for maintaining market leadership and capturing a larger share of the growing diabetes and obesity treatment landscape.

Key Drivers of Semaglutide Market Growth

The Semaglutide market is propelled by several key drivers. The escalating global prevalence of type 2 diabetes and obesity represents a fundamental market driver, creating a vast patient population requiring effective therapeutic interventions. Technological advancements in drug delivery systems, particularly the development of oral formulations, are enhancing patient convenience and adherence, thereby expanding market accessibility. Furthermore, robust clinical evidence highlighting the significant cardiovascular benefits and substantial weight loss efficacy of Semaglutide are crucial for driving prescription rates and physician confidence. Regulatory approvals for new indications beyond type 2 diabetes, such as for obesity management and potential cardiovascular risk reduction, are also critical growth accelerators.

Challenges in the Semaglutide Market Market

Despite its strong growth trajectory, the Semaglutide market faces several challenges. The significant demand surge, particularly for weight loss indications, has led to widespread supply chain disruptions and drug shortages, impacting patient access and physician prescribing patterns. The high cost of Semaglutide therapies poses a barrier to access for a significant portion of the patient population, particularly in regions with limited healthcare coverage. Intense competition from emerging GLP-1 receptor agonists and other weight management therapies necessitates continuous innovation and strategic market positioning. Furthermore, the risk of adverse events, although generally manageable, requires careful patient monitoring and physician oversight, which can influence adoption rates.

Emerging Opportunities in Semaglutide Market

The Semaglutide market is ripe with emerging opportunities. The expansion of therapeutic indications into areas such as non-alcoholic steatohepatitis (NASH), chronic kidney disease, and potentially neurodegenerative disorders presents significant avenues for market growth. Strategic partnerships between pharmaceutical companies and technology providers for enhanced patient monitoring and digital health solutions are expected to improve treatment outcomes and patient engagement. Furthermore, the development of novel delivery mechanisms, such as long-acting injectables or alternative administration routes, can further enhance patient convenience and market penetration. Exploring combination therapies that target multiple disease pathways simultaneously offers a promising strategy for enhanced efficacy and expanded market reach.

Leading Players in the Semaglutide Market Sector

- Novo Nordisk

- Eli Lilly

- Boehringer Ingelheim

Key Milestones in Semaglutide Market Industry

- November 2023: Novo Nordisk announced that Wegovy was shown to reduce the risk in people with cardiovascular disease or another cardiovascular event by 20%. The results were confirmed in a presentation of the entire dataset at the American Heart Association conference in Philadelphia. This milestone significantly enhances the market position of Wegovy by solidifying its cardiovascular benefits, potentially opening new treatment pathways and expanding its patient demographic.

- September 2023: Novo Nordisk advised the Ozempic Medicine Shortage Action Group and Therapeutic Goods Administration that the supply of weight loss drugs throughout FY 2023 and FY 2024 will be limited. The company stated that the demand for this drug has surged in recent months, particularly for the low-dose (0.25/0.5 mg) version, and additional demand is created by a rapid increase in prescription for ‘off-label’ use. This highlights the unprecedented demand for Semaglutide-based therapies and the resultant supply chain challenges, underscoring the drug's immense market impact and the need for robust manufacturing and distribution strategies.

Strategic Outlook for Semaglutide Market Market

The strategic outlook for the Semaglutide market is exceptionally positive, driven by an expanding therapeutic landscape and increasing global demand. Key growth accelerators include the ongoing expansion of approved indications, particularly in cardiovascular risk reduction and other metabolic disorders, which will broaden the addressable market significantly. Pharmaceutical companies are expected to focus on enhancing manufacturing capacity to alleviate supply chain constraints and meet the surging demand. Strategic collaborations aimed at developing next-generation GLP-1 receptor agonists with improved efficacy, safety profiles, and novel delivery methods will be critical for maintaining a competitive edge. Furthermore, the increasing focus on patient-centric care and the integration of digital health solutions will play a pivotal role in optimizing treatment outcomes and solidifying market dominance for leading Semaglutide players.

Semaglutide Market Segmentation

-

1. Brand

- 1.1. Wegovy

- 1.2. Rybelsus

- 1.3. Ozempic

Semaglutide Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. Spain

- 2.3. Italy

- 2.4. France

- 2.5. United Kingdom

- 2.6. Switzerland

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. Japan

- 3.2. India

- 3.3. Rest of Asia Pacific

- 4. Rest of the World

Semaglutide Market Regional Market Share

Geographic Coverage of Semaglutide Market

Semaglutide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Prevalence of Diabetes Increases Risk of Diabetic Retinopathy; Availability of Advanced Technology and Minimally Invasive Laser Technique

- 3.3. Market Restrains

- 3.3.1. ; Extended Approval Time for Drugs

- 3.4. Market Trends

- 3.4.1. Wegovy is Expected to Register Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semaglutide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Brand

- 5.1.1. Wegovy

- 5.1.2. Rybelsus

- 5.1.3. Ozempic

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Brand

- 6. North America Semaglutide Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Brand

- 6.1.1. Wegovy

- 6.1.2. Rybelsus

- 6.1.3. Ozempic

- 6.1. Market Analysis, Insights and Forecast - by Brand

- 7. Europe Semaglutide Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Brand

- 7.1.1. Wegovy

- 7.1.2. Rybelsus

- 7.1.3. Ozempic

- 7.1. Market Analysis, Insights and Forecast - by Brand

- 8. Asia Pacific Semaglutide Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Brand

- 8.1.1. Wegovy

- 8.1.2. Rybelsus

- 8.1.3. Ozempic

- 8.1. Market Analysis, Insights and Forecast - by Brand

- 9. Rest of the World Semaglutide Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Brand

- 9.1.1. Wegovy

- 9.1.2. Rybelsus

- 9.1.3. Ozempic

- 9.1. Market Analysis, Insights and Forecast - by Brand

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Novo Nordisk

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Eli Lilly

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Boeringer Ingelheim

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.1 Novo Nordisk

List of Figures

- Figure 1: Global Semaglutide Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Semaglutide Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Semaglutide Market Revenue (Million), by Brand 2025 & 2033

- Figure 4: North America Semaglutide Market Volume (K Unit), by Brand 2025 & 2033

- Figure 5: North America Semaglutide Market Revenue Share (%), by Brand 2025 & 2033

- Figure 6: North America Semaglutide Market Volume Share (%), by Brand 2025 & 2033

- Figure 7: North America Semaglutide Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Semaglutide Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Semaglutide Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Semaglutide Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Semaglutide Market Revenue (Million), by Brand 2025 & 2033

- Figure 12: Europe Semaglutide Market Volume (K Unit), by Brand 2025 & 2033

- Figure 13: Europe Semaglutide Market Revenue Share (%), by Brand 2025 & 2033

- Figure 14: Europe Semaglutide Market Volume Share (%), by Brand 2025 & 2033

- Figure 15: Europe Semaglutide Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Semaglutide Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Semaglutide Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Semaglutide Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Semaglutide Market Revenue (Million), by Brand 2025 & 2033

- Figure 20: Asia Pacific Semaglutide Market Volume (K Unit), by Brand 2025 & 2033

- Figure 21: Asia Pacific Semaglutide Market Revenue Share (%), by Brand 2025 & 2033

- Figure 22: Asia Pacific Semaglutide Market Volume Share (%), by Brand 2025 & 2033

- Figure 23: Asia Pacific Semaglutide Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Semaglutide Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific Semaglutide Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Semaglutide Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Rest of the World Semaglutide Market Revenue (Million), by Brand 2025 & 2033

- Figure 28: Rest of the World Semaglutide Market Volume (K Unit), by Brand 2025 & 2033

- Figure 29: Rest of the World Semaglutide Market Revenue Share (%), by Brand 2025 & 2033

- Figure 30: Rest of the World Semaglutide Market Volume Share (%), by Brand 2025 & 2033

- Figure 31: Rest of the World Semaglutide Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Rest of the World Semaglutide Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Rest of the World Semaglutide Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Semaglutide Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semaglutide Market Revenue Million Forecast, by Brand 2020 & 2033

- Table 2: Global Semaglutide Market Volume K Unit Forecast, by Brand 2020 & 2033

- Table 3: Global Semaglutide Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Semaglutide Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Semaglutide Market Revenue Million Forecast, by Brand 2020 & 2033

- Table 6: Global Semaglutide Market Volume K Unit Forecast, by Brand 2020 & 2033

- Table 7: Global Semaglutide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Semaglutide Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global Semaglutide Market Revenue Million Forecast, by Brand 2020 & 2033

- Table 16: Global Semaglutide Market Volume K Unit Forecast, by Brand 2020 & 2033

- Table 17: Global Semaglutide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Semaglutide Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Germany Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Spain Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Italy Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: France Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: France Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Switzerland Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Switzerland Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Global Semaglutide Market Revenue Million Forecast, by Brand 2020 & 2033

- Table 34: Global Semaglutide Market Volume K Unit Forecast, by Brand 2020 & 2033

- Table 35: Global Semaglutide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Semaglutide Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Japan Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Japan Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: India Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: India Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Asia Pacific Semaglutide Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Asia Pacific Semaglutide Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Semaglutide Market Revenue Million Forecast, by Brand 2020 & 2033

- Table 44: Global Semaglutide Market Volume K Unit Forecast, by Brand 2020 & 2033

- Table 45: Global Semaglutide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Semaglutide Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semaglutide Market?

The projected CAGR is approximately 12.80%.

2. Which companies are prominent players in the Semaglutide Market?

Key companies in the market include Novo Nordisk, Eli Lilly, Boeringer Ingelheim.

3. What are the main segments of the Semaglutide Market?

The market segments include Brand.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.55 Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Prevalence of Diabetes Increases Risk of Diabetic Retinopathy; Availability of Advanced Technology and Minimally Invasive Laser Technique.

6. What are the notable trends driving market growth?

Wegovy is Expected to Register Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

; Extended Approval Time for Drugs.

8. Can you provide examples of recent developments in the market?

November 2023: Novo Nordisk announced that Wegovy was shown to reduce the risk in people with cardiovascular disease or another cardiovascular event by 20%. The results were confirmed in a presentation of the entire dataset at the American Heart Association conference in Philadelphia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semaglutide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semaglutide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semaglutide Market?

To stay informed about further developments, trends, and reports in the Semaglutide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence