Key Insights

The North American omega-3 products market, encompassing functional foods, dietary supplements, infant nutrition, pet food, pharmaceuticals, and diverse distribution channels, is poised for significant expansion. This growth is propelled by heightened consumer awareness regarding the multifaceted health benefits of omega-3 fatty acids, including their crucial roles in cardiovascular health, cognitive function, and inflammation reduction. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 5.9%. This upward trend is further reinforced by the rising incidence of chronic diseases and a proactive shift towards preventative healthcare. Segmentation analysis indicates robust demand across all product categories, with dietary supplements and functional foods leading due to their convenience and accessibility. Grocery retailers and pharmacies remain primary distribution avenues, while e-commerce platforms are witnessing accelerated growth, mirroring evolving consumer purchasing habits. Leading industry players are strategically innovating and marketing to capitalize on this burgeoning market, fostering a competitive environment characterized by established entities and emerging brands focused on specialized formulations.

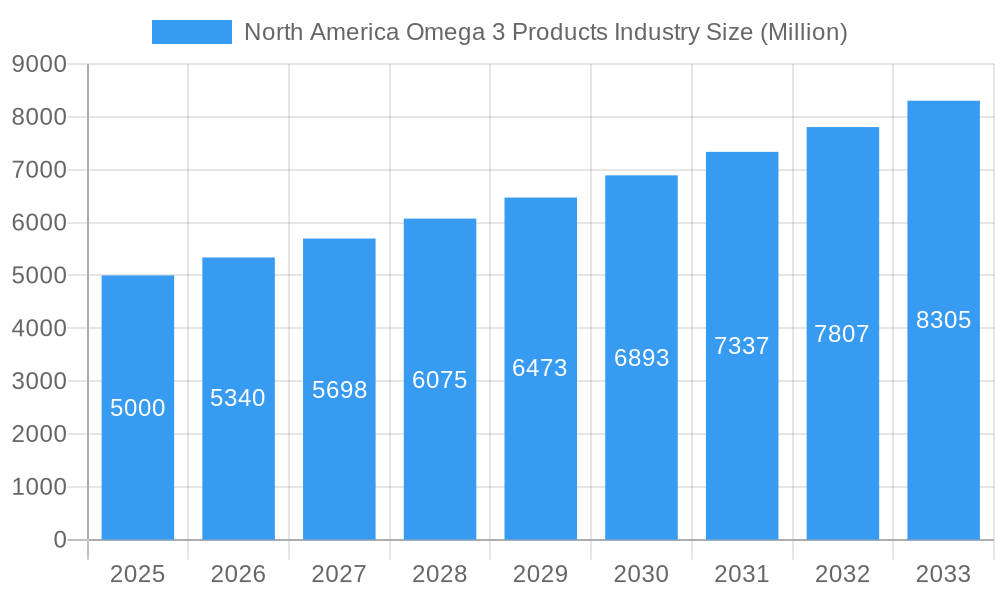

North America Omega 3 Products Industry Market Size (In Billion)

Despite robust growth prospects, the market faces potential headwinds. These include fluctuations in raw material prices (e.g., fish oil), rigorous regulatory compliance for health and dietary supplements, and concerns surrounding the sustainability of fishing practices. Nevertheless, these challenges are anticipated to be mitigated by escalating health consciousness, expanding scientific validation of omega-3 benefits, and continuous product innovation, such as advancements in sustainable sourcing and bioavailability. The forecast period (2024-2031) anticipates sustained market expansion, driven by these dynamic factors, solidifying North America's prominent position in the global omega-3 products sector. With a base year market size of $2.5 billion and a projected CAGR of 5.9%, substantial market growth is expected throughout the forecast period, presenting considerable opportunities for both incumbent firms and new entrants.

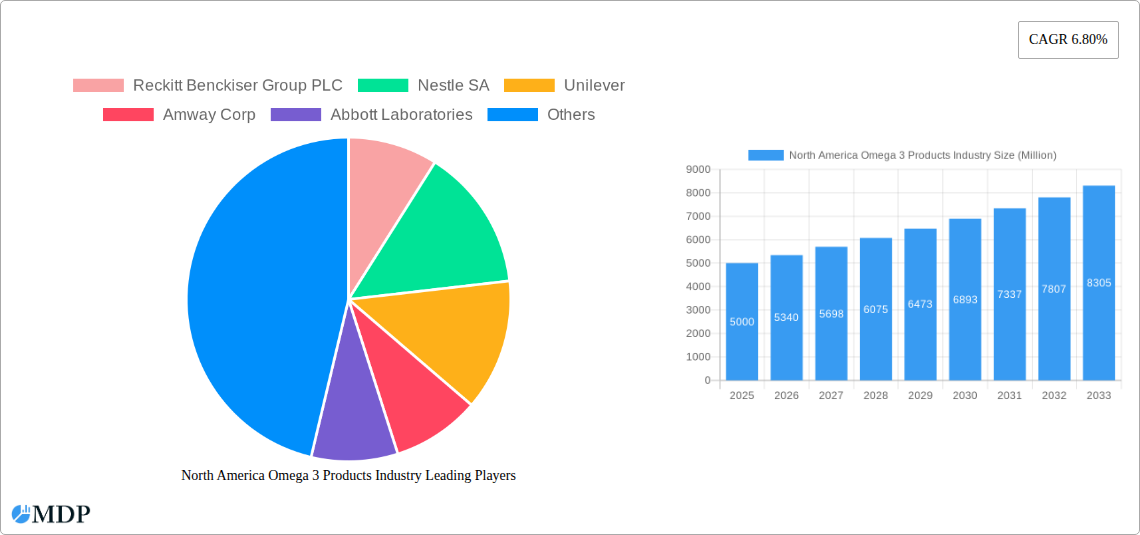

North America Omega 3 Products Industry Company Market Share

North America Omega-3 Products Industry Report: 2019-2033

Unlocking the Potential of the Multi-Billion Dollar Omega-3 Market in North America: A Comprehensive Analysis & Forecast

This comprehensive report provides an in-depth analysis of the North America Omega-3 products industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils key trends, growth drivers, challenges, and opportunities, empowering informed decision-making. The market is poised for significant expansion, with projected growth fueled by increasing consumer awareness of health benefits and technological advancements.

Key Highlights:

- Market Size & Growth: Discover the current market value (estimated at xx Million in 2025) and projected growth trajectory (CAGR of xx% from 2025 to 2033).

- Competitive Landscape: Analyze the strategies of leading players like Reckitt Benckiser Group PLC, Nestle SA, Unilever, Amway Corp, Abbott Laboratories, Herbalife Nutrition, Nutrigold Inc., and GNC, and understand their market share.

- Segment Analysis: Deep dive into performance across key product types (Functional Food, Dietary Supplements, Infant Nutrition, Pet Food and Feed, Pharmaceuticals) and distribution channels (Grocery Retailers, Pharmacies and Health Stores, Internet Retailing, Other Distribution Channels).

- Future Outlook: Identify emerging opportunities and potential challenges, allowing for strategic planning and proactive adaptation.

North America Omega-3 Products Industry Market Dynamics & Concentration

The North American Omega-3 products market exhibits a moderately consolidated structure, with a handful of multinational corporations holding significant market share. Reckitt Benckiser Group PLC, Nestle SA, and Unilever are among the dominant players, leveraging their established brand presence and extensive distribution networks. However, the market also features several smaller, specialized companies catering to niche segments. Market share dynamics are influenced by factors including brand recognition, product innovation, pricing strategies, and distribution reach. M&A activity has played a role in shaping the competitive landscape, with approximately xx M&A deals recorded between 2019 and 2024. These transactions often involved larger companies acquiring smaller players to expand their product portfolios or gain access to new technologies or distribution channels.

- Innovation Drivers: Growing consumer demand for natural and functional foods, as well as advancements in omega-3 extraction and encapsulation technologies, are driving innovation.

- Regulatory Frameworks: Government regulations regarding labeling, ingredient sourcing, and health claims impact product development and marketing strategies.

- Product Substitutes: The market faces competition from other dietary supplements and functional foods offering similar health benefits.

- End-User Trends: Increasing awareness of the health benefits of omega-3 fatty acids, coupled with changing dietary habits, is boosting demand.

North America Omega-3 Products Industry Industry Trends & Analysis

The North America Omega-3 products market is experiencing robust growth, driven by several factors. Rising consumer awareness regarding cardiovascular health, cognitive function, and overall well-being has led to increased demand for omega-3 supplements and functional foods. This trend is amplified by the growing prevalence of chronic diseases linked to omega-3 deficiency. Technological advancements in extraction and delivery systems are enabling the development of more effective and convenient products, contributing to market expansion. The shift towards healthier lifestyles and growing adoption of plant-based diets are also fueling market growth. The market is witnessing a surge in demand for sustainable and ethically sourced omega-3 products. Competitive dynamics are shaped by brand loyalty, product differentiation, pricing, and distribution strategies. The projected CAGR for the forecast period (2025-2033) is estimated at xx%, with market penetration projected to reach xx% by 2033.

Leading Markets & Segments in North America Omega-3 Products Industry

The United States is the dominant market for omega-3 products in North America, accounting for xx% of the total market value in 2025. Canada holds a significant share, but its market size is smaller compared to the US. Dietary supplements represent the largest segment, driven by convenience and targeted health benefits. The functional food segment is also witnessing considerable growth, with consumers increasingly integrating omega-3s into their daily diets through food products. Internet retailing is a rapidly expanding distribution channel, providing consumers with easier access to a wider variety of products.

Key Drivers:

- United States: High disposable incomes, increasing health consciousness, and robust healthcare infrastructure contribute to higher market demand.

- Dietary Supplements Segment: Consumers prefer convenient options for supplementing their omega-3 intake, boosting supplement sales.

- Internet Retailing: E-commerce platforms offer a convenient and accessible shopping experience, increasing online sales.

North America Omega-3 Products Industry Product Developments

Recent innovations in the omega-3 products industry focus on improving bioavailability, taste, and sustainability. Microencapsulation technologies enhance absorption, while new formulations address taste challenges. Sustainable sourcing practices and eco-friendly packaging are gaining traction. Companies are increasingly focusing on developing products tailored to specific consumer needs, such as those targeted at pregnant women, children, or athletes. These advancements aim to improve market fit and strengthen competitive advantages.

Key Drivers of North America Omega-3 Products Industry Growth

Several factors contribute to the growth of the North American Omega-3 products market. Rising awareness of the health benefits of omega-3 fatty acids, coupled with the increasing prevalence of chronic diseases, is driving consumer demand. Technological advancements in extraction and delivery methods lead to more effective and convenient products. Favorable regulatory environments in certain regions further support market expansion. Growing consumer preference for natural and organic products also fuels market growth. Moreover, government initiatives promoting health and wellness further catalyze the market's expansion.

Challenges in the North America Omega-3 Products Industry Market

The North America Omega-3 products market faces challenges such as fluctuations in raw material prices, stringent regulatory requirements, and intense competition. Supply chain disruptions can impact product availability and pricing. Maintaining product quality and ensuring the authenticity of omega-3 sources are crucial. The market is also characterized by fierce competition, requiring companies to differentiate their products through innovation and effective marketing strategies. These factors impact market profitability and require agile adaptation from market players.

Emerging Opportunities in North America Omega-3 Products Industry

Future growth in the North America Omega-3 products market is driven by increasing scientific research highlighting the benefits of omega-3s for various health conditions. This creates opportunities for developing targeted products addressing specific health concerns. Strategic partnerships between manufacturers and healthcare providers could expand reach and credibility. Furthermore, exploring new delivery methods and formulations could lead to increased product innovation and market expansion.

Leading Players in the North America Omega-3 Products Industry Sector

- Reckitt Benckiser Group PLC

- Nestle SA

- Unilever

- Amway Corp

- Abbott Laboratories

- Herbalife Nutrition

- Nutrigold Inc.

- GNC

Key Milestones in North America Omega-3 Products Industry Industry

- 2020-Q3: Increased consumer demand for immune-boosting supplements containing omega-3s.

- 2021-Q1: Launch of several sustainable and ethically sourced omega-3 products.

- 2022-Q4: Major mergers and acquisitions within the industry, consolidating market share.

- 2023-Q2: Introduction of innovative omega-3 delivery systems (e.g., liposomal formulations).

- 2024-Q1: Increased regulatory scrutiny on health claims associated with omega-3 products.

Strategic Outlook for North America Omega-3 Products Industry Market

The North America Omega-3 products market presents considerable long-term growth potential. Focusing on product innovation, sustainable sourcing, and targeted marketing strategies will be key for success. Strategic partnerships and expansions into new markets will further enhance market penetration. Leveraging technological advancements and responding to evolving consumer preferences are crucial for maintaining a competitive edge in this dynamic industry. The market is expected to experience significant expansion, driven by the ongoing convergence of health consciousness, technological innovations, and expanding consumer base.

North America Omega 3 Products Industry Segmentation

-

1. Product Type

- 1.1. Functional Food

- 1.2. Dietary Supplements

- 1.3. Infant Nutrition

- 1.4. Pet Food and Feed

- 1.5. Pharmaceuticals

-

2. Distribution Channel

- 2.1. Grocery Retailers

- 2.2. Pharmacies and Health Stores

- 2.3. Internet Retailing

- 2.4. Other Distribution Channels

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

- 3.1.4. Rest of North America

-

3.1. North America

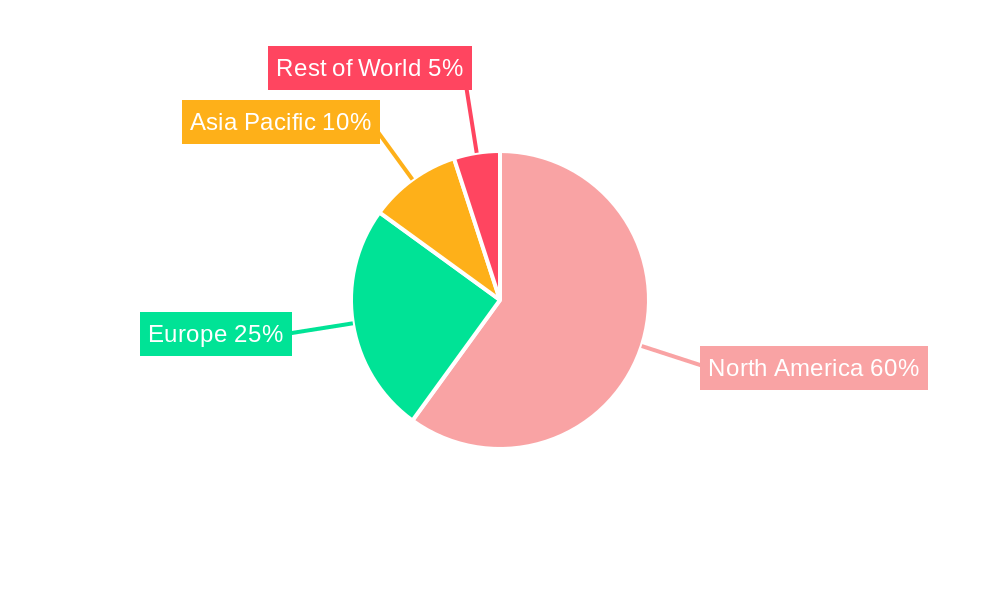

North America Omega 3 Products Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

North America Omega 3 Products Industry Regional Market Share

Geographic Coverage of North America Omega 3 Products Industry

North America Omega 3 Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness of the health benefits of Omega-3 fatty acids; Rising Prevalence of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. Omega-3 supplements can be expensive compared to other nutritional products

- 3.4. Market Trends

- 3.4.1. Growing interest in plant-based diets and veganism is driving demand for plant-derived Omega-3 sources

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Omega 3 Products Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food

- 5.1.2. Dietary Supplements

- 5.1.3. Infant Nutrition

- 5.1.4. Pet Food and Feed

- 5.1.5. Pharmaceuticals

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Grocery Retailers

- 5.2.2. Pharmacies and Health Stores

- 5.2.3. Internet Retailing

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1.4. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Reckitt Benckiser Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unilever

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amway Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abbott Laboratories

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Herbalife Nutrition

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nutrigold Inc.

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GNC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Reckitt Benckiser Group PLC

List of Figures

- Figure 1: North America Omega 3 Products Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Omega 3 Products Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Omega 3 Products Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Omega 3 Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Omega 3 Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Omega 3 Products Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Omega 3 Products Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: North America Omega 3 Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Omega 3 Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Omega 3 Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Omega 3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Omega 3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Omega 3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America North America Omega 3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Omega 3 Products Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the North America Omega 3 Products Industry?

Key companies in the market include Reckitt Benckiser Group PLC, Nestle SA, Unilever, Amway Corp, Abbott Laboratories, Herbalife Nutrition, Nutrigold Inc., GNC.

3. What are the main segments of the North America Omega 3 Products Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness of the health benefits of Omega-3 fatty acids; Rising Prevalence of Chronic Diseases.

6. What are the notable trends driving market growth?

Growing interest in plant-based diets and veganism is driving demand for plant-derived Omega-3 sources.

7. Are there any restraints impacting market growth?

Omega-3 supplements can be expensive compared to other nutritional products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Omega 3 Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Omega 3 Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Omega 3 Products Industry?

To stay informed about further developments, trends, and reports in the North America Omega 3 Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence