Key Insights

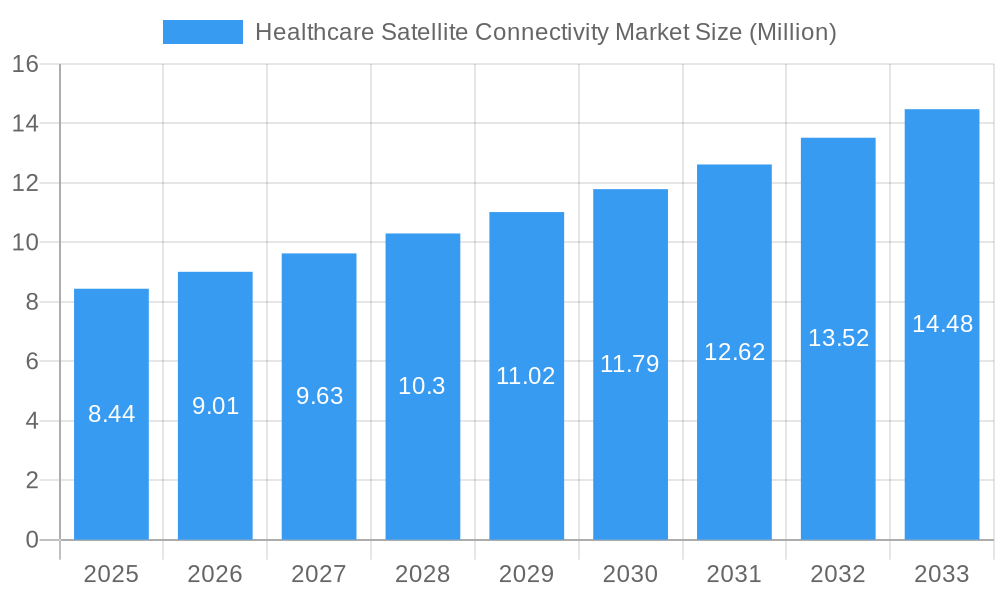

The Healthcare Satellite Connectivity Market is poised for significant expansion, with a current market size of approximately USD 8.44 million. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 6.50% projected over the forecast period of 2025-2033. Key drivers underpinning this surge include the increasing demand for remote patient monitoring, the expansion of telemedicine services into underserved regions, and the critical need for reliable data transmission in clinical trials and research. The market is experiencing a notable trend towards the integration of satellite technology with advanced medical devices, enabling real-time data capture and transmission from remote locations. Furthermore, the development of innovative software solutions designed to manage and analyze this data is a crucial component of market growth. The adoption of satellite connectivity for clinical operations, particularly in areas with limited terrestrial infrastructure, is also a prominent trend, enhancing operational efficiency and patient care.

Healthcare Satellite Connectivity Market Market Size (In Million)

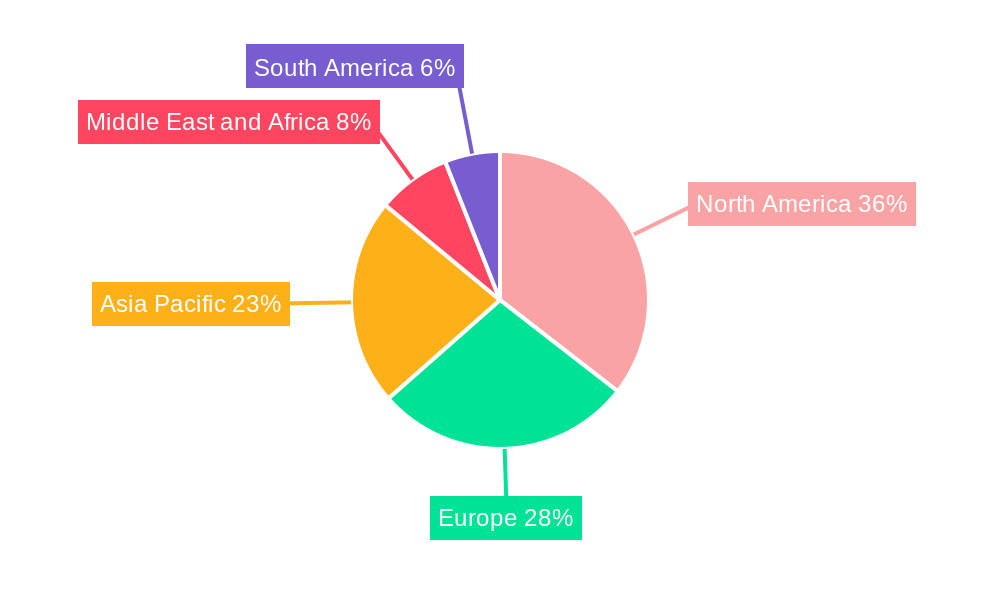

Despite the promising outlook, certain restraints could temper the market's trajectory. High initial investment costs for satellite infrastructure and equipment, coupled with the complexities of regulatory frameworks across different regions, present significant hurdles. However, advancements in satellite technology, leading to reduced costs and improved bandwidth, are gradually mitigating these challenges. The market is segmented into various components, including medical devices, software, and services, with applications spanning telemedicine, clinical operations, and connected imaging. Connectivity options range from mobile to fixed satellite services, catering to diverse end-user needs such as hospitals, clinics, research organizations, and diagnostic laboratories. North America is anticipated to lead the market, followed by Europe and the Asia Pacific region, driven by technological advancements and the increasing adoption of digital health solutions.

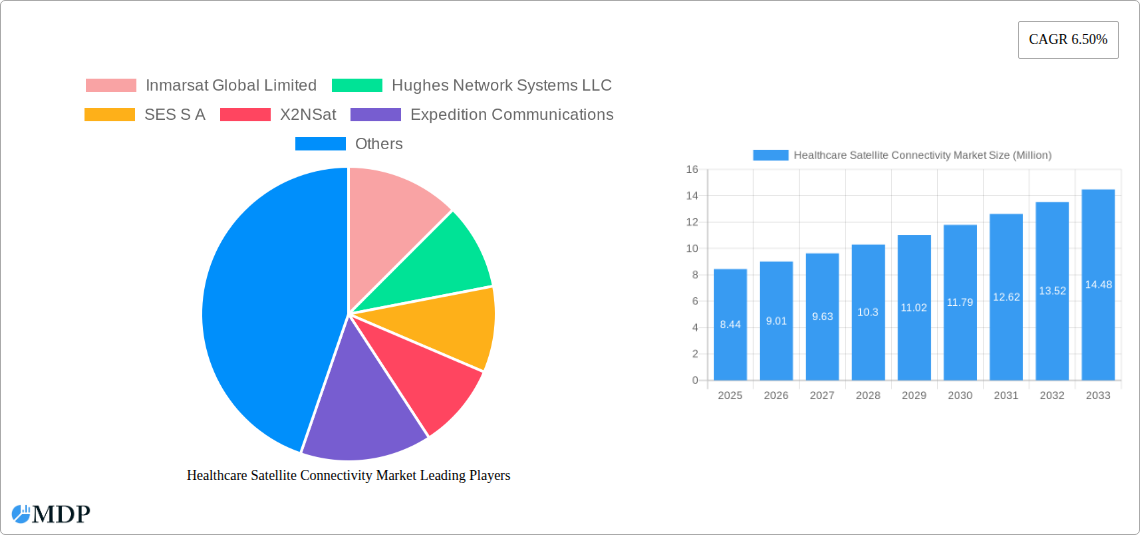

Healthcare Satellite Connectivity Market Company Market Share

Report Description:

Dive into the transformative world of the Healthcare Satellite Connectivity Market, a critical sector poised for exponential growth as it bridges the digital divide in healthcare delivery. This comprehensive report, spanning from 2019 to 2033, with a deep dive into the Base Year (2025) and a robust Forecast Period (2025-2033), offers unparalleled insights into the market dynamics, key trends, leading players, and future outlook. Explore how satellite technology is revolutionizing telemedicine, clinical operations, and connected imaging, empowering healthcare providers with reliable connectivity in remote and underserved regions. Understand the intricate interplay of components like medical devices, software, and services, and how mobile satellite services and fixed satellite services are driving adoption across hospitals and clinics, clinical research organizations, and diagnostic laboratories. With estimated market values reaching billions of USD, this report is your definitive guide to navigating the healthcare satellite connectivity landscape, identifying lucrative opportunities, and understanding the strategic imperatives for stakeholders.

Healthcare Satellite Connectivity Market Market Dynamics & Concentration

The Healthcare Satellite Connectivity Market exhibits a moderate concentration, characterized by the presence of established global players and emerging innovators. Key drivers of innovation include the escalating demand for remote healthcare solutions, the proliferation of connected medical devices, and advancements in satellite technology, particularly the deployment of Low Earth Orbit (LEO) constellations offering higher bandwidth and lower latency. Regulatory frameworks, while still evolving, are increasingly supportive of telemedicine and remote patient monitoring, further fueling market expansion. Product substitutes, such as terrestrial broadband, are limited in areas lacking infrastructure, thus highlighting the indispensable role of satellite connectivity. End-user trends clearly indicate a growing preference for decentralized healthcare models and a reliance on real-time data for patient care and research. Mergers and acquisitions (M&A) activities are anticipated to increase as larger players seek to consolidate market share and acquire innovative technologies. For instance, the market saw significant strategic partnerships and investments aimed at expanding network coverage and enhancing service offerings. M&A deal counts are projected to rise as companies aim to gain a competitive edge and capitalize on the burgeoning demand.

Healthcare Satellite Connectivity Market Industry Trends & Analysis

The Healthcare Satellite Connectivity Market is witnessing a period of dynamic evolution, driven by a confluence of factors that are reshaping healthcare delivery worldwide. The increasing adoption of telemedicine is a primary growth engine, enabling remote consultations, diagnostics, and patient monitoring, especially in geographically dispersed or infrastructure-poor regions. This trend is significantly amplified by the ongoing global healthcare crisis, which has underscored the necessity for resilient and accessible healthcare services. Technological disruptions, such as the advent of LEO satellite constellations, are proving to be a game-changer, offering enhanced speed, reduced latency, and greater capacity compared to traditional geostationary (GEO) satellites. This leap in performance is crucial for supporting bandwidth-intensive applications like connected imaging and real-time data transmission for clinical operations. Consumer preferences are shifting towards more convenient and accessible healthcare options, with patients increasingly comfortable using digital health platforms and remote monitoring devices. The competitive landscape is becoming more intense, with a blend of established satellite operators, telecommunication giants, and specialized healthcare technology providers vying for market dominance. Investments in research and development are soaring, focusing on improving antenna technology, data compression, and cybersecurity to ensure the integrity and reliability of healthcare data transmitted via satellite. The market penetration of satellite connectivity in remote healthcare facilities is on an upward trajectory, with an estimated Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period. This growth is underpinned by the tangible benefits satellite services offer: ensuring continuity of care, enabling faster access to medical expertise, and facilitating critical data sharing for research and public health initiatives. The integration of artificial intelligence (AI) and machine learning (ML) with satellite-connected healthcare platforms is another emerging trend, promising to optimize diagnostics, personalize treatment plans, and improve operational efficiencies. As the global population grows and healthcare demands intensify, the strategic importance of robust, satellite-enabled healthcare connectivity will only become more pronounced, driving innovation and market expansion.

Leading Markets & Segments in Healthcare Satellite Connectivity Market

The Healthcare Satellite Connectivity Market is characterized by distinct regional strengths and segment-specific dominance, offering a multifaceted view of its growth trajectory.

Dominant Region: North America currently leads the market, driven by advanced healthcare infrastructure, high adoption rates of telemedicine, and significant investments in connected health technologies. The United States, in particular, boasts a robust ecosystem of healthcare providers and technology innovators, supported by favorable regulatory policies for digital health.

Key Segment Drivers:

Component:

- Services: The Services segment is projected to experience the highest growth, encompassing crucial elements like managed network services, remote monitoring platforms, and data analytics. The increasing complexity of healthcare IT infrastructure and the need for specialized support are driving demand for these services.

- Software: Software solutions, including electronic health records (EHR) integration, telemedicine platforms, and data management systems, are vital enablers of satellite connectivity in healthcare. Their seamless integration with satellite networks is crucial for efficient data exchange and operational efficiency.

Application:

- Telemedicine: Telemedicine is the undisputed leader within applications. Its ability to extend healthcare access to remote areas, facilitate specialist consultations, and enable continuous patient monitoring makes it indispensable. The growing prevalence of chronic diseases and the aging population further bolster the demand for telemedicine solutions.

- Clinical Operations: Enhancing Clinical Operations through reliable connectivity is another significant driver. This includes real-time patient data management, efficient communication between healthcare professionals, and streamlined administrative processes, all of which are critical for improving patient outcomes and operational efficiency.

Connectivity:

- Mobile Satellite Services (MSS): Mobile Satellite Services are crucial for healthcare applications requiring mobility, such as ambulance services, remote disaster response, and mobile clinics. Their ability to provide connectivity on the go is paramount for emergency medical services and outreach programs.

- Fixed Satellite Services (FSS): Fixed Satellite Services are essential for providing stable and reliable connectivity to stationary healthcare facilities in remote locations. This includes hospitals, clinics, and research laboratories that lack access to terrestrial broadband.

End-User:

- Hospitals and Clinics: Hospitals and Clinics represent the largest end-user segment. The increasing need for advanced medical equipment, remote diagnostics, and efficient patient management systems is driving their adoption of satellite connectivity solutions.

- Research and Diagnostic Laboratories: Research and Diagnostic Laboratories are increasingly relying on satellite connectivity for high-speed data transfer, collaborative research projects, and accessing large datasets for analysis, especially in fields like genomics and pathology.

The dominance of these segments is further supported by governmental initiatives promoting digital health adoption, significant R&D investments, and the inherent demand for improved healthcare accessibility and quality, particularly in regions with underdeveloped terrestrial networks. Economic policies that incentivize technology adoption and infrastructure development in healthcare are also playing a pivotal role in shaping the market landscape.

Healthcare Satellite Connectivity Market Product Developments

Recent product developments in the Healthcare Satellite Connectivity Market focus on enhancing speed, reliability, and security. Innovations include the integration of advanced antenna technologies for improved signal reception in challenging environments, more efficient data compression algorithms to reduce bandwidth consumption, and enhanced cybersecurity protocols to safeguard sensitive patient data. The development of specialized medical devices with built-in satellite communication capabilities is enabling seamless real-time data transmission for remote patient monitoring and diagnostics. These advancements offer a significant competitive advantage by addressing the critical need for consistent and secure connectivity in remote healthcare settings, thereby expanding the reach and effectiveness of medical services.

Key Drivers of Healthcare Satellite Connectivity Market Growth

The Healthcare Satellite Connectivity Market is propelled by several key drivers. The fundamental need to expand healthcare access to underserved and remote populations remains a primary catalyst. Advancements in satellite technology, such as the deployment of LEO constellations, are delivering higher speeds and lower latency, making advanced healthcare applications feasible. The burgeoning demand for telemedicine, remote patient monitoring, and connected medical devices further fuels market growth. Additionally, supportive government initiatives and increasing investments in digital health infrastructure are creating a favorable environment for adoption. The growing prevalence of chronic diseases also necessitates continuous remote monitoring, a capability strongly supported by satellite connectivity.

Challenges in the Healthcare Satellite Connectivity Market Market

Despite its immense potential, the Healthcare Satellite Connectivity Market faces several challenges. High upfront costs associated with satellite equipment and service subscriptions can be a significant barrier, particularly for smaller healthcare providers or in resource-limited regions. Regulatory hurdles and varying data privacy laws across different countries can complicate the implementation of cross-border telemedicine and data sharing initiatives. Supply chain disruptions and geopolitical factors can also impact the availability and cost of satellite components and services. Furthermore, the competitive pressure from emerging terrestrial broadband technologies in areas where infrastructure is being rapidly developed presents an ongoing challenge to market share.

Emerging Opportunities in Healthcare Satellite Connectivity Market

Emerging opportunities in the Healthcare Satellite Connectivity Market are abundant and poised to drive long-term growth. The expansion of LEO satellite networks presents a significant opportunity for providing high-speed, low-latency broadband to remote healthcare facilities, enabling advanced applications like real-time surgical assistance and high-resolution medical imaging transfer. Strategic partnerships between satellite operators, healthcare providers, and technology companies are crucial for developing integrated solutions and expanding market reach. Market expansion into emerging economies with significant gaps in healthcare infrastructure offers substantial untapped potential. Furthermore, the integration of AI and machine learning with satellite-connected healthcare platforms promises to unlock new capabilities in diagnostics, predictive analytics, and personalized medicine.

Leading Players in the Healthcare Satellite Connectivity Market Sector

- Inmarsat Global Limited

- Hughes Network Systems LLC

- SES S A

- X2NSat

- Expedition Communications

- Globalstar

- Eutelsat Communications SA

- AT&T Intellectual Property

- DISH Network L L C

- Ligado Networks

Key Milestones in Healthcare Satellite Connectivity Market Industry

- July 2022: Neom Tech and OneWeb agreed to a USD 200 million satellite network agreement. In the region where access to fiber-like Internet was previously unthinkable, Neom's ecosystem of cognitive technologies will transform companies and rural communities with OneWeb's Low Earth Orbit (LEO) satellite constellation.

- June 2022: Johnson & Johnson launched the J&J Satellite Center for Global Health Discovery (Satellite Center) at Singapore's Duke-NUS Medical School, jointly established by Duke University and the National University of Singapore (NUS).

Strategic Outlook for Healthcare Satellite Connectivity Market Market

The strategic outlook for the Healthcare Satellite Connectivity Market is exceptionally positive, driven by an unwavering demand for accessible and advanced healthcare solutions. Future growth accelerators will stem from the continued development and widespread deployment of LEO satellite constellations, promising enhanced performance and cost-effectiveness for healthcare applications. The increasing sophistication of connected medical devices and the growing reliance on data analytics for proactive healthcare will further solidify the market's trajectory. Strategic opportunities lie in forging deeper collaborations between satellite providers and the healthcare ecosystem to develop tailored connectivity solutions that address specific clinical needs. Market expansion into developing regions, coupled with government support for digital health initiatives, will continue to be a significant growth engine, ensuring that the benefits of advanced healthcare are extended to all.

Healthcare Satellite Connectivity Market Segmentation

-

1. Component

- 1.1. Medical Device

- 1.2. Software

- 1.3. Services

-

2. Application

- 2.1. Telemedicine

- 2.2. Clinical Operations

- 2.3. Connected Imaging

-

3. Connectivity

- 3.1. Mobile Satellite Services

- 3.2. Fixed Satellite Services

-

4. End-User

- 4.1. Clinical Research Organization

- 4.2. Hospitals and Clinics

- 4.3. Research and Diagnostic Laboratories

- 4.4. Other End-Users

Healthcare Satellite Connectivity Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canda

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United kingdom

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Healthcare Satellite Connectivity Market Regional Market Share

Geographic Coverage of Healthcare Satellite Connectivity Market

Healthcare Satellite Connectivity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives for Promotion and Development of Satellite Connectivity; Rising Adoption of eHealth

- 3.3. Market Restrains

- 3.3.1. Government Initiatives for Promotion and Development of Satellite Connectivity; Rising Adoption of eHealth

- 3.4. Market Trends

- 3.4.1. Telemedicine Segment is Expected to Hold Significant Share Over The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Healthcare Satellite Connectivity Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Medical Device

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Telemedicine

- 5.2.2. Clinical Operations

- 5.2.3. Connected Imaging

- 5.3. Market Analysis, Insights and Forecast - by Connectivity

- 5.3.1. Mobile Satellite Services

- 5.3.2. Fixed Satellite Services

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Clinical Research Organization

- 5.4.2. Hospitals and Clinics

- 5.4.3. Research and Diagnostic Laboratories

- 5.4.4. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Healthcare Satellite Connectivity Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Medical Device

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Telemedicine

- 6.2.2. Clinical Operations

- 6.2.3. Connected Imaging

- 6.3. Market Analysis, Insights and Forecast - by Connectivity

- 6.3.1. Mobile Satellite Services

- 6.3.2. Fixed Satellite Services

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. Clinical Research Organization

- 6.4.2. Hospitals and Clinics

- 6.4.3. Research and Diagnostic Laboratories

- 6.4.4. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Healthcare Satellite Connectivity Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Medical Device

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Telemedicine

- 7.2.2. Clinical Operations

- 7.2.3. Connected Imaging

- 7.3. Market Analysis, Insights and Forecast - by Connectivity

- 7.3.1. Mobile Satellite Services

- 7.3.2. Fixed Satellite Services

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. Clinical Research Organization

- 7.4.2. Hospitals and Clinics

- 7.4.3. Research and Diagnostic Laboratories

- 7.4.4. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Healthcare Satellite Connectivity Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Medical Device

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Telemedicine

- 8.2.2. Clinical Operations

- 8.2.3. Connected Imaging

- 8.3. Market Analysis, Insights and Forecast - by Connectivity

- 8.3.1. Mobile Satellite Services

- 8.3.2. Fixed Satellite Services

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. Clinical Research Organization

- 8.4.2. Hospitals and Clinics

- 8.4.3. Research and Diagnostic Laboratories

- 8.4.4. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Middle East and Africa Healthcare Satellite Connectivity Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Medical Device

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Telemedicine

- 9.2.2. Clinical Operations

- 9.2.3. Connected Imaging

- 9.3. Market Analysis, Insights and Forecast - by Connectivity

- 9.3.1. Mobile Satellite Services

- 9.3.2. Fixed Satellite Services

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. Clinical Research Organization

- 9.4.2. Hospitals and Clinics

- 9.4.3. Research and Diagnostic Laboratories

- 9.4.4. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. South America Healthcare Satellite Connectivity Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Medical Device

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Telemedicine

- 10.2.2. Clinical Operations

- 10.2.3. Connected Imaging

- 10.3. Market Analysis, Insights and Forecast - by Connectivity

- 10.3.1. Mobile Satellite Services

- 10.3.2. Fixed Satellite Services

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. Clinical Research Organization

- 10.4.2. Hospitals and Clinics

- 10.4.3. Research and Diagnostic Laboratories

- 10.4.4. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Inmarsat Global Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hughes Network Systems LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SES S A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 X2NSat

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Expedition Communications

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Globalstar

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Eutelsat Communications SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AT&T Intellectual Property

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DISH Network L L C

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ligado Networks*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Inmarsat Global Limited

List of Figures

- Figure 1: Global Healthcare Satellite Connectivity Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Healthcare Satellite Connectivity Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Healthcare Satellite Connectivity Market Revenue (Million), by Component 2025 & 2033

- Figure 4: North America Healthcare Satellite Connectivity Market Volume (Billion), by Component 2025 & 2033

- Figure 5: North America Healthcare Satellite Connectivity Market Revenue Share (%), by Component 2025 & 2033

- Figure 6: North America Healthcare Satellite Connectivity Market Volume Share (%), by Component 2025 & 2033

- Figure 7: North America Healthcare Satellite Connectivity Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Healthcare Satellite Connectivity Market Volume (Billion), by Application 2025 & 2033

- Figure 9: North America Healthcare Satellite Connectivity Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Healthcare Satellite Connectivity Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Healthcare Satellite Connectivity Market Revenue (Million), by Connectivity 2025 & 2033

- Figure 12: North America Healthcare Satellite Connectivity Market Volume (Billion), by Connectivity 2025 & 2033

- Figure 13: North America Healthcare Satellite Connectivity Market Revenue Share (%), by Connectivity 2025 & 2033

- Figure 14: North America Healthcare Satellite Connectivity Market Volume Share (%), by Connectivity 2025 & 2033

- Figure 15: North America Healthcare Satellite Connectivity Market Revenue (Million), by End-User 2025 & 2033

- Figure 16: North America Healthcare Satellite Connectivity Market Volume (Billion), by End-User 2025 & 2033

- Figure 17: North America Healthcare Satellite Connectivity Market Revenue Share (%), by End-User 2025 & 2033

- Figure 18: North America Healthcare Satellite Connectivity Market Volume Share (%), by End-User 2025 & 2033

- Figure 19: North America Healthcare Satellite Connectivity Market Revenue (Million), by Country 2025 & 2033

- Figure 20: North America Healthcare Satellite Connectivity Market Volume (Billion), by Country 2025 & 2033

- Figure 21: North America Healthcare Satellite Connectivity Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Healthcare Satellite Connectivity Market Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Healthcare Satellite Connectivity Market Revenue (Million), by Component 2025 & 2033

- Figure 24: Europe Healthcare Satellite Connectivity Market Volume (Billion), by Component 2025 & 2033

- Figure 25: Europe Healthcare Satellite Connectivity Market Revenue Share (%), by Component 2025 & 2033

- Figure 26: Europe Healthcare Satellite Connectivity Market Volume Share (%), by Component 2025 & 2033

- Figure 27: Europe Healthcare Satellite Connectivity Market Revenue (Million), by Application 2025 & 2033

- Figure 28: Europe Healthcare Satellite Connectivity Market Volume (Billion), by Application 2025 & 2033

- Figure 29: Europe Healthcare Satellite Connectivity Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Healthcare Satellite Connectivity Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Healthcare Satellite Connectivity Market Revenue (Million), by Connectivity 2025 & 2033

- Figure 32: Europe Healthcare Satellite Connectivity Market Volume (Billion), by Connectivity 2025 & 2033

- Figure 33: Europe Healthcare Satellite Connectivity Market Revenue Share (%), by Connectivity 2025 & 2033

- Figure 34: Europe Healthcare Satellite Connectivity Market Volume Share (%), by Connectivity 2025 & 2033

- Figure 35: Europe Healthcare Satellite Connectivity Market Revenue (Million), by End-User 2025 & 2033

- Figure 36: Europe Healthcare Satellite Connectivity Market Volume (Billion), by End-User 2025 & 2033

- Figure 37: Europe Healthcare Satellite Connectivity Market Revenue Share (%), by End-User 2025 & 2033

- Figure 38: Europe Healthcare Satellite Connectivity Market Volume Share (%), by End-User 2025 & 2033

- Figure 39: Europe Healthcare Satellite Connectivity Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Europe Healthcare Satellite Connectivity Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Europe Healthcare Satellite Connectivity Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Healthcare Satellite Connectivity Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Pacific Healthcare Satellite Connectivity Market Revenue (Million), by Component 2025 & 2033

- Figure 44: Asia Pacific Healthcare Satellite Connectivity Market Volume (Billion), by Component 2025 & 2033

- Figure 45: Asia Pacific Healthcare Satellite Connectivity Market Revenue Share (%), by Component 2025 & 2033

- Figure 46: Asia Pacific Healthcare Satellite Connectivity Market Volume Share (%), by Component 2025 & 2033

- Figure 47: Asia Pacific Healthcare Satellite Connectivity Market Revenue (Million), by Application 2025 & 2033

- Figure 48: Asia Pacific Healthcare Satellite Connectivity Market Volume (Billion), by Application 2025 & 2033

- Figure 49: Asia Pacific Healthcare Satellite Connectivity Market Revenue Share (%), by Application 2025 & 2033

- Figure 50: Asia Pacific Healthcare Satellite Connectivity Market Volume Share (%), by Application 2025 & 2033

- Figure 51: Asia Pacific Healthcare Satellite Connectivity Market Revenue (Million), by Connectivity 2025 & 2033

- Figure 52: Asia Pacific Healthcare Satellite Connectivity Market Volume (Billion), by Connectivity 2025 & 2033

- Figure 53: Asia Pacific Healthcare Satellite Connectivity Market Revenue Share (%), by Connectivity 2025 & 2033

- Figure 54: Asia Pacific Healthcare Satellite Connectivity Market Volume Share (%), by Connectivity 2025 & 2033

- Figure 55: Asia Pacific Healthcare Satellite Connectivity Market Revenue (Million), by End-User 2025 & 2033

- Figure 56: Asia Pacific Healthcare Satellite Connectivity Market Volume (Billion), by End-User 2025 & 2033

- Figure 57: Asia Pacific Healthcare Satellite Connectivity Market Revenue Share (%), by End-User 2025 & 2033

- Figure 58: Asia Pacific Healthcare Satellite Connectivity Market Volume Share (%), by End-User 2025 & 2033

- Figure 59: Asia Pacific Healthcare Satellite Connectivity Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Healthcare Satellite Connectivity Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific Healthcare Satellite Connectivity Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Healthcare Satellite Connectivity Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Healthcare Satellite Connectivity Market Revenue (Million), by Component 2025 & 2033

- Figure 64: Middle East and Africa Healthcare Satellite Connectivity Market Volume (Billion), by Component 2025 & 2033

- Figure 65: Middle East and Africa Healthcare Satellite Connectivity Market Revenue Share (%), by Component 2025 & 2033

- Figure 66: Middle East and Africa Healthcare Satellite Connectivity Market Volume Share (%), by Component 2025 & 2033

- Figure 67: Middle East and Africa Healthcare Satellite Connectivity Market Revenue (Million), by Application 2025 & 2033

- Figure 68: Middle East and Africa Healthcare Satellite Connectivity Market Volume (Billion), by Application 2025 & 2033

- Figure 69: Middle East and Africa Healthcare Satellite Connectivity Market Revenue Share (%), by Application 2025 & 2033

- Figure 70: Middle East and Africa Healthcare Satellite Connectivity Market Volume Share (%), by Application 2025 & 2033

- Figure 71: Middle East and Africa Healthcare Satellite Connectivity Market Revenue (Million), by Connectivity 2025 & 2033

- Figure 72: Middle East and Africa Healthcare Satellite Connectivity Market Volume (Billion), by Connectivity 2025 & 2033

- Figure 73: Middle East and Africa Healthcare Satellite Connectivity Market Revenue Share (%), by Connectivity 2025 & 2033

- Figure 74: Middle East and Africa Healthcare Satellite Connectivity Market Volume Share (%), by Connectivity 2025 & 2033

- Figure 75: Middle East and Africa Healthcare Satellite Connectivity Market Revenue (Million), by End-User 2025 & 2033

- Figure 76: Middle East and Africa Healthcare Satellite Connectivity Market Volume (Billion), by End-User 2025 & 2033

- Figure 77: Middle East and Africa Healthcare Satellite Connectivity Market Revenue Share (%), by End-User 2025 & 2033

- Figure 78: Middle East and Africa Healthcare Satellite Connectivity Market Volume Share (%), by End-User 2025 & 2033

- Figure 79: Middle East and Africa Healthcare Satellite Connectivity Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Healthcare Satellite Connectivity Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Middle East and Africa Healthcare Satellite Connectivity Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Healthcare Satellite Connectivity Market Volume Share (%), by Country 2025 & 2033

- Figure 83: South America Healthcare Satellite Connectivity Market Revenue (Million), by Component 2025 & 2033

- Figure 84: South America Healthcare Satellite Connectivity Market Volume (Billion), by Component 2025 & 2033

- Figure 85: South America Healthcare Satellite Connectivity Market Revenue Share (%), by Component 2025 & 2033

- Figure 86: South America Healthcare Satellite Connectivity Market Volume Share (%), by Component 2025 & 2033

- Figure 87: South America Healthcare Satellite Connectivity Market Revenue (Million), by Application 2025 & 2033

- Figure 88: South America Healthcare Satellite Connectivity Market Volume (Billion), by Application 2025 & 2033

- Figure 89: South America Healthcare Satellite Connectivity Market Revenue Share (%), by Application 2025 & 2033

- Figure 90: South America Healthcare Satellite Connectivity Market Volume Share (%), by Application 2025 & 2033

- Figure 91: South America Healthcare Satellite Connectivity Market Revenue (Million), by Connectivity 2025 & 2033

- Figure 92: South America Healthcare Satellite Connectivity Market Volume (Billion), by Connectivity 2025 & 2033

- Figure 93: South America Healthcare Satellite Connectivity Market Revenue Share (%), by Connectivity 2025 & 2033

- Figure 94: South America Healthcare Satellite Connectivity Market Volume Share (%), by Connectivity 2025 & 2033

- Figure 95: South America Healthcare Satellite Connectivity Market Revenue (Million), by End-User 2025 & 2033

- Figure 96: South America Healthcare Satellite Connectivity Market Volume (Billion), by End-User 2025 & 2033

- Figure 97: South America Healthcare Satellite Connectivity Market Revenue Share (%), by End-User 2025 & 2033

- Figure 98: South America Healthcare Satellite Connectivity Market Volume Share (%), by End-User 2025 & 2033

- Figure 99: South America Healthcare Satellite Connectivity Market Revenue (Million), by Country 2025 & 2033

- Figure 100: South America Healthcare Satellite Connectivity Market Volume (Billion), by Country 2025 & 2033

- Figure 101: South America Healthcare Satellite Connectivity Market Revenue Share (%), by Country 2025 & 2033

- Figure 102: South America Healthcare Satellite Connectivity Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Component 2020 & 2033

- Table 3: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Connectivity 2020 & 2033

- Table 6: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Connectivity 2020 & 2033

- Table 7: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 9: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Component 2020 & 2033

- Table 13: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Connectivity 2020 & 2033

- Table 16: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Connectivity 2020 & 2033

- Table 17: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 18: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 19: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: United States Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United States Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Canda Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Canda Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Mexico Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Component 2020 & 2033

- Table 28: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Component 2020 & 2033

- Table 29: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Application 2020 & 2033

- Table 31: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Connectivity 2020 & 2033

- Table 32: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Connectivity 2020 & 2033

- Table 33: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 34: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 35: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Germany Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Germany Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: France Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: France Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: United kingdom Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: United kingdom Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Italy Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Spain Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Europe Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Component 2020 & 2033

- Table 50: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Component 2020 & 2033

- Table 51: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Application 2020 & 2033

- Table 52: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Application 2020 & 2033

- Table 53: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Connectivity 2020 & 2033

- Table 54: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Connectivity 2020 & 2033

- Table 55: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 56: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 57: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Country 2020 & 2033

- Table 59: China Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: China Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Japan Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Japan Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: India Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: India Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Australia Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Australia Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: South Korea Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: South Korea Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Rest of Asia Pacific Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Rest of Asia Pacific Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Component 2020 & 2033

- Table 72: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Component 2020 & 2033

- Table 73: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Application 2020 & 2033

- Table 74: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Application 2020 & 2033

- Table 75: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Connectivity 2020 & 2033

- Table 76: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Connectivity 2020 & 2033

- Table 77: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 78: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 79: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Country 2020 & 2033

- Table 81: GCC Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: GCC Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: South Africa Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: South Africa Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: Rest of Middle East and Africa Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Rest of Middle East and Africa Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Component 2020 & 2033

- Table 88: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Component 2020 & 2033

- Table 89: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Application 2020 & 2033

- Table 90: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Application 2020 & 2033

- Table 91: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Connectivity 2020 & 2033

- Table 92: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Connectivity 2020 & 2033

- Table 93: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 94: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 95: Global Healthcare Satellite Connectivity Market Revenue Million Forecast, by Country 2020 & 2033

- Table 96: Global Healthcare Satellite Connectivity Market Volume Billion Forecast, by Country 2020 & 2033

- Table 97: Brazil Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: Brazil Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 99: Argentina Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: Argentina Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 101: Rest of South America Healthcare Satellite Connectivity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Rest of South America Healthcare Satellite Connectivity Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Healthcare Satellite Connectivity Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Healthcare Satellite Connectivity Market?

Key companies in the market include Inmarsat Global Limited, Hughes Network Systems LLC, SES S A, X2NSat, Expedition Communications, Globalstar, Eutelsat Communications SA, AT&T Intellectual Property, DISH Network L L C, Ligado Networks*List Not Exhaustive.

3. What are the main segments of the Healthcare Satellite Connectivity Market?

The market segments include Component, Application, Connectivity, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives for Promotion and Development of Satellite Connectivity; Rising Adoption of eHealth.

6. What are the notable trends driving market growth?

Telemedicine Segment is Expected to Hold Significant Share Over The Forecast Period.

7. Are there any restraints impacting market growth?

Government Initiatives for Promotion and Development of Satellite Connectivity; Rising Adoption of eHealth.

8. Can you provide examples of recent developments in the market?

July 2022: Neom Tech and OneWeb agreed to a USD 200 million satellite network agreement. In the region where access to fiber-like Internet was previously unthinkable, Neom's ecosystem of cognitive technologies will transform companies and rural communities with OneWeb's Low Earth Orbit (LEO) satellite constellation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Healthcare Satellite Connectivity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Healthcare Satellite Connectivity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Healthcare Satellite Connectivity Market?

To stay informed about further developments, trends, and reports in the Healthcare Satellite Connectivity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence