Key Insights

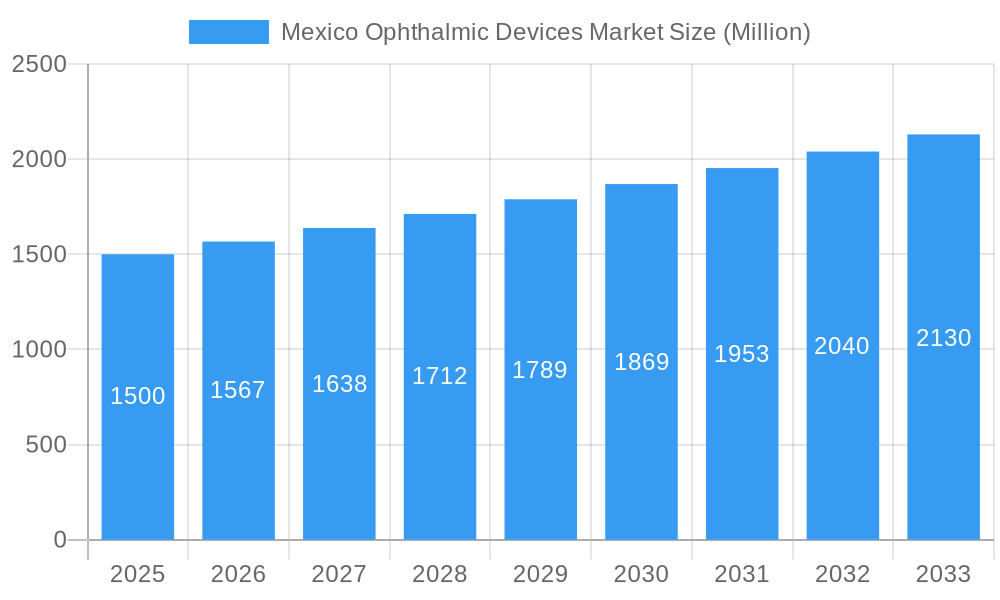

The Mexican ophthalmic devices market is projected for substantial growth, anticipated to reach $19.65 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.9% through 2033. This expansion is driven by the increasing incidence of eye conditions such as glaucoma, cataracts, and refractive errors, compounded by an aging demographic and heightened awareness of ocular health. Demand for advanced diagnostic and surgical interventions is rising, supported by healthcare infrastructure development initiatives. Technological advancements, including sophisticated laser treatments and minimally invasive surgical devices, are also key market drivers, complemented by the growing adoption of digital health solutions for remote monitoring and telehealth services.

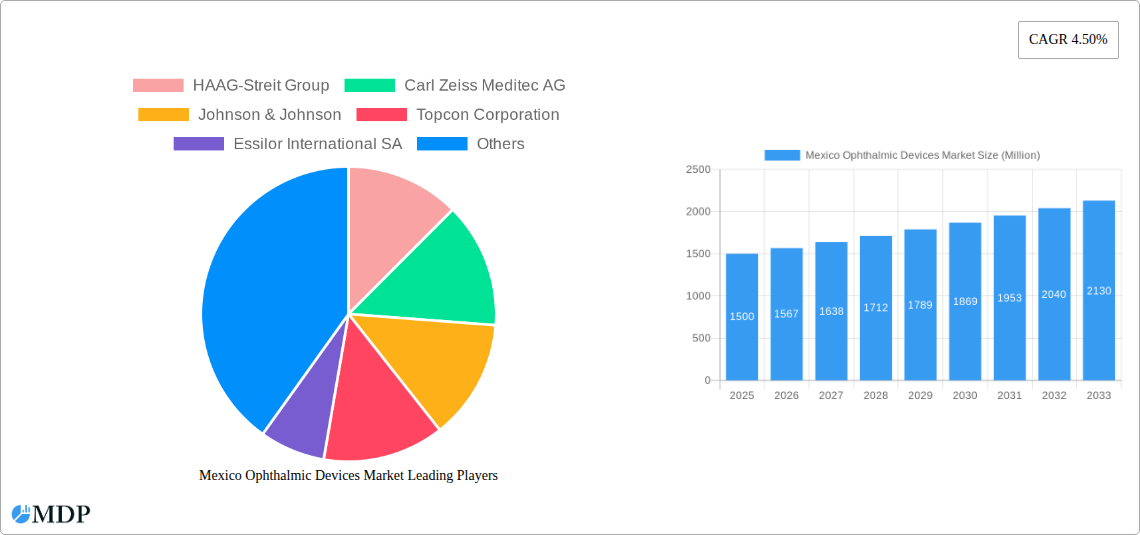

Mexico Ophthalmic Devices Market Market Size (In Billion)

Market segmentation indicates strong potential across all categories. Diagnostic and monitoring devices are expected to see significant uptake due to the growing need for early detection and personalized treatment of ocular diseases. Surgical devices, particularly for glaucoma and cataract surgery, will remain a core segment, benefiting from innovation and increasing surgical volumes. Vision correction devices, including advanced contact lenses and spectacles, will continue to experience sustained demand, addressing the widespread prevalence of refractive errors.

Mexico Ophthalmic Devices Market Company Market Share

This report provides a comprehensive analysis of the Mexico ophthalmic devices market, detailing market dynamics, industry trends, key segments, product developments, growth drivers, challenges, emerging opportunities, and leading players. Covering the study period 2019–2033, with a base year of 2025, this report utilizes high-traffic keywords to enhance search visibility for manufacturers, distributors, investors, and healthcare providers. Explore the evolving landscape of ophthalmic equipment in Mexico, encompassing advanced surgical devices, diagnostic imaging systems, and essential vision correction solutions.

Mexico Ophthalmic Devices Market Market Dynamics & Concentration

The Mexico ophthalmic devices market exhibits a moderate to high concentration, with key players like HAAG-Streit Group, Carl Zeiss Meditec AG, Johnson & Johnson, and Topcon Corporation dominating market share through strategic product portfolios and established distribution networks. Innovation is a significant driver, fueled by advancements in optical coherence tomography (OCT) scanners, refractive surgery lasers, and intraocular lenses (IOLs). Regulatory frameworks, while evolving, focus on ensuring product safety and efficacy, impacting market entry and product approvals. The threat of product substitutes exists, particularly in vision correction, with advancements in contact lens technology challenging traditional spectacle markets. End-user trends are shifting towards minimally invasive surgical procedures and early diagnosis of eye conditions, increasing demand for sophisticated diagnostic and monitoring devices. Mergers and acquisitions (M&A) activities are sporadic but strategic, aimed at consolidating market positions and expanding product offerings. Based on historical data and current market penetration, the market share distribution among top players is estimated to be: HAAG-Streit Group (XX%), Carl Zeiss Meditec AG (XX%), Johnson & Johnson (XX%), Topcon Corporation (XX%), and others (XX%). M&A deal counts in the past five years are approximately XX.

Mexico Ophthalmic Devices Market Industry Trends & Analysis

The Mexico ophthalmic devices market is poised for robust growth, driven by several key trends and factors. A significant growth driver is the increasing prevalence of age-related eye diseases, such as cataracts and glaucoma, coupled with a rising incidence of diabetes-related retinopathy. This demographic shift necessitates greater utilization of ophthalmic diagnostic equipment and surgical interventions. Technological disruptions are rapidly transforming the market. Innovations in AI-powered diagnostic tools, miniaturized surgical instruments, and advanced contact lens materials are enhancing patient outcomes and expanding treatment options. Consumer preferences are increasingly leaning towards convenient and effective vision correction solutions. The growing awareness of eye health and the accessibility of advanced treatments are contributing to higher market penetration of sophisticated ophthalmic devices. Competitive dynamics are characterized by intense product development and a focus on after-sales services and training. The market is experiencing a compound annual growth rate (CAGR) of approximately XX% during the forecast period, reflecting strong underlying demand and technological advancements. Market penetration for advanced diagnostic devices is estimated at XX%, with significant room for growth. The growing middle class and increasing disposable income further fuel the demand for premium eye care products and services.

Leading Markets & Segments in Mexico Ophthalmic Devices Market

Within the Mexico ophthalmic devices market, Surgical Devices emerge as a dominant segment, driven by the increasing number of ophthalmic surgeries performed annually. Within Surgical Devices, Intraocular Lenses (IOLs) hold a substantial market share due to the high incidence of cataract surgeries. The demand for advanced IOLs, including toric and multifocal options, is growing, reflecting a preference for improved visual outcomes and reduced dependency on corrective eyewear. Glaucoma Drainage Devices and Glaucoma Stents and Implants are also experiencing steady growth, owing to the rising prevalence of glaucoma.

Diagnostic and Monitoring Devices represent another critical segment, with Optical Coherence Tomography (OCT) Scanners leading the pack. OCT technology's ability to provide detailed cross-sectional images of the retina is invaluable for the early detection and management of various eye diseases, including macular degeneration and diabetic retinopathy. Autorefractors and Keratometers are essential for routine eye examinations and prescription accuracy. The increasing adoption of these diagnostic tools in both hospital and clinic settings is a key market driver.

Vision Correction Devices, while a mature segment, continue to evolve. Spectacles remain a primary mode of vision correction, with advancements in lens materials and coatings enhancing comfort and performance. Contact Lenses, particularly daily disposable and multifocal variants, are gaining traction due to their convenience and aesthetic appeal.

Key drivers for the dominance of these segments include:

- Growing Burden of Eye Diseases: High prevalence of cataracts, glaucoma, diabetic retinopathy, and refractive errors.

- Technological Advancements: Development of less invasive surgical techniques and more accurate diagnostic tools.

- Government Initiatives and Healthcare Infrastructure: Investments in public health programs and the establishment of specialized eye care centers.

- Increasing Disposable Income: Enabling wider access to advanced ophthalmic treatments and devices.

- Aging Population: A demographic trend that directly correlates with an increased need for ophthalmic interventions.

Mexico Ophthalmic Devices Market Product Developments

Product development in the Mexico ophthalmic devices market is characterized by a focus on enhanced precision, patient comfort, and improved diagnostic capabilities. Innovations in intraocular lenses offer better visual acuity and reduced aberrations, while advancements in surgical lasers enable faster and more precise procedures with quicker recovery times. The development of smaller, more intuitive diagnostic imaging systems, such as portable OCT scanners, is expanding access to advanced diagnostics in remote areas. Furthermore, the introduction of biocompatible materials for glaucoma implants and the ongoing evolution of contact lens technologies, including extended wear and specialized therapeutic lenses, underscore a commitment to patient-centric solutions that address unmet clinical needs and elevate the standard of eye care.

Key Drivers of Mexico Ophthalmic Devices Market Growth

The Mexico ophthalmic devices market is propelled by a confluence of technological, economic, and regulatory factors. Technologically, continuous innovation in areas like AI-driven diagnostics, robotic surgery, and advanced biomaterials for implants is creating new treatment paradigms. Economically, a growing middle class with increasing disposable income is translating into greater demand for premium eye care solutions and elective procedures. The rising prevalence of age-related eye conditions, such as cataracts and macular degeneration, due to an aging population, further fuels market expansion. Regulatory support, including government initiatives aimed at improving healthcare access and quality, also plays a crucial role in driving the adoption of advanced ophthalmic equipment.

Challenges in the Mexico Ophthalmic Devices Market Market

Despite its growth potential, the Mexico ophthalmic devices market faces several hurdles. Regulatory complexities and lengthy approval processes for new medical devices can hinder market entry for innovative products. Economic volatility and the affordability of advanced ophthalmic instruments for a segment of the population can also pose a challenge. Supply chain disruptions, particularly for specialized components and raw materials, can impact manufacturing and availability. Intense competition among established players and the emergence of new entrants necessitate continuous investment in research and development to maintain market share, adding to cost pressures. The lack of widespread awareness and accessibility of specialized eye care services in rural areas also represents a significant challenge.

Emerging Opportunities in Mexico Ophthalmic Devices Market

The Mexico ophthalmic devices market is ripe with emerging opportunities, particularly in the realm of technological advancements and expanding healthcare access. The increasing adoption of telemedicine and remote diagnostics presents a significant avenue for growth, allowing for the broader dissemination of specialized ophthalmic expertise. Advancements in personalized medicine, including custom-fit contact lenses and tailor-made intraocular lenses, are creating niche markets with high growth potential. Strategic partnerships between device manufacturers and healthcare providers, coupled with government efforts to expand health insurance coverage and invest in public health infrastructure, will further catalyze market expansion. The growing focus on preventative eye care and early disease detection also opens doors for innovative diagnostic and monitoring devices.

Leading Players in the Mexico Ophthalmic Devices Market Sector

- HAAG-Streit Group

- Carl Zeiss Meditec AG

- Johnson & Johnson

- Topcon Corporation

- Essilor International SA

- Alcon Inc

- Bausch & Lomb Inc

- Cooper Vision

- Ziemer Ophthalmic Systems AG

- Nidek Co Ltd

- Hoya Corporation

Key Milestones in Mexico Ophthalmic Devices Market Industry

- September 2022: Johnson & Johnson Vision Care, Inc launched its newest innovation, ACUVUE OASYS MAX 1-DAY contact lenses, including multifocal options for presbyopia, in North America, including Mexico. This launch signifies innovation in the vision correction devices segment.

- May 2022: The Naval Hospital of Coatzacoalcos in Mexico was inaugurated, starting services in ophthalmology and other fields. This expansion of healthcare infrastructure will drive demand for a wide range of ophthalmic devices, from diagnostic imaging systems to surgical equipment.

Strategic Outlook for Mexico Ophthalmic Devices Market Market

The strategic outlook for the Mexico ophthalmic devices market is overwhelmingly positive, characterized by sustained growth and innovation. Future market potential will be significantly shaped by the continued integration of digital health technologies, such as AI and telemedicine, into ophthalmic care. Strategic opportunities lie in expanding the reach of advanced diagnostic and monitoring devices to underserved regions and focusing on personalized vision correction solutions. Investments in training healthcare professionals on the latest ophthalmic equipment and procedures will be crucial. Furthermore, collaborations with governmental health agencies to address the burden of eye diseases and promote preventative care will accelerate market penetration and ensure long-term sustainability and growth.

Mexico Ophthalmic Devices Market Segmentation

-

1. Devices

-

1.1. Surgical Devices

- 1.1.1. Glaucoma Drainage Devices

- 1.1.2. Glaucoma Stents and Implants

- 1.1.3. Intraocular Lenses

- 1.1.4. Lasers

- 1.1.5. Other Surgical Devices

-

1.2. Diagnostic and Monitoring Devices

- 1.2.1. Autorefractors and Keratometers

- 1.2.2. Corneal Topography Systems

- 1.2.3. Ophthalmic Ultrasound Imaging Systems

- 1.2.4. Ophthalmoscopes

- 1.2.5. Optical Coherence Tomography Scanners

- 1.2.6. Other Diagnostic and Monitoring Devices

-

1.3. Vision Correction Devices

- 1.3.1. Spectacles

- 1.3.2. Contact Lenses

-

1.1. Surgical Devices

Mexico Ophthalmic Devices Market Segmentation By Geography

- 1. Mexico

Mexico Ophthalmic Devices Market Regional Market Share

Geographic Coverage of Mexico Ophthalmic Devices Market

Mexico Ophthalmic Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Eye Disease; Technological Advancements; High Adoption of Digital Devices

- 3.3. Market Restrains

- 3.3.1. Risk Associated with Eye Surgery; Lack of Awareness

- 3.4. Market Trends

- 3.4.1. The Contact Lenses Segment is Expected to Witness Significant Growth Over the Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Ophthalmic Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 5.1.1. Surgical Devices

- 5.1.1.1. Glaucoma Drainage Devices

- 5.1.1.2. Glaucoma Stents and Implants

- 5.1.1.3. Intraocular Lenses

- 5.1.1.4. Lasers

- 5.1.1.5. Other Surgical Devices

- 5.1.2. Diagnostic and Monitoring Devices

- 5.1.2.1. Autorefractors and Keratometers

- 5.1.2.2. Corneal Topography Systems

- 5.1.2.3. Ophthalmic Ultrasound Imaging Systems

- 5.1.2.4. Ophthalmoscopes

- 5.1.2.5. Optical Coherence Tomography Scanners

- 5.1.2.6. Other Diagnostic and Monitoring Devices

- 5.1.3. Vision Correction Devices

- 5.1.3.1. Spectacles

- 5.1.3.2. Contact Lenses

- 5.1.1. Surgical Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 HAAG-Streit Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carl Zeiss Meditec AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson & Johnson

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Topcon Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Essilor International SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alcon Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bausch & Lomb Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cooper Vision

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ziemer Ophthalmic Systems AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nidek Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hoya Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 HAAG-Streit Group

List of Figures

- Figure 1: Mexico Ophthalmic Devices Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Ophthalmic Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Ophthalmic Devices Market Revenue billion Forecast, by Devices 2020 & 2033

- Table 2: Mexico Ophthalmic Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 3: Mexico Ophthalmic Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mexico Ophthalmic Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Mexico Ophthalmic Devices Market Revenue billion Forecast, by Devices 2020 & 2033

- Table 6: Mexico Ophthalmic Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 7: Mexico Ophthalmic Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Mexico Ophthalmic Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Ophthalmic Devices Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Mexico Ophthalmic Devices Market?

Key companies in the market include HAAG-Streit Group, Carl Zeiss Meditec AG, Johnson & Johnson, Topcon Corporation, Essilor International SA, Alcon Inc, Bausch & Lomb Inc, Cooper Vision, Ziemer Ophthalmic Systems AG, Nidek Co Ltd, Hoya Corporation.

3. What are the main segments of the Mexico Ophthalmic Devices Market?

The market segments include Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.65 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Eye Disease; Technological Advancements; High Adoption of Digital Devices.

6. What are the notable trends driving market growth?

The Contact Lenses Segment is Expected to Witness Significant Growth Over the Forecast Period..

7. Are there any restraints impacting market growth?

Risk Associated with Eye Surgery; Lack of Awareness.

8. Can you provide examples of recent developments in the market?

In September 2022, Johnson & Johnson Vision Care, Inc launched its newest innovation, ACUVUE OASYS MAX 1-DAY contact lenses. ACUVUE OASYS MAX 1-Day multifocal contact lenses for presbyopia. The lens was launched in North America, including Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Ophthalmic Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Ophthalmic Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Ophthalmic Devices Market?

To stay informed about further developments, trends, and reports in the Mexico Ophthalmic Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence