Key Insights

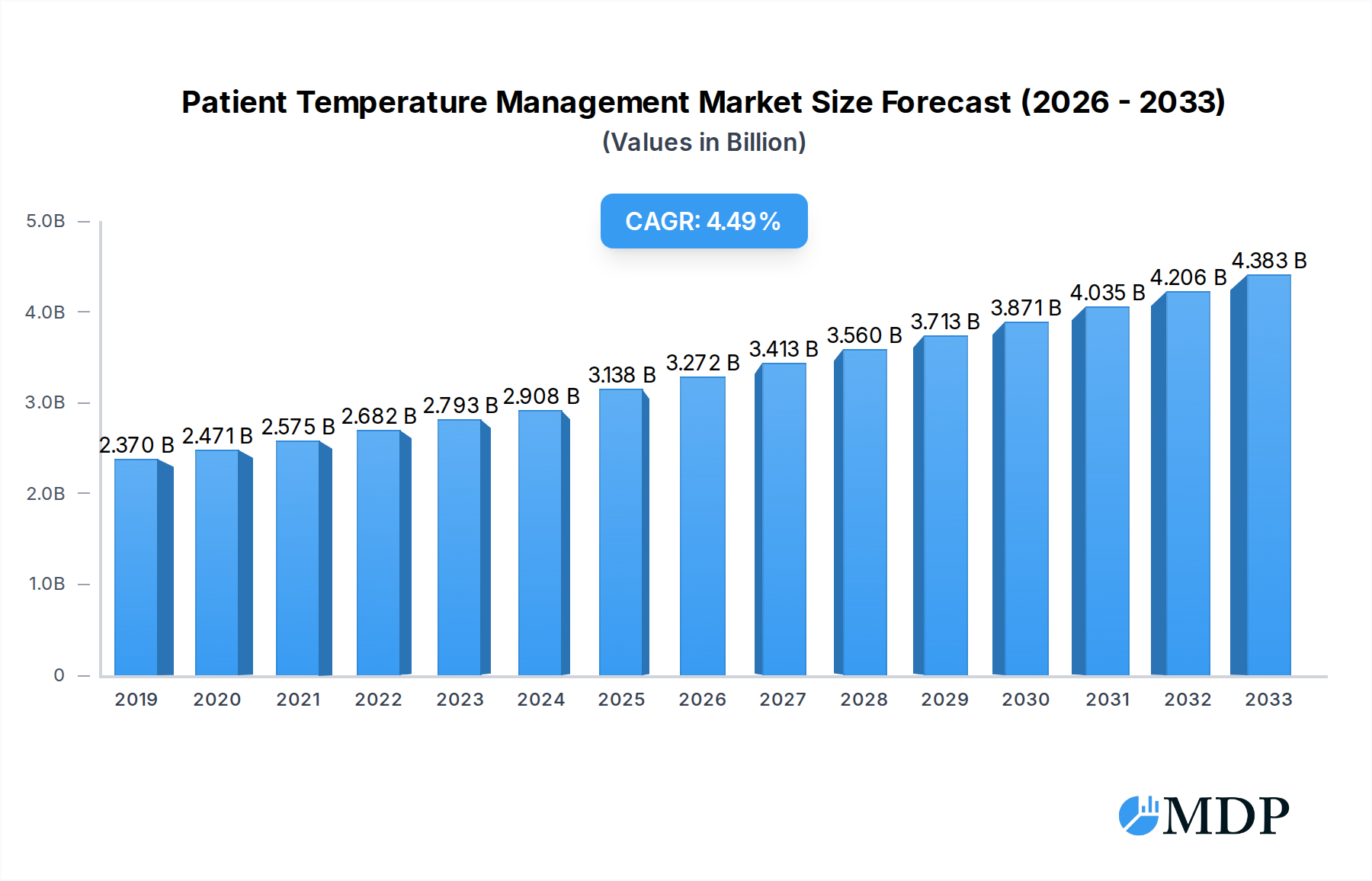

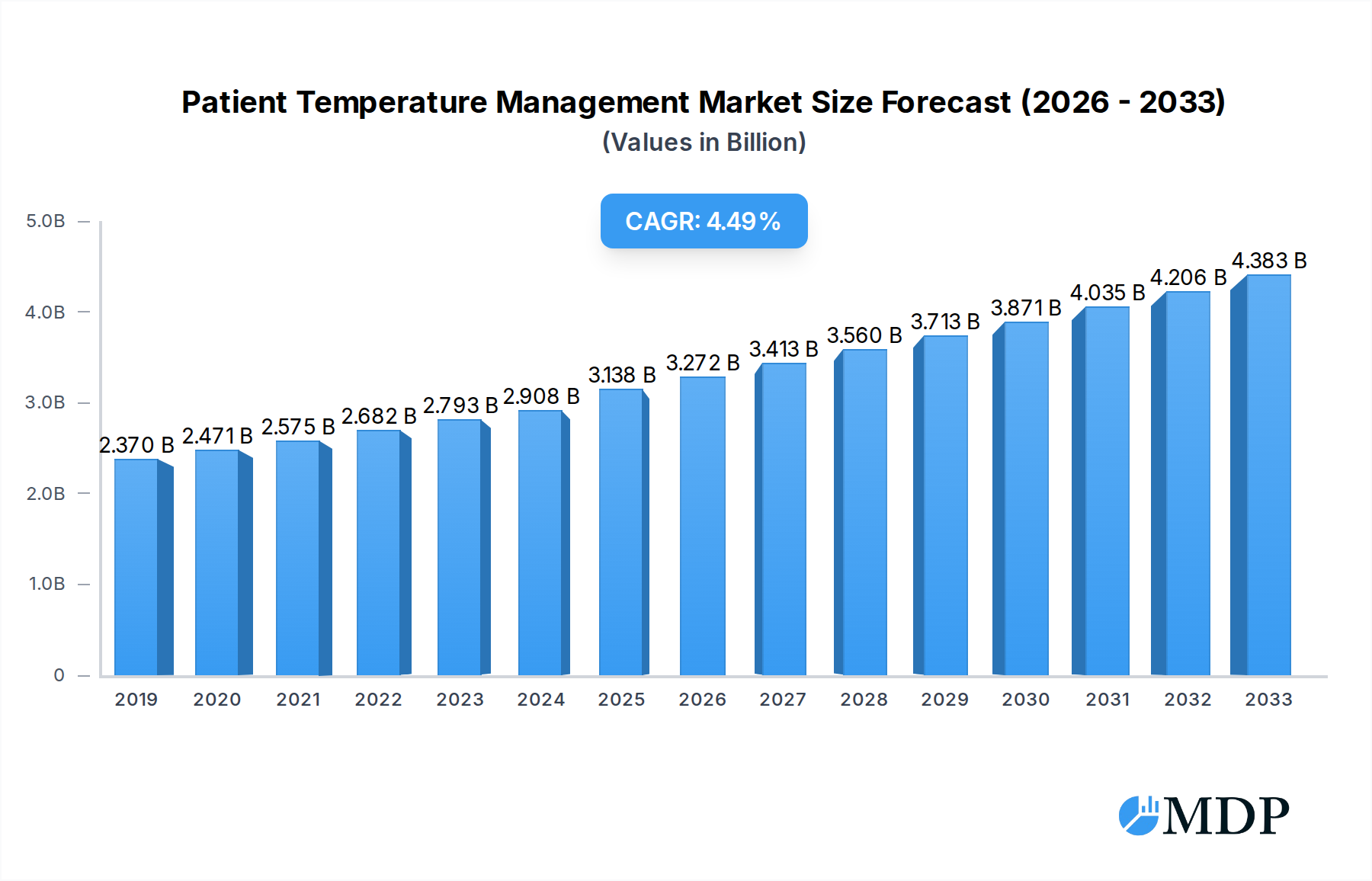

The global Patient Temperature Management market is poised for substantial growth, projected to reach an estimated $3,138 million by 2025, driven by a CAGR of 4.3% between 2019 and 2033. This upward trajectory is fueled by an increasing prevalence of surgical procedures, a growing elderly population susceptible to hypothermia, and the rising incidence of critical illnesses requiring precise temperature regulation. Patient warming systems, particularly those utilized in operating rooms, are expected to dominate the market due to their critical role in preventing perioperative hypothermia, reducing infection rates, and improving patient outcomes. The expansion of healthcare infrastructure in emerging economies and advancements in non-invasive temperature monitoring technologies will further bolster market expansion. Furthermore, the growing emphasis on patient safety protocols and the development of advanced, user-friendly temperature management devices are contributing to the robust market performance.

Patient Temperature Management Market Size (In Billion)

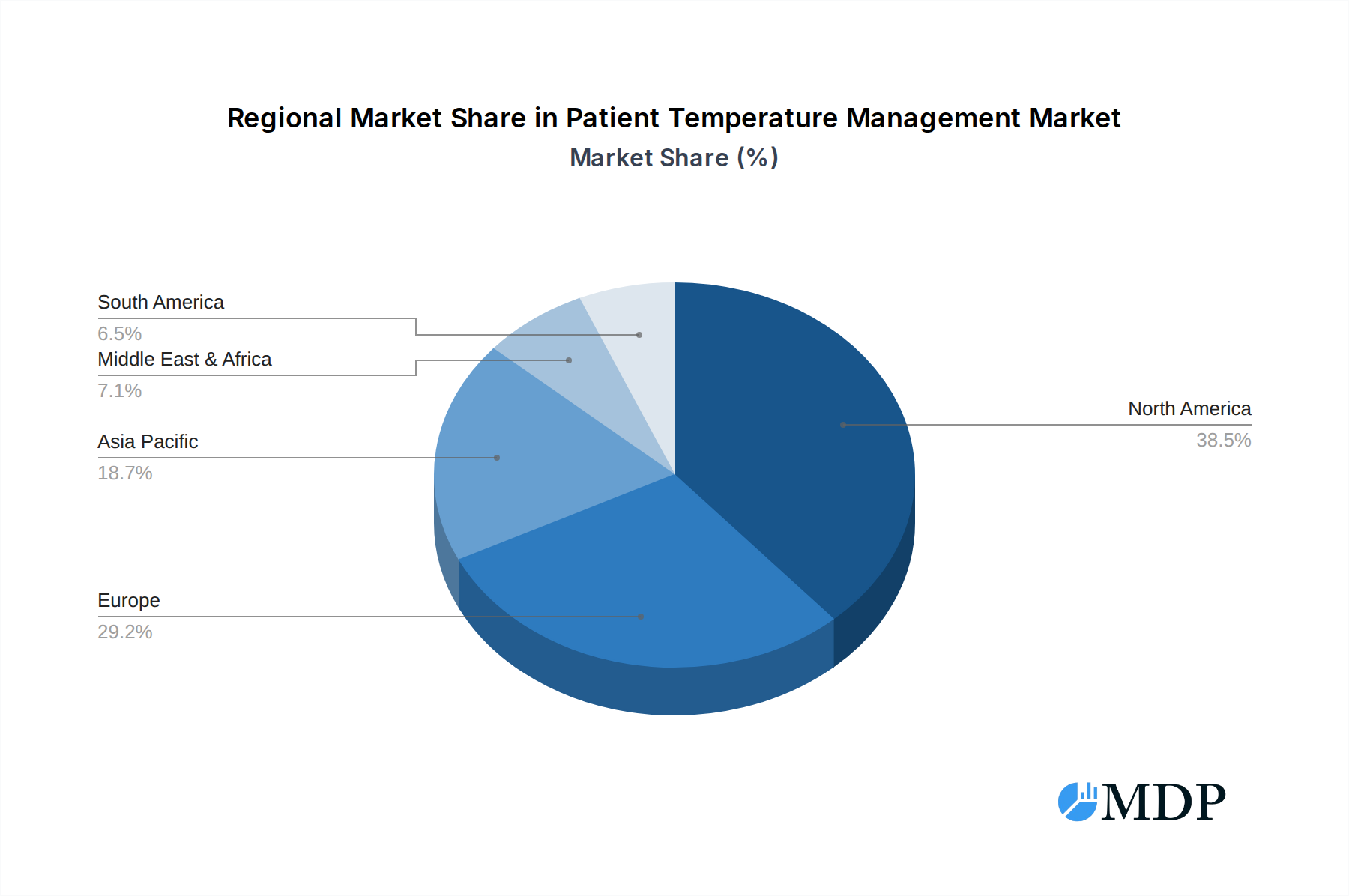

The market is segmented into patient warming systems and patient cooling systems, with the former holding a significant share. Key application areas include operating rooms, intensive care units (ICUs), and emergency rooms, where maintaining optimal patient temperature is paramount. While the market is generally robust, certain factors like the initial cost of advanced temperature management devices and the need for specialized training for healthcare professionals may present challenges. However, the clear benefits in terms of reduced hospital stays, lower complication rates, and enhanced patient comfort are expected to outweigh these restraints. Companies like 3M Healthcare, ZOLL Medical, and Medtronic are at the forefront of innovation, continuously introducing advanced solutions. North America and Europe currently lead the market, driven by established healthcare systems and high adoption rates of advanced medical technologies, with the Asia Pacific region showing immense potential for rapid growth due to increasing healthcare investments and a burgeoning patient population.

Patient Temperature Management Company Market Share

Patient Temperature Management Market Insights Report: Growth, Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the global Patient Temperature Management market, encompassing market dynamics, industry trends, leading segments, product innovations, growth drivers, challenges, emerging opportunities, key players, and significant milestones. Spanning from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for healthcare providers, medical device manufacturers, investors, and industry stakeholders seeking to understand and capitalize on this evolving market. The market is projected to experience significant growth, driven by increasing demand for effective patient care and technological advancements.

Patient Temperature Management Market Dynamics & Concentration

The Patient Temperature Management market exhibits a moderate to high level of concentration, with several key players dominating significant market share. Leading entities such as 3M Healthcare, ZOLL Medical, Medtronic (Covidien), Stryker, and Smiths Medical have established strong presences through continuous innovation and strategic acquisitions. Market concentration is influenced by the substantial investment required for research and development, stringent regulatory approvals, and the need for established distribution networks. Innovation drivers are primarily focused on enhancing patient outcomes, improving device efficiency, and reducing the risk of adverse events associated with temperature deviations. Regulatory frameworks, including those from the FDA and EMA, play a crucial role in shaping product development and market entry, often demanding rigorous clinical validation. Product substitutes, while present in the form of traditional methods, are increasingly being outpaced by advanced technological solutions offering greater precision and patient comfort. End-user trends indicate a growing preference for integrated systems and user-friendly interfaces, particularly in critical care settings. Mergers and acquisitions (M&A) activities, with an estimated xx M&A deal counts in the historical period, have been instrumental in consolidating market share and expanding product portfolios.

Patient Temperature Management Industry Trends & Analysis

The Patient Temperature Management industry is poised for robust growth, driven by a confluence of factors including an aging global population, a rising incidence of chronic diseases requiring precise temperature regulation, and an increasing focus on patient safety and comfort during medical procedures. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. Market penetration is expected to deepen significantly, particularly in emerging economies where healthcare infrastructure is rapidly developing. Technological disruptions are at the forefront of this evolution, with advancements in smart sensors, AI-powered predictive analytics for temperature management, and the development of less invasive and more personalized therapeutic approaches. Consumer preferences are shifting towards systems that offer seamless integration with electronic health records (EHRs), real-time monitoring capabilities, and enhanced patient comfort, thereby minimizing the stress and discomfort associated with hypothermia or hyperthermia. Competitive dynamics are intensifying, with companies vying for market leadership through product differentiation, strategic partnerships, and aggressive marketing strategies. The growing emphasis on evidence-based medicine further fuels the demand for sophisticated temperature management solutions that can demonstrate clear clinical benefits and cost-effectiveness. The projected market size for Patient Temperature Management is estimated to reach over $3,000 million by 2025, with significant expansion anticipated throughout the forecast period.

Leading Markets & Segments in Patient Temperature Management

The Operating Room emerges as the dominant application segment within the Patient Temperature Management market, driven by the critical need for precise temperature control during surgical procedures to prevent complications such as surgical site infections and impaired wound healing. The market size for this segment is estimated to be over $1,500 million in 2025.

- Operating Room Dominance:

- Economic Policies: Increased healthcare spending on surgical infrastructure and advanced medical technologies directly impacts the adoption of sophisticated patient temperature management systems in O.Rs.

- Infrastructure: The availability of advanced surgical suites equipped with integrated temperature monitoring and control systems facilitates the widespread use of these devices.

- Clinical Efficacy: Proven benefits in reducing perioperative hypothermia, improving patient recovery times, and mitigating surgical risks are strong drivers for adoption.

- Technological Advancements: Development of faster-acting, more precise, and less invasive warming and cooling technologies tailored for surgical environments.

In terms of product type, Patient Warming Systems represent the larger segment, estimated at over $2,000 million in 2025, owing to their broader applicability across various medical settings and the higher prevalence of hypothermia-related risks. However, Patient Cooling Systems are experiencing rapid growth, particularly in neurological applications and critical care, with a projected market size of approximately $1,000 million in 2025.

Patient Warming Systems:

- Prevalence of Hypothermia: The widespread occurrence of inadvertent perioperative hypothermia necessitates effective warming solutions.

- Versatility: Applicable in pre-operative, intra-operative, and post-operative care, as well as in other critical care settings.

- Technological Evolution: Innovations in forced-air systems, conductive blankets, and intravenous fluid warmers offer a range of options for different clinical needs.

Patient Cooling Systems:

- Therapeutic Hypothermia Applications: Growing use in managing acute brain injury, cardiac arrest, and stroke to reduce cellular damage.

- Advancements in Technology: Development of more precise and less invasive cooling devices, including surface cooling and endovascular cooling systems.

- Research and Clinical Evidence: Increasing clinical studies demonstrating the efficacy of therapeutic hypothermia in improving patient outcomes.

The North American region, particularly the United States, is the leading market, driven by high healthcare expenditure, early adoption of advanced technologies, and a robust regulatory environment. The estimated market size for North America is over $1,200 million in 2025.

Patient Temperature Management Product Developments

Recent product developments in Patient Temperature Management are characterized by a focus on enhanced precision, patient comfort, and seamless integration. Innovations include intelligent warming and cooling blankets with advanced sensor technology for real-time temperature monitoring and automated adjustments, as well as portable and wireless devices for greater flexibility in various clinical settings. AI-driven predictive algorithms are being integrated to anticipate temperature fluctuations and proactively manage patient status. The competitive advantage of these new products lies in their ability to offer personalized therapy, reduce the incidence of temperature-related complications, and improve overall patient outcomes, thereby aligning with the growing demand for value-based healthcare solutions.

Key Drivers of Patient Temperature Management Growth

The growth of the Patient Temperature Management market is propelled by several key factors. Technological advancements, such as the development of more accurate and efficient warming and cooling devices, are critical. The increasing prevalence of conditions requiring temperature regulation, including surgical procedures, critical illnesses, and neurological emergencies, significantly expands the demand for these solutions. Furthermore, growing awareness among healthcare professionals and patients regarding the adverse effects of temperature dysregulation is a significant driver. Supportive government initiatives and favorable reimbursement policies for advanced patient care technologies also contribute to market expansion.

Challenges in the Patient Temperature Management Market

Despite its growth potential, the Patient Temperature Management market faces certain challenges. High acquisition costs for advanced devices can be a barrier, particularly for smaller healthcare facilities or in developing economies. Stringent regulatory approval processes can lead to extended timelines for new product launches. The need for specialized training for healthcare professionals to effectively operate and utilize these complex systems can also pose a hurdle. Additionally, the presence of established, albeit less advanced, alternative methods for temperature management can create competitive pressure, especially in cost-sensitive markets.

Emerging Opportunities in Patient Temperature Management

Emerging opportunities in the Patient Temperature Management market are ripe for exploitation. The expanding use of therapeutic hypothermia in critical care and neurological applications presents a significant growth avenue. The development of integrated, smart temperature management systems that seamlessly connect with hospital IT infrastructure and provide data analytics for performance optimization is another key area. Strategic partnerships between device manufacturers and healthcare providers can lead to customized solutions and improved patient care pathways. Furthermore, the untapped potential in emerging markets, driven by increasing healthcare investments and a growing demand for advanced medical technologies, offers substantial expansion opportunities.

Leading Players in the Patient Temperature Management Sector

- 3M Healthcare

- ZOLL Medical

- Medtronic (Covidien)

- Stryker

- C. R. Bard

- Smiths Medical

- Cincinnati Sub-Zero (CSZ)

- The 37Company

- Mennen Medical

- Inspiration

- Geratherm Medical

- Healthcare 21

Key Milestones in Patient Temperature Management Industry

- 2019: Introduction of next-generation forced-air warming systems with enhanced airflow and temperature uniformity.

- 2020: Launch of AI-powered predictive temperature management software for intensive care units.

- 2021: Significant increase in clinical studies demonstrating the efficacy of therapeutic hypothermia for post-cardiac arrest care.

- 2022: Advancements in wireless and wearable temperature monitoring devices for enhanced patient mobility.

- 2023: Regulatory approvals for novel endovascular cooling systems offering rapid and precise temperature reduction.

- 2024: Increased adoption of integrated patient warming and cooling solutions in surgical centers.

Strategic Outlook for Patient Temperature Management Market

The strategic outlook for the Patient Temperature Management market is highly positive, driven by continuous innovation and an increasing recognition of its critical role in patient care. Future growth will likely be accelerated by the development of more personalized and adaptive temperature management solutions, the integration of advanced data analytics for predictive care, and the expansion of product offerings for diverse clinical needs. Strategic partnerships and collaborations will be crucial for market penetration, especially in emerging economies. The focus on reducing adverse patient outcomes and improving healthcare efficiency will continue to fuel the demand for these advanced technologies, positioning the market for sustained expansion.

Patient Temperature Management Segmentation

-

1. Application

- 1.1. Operating Room

- 1.2. ICU

- 1.3. Emergency Room

- 1.4. Others

-

2. Type

- 2.1. Patient Warming Systems

- 2.2. Patient Cooling Systems

Patient Temperature Management Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Patient Temperature Management Regional Market Share

Geographic Coverage of Patient Temperature Management

Patient Temperature Management REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Patient Temperature Management Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Operating Room

- 5.1.2. ICU

- 5.1.3. Emergency Room

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Patient Warming Systems

- 5.2.2. Patient Cooling Systems

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Patient Temperature Management Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Operating Room

- 6.1.2. ICU

- 6.1.3. Emergency Room

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Patient Warming Systems

- 6.2.2. Patient Cooling Systems

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Patient Temperature Management Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Operating Room

- 7.1.2. ICU

- 7.1.3. Emergency Room

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Patient Warming Systems

- 7.2.2. Patient Cooling Systems

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Patient Temperature Management Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Operating Room

- 8.1.2. ICU

- 8.1.3. Emergency Room

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Patient Warming Systems

- 8.2.2. Patient Cooling Systems

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Patient Temperature Management Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Operating Room

- 9.1.2. ICU

- 9.1.3. Emergency Room

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Patient Warming Systems

- 9.2.2. Patient Cooling Systems

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Patient Temperature Management Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Operating Room

- 10.1.2. ICU

- 10.1.3. Emergency Room

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Patient Warming Systems

- 10.2.2. Patient Cooling Systems

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 3M Healthcare

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ZOLL Medical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Medtronic (Covidien)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Stryker

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 C. R. Bard

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Smiths Medical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cincinnati Sub-Zero (CSZ)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The 37Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mennen Medical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Inspiration

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Geratherm Medical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Healthcare 21

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 3M Healthcare

List of Figures

- Figure 1: Global Patient Temperature Management Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Patient Temperature Management Revenue (million), by Application 2025 & 2033

- Figure 3: North America Patient Temperature Management Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Patient Temperature Management Revenue (million), by Type 2025 & 2033

- Figure 5: North America Patient Temperature Management Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Patient Temperature Management Revenue (million), by Country 2025 & 2033

- Figure 7: North America Patient Temperature Management Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Patient Temperature Management Revenue (million), by Application 2025 & 2033

- Figure 9: South America Patient Temperature Management Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Patient Temperature Management Revenue (million), by Type 2025 & 2033

- Figure 11: South America Patient Temperature Management Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Patient Temperature Management Revenue (million), by Country 2025 & 2033

- Figure 13: South America Patient Temperature Management Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Patient Temperature Management Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Patient Temperature Management Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Patient Temperature Management Revenue (million), by Type 2025 & 2033

- Figure 17: Europe Patient Temperature Management Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Patient Temperature Management Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Patient Temperature Management Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Patient Temperature Management Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Patient Temperature Management Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Patient Temperature Management Revenue (million), by Type 2025 & 2033

- Figure 23: Middle East & Africa Patient Temperature Management Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Patient Temperature Management Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Patient Temperature Management Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Patient Temperature Management Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Patient Temperature Management Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Patient Temperature Management Revenue (million), by Type 2025 & 2033

- Figure 29: Asia Pacific Patient Temperature Management Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Patient Temperature Management Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Patient Temperature Management Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Patient Temperature Management Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Patient Temperature Management Revenue million Forecast, by Type 2020 & 2033

- Table 3: Global Patient Temperature Management Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Patient Temperature Management Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Patient Temperature Management Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Patient Temperature Management Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Patient Temperature Management Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Patient Temperature Management Revenue million Forecast, by Type 2020 & 2033

- Table 12: Global Patient Temperature Management Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Patient Temperature Management Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Patient Temperature Management Revenue million Forecast, by Type 2020 & 2033

- Table 18: Global Patient Temperature Management Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Patient Temperature Management Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Patient Temperature Management Revenue million Forecast, by Type 2020 & 2033

- Table 30: Global Patient Temperature Management Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Patient Temperature Management Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Patient Temperature Management Revenue million Forecast, by Type 2020 & 2033

- Table 39: Global Patient Temperature Management Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Patient Temperature Management Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Patient Temperature Management?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Patient Temperature Management?

Key companies in the market include 3M Healthcare, ZOLL Medical, Medtronic (Covidien), Stryker, C. R. Bard, Smiths Medical, Cincinnati Sub-Zero (CSZ), The 37Company, Mennen Medical, Inspiration, Geratherm Medical, Healthcare 21.

3. What are the main segments of the Patient Temperature Management?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2274 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Patient Temperature Management," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Patient Temperature Management report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Patient Temperature Management?

To stay informed about further developments, trends, and reports in the Patient Temperature Management, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence