Key Insights

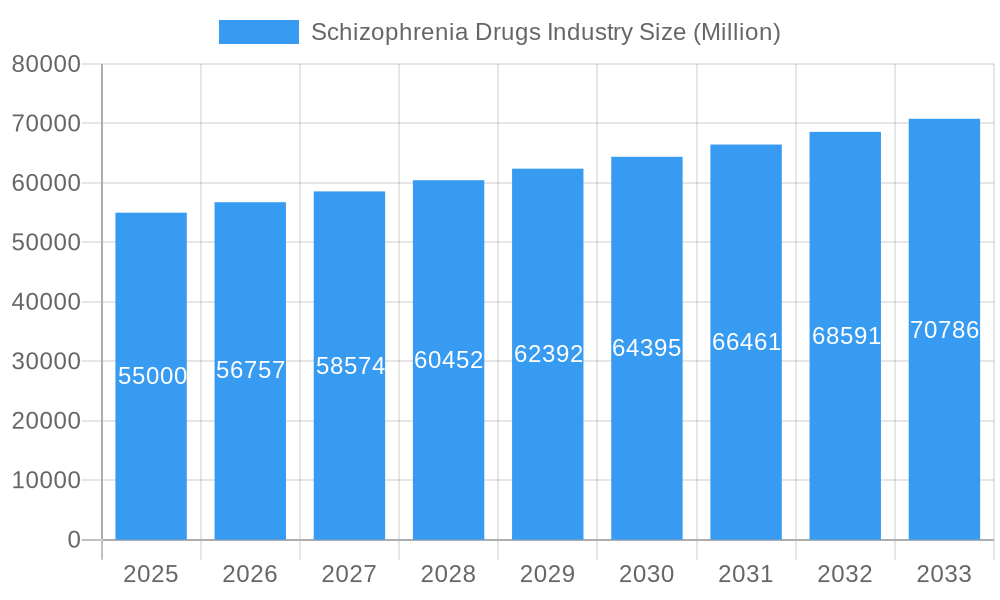

The global Schizophrenia Drugs market is poised for significant growth, projected to reach an estimated USD 55,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.24% through 2033. This expansion is largely driven by the increasing prevalence of schizophrenia, rising awareness and diagnosis rates, and continuous advancements in drug development, particularly the introduction of novel therapeutic classes and more effective treatment formulations. The market is experiencing a notable shift towards more sophisticated treatment options, including third-generation antipsychotics, which offer improved efficacy and reduced side effects compared to their predecessors. The growing demand for long-acting injectable formulations over oral medications is a key trend, offering better patient adherence and treatment outcomes. Furthermore, a robust pipeline of investigational drugs targeting unmet needs within schizophrenia management is anticipated to fuel further market evolution and address diverse patient populations more effectively.

Schizophrenia Drugs Industry Market Size (In Billion)

Despite the promising outlook, several factors could influence the market's trajectory. High research and development costs associated with bringing new antipsychotic drugs to market, coupled with stringent regulatory approvals, present significant restraints. Patent expiries of established blockbuster drugs and the subsequent rise of generic competition also pose a challenge to revenue growth for certain segments. However, the increasing investment in mental health infrastructure and government initiatives aimed at improving access to treatment, especially in emerging economies, are expected to counterbalance these restraints. The market is characterized by intense competition among major pharmaceutical players, including Alkermes Plc, AbbVie, Karuna Therapeutics, Eli Lilly and Company, and AstraZeneca, all vying for market share through strategic partnerships, mergers, and the development of innovative therapies. The focus on personalized medicine and the exploration of combination therapies are emerging trends that will likely shape the future landscape of schizophrenia treatment.

Schizophrenia Drugs Industry Company Market Share

Here's an SEO-optimized and engaging report description for the Schizophrenia Drugs Industry, designed for maximum visibility and industry stakeholder attraction.

Schizophrenia Drugs Industry Market Dynamics & Concentration

The schizophrenia drugs industry is characterized by a moderate level of market concentration, with a few key players dominating market share. Major companies like Alkermes Plc, AbbVie (Allergan Plc), Karuna Therapeutics, Eli Lilly and Company, AstraZeneca, Otsuka America Pharmaceutical Inc, Sumitomo Dainippon Pharma, Vanda Pharmaceuticals, Johnson & Johnson, Bristol-Myers Squibb and Company, Acadia Pharmaceuticals, and Pfizer Inc. are at the forefront of research, development, and commercialization. Innovation is a primary driver, fueled by a growing understanding of the neurobiological underpinnings of schizophrenia and the demand for more effective and targeted treatments with fewer side effects. Regulatory frameworks, overseen by agencies like the FDA and EMA, play a crucial role in approving new drug candidates and ensuring patient safety. While product substitutes exist in the form of behavioral therapies and other treatment modalities, pharmaceutical interventions remain central. End-user trends indicate a demand for long-acting injectables and oral formulations offering improved adherence and patient convenience. Mergers and acquisitions (M&A) activity, while not consistently high, has been significant as larger pharmaceutical companies seek to bolster their pipelines and acquire innovative technologies. For instance, an estimated xx M&A deals were recorded during the historical period of 2019-2024, indicating strategic consolidation and investment. The market share distribution highlights the influence of established antipsychotics alongside the emergence of novel therapeutic classes.

Schizophrenia Drugs Industry Industry Trends & Analysis

The global schizophrenia drugs market is poised for significant expansion, driven by a confluence of factors that underscore a robust growth trajectory. The estimated Compound Annual Growth Rate (CAGR) for the forecast period of 2025–2033 is projected to be xx%, reflecting an increasing demand for effective treatments for schizophrenia and related neuropsychiatric disorders. This growth is propelled by substantial investments in research and development (R&D) by leading pharmaceutical companies, focusing on identifying novel therapeutic targets and developing drugs with improved efficacy and safety profiles. Technological disruptions, such as advancements in gene sequencing, precision medicine, and the integration of artificial intelligence (AI) in drug discovery, are revolutionizing the R&D landscape. These innovations are enabling a deeper understanding of the genetic and biological factors contributing to schizophrenia, paving the way for personalized treatment approaches. Consumer preferences are shifting towards treatments that offer better symptom management, reduced side effects, and improved quality of life for patients. This includes a growing demand for long-acting injectable formulations that enhance medication adherence and convenience for individuals with schizophrenia. Competitive dynamics within the industry are intensifying, with both established players and emerging biopharmaceutical companies vying for market share. The launch of third-generation antipsychotics and the exploration of novel mechanisms of action are key areas of competition. Market penetration is expected to deepen as awareness about schizophrenia and the availability of advanced treatment options increase, particularly in emerging economies. The increasing prevalence of mental health disorders globally, coupled with a greater societal acceptance and focus on mental well-being, further contributes to the expanding market size. The estimated market size in the base year of 2025 is valued at approximately xx Million.

Leading Markets & Segments in Schizophrenia Drugs Industry

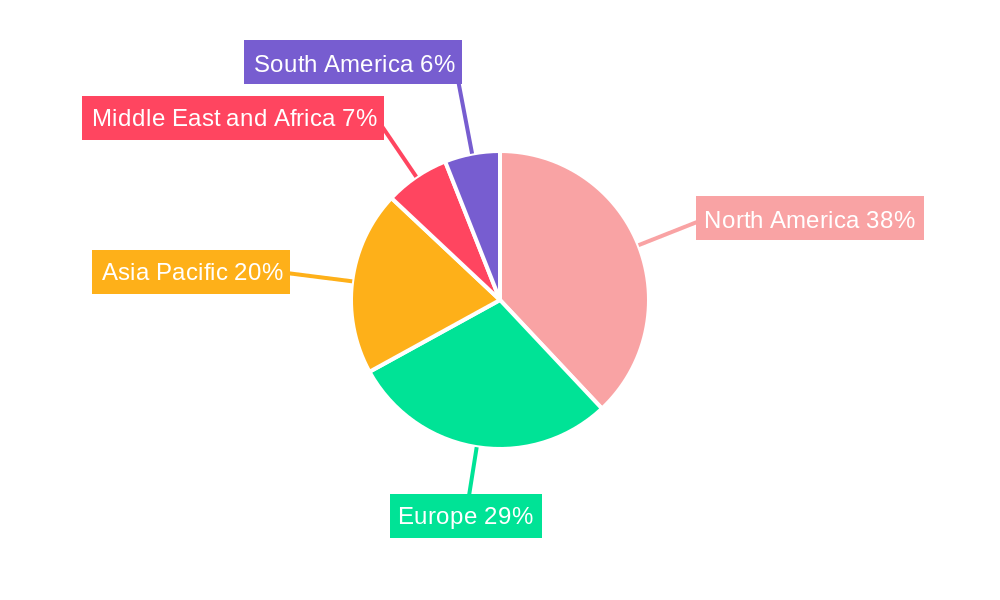

The schizophrenia drugs industry exhibits distinct regional and segmental dominance, crucial for understanding market dynamics and strategic planning.

Dominant Region: North America, primarily the United States, consistently emerges as the leading market for schizophrenia drugs. This dominance is attributed to several factors:

- High Healthcare Expenditure: The region boasts the highest healthcare spending globally, enabling greater access to advanced treatments and innovative therapies.

- Robust R&D Infrastructure: The presence of leading pharmaceutical companies, well-funded research institutions, and a strong regulatory framework fosters continuous innovation and drug development.

- High Prevalence and Diagnosis Rates: A high prevalence of schizophrenia, coupled with advanced diagnostic capabilities and widespread public awareness campaigns, leads to a larger patient pool actively seeking treatment.

- Reimbursement Policies: Favorable reimbursement policies for psychiatric medications facilitate patient access to a wide range of therapeutic options.

Leading Therapeutic Class: Second-generation Antipsychotics

- Market Share: This segment continues to hold a significant market share due to its established efficacy in managing positive and negative symptoms of schizophrenia with a generally better side-effect profile compared to first-generation antipsychotics.

- Key Drivers: The availability of numerous generic options, ongoing clinical trials demonstrating their continued relevance, and physician familiarity contribute to their sustained demand.

Emerging Therapeutic Class: Third-generation Antipsychotics

- Market Growth: While newer, this segment is experiencing rapid growth driven by their novel mechanisms of action, aiming to address negative symptoms and cognitive deficits more effectively, and often boasting improved tolerability profiles.

- Innovation Focus: Companies are heavily investing in R&D for third-generation antipsychotics, seeking to capture market share by offering differentiated treatment solutions.

Leading Treatment Modality: Oral Formulations

- Patient Preference: Oral medications remain the preferred mode of administration for a large segment of the patient population due to convenience and ease of use in daily life.

- Market Dominance: The established market presence and accessibility of oral antipsychotics ensure their continued dominance in market share.

Growing Segment: Injectables

- Adherence Improvement: Long-acting injectable (LAI) antipsychotics are gaining significant traction due to their proven ability to improve medication adherence, a critical factor in preventing relapse and improving long-term outcomes in schizophrenia.

- Clinical Benefits: The convenience of infrequent dosing (e.g., monthly or quarterly) makes LAIs an increasingly attractive option for both patients and healthcare providers.

Other Therapeutic Classes

- This category encompasses adjunctive therapies and drugs targeting specific symptoms or co-occurring conditions, representing a smaller but important segment for comprehensive patient care.

Schizophrenia Drugs Industry Product Developments

The schizophrenia drugs industry is witnessing a wave of product developments driven by a quest for enhanced efficacy and improved patient outcomes. Innovations are focused on novel mechanisms of action, such as dopamine D2 partial agonists and serotonin-dopamine antagonists, aiming to offer better symptom control with reduced side effects. The development of long-acting injectable (LAI) formulations continues to be a key trend, addressing the critical issue of medication adherence. Furthermore, research into the treatment of negative symptoms and cognitive deficits, often undertreated by existing therapies, is a significant area of focus. Companies are leveraging advanced drug delivery systems and precision medicine approaches to develop targeted therapies, enhancing the competitive advantage of their product portfolios.

Key Drivers of Schizophrenia Drugs Industry Growth

The schizophrenia drugs industry's growth is primarily propelled by a combination of escalating prevalence rates of mental health disorders globally, significant investments in cutting-edge research and development by leading pharmaceutical firms, and advancements in neuroscientific understanding. The development of novel therapeutic classes, such as third-generation antipsychotics offering improved efficacy and tolerability, is a major catalyst. Favorable reimbursement policies in key markets, coupled with increasing awareness and reduced stigma surrounding mental illness, are expanding patient access to advanced treatments. Furthermore, the push for precision medicine and personalized treatment approaches, supported by genetic insights, is driving innovation and market expansion.

Challenges in the Schizophrenia Drugs Industry Market

Despite the promising growth trajectory, the schizophrenia drugs industry faces several significant challenges. Stringent and lengthy regulatory approval processes pose a considerable hurdle for new drug development, leading to extended timelines and high R&D costs. The high cost of novel therapeutics can limit patient access, particularly in resource-constrained regions, and lead to payer pushback. Furthermore, the development of truly novel treatments that significantly outperform existing options remains a scientific challenge, with many new drugs offering incremental improvements. Side effect profiles, although improving, can still impact patient adherence and quality of life, necessitating continuous innovation in drug design. Lastly, competition from generic alternatives for established antipsychotics puts pressure on pricing for older medications.

Emerging Opportunities in Schizophrenia Drugs Industry

The schizophrenia drugs industry is ripe with emerging opportunities, driven by continuous scientific breakthroughs and evolving patient needs. The growing emphasis on precision medicine presents a significant avenue, with opportunities to develop targeted therapies based on genetic biomarkers and individual patient responses. Advancements in understanding the neurobiology of schizophrenia are paving the way for novel drug targets and therapeutic modalities aimed at addressing negative symptoms and cognitive impairment. Strategic partnerships and collaborations between pharmaceutical companies, academic institutions, and biotech firms are crucial for accelerating drug discovery and development. Furthermore, the expansion of healthcare access and increased mental health awareness in emerging markets represent substantial untapped opportunities for market growth.

Leading Players in the Schizophrenia Drugs Industry Sector

- Alkermes Plc

- AbbVie (Allergan Plc)

- Karuna Therapeutics

- Eli Lilly and Company

- AstraZeneca

- Otsuka America Pharmaceutical Inc

- Sumitomo Dainippon Pharma

- Vanda Pharmaceuticals

- Johnson & Johnson

- Bristol-Myers Squibb and Company

- Acadia Pharmaceuticals

- Pfizer Inc

Key Milestones in Schizophrenia Drugs Industry Industry

- February 2022: Vanderbilt University signed a worldwide license and a research collaboration agreement with Neumora Therapeutics to develop precision medicines for brain diseases through the integration of data science and neuroscience. The license program includes two new series of compounds that targets schizophrenia and other neuropsychiatric disorders.

- March 2022: AbbVie entered into a new co-development and license agreement with Gedeon Richter, to research, develop and commercialize novel dopamine receptor modulators for the potential treatment of neuropsychiatric diseases.

Strategic Outlook for Schizophrenia Drugs Industry Market

The strategic outlook for the schizophrenia drugs industry is characterized by a sustained focus on innovation and market expansion. Key growth accelerators include the relentless pursuit of novel therapeutic targets and the development of first-in-class treatments that address unmet medical needs, particularly concerning negative symptoms and cognitive dysfunction. The strategic imperative for pharmaceutical companies is to leverage advancements in precision medicine and AI-driven drug discovery to accelerate R&D pipelines and bring differentiated therapies to market. Furthermore, exploring strategic partnerships and licensing agreements will be crucial for expanding therapeutic portfolios and gaining access to cutting-edge technologies. The growing global demand for effective mental health treatments, coupled with increasing healthcare infrastructure development in emerging economies, presents significant long-term growth potential for market participants who can adapt to evolving clinical landscapes and patient needs.

Schizophrenia Drugs Industry Segmentation

-

1. Therapeutic Class

- 1.1. Second-generation Antipsychotics

- 1.2. Third-generation Antipsychotics

- 1.3. Other Therapeutic Classes

-

2. Treatment

- 2.1. Oral

- 2.2. Injectables

Schizophrenia Drugs Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Schizophrenia Drugs Industry Regional Market Share

Geographic Coverage of Schizophrenia Drugs Industry

Schizophrenia Drugs Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Schizophrenia and Associated Disorders; Increase in Focus of Governments and Health Care Organizations on Mental Health and Increasing Investments in R&D

- 3.3. Market Restrains

- 3.3.1. Increase in Cases of Addiction Associated with these Drugs; Patent Expiry of Major Drugs

- 3.4. Market Trends

- 3.4.1. The Second-generation Antipsychotics Segment Expects to Register a High CAGR in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Schizophrenia Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Therapeutic Class

- 5.1.1. Second-generation Antipsychotics

- 5.1.2. Third-generation Antipsychotics

- 5.1.3. Other Therapeutic Classes

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Oral

- 5.2.2. Injectables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Therapeutic Class

- 6. North America Schizophrenia Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Therapeutic Class

- 6.1.1. Second-generation Antipsychotics

- 6.1.2. Third-generation Antipsychotics

- 6.1.3. Other Therapeutic Classes

- 6.2. Market Analysis, Insights and Forecast - by Treatment

- 6.2.1. Oral

- 6.2.2. Injectables

- 6.1. Market Analysis, Insights and Forecast - by Therapeutic Class

- 7. Europe Schizophrenia Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Therapeutic Class

- 7.1.1. Second-generation Antipsychotics

- 7.1.2. Third-generation Antipsychotics

- 7.1.3. Other Therapeutic Classes

- 7.2. Market Analysis, Insights and Forecast - by Treatment

- 7.2.1. Oral

- 7.2.2. Injectables

- 7.1. Market Analysis, Insights and Forecast - by Therapeutic Class

- 8. Asia Pacific Schizophrenia Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Therapeutic Class

- 8.1.1. Second-generation Antipsychotics

- 8.1.2. Third-generation Antipsychotics

- 8.1.3. Other Therapeutic Classes

- 8.2. Market Analysis, Insights and Forecast - by Treatment

- 8.2.1. Oral

- 8.2.2. Injectables

- 8.1. Market Analysis, Insights and Forecast - by Therapeutic Class

- 9. Middle East and Africa Schizophrenia Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Therapeutic Class

- 9.1.1. Second-generation Antipsychotics

- 9.1.2. Third-generation Antipsychotics

- 9.1.3. Other Therapeutic Classes

- 9.2. Market Analysis, Insights and Forecast - by Treatment

- 9.2.1. Oral

- 9.2.2. Injectables

- 9.1. Market Analysis, Insights and Forecast - by Therapeutic Class

- 10. South America Schizophrenia Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Therapeutic Class

- 10.1.1. Second-generation Antipsychotics

- 10.1.2. Third-generation Antipsychotics

- 10.1.3. Other Therapeutic Classes

- 10.2. Market Analysis, Insights and Forecast - by Treatment

- 10.2.1. Oral

- 10.2.2. Injectables

- 10.1. Market Analysis, Insights and Forecast - by Therapeutic Class

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Alkermes Plc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Abbvie (Allergan Plc)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Karuna Therapeutics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eli Lilly and Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AstraZeneca

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Otsuka America Pharmaceutical Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sumitomo Dainippon Pharma

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vanda Pharmaceuticals

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bristol-Myers Squibb and Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Acadia Pharmaceuticals

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pfizer Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Alkermes Plc

List of Figures

- Figure 1: Global Schizophrenia Drugs Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Schizophrenia Drugs Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Schizophrenia Drugs Industry Revenue (undefined), by Therapeutic Class 2025 & 2033

- Figure 4: North America Schizophrenia Drugs Industry Volume (K Unit), by Therapeutic Class 2025 & 2033

- Figure 5: North America Schizophrenia Drugs Industry Revenue Share (%), by Therapeutic Class 2025 & 2033

- Figure 6: North America Schizophrenia Drugs Industry Volume Share (%), by Therapeutic Class 2025 & 2033

- Figure 7: North America Schizophrenia Drugs Industry Revenue (undefined), by Treatment 2025 & 2033

- Figure 8: North America Schizophrenia Drugs Industry Volume (K Unit), by Treatment 2025 & 2033

- Figure 9: North America Schizophrenia Drugs Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 10: North America Schizophrenia Drugs Industry Volume Share (%), by Treatment 2025 & 2033

- Figure 11: North America Schizophrenia Drugs Industry Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Schizophrenia Drugs Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Schizophrenia Drugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Schizophrenia Drugs Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Schizophrenia Drugs Industry Revenue (undefined), by Therapeutic Class 2025 & 2033

- Figure 16: Europe Schizophrenia Drugs Industry Volume (K Unit), by Therapeutic Class 2025 & 2033

- Figure 17: Europe Schizophrenia Drugs Industry Revenue Share (%), by Therapeutic Class 2025 & 2033

- Figure 18: Europe Schizophrenia Drugs Industry Volume Share (%), by Therapeutic Class 2025 & 2033

- Figure 19: Europe Schizophrenia Drugs Industry Revenue (undefined), by Treatment 2025 & 2033

- Figure 20: Europe Schizophrenia Drugs Industry Volume (K Unit), by Treatment 2025 & 2033

- Figure 21: Europe Schizophrenia Drugs Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 22: Europe Schizophrenia Drugs Industry Volume Share (%), by Treatment 2025 & 2033

- Figure 23: Europe Schizophrenia Drugs Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Schizophrenia Drugs Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Schizophrenia Drugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Schizophrenia Drugs Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Schizophrenia Drugs Industry Revenue (undefined), by Therapeutic Class 2025 & 2033

- Figure 28: Asia Pacific Schizophrenia Drugs Industry Volume (K Unit), by Therapeutic Class 2025 & 2033

- Figure 29: Asia Pacific Schizophrenia Drugs Industry Revenue Share (%), by Therapeutic Class 2025 & 2033

- Figure 30: Asia Pacific Schizophrenia Drugs Industry Volume Share (%), by Therapeutic Class 2025 & 2033

- Figure 31: Asia Pacific Schizophrenia Drugs Industry Revenue (undefined), by Treatment 2025 & 2033

- Figure 32: Asia Pacific Schizophrenia Drugs Industry Volume (K Unit), by Treatment 2025 & 2033

- Figure 33: Asia Pacific Schizophrenia Drugs Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 34: Asia Pacific Schizophrenia Drugs Industry Volume Share (%), by Treatment 2025 & 2033

- Figure 35: Asia Pacific Schizophrenia Drugs Industry Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Schizophrenia Drugs Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Schizophrenia Drugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Schizophrenia Drugs Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Schizophrenia Drugs Industry Revenue (undefined), by Therapeutic Class 2025 & 2033

- Figure 40: Middle East and Africa Schizophrenia Drugs Industry Volume (K Unit), by Therapeutic Class 2025 & 2033

- Figure 41: Middle East and Africa Schizophrenia Drugs Industry Revenue Share (%), by Therapeutic Class 2025 & 2033

- Figure 42: Middle East and Africa Schizophrenia Drugs Industry Volume Share (%), by Therapeutic Class 2025 & 2033

- Figure 43: Middle East and Africa Schizophrenia Drugs Industry Revenue (undefined), by Treatment 2025 & 2033

- Figure 44: Middle East and Africa Schizophrenia Drugs Industry Volume (K Unit), by Treatment 2025 & 2033

- Figure 45: Middle East and Africa Schizophrenia Drugs Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 46: Middle East and Africa Schizophrenia Drugs Industry Volume Share (%), by Treatment 2025 & 2033

- Figure 47: Middle East and Africa Schizophrenia Drugs Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East and Africa Schizophrenia Drugs Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Schizophrenia Drugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Schizophrenia Drugs Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Schizophrenia Drugs Industry Revenue (undefined), by Therapeutic Class 2025 & 2033

- Figure 52: South America Schizophrenia Drugs Industry Volume (K Unit), by Therapeutic Class 2025 & 2033

- Figure 53: South America Schizophrenia Drugs Industry Revenue Share (%), by Therapeutic Class 2025 & 2033

- Figure 54: South America Schizophrenia Drugs Industry Volume Share (%), by Therapeutic Class 2025 & 2033

- Figure 55: South America Schizophrenia Drugs Industry Revenue (undefined), by Treatment 2025 & 2033

- Figure 56: South America Schizophrenia Drugs Industry Volume (K Unit), by Treatment 2025 & 2033

- Figure 57: South America Schizophrenia Drugs Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 58: South America Schizophrenia Drugs Industry Volume Share (%), by Treatment 2025 & 2033

- Figure 59: South America Schizophrenia Drugs Industry Revenue (undefined), by Country 2025 & 2033

- Figure 60: South America Schizophrenia Drugs Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Schizophrenia Drugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Schizophrenia Drugs Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Therapeutic Class 2020 & 2033

- Table 2: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Therapeutic Class 2020 & 2033

- Table 3: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Treatment 2020 & 2033

- Table 4: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Treatment 2020 & 2033

- Table 5: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Therapeutic Class 2020 & 2033

- Table 8: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Therapeutic Class 2020 & 2033

- Table 9: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Treatment 2020 & 2033

- Table 10: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Treatment 2020 & 2033

- Table 11: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Therapeutic Class 2020 & 2033

- Table 20: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Therapeutic Class 2020 & 2033

- Table 21: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Treatment 2020 & 2033

- Table 22: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Treatment 2020 & 2033

- Table 23: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Germany Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: France Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Italy Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Spain Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Therapeutic Class 2020 & 2033

- Table 38: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Therapeutic Class 2020 & 2033

- Table 39: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Treatment 2020 & 2033

- Table 40: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Treatment 2020 & 2033

- Table 41: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: China Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Japan Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: India Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Australia Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: South Korea Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Therapeutic Class 2020 & 2033

- Table 56: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Therapeutic Class 2020 & 2033

- Table 57: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Treatment 2020 & 2033

- Table 58: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Treatment 2020 & 2033

- Table 59: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: GCC Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: South Africa Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Therapeutic Class 2020 & 2033

- Table 68: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Therapeutic Class 2020 & 2033

- Table 69: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Treatment 2020 & 2033

- Table 70: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Treatment 2020 & 2033

- Table 71: Global Schizophrenia Drugs Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 72: Global Schizophrenia Drugs Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Brazil Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Argentina Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Schizophrenia Drugs Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Schizophrenia Drugs Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Schizophrenia Drugs Industry?

The projected CAGR is approximately 3.15%.

2. Which companies are prominent players in the Schizophrenia Drugs Industry?

Key companies in the market include Alkermes Plc, Abbvie (Allergan Plc), Karuna Therapeutics, Eli Lilly and Company, AstraZeneca, Otsuka America Pharmaceutical Inc, Sumitomo Dainippon Pharma, Vanda Pharmaceuticals, Johnson & Johnson, Bristol-Myers Squibb and Company, Acadia Pharmaceuticals, Pfizer Inc.

3. What are the main segments of the Schizophrenia Drugs Industry?

The market segments include Therapeutic Class, Treatment.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Schizophrenia and Associated Disorders; Increase in Focus of Governments and Health Care Organizations on Mental Health and Increasing Investments in R&D.

6. What are the notable trends driving market growth?

The Second-generation Antipsychotics Segment Expects to Register a High CAGR in the Forecast Period.

7. Are there any restraints impacting market growth?

Increase in Cases of Addiction Associated with these Drugs; Patent Expiry of Major Drugs.

8. Can you provide examples of recent developments in the market?

In February 2022, Vanderbilt University signed a worldwide license and a research collaboration agreement with Neumora Therapeutics to develop precision medicines for brain diseases through the integration of data science and neuroscience. The license program includes two new series of compounds that targets schizophrenia and other neuropsychiatric disorders.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Schizophrenia Drugs Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Schizophrenia Drugs Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Schizophrenia Drugs Industry?

To stay informed about further developments, trends, and reports in the Schizophrenia Drugs Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence