Key Insights

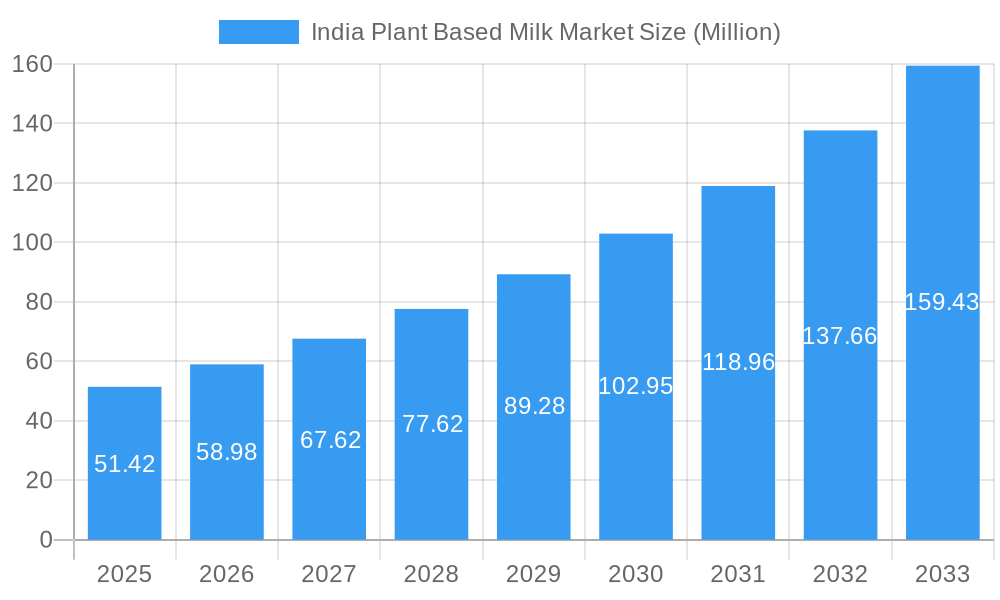

The India plant-based milk market, valued at $51.42 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 14.78% from 2025 to 2033. This surge is driven by several key factors. Rising health consciousness among Indian consumers is fueling demand for healthier alternatives to dairy milk, particularly among lactose-intolerant individuals and those seeking to reduce saturated fat intake. The increasing awareness of the environmental impact of dairy farming is also contributing to the market's expansion, with plant-based options perceived as more sustainable. Furthermore, the growing popularity of veganism and vegetarianism within India is significantly boosting the adoption of plant-based milk alternatives. Key players like Blue Diamond Growers, Dabur India Ltd, and Nestlé S.A. are actively contributing to market growth through product innovation, strategic partnerships, and expansion into new distribution channels. The market is segmented by product type (soy, almond, oat, etc.), distribution channels (online and offline), and region (North, South, East, West). The competitive landscape is characterized by both established multinational corporations and emerging domestic brands, creating a dynamic and rapidly evolving market.

India Plant Based Milk Market Market Size (In Million)

The continued growth of the Indian plant-based milk market is expected to be influenced by several factors. Government initiatives promoting sustainable agriculture and healthy eating habits will likely provide further impetus. Innovation in product development, focusing on taste, texture, and nutritional value, will be crucial for sustained growth. Expanding distribution networks, particularly in rural areas, will also play a significant role. However, challenges such as price sensitivity among consumers, potential supply chain issues, and competition from established dairy products will require careful management by market players. While soy and almond milk currently dominate the market, other varieties like oat and coconut milk are anticipated to witness strong growth in the coming years, driven by increasing consumer preferences for diverse flavor profiles and nutritional benefits. The market's future trajectory suggests substantial potential for both domestic and international players.

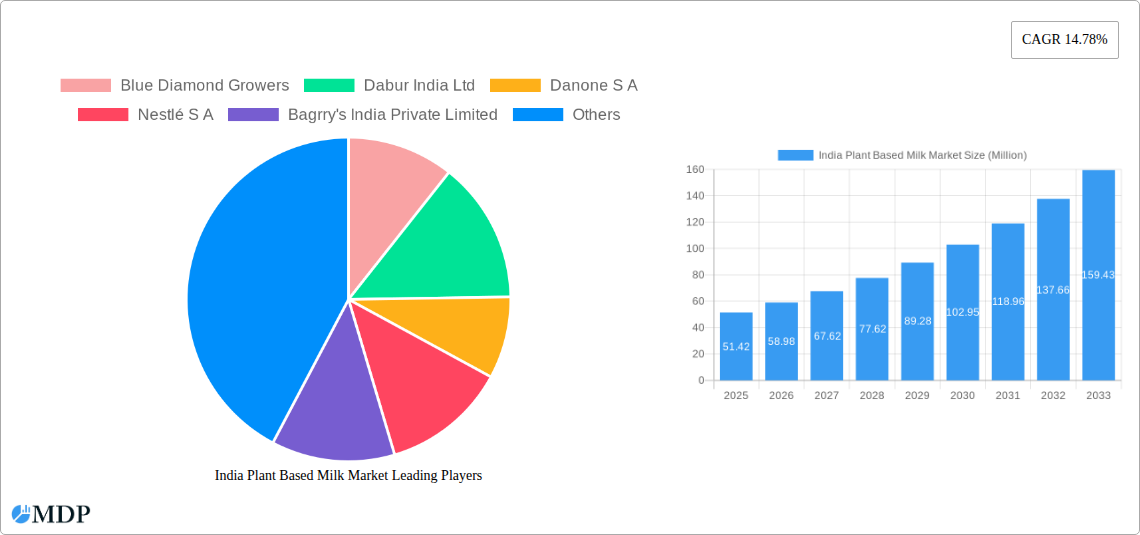

India Plant Based Milk Market Company Market Share

India Plant Based Milk Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic India Plant Based Milk Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this rapidly evolving sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a complete picture of historical trends, current market dynamics, and future growth projections. The report projects a market value of xx Million by 2033, showcasing significant growth potential.

India Plant Based Milk Market Dynamics & Concentration

The India Plant Based Milk Market is experiencing robust growth, driven by increasing consumer awareness of health benefits, rising veganism and lactose intolerance, and expanding product diversification. Market concentration is relatively fragmented, with several key players vying for market share. However, larger multinational companies are progressively increasing their presence through acquisitions and organic growth. The market is influenced by stringent food safety regulations, the availability of affordable substitutes, and evolving consumer preferences for functional and sustainable products.

- Market Share: The top five players currently hold an estimated xx% market share, with smaller players accounting for the remaining xx%.

- Innovation Drivers: Product diversification, functional benefits (e.g., added vitamins and minerals), and sustainable sourcing are major innovation drivers.

- Regulatory Framework: Stringent food safety and labeling regulations influence market players' strategies.

- Product Substitutes: Traditional dairy milk remains a primary substitute, while other plant-based beverages (e.g., coconut water) also compete.

- End-User Trends: Growing health consciousness, rising disposable incomes, and increased adoption of vegan lifestyles fuel market demand.

- M&A Activities: The past five years have witnessed xx M&A deals, primarily involving smaller companies being acquired by larger players.

India Plant Based Milk Market Industry Trends & Analysis

The India Plant Based Milk Market exhibits a significant Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the increasing adoption of plant-based diets, rising awareness of the environmental impact of dairy farming, and the expanding availability of diverse plant-based milk options. Technological advancements in product formulation and processing are further driving market expansion. Consumer preferences are shifting towards healthier, more sustainable, and convenient options, prompting companies to innovate with new flavors, functional ingredients, and eco-friendly packaging. Competitive dynamics are characterized by both intense competition among established players and the emergence of new entrants, leading to continuous product innovation and price adjustments. Market penetration of plant-based milk is estimated to be at xx% in 2025, projected to increase significantly by 2033.

Leading Markets & Segments in India Plant Based Milk Market

While the market is experiencing growth across India, urban areas exhibit higher consumption rates driven by increased awareness, higher disposable incomes, and greater access to diverse product offerings. The almond and soy milk segments are currently leading the market, driven by their established consumer base and readily available supply chains. Other segments, such as oat, coconut, and rice milk, are exhibiting rapid growth.

- Key Drivers of Urban Area Dominance:

- Higher disposable incomes enabling premium product consumption.

- Increased availability through modern retail channels.

- Greater awareness of health and environmental benefits through increased media reach.

- Access to a larger number of diverse products.

The dominance of these segments is further strengthened by successful marketing campaigns emphasizing their health and lifestyle benefits.

India Plant Based Milk Market Product Developments

Recent years have witnessed a surge in product innovation, with companies introducing a wide range of plant-based milk varieties, flavored options, and functional formulations enriched with vitamins, minerals, and protein. Technological advancements have improved the taste, texture, and shelf life of plant-based milk, enhancing consumer appeal and reducing manufacturing costs. These innovations cater to the growing demand for convenient, healthy, and sustainable food options, thereby expanding market reach and catering to diverse consumer preferences.

Key Drivers of India Plant Based Milk Market Growth

Several factors contribute to the robust growth trajectory of the India Plant Based Milk Market. These include:

- Growing Health Consciousness: Increased awareness of the health benefits of plant-based diets and the negative impacts of dairy consumption on health is driving demand.

- Rising Veganism and Lactose Intolerance: The increasing adoption of veganism and the high prevalence of lactose intolerance in India contribute significantly to market expansion.

- Technological Advancements: Improvements in processing technology resulting in improved taste and texture have broadened consumer appeal.

- Favorable Government Policies: Government initiatives promoting sustainable agriculture and plant-based diets also contribute positively to market growth.

Challenges in the India Plant Based Milk Market

Despite the positive growth trajectory, the India Plant Based Milk Market faces certain challenges. These include:

- Price Sensitivity: The higher cost of plant-based milk compared to traditional dairy milk poses a barrier to wider adoption among price-sensitive consumers.

- Supply Chain Limitations: Consistent supply chain management is crucial, especially for certain plant-based milk varieties that require specific growing conditions.

- Competition from Traditional Dairy Milk: The continued dominance of traditional dairy milk in the market presents a major competitive challenge.

Emerging Opportunities in India Plant Based Milk Market

The long-term outlook for the India Plant Based Milk Market remains exceptionally positive. Continued technological innovations leading to cost reductions and improved product quality will play a pivotal role in driving further growth. Strategic partnerships between established players and innovative start-ups could lead to significant market expansion, particularly in reaching rural and semi-urban areas. Diversification into new product categories and flavors, such as functional and fortified plant-based beverages, holds substantial growth potential.

Leading Players in the India Plant Based Milk Market Sector

Key Milestones in India Plant Based Milk Market Industry

- September 2024: Maiva Fresh launched its Unsweetened Almond Milk, emphasizing health and taste.

- September 2024: Oxbow Brands launched the Vegan Drink Company (VDC), focusing on vitamin-rich dairy-free beverages.

- August 2024: 1.5 Degree Inc. introduced a line of oat and soy milk, highlighting health and sustainability.

Strategic Outlook for India Plant Based Milk Market

The India Plant Based Milk Market is poised for significant expansion driven by the convergence of several factors, including rising health consciousness, increased environmental awareness, and technological advancements. Strategic opportunities lie in developing innovative product formulations, expanding distribution networks to reach wider consumer segments, and engaging in strategic partnerships to strengthen market presence. Focusing on sustainability and ethical sourcing practices will further solidify market leadership and attract environmentally conscious consumers.

India Plant Based Milk Market Segmentation

-

1. Product Type

- 1.1. Almond Milk

- 1.2. Cashew Milk

- 1.3. Coconut Milk

- 1.4. Hazelnut Milk

- 1.5. Oat Milk

- 1.6. Soy Milk

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Supermarkets/Hypermarkets

- 2.1.2. Convenience Stores

- 2.1.3. Specialist Retailers

- 2.1.4. Online Retail Stores

- 2.1.5. Other Off-Trade Channels

- 2.2. On-Trade

-

2.1. Off-Trade

India Plant Based Milk Market Segmentation By Geography

- 1. India

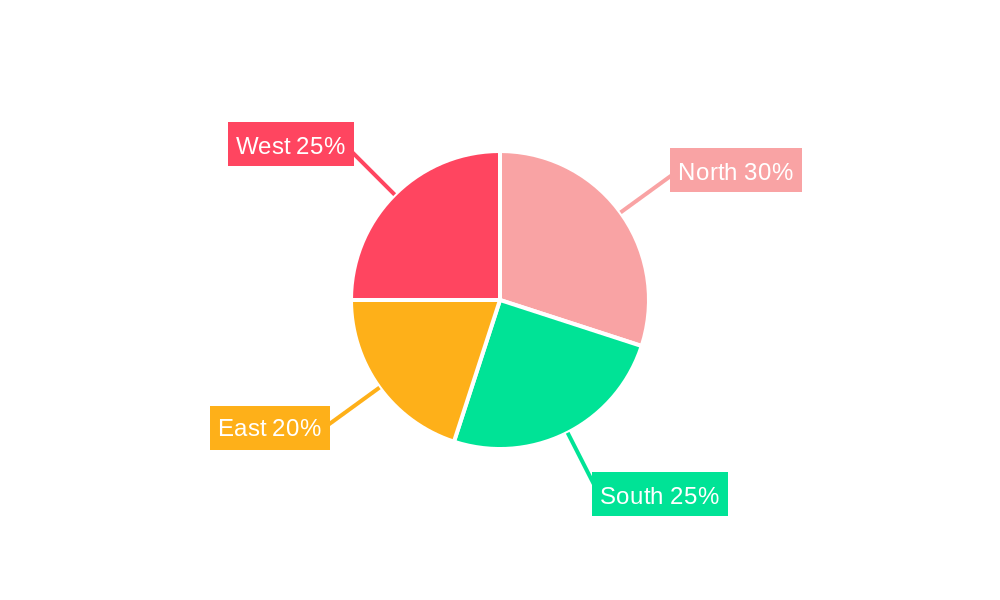

India Plant Based Milk Market Regional Market Share

Geographic Coverage of India Plant Based Milk Market

India Plant Based Milk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Proclivity Toward Vegan/Non-Dairy Milk; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Growing Proclivity Toward Vegan/Non-Dairy Milk; Favorable Government Initiatives

- 3.4. Market Trends

- 3.4.1. Soy Milk Is Liked By Majority

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Plant Based Milk Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Almond Milk

- 5.1.2. Cashew Milk

- 5.1.3. Coconut Milk

- 5.1.4. Hazelnut Milk

- 5.1.5. Oat Milk

- 5.1.6. Soy Milk

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Supermarkets/Hypermarkets

- 5.2.1.2. Convenience Stores

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Online Retail Stores

- 5.2.1.5. Other Off-Trade Channels

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Blue Diamond Growers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dabur India Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Danone S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nestlé S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bagrry's India Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wingreens Farms Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sanitarium Health & Wellbeing Company (Life Health Foods)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Hershey Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Alternative Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Drums Food International Private Limited*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Blue Diamond Growers

List of Figures

- Figure 1: India Plant Based Milk Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Plant Based Milk Market Share (%) by Company 2025

List of Tables

- Table 1: India Plant Based Milk Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Plant Based Milk Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: India Plant Based Milk Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: India Plant Based Milk Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: India Plant Based Milk Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Plant Based Milk Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: India Plant Based Milk Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: India Plant Based Milk Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 9: India Plant Based Milk Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: India Plant Based Milk Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: India Plant Based Milk Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Plant Based Milk Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Plant Based Milk Market?

The projected CAGR is approximately 14.78%.

2. Which companies are prominent players in the India Plant Based Milk Market?

Key companies in the market include Blue Diamond Growers, Dabur India Ltd, Danone S A, Nestlé S A, Bagrry's India Private Limited, Wingreens Farms Private Limited, Sanitarium Health & Wellbeing Company (Life Health Foods), The Hershey Company, The Alternative Company, Drums Food International Private Limited*List Not Exhaustive.

3. What are the main segments of the India Plant Based Milk Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Proclivity Toward Vegan/Non-Dairy Milk; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

Soy Milk Is Liked By Majority.

7. Are there any restraints impacting market growth?

Growing Proclivity Toward Vegan/Non-Dairy Milk; Favorable Government Initiatives.

8. Can you provide examples of recent developments in the market?

September 2024: Maiva Fresh introduced its flagship product - the Maiva Unsweetened Almond Milk. The newly branded health beverage line, "Maiva Fresh," was promoted with the slogans "Pure Good" (focusing on health) and "Pure Joy" (emphasizing taste), highlighting its dual appeal of health and flavor. With zero cholesterol, a low glycemic index (GI), and fortification with Vitamin B12 and Vitamin D, Maiva Fresh Almond is positioned as an ideal daily choice.September 2024: Oxbow Brands unveiled its latest venture, the Vegan Drink Company (VDC). VDC emerges in response to the surging demand for dairy-free products, particularly among the expanding lactose-intolerant and vegan demographics. Understanding the unique nutritional requirements of its audience, VDC crafts its beverages with a rich mix of vital vitamins, such as A, D, B1, B2, and B12, guaranteeing a tasty and wholesome dairy-free choice.August 2024: 1.5 Degree Inc. launched a product line that includes oat milk and soy milk, catering to both vegan and non-vegan consumers in search of healthier, lactose-free alternatives. The entire product line underscores health benefits, boasting gluten-free, eco-friendly, cholesterol-free, and 100% vegan options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Plant Based Milk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Plant Based Milk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Plant Based Milk Market?

To stay informed about further developments, trends, and reports in the India Plant Based Milk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence