Key Insights

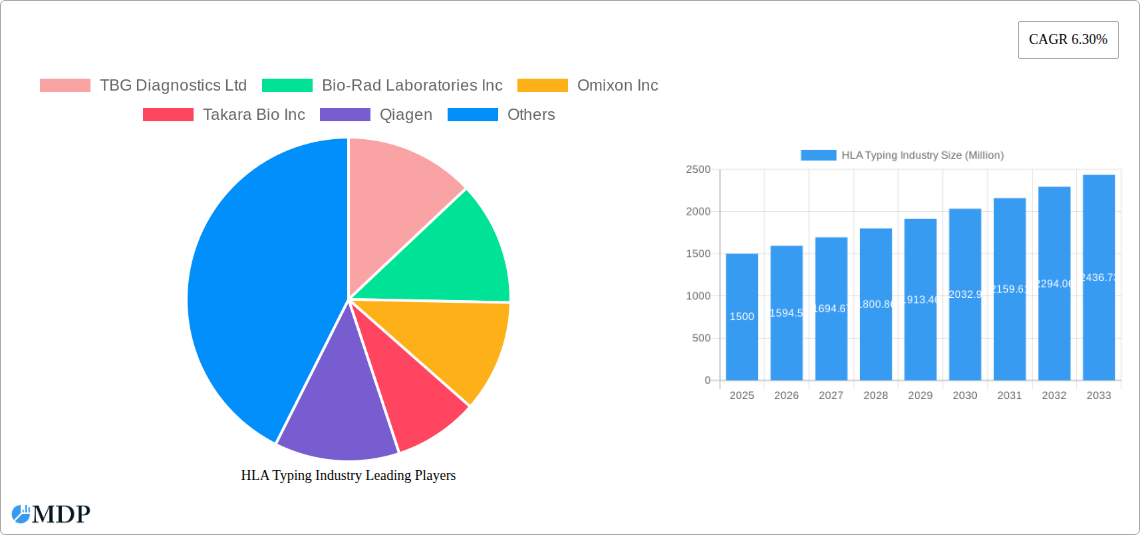

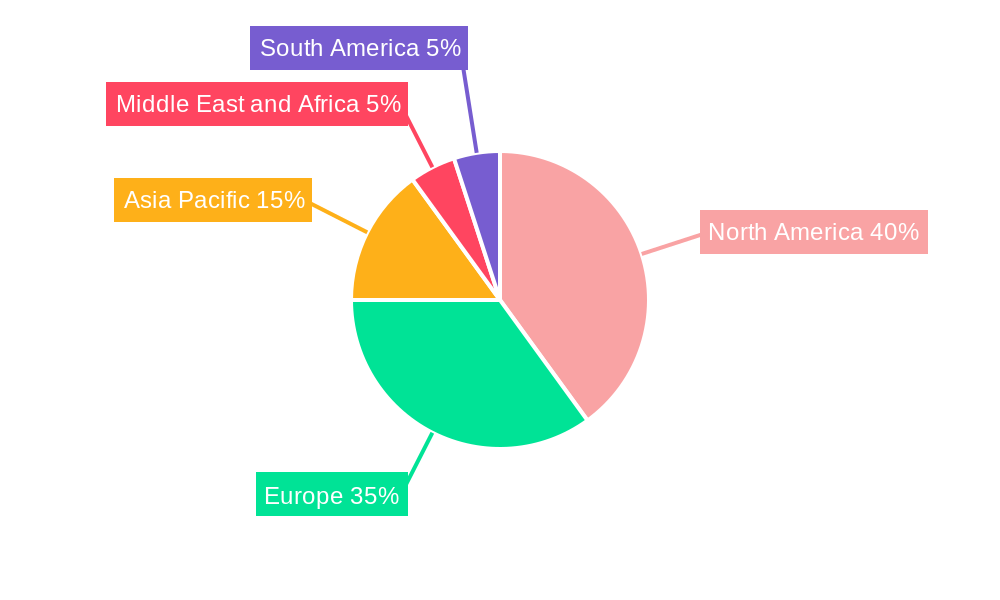

The Human Leukocyte Antigen (HLA) Typing market is projected to reach $0.8 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.15% from 2025 to 2033. This expansion is primarily driven by the rising incidence of autoimmune disorders and organ transplantation procedures worldwide. Accurate HLA matching is essential for successful transplantation outcomes and mitigating rejection risks. Advancements in Next-Generation Sequencing (NGS) are transforming HLA typing, offering enhanced resolution, accelerated turnaround times, and superior accuracy compared to conventional methods. The increasing adoption of personalized medicine, where HLA typing is pivotal for tailoring treatment plans based on individual genetic profiles, further fuels market growth. Within the product and service landscape, instruments, reagents, and consumables represent the largest segments, indicating significant investment in sophisticated HLA typing technologies. North America and Europe currently lead the market due to well-developed healthcare infrastructures and substantial research investments. However, the Asia-Pacific region is anticipated to experience considerable growth, propelled by escalating healthcare expenditures and a burgeoning network of diagnostic centers.

HLA Typing Industry Market Size (In Million)

The competitive environment features prominent players including Thermo Fisher Scientific, Roche, and Illumina, alongside niche companies such as Omixon and CareDx. These entities are committed to continuous innovation, introducing more efficient and cost-effective HLA typing solutions and broadening their product offerings to address evolving market demands. Ongoing research and development focused on enhancing the accuracy, speed, and affordability of HLA typing are key determinants of future market dynamics. While regulatory complexities and the high cost of advanced technologies may pose challenges, the overall market outlook remains optimistic, driven by the increasing need for precise HLA typing across diverse medical applications. The ongoing evolution of sophisticated techniques, a deeper comprehension of HLA's role in disease predisposition, and the growing embrace of preventative and personalized healthcare approaches will significantly shape the future trajectory of this expanding market.

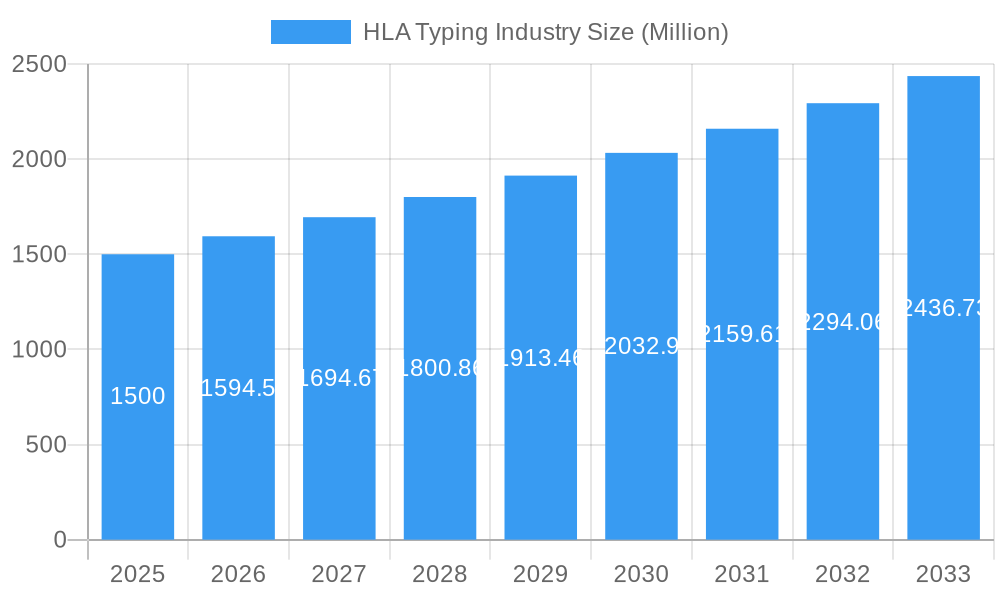

HLA Typing Industry Company Market Share

HLA Typing Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the HLA Typing industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a focus on market dynamics, leading players, and future trends, this report covers the period from 2019 to 2033, with a base year of 2025. The report projects a market value of xx Million by 2033, showcasing significant growth opportunities. This report is your definitive guide to navigating the complexities and capitalizing on the potential within the HLA Typing market.

HLA Typing Industry Market Dynamics & Concentration

The HLA Typing industry is characterized by a moderately concentrated market structure, with key players holding significant market share. While exact figures for 2025 are proprietary information within the full report, initial estimates suggest that the top five players (including companies like Bio-Rad Laboratories Inc, Qiagen, and Thermofisher Scientific Inc) collectively account for approximately xx% of the global market. This concentration is driven by factors such as high barriers to entry (requiring significant R&D investment and regulatory approvals), brand recognition, and established distribution networks.

Innovation within the HLA typing sector is predominantly fueled by the development of next-generation sequencing (NGS) technologies, offering higher throughput, greater accuracy, and reduced costs compared to traditional methods. The industry operates under stringent regulatory frameworks, primarily governed by agencies like the FDA (in the US) and EMA (in Europe), which mandate rigorous testing and validation procedures for HLA typing products. This regulatory landscape impacts the speed of product launches and market entry. While no direct substitutes exist for HLA typing, alternative technologies (like antibody-based methods) continue to compete in niche segments.

End-user trends indicate a growing preference for automated, high-throughput systems, particularly in large clinical laboratories and research institutions. Mergers and acquisitions (M&A) activities have played a significant role in shaping the industry landscape, with an estimated xx M&A deals occurring between 2019 and 2024. These deals often aim to expand product portfolios, enhance technological capabilities, and secure access to new markets.

- Market Share: Top 5 players holding approximately xx% of the market (2025 estimate).

- M&A Activity: Approximately xx deals between 2019-2024.

- Key Innovation Drivers: NGS technologies, automation, improved accuracy.

- Regulatory Landscape: Stringent requirements impacting product launches.

HLA Typing Industry Industry Trends & Analysis

The HLA Typing industry is experiencing robust growth, driven by several key factors. The increasing prevalence of autoimmune diseases and the rising demand for organ transplantation are major contributors to the market expansion. The development of advanced technologies, such as NGS and microarrays, has significantly enhanced the accuracy and efficiency of HLA typing, leading to wider adoption across various applications. The rising adoption of personalized medicine approaches further fuels the demand for accurate HLA typing, as it plays a crucial role in tailoring treatment strategies and predicting treatment outcomes. Furthermore, the growing awareness among healthcare professionals regarding the importance of HLA typing in diagnosis and treatment is significantly boosting the market.

Technological advancements, including the development of more efficient and cost-effective technologies, are disrupting the traditional HLA typing methods. NGS, in particular, is transforming the landscape, offering scalability and high-throughput capabilities. The market also witnesses evolving consumer preferences, with a strong emphasis on user-friendly platforms, streamlined workflows, and reduced turnaround times. Competitive dynamics are intense, with existing players investing heavily in R&D and actively pursuing strategic partnerships and acquisitions to maintain their market positions.

- CAGR (2025-2033): xx%

- Market Penetration (2025): xx% in key regions

- Key Growth Drivers: Increasing prevalence of autoimmune diseases, advancements in NGS technology, rising demand for organ transplantation.

Leading Markets & Segments in HLA Typing Industry

The North American region currently dominates the HLA Typing market, driven by robust healthcare infrastructure, high prevalence of target diseases, and significant investments in R&D. Europe follows closely, although with slightly lower growth rates. Asia-Pacific is emerging as a high-growth market, fueled by increasing awareness and healthcare infrastructure development.

By Product and Service: The reagents and consumables segment currently holds the largest market share, accounting for approximately xx% of the total market revenue in 2025. This is followed by instruments and then software and services. The growth of software and services is expected to accelerate in the forecast period.

By Application: The diagnostic application is the largest segment, driven by routine HLA typing for transplantation and disease diagnosis. Research applications are also growing rapidly.

By End User: Hospitals are the primary users of HLA typing services, followed by research laboratories and other end users.

- North America: Strong healthcare infrastructure, high disease prevalence, and high R&D spending.

- Europe: Mature market with steady growth.

- Asia-Pacific: Rapid growth potential due to improving healthcare infrastructure and rising disease prevalence.

- Reagents and Consumables: Largest market segment by revenue (xx% in 2025).

- Diagnosis: Dominant application segment.

HLA Typing Industry Product Developments

Recent years have witnessed significant advancements in HLA typing technology, with a focus on improving accuracy, speed, and cost-effectiveness. Next-generation sequencing (NGS) platforms are gaining traction due to their high throughput and ability to detect a wider range of HLA alleles. Miniaturization and automation of HLA typing assays have streamlined workflows and reduced manual intervention, improving turnaround time and minimizing errors. These developments have resulted in a broader range of applications, expanding the market beyond transplantation to include areas like disease diagnostics, pharmacogenomics, and population genetics research. The market also shows a growing trend towards integrated systems offering comprehensive solutions encompassing all stages of the HLA typing workflow.

Key Drivers of HLA Typing Industry Growth

The HLA Typing industry's growth is propelled by several key factors: The rising prevalence of autoimmune diseases like rheumatoid arthritis and type 1 diabetes necessitates accurate HLA typing for diagnosis and disease management. Organ transplantation procedures are steadily increasing, making HLA matching crucial for transplant success. Advances in NGS and other technologies have made HLA typing faster, more accurate, and cost-effective. Finally, supportive government regulations and funding initiatives are driving market expansion.

Challenges in the HLA Typing Industry Market

The HLA Typing industry faces several challenges, including the high cost of equipment and reagents, limiting accessibility in resource-constrained settings. Complex regulatory approvals for new products create hurdles for market entry. The intensity of competition among established players and the emergence of new technologies lead to pricing pressures. Supply chain disruptions can further impact the availability of critical reagents and consumables.

Emerging Opportunities in HLA Typing Industry

The HLA typing industry is poised for significant growth, driven by several emerging opportunities. The integration of artificial intelligence and machine learning into HLA typing workflows is promising improvements in accuracy and speed. The expansion of HLA typing applications into personalized medicine, pharmacogenomics, and population genetics research represents significant market expansion. Strategic partnerships and collaborations between technology providers, research institutions, and healthcare providers are driving innovation and market penetration.

Leading Players in the HLA Typing Industry Sector

- TBG Diagnostics Ltd

- Bio-Rad Laboratories Inc

- Omixon Inc

- Takara Bio Inc

- Qiagen

- Beckton Dickinson and Company

- CareDx

- Illumina Inc

- Thermofisher Scientific Inc

- F Hoffman-La Roche Limited

- Biofortuna

- GenDX

Key Milestones in HLA Typing Industry Industry

- May 2022: Mylab Discovery Solutions launched DiscoverSeries HLA-B*27 detection kit for Ankylosing Spondylitis (AS).

- April 2022: Genome Diagnostics (GenDx) received Canadian regulatory approval for its NGSgo-MX11-3 HLA genotyping test.

Strategic Outlook for HLA Typing Industry Market

The HLA Typing industry is poised for continued growth, driven by technological advancements, increasing demand from diverse applications, and supportive regulatory environments. Strategic partnerships, acquisitions, and expansion into emerging markets will further shape the industry landscape. Companies focusing on innovation, automation, and cost-effectiveness are likely to capture significant market share in the coming years. The development of comprehensive, integrated solutions incorporating advanced technologies will be a key driver of future growth.

HLA Typing Industry Segmentation

-

1. Product and Service

- 1.1. Instruments

- 1.2. Reagents and Consumables

- 1.3. Softwares and Services

-

2. Application

- 2.1. Diagnosis

- 2.2. Research

-

3. End User

- 3.1. Hospitals

- 3.2. Research Laboratories

- 3.3. Other End Users

HLA Typing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

HLA Typing Industry Regional Market Share

Geographic Coverage of HLA Typing Industry

HLA Typing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Genetic Diseases; Increasing Number of Organ Transplantation; Rising Government Initiatives Related to Advanced Diagnostics

- 3.3. Market Restrains

- 3.3.1. Small Size of Study Population and Ethical Concern; Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Hospital Segment is Expected to Exhibhit a Significant Market Growth in the HLA Typing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global HLA Typing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product and Service

- 5.1.1. Instruments

- 5.1.2. Reagents and Consumables

- 5.1.3. Softwares and Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Diagnosis

- 5.2.2. Research

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Research Laboratories

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product and Service

- 6. North America HLA Typing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product and Service

- 6.1.1. Instruments

- 6.1.2. Reagents and Consumables

- 6.1.3. Softwares and Services

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Diagnosis

- 6.2.2. Research

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Research Laboratories

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product and Service

- 7. Europe HLA Typing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product and Service

- 7.1.1. Instruments

- 7.1.2. Reagents and Consumables

- 7.1.3. Softwares and Services

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Diagnosis

- 7.2.2. Research

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Research Laboratories

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product and Service

- 8. Asia Pacific HLA Typing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product and Service

- 8.1.1. Instruments

- 8.1.2. Reagents and Consumables

- 8.1.3. Softwares and Services

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Diagnosis

- 8.2.2. Research

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Research Laboratories

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product and Service

- 9. Middle East and Africa HLA Typing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product and Service

- 9.1.1. Instruments

- 9.1.2. Reagents and Consumables

- 9.1.3. Softwares and Services

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Diagnosis

- 9.2.2. Research

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Research Laboratories

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product and Service

- 10. South America HLA Typing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product and Service

- 10.1.1. Instruments

- 10.1.2. Reagents and Consumables

- 10.1.3. Softwares and Services

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Diagnosis

- 10.2.2. Research

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Research Laboratories

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product and Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 TBG Diagnostics Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bio-Rad Laboratories Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Omixon Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Takara Bio Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Qiagen

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Beckton Dickinson and Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CareDx

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Illumina Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thermofisher Scientific Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 F Hoffman-La Roche Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Biofortuna*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GenDX

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 TBG Diagnostics Ltd

List of Figures

- Figure 1: Global HLA Typing Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America HLA Typing Industry Revenue (billion), by Product and Service 2025 & 2033

- Figure 3: North America HLA Typing Industry Revenue Share (%), by Product and Service 2025 & 2033

- Figure 4: North America HLA Typing Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America HLA Typing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America HLA Typing Industry Revenue (billion), by End User 2025 & 2033

- Figure 7: North America HLA Typing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America HLA Typing Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America HLA Typing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe HLA Typing Industry Revenue (billion), by Product and Service 2025 & 2033

- Figure 11: Europe HLA Typing Industry Revenue Share (%), by Product and Service 2025 & 2033

- Figure 12: Europe HLA Typing Industry Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe HLA Typing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe HLA Typing Industry Revenue (billion), by End User 2025 & 2033

- Figure 15: Europe HLA Typing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe HLA Typing Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe HLA Typing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific HLA Typing Industry Revenue (billion), by Product and Service 2025 & 2033

- Figure 19: Asia Pacific HLA Typing Industry Revenue Share (%), by Product and Service 2025 & 2033

- Figure 20: Asia Pacific HLA Typing Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific HLA Typing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific HLA Typing Industry Revenue (billion), by End User 2025 & 2033

- Figure 23: Asia Pacific HLA Typing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific HLA Typing Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific HLA Typing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa HLA Typing Industry Revenue (billion), by Product and Service 2025 & 2033

- Figure 27: Middle East and Africa HLA Typing Industry Revenue Share (%), by Product and Service 2025 & 2033

- Figure 28: Middle East and Africa HLA Typing Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa HLA Typing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa HLA Typing Industry Revenue (billion), by End User 2025 & 2033

- Figure 31: Middle East and Africa HLA Typing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa HLA Typing Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa HLA Typing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America HLA Typing Industry Revenue (billion), by Product and Service 2025 & 2033

- Figure 35: South America HLA Typing Industry Revenue Share (%), by Product and Service 2025 & 2033

- Figure 36: South America HLA Typing Industry Revenue (billion), by Application 2025 & 2033

- Figure 37: South America HLA Typing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America HLA Typing Industry Revenue (billion), by End User 2025 & 2033

- Figure 39: South America HLA Typing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America HLA Typing Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: South America HLA Typing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global HLA Typing Industry Revenue billion Forecast, by Product and Service 2020 & 2033

- Table 2: Global HLA Typing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global HLA Typing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global HLA Typing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global HLA Typing Industry Revenue billion Forecast, by Product and Service 2020 & 2033

- Table 6: Global HLA Typing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global HLA Typing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global HLA Typing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global HLA Typing Industry Revenue billion Forecast, by Product and Service 2020 & 2033

- Table 13: Global HLA Typing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global HLA Typing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global HLA Typing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global HLA Typing Industry Revenue billion Forecast, by Product and Service 2020 & 2033

- Table 23: Global HLA Typing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global HLA Typing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 25: Global HLA Typing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global HLA Typing Industry Revenue billion Forecast, by Product and Service 2020 & 2033

- Table 33: Global HLA Typing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global HLA Typing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 35: Global HLA Typing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global HLA Typing Industry Revenue billion Forecast, by Product and Service 2020 & 2033

- Table 40: Global HLA Typing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Global HLA Typing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 42: Global HLA Typing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America HLA Typing Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the HLA Typing Industry?

The projected CAGR is approximately 7.15%.

2. Which companies are prominent players in the HLA Typing Industry?

Key companies in the market include TBG Diagnostics Ltd, Bio-Rad Laboratories Inc, Omixon Inc, Takara Bio Inc, Qiagen, Beckton Dickinson and Company, CareDx, Illumina Inc, Thermofisher Scientific Inc, F Hoffman-La Roche Limited, Biofortuna*List Not Exhaustive, GenDX.

3. What are the main segments of the HLA Typing Industry?

The market segments include Product and Service, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Genetic Diseases; Increasing Number of Organ Transplantation; Rising Government Initiatives Related to Advanced Diagnostics.

6. What are the notable trends driving market growth?

Hospital Segment is Expected to Exhibhit a Significant Market Growth in the HLA Typing Market.

7. Are there any restraints impacting market growth?

Small Size of Study Population and Ethical Concern; Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

In May 2022, Mylab Discovery Solutions launched DiscoverSeries HLAB*27 detection kit, an in-vitro diagnostic test for Ankylosing Spondylitis (AS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "HLA Typing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the HLA Typing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the HLA Typing Industry?

To stay informed about further developments, trends, and reports in the HLA Typing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence