Key Insights

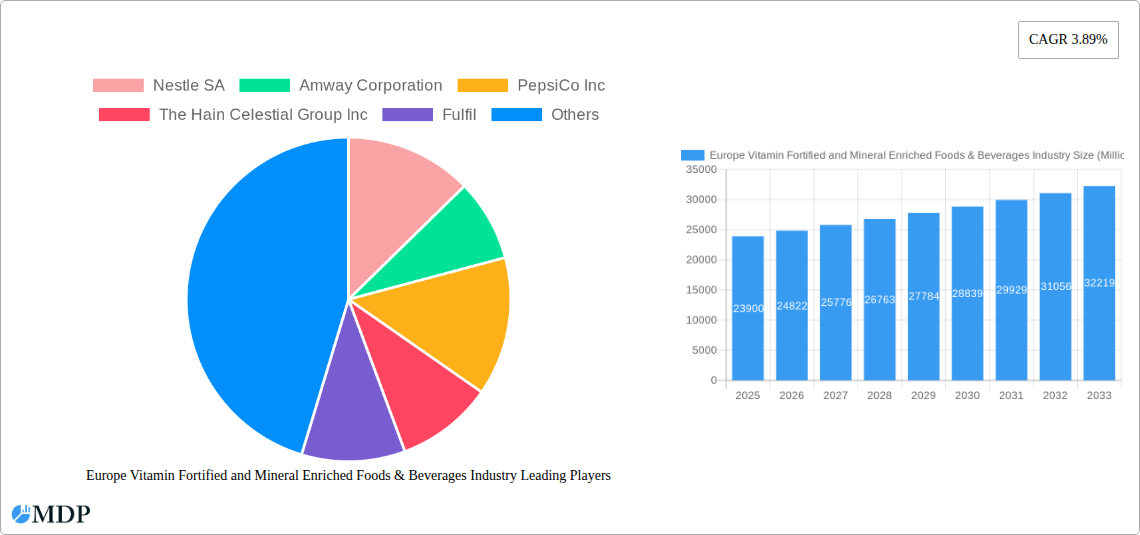

The European market for vitamin-fortified and mineral-enriched foods and beverages is a robust and expanding sector, projected to reach €23.90 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 3.89% from 2025 to 2033. This growth is driven by several key factors. Increasing consumer awareness of the importance of nutrition and preventative healthcare fuels demand for functional foods and beverages. The rising prevalence of lifestyle diseases, such as heart disease and osteoporosis, further boosts the market, as consumers seek dietary solutions to mitigate health risks. Furthermore, the expanding health and wellness industry, coupled with the increasing availability of fortified products across diverse segments (cereals, dairy, beverages, infant formulas), contributes significantly to market expansion. The preference for convenient and readily available nutritional options is also a contributing factor, with supermarket/hypermarkets and online retail channels playing a significant role in distribution. Leading players like Nestlé, PepsiCo, and Danone are capitalizing on these trends, continuously innovating and expanding their product portfolios to cater to evolving consumer demands.

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Market Size (In Billion)

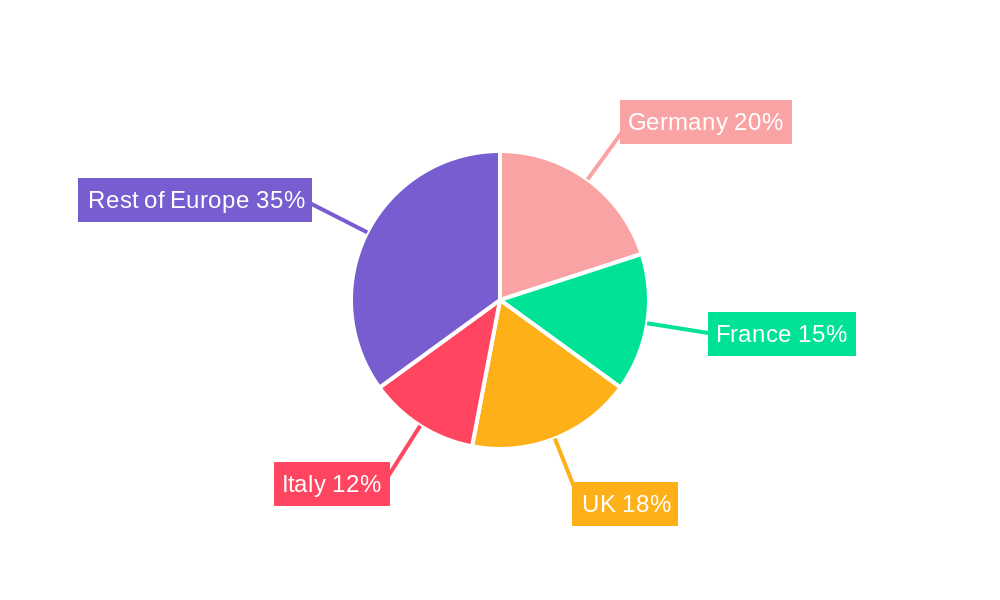

However, certain challenges remain. Fluctuations in raw material prices and stringent regulatory requirements related to fortification levels and labeling can impact profitability and market growth. Furthermore, consumer preferences for natural and organic products pose a challenge, requiring manufacturers to adapt their formulations and marketing strategies to meet these demands. Despite these restraints, the long-term outlook for the European vitamin-fortified and mineral-enriched foods and beverages market remains positive, driven by the sustained focus on health and wellness, increased product innovation, and evolving consumer purchasing habits. The competitive landscape is characterized by both established multinational corporations and smaller, specialized players, leading to a dynamic and innovative market. Specific regional variations exist within Europe, with countries like Germany, France, and the UK leading the market, owing to their higher levels of health consciousness and disposable income.

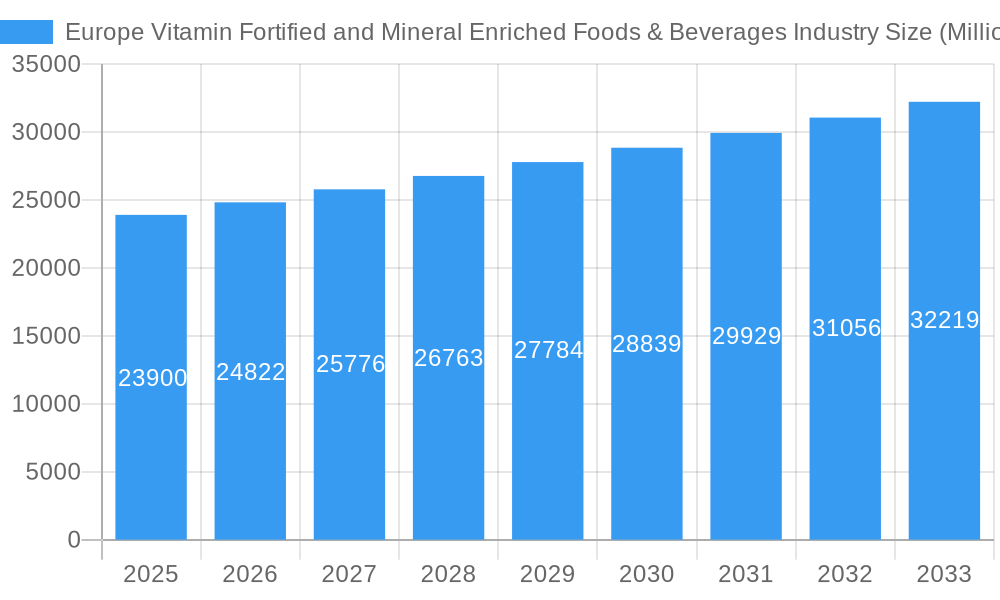

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Company Market Share

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence based on rigorous market research and analysis. The report covers key players including Nestle SA, Amway Corporation, PepsiCo Inc, The Hain Celestial Group Inc, Fulfil, Abbott Laboratories, Danone SA, The Coca-Cola Company, Kellogg Company, and Marks and Spencer, examining market trends across various product types and distribution channels.

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the European vitamin-fortified and mineral-enriched food and beverage industry. Market concentration is assessed through examination of market share held by key players like Nestle SA and PepsiCo Inc, revealing the degree of dominance and competitive intensity. Innovation drivers, such as consumer demand for healthier options and advancements in fortification technologies, are explored alongside their impact on market growth.

The regulatory framework governing food fortification in Europe is also critically examined, detailing compliance requirements and their influence on industry practices. The report also identifies product substitutes (e.g., dietary supplements) and their competitive pressure, analyzing the impact on market share and pricing strategies. Further, end-user trends—including growing health consciousness and increasing demand for convenient, fortified options—are investigated. Finally, the report analyzes mergers and acquisitions (M&A) activity within the sector, quantifying the number of deals over the historical period (2019-2024) and assessing their impact on market consolidation. The xx number of M&A deals in the historical period suggests a dynamic market landscape with significant consolidation. Major players are likely vying for market share and expanding their product portfolios through acquisitions.

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Industry Trends & Analysis

This section delves into the prevailing trends shaping the European vitamin-fortified and mineral-enriched food and beverage market. The report explores the key growth drivers, quantifying the compound annual growth rate (CAGR) during the historical period (2019-2024) at xx% and projecting a CAGR of xx% for the forecast period (2025-2033). Technological disruptions, such as advancements in food processing and packaging, are examined, along with their effects on production efficiency and product shelf life. Consumer preferences, including increasing demand for natural and organic fortified foods, are analyzed, along with their implications for product development and marketing strategies. The report also evaluates competitive dynamics, including pricing strategies, branding, and product differentiation, assessing their impact on market share and profitability. Market penetration of fortified products in various segments is also explored, highlighting regional differences and consumer adoption rates.

Leading Markets & Segments in Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry

This section identifies the leading markets and segments within the European vitamin-fortified and mineral-enriched food and beverage industry. Dominant regions and countries are analyzed, considering factors such as consumer preferences, regulatory environments, and economic conditions. The analysis covers key segments by product type (Cereal-based Products, Dairy Products, Beverages, Infant Formulas, Other Product Types) and distribution channel (Supermarket/Hypermarket, Convenience Stores, Pharmacy/Drug Store, Online Retail Store, Other Distribution Channels).

- Product Type: The report will identify the leading product type (e.g., beverages or dairy products) based on market value and volume. Reasons for dominance will be explored, considering factors such as consumer preference, ease of fortification, and established market presence.

- Distribution Channel: The analysis identifies the leading distribution channels based on market share and growth trajectory, examining the influence of factors such as consumer shopping habits, retailer strategies, and online retail expansion. Specific factors contributing to the dominance of each channel will be discussed.

For example, the supermarket/hypermarket channel may dominate due to its wide reach and established distribution networks. Conversely, online retail may experience rapid growth driven by changing consumer behavior and e-commerce expansion. Factors like economic policies, infrastructure development (e.g., improved cold chain logistics), and consumer purchasing power will also be highlighted in driving the performance of specific regions and segments.

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Product Developments

Recent product innovations in the European vitamin-fortified and mineral-enriched food and beverage market demonstrate a clear focus on meeting evolving consumer demands. Key examples include Kellogg's launch of vitamin D-infused Rice Krispies and Operate Drinks' introduction of its vitamin and mineral-enriched sports drink. These developments highlight trends towards convenient, functional foods and beverages tailored to specific health needs. The competitive advantages derived from these innovations include enhanced brand appeal, increased market differentiation, and potential for premium pricing. Technological advancements in fortification techniques, enabling precise vitamin and mineral addition without compromising taste or quality, are further contributing to this growth area. The market fit of these new products is largely determined by factors such as consumer acceptance, pricing strategies, and distribution effectiveness.

Key Drivers of Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Growth

The growth of the European vitamin-fortified and mineral-enriched food and beverage industry is driven by several converging factors. Firstly, increasing consumer awareness of the importance of nutrition and health is fueling demand for functional foods and beverages. Secondly, technological advancements in fortification processes allow for more efficient and cost-effective production of fortified products. Finally, supportive regulatory frameworks promoting food fortification are fostering market expansion. These factors combine to create a favorable environment for continued industry growth. For example, the increasing popularity of health and wellness trends drives the demand for functional foods.

Challenges in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Market

Despite the positive growth outlook, several challenges exist. Regulatory hurdles concerning labeling and fortification standards can create barriers to market entry and increase compliance costs. Supply chain disruptions, particularly concerning raw materials and packaging, can impact production and profitability. Furthermore, intense competition from established players and emerging brands can create pressure on pricing and margins. These factors collectively contribute to maintaining a complex and dynamic market landscape. The exact quantifiable impacts on margins can vary depending on the company's ability to handle these challenges effectively. For example, if a company fails to comply with regulations, it will face significant financial penalties.

Emerging Opportunities in Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry

The future of the European vitamin-fortified and mineral-enriched food and beverage industry presents significant opportunities for growth. Technological breakthroughs in nutrient delivery systems and personalized nutrition offer potential for innovative product development. Strategic partnerships between food manufacturers and health technology companies are enabling the creation of value-added products. Expanding into new markets, targeting specific demographics with tailored products, presents further growth avenues. These factors promise to further shape the industry's long-term trajectory.

Leading Players in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Sector

Key Milestones in Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Industry

- April 2023: Kellogg's launched vitamin D-infused Rice Krispies cereals, initially via online channels. This indicates a strategic move towards leveraging the growing popularity of online retail and the demand for healthier breakfast options.

- August 2022: Operate Drinks launched Operate Recovery, a vitamin and mineral-enriched sports drink, demonstrating a response to the growing health and wellness market and the demand for functional beverages.

- March 2022: Moulins Dumée and Moulins Bourgeois launched hemp-fortified bakery products, highlighting the growing interest in plant-based and nutrient-rich food sources. This showcases innovation within specific niche markets.

Strategic Outlook for Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Market

The future of the European vitamin-fortified and mineral-enriched food and beverage market presents considerable growth potential. Continued innovation in product development, coupled with expanding consumer awareness of health and wellness, will drive market expansion. Strategic partnerships and acquisitions will further consolidate the market landscape and unlock synergies. Companies adapting to changing consumer preferences and regulatory landscapes will achieve sustainable growth, while those failing to adapt risk being left behind. The opportunities for expansion are vast, particularly in underserved segments and emerging markets.

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Segmentation

-

1. Product Type

- 1.1. Cereal-based Products

- 1.2. Dairy Products

- 1.3. Beverages

- 1.4. Infant Formulas

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Stores

- 2.3. Pharmacy/Drug Store

- 2.4. Online Retail Store

- 2.5. Other Distribution Channels

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Russia

- 6. Italy

- 7. Rest of Europe

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Regional Market Share

Geographic Coverage of Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for healthy alternative food products; Advancements in vitamin infusion into food products

- 3.3. Market Restrains

- 3.3.1. Expensive pricing of vitamin-infused food products

- 3.4. Market Trends

- 3.4.1. Growing Demand for Functional Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cereal-based Products

- 5.1.2. Dairy Products

- 5.1.3. Beverages

- 5.1.4. Infant Formulas

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Pharmacy/Drug Store

- 5.2.4. Online Retail Store

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Spain

- 5.3.5. Russia

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cereal-based Products

- 6.1.2. Dairy Products

- 6.1.3. Beverages

- 6.1.4. Infant Formulas

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Convenience Stores

- 6.2.3. Pharmacy/Drug Store

- 6.2.4. Online Retail Store

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cereal-based Products

- 7.1.2. Dairy Products

- 7.1.3. Beverages

- 7.1.4. Infant Formulas

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Convenience Stores

- 7.2.3. Pharmacy/Drug Store

- 7.2.4. Online Retail Store

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cereal-based Products

- 8.1.2. Dairy Products

- 8.1.3. Beverages

- 8.1.4. Infant Formulas

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Convenience Stores

- 8.2.3. Pharmacy/Drug Store

- 8.2.4. Online Retail Store

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Spain Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cereal-based Products

- 9.1.2. Dairy Products

- 9.1.3. Beverages

- 9.1.4. Infant Formulas

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarket/Hypermarket

- 9.2.2. Convenience Stores

- 9.2.3. Pharmacy/Drug Store

- 9.2.4. Online Retail Store

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cereal-based Products

- 10.1.2. Dairy Products

- 10.1.3. Beverages

- 10.1.4. Infant Formulas

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarket/Hypermarket

- 10.2.2. Convenience Stores

- 10.2.3. Pharmacy/Drug Store

- 10.2.4. Online Retail Store

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Italy Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Cereal-based Products

- 11.1.2. Dairy Products

- 11.1.3. Beverages

- 11.1.4. Infant Formulas

- 11.1.5. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarket/Hypermarket

- 11.2.2. Convenience Stores

- 11.2.3. Pharmacy/Drug Store

- 11.2.4. Online Retail Store

- 11.2.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Cereal-based Products

- 12.1.2. Dairy Products

- 12.1.3. Beverages

- 12.1.4. Infant Formulas

- 12.1.5. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Supermarket/Hypermarket

- 12.2.2. Convenience Stores

- 12.2.3. Pharmacy/Drug Store

- 12.2.4. Online Retail Store

- 12.2.5. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nestle SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Amway Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 PepsiCo Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 The Hain Celestial Group Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fulfil

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Abbott Laboratories

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Danone SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 The Coca-Cola Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Kellogg Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Marks and Spencer

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Nestle SA

List of Figures

- Figure 1: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 21: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry?

The projected CAGR is approximately 3.89%.

2. Which companies are prominent players in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry?

Key companies in the market include Nestle SA, Amway Corporation, PepsiCo Inc, The Hain Celestial Group Inc, Fulfil, Abbott Laboratories, Danone SA, The Coca-Cola Company, Kellogg Company, Marks and Spencer.

3. What are the main segments of the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for healthy alternative food products; Advancements in vitamin infusion into food products.

6. What are the notable trends driving market growth?

Growing Demand for Functional Food.

7. Are there any restraints impacting market growth?

Expensive pricing of vitamin-infused food products.

8. Can you provide examples of recent developments in the market?

April 2023: Kellogg's launched its new breakfast: Rice Krispies cereals infused with vitamin D in fruity flavors. The company claims that consuming one bowl of these cereals provides 20% of the daily vitamin D requirement. These products are initially available in Europe through online distribution channels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry?

To stay informed about further developments, trends, and reports in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence