Key Insights

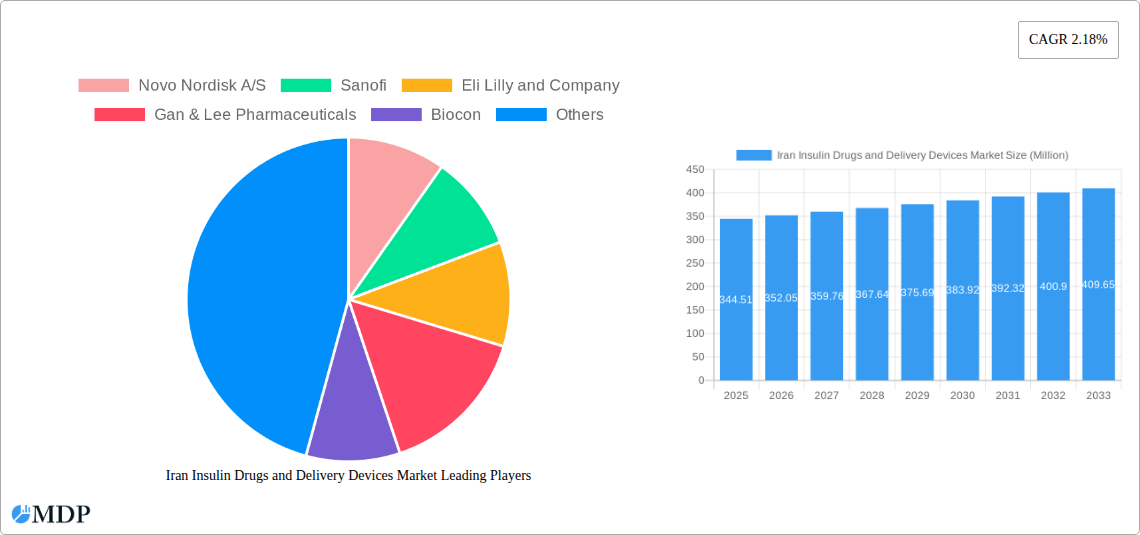

The Iranian insulin drugs and delivery devices market, valued at $344.51 million in 2025, is projected to experience moderate growth with a Compound Annual Growth Rate (CAGR) of 2.18% from 2025 to 2033. This growth is driven by several factors. The rising prevalence of diabetes, particularly type 1 and type 2, within Iran's aging population fuels the demand for insulin therapies. Improved healthcare infrastructure and increased awareness of diabetes management contribute to higher diagnosis rates and subsequently, greater insulin utilization. Furthermore, the market is witnessing a shift towards more convenient and technologically advanced delivery systems such as insulin pens and pumps, replacing traditional syringes. This transition reflects a global trend toward improved patient compliance and therapeutic efficacy. However, the market faces challenges, including limitations on healthcare affordability and access for certain segments of the population, potentially restraining overall market expansion. The market segmentation reveals significant contributions from basal/long-acting insulins, reflecting preference for sustained glycemic control, while the insulin pen segment is expected to dominate the delivery devices market due to ease of use and portability. Key players like Novo Nordisk, Sanofi, and Eli Lilly, along with domestic manufacturers like Gan & Lee Pharmaceuticals and Biocon, are actively competing to cater to the evolving needs of the Iranian market.

Iran Insulin Drugs and Delivery Devices Market Market Size (In Million)

Considering the historical period (2019-2024) and the provided CAGR, we can infer a steady, albeit incremental, growth trajectory. The consistent presence of major global players alongside domestic producers indicates a healthy and competitive environment. Future market performance will largely depend on government initiatives aimed at improving diabetes management programs, enhancing healthcare accessibility, and promoting patient education regarding insulin therapy. The increasing adoption of newer insulin analogs and advanced delivery devices suggests a potential acceleration in market growth towards the latter part of the forecast period (2030-2033), despite initial relatively modest expansion. The market's future prospects are positive, albeit contingent on the successful addressal of affordability and access issues.

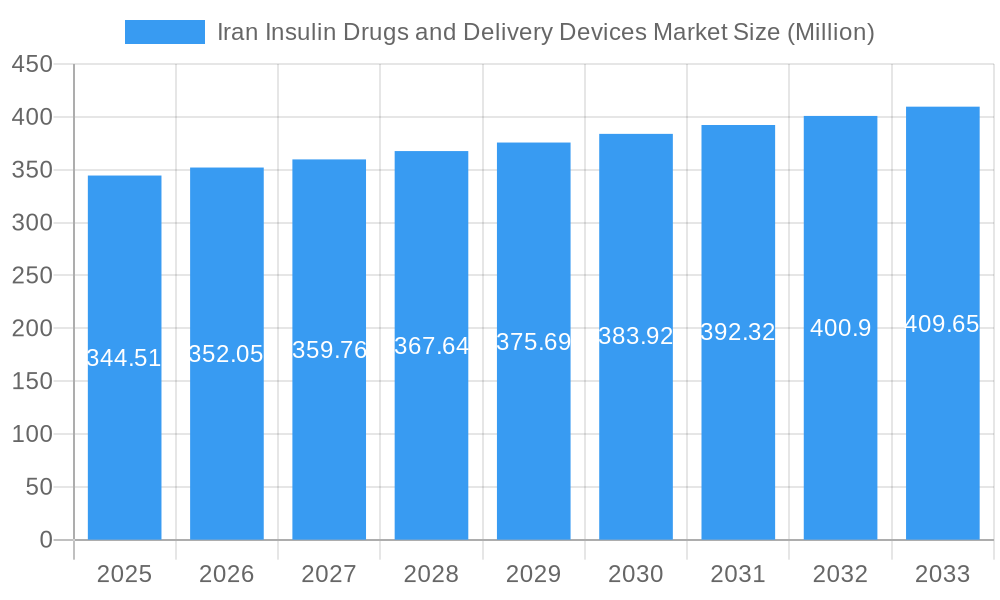

Iran Insulin Drugs and Delivery Devices Market Company Market Share

Iran Insulin Drugs and Delivery Devices Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Iran insulin drugs and delivery devices market, offering invaluable insights for stakeholders across the pharmaceutical and medical device industries. The report covers the period 2019-2033, with a focus on the base year 2025 and forecast period 2025-2033. It meticulously examines market dynamics, leading players, emerging trends, and future growth opportunities. The market is expected to reach XX Million by 2033, exhibiting a CAGR of XX% during the forecast period.

Iran Insulin Drugs and Delivery Devices Market Market Dynamics & Concentration

The Iranian insulin market is characterized by a complex interplay of factors impacting its dynamics and concentration. While global giants like Novo Nordisk A/S, Sanofi, and Eli Lilly and Company hold significant market share, domestic players like Gan & Lee Pharmaceuticals and Biocon are also actively contributing. Market concentration is moderate, with the top three players holding an estimated XX% market share in 2025. Innovation is driven by the need for more affordable and accessible insulin products, particularly long-acting insulins, to address the growing diabetic population.

The regulatory framework plays a crucial role, influencing pricing, approvals, and market access. Government initiatives aimed at promoting domestic production and reducing reliance on imports are shaping the competitive landscape. Substitutes for insulin therapy are limited, although ongoing research into alternative treatments is impacting the market outlook. End-user trends show a growing preference for convenient delivery devices like insulin pens and pumps. Mergers and acquisitions (M&A) activity has been relatively low in recent years, with approximately XX M&A deals recorded between 2019 and 2024. This limited M&A activity might be due to sanctions and regulatory complexities within the country.

- Market Concentration: Moderate, top 3 players holding approximately XX% market share in 2025.

- Innovation Drivers: Demand for affordable and accessible long-acting insulins.

- Regulatory Framework: Significant influence on pricing, approvals, and market access.

- Product Substitutes: Limited, with research into alternatives impacting the market outlook.

- End-User Trends: Growing preference for insulin pens and pumps.

- M&A Activity: Low, with approximately XX deals recorded between 2019-2024.

Iran Insulin Drugs and Delivery Devices Market Industry Trends & Analysis

The Iranian insulin market is witnessing significant growth driven by several factors. The rising prevalence of diabetes, particularly type 2 diabetes, is a key driver, fueling demand for both insulin drugs and delivery devices. Technological advancements, such as the introduction of newer insulin analogs with improved efficacy and safety profiles, are also impacting market growth. Consumer preferences are shifting towards more user-friendly and convenient delivery systems, like insulin pens and pumps. Competitive dynamics are shaped by both domestic and international players vying for market share, leading to price competition and the introduction of innovative products. The market is expected to grow at a CAGR of XX% from 2025 to 2033, with market penetration of insulin therapy increasing steadily due to raising awareness of the condition. The increasing healthcare expenditure by the government also supports market growth.

The recent establishment of Iran's first insulin raw material production line marks a significant milestone in enhancing self-sufficiency. This move shows a reduction in reliance on imports, boosting domestic production and potentially impacting pricing and market competition.

Leading Markets & Segments in Iran Insulin Drugs and Delivery Devices Market

While data on regional variations is limited, the urban areas of Iran, with greater access to healthcare and higher diabetes prevalence, are likely to dominate the market. Within the product segments, Bolus or Fast-acting Insulins are currently leading the drug market, owing to their immediate effect and wide usage. Among delivery devices, insulin pens are expected to remain dominant due to their convenience and ease of use. However, the market for insulin pumps is anticipated to show promising growth as awareness and affordability increase.

- Key Drivers for Bolus or Fast-acting Insulins: High demand due to immediate effect & wide usage

- Key Drivers for Insulin Pens: Convenience and ease of use leading to higher adoption.

- Key Drivers for Urban Areas: Greater access to healthcare and higher prevalence of diabetes.

- Economic Policies: Government initiatives supporting domestic production and healthcare access.

- Infrastructure: Improved healthcare infrastructure in urban areas facilitates wider adoption.

Iran Insulin Drugs and Delivery Devices Market Product Developments

Recent product innovations have focused on enhancing the efficacy and convenience of insulin delivery. The introduction of new insulin analogs with improved pharmacokinetic profiles and the development of advanced insulin delivery devices are key examples. These innovations are designed to improve glycemic control, minimize hypoglycemic events, and enhance patient compliance. The market fit of these new products is driven by the unmet needs of diabetic patients, a need for better glycemic control, and the desire for greater ease of use and convenience in insulin delivery systems.

Key Drivers of Iran Insulin Drugs and Delivery Devices Market Growth

Several factors are driving growth in the Iranian insulin market. The rising prevalence of diabetes and the increasing awareness of the condition are primary drivers. Government initiatives to improve healthcare access and affordability are also contributing significantly. Technological advancements, particularly in insulin delivery systems, are also positively impacting market growth, offering patients more convenient and effective treatment options. Furthermore, improvements in healthcare infrastructure, such as increased availability of clinics and hospitals, are making insulin more accessible to patients.

Challenges in the Iran Insulin Drugs and Delivery Devices Market Market

The Iranian insulin market faces several challenges. International sanctions have impacted the availability and affordability of imported insulin products, thus impacting market stability. Supply chain disruptions can lead to shortages and affect market dynamics. The competitive landscape, with both domestic and international players, can put pressure on pricing and profitability. Furthermore, regulatory complexities and bureaucratic processes can create hurdles for new product launches and market entry. These factors can lead to a lack of timely access to newer insulin technologies for patients.

Emerging Opportunities in Iran Insulin Drugs and Delivery Devices Market

Despite the challenges, several opportunities exist for growth in the Iranian insulin market. Continued technological advancements in insulin delivery systems and the development of novel insulin analogs present opportunities for innovative product launches. Strategic partnerships between domestic and international players can facilitate technology transfer and enhance domestic production capacity. Government initiatives aimed at promoting self-sufficiency in insulin production are expected to further accelerate market growth. The expansion of access to healthcare, particularly in rural areas, will also help increase market penetration for insulin products.

Leading Players in the Iran Insulin Drugs and Delivery Devices Market Sector

- Novo Nordisk A/S

- Sanofi

- Eli Lilly and Company

- Gan & Lee Pharmaceuticals

- Biocon

- Medtronic

- Becton Dickinson and Company

- List Not Exhaustive

Key Milestones in Iran Insulin Drugs and Delivery Devices Market Industry

- September 2024: Launch of Raizodag, a foreign insulin brand similar to Nomix, covered by health insurance and Armed Forces Medical Services insurance; anticipated Social Security coverage extension. This significantly increases market access and competition.

- September 2023: Inauguration of Iran's first insulin raw material production line, marking a significant step towards self-sufficiency and reducing reliance on imports. This impacts long-term market dynamics through greater domestic production.

Strategic Outlook for Iran Insulin Drugs and Delivery Devices Market Market

The Iranian insulin market holds significant future potential, driven by rising diabetes prevalence, government support for healthcare, and technological advancements. Strategic partnerships focused on technology transfer and domestic production capacity building will be crucial for sustained growth. Focusing on patient education and awareness campaigns to promote early diagnosis and treatment can also significantly boost market expansion. Furthermore, the continued development and introduction of innovative insulin delivery systems and analogs will be key to maintaining the market's growth trajectory.

Iran Insulin Drugs and Delivery Devices Market Segmentation

-

1. Product Type

-

1.1. By Drug

- 1.1.1. Basal or Long-acting Insulins

- 1.1.2. Bolus or Fast-acting Insulins

- 1.1.3. Traditional Human Insulins

- 1.1.4. Other Product Types

-

1.2. By Device

- 1.2.1. Insulin Pumps

- 1.2.2. Insulin Pens

- 1.2.3. Insulin Syringes

- 1.2.4. Insulin Jet Injectors

-

1.1. By Drug

Iran Insulin Drugs and Delivery Devices Market Segmentation By Geography

- 1. Iran

Iran Insulin Drugs and Delivery Devices Market Regional Market Share

Geographic Coverage of Iran Insulin Drugs and Delivery Devices Market

Iran Insulin Drugs and Delivery Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Strategic Initiatives by the Government and Organizations; Increasing Prevalence of Diabetes in Iran

- 3.3. Market Restrains

- 3.3.1. Growing Strategic Initiatives by the Government and Organizations; Increasing Prevalence of Diabetes in Iran

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in Iran

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Insulin Drugs and Delivery Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. By Drug

- 5.1.1.1. Basal or Long-acting Insulins

- 5.1.1.2. Bolus or Fast-acting Insulins

- 5.1.1.3. Traditional Human Insulins

- 5.1.1.4. Other Product Types

- 5.1.2. By Device

- 5.1.2.1. Insulin Pumps

- 5.1.2.2. Insulin Pens

- 5.1.2.3. Insulin Syringes

- 5.1.2.4. Insulin Jet Injectors

- 5.1.1. By Drug

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Novo Nordisk A/S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sanofi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eli Lilly and Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gan & Lee Pharmaceuticals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Biocon

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Medtronic

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Becton Dickinson and Company*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Novo Nordisk A/S

List of Figures

- Figure 1: Iran Insulin Drugs and Delivery Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Iran Insulin Drugs and Delivery Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Iran Insulin Drugs and Delivery Devices Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Iran Insulin Drugs and Delivery Devices Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: Iran Insulin Drugs and Delivery Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Iran Insulin Drugs and Delivery Devices Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Iran Insulin Drugs and Delivery Devices Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Iran Insulin Drugs and Delivery Devices Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 7: Iran Insulin Drugs and Delivery Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Iran Insulin Drugs and Delivery Devices Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Insulin Drugs and Delivery Devices Market?

The projected CAGR is approximately 2.18%.

2. Which companies are prominent players in the Iran Insulin Drugs and Delivery Devices Market?

Key companies in the market include Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Gan & Lee Pharmaceuticals, Biocon, Medtronic, Becton Dickinson and Company*List Not Exhaustive.

3. What are the main segments of the Iran Insulin Drugs and Delivery Devices Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 344.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Strategic Initiatives by the Government and Organizations; Increasing Prevalence of Diabetes in Iran.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in Iran.

7. Are there any restraints impacting market growth?

Growing Strategic Initiatives by the Government and Organizations; Increasing Prevalence of Diabetes in Iran.

8. Can you provide examples of recent developments in the market?

September 2024: The Vice President of Food and Drugs at Hamedan University of Medical Sciences announced the introduction of a foreign insulin brand, Raizodag. The insulin, akin to the Nomix brand, was launched. It is covered by health insurance and the Armed Forces Medical Services insurance. The authority anticipates that Social Security insurance will extend its coverage soon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Insulin Drugs and Delivery Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Insulin Drugs and Delivery Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Insulin Drugs and Delivery Devices Market?

To stay informed about further developments, trends, and reports in the Iran Insulin Drugs and Delivery Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence