Key Insights

The Inhalation and Nasal Spray Generic Drugs Market is projected for significant expansion, driven by rising global respiratory and allergic conditions and a growing demand for affordable generic treatments. The market is valued at USD 10.35 billion in the base year 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 12.26% through 2033. This growth is fueled by the increasing incidence of chronic respiratory diseases like Asthma and COPD, especially in emerging economies with developing healthcare systems. Escalating rates of allergic rhinitis, influenced by environmental and lifestyle factors, are also driving consistent demand for accessible generic nasal spray and inhalation therapies. Government initiatives to reduce healthcare costs by promoting generics and ongoing product development by key players, introducing advanced bioequivalent formulations, further support market expansion.

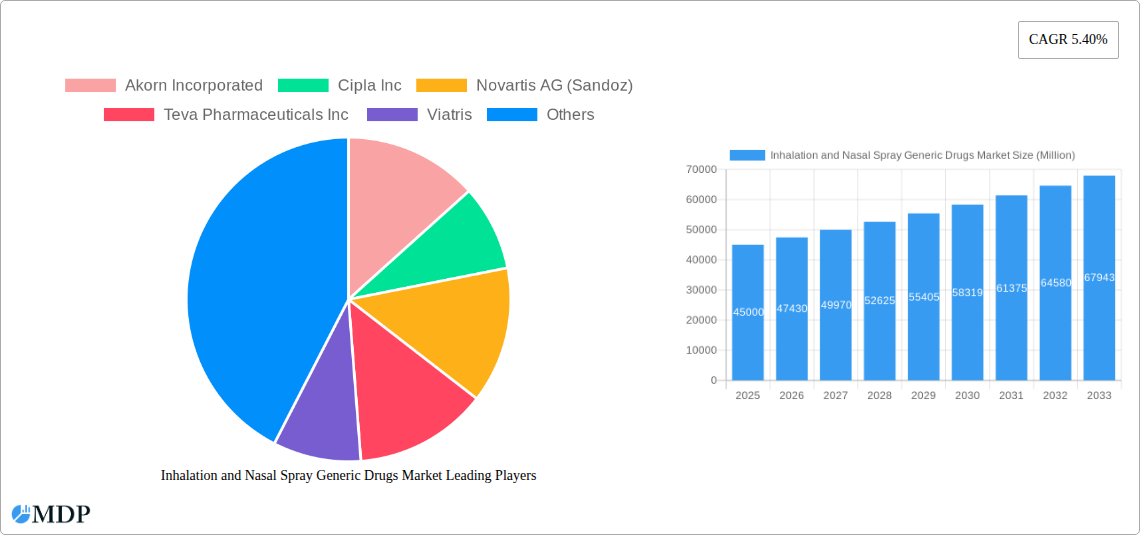

Inhalation and Nasal Spray Generic Drugs Market Market Size (In Billion)

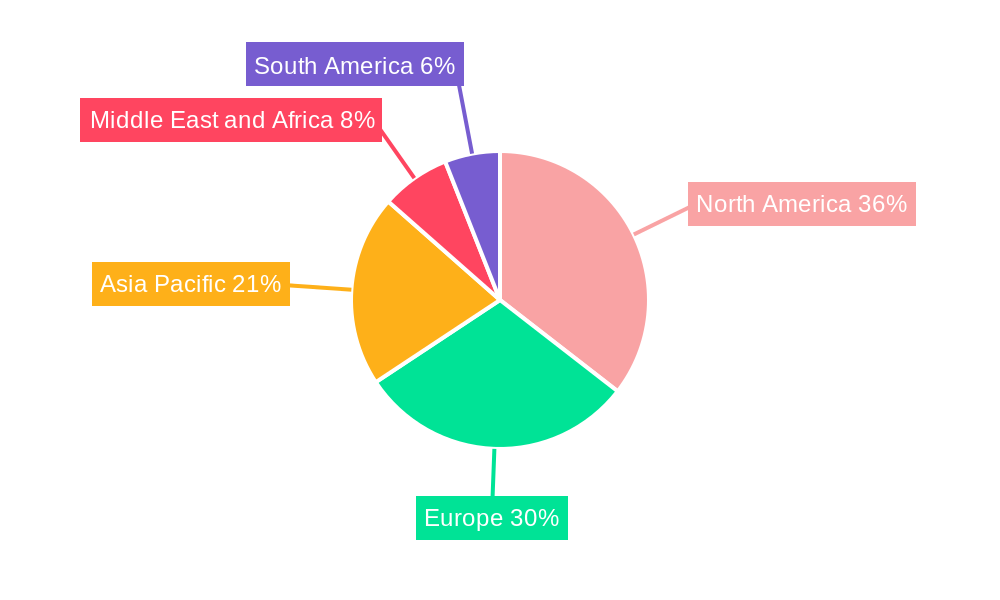

The market features a competitive landscape with established and emerging pharmaceutical companies. Dominant drug classes include Corticosteroids and Bronchodilators for chronic respiratory management, followed by Antihistamines and Decongestant Sprays for allergic rhinitis and nasal congestion. North America and Europe currently lead due to advanced healthcare systems and high respiratory disease awareness. However, the Asia Pacific region is expected to experience the fastest growth, driven by a large patient base, rising disposable incomes, and supportive regulatory frameworks for generic drug approvals. Challenges such as stringent regulatory processes and the need for patient education on generic efficacy are being mitigated by their cost-effectiveness and accessibility, ensuring their long-term market potential.

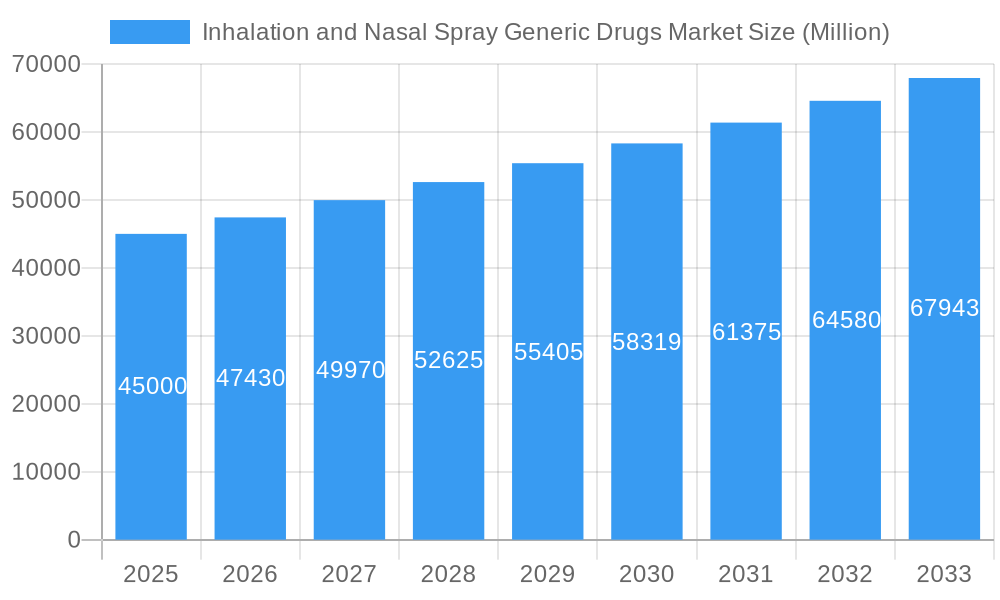

Inhalation and Nasal Spray Generic Drugs Market Company Market Share

Inhalation and Nasal Spray Generic Drugs Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth market research report provides a comprehensive analysis of the global Inhalation and Nasal Spray Generic Drugs Market. Spanning a study period from 2019 to 2033, with a base year of 2025, the report offers critical insights into market dynamics, industry trends, leading segments, and the competitive landscape. We delve into the strategic imperatives for key players and outline the future trajectory of this rapidly evolving sector, driven by increasing demand for affordable respiratory and nasal treatments. This report is essential for pharmaceutical manufacturers, R&D professionals, investors, and regulatory bodies seeking to understand and capitalize on opportunities within the inhalation and nasal spray generic drugs market.

Inhalation and Nasal Spray Generic Drugs Market Market Dynamics & Concentration

The Inhalation and Nasal Spray Generic Drugs Market is characterized by moderate concentration, with key players vying for market share through strategic product launches and acquisitions. Innovation is primarily driven by the development of bioequivalent generic versions of branded inhaled and nasal medications, often focusing on improved delivery mechanisms or formulations for enhanced patient compliance. Regulatory frameworks, particularly stringent FDA and EMA approvals, play a pivotal role in market entry and product lifecycle management. Product substitutes, such as branded generics and increasingly, advanced drug-device combinations, present a continuous challenge. End-user trends lean towards seeking cost-effective alternatives to branded respiratory and allergy medications, fueled by rising healthcare costs and increased prevalence of respiratory and allergic conditions. Mergers and acquisitions (M&A) activity, while not overly aggressive, indicates a consolidation strategy among larger players to expand their generic portfolios and geographic reach. We estimate over 50 M&A deals in the last five years contributing to market consolidation. Key market share players hold an estimated 30-40% of the total market revenue, with the remaining spread across numerous smaller manufacturers.

Inhalation and Nasal Spray Generic Drugs Market Industry Trends & Analysis

The Inhalation and Nasal Spray Generic Drugs Market is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025-2033. This expansion is propelled by several key market growth drivers, including the increasing global prevalence of respiratory ailments like asthma, Chronic Obstructive Pulmonary Disease (COPD), and allergic rhinitis, necessitating continuous and often long-term treatment. The patent expiries of several blockbuster branded inhalation and nasal spray medications have opened significant avenues for generic manufacturers to introduce affordable alternatives, thereby driving market penetration. Technological disruptions, such as the development of advanced dry powder inhalers (DPIs) and metered-dose inhalers (MDIs) with improved dose consistency and patient-friendly designs, are enhancing treatment efficacy and patient adherence. Consumer preferences are increasingly shifting towards these generic options due to significant cost savings, making them more accessible to a wider patient population, especially in emerging economies. Competitive dynamics are intensifying, with both established generic players and emerging manufacturers focusing on building comprehensive product pipelines and optimizing manufacturing processes to achieve economies of scale. The overall market penetration of generic inhalation and nasal spray drugs is estimated to reach over 65% by 2033, indicating a substantial shift from branded to generic formulations.

Leading Markets & Segments in Inhalation and Nasal Spray Generic Drugs Market

The global Inhalation and Nasal Spray Generic Drugs Market is segmented by Drug Class and Application, with significant regional variations in dominance.

By Drug Class:

- Corticosteroids: This segment is a dominant force, driven by their widespread use in managing chronic inflammatory respiratory conditions like asthma and COPD. The availability of numerous generic inhaled corticosteroids (ICS) has made them highly accessible. Key drivers include:

- High prevalence of asthma and allergic rhinitis.

- Long-term treatment requirements for these conditions.

- Extensive clinical evidence supporting their efficacy.

- Bronchodilators: Another critical segment, bronchodilators, are essential for symptomatic relief in asthma and COPD. The development of generic short-acting and long-acting beta-agonists (SABAs and LABAs) and anticholinergics fuels this segment's growth. Key drivers include:

- Immediate relief of bronchoconstriction.

- Complementary therapy with corticosteroids.

- Technological advancements in inhaler devices.

- Antihistamines: Primarily used for allergic rhinitis, this segment is bolstered by the high incidence of seasonal and perennial allergies. Generic nasal spray antihistamines offer cost-effective and targeted relief. Key drivers include:

- Rising incidence of allergic rhinitis globally.

- Convenience of nasal spray administration.

- Development of non-sedating formulations.

- Decongestant Sprays: These are widely used for temporary relief of nasal congestion. The accessibility and affordability of generic decongestant nasal sprays contribute to their significant market presence. Key drivers include:

- High incidence of common colds and sinus infections.

- Over-the-counter availability in many regions.

- Other Drug Classes: This category encompasses a range of medications, including leukotriene modifiers and mast cell stabilizers, which also find application in respiratory and allergic conditions, contributing to the overall market.

By Application:

- Asthma: This remains the largest application segment, with inhaled corticosteroids and bronchodilators being cornerstone treatments. The increasing diagnosis rates and the need for consistent, affordable management strategies propel this segment.

- COPD: As a major global health burden, COPD treatment, heavily reliant on inhaled bronchodilators and corticosteroids, represents a substantial market. The aging population and environmental factors contribute to its growth.

- Allergic Rhinitis: The widespread prevalence of allergies makes this a significant application. Generic antihistamine nasal sprays and corticosteroid nasal sprays are key to managing symptoms.

- Other Applications: This includes treatments for conditions like cystic fibrosis, pulmonary hypertension, and various nasal polyps, contributing to the diverse market landscape.

Regional Dominance: North America and Europe currently dominate the market due to high healthcare expenditure, advanced healthcare infrastructure, and established regulatory pathways. However, the Asia-Pacific region is poised for significant growth, driven by increasing respiratory disease prevalence, growing middle-class populations, and a burgeoning generic pharmaceutical industry.

Inhalation and Nasal Spray Generic Drugs Market Product Developments

Product developments in the Inhalation and Nasal Spray Generic Drugs Market are primarily focused on achieving bioequivalence to innovator products while offering enhanced patient convenience and cost-effectiveness. Key trends include the development of generic versions of complex combination therapies, such as those containing both corticosteroids and long-acting bronchodilators for asthma and COPD. Manufacturers are also investing in generic formulations for newer delivery systems like soft mist inhalers and advanced nasal spray devices that offer improved spray characteristics and patient comfort. These developments aim to capture market share by providing accessible alternatives to high-priced branded medications, addressing unmet clinical needs, and leveraging technological advancements to create competitive advantages. The focus is on robust R&D to navigate complex regulatory pathways and ensure product differentiation.

Key Drivers of Inhalation and Nasal Spray Generic Drugs Market Growth

The Inhalation and Nasal Spray Generic Drugs Market is driven by a confluence of potent factors. The escalating global prevalence of respiratory diseases such as asthma, COPD, and allergic rhinitis is a primary catalyst, creating sustained demand for effective and affordable treatments. The expiration of patents for numerous branded inhalation and nasal spray medications is a significant market enabler, allowing generic manufacturers to introduce cost-effective alternatives and expand patient access. Furthermore, healthcare reforms and initiatives in various countries aimed at reducing healthcare expenditure are actively promoting the adoption of generic drugs. Technological advancements in drug delivery devices, leading to improved efficacy and patient compliance, also contribute to market expansion. The growing awareness among healthcare providers and patients about the cost-benefit advantages of generic alternatives further bolsters market growth.

Challenges in the Inhalation and Nasal Spray Generic Drugs Market Market

Despite its growth trajectory, the Inhalation and Nasal Spray Generic Drugs Market faces several challenges. The stringent and often lengthy regulatory approval processes for generic inhalation and nasal spray products, particularly those involving complex drug-device combinations, pose a significant hurdle, leading to extended market entry timelines. Intense competition among generic manufacturers can lead to price erosion, impacting profit margins. Supply chain complexities, including sourcing raw materials and ensuring consistent manufacturing quality across multiple facilities, can also present challenges. Furthermore, ensuring bioequivalence for complex inhalation and nasal drug products can be technically demanding. Lastly, educating healthcare professionals and patients about the efficacy and safety of generic alternatives, especially for chronic conditions, remains an ongoing effort to overcome potential skepticism.

Emerging Opportunities in Inhalation and Nasal Spray Generic Drugs Market

Emerging opportunities in the Inhalation and Nasal Spray Generic Drugs Market are abundant, driven by innovation and expanding market reach. The increasing focus on combination therapies, where generic versions of dual-acting or triple-acting inhalers are developed, presents a significant growth avenue. The development of generic biosimil versions of biologics used for severe respiratory conditions also represents a future opportunity. Furthermore, the burgeoning healthcare markets in developing economies, with their growing patient populations and increasing demand for affordable medicines, offer substantial untapped potential. Strategic partnerships and collaborations between generic drug manufacturers and device companies can lead to the development of next-generation, user-friendly inhalation and nasal delivery systems, creating new market niches. The rise of telehealth and remote patient monitoring also creates opportunities for improved drug delivery and adherence solutions.

Leading Players in the Inhalation and Nasal Spray Generic Drugs Market Sector

- Akorn Incorporated

- Cipla Inc

- Novartis AG (Sandoz)

- Teva Pharmaceuticals Inc

- Viatris

- Sun Pharma (Ranbaxy)

- Apotex

- Hikma (Roxane)

- Beximco Pharma

Key Milestones in Inhalation and Nasal Spray Generic Drugs Market Industry

- August 2022: Lupin received approval from the FDA for Formoterol Fumarate Inhalation Solution, used to treat chronic obstructive pulmonary disease symptoms. The company received approval from the US Food and Drug Administration (USFDA) for the generic version of Mylan Specialty's Perforomist Inhalation Solution. This significantly expanded treatment options for COPD patients.

- March 2022: Viatris Inc., in partnership with Kindeva, received its first FDA approval for the generic version of Symbicort Inhalation Aerosol, Breyna (Budesonide and Formoterol Fumarate Dihydrate Inhalation Aerosol), which is used for the maintenance treatment of asthma and chronic obstructive pulmonary disease (COPD). This marked a significant step in making essential asthma and COPD treatments more accessible.

Strategic Outlook for Inhalation and Nasal Spray Generic Drugs Market Market

The strategic outlook for the Inhalation and Nasal Spray Generic Drugs Market is one of sustained growth and increasing sophistication. Key growth accelerators will include the continued patent expiries of high-value branded drugs, creating further opportunities for generic market penetration. Manufacturers will focus on expanding their portfolios to include more complex inhalation and nasal spray generics, such as combination products and those requiring specialized delivery devices. Strategic mergers and acquisitions will likely continue as companies seek to consolidate their market positions, gain access to new technologies, and expand their geographic footprints, particularly in emerging markets. Investment in robust R&D to navigate complex regulatory landscapes and develop differentiated generic products will be paramount. Furthermore, building strong relationships with healthcare providers and payers to advocate for generic utilization will be crucial for long-term success. The market is expected to witness a greater emphasis on sustainable manufacturing practices and innovative patient support programs.

Inhalation and Nasal Spray Generic Drugs Market Segmentation

-

1. Drug Class

- 1.1. Corticosteroids

- 1.2. Bronchodilators

- 1.3. Antihistamines

- 1.4. Decongestant Sprays

- 1.5. Other Drug Classes

-

2. Application

- 2.1. Asthma

- 2.2. COPD

- 2.3. Allergic Rhinitis

- 2.4. Other Applications

Inhalation and Nasal Spray Generic Drugs Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Inhalation and Nasal Spray Generic Drugs Market Regional Market Share

Geographic Coverage of Inhalation and Nasal Spray Generic Drugs Market

Inhalation and Nasal Spray Generic Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Asthma and COPD; Low Cost of Generic Drugs

- 3.3. Market Restrains

- 3.3.1. Strict Government Regulations

- 3.4. Market Trends

- 3.4.1. Asthma Holds Significant Share in the Global Inhalation and Nasal Spray Generic Drugs Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Inhalation and Nasal Spray Generic Drugs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Corticosteroids

- 5.1.2. Bronchodilators

- 5.1.3. Antihistamines

- 5.1.4. Decongestant Sprays

- 5.1.5. Other Drug Classes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Asthma

- 5.2.2. COPD

- 5.2.3. Allergic Rhinitis

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. North America Inhalation and Nasal Spray Generic Drugs Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 6.1.1. Corticosteroids

- 6.1.2. Bronchodilators

- 6.1.3. Antihistamines

- 6.1.4. Decongestant Sprays

- 6.1.5. Other Drug Classes

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Asthma

- 6.2.2. COPD

- 6.2.3. Allergic Rhinitis

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 7. Europe Inhalation and Nasal Spray Generic Drugs Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 7.1.1. Corticosteroids

- 7.1.2. Bronchodilators

- 7.1.3. Antihistamines

- 7.1.4. Decongestant Sprays

- 7.1.5. Other Drug Classes

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Asthma

- 7.2.2. COPD

- 7.2.3. Allergic Rhinitis

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 8. Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 8.1.1. Corticosteroids

- 8.1.2. Bronchodilators

- 8.1.3. Antihistamines

- 8.1.4. Decongestant Sprays

- 8.1.5. Other Drug Classes

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Asthma

- 8.2.2. COPD

- 8.2.3. Allergic Rhinitis

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 9. Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 9.1.1. Corticosteroids

- 9.1.2. Bronchodilators

- 9.1.3. Antihistamines

- 9.1.4. Decongestant Sprays

- 9.1.5. Other Drug Classes

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Asthma

- 9.2.2. COPD

- 9.2.3. Allergic Rhinitis

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 10. South America Inhalation and Nasal Spray Generic Drugs Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 10.1.1. Corticosteroids

- 10.1.2. Bronchodilators

- 10.1.3. Antihistamines

- 10.1.4. Decongestant Sprays

- 10.1.5. Other Drug Classes

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Asthma

- 10.2.2. COPD

- 10.2.3. Allergic Rhinitis

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Akorn Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cipla Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novartis AG (Sandoz)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Teva Pharmaceuticals Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Viatris

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sun Pharma (Ranbaxy)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Apotex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hikma (Roxane)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Beximco Pharma

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Akorn Incorporated

List of Figures

- Figure 1: Global Inhalation and Nasal Spray Generic Drugs Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Inhalation and Nasal Spray Generic Drugs Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 4: North America Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Drug Class 2025 & 2033

- Figure 5: North America Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 6: North America Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 7: North America Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 16: Europe Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Drug Class 2025 & 2033

- Figure 17: Europe Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 18: Europe Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 19: Europe Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Application 2025 & 2033

- Figure 20: Europe Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 28: Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Drug Class 2025 & 2033

- Figure 29: Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 30: Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 31: Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Application 2025 & 2033

- Figure 32: Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 40: Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Drug Class 2025 & 2033

- Figure 41: Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 42: Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 43: Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Application 2025 & 2033

- Figure 44: Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 45: Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Drug Class 2025 & 2033

- Figure 52: South America Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Drug Class 2025 & 2033

- Figure 53: South America Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 54: South America Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 55: South America Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Application 2025 & 2033

- Figure 56: South America Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 57: South America Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: South America Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 59: South America Inhalation and Nasal Spray Generic Drugs Market Revenue (billion), by Country 2025 & 2033

- Figure 60: South America Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Inhalation and Nasal Spray Generic Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Inhalation and Nasal Spray Generic Drugs Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 2: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 3: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 8: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 9: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 20: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 21: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: France Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Italy Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Spain Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 38: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 39: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: China Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Japan Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: India Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Australia Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: South Korea Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 56: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 57: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 58: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 59: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: GCC Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: South Africa Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 68: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 69: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 70: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 71: Global Inhalation and Nasal Spray Generic Drugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Inhalation and Nasal Spray Generic Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Brazil Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Argentina Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Inhalation and Nasal Spray Generic Drugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Inhalation and Nasal Spray Generic Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Inhalation and Nasal Spray Generic Drugs Market?

The projected CAGR is approximately 12.26%.

2. Which companies are prominent players in the Inhalation and Nasal Spray Generic Drugs Market?

Key companies in the market include Akorn Incorporated, Cipla Inc, Novartis AG (Sandoz), Teva Pharmaceuticals Inc , Viatris, Sun Pharma (Ranbaxy), Apotex, Hikma (Roxane), Beximco Pharma.

3. What are the main segments of the Inhalation and Nasal Spray Generic Drugs Market?

The market segments include Drug Class, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.35 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Asthma and COPD; Low Cost of Generic Drugs.

6. What are the notable trends driving market growth?

Asthma Holds Significant Share in the Global Inhalation and Nasal Spray Generic Drugs Market.

7. Are there any restraints impacting market growth?

Strict Government Regulations.

8. Can you provide examples of recent developments in the market?

August 2022: Lupin received approval from the FDA for Formoterol Fumarate Inhalation Solution, used to treat chronic obstructive pulmonary disease symptoms. The company received approval from the US Food and Drug Administration (USFDA) for the generic version of Mylan Specialty's Perforomist Inhalation Solution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Inhalation and Nasal Spray Generic Drugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Inhalation and Nasal Spray Generic Drugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Inhalation and Nasal Spray Generic Drugs Market?

To stay informed about further developments, trends, and reports in the Inhalation and Nasal Spray Generic Drugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence