Key Insights

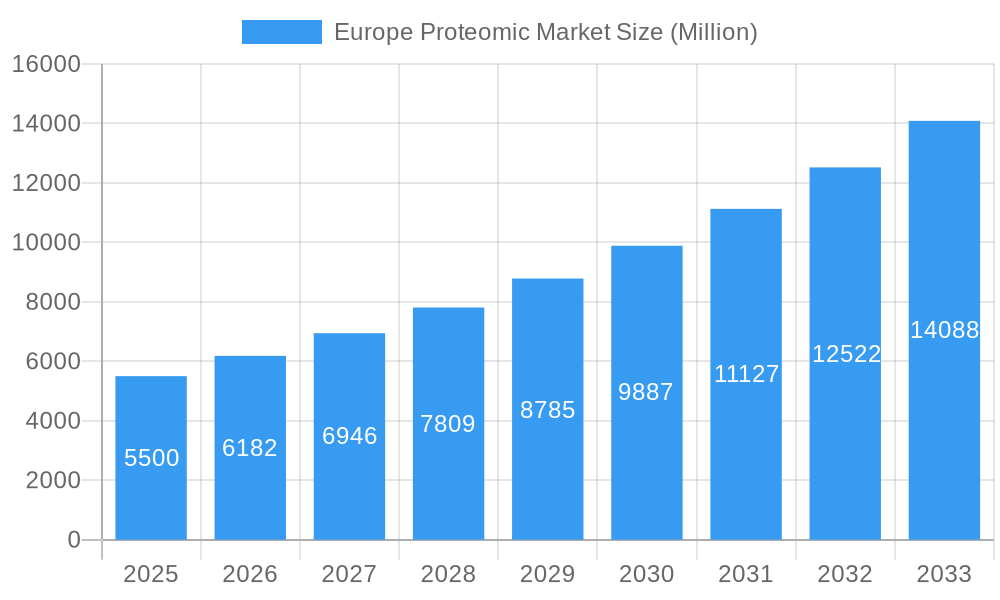

The European Proteomics Market is projected for substantial growth, anticipated to reach approximately $31 billion by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 13% through 2033. This expansion is largely fueled by the increasing demand for personalized medicine and companion diagnostics. Intensified research into complex disease mechanisms necessitates advanced proteomic tools for early detection, precise diagnosis, and targeted therapies. Furthermore, robust government initiatives and funding for life sciences research across Europe are stimulating innovation and the adoption of cutting-edge proteomic technologies. The market also benefits from the growing application of proteomics in drug discovery and development, facilitating the identification of novel therapeutic targets and biomarkers to accelerate drug pipelines and enhance treatment outcomes.

Europe Proteomic Market Market Size (In Billion)

Market segmentation highlights key growth areas. Within Products and Services, Instrumentation Technology, including spectroscopy, chromatography, electrophoresis, and protein microarrays, is expected to lead due to continuous technological advancements in sensitivity, throughput, and accuracy. Reagents and consumables are also a significant segment, essential for various proteomic workflows. In terms of applications, Clinical Diagnostics is a major driver, with proteomics increasingly vital for identifying disease biomarkers for early detection and prognosis. Drug Discovery remains a critical segment, offering crucial insights into drug-target interactions and mechanisms of action. While leading companies like Thermo Fisher Scientific, Danaher Corporation, and Agilent Technologies operate in Europe, the competitive landscape is dynamic, fostering innovation and strategic collaborations. Emerging players are also contributing to market evolution by advancing proteomic capabilities.

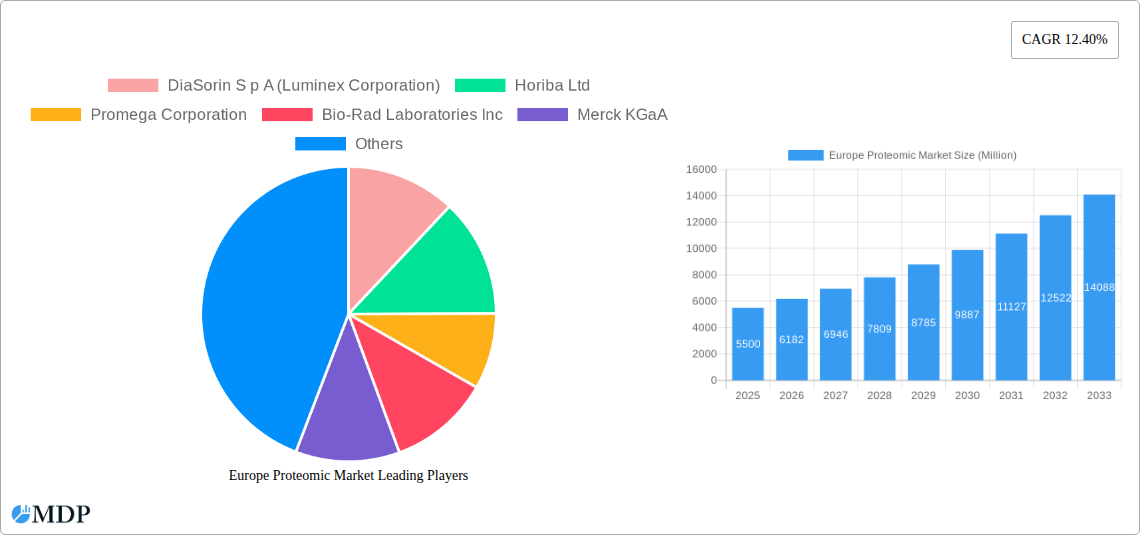

Europe Proteomic Market Company Market Share

Europe Proteomic Market: Unlocking Biomarker Insights for Clinical Diagnostics & Drug Discovery (2025-2033)

**Gain unparalleled insights into the burgeoning European Proteomic Market, projected to reach an estimated *USD XX Billion* by 2033. This comprehensive report delves into the intricate dynamics, technological advancements, and strategic imperatives shaping the future of proteomics in Europe.** Covering the study period from 2019 to 2033, with a base year of 2025, this analysis is an essential resource for stakeholders seeking to capitalize on the growing demand for advanced protein analysis in clinical diagnostics, drug discovery, and beyond. We dissect market segmentation, analyze key players, and highlight crucial industry developments that are redefining the landscape of precision medicine and personalized healthcare across Europe.

Europe Proteomic Market Market Dynamics & Concentration

The European proteomic market exhibits a moderate to high concentration, driven by a select group of multinational corporations alongside a growing number of specialized European biotechnology firms. Innovation remains a primary driver, fueled by substantial R&D investments in advanced instrumentation and assay development. Regulatory frameworks, particularly within the EU, play a significant role, fostering standardization while also necessitating rigorous validation for diagnostic applications. Product substitutes exist, primarily in the form of genomics and transcriptomics, yet proteomics offers unique insights into functional biology and disease mechanisms, mitigating substitution risks. End-user trends reveal a strong pull from the pharmaceutical industry for drug discovery and development, alongside increasing adoption in clinical diagnostics for biomarker identification and patient stratification. Mergers and acquisitions (M&A) activity is on the rise, with an estimated XX M&A deals in the historical period (2019-2024), as larger players seek to acquire innovative technologies and expand their service portfolios. Market share is dominated by companies offering comprehensive solutions, from instrumentation to reagents and data analysis.

- Key Market Drivers:

- Advancements in mass spectrometry and protein sequencing technologies.

- Increasing demand for personalized medicine and targeted therapies.

- Growing prevalence of chronic diseases requiring novel diagnostic and therapeutic approaches.

- Government initiatives and funding for life sciences research.

- Market Concentration: Moderate to High, with increasing consolidation.

- M&A Deal Count (Historical Period 2019-2024): XX

Europe Proteomic Market Industry Trends & Analysis

The European proteomic market is experiencing robust growth, propelled by an annual Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This expansion is fundamentally driven by the increasing realization of proteomics' critical role in unraveling complex biological pathways and identifying actionable biomarkers for a wide array of diseases. Technological disruptions are at the forefront, with continuous improvements in mass spectrometry resolution, sensitivity, and throughput significantly enhancing the ability to identify and quantify proteins in intricate biological samples. Innovations in liquid chromatography (LC) and high-resolution mass spectrometry (HRMS) are enabling deeper proteome coverage and more precise protein identification. Furthermore, the development of advanced software solutions for data analysis and interpretation is crucial, transforming raw proteomic data into clinically and therapeutically relevant information. Consumer preferences are shifting towards more personalized and precision healthcare solutions, creating a strong demand for proteomic applications in diagnostics, prognostics, and therapeutic monitoring. The competitive dynamics within the market are characterized by intense innovation, strategic collaborations, and a focus on developing specialized platforms for specific applications. Market penetration for proteomic technologies in clinical diagnostics is steadily increasing, driven by the validation of novel protein biomarkers for conditions such as cancer, neurological disorders, and infectious diseases. The drug discovery segment continues to be a major contributor, with pharmaceutical companies leveraging proteomics to accelerate target identification, lead optimization, and companion diagnostic development. Emerging trends include the rise of single-cell proteomics, providing unprecedented resolution of cellular heterogeneity, and the integration of multi-omics data, including genomics and metabolomics, for a more holistic understanding of biological systems. The European landscape benefits from a strong academic research base and a supportive regulatory environment that, while stringent, encourages innovation in the long run.

Leading Markets & Segments in Europe Proteomic Market

The United Kingdom and Germany are anticipated to emerge as dominant markets within Europe, driven by their well-established life science ecosystems, significant investment in research and development, and strong presence of leading pharmaceutical and biotechnology companies. The Clinical Diagnostics application segment is poised for substantial growth, fueled by the increasing demand for early disease detection, personalized treatment strategies, and the development of novel diagnostic biomarkers.

Dominant Region: Northern Europe (particularly UK & Germany)

Dominant Country: United Kingdom and Germany

Dominant Segment (Products & Services):

- Instrumentation Technology:

- Spectroscopy: Mass Spectrometry (LC-MS, GC-MS, MALDI-TOF) continues to lead due to its versatility and sensitivity in protein identification and quantification.

- Chromatography: High-Performance Liquid Chromatography (HPLC) and Ultra-High Performance Liquid Chromatography (UHPLC) are integral for sample separation prior to mass spectrometry analysis.

- Electrophoresis: While foundational, its role is evolving with advancements in 2D electrophoresis and capillary electrophoresis for specific applications.

- Protein Microarrays: Growing in importance for high-throughput biomarker discovery and validation in diagnostics.

- X-ray Crystallography: Crucial for structural biology and drug design.

- Other Instrumentation Technologies: Including imaging mass spectrometry and next-generation sequencing platforms that offer proteomic insights.

- Reagents: Essential for sample preparation, protein labeling, and antibody development, this segment is crucial for ensuring accurate and reliable proteomic analysis.

- Software and Services: The demand for sophisticated data analysis, bioinformatics tools, and specialized contract research services is skyrocketing as datasets become more complex.

- Instrumentation Technology:

Dominant Segment (Application):

- Clinical Diagnostics: Driven by the need for predictive, prognostic, and diagnostic biomarkers for oncology, infectious diseases, cardiovascular disorders, and neurological conditions. The development of companion diagnostics for targeted therapies is a significant growth catalyst.

- Drug Discovery: Remains a cornerstone, supporting target identification, validation, lead optimization, and pharmacodynamics studies for new drug development pipelines.

- Other Applications: Encompassing areas such as proteomics in academia, food safety, forensic science, and environmental monitoring, which collectively contribute to market expansion.

Europe Proteomic Market Product Developments

Recent product developments in the European proteomic market are heavily focused on enhancing sensitivity, throughput, and ease of use. Innovations in mass spectrometry instrumentation, such as benchtop HRMS systems and advanced ion mobility technologies, are enabling deeper and more comprehensive proteome profiling. The development of novel reagents and assay kits, including targeted proteomics kits and antibody panels, is streamlining biomarker discovery and validation workflows for both research and clinical applications. Furthermore, advancements in AI-powered software platforms are revolutionizing data analysis, interpretation, and visualization, making complex proteomic data more accessible and actionable for a broader range of users. These developments are driven by the increasing demand for precision medicine and personalized diagnostics, pushing the market towards more integrated and user-friendly proteomic solutions.

Key Drivers of Europe Proteomic Market Growth

The growth of the European proteomic market is propelled by several interconnected factors. Technological advancements, particularly in mass spectrometry and high-throughput screening, are making protein analysis more accessible and informative. The increasing prevalence of chronic diseases and the growing demand for personalized medicine and targeted therapies are creating a substantial need for reliable protein biomarkers. Furthermore, supportive government initiatives and increased funding for life sciences research and development across Europe are accelerating innovation and adoption of proteomic technologies. The expanding role of proteomics in drug discovery and development by pharmaceutical companies to identify novel targets and biomarkers is a significant growth engine.

- Technological Advancements (Mass Spectrometry, Bioinformatics)

- Growing Demand for Personalized Medicine & Companion Diagnostics

- Increasing Prevalence of Chronic Diseases

- Supportive Government Funding and Research Initiatives

- Expansion of Proteomics in Drug Discovery Pipelines

Challenges in the Europe Proteomic Market Market

Despite its promising growth, the European proteomic market faces several challenges. High costs associated with advanced instrumentation and consumables can be a barrier to widespread adoption, particularly for smaller research institutions and diagnostic labs. Regulatory hurdles for the clinical validation and approval of proteomic-based diagnostics can be complex and time-consuming. Standardization issues in sample preparation and data analysis can also lead to variability and hinder comparability across studies. Furthermore, the shortage of skilled bioinformaticians and proteomic scientists poses a challenge in harnessing the full potential of the generated data. Intense competitive pressures and the need for continuous innovation require significant ongoing investment.

- High Cost of Instrumentation and Consumables

- Complex Regulatory Pathways for Clinical Applications

- Lack of Standardization in Sample Preparation and Data Analysis

- Shortage of Skilled Workforce (Bioinformaticians, Proteomic Scientists)

- Intense Competitive Landscape

Emerging Opportunities in Europe Proteomic Market

Emerging opportunities in the European proteomic market lie in the rapid advancements in single-cell proteomics, offering unprecedented insights into cellular heterogeneity and disease mechanisms. The increasing integration of proteomics with other "-omics" technologies (genomics, transcriptomics, metabolomics) presents a significant opportunity for a more holistic understanding of biological systems and disease pathways. Strategic partnerships between instrument manufacturers, reagent suppliers, software developers, and academic research centers are crucial for accelerating innovation and market penetration. Furthermore, the growing focus on developing proteomic-based liquid biopsies for non-invasive disease detection and monitoring opens vast avenues for clinical diagnostics. Expansion into emerging European economies and specific therapeutic areas with unmet diagnostic needs also presents substantial growth potential.

Leading Players in the Europe Proteomic Market Sector

- DiaSorin S p A (Luminex Corporation)

- Horiba Ltd

- Promega Corporation

- Bio-Rad Laboratories Inc

- Merck KGaA

- Sengenics

- Waters Corporation

- Thermo Fisher Scientific Inc

- Danaher Corporation

- Agilent Technologies Inc

- Becton Dickinson and Company

- PerkinElmer Inc

- Creative Proteomics

- Bruker Corporation

Key Milestones in Europe Proteomic Market Industry

- August 2022: Proteome Sciences, a European-based company, completed the next milestone towards the launch of "single cell proteomics" services, enhancing high-resolution protein analysis capabilities.

- March 2022: Biognosys, a Switzerland-based company, launched its expanded suite of proteomics platforms, TrueDiscovery, TrueTarget, and TrueSignature, to provide an integrated suite of research services to pharmaceutical and diagnostics customers with deep biological insights across the entire research and development pipeline, from early-stage discovery to clinical settings. Through this launch, the company develops and runs customizable precision proteomics biomarker panels.

Strategic Outlook for Europe Proteomic Market Market

The strategic outlook for the European proteomic market is exceptionally positive, driven by continuous innovation and increasing clinical utility. Growth will be accelerated by the development of more targeted and multiplexed proteomic assays for improved diagnostic accuracy and therapeutic monitoring. Investments in artificial intelligence and machine learning will further enhance data analysis capabilities, enabling deeper insights and faster discovery. Strategic collaborations and partnerships across the value chain, from instrument development to clinical implementation, will be crucial for overcoming market entry barriers and expanding adoption. The increasing focus on translational research and clinical validation will solidify the role of proteomics in routine healthcare, driving demand for robust and scalable solutions. Furthermore, the market is poised to benefit from the ongoing expansion of companion diagnostics and the growing demand for advanced research tools in academic and industrial settings.

Europe Proteomic Market Segmentation

-

1. Products and Services

-

1.1. Instrumentation Technology

- 1.1.1. Spectroscopy

- 1.1.2. Chromatography

- 1.1.3. Electrophoresis

- 1.1.4. Protein Microarrays

- 1.1.5. X-ray Crystallography

- 1.1.6. Other Instrumentation Technologies

- 1.2. Reagents

- 1.3. Software and Services

-

1.1. Instrumentation Technology

-

2. Application

- 2.1. Clinical Diagnostics

- 2.2. Drug Discovery

- 2.3. Other Applications

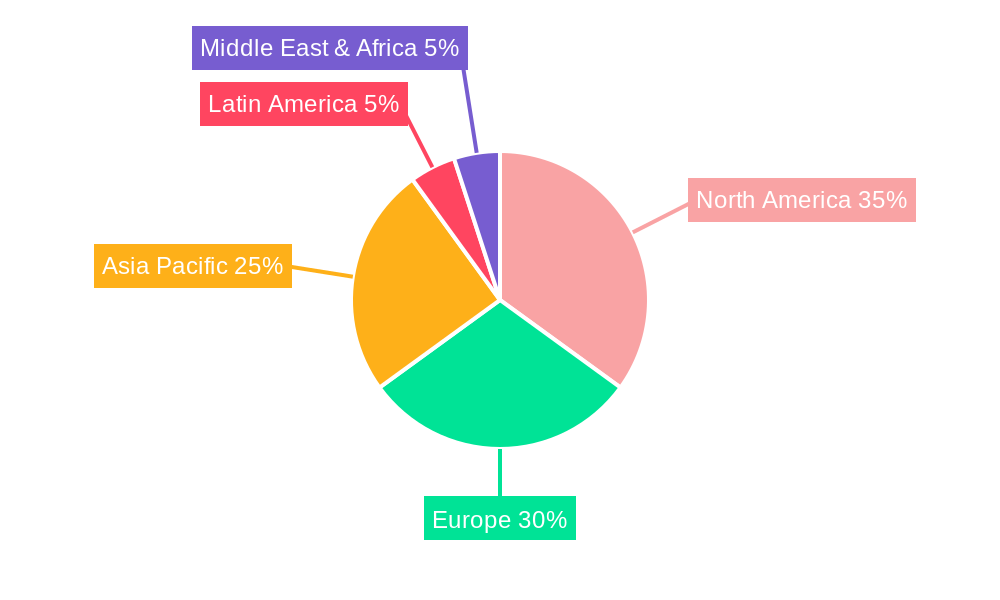

Europe Proteomic Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Proteomic Market Regional Market Share

Geographic Coverage of Europe Proteomic Market

Europe Proteomic Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Personalized Medicine; Increasing R&D Expenditure and Government Funding for Proteomics; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Instruments

- 3.4. Market Trends

- 3.4.1. The Drug Discovery Segment is Expected to Have a Notable Growth Rate over the Forecast Period in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Proteomic Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products and Services

- 5.1.1. Instrumentation Technology

- 5.1.1.1. Spectroscopy

- 5.1.1.2. Chromatography

- 5.1.1.3. Electrophoresis

- 5.1.1.4. Protein Microarrays

- 5.1.1.5. X-ray Crystallography

- 5.1.1.6. Other Instrumentation Technologies

- 5.1.2. Reagents

- 5.1.3. Software and Services

- 5.1.1. Instrumentation Technology

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Clinical Diagnostics

- 5.2.2. Drug Discovery

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Products and Services

- 6. Germany Europe Proteomic Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Products and Services

- 6.1.1. Instrumentation Technology

- 6.1.1.1. Spectroscopy

- 6.1.1.2. Chromatography

- 6.1.1.3. Electrophoresis

- 6.1.1.4. Protein Microarrays

- 6.1.1.5. X-ray Crystallography

- 6.1.1.6. Other Instrumentation Technologies

- 6.1.2. Reagents

- 6.1.3. Software and Services

- 6.1.1. Instrumentation Technology

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Clinical Diagnostics

- 6.2.2. Drug Discovery

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Products and Services

- 7. United Kingdom Europe Proteomic Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Products and Services

- 7.1.1. Instrumentation Technology

- 7.1.1.1. Spectroscopy

- 7.1.1.2. Chromatography

- 7.1.1.3. Electrophoresis

- 7.1.1.4. Protein Microarrays

- 7.1.1.5. X-ray Crystallography

- 7.1.1.6. Other Instrumentation Technologies

- 7.1.2. Reagents

- 7.1.3. Software and Services

- 7.1.1. Instrumentation Technology

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Clinical Diagnostics

- 7.2.2. Drug Discovery

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Products and Services

- 8. France Europe Proteomic Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Products and Services

- 8.1.1. Instrumentation Technology

- 8.1.1.1. Spectroscopy

- 8.1.1.2. Chromatography

- 8.1.1.3. Electrophoresis

- 8.1.1.4. Protein Microarrays

- 8.1.1.5. X-ray Crystallography

- 8.1.1.6. Other Instrumentation Technologies

- 8.1.2. Reagents

- 8.1.3. Software and Services

- 8.1.1. Instrumentation Technology

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Clinical Diagnostics

- 8.2.2. Drug Discovery

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Products and Services

- 9. Italy Europe Proteomic Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Products and Services

- 9.1.1. Instrumentation Technology

- 9.1.1.1. Spectroscopy

- 9.1.1.2. Chromatography

- 9.1.1.3. Electrophoresis

- 9.1.1.4. Protein Microarrays

- 9.1.1.5. X-ray Crystallography

- 9.1.1.6. Other Instrumentation Technologies

- 9.1.2. Reagents

- 9.1.3. Software and Services

- 9.1.1. Instrumentation Technology

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Clinical Diagnostics

- 9.2.2. Drug Discovery

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Products and Services

- 10. Spain Europe Proteomic Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Products and Services

- 10.1.1. Instrumentation Technology

- 10.1.1.1. Spectroscopy

- 10.1.1.2. Chromatography

- 10.1.1.3. Electrophoresis

- 10.1.1.4. Protein Microarrays

- 10.1.1.5. X-ray Crystallography

- 10.1.1.6. Other Instrumentation Technologies

- 10.1.2. Reagents

- 10.1.3. Software and Services

- 10.1.1. Instrumentation Technology

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Clinical Diagnostics

- 10.2.2. Drug Discovery

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Products and Services

- 11. Rest of Europe Europe Proteomic Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Products and Services

- 11.1.1. Instrumentation Technology

- 11.1.1.1. Spectroscopy

- 11.1.1.2. Chromatography

- 11.1.1.3. Electrophoresis

- 11.1.1.4. Protein Microarrays

- 11.1.1.5. X-ray Crystallography

- 11.1.1.6. Other Instrumentation Technologies

- 11.1.2. Reagents

- 11.1.3. Software and Services

- 11.1.1. Instrumentation Technology

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Clinical Diagnostics

- 11.2.2. Drug Discovery

- 11.2.3. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Products and Services

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 DiaSorin S p A (Luminex Corporation)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Horiba Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Promega Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bio-Rad Laboratories Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Merck KGaA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Sengenics

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Waters Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Thermo Fisher Scientific Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Danaher Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Agilent Technologies Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Becton Dickinson and Company

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 PerkinElmer Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Creative Proteomics

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Bruker Corporation

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 DiaSorin S p A (Luminex Corporation)

List of Figures

- Figure 1: Europe Proteomic Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Proteomic Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Proteomic Market Revenue billion Forecast, by Products and Services 2020 & 2033

- Table 2: Europe Proteomic Market Volume K Unit Forecast, by Products and Services 2020 & 2033

- Table 3: Europe Proteomic Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe Proteomic Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Europe Proteomic Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Proteomic Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Europe Proteomic Market Revenue billion Forecast, by Products and Services 2020 & 2033

- Table 8: Europe Proteomic Market Volume K Unit Forecast, by Products and Services 2020 & 2033

- Table 9: Europe Proteomic Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Europe Proteomic Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Europe Proteomic Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Proteomic Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Europe Proteomic Market Revenue billion Forecast, by Products and Services 2020 & 2033

- Table 14: Europe Proteomic Market Volume K Unit Forecast, by Products and Services 2020 & 2033

- Table 15: Europe Proteomic Market Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Europe Proteomic Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 17: Europe Proteomic Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe Proteomic Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Europe Proteomic Market Revenue billion Forecast, by Products and Services 2020 & 2033

- Table 20: Europe Proteomic Market Volume K Unit Forecast, by Products and Services 2020 & 2033

- Table 21: Europe Proteomic Market Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Europe Proteomic Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Europe Proteomic Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Proteomic Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Europe Proteomic Market Revenue billion Forecast, by Products and Services 2020 & 2033

- Table 26: Europe Proteomic Market Volume K Unit Forecast, by Products and Services 2020 & 2033

- Table 27: Europe Proteomic Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Europe Proteomic Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Europe Proteomic Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Proteomic Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Europe Proteomic Market Revenue billion Forecast, by Products and Services 2020 & 2033

- Table 32: Europe Proteomic Market Volume K Unit Forecast, by Products and Services 2020 & 2033

- Table 33: Europe Proteomic Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Europe Proteomic Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 35: Europe Proteomic Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe Proteomic Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Europe Proteomic Market Revenue billion Forecast, by Products and Services 2020 & 2033

- Table 38: Europe Proteomic Market Volume K Unit Forecast, by Products and Services 2020 & 2033

- Table 39: Europe Proteomic Market Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Europe Proteomic Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Europe Proteomic Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Europe Proteomic Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Proteomic Market?

The projected CAGR is approximately 13%.

2. Which companies are prominent players in the Europe Proteomic Market?

Key companies in the market include DiaSorin S p A (Luminex Corporation), Horiba Ltd, Promega Corporation, Bio-Rad Laboratories Inc, Merck KGaA, Sengenics, Waters Corporation, Thermo Fisher Scientific Inc, Danaher Corporation, Agilent Technologies Inc, Becton Dickinson and Company, PerkinElmer Inc, Creative Proteomics, Bruker Corporation.

3. What are the main segments of the Europe Proteomic Market?

The market segments include Products and Services, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 31 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Personalized Medicine; Increasing R&D Expenditure and Government Funding for Proteomics; Technological Advancements.

6. What are the notable trends driving market growth?

The Drug Discovery Segment is Expected to Have a Notable Growth Rate over the Forecast Period in Europe.

7. Are there any restraints impacting market growth?

High Cost of Instruments.

8. Can you provide examples of recent developments in the market?

August 2022: Proteome Sciences, a European-based company, completed the next milestone towards the launch of "single cell proteomics" services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Proteomic Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Proteomic Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Proteomic Market?

To stay informed about further developments, trends, and reports in the Europe Proteomic Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence