Key Insights

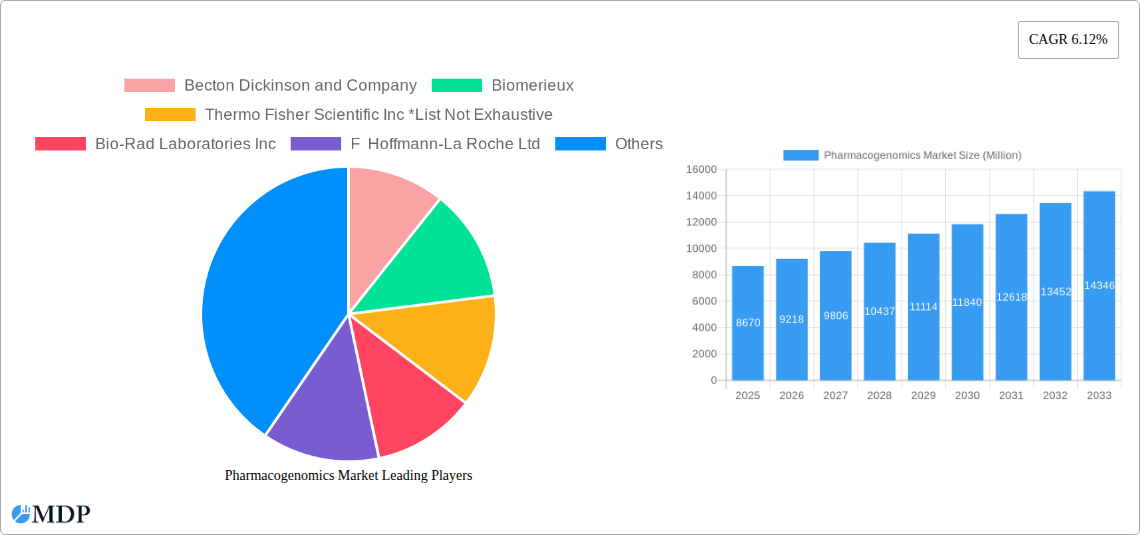

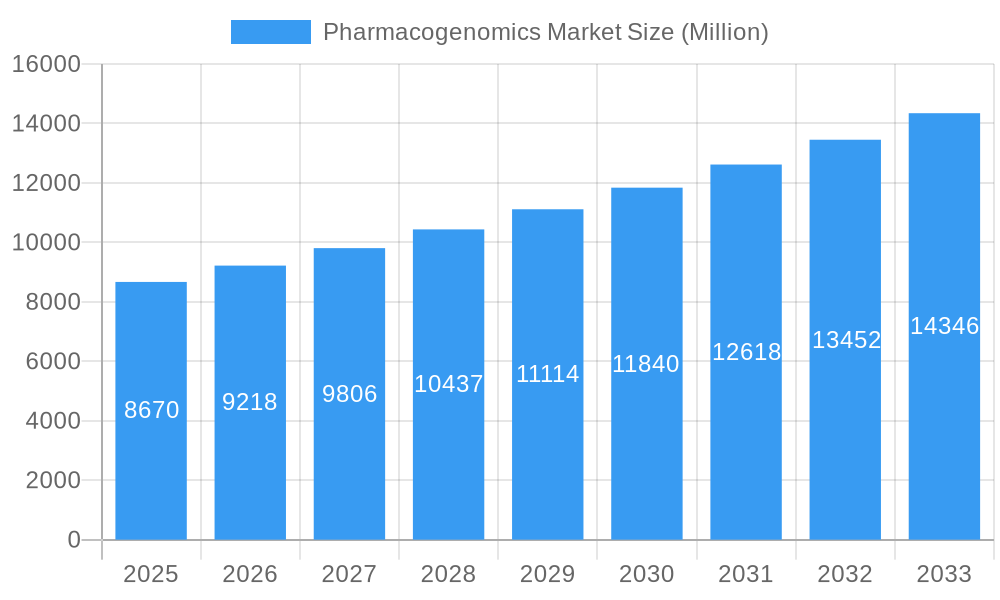

The pharmacogenomics market, valued at $8.67 billion in 2025, is projected to experience robust growth, driven by the increasing adoption of personalized medicine and advancements in genomic technologies. The Compound Annual Growth Rate (CAGR) of 6.12% from 2025 to 2033 signifies a significant expansion, fueled by several key factors. Rising prevalence of chronic diseases like cancer and cardiovascular ailments necessitates tailored treatment approaches, making pharmacogenomics indispensable. Technological advancements, such as next-generation sequencing (NGS) and microarrays, are enabling faster, more accurate, and cost-effective genetic testing, further accelerating market growth. The integration of pharmacogenomics into clinical practice is gaining momentum, supported by increasing awareness among healthcare professionals and patients regarding the benefits of personalized therapies. Drug discovery and development are also significantly impacted, with pharmacogenomics aiding in identifying potential drug candidates and predicting efficacy and safety profiles, streamlining the process and reducing development costs. The market segmentation, encompassing technologies like DNA sequencing, microarray analysis, and PCR, and applications spanning oncology, neurology, and drug discovery, reflects the diverse applications of pharmacogenomics across various therapeutic areas. Significant investments in research and development from both public and private sectors further bolster market growth.

Pharmacogenomics Market Market Size (In Billion)

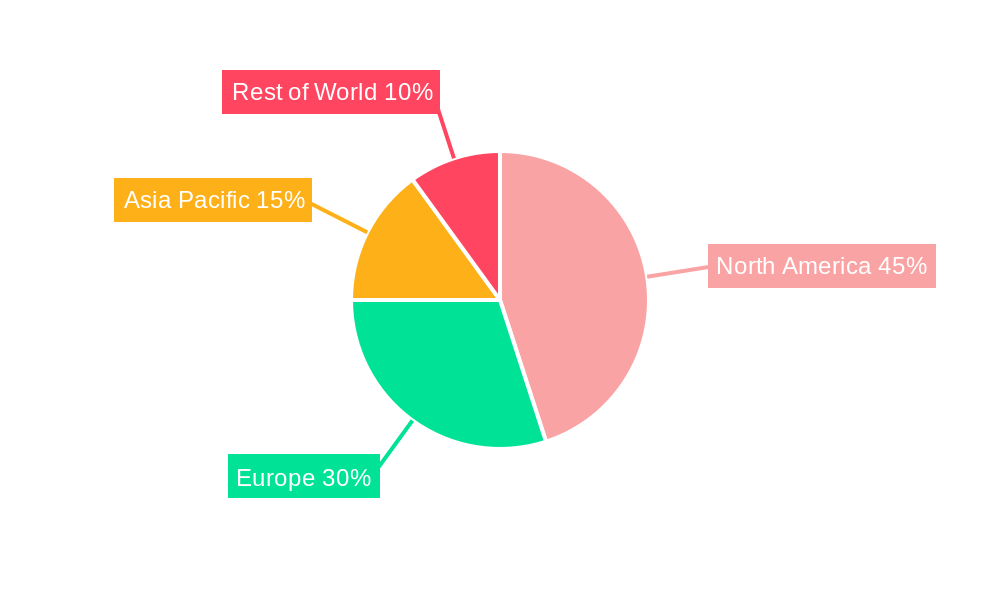

However, the market faces certain restraints. High costs associated with genomic testing and data analysis can limit accessibility, particularly in resource-constrained settings. The complexity of interpreting genomic data and translating it into actionable clinical insights requires highly skilled professionals, leading to a potential bottleneck. Regulatory hurdles and ethical considerations surrounding the use of genetic information also present challenges. Despite these limitations, the long-term prospects for the pharmacogenomics market remain positive, driven by continuous technological innovations, expanding clinical applications, and a growing understanding of the importance of personalized medicine. The market is expected to witness substantial expansion across regions like North America and Europe, followed by a steady growth trajectory in Asia-Pacific and other emerging markets.

Pharmacogenomics Market Company Market Share

Pharmacogenomics Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Pharmacogenomics Market, covering market dynamics, industry trends, leading segments, key players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders seeking actionable insights into this rapidly evolving market. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Pharmacogenomics Market Dynamics & Concentration

The Pharmacogenomics market is experiencing significant growth driven by factors such as increasing prevalence of chronic diseases, rising demand for personalized medicine, and technological advancements in DNA sequencing and other related technologies. Market concentration is moderately high, with several key players holding substantial market share. However, the market also features a number of smaller companies contributing to innovation and niche applications.

Market Concentration: The top 5 companies account for approximately xx% of the global market share in 2025. The market exhibits a slightly fragmented nature due to the presence of numerous smaller players specializing in specific technologies or applications.

Innovation Drivers: Continuous advancements in DNA sequencing technologies (NGS, microarrays), bioinformatics, and AI-driven data analysis are driving innovation and expanding the application scope of pharmacogenomics.

Regulatory Frameworks: Stringent regulatory approvals and guidelines for pharmacogenomic tests and therapies influence market growth and adoption rates. Variations in regulatory landscapes across different regions impact market dynamics.

Product Substitutes: While no direct substitutes exist for pharmacogenomics, alternative approaches like traditional drug development and trial-and-error medication strategies remain. The superior efficacy and reduced side effects associated with pharmacogenomics drive market growth despite these alternatives.

End-User Trends: Growing awareness among healthcare professionals and patients about the benefits of personalized medicine is driving increased adoption of pharmacogenomic testing. This trend is strongly influenced by increasing investment in personalized healthcare solutions, particularly in developed nations.

M&A Activities: The number of mergers and acquisitions (M&As) in the pharmacogenomics sector has been steadily increasing in recent years, driven by the desire of larger companies to expand their product portfolio and market reach. An estimated xx M&A deals were reported during the historical period (2019-2024), with a projected increase in the forecast period.

Pharmacogenomics Market Industry Trends & Analysis

The pharmacogenomics market is characterized by robust growth driven by several key factors. Technological advancements, particularly in next-generation sequencing (NGS), have significantly reduced the cost and increased the speed of genomic testing, making pharmacogenomics more accessible. This has led to increased market penetration across various therapeutic areas, particularly oncology and neurology, which are witnessing high growth rates.

Consumer preferences are shifting towards personalized healthcare, fueling demand for pharmacogenomic services. The market is witnessing a rise in direct-to-consumer (DTC) testing, although regulatory aspects continue to be a point of consideration in many regions. The competitive landscape is dynamic, with both established players and emerging companies vying for market share through strategic partnerships, product innovation, and geographic expansion. The market’s Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%, signifying substantial growth potential.

Leading Markets & Segments in Pharmacogenomics Market

The North American region holds the largest market share globally, driven by factors such as high adoption of advanced technologies, strong regulatory support for personalized medicine initiatives, and significant investments in healthcare research. The European market is also experiencing substantial growth, while the Asia-Pacific region exhibits significant untapped potential due to rising healthcare expenditure and increasing prevalence of chronic diseases.

By Technology:

- DNA Sequencing: Holds the largest market share due to its high accuracy, throughput, and ability to analyze a wide range of genetic variations. NGS technologies are particularly driving growth in this segment.

- Microarray: Offers a cost-effective alternative for specific pharmacogenomic applications, particularly in genotyping.

- Polymerase Chain Reaction (PCR): Remains important for targeted gene analysis, complementing NGS technologies.

- Electrophoresis: Used in conjunction with other technologies for genetic variant identification.

- Mass Spectrometry: Plays a role in metabolomic studies related to drug response.

- Other Technologies: Emerging technologies like CRISPR-Cas9 are expected to contribute to future growth in this segment.

By Application:

- Oncology: Represents the largest application segment, fueled by the growing demand for personalized cancer therapies.

- Neurology: Growing awareness about the role of genetics in neurological disorders and personalized treatment plans drives market growth.

- Drug Discovery: Pharmacogenomics plays a critical role in accelerating drug development processes.

- Pain Management: Pharmacogenomics is increasingly used to optimize pain management strategies and minimize side effects.

- Other Applications: Applications are expanding into areas such as infectious diseases, cardiology, and psychiatry.

Key Drivers (Regional):

- North America: High healthcare expenditure, robust regulatory framework, advanced healthcare infrastructure, and strong R&D investments.

- Europe: Growing adoption of personalized medicine, favourable regulatory environment, and increasing healthcare awareness.

- Asia-Pacific: Rising prevalence of chronic diseases, increasing healthcare expenditure, and expanding healthcare infrastructure.

Pharmacogenomics Market Product Developments

Recent product developments highlight the trend towards more accurate, faster, and cost-effective pharmacogenomic testing. The integration of next-generation sequencing (NGS) with advanced bioinformatics tools and AI-driven algorithms is enhancing the analytical capabilities of these tests, leading to improved clinical decision-making. Furthermore, the development of user-friendly platforms and streamlined workflows is making these tests more accessible to clinicians and patients. This focus on user experience, along with technological advancements, significantly enhances market fit and clinical adoption.

Key Drivers of Pharmacogenomics Market Growth

Several factors contribute to the growth of the pharmacogenomics market. Technological advancements like NGS have significantly lowered the cost and improved the speed of genomic testing. Increased government funding and initiatives supporting personalized medicine research and development are further accelerating market growth. Furthermore, the growing prevalence of chronic diseases and the rising demand for effective and safer treatment options are driving the adoption of pharmacogenomics across various therapeutic areas.

Challenges in the Pharmacogenomics Market

Despite the significant potential, challenges remain for the pharmacogenomics market. The lack of standardized guidelines and regulatory frameworks across different regions poses a significant obstacle to the widespread adoption of these tests. High costs associated with genomic testing, data analysis, and interpretation continue to present barriers. Furthermore, the need for robust infrastructure and skilled professionals capable of interpreting complex genomic data adds to the challenges. The market faces competition from alternative approaches to treatment, impacting its overall growth.

Emerging Opportunities in Pharmacogenomics Market

The future of pharmacogenomics looks promising. Technological breakthroughs, such as advancements in CRISPR gene editing, hold immense potential for treating genetic diseases. Strategic collaborations between pharmaceutical companies, biotechnology firms, and healthcare providers are fostering innovation and expanding market access. The expansion into new therapeutic areas and the development of more affordable and accessible testing options promise to unlock new growth opportunities for the pharmacogenomics market.

Leading Players in the Pharmacogenomics Market Sector

- Becton Dickinson and Company

- Biomerieux

- Thermo Fisher Scientific Inc

- Bio-Rad Laboratories Inc

- F Hoffmann-La Roche Ltd

- Eurofins Scientific

- Merck KgAA

- Agilent Technologies Inc

- PerkinElmer Inc

- Qiagen NV

- Illumina Inc

- Abbott Laboratories Inc

- Pacific Biosciences of California Inc

Key Milestones in Pharmacogenomics Market Industry

- February 2024: Nicklaus Children's Hospital in South Florida adopted Applied Biosystems PharmacoScan Solution and GeneTitan MC Fast Scan Instrument, enhancing personalized treatment plans and reducing drug interaction complications.

- May 2024: Oxford Nanopore Technologies launched a Pharmacogenomics (PGx) Beta Programme, combining Twist Bioscience's NGS technology with Oxford Nanopore's sequencing platform to advance personalized medicine. This exemplifies the increasing collaborative efforts within the sector.

Strategic Outlook for Pharmacogenomics Market

The pharmacogenomics market is poised for significant growth driven by technological advancements, increasing adoption of personalized medicine, and expansion into new therapeutic areas. Strategic partnerships, investments in R&D, and the development of innovative testing platforms will be key to unlocking the full potential of this market. The focus on improving accessibility, reducing costs, and enhancing the clinical utility of pharmacogenomic testing will be crucial for future success.

Pharmacogenomics Market Segmentation

-

1. Technology

- 1.1. DNA Sequencing

- 1.2. Microarray

- 1.3. Polymerase Chain Reaction

- 1.4. Electrophoresis

- 1.5. Mass Spectrometry

- 1.6. Other Technologies

-

2. Application

- 2.1. Drug Discovery

- 2.2. Neurology

- 2.3. Oncology

- 2.4. Pain Management

- 2.5. Other Applications

Pharmacogenomics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Pharmacogenomics Market Regional Market Share

Geographic Coverage of Pharmacogenomics Market

Pharmacogenomics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Focus on Precision Medicine; Increasing Expenditure in Research and Development; High Rate of Adverse Drug Reaction; Enhancement of Drug Safety and Efficiency to Increase Success Rates in Pharmaceutical R&D

- 3.3. Market Restrains

- 3.3.1. Difficulties in Detecting Gene Variation that Affect Drug Response; Reimbursement Issues

- 3.4. Market Trends

- 3.4.1. Drug Discovery Segment is Expected to Occupy a Significant Share in the Pharmacogenomics Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmacogenomics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. DNA Sequencing

- 5.1.2. Microarray

- 5.1.3. Polymerase Chain Reaction

- 5.1.4. Electrophoresis

- 5.1.5. Mass Spectrometry

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Drug Discovery

- 5.2.2. Neurology

- 5.2.3. Oncology

- 5.2.4. Pain Management

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Pharmacogenomics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. DNA Sequencing

- 6.1.2. Microarray

- 6.1.3. Polymerase Chain Reaction

- 6.1.4. Electrophoresis

- 6.1.5. Mass Spectrometry

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Drug Discovery

- 6.2.2. Neurology

- 6.2.3. Oncology

- 6.2.4. Pain Management

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Pharmacogenomics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. DNA Sequencing

- 7.1.2. Microarray

- 7.1.3. Polymerase Chain Reaction

- 7.1.4. Electrophoresis

- 7.1.5. Mass Spectrometry

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Drug Discovery

- 7.2.2. Neurology

- 7.2.3. Oncology

- 7.2.4. Pain Management

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Pharmacogenomics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. DNA Sequencing

- 8.1.2. Microarray

- 8.1.3. Polymerase Chain Reaction

- 8.1.4. Electrophoresis

- 8.1.5. Mass Spectrometry

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Drug Discovery

- 8.2.2. Neurology

- 8.2.3. Oncology

- 8.2.4. Pain Management

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Middle East and Africa Pharmacogenomics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. DNA Sequencing

- 9.1.2. Microarray

- 9.1.3. Polymerase Chain Reaction

- 9.1.4. Electrophoresis

- 9.1.5. Mass Spectrometry

- 9.1.6. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Drug Discovery

- 9.2.2. Neurology

- 9.2.3. Oncology

- 9.2.4. Pain Management

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. South America Pharmacogenomics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. DNA Sequencing

- 10.1.2. Microarray

- 10.1.3. Polymerase Chain Reaction

- 10.1.4. Electrophoresis

- 10.1.5. Mass Spectrometry

- 10.1.6. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Drug Discovery

- 10.2.2. Neurology

- 10.2.3. Oncology

- 10.2.4. Pain Management

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Biomerieux

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Thermo Fisher Scientific Inc *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bio-Rad Laboratories Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 F Hoffmann-La Roche Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eurofins Scientific

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Merck KgAA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Agilent Technologies Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PerkinElmer Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Qiagen NV

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Illumina Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Abbott Laboratories Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Pacific Biosciences of California Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Pharmacogenomics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pharmacogenomics Market Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Pharmacogenomics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Pharmacogenomics Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Pharmacogenomics Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Pharmacogenomics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Pharmacogenomics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Pharmacogenomics Market Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Pharmacogenomics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Pharmacogenomics Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Pharmacogenomics Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Pharmacogenomics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Pharmacogenomics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Pharmacogenomics Market Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Pharmacogenomics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Pharmacogenomics Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Pharmacogenomics Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Pharmacogenomics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Pharmacogenomics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Pharmacogenomics Market Revenue (Million), by Technology 2025 & 2033

- Figure 21: Middle East and Africa Pharmacogenomics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Middle East and Africa Pharmacogenomics Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East and Africa Pharmacogenomics Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East and Africa Pharmacogenomics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Pharmacogenomics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Pharmacogenomics Market Revenue (Million), by Technology 2025 & 2033

- Figure 27: South America Pharmacogenomics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: South America Pharmacogenomics Market Revenue (Million), by Application 2025 & 2033

- Figure 29: South America Pharmacogenomics Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Pharmacogenomics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Pharmacogenomics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmacogenomics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Pharmacogenomics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Pharmacogenomics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Pharmacogenomics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Pharmacogenomics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Pharmacogenomics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Pharmacogenomics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Pharmacogenomics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Pharmacogenomics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Pharmacogenomics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 20: Global Pharmacogenomics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Pharmacogenomics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South korea Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Pharmacogenomics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 29: Global Pharmacogenomics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Pharmacogenomics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: GCC Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Pharmacogenomics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 35: Global Pharmacogenomics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Pharmacogenomics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Pharmacogenomics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmacogenomics Market?

The projected CAGR is approximately 6.12%.

2. Which companies are prominent players in the Pharmacogenomics Market?

Key companies in the market include Becton Dickinson and Company, Biomerieux, Thermo Fisher Scientific Inc *List Not Exhaustive, Bio-Rad Laboratories Inc, F Hoffmann-La Roche Ltd, Eurofins Scientific, Merck KgAA, Agilent Technologies Inc, PerkinElmer Inc, Qiagen NV, Illumina Inc, Abbott Laboratories Inc, Pacific Biosciences of California Inc.

3. What are the main segments of the Pharmacogenomics Market?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Focus on Precision Medicine; Increasing Expenditure in Research and Development; High Rate of Adverse Drug Reaction; Enhancement of Drug Safety and Efficiency to Increase Success Rates in Pharmaceutical R&D.

6. What are the notable trends driving market growth?

Drug Discovery Segment is Expected to Occupy a Significant Share in the Pharmacogenomics Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Difficulties in Detecting Gene Variation that Affect Drug Response; Reimbursement Issues.

8. Can you provide examples of recent developments in the market?

May 2024: Oxford Nanopore Technologies introduced a new Pharmacogenomics (PGx) Beta Programme for advancing personalized medicine with the combination of Twist Bioscience’s next-generation sequencing (NGS) target enrichment technology with Oxford Nanopore’s sequencing platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmacogenomics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmacogenomics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmacogenomics Market?

To stay informed about further developments, trends, and reports in the Pharmacogenomics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence