Key Insights

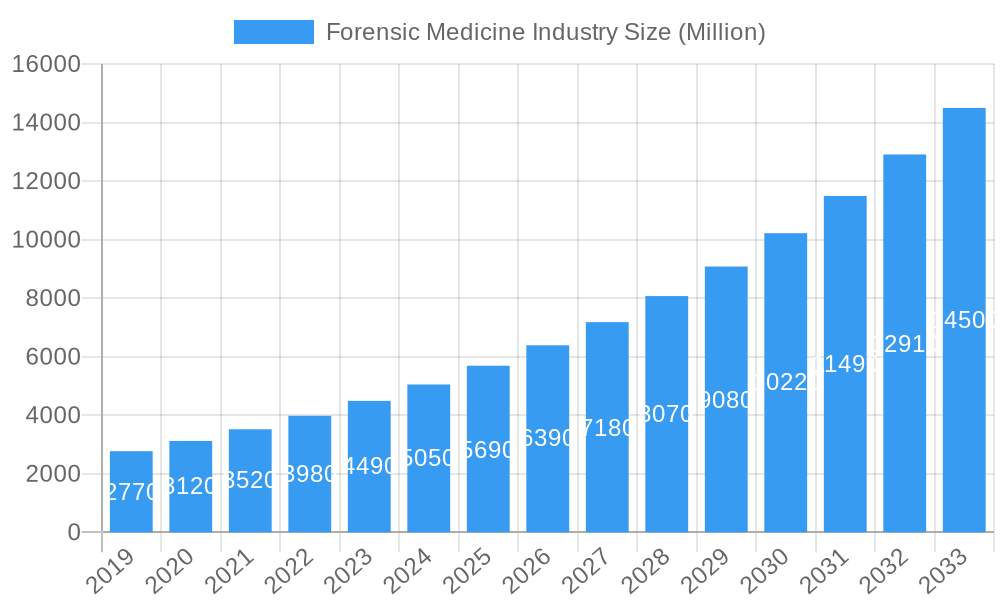

The global Forensic Medicine market is projected for substantial growth, anticipated to reach $9.69 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 12.92%. This expansion is primarily driven by the increasing reliance on advanced forensic techniques in criminal investigations, heightened public safety awareness, and escalating investments in law enforcement. Key growth factors include the growing complexity of criminal cases, the imperative for conclusive evidence, and rapid advancements in DNA profiling and other analytical methodologies enhancing accuracy and efficiency. The judicial and law enforcement sectors are pivotal beneficiaries, utilizing forensic medicine to resolve cases, exonerate the innocent, and uphold justice. Emerging applications in personalized medicine and historical research also contribute to the market's positive trajectory, with sophisticated technologies like genome sequencing further expanding the capabilities of forensic analysis.

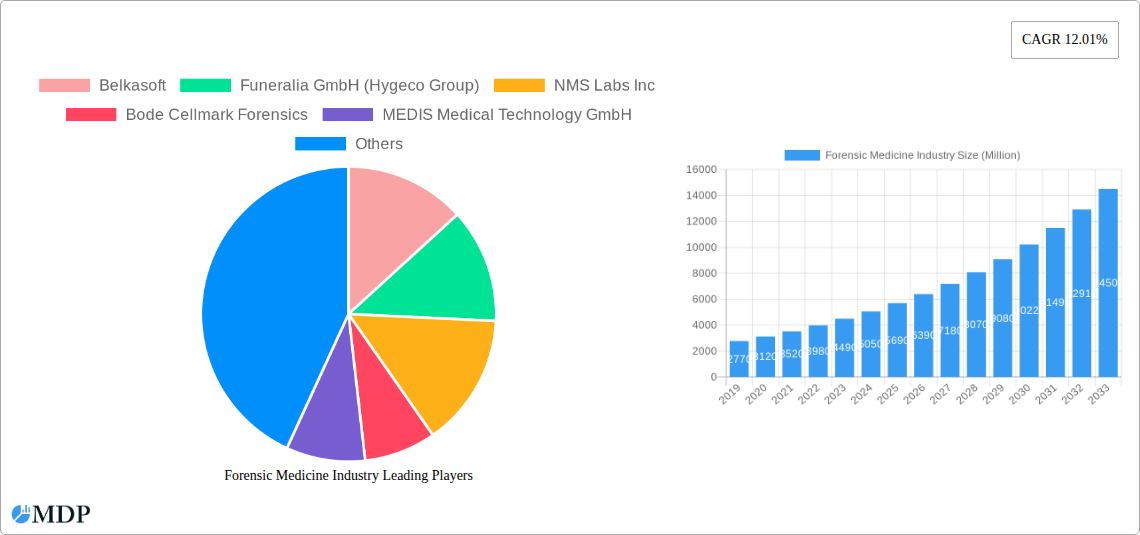

Forensic Medicine Industry Market Size (In Billion)

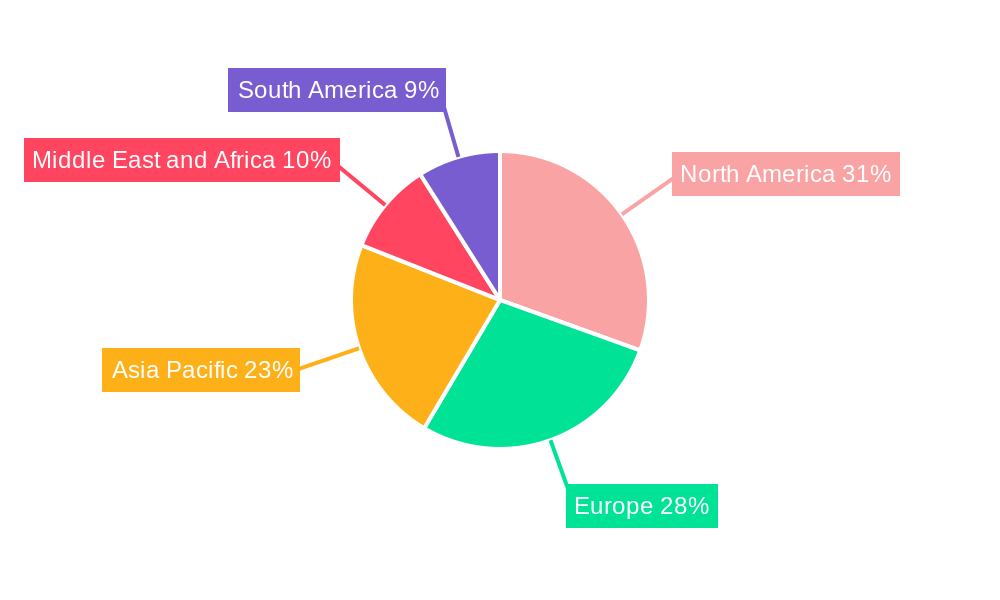

Market segmentation highlights DNA Profiling as a dominant segment, attributed to its extensive adoption and proven reliability. Fingerprint Analysis and Chemical Analysis are also integral to forensic investigations, offering distinct yet complementary insights. While robust market growth is evident, challenges such as the high cost of advanced instrumentation, the necessity for specialized expertise, and stringent regulatory compliance may present obstacles. Geographically, North America and Europe are expected to lead the market, supported by well-developed healthcare infrastructure, significant R&D funding, and supportive government policies. However, the Asia Pacific region is poised for the most rapid expansion, driven by increased investments in public safety infrastructure, rising crime rates, and wider adoption of sophisticated forensic technologies. The strategic integration of these advanced techniques is vital for the continued evolution and impact of forensic medicine worldwide.

Forensic Medicine Industry Company Market Share

Forensic Medicine Industry Market Dynamics & Concentration

The Forensic Medicine industry is characterized by a moderately concentrated market structure, with key players like Agilent Technologies, Eurofins Medigenomix Gmbh, NMS Labs Inc, Bode Cellmark Forensics, and Belkasoft holding significant market share. Innovation is a primary driver, fueled by advancements in DNA profiling and genome sequencing technologies. The regulatory landscape is complex, with stringent standards for evidence handling and admissibility in legal proceedings. Product substitutes are limited due to the specialized nature of forensic services. End-user trends show a growing demand for faster, more accurate, and comprehensive analysis, particularly in criminal investigations and civil litigation. Mergers and acquisitions (M&A) are a strategic tool for consolidation and expansion, with an estimated 5 significant M&A deals in the historical period (2019-2024). The market share of top companies is estimated to be around 60%.

Forensic Medicine Industry Industry Trends & Analysis

The Forensic Medicine industry is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12% during the forecast period of 2025–2033. This robust growth is propelled by an increasing global crime rate, rising awareness of forensic science's importance in justice systems, and continuous technological advancements. Genome sequencing, in particular, is revolutionizing DNA profiling, offering higher accuracy and the ability to analyze degraded or limited samples. The integration of artificial intelligence and machine learning is enhancing the speed and efficiency of data analysis, particularly in areas like fingerprint recognition and digital forensics. Consumer preferences are leaning towards more personalized and accessible forensic testing, not just for legal purposes but also for ancestral tracing and disease predisposition. The market penetration of advanced forensic techniques is steadily increasing as law enforcement agencies and judicial bodies recognize their value in solving complex cases and ensuring justice. Competitive dynamics are intensifying, with companies investing heavily in R&D to develop proprietary technologies and expand their service portfolios. The expansion of Bode Technology's DNA testing lab in Fairfax County with a $2 Million investment in April 2022 highlights the commitment to meeting escalating customer demand and underscores the sector's growth trajectory. The increasing adoption of digital forensics, spurred by the Belkasoft partnership with Grayshift's Technology Alliances Program in August 2022, further signals the industry's adaptation to evolving investigative needs.

Leading Markets & Segments in Forensic Medicine Industry

The Judicial/Law Enforcement application segment is the dominant force within the Forensic Medicine industry, driven by the relentless global need for effective crime investigation and prosecution. This dominance is further amplified by the critical role of DNA Profiling as the most widely adopted and impactful method, due to its high accuracy and discriminatory power.

- Dominant Region/Country: North America, specifically the United States, stands out as a leading market due to its well-established legal framework, substantial government funding for law enforcement and forensic services, and a high adoption rate of advanced technologies. The country's robust judicial system and a proactive approach to combating crime contribute significantly to the demand for forensic solutions.

- Dominant Segment - Method: DNA Profiling: This method consistently leads the market. Key drivers include its indisputable scientific validity in criminal courts, continuous technological improvements leading to faster and more sensitive results, and the increasing availability of DNA databases for identification. The ability to profile from minuscule or degraded samples has made it indispensable.

- Dominant Segment - Application: Judicial/Law Enforcement: The persistent and universal need for identifying perpetrators, exonerating the innocent, and reconstructing crime scenes solidifies this application as paramount. Government initiatives to modernize forensic laboratories and equip law enforcement with cutting-edge tools further fuel this segment's growth.

- Emerging Strength - Application: Genome Sequencing: While currently a smaller segment, genome sequencing is rapidly gaining traction. Its application extends beyond simple identification to understanding disease predispositions and ancestry, hinting at future growth in personalized medicine and advanced investigative techniques.

- Key Drivers for Dominance:

- Technological Advancements: Continuous innovation in DNA sequencing, fingerprint analysis, and chemical detection methods enhances accuracy and efficiency.

- Regulatory Support: Favorable legal frameworks and government funding initiatives for forensic science development.

- Increasing Crime Rates & Security Concerns: A persistent global challenge that necessitates advanced investigative tools.

- Growing Awareness: Increased public and professional understanding of the value of forensic evidence.

- Detailed Dominance Analysis: The synergy between DNA profiling and the judicial/law enforcement application creates a powerful market engine. As DNA databases expand and sequencing technologies become more affordable, the power of DNA profiling in solving cases will only increase. While fingerprint analysis remains a foundational technique, DNA profiling offers a higher level of individualization. Chemical analysis plays a crucial role in drug and toxicology cases, supporting the judicial process. The market's focus remains firmly on applications that directly aid in the administration of justice, making these segments the undisputed leaders.

Forensic Medicine Industry Product Developments

The Forensic Medicine industry is witnessing rapid product innovation focused on enhancing speed, accuracy, and portability. Companies like Belkasoft are at the forefront of digital forensics software, enabling comprehensive data recovery and analysis from electronic devices. Agilent Technologies and MEDIS Medical Technology GmbH are developing advanced laboratory instrumentation for DNA sequencing and analysis, leading to more efficient sample processing and higher throughput. Bode Cellmark Forensics and NMS Labs Inc are consistently refining their DNA testing kits and services, offering greater sensitivity and broader applicability to challenging samples. These developments aim to provide actionable insights faster, reducing turnaround times for critical investigations and offering competitive advantages through improved analytical capabilities and user-friendly interfaces.

Key Drivers of Forensic Medicine Industry Growth

Several factors are propelling the growth of the Forensic Medicine industry. Technologically, the continuous innovation in DNA sequencing, mass spectrometry, and digital forensics software significantly enhances analytical capabilities and accuracy. Economically, increased government funding for criminal justice systems and law enforcement agencies worldwide is a major catalyst. Regulatory frameworks are evolving to accommodate and standardize advanced forensic techniques, further encouraging adoption. The growing global prevalence of complex crimes, coupled with a heightened public and judicial demand for irrefutable evidence, also plays a crucial role in driving market expansion. The need to resolve cold cases and address emerging threats like cybercrime further fuels demand for sophisticated forensic solutions.

Challenges in the Forensic Medicine Industry Market

Despite its growth, the Forensic Medicine industry faces several challenges. Regulatory hurdles can arise from the evolving admissibility standards for novel forensic techniques and the need for rigorous validation. Supply chain issues for specialized reagents and equipment can impact turnaround times and operational efficiency. High operational costs associated with advanced instrumentation and skilled personnel represent a significant barrier for smaller organizations. Furthermore, intense competitive pressures necessitate continuous investment in R&D and service diversification to maintain market share. The ongoing need for highly trained forensic experts also poses a challenge in terms of talent acquisition and retention.

Emerging Opportunities in Forensic Medicine Industry

Emerging opportunities in the Forensic Medicine industry are largely driven by technological breakthroughs and strategic market expansions. The increasing affordability and capability of next-generation sequencing (NGS) technologies are opening avenues for advanced genetic analysis, including phenotyping and ancestral inference. Artificial intelligence (AI) and machine learning (ML) are creating opportunities for automating data analysis, improving predictive capabilities in crime scene reconstruction, and enhancing digital forensics investigations. Strategic partnerships, such as Belkasoft's integration into Grayshift's Technology Alliances Program, are expanding service offerings and market reach. Furthermore, the growing emphasis on forensic toxicology and environmental forensics presents new application areas and revenue streams for specialized providers.

Leading Players in the Forensic Medicine Industry Sector

- Belkasoft

- Funeralia GmbH (Hygeco Group)

- NMS Labs Inc

- Bode Cellmark Forensics

- MEDIS Medical Technology GmbH

- Eurofins Medigenomix Gmbh

- Agilent Technologies

Key Milestones in Forensic Medicine Industry Industry

- August 2022: Belkasoft, a pioneer in digital forensics and incident response, joined Grayshift's Technology Alliances Program and officially partnered with Technology Alliances Program (TAP). This collaboration is set to enhance digital forensic capabilities by integrating Belkasoft's advanced tools with Grayshift's specialized hardware solutions, improving efficiency in mobile device investigations.

- April 2022: Bode Technology, one of the top providers of forensic services across the world, invested USD 2 Million to expand its DNA testing lab in Fairfax County to meet the growing customer demand. This expansion signifies the escalating need for DNA analysis in criminal justice and is expected to boost capacity and reduce turnaround times for crucial forensic examinations.

Strategic Outlook for Forensic Medicine Industry Market

The strategic outlook for the Forensic Medicine industry is overwhelmingly positive, characterized by sustained growth and continuous innovation. The increasing adoption of advanced technologies like AI-powered analytics and next-generation sequencing will further refine diagnostic accuracy and investigative efficiency. Expansion into emerging markets and diversification of service offerings, particularly in areas like digital forensics and specialized toxicology, will be key growth accelerators. Strategic collaborations and mergers will continue to shape the competitive landscape, driving consolidation and enhancing capabilities. The industry's future lies in its ability to adapt to evolving crime patterns, leverage cutting-edge technologies, and provide robust, reliable forensic evidence essential for a just legal system.

Forensic Medicine Industry Segmentation

-

1. Method

- 1.1. DNA Profiling

- 1.2. Finger Print Analysis

- 1.3. Chemical Analysis

- 1.4. Other Methods

-

2. Application

- 2.1. Genome Sequencing

- 2.2. Judicial/Law Enforcement

- 2.3. Other Applications

Forensic Medicine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Forensic Medicine Industry Regional Market Share

Geographic Coverage of Forensic Medicine Industry

Forensic Medicine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Global Crime Rate; Sophistication of Crime; Increasing Demand for Forensic Technologies

- 3.3. Market Restrains

- 3.3.1. Declining Supply of Forensic Services; Regulatory Constraints

- 3.4. Market Trends

- 3.4.1. Fingerprint Analysis Segment is Expected to Witness Considerable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Forensic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Method

- 5.1.1. DNA Profiling

- 5.1.2. Finger Print Analysis

- 5.1.3. Chemical Analysis

- 5.1.4. Other Methods

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Genome Sequencing

- 5.2.2. Judicial/Law Enforcement

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Method

- 6. North America Forensic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Method

- 6.1.1. DNA Profiling

- 6.1.2. Finger Print Analysis

- 6.1.3. Chemical Analysis

- 6.1.4. Other Methods

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Genome Sequencing

- 6.2.2. Judicial/Law Enforcement

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Method

- 7. Europe Forensic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Method

- 7.1.1. DNA Profiling

- 7.1.2. Finger Print Analysis

- 7.1.3. Chemical Analysis

- 7.1.4. Other Methods

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Genome Sequencing

- 7.2.2. Judicial/Law Enforcement

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Method

- 8. Asia Pacific Forensic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Method

- 8.1.1. DNA Profiling

- 8.1.2. Finger Print Analysis

- 8.1.3. Chemical Analysis

- 8.1.4. Other Methods

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Genome Sequencing

- 8.2.2. Judicial/Law Enforcement

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Method

- 9. Middle East and Africa Forensic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Method

- 9.1.1. DNA Profiling

- 9.1.2. Finger Print Analysis

- 9.1.3. Chemical Analysis

- 9.1.4. Other Methods

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Genome Sequencing

- 9.2.2. Judicial/Law Enforcement

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Method

- 10. South America Forensic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Method

- 10.1.1. DNA Profiling

- 10.1.2. Finger Print Analysis

- 10.1.3. Chemical Analysis

- 10.1.4. Other Methods

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Genome Sequencing

- 10.2.2. Judicial/Law Enforcement

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Method

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Belkasoft

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Funeralia GmbH (Hygeco Group)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NMS Labs Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bode Cellmark Forensics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MEDIS Medical Technology GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eurofins Medigenomix Gmbh

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Agilent Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Belkasoft

List of Figures

- Figure 1: Global Forensic Medicine Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Forensic Medicine Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Forensic Medicine Industry Revenue (billion), by Method 2025 & 2033

- Figure 4: North America Forensic Medicine Industry Volume (K Unit), by Method 2025 & 2033

- Figure 5: North America Forensic Medicine Industry Revenue Share (%), by Method 2025 & 2033

- Figure 6: North America Forensic Medicine Industry Volume Share (%), by Method 2025 & 2033

- Figure 7: North America Forensic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Forensic Medicine Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Forensic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Forensic Medicine Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Forensic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Forensic Medicine Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Forensic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Forensic Medicine Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Forensic Medicine Industry Revenue (billion), by Method 2025 & 2033

- Figure 16: Europe Forensic Medicine Industry Volume (K Unit), by Method 2025 & 2033

- Figure 17: Europe Forensic Medicine Industry Revenue Share (%), by Method 2025 & 2033

- Figure 18: Europe Forensic Medicine Industry Volume Share (%), by Method 2025 & 2033

- Figure 19: Europe Forensic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 20: Europe Forensic Medicine Industry Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Forensic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Forensic Medicine Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Forensic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Forensic Medicine Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Forensic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Forensic Medicine Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Forensic Medicine Industry Revenue (billion), by Method 2025 & 2033

- Figure 28: Asia Pacific Forensic Medicine Industry Volume (K Unit), by Method 2025 & 2033

- Figure 29: Asia Pacific Forensic Medicine Industry Revenue Share (%), by Method 2025 & 2033

- Figure 30: Asia Pacific Forensic Medicine Industry Volume Share (%), by Method 2025 & 2033

- Figure 31: Asia Pacific Forensic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 32: Asia Pacific Forensic Medicine Industry Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Forensic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Forensic Medicine Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Forensic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Forensic Medicine Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Forensic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Forensic Medicine Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Forensic Medicine Industry Revenue (billion), by Method 2025 & 2033

- Figure 40: Middle East and Africa Forensic Medicine Industry Volume (K Unit), by Method 2025 & 2033

- Figure 41: Middle East and Africa Forensic Medicine Industry Revenue Share (%), by Method 2025 & 2033

- Figure 42: Middle East and Africa Forensic Medicine Industry Volume Share (%), by Method 2025 & 2033

- Figure 43: Middle East and Africa Forensic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 44: Middle East and Africa Forensic Medicine Industry Volume (K Unit), by Application 2025 & 2033

- Figure 45: Middle East and Africa Forensic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Forensic Medicine Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East and Africa Forensic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East and Africa Forensic Medicine Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Forensic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Forensic Medicine Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Forensic Medicine Industry Revenue (billion), by Method 2025 & 2033

- Figure 52: South America Forensic Medicine Industry Volume (K Unit), by Method 2025 & 2033

- Figure 53: South America Forensic Medicine Industry Revenue Share (%), by Method 2025 & 2033

- Figure 54: South America Forensic Medicine Industry Volume Share (%), by Method 2025 & 2033

- Figure 55: South America Forensic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 56: South America Forensic Medicine Industry Volume (K Unit), by Application 2025 & 2033

- Figure 57: South America Forensic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: South America Forensic Medicine Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: South America Forensic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: South America Forensic Medicine Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Forensic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Forensic Medicine Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Forensic Medicine Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 2: Global Forensic Medicine Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 3: Global Forensic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Forensic Medicine Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Forensic Medicine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Forensic Medicine Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Forensic Medicine Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 8: Global Forensic Medicine Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 9: Global Forensic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Forensic Medicine Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Forensic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Forensic Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Forensic Medicine Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 20: Global Forensic Medicine Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 21: Global Forensic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Forensic Medicine Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Forensic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Forensic Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: France Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Italy Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Spain Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Forensic Medicine Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 38: Global Forensic Medicine Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 39: Global Forensic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Global Forensic Medicine Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Global Forensic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Forensic Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: China Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Japan Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: India Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Australia Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: South Korea Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Forensic Medicine Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 56: Global Forensic Medicine Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 57: Global Forensic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 58: Global Forensic Medicine Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 59: Global Forensic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Forensic Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: GCC Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: South Africa Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Forensic Medicine Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 68: Global Forensic Medicine Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 69: Global Forensic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 70: Global Forensic Medicine Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 71: Global Forensic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Forensic Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Brazil Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Argentina Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Forensic Medicine Industry?

The projected CAGR is approximately 12.92%.

2. Which companies are prominent players in the Forensic Medicine Industry?

Key companies in the market include Belkasoft, Funeralia GmbH (Hygeco Group), NMS Labs Inc , Bode Cellmark Forensics, MEDIS Medical Technology GmbH, Eurofins Medigenomix Gmbh, Agilent Technologies.

3. What are the main segments of the Forensic Medicine Industry?

The market segments include Method, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.69 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Global Crime Rate; Sophistication of Crime; Increasing Demand for Forensic Technologies.

6. What are the notable trends driving market growth?

Fingerprint Analysis Segment is Expected to Witness Considerable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Declining Supply of Forensic Services; Regulatory Constraints.

8. Can you provide examples of recent developments in the market?

In August 2022, Belkasoft, a pioneer in digital forensics and incident response, joined Grayshift's Technology Alliances Program and officially partnered with Technology Alliances Program (TAP).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Forensic Medicine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Forensic Medicine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Forensic Medicine Industry?

To stay informed about further developments, trends, and reports in the Forensic Medicine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence