Key Insights

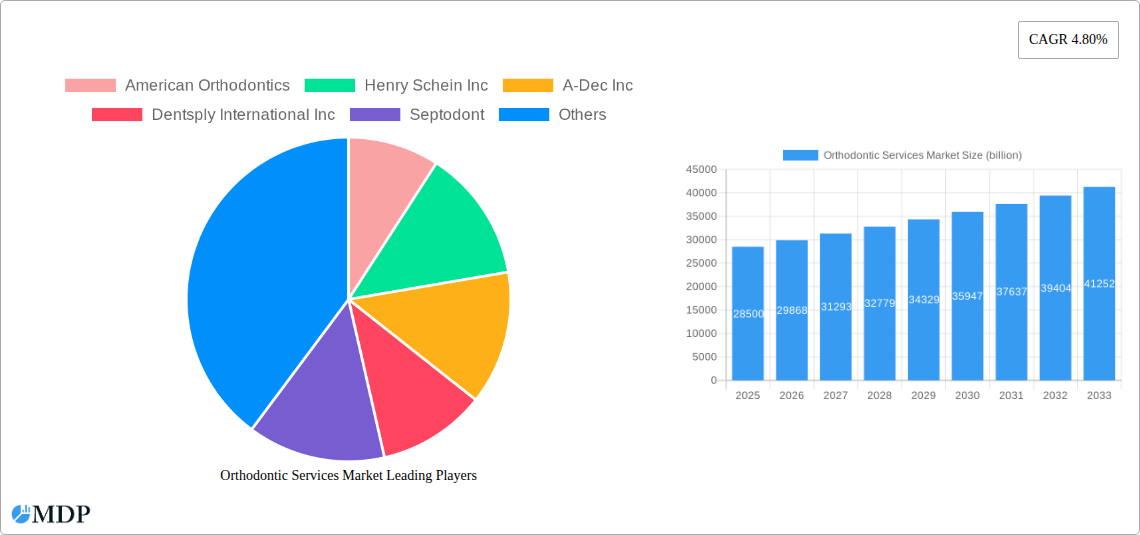

The global orthodontic services market is poised for significant expansion, projected to reach $28.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.80% through 2033. This growth is propelled by increasing demand for aesthetic smiles, rapid advancements in orthodontic technologies, and the rising prevalence of malocclusion across all age demographics. Growing disposable incomes in emerging economies and the adoption of innovative treatments such as clear aligners and lingual braces further accelerate market growth. Digital integration, including CAD/CAM systems and 3D imaging, is transforming treatment planning and patient outcomes, contributing to the market's upward trend. Key industry players are actively investing in R&D and global expansion to introduce novel products and services.

Orthodontic Services Market Market Size (In Billion)

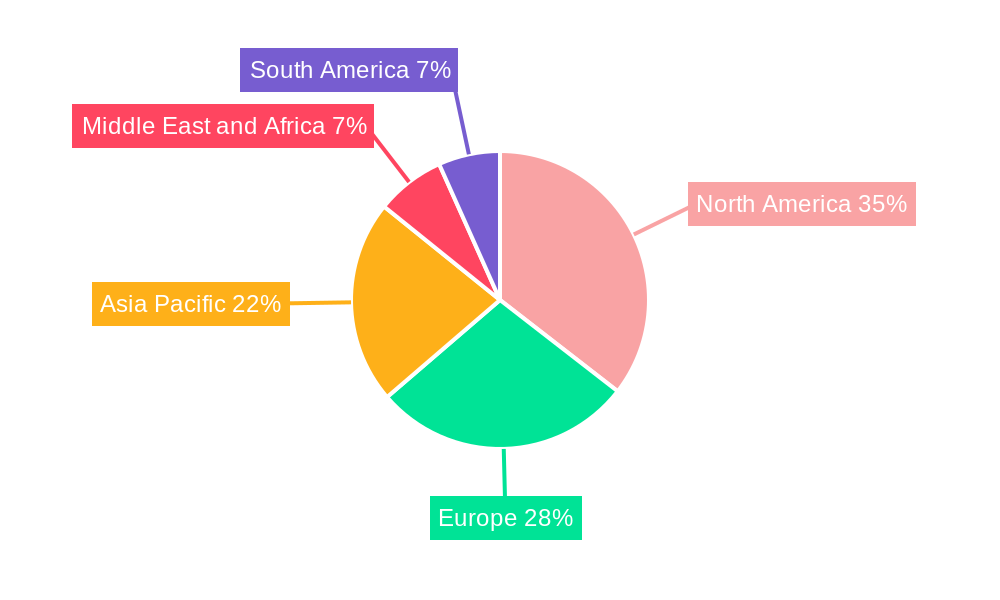

The market encompasses diverse product categories, including essential equipment like dental chairs, lasers, handpieces, light cure units, scaling units, CAD/CAM systems, and radiology equipment, as well as consumables such as anchorage appliances, ligatures, brackets, and archwires. North America currently leads the market, driven by high healthcare expenditure and early adoption of advanced dental technologies. The Asia Pacific region is expected to experience the most rapid growth, fueled by a large population, increasing oral health awareness, and expanding healthcare infrastructure. Challenges include the high cost of advanced treatments and the limited availability of trained orthodontic professionals in certain regions. However, the persistent pursuit of enhanced oral aesthetics and continuous innovation are anticipated to overcome these restraints, ensuring a dynamic and growing orthodontic services market.

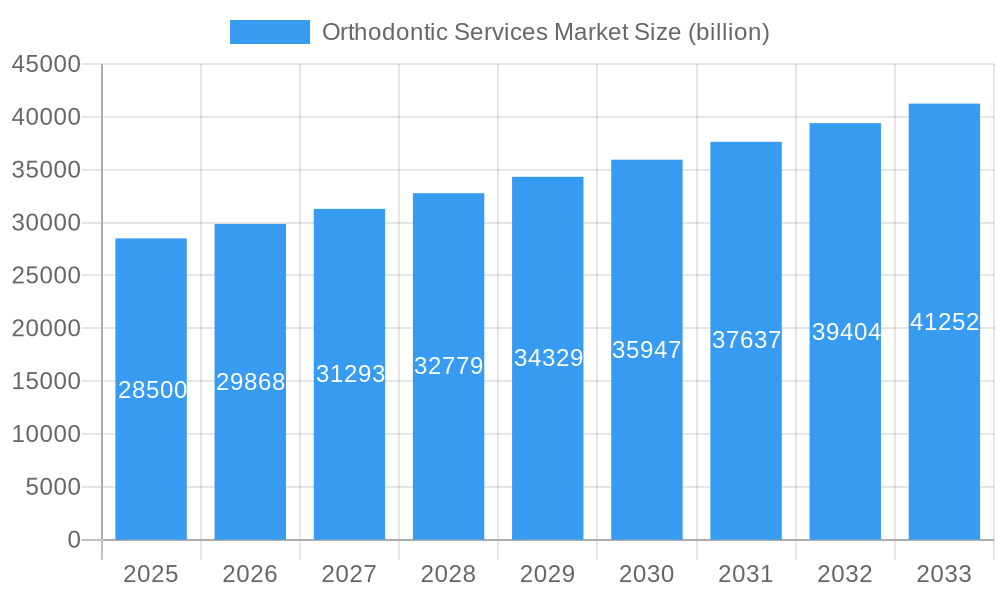

Orthodontic Services Market Company Market Share

This comprehensive report offers an in-depth analysis of the global Orthodontic Services Market, providing actionable insights for industry stakeholders. Covering the study period from 2019–2033, with a base year of 2025 and a forecast period from 2025–2033, this report examines market dynamics, emerging trends, leading segments, and strategic outlooks. We project the Orthodontic Services Market to reach $4.1 billion by 2033, exhibiting a robust CAGR of 1.1% during the forecast period.

Orthodontic Services Market Dynamics & Concentration

The Orthodontic Services Market is characterized by moderate to high concentration, with a few key players dominating significant market share. Innovation drivers such as advancements in CAD/CAM Systems, dental lasers, and the development of novel consumables like brackets and archwires are continuously reshaping the competitive landscape. Stringent regulatory frameworks governing medical devices and patient safety necessitate adherence to global standards, impacting market entry and product development. Product substitutes, particularly the increasing popularity of clear aligners, pose a dynamic challenge to traditional braces. End-user trends lean towards minimally invasive procedures, aesthetic appeal, and faster treatment times, driving demand for innovative orthodontic solutions. Mergers and Acquisitions (M&A) activities, estimated at approximately xx deals during the historical period, are crucial for market consolidation, technological integration, and expanding geographical reach. Key companies like 3M Company, Henry Schein Inc., and Patterson Companies Inc. are actively involved in strategic M&A to bolster their product portfolios and market presence.

Orthodontic Services Market Industry Trends & Analysis

The Orthodontic Services Market is experiencing substantial growth, propelled by a confluence of factors. Rising awareness regarding oral hygiene and the aesthetic benefits of orthodontic treatments among a growing global population is a primary growth driver. The increasing disposable income in emerging economies is further fueling demand for elective cosmetic procedures, including orthodontic interventions. Technological disruptions are at the forefront of market evolution. The widespread adoption of digital orthodontics, including CAD/CAM Systems for precise treatment planning and the integration of AI for diagnostics and treatment prediction, is transforming patient care. Furthermore, innovations in materials science are leading to the development of more durable, biocompatible, and aesthetically pleasing brackets and archwires. Consumer preferences are shifting towards less visible and more comfortable treatment options, evident in the surging demand for clear aligners. This trend, alongside the continued need for traditional braces, creates a diverse market catering to varied patient requirements. Competitive dynamics are intensifying, with both established players and emerging startups vying for market share. Key players are investing heavily in research and development to introduce advanced hand pieces, light cure units, and dental radiology equipment. The market penetration of orthodontic services is steadily increasing, estimated to reach xx% by 2033, signifying a significant expansion in patient access and adoption. The CAGR of the Orthodontic Services Market is projected to be xx% from 2025 to 2033.

Leading Markets & Segments in Orthodontic Services Market

North America currently holds a dominant position in the Orthodontic Services Market, driven by high disposable incomes, advanced healthcare infrastructure, and a strong emphasis on aesthetic dentistry. The United States, in particular, represents a significant market share due to early adoption of innovative orthodontic technologies and a large patient pool seeking cosmetic improvements. The Equipments segment, specifically CAD/CAM Systems and advanced dental radiology equipment, is experiencing rapid expansion in this region, facilitating precision and efficiency in orthodontic procedures. Economic policies supporting healthcare innovation and robust reimbursement frameworks further bolster market growth.

In contrast, the Asia Pacific region is projected to witness the fastest growth during the forecast period, fueled by increasing awareness of orthodontic treatments, a burgeoning middle class, and expanding access to dental care. Government initiatives aimed at improving oral health infrastructure and the growing prevalence of malocclusion cases are key drivers in this region.

Within the Product segmentation:

- Equipments:

- CAD/CAM Systems: Essential for precise digital impressions and custom appliance fabrication, driving efficiency and patient comfort.

- Dental Radiology Equipment: Advanced imaging technologies enabling accurate diagnosis and treatment planning.

- Dental Chairs: Integral to the overall patient experience and the efficiency of orthodontic clinics.

- Hand Pieces: Essential tools for various stages of orthodontic treatment, with ongoing innovation in ergonomics and power.

- Light Cure Units: Crucial for bonding brackets and curing restorative materials.

- Scaling Units: Contribute to overall oral hygiene, a prerequisite for successful orthodontic treatment.

- Dental Lasers: Emerging applications in soft tissue management and accelerated treatment.

- Consumables:

- Brackets: The cornerstone of traditional orthodontics, with continuous innovation in materials and designs for enhanced aesthetics and comfort.

- Archwires: Critical for applying forces to move teeth, with advancements in materials offering improved elasticity and reduced friction.

- Anchorage Appliances: Essential for controlling tooth movement and achieving desired outcomes.

- Ligatures: Used to secure archwires to brackets, with new options offering improved durability and aesthetics.

The increasing demand for aesthetic and less invasive treatments is a significant trend impacting both segments, driving innovation in materials and digital technologies.

Orthodontic Services Market Product Developments

Product developments in the Orthodontic Services Market are characterized by a strong focus on enhancing patient comfort, treatment efficiency, and aesthetic outcomes. Innovations in materials science have led to the introduction of advanced brackets and archwires with reduced friction and improved biocompatibility. The widespread adoption of CAD/CAM Systems has revolutionized treatment planning, enabling personalized approaches and the creation of highly accurate aligners. Furthermore, the integration of digital technologies, including AI-powered diagnostic tools and 3D printing for customized appliances, is enhancing precision and speed. These advancements offer competitive advantages by improving patient compliance, shortening treatment durations, and delivering superior results, catering to evolving consumer demands.

Key Drivers of Orthodontic Services Market Growth

Several key drivers are propelling the growth of the Orthodontic Services Market. Technological advancements, particularly in digital orthodontics and material science, are making treatments more efficient, comfortable, and aesthetically pleasing. The rising global awareness of the importance of oral health and the aesthetic benefits of straight teeth are significantly increasing patient demand. Furthermore, an expanding middle class in emerging economies is enhancing affordability and access to these elective procedures. Regulatory support for medical device innovation and increasing investment in R&D by market players are also crucial growth catalysts.

Challenges in the Orthodontic Services Market Market

Despite robust growth, the Orthodontic Services Market faces several challenges. Stringent regulatory hurdles and the need for extensive clinical trials for new product approvals can lead to extended market entry timelines and increased development costs. High initial investment costs associated with advanced CAD/CAM Systems and digital imaging equipment can be a barrier for smaller practices, particularly in developing regions. Supply chain disruptions, as seen in recent global events, can impact the availability and cost of essential consumables and equipments. Intense competition among established players and the emergence of new market entrants also exert downward pressure on pricing.

Emerging Opportunities in Orthodontic Services Market

The Orthodontic Services Market is ripe with emerging opportunities. The growing demand for clear aligners presents a significant growth avenue, driving innovation in material science and manufacturing processes. Expansion into underserved emerging markets, where awareness and affordability are increasing, offers substantial potential. Strategic partnerships between technology providers and orthodontic practices can accelerate the adoption of digital solutions. Furthermore, advancements in AI and machine learning are creating opportunities for predictive analytics, personalized treatment planning, and improved patient outcomes, setting the stage for long-term market expansion.

Leading Players in the Orthodontic Services Market Sector

- American Orthodontics

- Henry Schein Inc.

- A-Dec Inc.

- Dentsply International Inc.

- Septodont

- Zimmer Holdings Inc.

- GC Corporation

- 3M Company

- Midmark Corporation

- Patterson Companies Inc.

Key Milestones in Orthodontic Services Market Industry

- 2019: Introduction of advanced 3D printing techniques for customized orthodontic appliances.

- 2020: Increased adoption of teledentistry platforms for remote patient monitoring and consultations.

- 2021: Launch of novel biocompatible materials for brackets and archwires, enhancing patient comfort.

- 2022: Significant investment in AI-driven diagnostic tools for more accurate treatment planning.

- 2023: Expansion of clear aligner market share due to advancements in material science and treatment efficacy.

- 2024: Strategic collaborations between traditional orthodontic companies and tech startups to integrate digital workflows.

Strategic Outlook for Orthodontic Services Market Market

The strategic outlook for the Orthodontic Services Market is overwhelmingly positive, with sustained growth anticipated. Key growth accelerators will include the continued innovation and refinement of digital orthodontic technologies, such as AI-powered treatment planning and advanced CAD/CAM Systems. The expanding global demand for aesthetic and minimally invasive treatments will further drive the market, particularly for clear aligners. Focus on enhancing patient experience through personalized treatments and improved comfort will remain paramount. Strategic acquisitions and partnerships will continue to shape the market landscape, fostering consolidation and the diffusion of advanced technologies, positioning the market for significant future expansion and value creation.

Orthodontic Services Market Segmentation

-

1. Product

-

1.1. Equipments

- 1.1.1. Dental Chairs

- 1.1.2. Dental Lasers

- 1.1.3. Hand Pieces

- 1.1.4. Light Cure

- 1.1.5. Scaling Unit

- 1.1.6. CAD/CAM Systems

- 1.1.7. Dental Radiology Equipment

-

1.2. Consumables

- 1.2.1. Anchorage Appliances

- 1.2.2. Ligatures

- 1.2.3. Brackets

- 1.2.4. Archwires

-

1.1. Equipments

Orthodontic Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Orthodontic Services Market Regional Market Share

Geographic Coverage of Orthodontic Services Market

Orthodontic Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Dental Cosmetic Procedures; Technological Advancements in the Orthodontic Equipment; Increasing Incidence of Dental Diseases

- 3.3. Market Restrains

- 3.3.1. ; Lack of Proper Reimbursement; Lack of Awareness in Few Countries

- 3.4. Market Trends

- 3.4.1. Dental Lasers are Expected to Show a High Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Orthodontic Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Equipments

- 5.1.1.1. Dental Chairs

- 5.1.1.2. Dental Lasers

- 5.1.1.3. Hand Pieces

- 5.1.1.4. Light Cure

- 5.1.1.5. Scaling Unit

- 5.1.1.6. CAD/CAM Systems

- 5.1.1.7. Dental Radiology Equipment

- 5.1.2. Consumables

- 5.1.2.1. Anchorage Appliances

- 5.1.2.2. Ligatures

- 5.1.2.3. Brackets

- 5.1.2.4. Archwires

- 5.1.1. Equipments

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Orthodontic Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Equipments

- 6.1.1.1. Dental Chairs

- 6.1.1.2. Dental Lasers

- 6.1.1.3. Hand Pieces

- 6.1.1.4. Light Cure

- 6.1.1.5. Scaling Unit

- 6.1.1.6. CAD/CAM Systems

- 6.1.1.7. Dental Radiology Equipment

- 6.1.2. Consumables

- 6.1.2.1. Anchorage Appliances

- 6.1.2.2. Ligatures

- 6.1.2.3. Brackets

- 6.1.2.4. Archwires

- 6.1.1. Equipments

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Orthodontic Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Equipments

- 7.1.1.1. Dental Chairs

- 7.1.1.2. Dental Lasers

- 7.1.1.3. Hand Pieces

- 7.1.1.4. Light Cure

- 7.1.1.5. Scaling Unit

- 7.1.1.6. CAD/CAM Systems

- 7.1.1.7. Dental Radiology Equipment

- 7.1.2. Consumables

- 7.1.2.1. Anchorage Appliances

- 7.1.2.2. Ligatures

- 7.1.2.3. Brackets

- 7.1.2.4. Archwires

- 7.1.1. Equipments

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Orthodontic Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Equipments

- 8.1.1.1. Dental Chairs

- 8.1.1.2. Dental Lasers

- 8.1.1.3. Hand Pieces

- 8.1.1.4. Light Cure

- 8.1.1.5. Scaling Unit

- 8.1.1.6. CAD/CAM Systems

- 8.1.1.7. Dental Radiology Equipment

- 8.1.2. Consumables

- 8.1.2.1. Anchorage Appliances

- 8.1.2.2. Ligatures

- 8.1.2.3. Brackets

- 8.1.2.4. Archwires

- 8.1.1. Equipments

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Orthodontic Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Equipments

- 9.1.1.1. Dental Chairs

- 9.1.1.2. Dental Lasers

- 9.1.1.3. Hand Pieces

- 9.1.1.4. Light Cure

- 9.1.1.5. Scaling Unit

- 9.1.1.6. CAD/CAM Systems

- 9.1.1.7. Dental Radiology Equipment

- 9.1.2. Consumables

- 9.1.2.1. Anchorage Appliances

- 9.1.2.2. Ligatures

- 9.1.2.3. Brackets

- 9.1.2.4. Archwires

- 9.1.1. Equipments

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Orthodontic Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Equipments

- 10.1.1.1. Dental Chairs

- 10.1.1.2. Dental Lasers

- 10.1.1.3. Hand Pieces

- 10.1.1.4. Light Cure

- 10.1.1.5. Scaling Unit

- 10.1.1.6. CAD/CAM Systems

- 10.1.1.7. Dental Radiology Equipment

- 10.1.2. Consumables

- 10.1.2.1. Anchorage Appliances

- 10.1.2.2. Ligatures

- 10.1.2.3. Brackets

- 10.1.2.4. Archwires

- 10.1.1. Equipments

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 American Orthodontics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Henry Schein Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 A-Dec Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dentsply International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Septodont

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zimmer Holdings Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GC Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 3M Company*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Midmark Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Patterson Companies Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 American Orthodontics

List of Figures

- Figure 1: Global Orthodontic Services Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Orthodontic Services Market Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Orthodontic Services Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Orthodontic Services Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Orthodontic Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Orthodontic Services Market Revenue (billion), by Product 2025 & 2033

- Figure 7: Europe Orthodontic Services Market Revenue Share (%), by Product 2025 & 2033

- Figure 8: Europe Orthodontic Services Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Orthodontic Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Orthodontic Services Market Revenue (billion), by Product 2025 & 2033

- Figure 11: Asia Pacific Orthodontic Services Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: Asia Pacific Orthodontic Services Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Orthodontic Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East and Africa Orthodontic Services Market Revenue (billion), by Product 2025 & 2033

- Figure 15: Middle East and Africa Orthodontic Services Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Middle East and Africa Orthodontic Services Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East and Africa Orthodontic Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Orthodontic Services Market Revenue (billion), by Product 2025 & 2033

- Figure 19: South America Orthodontic Services Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: South America Orthodontic Services Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America Orthodontic Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Orthodontic Services Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Orthodontic Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Orthodontic Services Market Revenue billion Forecast, by Product 2020 & 2033

- Table 4: Global Orthodontic Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Orthodontic Services Market Revenue billion Forecast, by Product 2020 & 2033

- Table 9: Global Orthodontic Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Germany Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: France Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Italy Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Spain Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Orthodontic Services Market Revenue billion Forecast, by Product 2020 & 2033

- Table 17: Global Orthodontic Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: China Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Australia Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: South Korea Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Orthodontic Services Market Revenue billion Forecast, by Product 2020 & 2033

- Table 25: Global Orthodontic Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: GCC Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: South Africa Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Middle East and Africa Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Orthodontic Services Market Revenue billion Forecast, by Product 2020 & 2033

- Table 30: Global Orthodontic Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Brazil Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Argentina Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Orthodontic Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Orthodontic Services Market?

The projected CAGR is approximately 1.1%.

2. Which companies are prominent players in the Orthodontic Services Market?

Key companies in the market include American Orthodontics, Henry Schein Inc, A-Dec Inc, Dentsply International Inc, Septodont, Zimmer Holdings Inc, GC Corporation, 3M Company*List Not Exhaustive, Midmark Corporation, Patterson Companies Inc.

3. What are the main segments of the Orthodontic Services Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.1 billion as of 2022.

5. What are some drivers contributing to market growth?

; Rising Dental Cosmetic Procedures; Technological Advancements in the Orthodontic Equipment; Increasing Incidence of Dental Diseases.

6. What are the notable trends driving market growth?

Dental Lasers are Expected to Show a High Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

; Lack of Proper Reimbursement; Lack of Awareness in Few Countries.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Orthodontic Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Orthodontic Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Orthodontic Services Market?

To stay informed about further developments, trends, and reports in the Orthodontic Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence