Key Insights

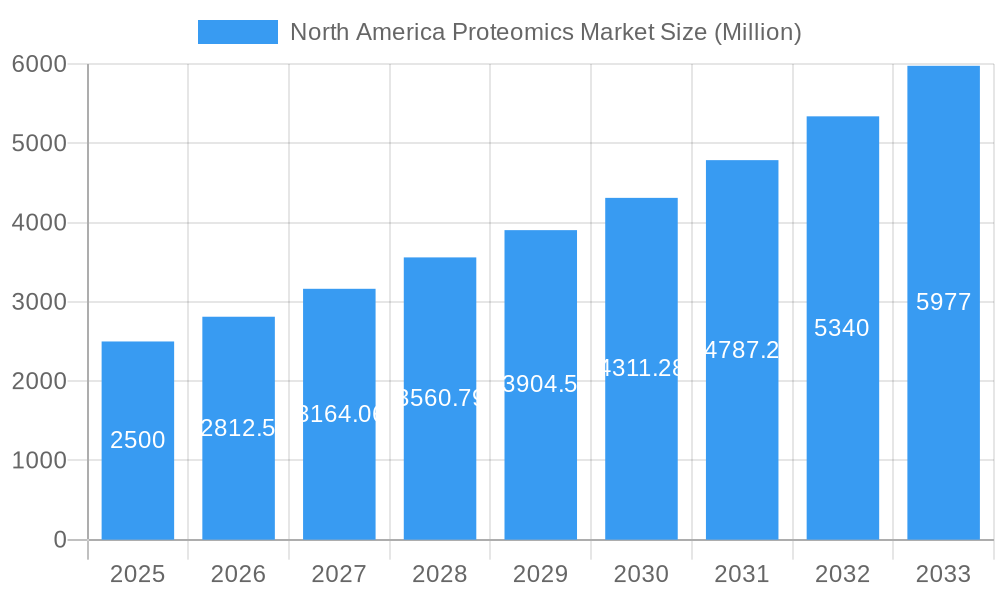

The North American proteomics market, valued at approximately $14.11 billion in 2025, is projected for substantial expansion. Driven by a compound annual growth rate (CAGR) of 12.7% from 2025 to 2033, this growth is propelled by key factors. The rising incidence of chronic diseases, including cancer and diabetes, is increasing demand for advanced diagnostics and personalized medicine, areas where proteomics is critical. Furthermore, significant technological advancements in instrumentation, such as high-resolution mass spectrometry and sophisticated chromatography, are enhancing the speed, accuracy, and cost-effectiveness of proteomic analysis. Concurrently, the burgeoning field of bioinformatics, supported by accessible software and services for data interpretation, empowers researchers to derive valuable insights from complex proteomic data. Substantial R&D investments from public and private sectors are also accelerating market growth. Clinical diagnostics currently represent the largest application segment, followed by drug discovery, with both benefiting from increased adoption of proteomics for biomarker identification and target validation. Leading companies like Thermo Fisher Scientific, Danaher Corporation (Cytiva), and Bio-Rad Laboratories are strategically enhancing their product offerings and market reach through acquisitions and partnerships.

North America Proteomics Market Market Size (In Billion)

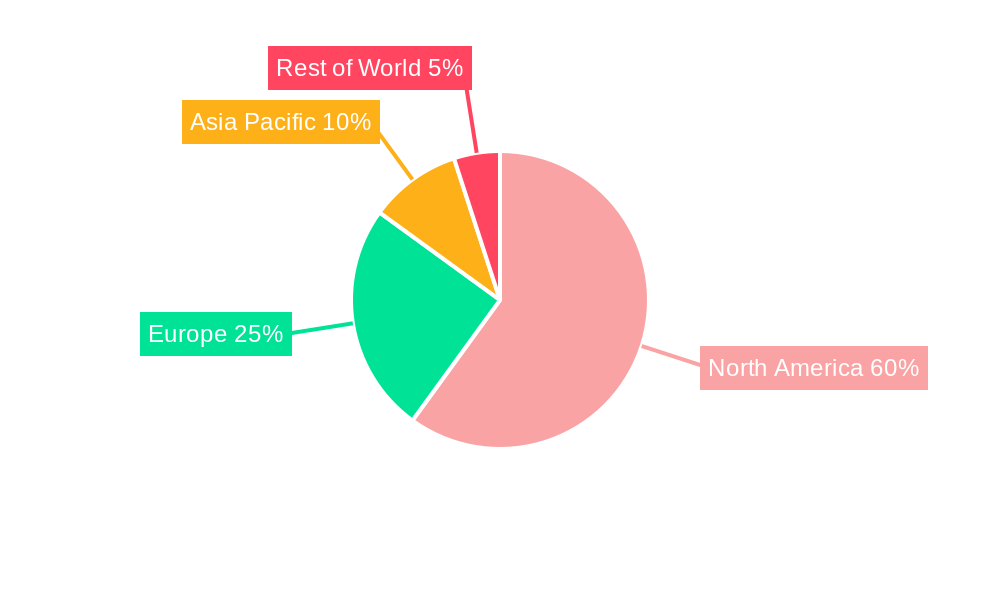

Market segmentation highlights the significant contribution of instrumentation, including advanced mass spectrometers and chromatography systems. The services and software segment is experiencing rapid growth due to the increasing complexity of data analysis and the demand for specialized expertise. While North America leads the market, supported by robust healthcare infrastructure and funding, other regions are expected to see notable growth driven by increasing healthcare spending and awareness of proteomics' potential. However, the high cost of proteomic technologies and the requirement for skilled professionals to interpret results may pose limitations. Despite these challenges, the overall market outlook is strongly positive, with considerable growth anticipated throughout the forecast period.

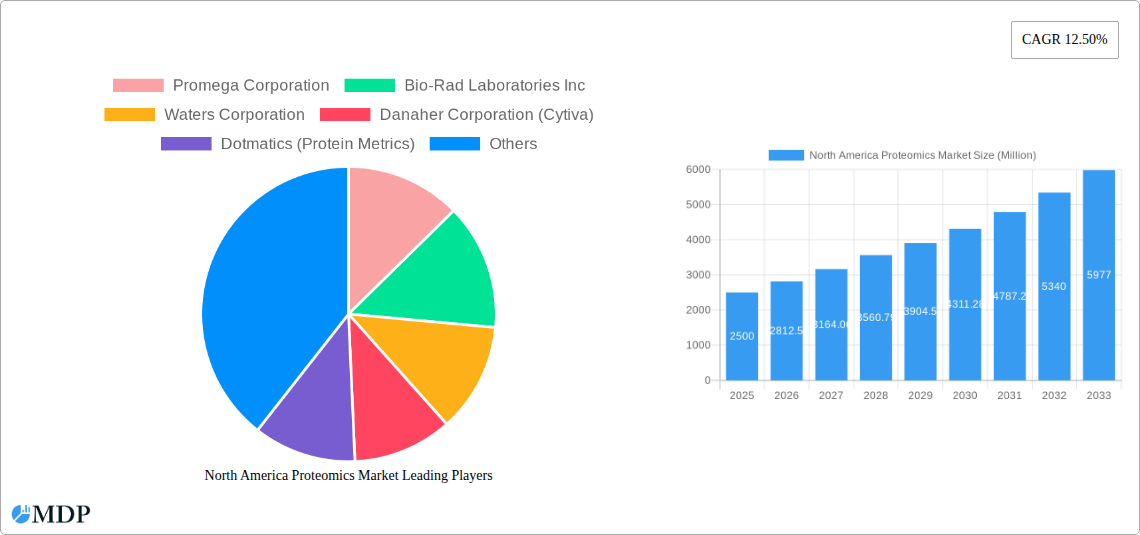

North America Proteomics Market Company Market Share

North America Proteomics Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America proteomics market, covering the period from 2019 to 2033. With a focus on market dynamics, leading players, and future trends, this report is an essential resource for industry stakeholders, investors, and researchers seeking to understand and capitalize on the growth opportunities within this rapidly evolving sector. The report leverages extensive market research to project a market value of xx Million by 2033, demonstrating substantial growth potential.

North America Proteomics Market Dynamics & Concentration

The North America proteomics market is characterized by a moderately concentrated landscape, with key players holding significant market share. Market concentration is influenced by factors such as technological advancements, regulatory approvals, and strategic mergers and acquisitions (M&A). The market witnessed xx M&A deals between 2019 and 2024, indicating a dynamic competitive environment. Innovation drives market growth, with companies constantly developing advanced instrumentation, software, and reagents to enhance proteomics research and applications. Stringent regulatory frameworks, particularly in the clinical diagnostics segment, impact market access and adoption rates. The availability of substitute technologies also influences market dynamics. End-user trends, primarily driven by increasing demand for personalized medicine and advanced diagnostics, are shaping market growth.

- Market Share: Thermo Fisher Scientific, Bio-Rad Laboratories, and Danaher Corporation (Cytiva) collectively hold an estimated xx% market share in 2025.

- M&A Activity: The average annual M&A deal count from 2019-2024 was approximately xx deals per year.

- Innovation Drivers: Advancements in mass spectrometry, bioinformatics software, and sample preparation techniques are key innovation drivers.

- Regulatory Impact: FDA approvals and other regulatory clearances significantly affect market entry for new products and services.

North America Proteomics Market Industry Trends & Analysis

The North America proteomics market is experiencing robust growth, driven by several key factors. The market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as advancements in mass spectrometry and spatial proteomics, are significantly impacting market dynamics. Increasing adoption of proteomics in clinical diagnostics and drug discovery is driving market penetration. The rising prevalence of chronic diseases and the increasing demand for personalized medicine are also contributing to market growth. Competitive dynamics are shaped by both established players and emerging companies entering the market with innovative solutions.

Leading Markets & Segments in North America Proteomics Market

The United States is the dominant market within North America, accounting for approximately xx% of the total market value in 2025. This dominance is attributed to strong government funding for research, a high concentration of biotech and pharmaceutical companies, and well-established healthcare infrastructure. Within segments:

Type: Instrumentation technology constitutes the largest segment, driven by the continuous demand for high-throughput and high-resolution instruments. Other instrumentation technologies and reagents contribute significantly as well. Services and software are also witnessing growth due to the increasing demand for data analysis and bioinformatics support. Bioinformatics software and services are also expected to grow.

Application: Clinical diagnostics and drug discovery are the leading application segments, fueled by the potential of proteomics to identify biomarkers and develop targeted therapies. The other applications segment, including academic research and agricultural biotechnology, also represents a significant opportunity.

Key Drivers (US):

- Strong government funding for biomedical research.

- High concentration of biotechnology and pharmaceutical companies.

- Well-developed healthcare infrastructure and regulatory framework.

North America Proteomics Market Product Developments

Recent product developments emphasize enhanced sensitivity, speed, and automation in proteomics workflows. Companies are focusing on developing integrated solutions combining instrumentation, software, and reagents for streamlined workflows. Innovations in spatial proteomics are gaining traction, allowing for the simultaneous analysis of protein location and abundance. These advancements improve data quality, reduce experimental time, and broaden the applicability of proteomics across various research and clinical applications, enhancing the market fit for advanced products and services.

Key Drivers of North America Proteomics Market Growth

Several factors are driving the growth of the North America proteomics market:

- Technological Advancements: Continuous improvements in mass spectrometry technology, bioinformatics software, and sample preparation methods are enhancing the speed, sensitivity, and accuracy of proteomics research.

- Increased Funding for Research: Government and private funding for proteomics research are fueling innovation and application development.

- Growing Demand for Personalized Medicine: Proteomics plays a critical role in identifying biomarkers for personalized disease diagnosis and treatment, driving market growth.

- Rising Prevalence of Chronic Diseases: The increasing incidence of chronic diseases such as cancer, diabetes, and cardiovascular diseases is driving the need for more effective diagnostic and therapeutic tools, thus boosting proteomics adoption.

Challenges in the North America Proteomics Market

Despite the significant growth potential, the North America proteomics market faces certain challenges:

- High Cost of Instrumentation and Reagents: The high cost of advanced proteomics equipment and reagents can limit market access for smaller research institutions and laboratories. This results in an estimated xx Million loss in potential revenue per year.

- Data Analysis Complexity: Analyzing large proteomics datasets requires specialized expertise and sophisticated bioinformatics tools, posing a barrier to entry for some researchers.

- Regulatory Hurdles: Obtaining regulatory approvals for proteomics-based diagnostic and therapeutic products can be time-consuming and complex.

Emerging Opportunities in North America Proteomics Market

Emerging opportunities in the North America proteomics market include:

- Advancements in Spatial Proteomics: This technology allows for the analysis of protein location and abundance within cells and tissues, offering new insights into biological processes and disease mechanisms.

- Integration of AI and Machine Learning: The application of AI and machine learning is improving data analysis and interpretation, accelerating the discovery of new biomarkers and therapeutic targets.

- Expanding Applications in Agriculture and Environmental Science: Proteomics is finding increasing application in agriculture and environmental monitoring, offering solutions for crop improvement and environmental pollution control. The predicted market value for this is xx Million by 2033.

Leading Players in the North America Proteomics Market Sector

Key Milestones in North America Proteomics Market Industry

- May 2022: Ionpath received a strategic investment from Thermo Fisher Scientific to support spatial proteomics innovation. This highlights the growing interest and investment in advanced proteomics technologies.

- January 2023: Bruker made a majority-ownership investment in Biognosys. Biognosys plans to open an advanced US proteomics CRO facility, signifying expansion of proteomics services for drug discovery and development.

Strategic Outlook for North America Proteomics Market Market

The North America proteomics market is poised for continued growth, driven by technological innovations, increased research funding, and expanding applications. Strategic partnerships and collaborations among companies will play a crucial role in accelerating market expansion. The development of novel applications and the integration of proteomics with other omics technologies will further fuel market growth. The market’s future potential lies in the development of affordable, high-throughput technologies and the broader adoption of proteomics in clinical diagnostics and personalized medicine.

North America Proteomics Market Segmentation

-

1. Type

-

1.1. Instrumentation Technology

- 1.1.1. Spectroscopy

- 1.1.2. Chromatography

- 1.1.3. Electrophoresis

- 1.1.4. Protein Microarrays

- 1.1.5. X-Ray Crystallography

- 1.1.6. Other Instrumentation Technologies

-

1.2. Services and Software

- 1.2.1. Core Proteomics Services

- 1.2.2. Bioinformatics Software and Services

- 1.3. Reagents

-

1.1. Instrumentation Technology

-

2. Application

- 2.1. Clinical Diagnostics

- 2.2. Drug Discovery

- 2.3. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Proteomics Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Proteomics Market Regional Market Share

Geographic Coverage of North America Proteomics Market

North America Proteomics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Personalized Medicine; Increasing R&D Expenditure and Government Funding for Proteomics; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Instruments

- 3.4. Market Trends

- 3.4.1. Drug Discovery is Expected to Witness Highest CAGR in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Proteomics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Instrumentation Technology

- 5.1.1.1. Spectroscopy

- 5.1.1.2. Chromatography

- 5.1.1.3. Electrophoresis

- 5.1.1.4. Protein Microarrays

- 5.1.1.5. X-Ray Crystallography

- 5.1.1.6. Other Instrumentation Technologies

- 5.1.2. Services and Software

- 5.1.2.1. Core Proteomics Services

- 5.1.2.2. Bioinformatics Software and Services

- 5.1.3. Reagents

- 5.1.1. Instrumentation Technology

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Clinical Diagnostics

- 5.2.2. Drug Discovery

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Proteomics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Instrumentation Technology

- 6.1.1.1. Spectroscopy

- 6.1.1.2. Chromatography

- 6.1.1.3. Electrophoresis

- 6.1.1.4. Protein Microarrays

- 6.1.1.5. X-Ray Crystallography

- 6.1.1.6. Other Instrumentation Technologies

- 6.1.2. Services and Software

- 6.1.2.1. Core Proteomics Services

- 6.1.2.2. Bioinformatics Software and Services

- 6.1.3. Reagents

- 6.1.1. Instrumentation Technology

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Clinical Diagnostics

- 6.2.2. Drug Discovery

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Proteomics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Instrumentation Technology

- 7.1.1.1. Spectroscopy

- 7.1.1.2. Chromatography

- 7.1.1.3. Electrophoresis

- 7.1.1.4. Protein Microarrays

- 7.1.1.5. X-Ray Crystallography

- 7.1.1.6. Other Instrumentation Technologies

- 7.1.2. Services and Software

- 7.1.2.1. Core Proteomics Services

- 7.1.2.2. Bioinformatics Software and Services

- 7.1.3. Reagents

- 7.1.1. Instrumentation Technology

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Clinical Diagnostics

- 7.2.2. Drug Discovery

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Proteomics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Instrumentation Technology

- 8.1.1.1. Spectroscopy

- 8.1.1.2. Chromatography

- 8.1.1.3. Electrophoresis

- 8.1.1.4. Protein Microarrays

- 8.1.1.5. X-Ray Crystallography

- 8.1.1.6. Other Instrumentation Technologies

- 8.1.2. Services and Software

- 8.1.2.1. Core Proteomics Services

- 8.1.2.2. Bioinformatics Software and Services

- 8.1.3. Reagents

- 8.1.1. Instrumentation Technology

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Clinical Diagnostics

- 8.2.2. Drug Discovery

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Promega Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Bio-Rad Laboratories Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Waters Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Danaher Corporation (Cytiva)

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Dotmatics (Protein Metrics)

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Thermo Fisher Scientific Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Seer Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Merck KGaA (Sigma-Aldrich)

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Agilent Technologies Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Creative Proteomics

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Bruker Corporation

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Promega Corporation

List of Figures

- Figure 1: North America Proteomics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Proteomics Market Share (%) by Company 2025

List of Tables

- Table 1: North America Proteomics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Proteomics Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: North America Proteomics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: North America Proteomics Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: North America Proteomics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Proteomics Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: North America Proteomics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Proteomics Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: North America Proteomics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Proteomics Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: North America Proteomics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: North America Proteomics Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: North America Proteomics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Proteomics Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: North America Proteomics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Proteomics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: North America Proteomics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Proteomics Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 19: North America Proteomics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: North America Proteomics Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: North America Proteomics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Proteomics Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: North America Proteomics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Proteomics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: North America Proteomics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: North America Proteomics Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: North America Proteomics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: North America Proteomics Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: North America Proteomics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Proteomics Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: North America Proteomics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Proteomics Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Proteomics Market?

The projected CAGR is approximately 12.7%.

2. Which companies are prominent players in the North America Proteomics Market?

Key companies in the market include Promega Corporation, Bio-Rad Laboratories Inc, Waters Corporation, Danaher Corporation (Cytiva), Dotmatics (Protein Metrics), Thermo Fisher Scientific Inc, Seer Inc , Merck KGaA (Sigma-Aldrich), Agilent Technologies Inc, Creative Proteomics, Bruker Corporation.

3. What are the main segments of the North America Proteomics Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.11 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Personalized Medicine; Increasing R&D Expenditure and Government Funding for Proteomics; Technological Advancements.

6. What are the notable trends driving market growth?

Drug Discovery is Expected to Witness Highest CAGR in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Instruments.

8. Can you provide examples of recent developments in the market?

January 2023: Bruker made a majority-ownership investment in Biognosys. With Bruker's investments, Biognosys plans to open advanced United States proteomics CRO facility for proteomics biomarker and drug discovery and development and pharmacoproteomics clinical trial support.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Proteomics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Proteomics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Proteomics Market?

To stay informed about further developments, trends, and reports in the North America Proteomics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence