Key Insights

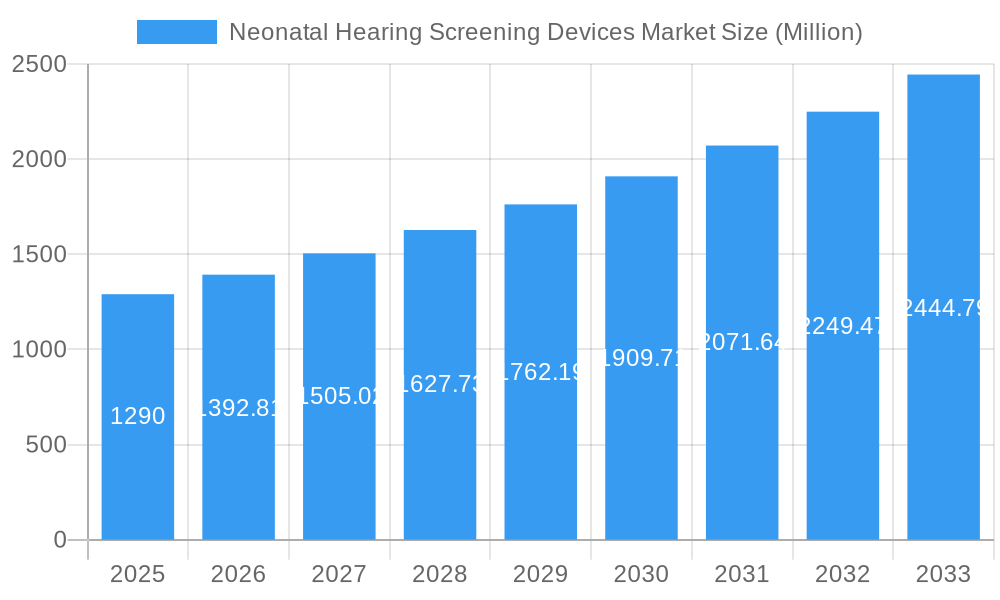

The global Neonatal Hearing Screening Devices Market is poised for significant expansion, projected to reach an estimated value of $1.29 billion in 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 8.90%, indicating a dynamic and expanding industry. The market's trajectory is largely propelled by increasing global awareness regarding the critical importance of early detection of hearing impairments in newborns, leading to a higher adoption rate of advanced screening technologies. Favorable government initiatives mandating newborn hearing screening programs, coupled with a rising birth rate, particularly in emerging economies, are also substantial drivers. Furthermore, advancements in diagnostic technologies, such as the integration of artificial intelligence and machine learning for more accurate and efficient screening, are fostering market growth. The increasing prevalence of prematurity and low birth weight, which are associated with a higher risk of hearing loss, further accentuates the demand for these essential devices.

Neonatal Hearing Screening Devices Market Market Size (In Billion)

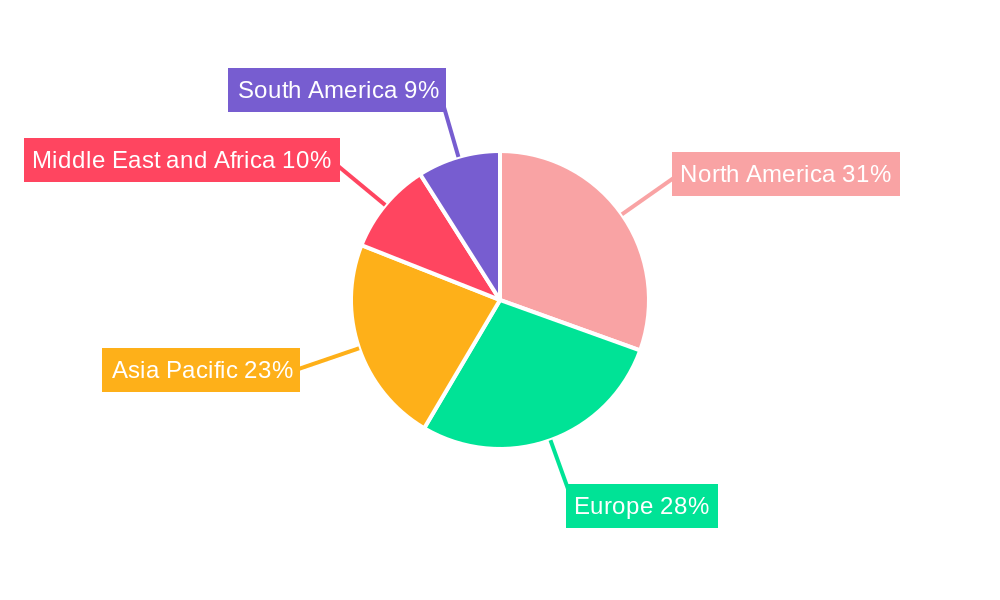

The market is segmented by technology, test type, and end-user, offering a diversified landscape for growth. Tandem Mass Spectrometry and Pulse Oximetry are emerging as dominant technologies due to their precision and non-invasiveness. Dried Blood Spot and Critical Congenital Heart Defect (CCHD) screening represent key test types gaining traction. Hospitals and diagnostic centers are the primary end-users, reflecting the critical role these institutions play in neonatal care. Geographically, North America and Europe currently hold significant market share due to well-established healthcare infrastructure and early adoption of screening protocols. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by expanding healthcare expenditure, increasing disposable incomes, and a growing focus on infant healthcare initiatives. Major players like Medtronic Inc., Natus Medical Incorporated, and Thermo Fisher Scientific are actively investing in research and development to introduce innovative solutions and expand their market presence, further fueling the market's upward trend.

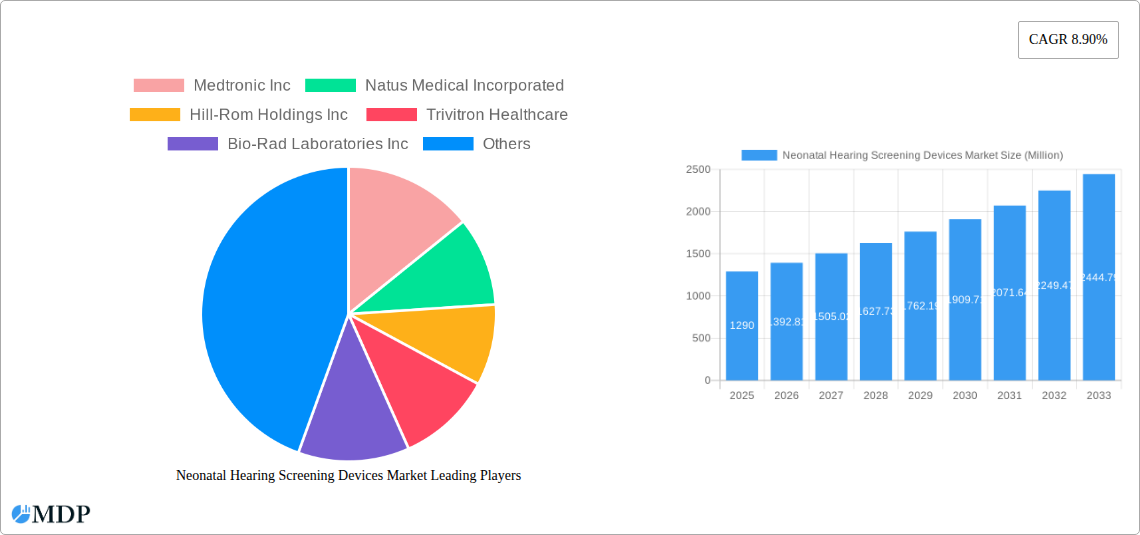

Neonatal Hearing Screening Devices Market Company Market Share

Unlock critical insights into the rapidly evolving Neonatal Hearing Screening Devices Market with this in-depth report. Covering the study period of 2019–2033, with a base year of 2025, this analysis delves into market dynamics, industry trends, leading segments, and future opportunities. Discover the key players, technological advancements, and market drivers shaping the global landscape of newborn screening, estimated to reach xx Million by 2033. This report provides actionable intelligence for hospitals, diagnostic centers, and other end users, alongside manufacturers, investors, and researchers focused on neonatal health, early detection, and pediatric diagnostics.

Neonatal Hearing Screening Devices Market Dynamics & Concentration

The Neonatal Hearing Screening Devices Market exhibits a moderate to high concentration, with key players like Medtronic Inc, Natus Medical Incorporated, and GE Healthcare holding significant market share. Innovation drivers are primarily centered on improving screening accuracy, reducing false positives, and enhancing ease of use for healthcare professionals. Regulatory frameworks, particularly those mandating newborn hearing screening programs in various countries, play a crucial role in market expansion. Product substitutes, while present in broader infant health monitoring, are limited within the specialized niche of hearing screening. End-user trends indicate a growing preference for integrated diagnostic solutions and point-of-care devices. Merger and acquisition activities, while not exceptionally high, are strategic moves by larger companies to expand their product portfolios and geographical reach. The market's growth is further fueled by increasing awareness of the long-term implications of untreated hearing loss and the proven benefits of early intervention. The increasing adoption of advanced technologies such as Tandem Mass Spectrometry and DNA Assays for broader newborn screening also indirectly influences the hearing screening market by promoting comprehensive diagnostic approaches. The estimated market share distribution among leading companies is approximately 15-20% for the top three players, with the remaining share distributed among a competitive landscape. M&A deal counts in the last three years stand at approximately 5-7, indicating strategic consolidation efforts.

Neonatal Hearing Screening Devices Market Industry Trends & Analysis

The Neonatal Hearing Screening Devices Market is poised for substantial growth, driven by a confluence of factors including rising global birth rates, increasing government initiatives for mandatory newborn screening, and a growing awareness among parents and healthcare providers regarding the critical importance of early detection of hearing impairments. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. Technological advancements are at the forefront of this expansion, with continuous innovation in screening methodologies, device portability, and data management systems. The integration of Artificial Intelligence (AI) and machine learning algorithms for analyzing screening results promises to enhance accuracy and efficiency, thereby reducing false positives and ensuring timely intervention. Pulse Oximetry remains a dominant technology due to its non-invasive nature and cost-effectiveness, particularly in conjunction with hearing screening as part of broader Critical Congenital Heart Defect (CCHD) screening programs. However, the emergence and adoption of DNA Assays and Enzyme Based Assays for genetic screening are also contributing to a more comprehensive approach to newborn diagnostics, indirectly benefiting the overall market by fostering a culture of proactive health monitoring. Consumer preferences are shifting towards user-friendly, accurate, and rapid screening solutions that minimize discomfort for newborns. The competitive landscape is characterized by a mix of established players and emerging innovators, all vying to capture market share through product differentiation, strategic partnerships, and geographical expansion. The increasing penetration of advanced screening devices in developing economies, coupled with supportive healthcare policies, is expected to further accelerate market growth. The market penetration of advanced hearing screening devices is estimated to reach xx% by 2033.

Leading Markets & Segments in Neonatal Hearing Screening Devices Market

The Hospitals segment is the dominant end-user in the Neonatal Hearing Screening Devices Market, accounting for an estimated xx% of the total market value. This dominance is attributed to hospitals being the primary point of birth and the mandated location for initial newborn screenings. Furthermore, the presence of specialized neonatal intensive care units (NICUs) within hospitals necessitates the availability of advanced diagnostic equipment. The Pulse Oximetry technology holds a significant market share within the technology segment, largely due to its established role in both hearing screening and CCHD screening, making it a cost-effective and efficient first-line diagnostic tool. In terms of test types, Hearing Screening itself represents the largest segment, reflecting the primary application of these devices.

- Dominant Region: North America currently leads the Neonatal Hearing Screening Devices Market, driven by robust healthcare infrastructure, strong government mandates for newborn screening, and high adoption rates of advanced medical technologies. The United States, in particular, contributes significantly due to its well-established healthcare system and proactive approach to pediatric health.

- Leading Technology:

- Pulse Oximetry: Widely adopted due to its non-invasive nature, affordability, and integration with other screening protocols like CCHD. This technology facilitates rapid assessment of oxygen saturation, a key indicator in hearing assessments.

- Tandem Mass Spectrometry: While more prevalent in broader newborn metabolic screening, its increasing integration into comprehensive diagnostic platforms offers potential growth avenues for sophisticated hearing assessment technologies.

- Dominant Test Type:

- Hearing Screening: The core application, driven by global mandates and parental awareness of early intervention benefits.

- Critical Congenital Heart Defect (CCHD) Screening: Often co-administered with hearing screening, leading to increased utilization of devices capable of multi-parameter assessment.

- Dominant End User:

- Hospitals: The primary setting for neonatal care and screening, equipped with dedicated pediatric departments and NICUs.

- Diagnostic Centers: Growing in importance as specialized centers for infant diagnostics, offering advanced screening services.

Neonatal Hearing Screening Devices Market Product Developments

Product development in the Neonatal Hearing Screening Devices Market is characterized by a relentless pursuit of enhanced accuracy, portability, and user-friendliness. Innovations are focusing on integrating multiple screening modalities into single devices, reducing the time required for testing, and providing clearer, more actionable results for healthcare professionals. The adoption of advanced signal processing algorithms and AI is improving the detection of subtle hearing impairments, thereby minimizing false negatives. Furthermore, manufacturers are developing wireless connectivity features for seamless data transfer and integration with electronic health records (EHRs), streamlining workflow in clinical settings. Competitive advantages are being forged through the development of non-invasive, comfortable testing methods for newborns, alongside robust data analytics capabilities that assist in early diagnosis and intervention planning, ultimately improving long-term pediatric health outcomes.

Key Drivers of Neonatal Hearing Screening Devices Market Growth

The growth of the Neonatal Hearing Screening Devices Market is propelled by several critical factors. Firstly, the increasing number of government mandates for universal newborn hearing screening programs worldwide, aimed at early identification and intervention of hearing loss, is a primary driver. Secondly, advancements in medical technology, leading to more accurate, efficient, and user-friendly screening devices, are enhancing adoption rates. Thirdly, a growing global awareness among healthcare professionals and parents about the severe developmental consequences of untreated hearing impairment in infants fosters greater demand for timely screening. Economic factors, such as increasing healthcare expenditure in emerging economies and the rising number of births, also contribute to market expansion. Finally, the integration of hearing screening with other essential newborn screening tests, like CCHD screening, offers a consolidated diagnostic approach, further boosting the market.

Challenges in the Neonatal Hearing Screening Devices Market Market

Despite the robust growth, the Neonatal Hearing Screening Devices Market faces several challenges. A significant hurdle is the variability in regulatory compliance and reimbursement policies across different countries and regions, which can slow down the adoption of advanced screening technologies. High initial investment costs for sophisticated screening devices can be a deterrent for smaller healthcare facilities, particularly in resource-limited settings. The presence of a sufficient number of trained personnel capable of operating and interpreting results from advanced devices remains a concern in certain areas. Furthermore, ensuring consistent data accuracy and managing the logistical challenges associated with follow-up testing and audiological evaluations for infants identified with potential hearing impairments can be complex. Competitive pressures among manufacturers also lead to pricing challenges, impacting profit margins.

Emerging Opportunities in Neonatal Hearing Screening Devices Market

The Neonatal Hearing Screening Devices Market is ripe with emerging opportunities, driven by technological innovation and expanding healthcare access. The increasing development of integrated screening platforms that combine hearing assessments with genetic screening and other diagnostic tests presents a significant growth avenue, offering comprehensive newborn health evaluations. The expansion of telemedicine and remote monitoring technologies can facilitate wider access to screening and follow-up care, especially in underserved rural areas. Strategic partnerships between device manufacturers, healthcare providers, and research institutions are fostering the development of next-generation screening tools and diagnostic algorithms. Furthermore, the growing focus on personalized medicine and precision diagnostics is creating demand for advanced genetic screening technologies that can identify predispositions to hearing loss, opening up new market segments and enhancing the value proposition of comprehensive newborn screening programs.

Leading Players in the Neonatal Hearing Screening Devices Market Sector

- Medtronic Inc

- Natus Medical Incorporated

- Hill-Rom Holdings Inc

- Trivitron Healthcare

- Bio-Rad Laboratories Inc

- ZenTech SA

- Masimo Corporation

- GE Healthcare

- Waters Corporation

- AB Sciex

- PerkinElmer Inc

- Demant A/S

- Thermo Fisher Scientific

Key Milestones in Neonatal Hearing Screening Devices Market Industry

- August 2022: Trivitron Healthcare launched a Centre of Excellence (CoE) with state-of-the-art research and development and manufacturing facilities at AMTZ Campus, Vishakhapatnam, India, for metabolomics, genomics, newborn screening, and molecular diagnostics, enhancing its capabilities in broader newborn health solutions.

- June 2022: Rady Children's Institute for Genomic Medicine launched a program to advance and evaluate the scalability of a diagnostic and precision medicine guidance tool called BeginNGS (pronounced 'beginnings') to screen newborns for approximately 400 genetic diseases that have known treatment options using rapid whole genome sequencing, signaling a trend towards comprehensive genetic screening in newborns.

Strategic Outlook for Neonatal Hearing Screening Devices Market Market

The strategic outlook for the Neonatal Hearing Screening Devices Market is overwhelmingly positive, driven by sustained global demand and continuous technological advancements. The focus will likely shift towards developing more intelligent, integrated, and cost-effective screening solutions that can be deployed universally. Companies that invest in AI-driven diagnostics, portable and user-friendly devices, and robust data analytics platforms will be well-positioned to capture market share. Strategic collaborations and partnerships will be crucial for expanding market reach, particularly in emerging economies. The increasing emphasis on early detection and preventative healthcare will continue to fuel growth, making the Neonatal Hearing Screening Devices Market a vital and expanding sector within the broader healthcare industry, with projected market expansion to reach xx Million by 2033.

Neonatal Hearing Screening Devices Market Segmentation

-

1. Technology

- 1.1. Tandem Mass Spectrometry

- 1.2. Pulse Oximetry

- 1.3. Enzyme Based Assays

- 1.4. DNA Assays

- 1.5. Other Technologies

-

2. Test Type

- 2.1. Dried Blood Spot

- 2.2. Hearing Screening

- 2.3. Critical Congenital Heart Defect (CCHD)

- 2.4. Other Test Types

-

3. End User

- 3.1. Hospitals

- 3.2. Diagnostic Centers

- 3.3. Other End Users

Neonatal Hearing Screening Devices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Neonatal Hearing Screening Devices Market Regional Market Share

Geographic Coverage of Neonatal Hearing Screening Devices Market

Neonatal Hearing Screening Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Congenital Diseases; Rising Funding from Government Sectors for Newborn Screening; Advancements in Technologies Used in Newborn Screening

- 3.3. Market Restrains

- 3.3.1. Lack of Uniformity of Newborn Screening Policies and Procedures Across the World; False Positive and False Negative Results

- 3.4. Market Trends

- 3.4.1. Dried Blood Spot Segment is Expected to Hold the Major Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Neonatal Hearing Screening Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Tandem Mass Spectrometry

- 5.1.2. Pulse Oximetry

- 5.1.3. Enzyme Based Assays

- 5.1.4. DNA Assays

- 5.1.5. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Test Type

- 5.2.1. Dried Blood Spot

- 5.2.2. Hearing Screening

- 5.2.3. Critical Congenital Heart Defect (CCHD)

- 5.2.4. Other Test Types

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Diagnostic Centers

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Neonatal Hearing Screening Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Tandem Mass Spectrometry

- 6.1.2. Pulse Oximetry

- 6.1.3. Enzyme Based Assays

- 6.1.4. DNA Assays

- 6.1.5. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Test Type

- 6.2.1. Dried Blood Spot

- 6.2.2. Hearing Screening

- 6.2.3. Critical Congenital Heart Defect (CCHD)

- 6.2.4. Other Test Types

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Diagnostic Centers

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Neonatal Hearing Screening Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Tandem Mass Spectrometry

- 7.1.2. Pulse Oximetry

- 7.1.3. Enzyme Based Assays

- 7.1.4. DNA Assays

- 7.1.5. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Test Type

- 7.2.1. Dried Blood Spot

- 7.2.2. Hearing Screening

- 7.2.3. Critical Congenital Heart Defect (CCHD)

- 7.2.4. Other Test Types

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Diagnostic Centers

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Neonatal Hearing Screening Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Tandem Mass Spectrometry

- 8.1.2. Pulse Oximetry

- 8.1.3. Enzyme Based Assays

- 8.1.4. DNA Assays

- 8.1.5. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Test Type

- 8.2.1. Dried Blood Spot

- 8.2.2. Hearing Screening

- 8.2.3. Critical Congenital Heart Defect (CCHD)

- 8.2.4. Other Test Types

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Diagnostic Centers

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Middle East and Africa Neonatal Hearing Screening Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Tandem Mass Spectrometry

- 9.1.2. Pulse Oximetry

- 9.1.3. Enzyme Based Assays

- 9.1.4. DNA Assays

- 9.1.5. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Test Type

- 9.2.1. Dried Blood Spot

- 9.2.2. Hearing Screening

- 9.2.3. Critical Congenital Heart Defect (CCHD)

- 9.2.4. Other Test Types

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Diagnostic Centers

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. South America Neonatal Hearing Screening Devices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Tandem Mass Spectrometry

- 10.1.2. Pulse Oximetry

- 10.1.3. Enzyme Based Assays

- 10.1.4. DNA Assays

- 10.1.5. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Test Type

- 10.2.1. Dried Blood Spot

- 10.2.2. Hearing Screening

- 10.2.3. Critical Congenital Heart Defect (CCHD)

- 10.2.4. Other Test Types

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Diagnostic Centers

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Medtronic Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Natus Medical Incorporated

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hill-Rom Holdings Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Trivitron Healthcare

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bio-Rad Laboratories Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ZenTech SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Masimo Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GE Healthcare

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Waters Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AB Sciex

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PerkinElmer Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Demant A/S

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Thermo Fisher Scientific

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Medtronic Inc

List of Figures

- Figure 1: Global Neonatal Hearing Screening Devices Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Neonatal Hearing Screening Devices Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Neonatal Hearing Screening Devices Market Revenue (Million), by Technology 2025 & 2033

- Figure 4: North America Neonatal Hearing Screening Devices Market Volume (K Units), by Technology 2025 & 2033

- Figure 5: North America Neonatal Hearing Screening Devices Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Neonatal Hearing Screening Devices Market Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America Neonatal Hearing Screening Devices Market Revenue (Million), by Test Type 2025 & 2033

- Figure 8: North America Neonatal Hearing Screening Devices Market Volume (K Units), by Test Type 2025 & 2033

- Figure 9: North America Neonatal Hearing Screening Devices Market Revenue Share (%), by Test Type 2025 & 2033

- Figure 10: North America Neonatal Hearing Screening Devices Market Volume Share (%), by Test Type 2025 & 2033

- Figure 11: North America Neonatal Hearing Screening Devices Market Revenue (Million), by End User 2025 & 2033

- Figure 12: North America Neonatal Hearing Screening Devices Market Volume (K Units), by End User 2025 & 2033

- Figure 13: North America Neonatal Hearing Screening Devices Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Neonatal Hearing Screening Devices Market Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Neonatal Hearing Screening Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Neonatal Hearing Screening Devices Market Volume (K Units), by Country 2025 & 2033

- Figure 17: North America Neonatal Hearing Screening Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Neonatal Hearing Screening Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Neonatal Hearing Screening Devices Market Revenue (Million), by Technology 2025 & 2033

- Figure 20: Europe Neonatal Hearing Screening Devices Market Volume (K Units), by Technology 2025 & 2033

- Figure 21: Europe Neonatal Hearing Screening Devices Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Europe Neonatal Hearing Screening Devices Market Volume Share (%), by Technology 2025 & 2033

- Figure 23: Europe Neonatal Hearing Screening Devices Market Revenue (Million), by Test Type 2025 & 2033

- Figure 24: Europe Neonatal Hearing Screening Devices Market Volume (K Units), by Test Type 2025 & 2033

- Figure 25: Europe Neonatal Hearing Screening Devices Market Revenue Share (%), by Test Type 2025 & 2033

- Figure 26: Europe Neonatal Hearing Screening Devices Market Volume Share (%), by Test Type 2025 & 2033

- Figure 27: Europe Neonatal Hearing Screening Devices Market Revenue (Million), by End User 2025 & 2033

- Figure 28: Europe Neonatal Hearing Screening Devices Market Volume (K Units), by End User 2025 & 2033

- Figure 29: Europe Neonatal Hearing Screening Devices Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Neonatal Hearing Screening Devices Market Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Neonatal Hearing Screening Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Neonatal Hearing Screening Devices Market Volume (K Units), by Country 2025 & 2033

- Figure 33: Europe Neonatal Hearing Screening Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Neonatal Hearing Screening Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Neonatal Hearing Screening Devices Market Revenue (Million), by Technology 2025 & 2033

- Figure 36: Asia Pacific Neonatal Hearing Screening Devices Market Volume (K Units), by Technology 2025 & 2033

- Figure 37: Asia Pacific Neonatal Hearing Screening Devices Market Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Asia Pacific Neonatal Hearing Screening Devices Market Volume Share (%), by Technology 2025 & 2033

- Figure 39: Asia Pacific Neonatal Hearing Screening Devices Market Revenue (Million), by Test Type 2025 & 2033

- Figure 40: Asia Pacific Neonatal Hearing Screening Devices Market Volume (K Units), by Test Type 2025 & 2033

- Figure 41: Asia Pacific Neonatal Hearing Screening Devices Market Revenue Share (%), by Test Type 2025 & 2033

- Figure 42: Asia Pacific Neonatal Hearing Screening Devices Market Volume Share (%), by Test Type 2025 & 2033

- Figure 43: Asia Pacific Neonatal Hearing Screening Devices Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Asia Pacific Neonatal Hearing Screening Devices Market Volume (K Units), by End User 2025 & 2033

- Figure 45: Asia Pacific Neonatal Hearing Screening Devices Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Neonatal Hearing Screening Devices Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Neonatal Hearing Screening Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Neonatal Hearing Screening Devices Market Volume (K Units), by Country 2025 & 2033

- Figure 49: Asia Pacific Neonatal Hearing Screening Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Neonatal Hearing Screening Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Neonatal Hearing Screening Devices Market Revenue (Million), by Technology 2025 & 2033

- Figure 52: Middle East and Africa Neonatal Hearing Screening Devices Market Volume (K Units), by Technology 2025 & 2033

- Figure 53: Middle East and Africa Neonatal Hearing Screening Devices Market Revenue Share (%), by Technology 2025 & 2033

- Figure 54: Middle East and Africa Neonatal Hearing Screening Devices Market Volume Share (%), by Technology 2025 & 2033

- Figure 55: Middle East and Africa Neonatal Hearing Screening Devices Market Revenue (Million), by Test Type 2025 & 2033

- Figure 56: Middle East and Africa Neonatal Hearing Screening Devices Market Volume (K Units), by Test Type 2025 & 2033

- Figure 57: Middle East and Africa Neonatal Hearing Screening Devices Market Revenue Share (%), by Test Type 2025 & 2033

- Figure 58: Middle East and Africa Neonatal Hearing Screening Devices Market Volume Share (%), by Test Type 2025 & 2033

- Figure 59: Middle East and Africa Neonatal Hearing Screening Devices Market Revenue (Million), by End User 2025 & 2033

- Figure 60: Middle East and Africa Neonatal Hearing Screening Devices Market Volume (K Units), by End User 2025 & 2033

- Figure 61: Middle East and Africa Neonatal Hearing Screening Devices Market Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East and Africa Neonatal Hearing Screening Devices Market Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East and Africa Neonatal Hearing Screening Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Neonatal Hearing Screening Devices Market Volume (K Units), by Country 2025 & 2033

- Figure 65: Middle East and Africa Neonatal Hearing Screening Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Neonatal Hearing Screening Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Neonatal Hearing Screening Devices Market Revenue (Million), by Technology 2025 & 2033

- Figure 68: South America Neonatal Hearing Screening Devices Market Volume (K Units), by Technology 2025 & 2033

- Figure 69: South America Neonatal Hearing Screening Devices Market Revenue Share (%), by Technology 2025 & 2033

- Figure 70: South America Neonatal Hearing Screening Devices Market Volume Share (%), by Technology 2025 & 2033

- Figure 71: South America Neonatal Hearing Screening Devices Market Revenue (Million), by Test Type 2025 & 2033

- Figure 72: South America Neonatal Hearing Screening Devices Market Volume (K Units), by Test Type 2025 & 2033

- Figure 73: South America Neonatal Hearing Screening Devices Market Revenue Share (%), by Test Type 2025 & 2033

- Figure 74: South America Neonatal Hearing Screening Devices Market Volume Share (%), by Test Type 2025 & 2033

- Figure 75: South America Neonatal Hearing Screening Devices Market Revenue (Million), by End User 2025 & 2033

- Figure 76: South America Neonatal Hearing Screening Devices Market Volume (K Units), by End User 2025 & 2033

- Figure 77: South America Neonatal Hearing Screening Devices Market Revenue Share (%), by End User 2025 & 2033

- Figure 78: South America Neonatal Hearing Screening Devices Market Volume Share (%), by End User 2025 & 2033

- Figure 79: South America Neonatal Hearing Screening Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 80: South America Neonatal Hearing Screening Devices Market Volume (K Units), by Country 2025 & 2033

- Figure 81: South America Neonatal Hearing Screening Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Neonatal Hearing Screening Devices Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 3: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Test Type 2020 & 2033

- Table 4: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Test Type 2020 & 2033

- Table 5: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by End User 2020 & 2033

- Table 7: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 11: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Test Type 2020 & 2033

- Table 12: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Test Type 2020 & 2033

- Table 13: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by End User 2020 & 2033

- Table 15: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: United States Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Canada Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Mexico Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 23: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 24: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 25: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Test Type 2020 & 2033

- Table 26: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Test Type 2020 & 2033

- Table 27: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by End User 2020 & 2033

- Table 29: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Germany Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: France Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Italy Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Spain Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 44: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 45: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Test Type 2020 & 2033

- Table 46: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Test Type 2020 & 2033

- Table 47: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by End User 2020 & 2033

- Table 48: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by End User 2020 & 2033

- Table 49: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Country 2020 & 2033

- Table 51: China Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Japan Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: India Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: India Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: Australia Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Australia Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 59: South Korea Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Korea Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 64: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 65: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Test Type 2020 & 2033

- Table 66: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Test Type 2020 & 2033

- Table 67: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by End User 2020 & 2033

- Table 69: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Country 2020 & 2033

- Table 71: GCC Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: GCC Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: South Africa Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 78: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 79: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Test Type 2020 & 2033

- Table 80: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Test Type 2020 & 2033

- Table 81: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by End User 2020 & 2033

- Table 82: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by End User 2020 & 2033

- Table 83: Global Neonatal Hearing Screening Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Global Neonatal Hearing Screening Devices Market Volume K Units Forecast, by Country 2020 & 2033

- Table 85: Brazil Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Brazil Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 87: Argentina Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Argentina Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Neonatal Hearing Screening Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Neonatal Hearing Screening Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Neonatal Hearing Screening Devices Market?

The projected CAGR is approximately 8.90%.

2. Which companies are prominent players in the Neonatal Hearing Screening Devices Market?

Key companies in the market include Medtronic Inc, Natus Medical Incorporated, Hill-Rom Holdings Inc , Trivitron Healthcare, Bio-Rad Laboratories Inc, ZenTech SA, Masimo Corporation, GE Healthcare, Waters Corporation, AB Sciex, PerkinElmer Inc, Demant A/S, Thermo Fisher Scientific.

3. What are the main segments of the Neonatal Hearing Screening Devices Market?

The market segments include Technology, Test Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Congenital Diseases; Rising Funding from Government Sectors for Newborn Screening; Advancements in Technologies Used in Newborn Screening.

6. What are the notable trends driving market growth?

Dried Blood Spot Segment is Expected to Hold the Major Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Uniformity of Newborn Screening Policies and Procedures Across the World; False Positive and False Negative Results.

8. Can you provide examples of recent developments in the market?

In August 2022, Trivitron Healthcare launched a Centre of Excellence (CoE) with state-of-the-art research and development and manufacturing facilities at AMTZ Campus, Vishakhapatnam, India, for metabolomics, genomics, newborn screening, and molecular diagnostics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Neonatal Hearing Screening Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Neonatal Hearing Screening Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Neonatal Hearing Screening Devices Market?

To stay informed about further developments, trends, and reports in the Neonatal Hearing Screening Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence