Key Insights

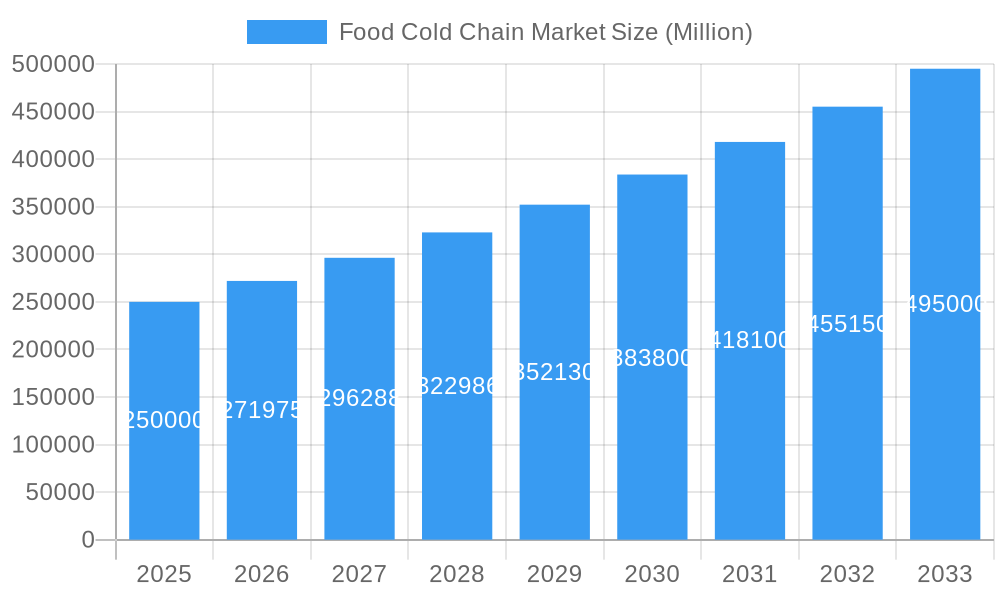

The global food cold chain market is projected to experience significant expansion, driven by heightened consumer demand for fresh and processed foods, increasing disposable incomes in emerging economies, and the rapid growth of online grocery sales. Projections indicate a substantial market increase with a Compound Annual Growth Rate (CAGR) of 16.32%. This upward trend is propelled by key innovations, including the adoption of advanced temperature-controlled packaging and real-time monitoring systems to reduce spoilage and optimize efficiency. Stringent food safety regulations and the imperative to maintain product integrity across the supply chain are also compelling market players to invest in sophisticated cold chain infrastructure. The market is segmented by key applications including fruits & vegetables, meat & seafood, and dairy products, with cold chain storage and transportation being the primary segments. Despite these growth catalysts, significant restraints persist, such as substantial infrastructure investment requirements, volatile energy prices, and the need for specialized labor. Leading companies, including VersaCold, Lineage Logistics, and AmeriCold Logistics, are actively influencing market dynamics through strategic acquisitions, technological advancements, and geographic expansion. The Asia-Pacific region, notably China and India, is anticipated to exhibit accelerated growth due to its expanding populations and burgeoning middle class. North America and Europe, while mature markets, are expected to maintain steady growth fueled by ongoing technological innovation and a growing emphasis on sustainability.

Food Cold Chain Market Market Size (In Billion)

Looking forward, the food cold chain market is anticipated to continue its growth trajectory. Future market expansion will be shaped by evolving consumer preferences for convenient and healthy food options, advancements in cold chain management technologies, and supportive government policies promoting food safety and security. Enhanced market penetration in developing economies, coupled with the integration of digital technologies such as blockchain for enhanced traceability and sustainable operational practices, will be crucial drivers of future growth. The competitive environment is expected to remain dynamic, characterized by strategic partnerships, mergers, and acquisitions aimed at strengthening market positions and service portfolios. The market size is estimated at $14.17 billion in the base year of 2025.

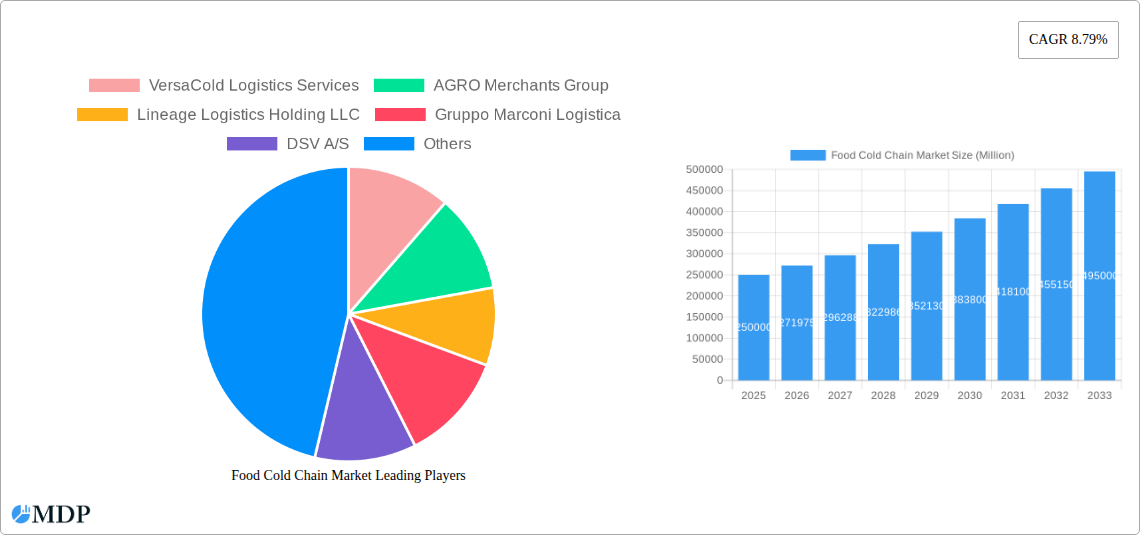

Food Cold Chain Market Company Market Share

Food Cold Chain Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Food Cold Chain Market, offering valuable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to predict future market trends and opportunities. The report covers key market segments, leading players, and recent industry developments, equipping readers with actionable intelligence to navigate this dynamic market. The global market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Food Cold Chain Market Market Dynamics & Concentration

The global food cold chain market exhibits a moderately concentrated structure, with several large players holding significant market share. However, the market also accommodates numerous smaller, regional players catering to niche demands. Market concentration is influenced by factors such as economies of scale in logistics and storage, technological advancements driving efficiency, and the increasing prevalence of mergers and acquisitions (M&A).

Key Dynamics:

- Innovation Drivers: Technological innovations, such as IoT-enabled monitoring systems, automated warehousing solutions, and advanced refrigeration technologies, significantly influence market growth and drive efficiency improvements.

- Regulatory Frameworks: Stringent food safety regulations and evolving environmental standards across different regions create both challenges and opportunities for market players. Compliance necessitates investment in infrastructure and technology, increasing operational costs but ensuring product safety and sustainability.

- Product Substitutes: Limited direct substitutes exist for refrigerated transportation and storage, yet cost optimization and alternative preservation methods (e.g., modified atmosphere packaging) exert indirect competitive pressure.

- End-User Trends: Growing consumer demand for fresh and convenient food products, along with increased health consciousness, fuels the need for robust cold chain infrastructure. The rise of e-commerce grocery deliveries further accelerates this demand.

- M&A Activities: Consolidation is evident through numerous M&A deals, which strategically expand the reach and capabilities of major players. The number of M&A deals in the sector averaged xx per year during the historical period, indicating a high level of consolidation. Market leaders such as Lineage Logistics have consistently expanded their footprint through acquisitions. For instance, Lineage Logistics LLC’s acquisition of Grupo Fuentes in September 2022 exemplifies this trend, increasing Lineage’s market share in Europe. The top 5 players hold an estimated xx% market share collectively.

Food Cold Chain Market Industry Trends & Analysis

The food cold chain market exhibits a robust growth trajectory, driven by several interconnected factors. The compound annual growth rate (CAGR) during the forecast period (2025-2033) is estimated at xx%. Market penetration is high in developed economies but shows significant growth potential in emerging markets with rising disposable incomes and evolving consumer preferences.

- Market Growth Drivers: Rising urbanization, increasing disposable incomes, especially in developing countries, growing demand for processed and ready-to-eat meals, and an expanding e-commerce sector are key drivers. The increasing focus on food safety and reducing food spoilage further stimulates market growth.

- Technological Disruptions: The integration of IoT devices, blockchain technology, and AI-powered analytics provides enhanced visibility and control over the cold chain, minimizing losses and improving efficiency. These technological disruptions continue to reshape the competitive landscape.

- Consumer Preferences: Consumers are increasingly demanding fresher produce, convenient meal options, and food transparency. Meeting these preferences requires sophisticated cold chain infrastructure and effective temperature control throughout the supply chain.

- Competitive Dynamics: The market is characterized by intense competition, with both large multinational corporations and specialized regional players vying for market share. Strategic alliances, technological innovations, and aggressive expansion strategies are key competitive tools.

Leading Markets & Segments in Food Cold Chain Market

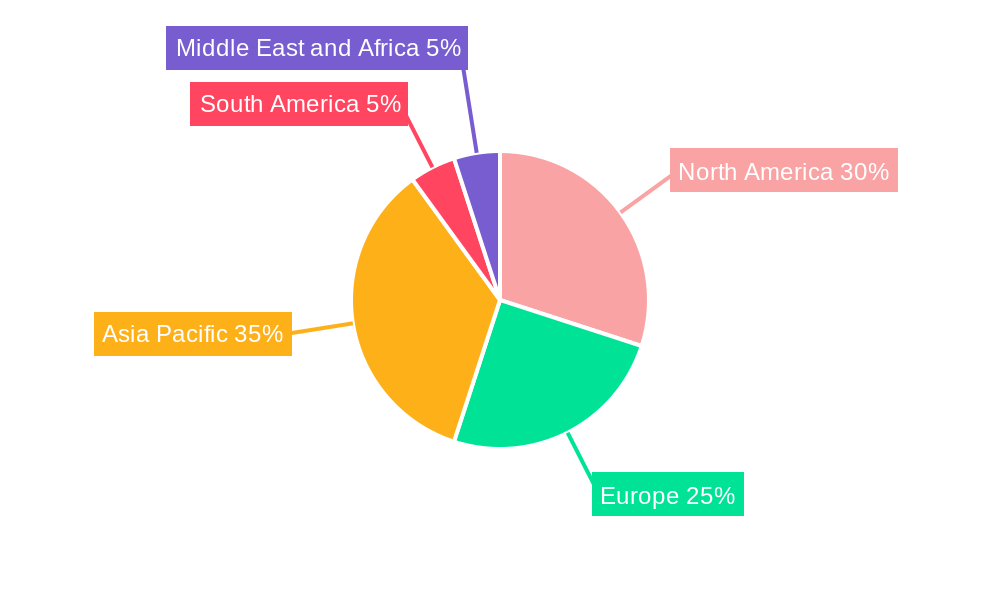

The Asia-Pacific region is currently the leading market for food cold chain, driven by factors including rapid population growth, rising disposable incomes, and increasing urbanization. Within this region, India and China are significant growth drivers. However, Europe and North America continue to maintain substantial market shares due to high per capita consumption of temperature-sensitive food products and advanced cold chain infrastructure.

Dominant Segments:

Type: Cold Chain Storage currently holds the largest share, reflecting the increasing need for efficient and large-scale storage facilities. Cold Chain Transport, however, is anticipated to show robust growth due to factors mentioned above.

Application: Fruits and Vegetables, Meat and Seafood, and Dairy and Frozen Dessert remain the most dominant application segments. Growth in these segments is driven by consumer demand for fresh products and growing health awareness. The Ready-to-Eat Meal segment exhibits particularly high growth potential.

Key Drivers by Region:

- Asia-Pacific: Rapid economic growth, expanding middle class, improved infrastructure development in certain regions, and government initiatives promoting food safety and logistics improvements.

- North America: High per capita consumption of perishable food products, advanced cold chain infrastructure, and a strong emphasis on food safety standards.

- Europe: Established cold chain infrastructure, increasing demand for convenience foods, and robust regulatory frameworks supporting food safety.

Food Cold Chain Market Product Developments

Recent innovations focus on improving temperature control, enhancing product traceability, and enhancing supply chain visibility. This includes the development of advanced refrigeration technologies, IoT-enabled monitoring devices, and sophisticated software solutions for real-time tracking and management. These developments are aimed at improving efficiency, minimizing food waste, and ensuring food safety. The integration of these technologies into existing cold chain operations, such as the launch of Celsius Logistics’ smart last-mile delivery platform, presents a significant competitive advantage for companies able to implement them effectively.

Key Drivers of Food Cold Chain Market Growth

Technological advancements are a primary driver, improving temperature control, monitoring, and traceability. Economic growth in emerging markets fuels demand, while stringent food safety regulations mandate efficient cold chains. The increasing preference for fresh produce and ready-to-eat meals drives market growth.

Challenges in the Food Cold Chain Market Market

High infrastructure costs, particularly in developing nations, pose a significant hurdle. Maintaining consistent temperature control throughout the entire supply chain remains challenging, leading to potential food spoilage and economic losses. Also, competition within the industry and fluctuating energy prices negatively impact profitability. Maintaining regulatory compliance varies across different regions and adds to operational complexity. The estimated annual loss due to inadequate cold chain infrastructure globally is xx Million.

Emerging Opportunities in Food Cold Chain Market

Technological advancements, such as AI-powered predictive maintenance and blockchain technology for enhanced transparency and traceability, offer significant growth opportunities. Strategic partnerships between cold chain providers and technology firms will be critical. Expansion into emerging markets with growing middle classes presents considerable market potential.

Leading Players in the Food Cold Chain Market Sector

- VersaCold Logistics Services

- AGRO Merchants Group

- Lineage Logistics Holding LLC

- Gruppo Marconi Logistica

- DSV A/S

- AmeriCold Logistics LLC

- Kloosterboer Group BV

- Henningsen Cold Storage Co

- Celsius Logistics

- Nichirei Corporation

Key Milestones in Food Cold Chain Market Industry

- September 2022: Celsius Logistics launched its smart last-mile delivery platform in India, addressing key challenges in the country's cold supply chain.

- September 2022: Lineage Logistics LLC acquired Grupo Fuentes, significantly expanding its European presence.

- August 2021: GeoTab launched cold chain vans with advanced refrigeration capabilities, enhancing temperature control during transportation.

Strategic Outlook for Food Cold Chain Market Market

The Food Cold Chain Market is poised for continued expansion, fueled by technological innovations, growing consumer demand, and increasing investments in infrastructure development. Strategic partnerships, focus on sustainable practices, and expansion into underserved markets will be key to success. The market’s future hinges on technological adaptation, proactive risk management, and a focus on providing end-to-end solutions that meet evolving consumer demands.

Food Cold Chain Market Segmentation

-

1. Type

- 1.1. Cold Chain Storage

- 1.2. Cold Chain Transport

-

2. Application

- 2.1. Fruits and Vegetables

- 2.2. Meat and Seafood

- 2.3. Dairy and Frozen Dessert

- 2.4. Bakery and Confectionery

- 2.5. Ready-to-Eat Meal

- 2.6. Other Applications

Food Cold Chain Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Food Cold Chain Market Regional Market Share

Geographic Coverage of Food Cold Chain Market

Food Cold Chain Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of Convenient and On the Go Snacking Options; Product Differentiation Playing a Key Role in Market Expansion

- 3.3. Market Restrains

- 3.3.1. Associated Health Risks; Easy Availability of Healthy Substitutes

- 3.4. Market Trends

- 3.4.1. Growing Investments in Cold Chain Infrastructure

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Cold Chain Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cold Chain Storage

- 5.1.2. Cold Chain Transport

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fruits and Vegetables

- 5.2.2. Meat and Seafood

- 5.2.3. Dairy and Frozen Dessert

- 5.2.4. Bakery and Confectionery

- 5.2.5. Ready-to-Eat Meal

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Food Cold Chain Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cold Chain Storage

- 6.1.2. Cold Chain Transport

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Fruits and Vegetables

- 6.2.2. Meat and Seafood

- 6.2.3. Dairy and Frozen Dessert

- 6.2.4. Bakery and Confectionery

- 6.2.5. Ready-to-Eat Meal

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Food Cold Chain Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cold Chain Storage

- 7.1.2. Cold Chain Transport

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Fruits and Vegetables

- 7.2.2. Meat and Seafood

- 7.2.3. Dairy and Frozen Dessert

- 7.2.4. Bakery and Confectionery

- 7.2.5. Ready-to-Eat Meal

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Food Cold Chain Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cold Chain Storage

- 8.1.2. Cold Chain Transport

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Fruits and Vegetables

- 8.2.2. Meat and Seafood

- 8.2.3. Dairy and Frozen Dessert

- 8.2.4. Bakery and Confectionery

- 8.2.5. Ready-to-Eat Meal

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Food Cold Chain Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cold Chain Storage

- 9.1.2. Cold Chain Transport

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Fruits and Vegetables

- 9.2.2. Meat and Seafood

- 9.2.3. Dairy and Frozen Dessert

- 9.2.4. Bakery and Confectionery

- 9.2.5. Ready-to-Eat Meal

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Food Cold Chain Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cold Chain Storage

- 10.1.2. Cold Chain Transport

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Fruits and Vegetables

- 10.2.2. Meat and Seafood

- 10.2.3. Dairy and Frozen Dessert

- 10.2.4. Bakery and Confectionery

- 10.2.5. Ready-to-Eat Meal

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 VersaCold Logistics Services

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AGRO Merchants Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lineage Logistics Holding LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gruppo Marconi Logistica

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DSV A/S

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AmeriCold Logistics LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kloosterboer Group BV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Henningsen Cold Storage Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Celsius Logistics*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nichirei Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 VersaCold Logistics Services

List of Figures

- Figure 1: Global Food Cold Chain Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Food Cold Chain Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Food Cold Chain Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Food Cold Chain Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Food Cold Chain Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Food Cold Chain Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Food Cold Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Food Cold Chain Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Food Cold Chain Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Food Cold Chain Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Food Cold Chain Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Food Cold Chain Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Food Cold Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Food Cold Chain Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Food Cold Chain Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Food Cold Chain Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Food Cold Chain Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Food Cold Chain Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Food Cold Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Food Cold Chain Market Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Food Cold Chain Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Food Cold Chain Market Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Food Cold Chain Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Food Cold Chain Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Food Cold Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Food Cold Chain Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Food Cold Chain Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Food Cold Chain Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Food Cold Chain Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Food Cold Chain Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Food Cold Chain Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Food Cold Chain Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Food Cold Chain Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Food Cold Chain Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Food Cold Chain Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Food Cold Chain Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Food Cold Chain Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Food Cold Chain Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Food Cold Chain Market Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Global Food Cold Chain Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Germany Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Spain Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Food Cold Chain Market Revenue billion Forecast, by Type 2020 & 2033

- Table 21: Global Food Cold Chain Market Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Food Cold Chain Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: China Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Japan Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: India Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Australia Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Food Cold Chain Market Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Food Cold Chain Market Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Food Cold Chain Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Brazil Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Argentina Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Food Cold Chain Market Revenue billion Forecast, by Type 2020 & 2033

- Table 35: Global Food Cold Chain Market Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Food Cold Chain Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: South Africa Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Saudi Arabia Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Food Cold Chain Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Cold Chain Market?

The projected CAGR is approximately 16.32%.

2. Which companies are prominent players in the Food Cold Chain Market?

Key companies in the market include VersaCold Logistics Services, AGRO Merchants Group, Lineage Logistics Holding LLC, Gruppo Marconi Logistica, DSV A/S, AmeriCold Logistics LLC, Kloosterboer Group BV, Henningsen Cold Storage Co, Celsius Logistics*List Not Exhaustive, Nichirei Corporation.

3. What are the main segments of the Food Cold Chain Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.17 billion as of 2022.

5. What are some drivers contributing to market growth?

Popularity of Convenient and On the Go Snacking Options; Product Differentiation Playing a Key Role in Market Expansion.

6. What are the notable trends driving market growth?

Growing Investments in Cold Chain Infrastructure.

7. Are there any restraints impacting market growth?

Associated Health Risks; Easy Availability of Healthy Substitutes.

8. Can you provide examples of recent developments in the market?

September 2022: Celcius Logistics, India's fastest-growing cold-chain marketplace startup, launched its smart last-mile delivery platform that addresses and fixes the most pertinent pain points in India's fragile cold supply chains. The brand has also partnered with vehicle owners and automotive manufacturers to create a robust on-ground network of reefer vehicles that will be integrated with the smart platform created with a unique Inventory Management System (IMS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Cold Chain Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Cold Chain Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Cold Chain Market?

To stay informed about further developments, trends, and reports in the Food Cold Chain Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence