Key Insights

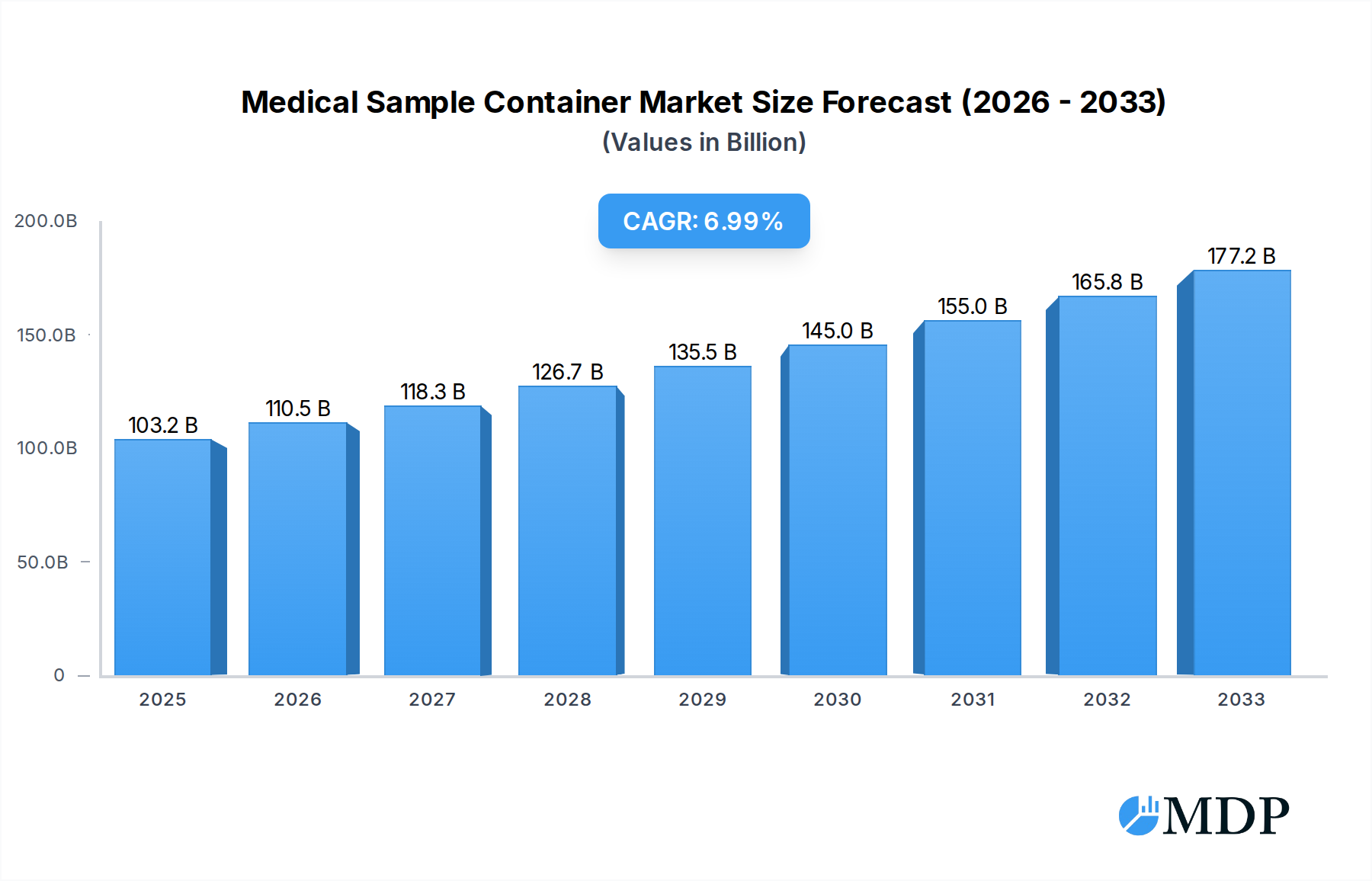

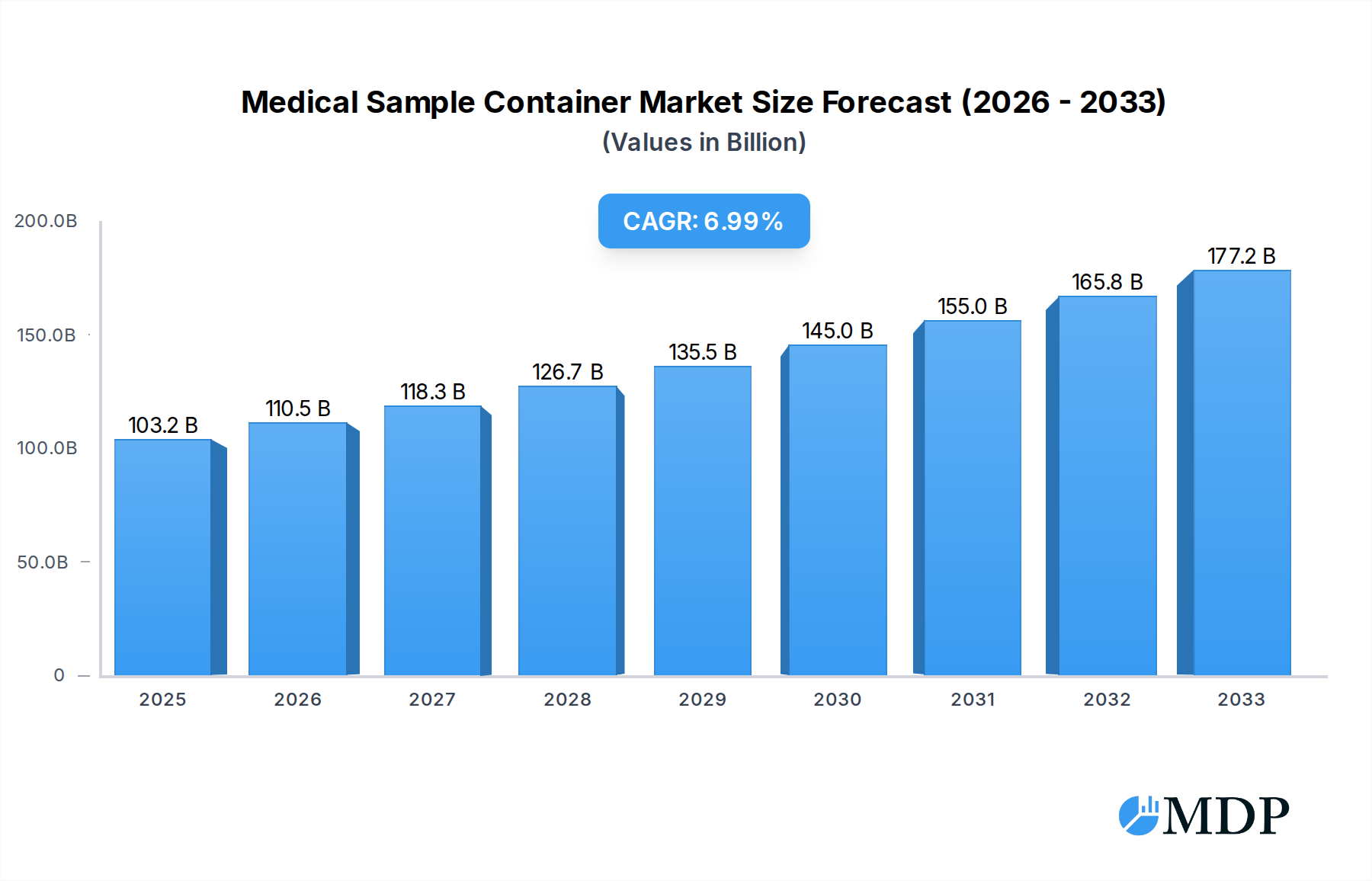

The global Medical Sample Container market is poised for significant expansion, projected to reach an estimated $103.23 billion by 2025, demonstrating robust growth with a CAGR of 6.98% throughout the forecast period extending to 2033. This upward trajectory is primarily fueled by the increasing demand for accurate and reliable diagnostics across both medical treatment and scientific research experiment applications. The expanding healthcare infrastructure, coupled with a growing emphasis on early disease detection and personalized medicine, is creating substantial opportunities for market players. Furthermore, advancements in material science and container design, leading to improved sample integrity and user convenience, are also key drivers. The market's growth is further propelled by the rising prevalence of chronic diseases, necessitating more frequent and sophisticated diagnostic testing.

Medical Sample Container Market Size (In Billion)

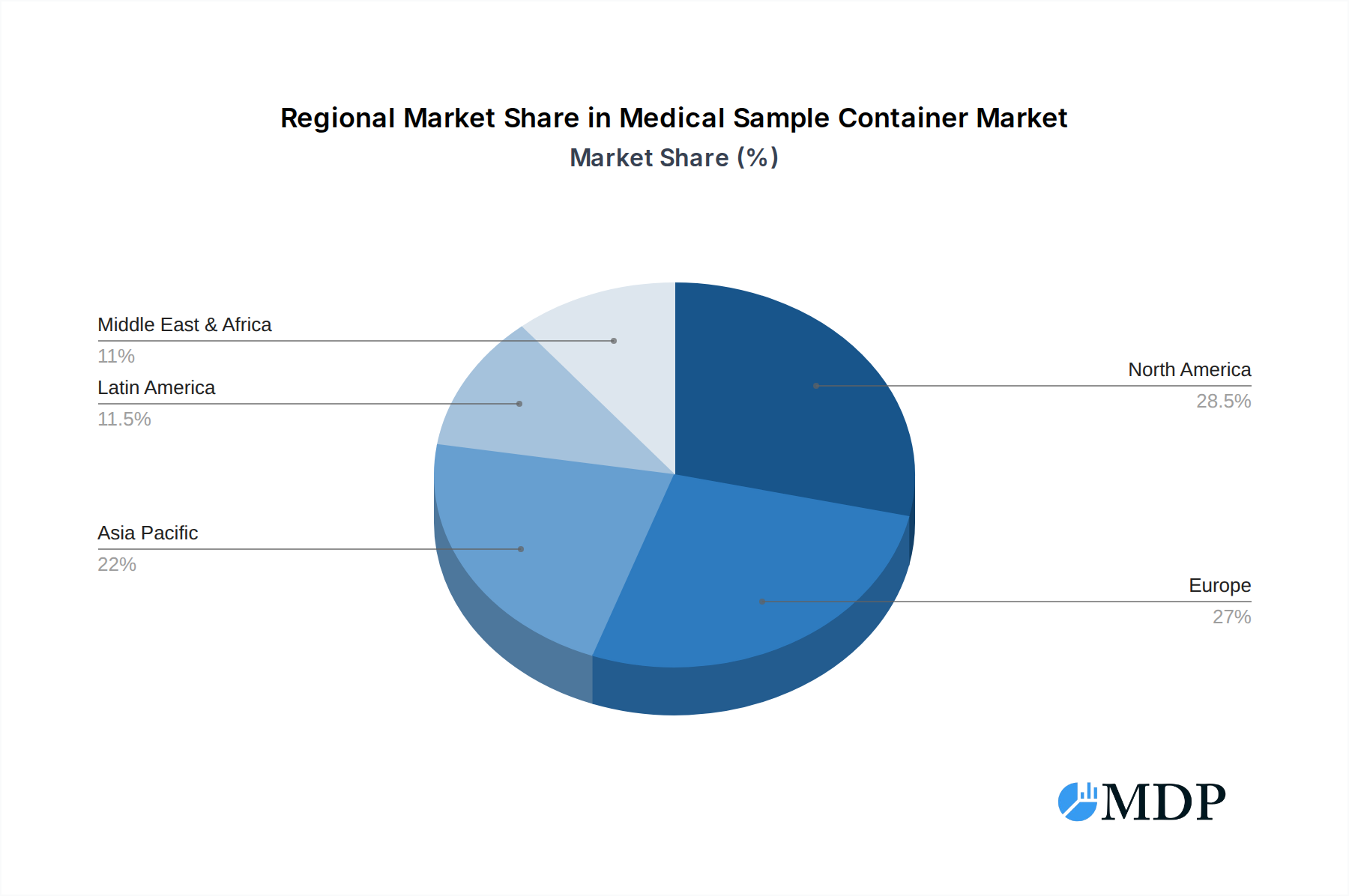

The market segmentation reveals a dynamic landscape. Within "Types," both "Low Temperature" and "General Temperature" containers are expected to witness steady demand, catering to diverse storage and transportation needs for various biological samples. "Medical Treatment" and "Scientific Research Experiment" applications are the primary growth engines, with escalating investments in R&D and an ever-growing need for high-quality sample handling in clinical settings. Key companies such as Eppendorf AG, Simport Scientific, and Hospitex International are actively innovating and expanding their product portfolios to capture market share. Geographically, North America and Europe are leading markets due to advanced healthcare systems and substantial research funding, while the Asia Pacific region is emerging as a high-growth area driven by increasing healthcare expenditure and a burgeoning research ecosystem. The collaborative efforts of these companies and the evolving needs of healthcare professionals are shaping a promising future for the medical sample container market.

Medical Sample Container Company Market Share

Here is an SEO-optimized, engaging report description for the Medical Sample Container market, structured as requested with no placeholder modifications.

Report Title: Global Medical Sample Container Market Analysis: Size, Share, Trends, Growth Forecast (2019-2033)

Report Description:

Unlock comprehensive insights into the burgeoning global Medical Sample Container market. This in-depth analysis, covering the period from 2019 to 2033 with a base year of 2025, provides a definitive guide for industry stakeholders. With an estimated market value poised to reach billion by 2025 and projected to surge to billion by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of xx%, this report dissects market dynamics, technological advancements, and strategic opportunities. Explore the intricate landscape of medical sample storage, from critical medical treatments and groundbreaking scientific research experiments to specialized low-temperature and general-temperature applications. Discover key players like Eppendorf AG, Simport Scientific, and Hospitex International, alongside emerging trends and pivotal industry developments shaping the future of sample integrity and accessibility.

Medical Sample Container Market Dynamics & Concentration

The global Medical Sample Container market exhibits a moderately concentrated landscape, driven by innovation in material science, stringent regulatory compliance, and increasing demand from advanced healthcare and research sectors. Key innovation drivers include the development of novel materials offering enhanced biocompatibility and chemical resistance, alongside advancements in leak-proof designs and tamper-evident features, crucial for both medical treatment and scientific research experiment applications. Regulatory frameworks, such as those established by the FDA and EMA, play a significant role in dictating product standards, sterilization requirements, and material safety, ensuring patient and research integrity. Product substitutes, while present in the form of less specialized containers, are largely outmatched by the specific performance and safety characteristics of dedicated medical sample containers, particularly for sensitive biological samples requiring low temperature storage. End-user trends are increasingly leaning towards pre-sterilized, single-use containers to mitigate cross-contamination risks, alongside a growing preference for containers designed for automated laboratory workflows. Mergers and Acquisitions (M&A) activities, with an estimated billion in deal value and xx M&A deals recorded during the historical period, are consolidating the market and fostering technological integration. Eppendorf AG currently holds a significant market share, estimated at xx%, showcasing the competitive intensity and the impact of strategic partnerships.

Medical Sample Container Industry Trends & Analysis

The Medical Sample Container industry is experiencing dynamic growth fueled by an escalating global demand for diagnostic testing, advanced medical treatments, and pioneering scientific research. The market's trajectory is significantly influenced by increasing healthcare expenditures worldwide, which directly translate to a higher volume of medical samples requiring secure and reliable containment. Technological disruptions are reshaping the industry, with innovations in advanced polymer science leading to the development of containers with superior chemical inertness, enhanced thermal stability for low-temperature applications, and improved sealing mechanisms to prevent leakage and evaporation. These advancements are critical for preserving the integrity of sensitive biological samples, including cells, tissues, and nucleic acids, essential for both medical treatment and scientific research experiment applications. Consumer preferences are evolving towards greater convenience and safety, driving the adoption of pre-sterilized, single-use containers designed for ease of handling and minimized risk of contamination. Furthermore, the rise of personalized medicine and complex drug discovery programs necessitates highly specialized sample containers that can withstand extreme temperature variations and maintain sample viability over extended periods. The market penetration of these advanced containers is steadily increasing, especially within developed economies. The competitive dynamics are characterized by a blend of established global players and agile regional manufacturers, each vying for market share through product differentiation, strategic alliances, and cost-effectiveness. The overall market penetration is estimated to be xx%, with significant room for expansion in emerging economies. The CAGR for the forecast period is projected at xx%, indicating a sustained upward trend in market value.

Leading Markets & Segments in Medical Sample Container

The Medical Treatment application segment is the dominant force within the global Medical Sample Container market, driven by the sheer volume of biological samples collected for patient diagnosis, monitoring, and therapeutic interventions. This segment is particularly robust in regions with advanced healthcare infrastructures and high healthcare spending, such as North America and Europe. Within this application, the need for reliable sample integrity during transport and storage for immediate clinical decision-making is paramount, underscoring the demand for high-quality containers.

The Scientific Research Experiment segment, while currently smaller in volume compared to medical treatment, presents a significant growth opportunity. This is largely attributable to the burgeoning fields of genomics, proteomics, personalized medicine, and drug discovery, all of which require extensive sample collection, preservation, and analysis. The demand for specialized containers, particularly those for low-temperature applications (e.g., cryovials, cryogenic tubes), is escalating as researchers push the boundaries of scientific understanding.

In terms of product types, Low Temperature medical sample containers are witnessing remarkable growth. The increasing reliance on cryopreservation for cell lines, stem cells, and other sensitive biological materials in research and regenerative medicine applications is a primary driver. This includes specialized cryotubes and vials designed to withstand ultra-low temperatures (e.g., -80°C and below) and maintain sample viability for extended periods.

The General Temperature segment, encompassing a broad range of everyday diagnostic and analytical needs, remains a substantial contributor to the market. These containers are essential for routine blood draws, urine samples, and various other bodily fluid collections in clinical settings. Their widespread use in general healthcare practices ensures a consistent demand.

Key drivers for the dominance of these segments include:

- Economic Policies: Government initiatives promoting healthcare access, research funding, and biopharmaceutical development in key regions are significantly boosting demand.

- Infrastructure: The presence of well-established clinical laboratories, research institutions, and sophisticated cold chain logistics supports the widespread adoption and utilization of advanced medical sample containers.

- Technological Advancements: Innovations in material science, sterilization techniques, and container design directly enhance the suitability of containers for specific medical and research applications.

Medical Sample Container Product Developments

Product developments in the Medical Sample Container market are characterized by a relentless pursuit of enhanced safety, integrity, and user convenience. Innovations include the introduction of advanced materials like high-density polyethylene (HDPE) and polypropylene (PP) for improved chemical resistance and durability, as well as the integration of tamper-evident seals and leak-proof closures. Pre-sterilized, ready-to-use containers are becoming standard, minimizing the risk of contamination for critical diagnostic and research samples. Furthermore, the development of specialized containers for specific applications, such as cryovials designed for ultra-low temperatures and blood collection tubes with advanced anticoagulant formulations, highlights the market's focus on niche requirements and competitive advantage.

Key Drivers of Medical Sample Container Growth

The Medical Sample Container market is propelled by several key drivers. Technologically, advancements in polymer science enable the creation of more robust, inert, and temperature-resistant containers, crucial for preserving sample integrity. Economically, rising global healthcare expenditures and increased investment in life sciences research and development directly translate to higher demand for diagnostic and research consumables. Regulatory mandates for sample traceability and patient safety also contribute, pushing for standardized, high-quality container solutions. The growing prevalence of chronic diseases and the increasing need for accurate diagnostics further fuel the demand for reliable sample collection and storage.

Challenges in the Medical Sample Container Market

Despite robust growth, the Medical Sample Container market faces several challenges. Stringent regulatory compliance, including FDA and ISO certifications, can increase manufacturing costs and lead times. Supply chain disruptions, particularly those impacting raw material availability and logistics for temperature-sensitive shipments, pose a significant risk to timely delivery. Intense competition from numerous global and regional manufacturers leads to price pressures, especially for standard general-temperature containers. Furthermore, the disposal of single-use plastic containers raises environmental concerns, prompting research into more sustainable material alternatives. The estimated annual cost impact of these challenges is billion.

Emerging Opportunities in Medical Sample Container

Emerging opportunities in the Medical Sample Container market are largely driven by technological breakthroughs and expanding application areas. The growth of personalized medicine and precision diagnostics creates a demand for highly specialized, custom-designed containers capable of preserving unique sample types under extreme conditions. Advancements in biosensor integration within containers, enabling real-time sample monitoring for temperature, pH, or other critical parameters, present a significant disruptive opportunity. Strategic partnerships between container manufacturers and diagnostic assay developers or genomic sequencing companies can lead to bundled solutions and increased market penetration. Furthermore, the expanding healthcare infrastructure in emerging economies offers substantial untapped potential for market expansion.

Leading Players in the Medical Sample Container Sector

- Eppendorf AG

- Simport Scientific

- Hospitex International

- Milestone

- Medline Scientific

- Hektros

- BIO-OPTICA Milano

- F.L. Medical

- Ritter Medical

- Changzhou Medical Appliances General Factory

- HISANTA S.L.

- Ratiolab

- Histo-Line Laboratories

- M.and G. INTL Srl

- Sofrigam

Key Milestones in Medical Sample Container Industry

- 2019: Launch of enhanced cryogenic vial series by Eppendorf AG, offering improved sealing and temperature resistance.

- 2020: Simport Scientific introduces a new line of self-standing cryovials with advanced anti-capping features.

- 2021: Hospitex International expands its portfolio with a range of sterile, individually wrapped blood collection tubes.

- 2022: Milestone introduces innovative sample storage solutions designed for automated laboratory systems.

- 2023: Medline Scientific announces strategic partnerships to enhance its cold chain logistics for sample transport.

- 2024: Ratiolab unveils bio-based sample container prototypes, exploring sustainable material alternatives.

Strategic Outlook for Medical Sample Container Market

The strategic outlook for the Medical Sample Container market is overwhelmingly positive, driven by continuous innovation and expanding global demand. Growth accelerators include the increasing adoption of advanced diagnostics and personalized medicine, which necessitate sophisticated sample handling and preservation. The push for automation in laboratories globally will favor container designs that seamlessly integrate with robotic systems. Emerging markets represent a significant area for expansion, as healthcare infrastructure continues to develop. Manufacturers focusing on sustainability, material innovation, and strategic collaborations with key players in the life sciences sector are best positioned for long-term success and market leadership, with an anticipated market value of billion by the end of the forecast period.

Medical Sample Container Segmentation

-

1. Application

- 1.1. Medical Treatment

- 1.2. Scientific Research Experiment

-

2. Types

- 2.1. Low Temperature

- 2.2. General Temperature

Medical Sample Container Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Sample Container Regional Market Share

Geographic Coverage of Medical Sample Container

Medical Sample Container REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Sample Container Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical Treatment

- 5.1.2. Scientific Research Experiment

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Low Temperature

- 5.2.2. General Temperature

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Sample Container Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical Treatment

- 6.1.2. Scientific Research Experiment

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Low Temperature

- 6.2.2. General Temperature

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Sample Container Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical Treatment

- 7.1.2. Scientific Research Experiment

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Low Temperature

- 7.2.2. General Temperature

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Sample Container Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical Treatment

- 8.1.2. Scientific Research Experiment

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Low Temperature

- 8.2.2. General Temperature

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Sample Container Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical Treatment

- 9.1.2. Scientific Research Experiment

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Low Temperature

- 9.2.2. General Temperature

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Sample Container Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical Treatment

- 10.1.2. Scientific Research Experiment

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Low Temperature

- 10.2.2. General Temperature

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Eppendorf AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Simport Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hospitex International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Milestone

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Medline Scientific

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hektros

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BIO-OPTICA Milano

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 F.L. Medical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ritter Medical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Changzhou Medical Appliances General Factory

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 HISANTA S.L.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ratiolab

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Histo-Line Laboratories

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 M.and G. INTL Srl

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sofrigam

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Eppendorf AG

List of Figures

- Figure 1: Global Medical Sample Container Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Medical Sample Container Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Medical Sample Container Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Medical Sample Container Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Medical Sample Container Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Medical Sample Container Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Medical Sample Container Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Medical Sample Container Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Medical Sample Container Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Medical Sample Container Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Medical Sample Container Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Medical Sample Container Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Medical Sample Container Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Medical Sample Container Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Medical Sample Container Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Medical Sample Container Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Medical Sample Container Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Medical Sample Container Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Medical Sample Container Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Medical Sample Container Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Medical Sample Container Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Medical Sample Container Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Medical Sample Container Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Medical Sample Container Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Medical Sample Container Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Medical Sample Container Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Medical Sample Container Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Medical Sample Container Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Medical Sample Container Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Medical Sample Container Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Medical Sample Container Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medical Sample Container Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Medical Sample Container Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Medical Sample Container Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Medical Sample Container Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Medical Sample Container Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Medical Sample Container Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Medical Sample Container Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Medical Sample Container Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Medical Sample Container Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Medical Sample Container Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Medical Sample Container Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global Medical Sample Container Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Medical Sample Container Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Medical Sample Container Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global Medical Sample Container Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Medical Sample Container Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Medical Sample Container Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global Medical Sample Container Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Medical Sample Container Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Sample Container?

The projected CAGR is approximately 6.98%.

2. Which companies are prominent players in the Medical Sample Container?

Key companies in the market include Eppendorf AG, Simport Scientific, Hospitex International, Milestone, Medline Scientific, Hektros, BIO-OPTICA Milano, F.L. Medical, Ritter Medical, Changzhou Medical Appliances General Factory, HISANTA S.L., Ratiolab, Histo-Line Laboratories, M.and G. INTL Srl, Sofrigam.

3. What are the main segments of the Medical Sample Container?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Sample Container," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Sample Container report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Sample Container?

To stay informed about further developments, trends, and reports in the Medical Sample Container, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence