Key Insights

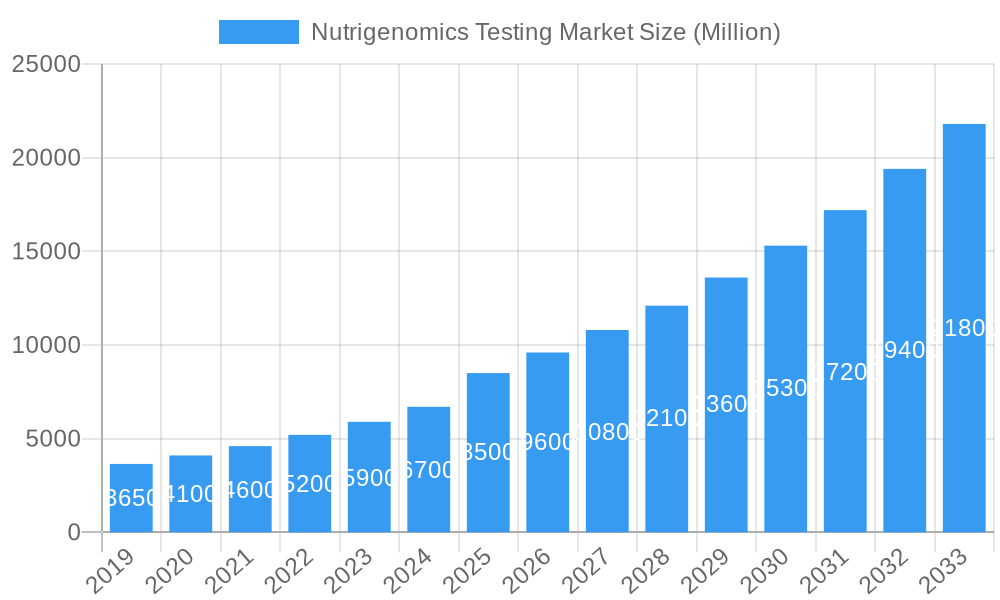

The global nutrigenomics testing market is set for significant expansion, projected to reach $14.86 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 7.75%. This growth is propelled by increasing consumer awareness of personalized health and wellness, the rising incidence of chronic diseases like obesity, diabetes, cardiovascular disease, and cancer, and a growing demand for preventative healthcare. Nutrigenomics, the interdisciplinary science of nutrition and genetics, offers customized dietary recommendations based on an individual's genetic profile, empowering proactive health management and disease risk mitigation. This personalized approach appeals to individuals seeking to optimize their well-being, fueling demand for direct-to-consumer genetic testing kits and clinical nutrigenomic applications. Advancements in genetic sequencing technologies are further enhancing accessibility and affordability, democratizing personalized nutrition.

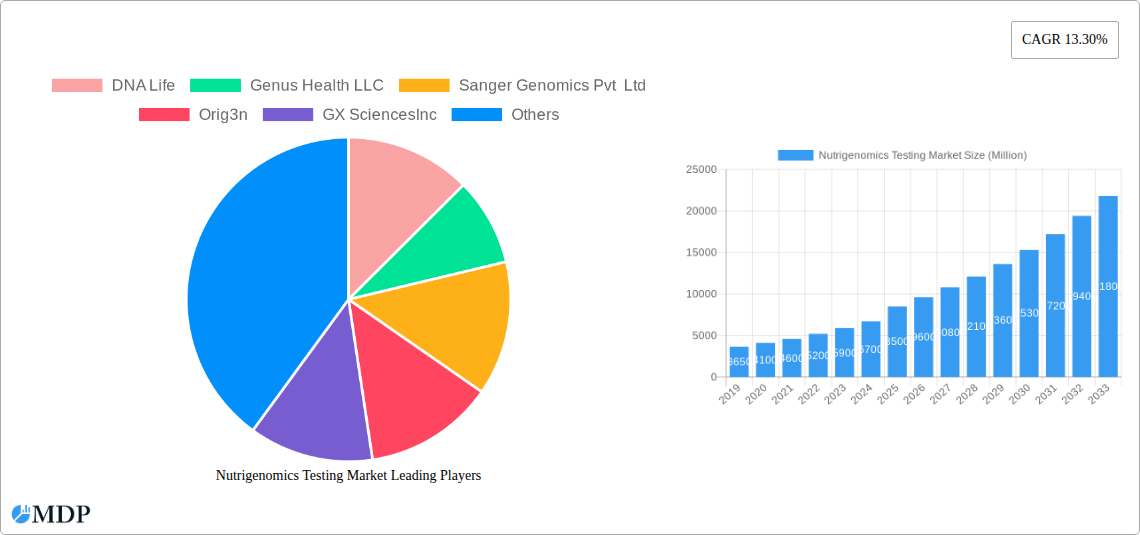

Nutrigenomics Testing Market Market Size (In Billion)

The market's growth is further bolstered by expanding applications in managing obesity, diabetes, cancer, and cardiovascular disease, where genetic predispositions can inform lifestyle interventions and treatment effectiveness. Leading players such as DNA Life, Genus Health LLC, Sanger Genomics Pvt Ltd, Orig3n, and Nutrigenomix are driving innovation and expanding service offerings. North America is anticipated to retain market leadership due to high adoption rates of advanced healthcare technologies and a strong focus on personalized medicine. However, the Asia Pacific region is expected to experience the fastest growth, attributed to rising disposable incomes, increasing health consciousness, and developing healthcare infrastructure. Market participants must strategically address potential challenges, including data privacy concerns, regulatory complexities, and the need for enhanced consumer education on nutrigenomics, to ensure sustained and responsible market expansion.

Nutrigenomics Testing Market Company Market Share

This comprehensive analysis of the Nutrigenomics Testing Market offers deep insights into a rapidly growing sector revolutionizing personalized nutrition and preventative healthcare. Covering the period 2019–2033, with 2025 as the base year and a forecast from 2025–2033, this report details market dynamics, key trends, prominent players, and future opportunities. The market is projected to reach an estimated $14.86 billion by 2025, demonstrating robust growth. This report is vital for stakeholders aiming to understand and capitalize on the escalating demand for genetic-based dietary recommendations.

Nutrigenomics Testing Market Market Dynamics & Concentration

The Nutrigenomics Testing Market is characterized by moderate concentration, with a significant presence of both established players and emerging innovators. Key innovation drivers include advancements in gene sequencing technologies, increased public awareness of personalized health, and a growing demand for science-backed dietary solutions. Regulatory frameworks, while still evolving, are becoming more defined, ensuring the ethical and accurate application of nutrigenomic testing. Product substitutes, such as generalized dietary guidelines and generic health apps, exist but lack the personalized precision offered by nutrigenomics. End-user trends reveal a strong inclination towards preventative healthcare, chronic disease management, and optimized athletic performance, fueling market penetration. Mergers and acquisitions (M&A) activities are on the rise, with an estimated 25+ M&A deals expected between 2019 and 2033, as larger companies seek to acquire innovative technologies and expand their market reach. The market share distribution is dynamic, with top players holding a combined share of approximately 55% in 2025.

Nutrigenomics Testing Market Industry Trends & Analysis

The Nutrigenomics Testing Market is poised for significant expansion, driven by a confluence of technological advancements, evolving consumer preferences, and a heightened focus on personalized health. The projected Compound Annual Growth Rate (CAGR) for the forecast period 2025–2033 is an impressive 18.5%, indicating substantial market growth. This expansion is fueled by breakthroughs in genetic sequencing, making tests more accessible and affordable, alongside sophisticated data analysis platforms that translate complex genetic information into actionable dietary advice. Consumer preferences are increasingly shifting towards proactive health management and personalized wellness solutions, moving beyond one-size-fits-all approaches. Individuals are actively seeking ways to optimize their health based on their unique genetic makeup, leading to higher market penetration in developed economies.

Technological disruptions are continuously reshaping the landscape. The integration of artificial intelligence (AI) and machine learning (ML) is enhancing the accuracy and interpretability of genetic data, enabling more precise nutritional recommendations. Furthermore, the development of user-friendly interfaces and mobile applications is improving customer engagement and accessibility. Competitive dynamics are intensifying, with companies differentiating themselves through proprietary algorithms, comprehensive test panels, and integrated wellness platforms. The focus is shifting from simply identifying genetic predispositions to providing holistic, actionable, and long-term dietary and lifestyle guidance. The increasing prevalence of chronic diseases like obesity, diabetes, and cardiovascular diseases globally also acts as a significant growth driver, as individuals seek personalized interventions to manage and mitigate these conditions. The market penetration is estimated to reach 30% by 2033 in key regions.

Leading Markets & Segments in Nutrigenomics Testing Market

The Nutrigenomics Testing Market exhibits significant regional dominance, with North America currently leading due to a strong emphasis on personalized medicine, high disposable incomes, and advanced healthcare infrastructure. Within North America, the United States represents the largest country market, contributing an estimated 45% of the global revenue in 2025. The economic policies in the US are supportive of innovative healthcare solutions, and robust infrastructure facilitates the adoption of advanced testing technologies.

Among the key application segments, Obesity is a primary driver, accounting for an estimated 30% of the market share in 2025. This dominance stems from the rising global obesity epidemic and the increasing consumer interest in genetic insights to aid weight management.

Obesity:

- Key Drivers: Growing public awareness of the genetic predisposition to obesity, demand for personalized weight loss strategies, and the integration of nutrigenomics into weight management programs by healthcare professionals and fitness centers.

- Dominance Analysis: The genetic links to metabolism, appetite regulation, and nutrient absorption make nutrigenomics an attractive tool for individuals seeking to understand and manage their weight more effectively.

Diabetes:

- Key Drivers: The escalating prevalence of type 2 diabetes globally, the need for personalized dietary interventions to manage blood sugar levels, and the role of genetics in insulin sensitivity and glucose metabolism.

- Dominance Analysis: Nutrigenomics offers insights into genetic predispositions that influence how individuals metabolize carbohydrates and fats, enabling tailored dietary plans to prevent or manage diabetes.

Cardiovascular Disease:

- Key Drivers: The significant global burden of cardiovascular diseases, the desire for early detection and prevention strategies, and the identification of genetic factors influencing cholesterol levels, blood pressure, and lipid metabolism.

- Dominance Analysis: Understanding genetic predispositions related to cardiovascular health allows for personalized dietary recommendations aimed at reducing risk factors and promoting heart health.

Cancer:

- Key Drivers: Growing interest in personalized cancer prevention strategies, understanding genetic predispositions to certain cancers, and the potential for nutrigenomics to complement oncological treatments by optimizing nutrient intake for better outcomes.

- Dominance Analysis: While a developing segment, nutrigenomics is gaining traction in identifying genetic markers associated with cancer risk and in developing personalized nutritional support for cancer patients.

Nutrigenomics Testing Market Product Developments

Product developments in the Nutrigenomics Testing Market are characterized by rapid innovation, focusing on enhanced accuracy, broader gene panels, and user-friendly insights. Companies are increasingly offering integrated testing solutions that not only identify genetic predispositions but also provide actionable dietary and lifestyle recommendations. These advancements leverage sophisticated algorithms and machine learning to translate complex genetic data into personalized nutrition plans. The competitive advantage lies in the depth of analysis, the scientific validation of recommendations, and the seamless integration with digital health platforms and wearable devices, making it easier for consumers to understand and implement their personalized wellness strategies.

Key Drivers of Nutrigenomics Testing Market Growth

The Nutrigenomics Testing Market is propelled by several key drivers. Technological advancements in gene sequencing and bioinformatics have made testing more affordable and accessible. The escalating prevalence of chronic diseases like obesity and diabetes fuels demand for personalized preventative and management solutions. Growing consumer awareness and interest in personalized health and wellness, coupled with the desire for optimized athletic performance, are significant market catalysts. Furthermore, supportive regulatory frameworks in some regions are fostering innovation and market adoption.

Challenges in the Nutrigenomics Testing Market Market

Despite its promising growth, the Nutrigenomics Testing Market faces several challenges. Regulatory hurdles and varying guidelines across different regions can impede market expansion and standardization. The ethical considerations surrounding genetic data privacy and security are paramount and require robust frameworks. Consumer understanding and acceptance of nutrigenomics can also be a barrier, necessitating effective education and outreach. Additionally, ensuring the scientific validity and clinical utility of recommendations, along with potential supply chain disruptions for testing kits and reagents, present ongoing challenges. The competitive landscape, with numerous players, can also lead to price pressures and market fragmentation.

Emerging Opportunities in Nutrigenomics Testing Market

Emerging opportunities in the Nutrigenomics Testing Market are vast. The integration of AI and machine learning in data analysis promises more accurate and predictive insights. The development of at-home testing kits with simplified user interfaces will further enhance accessibility. Strategic partnerships between nutrigenomics companies, healthcare providers, and wellness platforms are expected to drive market penetration and offer comprehensive health solutions. Expansion into emerging economies with growing health consciousness presents a significant untapped market potential. Furthermore, the application of nutrigenomics in sports nutrition and for managing specific dietary intolerances offers specialized growth avenues.

Leading Players in the Nutrigenomics Testing Market Sector

- DNA Life

- Genus Health LLC

- Sanger Genomics Pvt Ltd

- Orig3n

- GX Sciences Inc

- Nutrigenomix

- Holistic Health

- The Gene Box

- Cura Integrative Medicine

Key Milestones in Nutrigenomics Testing Market Industry

- 2019: Increased adoption of direct-to-consumer genetic testing for general wellness insights.

- 2020: Rise in demand for personalized nutrition recommendations to support immune health during global health events.

- 2021: Advancements in AI and ML significantly improve the accuracy of genetic data interpretation for dietary guidance.

- 2022: Expansion of nutrigenomics testing panels to include a wider range of health conditions and predispositions.

- 2023: Growing integration of nutrigenomics data with wearable fitness trackers and digital health platforms.

- 2024: Increased research highlighting the link between genetic variations and response to specific diets for chronic disease management.

- 2025 (Estimated): Significant growth in the application of nutrigenomics for personalized weight management and diabetes prevention.

- 2026-2033 (Forecast): Continued acceleration in market adoption driven by regulatory clarity, technological maturation, and consumer demand for proactive health solutions.

Strategic Outlook for Nutrigenomics Testing Market Market

The strategic outlook for the Nutrigenomics Testing Market is exceptionally positive, driven by the increasing demand for personalized health solutions. Growth accelerators include continued technological innovation in gene sequencing and data analytics, leading to more affordable and accurate testing. The expanding understanding of the intricate relationship between genetics and diet will fuel the adoption of nutrigenomics for preventative healthcare, chronic disease management, and overall wellness optimization. Strategic partnerships between testing providers, healthcare institutions, and corporate wellness programs will broaden market reach and enhance service offerings. The focus will remain on translating complex genetic information into actionable, user-friendly recommendations that empower individuals to make informed dietary and lifestyle choices for long-term health benefits.

Nutrigenomics Testing Market Segmentation

-

1. Application

- 1.1. Obesity

- 1.2. Diabetes

- 1.3. Cancer

- 1.4. Cardiovascular Disease

Nutrigenomics Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Nutrigenomics Testing Market Regional Market Share

Geographic Coverage of Nutrigenomics Testing Market

Nutrigenomics Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Prevalence of Lifestyle Disorders; Increasing Popularity for Personalised Diet

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Obesity Segment is Expected to Exhibhit a Significant Market Growth in the Nutrigenomics Testing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nutrigenomics Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Obesity

- 5.1.2. Diabetes

- 5.1.3. Cancer

- 5.1.4. Cardiovascular Disease

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Nutrigenomics Testing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Obesity

- 6.1.2. Diabetes

- 6.1.3. Cancer

- 6.1.4. Cardiovascular Disease

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Nutrigenomics Testing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Obesity

- 7.1.2. Diabetes

- 7.1.3. Cancer

- 7.1.4. Cardiovascular Disease

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Nutrigenomics Testing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Obesity

- 8.1.2. Diabetes

- 8.1.3. Cancer

- 8.1.4. Cardiovascular Disease

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Nutrigenomics Testing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Obesity

- 9.1.2. Diabetes

- 9.1.3. Cancer

- 9.1.4. Cardiovascular Disease

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 DNA Life

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Genus Health LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sanger Genomics Pvt Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Orig3n

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 GX SciencesInc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nutrigenomix

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Holistic Health

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 The Gene Box

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Cura Integrative Medicine

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 DNA Life

List of Figures

- Figure 1: Global Nutrigenomics Testing Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Nutrigenomics Testing Market Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Nutrigenomics Testing Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Nutrigenomics Testing Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Nutrigenomics Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Nutrigenomics Testing Market Revenue (billion), by Application 2025 & 2033

- Figure 7: Europe Nutrigenomics Testing Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Nutrigenomics Testing Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Nutrigenomics Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Nutrigenomics Testing Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Asia Pacific Nutrigenomics Testing Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Nutrigenomics Testing Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Nutrigenomics Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Nutrigenomics Testing Market Revenue (billion), by Application 2025 & 2033

- Figure 15: Rest of the World Nutrigenomics Testing Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World Nutrigenomics Testing Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of the World Nutrigenomics Testing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nutrigenomics Testing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Nutrigenomics Testing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Nutrigenomics Testing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Nutrigenomics Testing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Nutrigenomics Testing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Nutrigenomics Testing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Germany Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: France Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Italy Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Spain Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Nutrigenomics Testing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Nutrigenomics Testing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: China Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Australia Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: South Korea Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Nutrigenomics Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Nutrigenomics Testing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global Nutrigenomics Testing Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nutrigenomics Testing Market?

The projected CAGR is approximately 7.75%.

2. Which companies are prominent players in the Nutrigenomics Testing Market?

Key companies in the market include DNA Life, Genus Health LLC, Sanger Genomics Pvt Ltd, Orig3n, GX SciencesInc, Nutrigenomix, Holistic Health, The Gene Box, Cura Integrative Medicine.

3. What are the main segments of the Nutrigenomics Testing Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.86 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Prevalence of Lifestyle Disorders; Increasing Popularity for Personalised Diet.

6. What are the notable trends driving market growth?

Obesity Segment is Expected to Exhibhit a Significant Market Growth in the Nutrigenomics Testing Market.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nutrigenomics Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nutrigenomics Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nutrigenomics Testing Market?

To stay informed about further developments, trends, and reports in the Nutrigenomics Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence