Key Insights

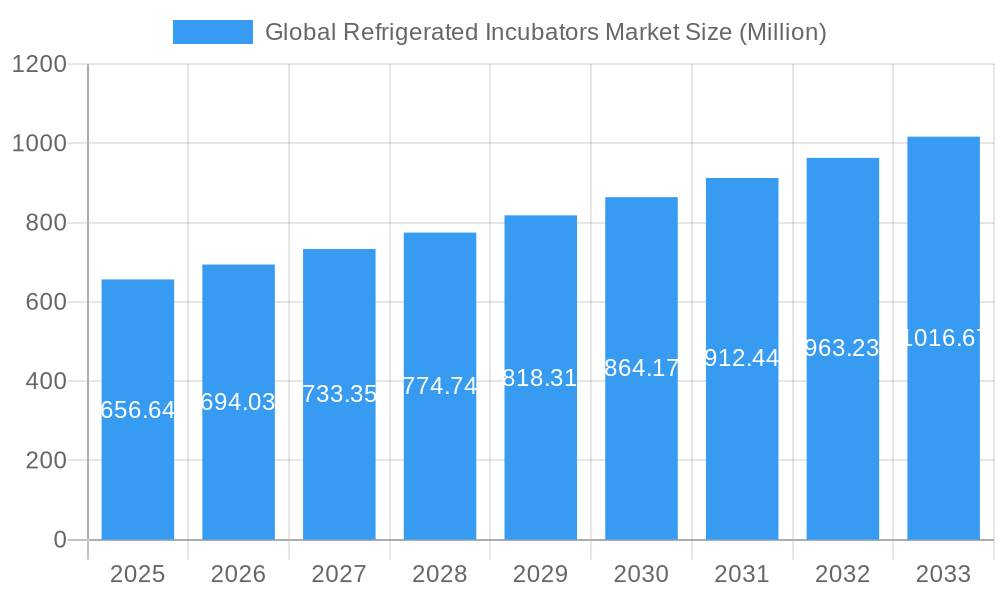

The Global Refrigerated Incubators Market is poised for significant expansion, with a current market size of USD 656.64 million and a projected Compound Annual Growth Rate (CAGR) of 5.60% throughout the forecast period of 2025-2033. This robust growth is primarily fueled by the escalating demand for advanced temperature-controlled environments essential for critical biological research, pharmaceutical development, and accurate diagnostics across diverse end-user segments. Hospitals are increasingly investing in reliable refrigerated incubators for sample storage and incubation during patient treatment and diagnostic processes. Similarly, the burgeoning research laboratories and academic institutes, driven by a continuous pursuit of scientific discovery and educational advancements, represent a substantial consumer base. The pharmaceutical and biotechnology sectors are also major contributors, relying heavily on these sophisticated instruments for drug discovery, development, quality control, and the cultivation of cell lines and microbial cultures under precisely maintained conditions. The expanding healthcare infrastructure, coupled with a growing emphasis on R&D, particularly in emerging economies, is creating a fertile ground for market penetration. Furthermore, technological innovations leading to enhanced features such as precise temperature control, improved energy efficiency, and advanced monitoring capabilities are further stimulating market demand.

Global Refrigerated Incubators Market Market Size (In Million)

The market's trajectory is also influenced by a dynamic interplay of trends, drivers, and restraints. Key drivers include the increasing prevalence of chronic diseases necessitating extensive research and development, a surge in gene editing technologies and personalized medicine, and a growing global focus on food safety and quality control that relies on microbial testing. The market is witnessing a trend towards the development of smart incubators with IoT connectivity, enabling remote monitoring and data logging, which significantly improves operational efficiency and data integrity. Moreover, advancements in refrigeration technology are leading to more energy-efficient and environmentally friendly models. However, the market faces certain restraints, including the high initial cost of sophisticated refrigerated incubators and the stringent regulatory landscape governing medical and laboratory equipment, which can impact adoption rates. Despite these challenges, the continuous innovation pipeline, coupled with the indispensable role of refrigerated incubators in various scientific and healthcare applications, ensures a positive outlook for the global market. The market is segmented by type, with the "51 to 200 L" and "201 to 750 L" segments likely to dominate due to their versatility and widespread application in research and clinical settings.

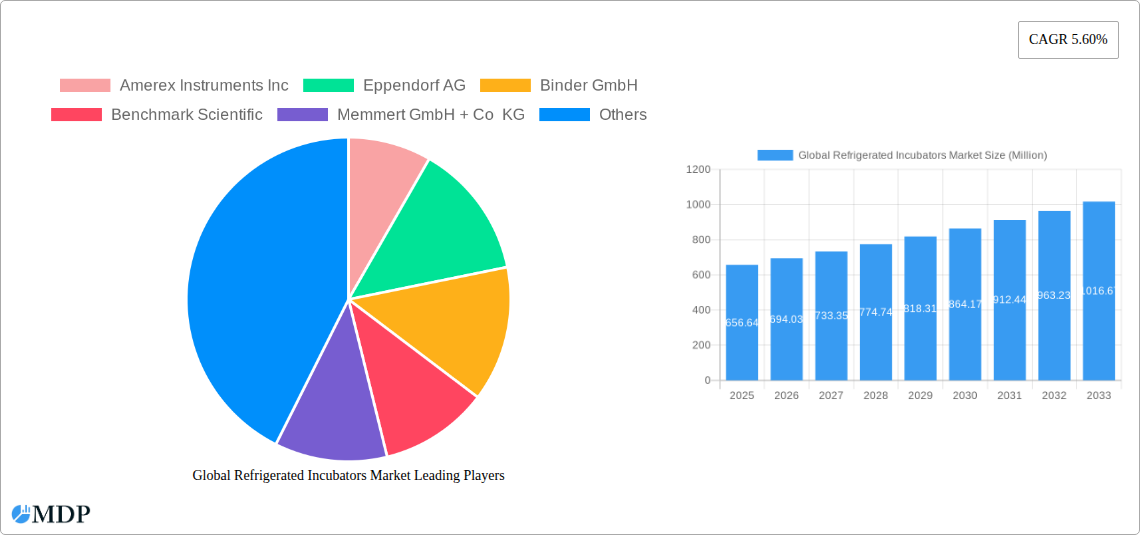

Global Refrigerated Incubators Market Company Market Share

This in-depth report provides an unparalleled analysis of the Global Refrigerated Incubators Market, offering crucial insights for stakeholders in the life sciences, pharmaceutical, and biotechnology sectors. With a study period spanning 2019–2033, a base and estimated year of 2025, and a forecast period of 2025–2033, this report delves into historical trends (2019–2024) and future projections. It dissects market dynamics, industry trends, leading segments, product developments, key growth drivers, challenges, emerging opportunities, and the competitive landscape, featuring contributions from Amerex Instruments Inc, Eppendorf AG, Binder GmbH, Benchmark Scientific, Memmert GmbH + Co KG, LEEC Ltd, Thermo Fisher Scientific, PHC Holdings Corporation, Sheldon Manufacturing Inc, and Gilson Inc. The market is segmented by Type (Below 50 l, 51 to 200 l, 201 to 750 l, 751 to 1,500 l, Above 1,501 l) and End User (Hospitals, Research Laboratories and Academic Institutes, Pharmaceutical and Biotechnology Companies).

Global Refrigerated Incubators Market Market Dynamics & Concentration

The global refrigerated incubators market exhibits a moderate level of concentration, with a few dominant players holding significant market share. Innovation remains a key driver, fueled by the increasing demand for precise temperature control, advanced features like CO2 and humidity management, and energy efficiency. Regulatory frameworks, particularly those governing pharmaceutical manufacturing and clinical trials, play a pivotal role in shaping product development and market entry. While direct product substitutes are limited, advancements in alternative storage solutions could present a long-term challenge. End-user trends are heavily influenced by the expanding scope of research in areas like cell therapy, vaccine development, and personalized medicine, driving demand for specialized refrigerated incubators. Mergers and acquisition (M&A) activities, though not widespread, are indicative of strategic consolidation and expansion efforts by key market participants aiming to broaden their product portfolios and geographical reach. Market share is estimated to be around xx Billion in 2025. The number of significant M&A deals in the past three years is estimated to be between 5-8.

Global Refrigerated Incubators Market Industry Trends & Analysis

The refrigerated incubators market is experiencing robust growth, driven by several interconnected factors. A significant growth driver is the escalating investment in life sciences research and development by both public and private entities worldwide. This includes substantial funding for drug discovery, genomics, proteomics, and cell-based assays, all of which necessitate reliable and precise temperature-controlled environments for sample preservation and experimental procedures. Technological disruptions are continuously reshaping the market. Manufacturers are increasingly incorporating advanced features such as sophisticated digital controllers, programmable temperature and humidity settings, data logging capabilities, and remote monitoring systems to enhance user experience and experimental accuracy. The rise of AI and machine learning in laboratory automation is also influencing the design and functionality of incubators, leading to more intelligent and integrated systems.

Consumer preferences are shifting towards energy-efficient, user-friendly, and space-saving solutions. The increasing adoption of under-counter and compact refrigerated incubators, particularly in research laboratories and academic institutions with limited space, highlights this trend. Furthermore, the growing emphasis on sustainability is pushing manufacturers to develop models with reduced power consumption and eco-friendly refrigerants. Competitive dynamics within the market are characterized by intense product innovation and strategic collaborations. Companies are vying for market share through the introduction of novel technologies, enhanced performance specifications, and competitive pricing. The refrigerated incubators market size is projected to reach xx Billion by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. Market penetration for advanced refrigerated incubators within research settings is estimated to be around 70% in developed economies.

Leading Markets & Segments in Global Refrigerated Incubators Market

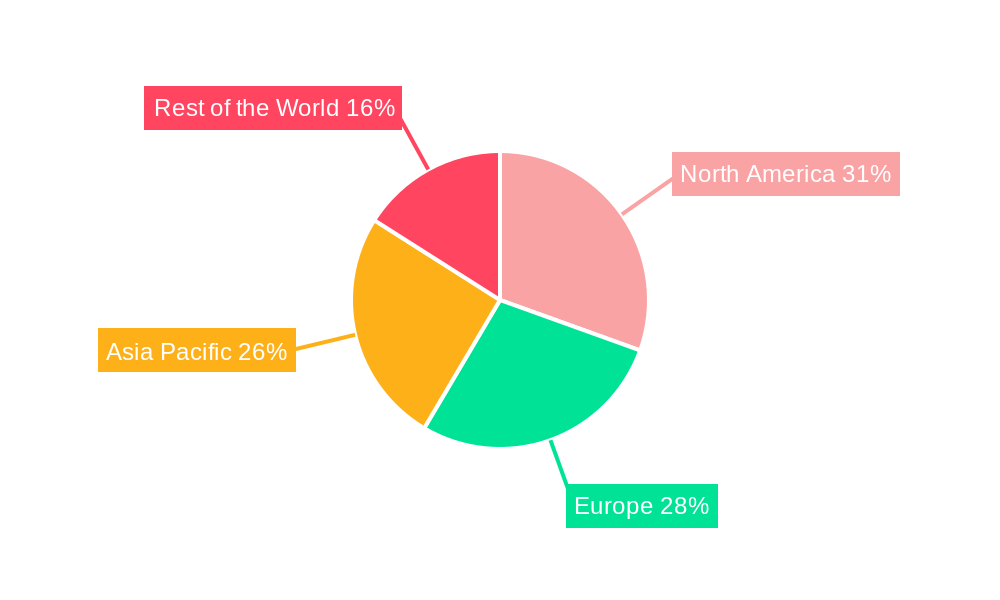

The global refrigerated incubators market is led by North America and Europe, owing to the substantial presence of leading pharmaceutical and biotechnology companies, robust government funding for R&D, and a well-established academic research infrastructure. The United States, in particular, stands out as a dominant country due to its extensive network of research institutions and a thriving biopharmaceutical industry.

- Dominant Region: North America, driven by the USA.

- Key Drivers: Significant government funding for life sciences research (e.g., NIH grants), presence of major pharmaceutical and biotechnology hubs, a high concentration of academic research laboratories, and advanced healthcare infrastructure. Economic policies supporting innovation and a strong intellectual property framework further bolster market dominance.

- Leading Segment by Type: The 201 to 750 l segment is expected to hold a significant market share.

- Key Drivers: This capacity range offers a balance between volume and space efficiency, making it ideal for a wide array of applications in research laboratories, pharmaceutical quality control, and cell culture. The versatility of these incubators caters to diverse experimental needs, from small-scale pilot studies to larger batch processing.

- Leading Segment by End User: Research Laboratories and Academic Institutes represent the largest end-user segment.

- Key Drivers: The continuous need for sample storage, cell culture, and various experimental procedures in academic research, drug discovery, and basic science fuels sustained demand. Government grants and institutional funding for research projects directly translate into increased procurement of refrigerated incubators.

- Emerging Segment: The Pharmaceutical and Biotechnology Companies segment is also a significant and growing consumer of refrigerated incubators.

- Key Drivers: Stringent quality control requirements, the development of new biologics and vaccines, and the need for reliable long-term storage of sensitive materials contribute to their increasing demand. The expansion of biomanufacturing facilities further amplifies this trend. The Above 1,501 l segment is gaining traction for large-scale bioprocessing and long-term archival storage needs.

Global Refrigerated Incubators Market Product Developments

Product development in the refrigerated incubators market is characterized by a focus on enhancing precision, reliability, and energy efficiency. Manufacturers are integrating advanced control systems for tighter temperature uniformity and stability, crucial for sensitive biological samples and cell cultures. Innovations include specialized models designed for specific applications like vaccine storage, cell therapy development, and high-throughput screening. The integration of IoT capabilities for remote monitoring and data management is a growing trend, offering researchers greater control and traceability. These advancements provide a competitive edge by addressing evolving laboratory needs and regulatory demands for sample integrity and experimental reproducibility.

Key Drivers of Global Refrigerated Incubators Market Growth

The global refrigerated incubators market is propelled by several key factors. Firstly, the relentless growth in life sciences research and development, particularly in areas like oncology, immunology, and regenerative medicine, creates an ongoing demand for precise temperature-controlled storage and incubation. Secondly, the expanding pharmaceutical and biotechnology sectors, driven by the development of new drugs, biologics, and vaccines, require reliable equipment for sample management and quality control. Thirdly, increasing government initiatives and funding for scientific research globally, especially in emerging economies, are expanding the customer base. Lastly, technological advancements leading to more sophisticated, energy-efficient, and user-friendly refrigerated incubators are driving adoption.

Challenges in the Global Refrigerated Incubators Market Market

Despite the positive growth trajectory, the global refrigerated incubators market faces certain challenges. High initial investment costs for advanced models can be a barrier for smaller research institutions and developing regions. Intense competition among manufacturers can lead to price pressures, impacting profit margins. Furthermore, the stringent regulatory requirements for validation and calibration of laboratory equipment can add to the complexity and cost of market entry and compliance. Supply chain disruptions for critical components can also impact production timelines and availability.

Emerging Opportunities in Global Refrigerated Incubators Market

The global refrigerated incubators market presents several promising opportunities for growth. The accelerating development of cell and gene therapies, which require highly controlled and sterile incubation environments, is a significant catalyst. Strategic partnerships between incubator manufacturers and biotechnology firms for customized solutions can unlock new market segments. The increasing demand for refurbished and reconditioned incubators in cost-conscious markets offers an avenue for expanding market reach. Furthermore, the growing focus on precision medicine and personalized treatments necessitates advanced incubation technologies for patient-specific sample processing.

Leading Players in the Global Refrigerated Incubators Market Sector

- Amerex Instruments Inc

- Eppendorf AG

- Binder GmbH

- Benchmark Scientific

- Memmert GmbH + Co KG

- LEEC Ltd

- Thermo Fisher Scientific

- PHC Holdings Corporation

- Sheldon Manufacturing Inc

- Gilson Inc

Key Milestones in Global Refrigerated Incubators Market Industry

- September 2023: Cleveland Clinic opened its new research programs, including the Center for Computational Life Sciences, the Center for Immunotherapy and Precision Immuno-oncology, and the Center for Therapeutics Discovery. These initiatives are expected to significantly increase the utilization of advanced refrigerated incubators for cell therapy, vaccine development, and drug discovery.

- January 2022: PHC Corporation of North America introduced the PF-L5181W-PA, a high-performance under-counter freezer. This product meets CDC guidelines, offering precise temperature control between -15 °C and -25 °C with ±5°C uniformity for storing critical vaccines and biologics, enhancing the storage capabilities for sensitive medical supplies.

Strategic Outlook for Global Refrigerated Incubators Market Market

The strategic outlook for the global refrigerated incubators market is characterized by continued innovation and market expansion. Key growth accelerators include the increasing adoption of smart and connected incubators with IoT capabilities for remote monitoring and data analytics, catering to the evolving needs of digital laboratories. Manufacturers are also focusing on developing specialized incubators for niche applications like organoid culture and exosome research, reflecting the cutting-edge advancements in life sciences. Furthermore, strategic collaborations and partnerships aimed at addressing specific industry challenges, such as enhancing cold chain integrity for biologics, will be crucial for sustained market leadership and future growth potential.

Global Refrigerated Incubators Market Segmentation

-

1. Type

- 1.1. Below 50 l

- 1.2. 51 to 200 l

- 1.3. 201 to 750 l

- 1.4. 751 to 1,500 l

- 1.5. Above 1,501 l

-

2. End User

- 2.1. Hospitals

- 2.2. Research Laboratories and Academic Institutes

- 2.3. Pharmaceutical and Biotechnology Companies

Global Refrigerated Incubators Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Global Refrigerated Incubators Market Regional Market Share

Geographic Coverage of Global Refrigerated Incubators Market

Global Refrigerated Incubators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Refrigerated Incubators for Research Activities Targeting Infectious Diseases; Increasing Technological Advancements in Refrigerated Incubators

- 3.3. Market Restrains

- 3.3.1. Availability of Alternative Incubators

- 3.4. Market Trends

- 3.4.1. 51 to 200 l Segment is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Refrigerated Incubators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Below 50 l

- 5.1.2. 51 to 200 l

- 5.1.3. 201 to 750 l

- 5.1.4. 751 to 1,500 l

- 5.1.5. Above 1,501 l

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Research Laboratories and Academic Institutes

- 5.2.3. Pharmaceutical and Biotechnology Companies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Refrigerated Incubators Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Below 50 l

- 6.1.2. 51 to 200 l

- 6.1.3. 201 to 750 l

- 6.1.4. 751 to 1,500 l

- 6.1.5. Above 1,501 l

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Research Laboratories and Academic Institutes

- 6.2.3. Pharmaceutical and Biotechnology Companies

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Refrigerated Incubators Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Below 50 l

- 7.1.2. 51 to 200 l

- 7.1.3. 201 to 750 l

- 7.1.4. 751 to 1,500 l

- 7.1.5. Above 1,501 l

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Research Laboratories and Academic Institutes

- 7.2.3. Pharmaceutical and Biotechnology Companies

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Global Refrigerated Incubators Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Below 50 l

- 8.1.2. 51 to 200 l

- 8.1.3. 201 to 750 l

- 8.1.4. 751 to 1,500 l

- 8.1.5. Above 1,501 l

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Research Laboratories and Academic Institutes

- 8.2.3. Pharmaceutical and Biotechnology Companies

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Global Refrigerated Incubators Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Below 50 l

- 9.1.2. 51 to 200 l

- 9.1.3. 201 to 750 l

- 9.1.4. 751 to 1,500 l

- 9.1.5. Above 1,501 l

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Research Laboratories and Academic Institutes

- 9.2.3. Pharmaceutical and Biotechnology Companies

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Amerex Instruments Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Eppendorf AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Binder GmbH

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Benchmark Scientific

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Memmert GmbH + Co KG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 LEEC Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Thermo Fisher Scientific

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 PHC Holdings Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sheldon Manufacturing Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Gilson Inc *List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Amerex Instruments Inc

List of Figures

- Figure 1: Global Global Refrigerated Incubators Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Global Refrigerated Incubators Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Global Refrigerated Incubators Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Global Refrigerated Incubators Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Global Refrigerated Incubators Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Global Refrigerated Incubators Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Global Refrigerated Incubators Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Global Refrigerated Incubators Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Global Refrigerated Incubators Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Global Refrigerated Incubators Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Global Refrigerated Incubators Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Global Refrigerated Incubators Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Global Refrigerated Incubators Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Global Refrigerated Incubators Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Global Refrigerated Incubators Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Global Refrigerated Incubators Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Global Refrigerated Incubators Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Global Refrigerated Incubators Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Global Refrigerated Incubators Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Global Refrigerated Incubators Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World Global Refrigerated Incubators Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Global Refrigerated Incubators Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Rest of the World Global Refrigerated Incubators Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World Global Refrigerated Incubators Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Global Refrigerated Incubators Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Refrigerated Incubators Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Refrigerated Incubators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Refrigerated Incubators Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Refrigerated Incubators Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Refrigerated Incubators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Refrigerated Incubators Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Refrigerated Incubators Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Refrigerated Incubators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Refrigerated Incubators Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Refrigerated Incubators Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Refrigerated Incubators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 21: Global Refrigerated Incubators Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Global Refrigerated Incubators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Refrigerated Incubators Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Refrigerated Incubators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global Refrigerated Incubators Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Refrigerated Incubators Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Global Refrigerated Incubators Market?

Key companies in the market include Amerex Instruments Inc, Eppendorf AG, Binder GmbH, Benchmark Scientific, Memmert GmbH + Co KG, LEEC Ltd, Thermo Fisher Scientific, PHC Holdings Corporation, Sheldon Manufacturing Inc, Gilson Inc *List Not Exhaustive.

3. What are the main segments of the Global Refrigerated Incubators Market?

The market segments include Type, End User .

4. Can you provide details about the market size?

The market size is estimated to be USD 656.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Refrigerated Incubators for Research Activities Targeting Infectious Diseases; Increasing Technological Advancements in Refrigerated Incubators.

6. What are the notable trends driving market growth?

51 to 200 l Segment is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Availability of Alternative Incubators.

8. Can you provide examples of recent developments in the market?

September 2023: Cleveland Clinic opened to involve research programs, the Center for Computational Life Sciences, the Center for Immunotherapy and Precision Immuno-oncology, including the Cell Therapy Program and vaccine development, and the Center for Therapeutics Discovery. Thus, such research programs are likely to involve the utilization of refrigerated incubators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Refrigerated Incubators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Refrigerated Incubators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Refrigerated Incubators Market?

To stay informed about further developments, trends, and reports in the Global Refrigerated Incubators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence