Key Insights

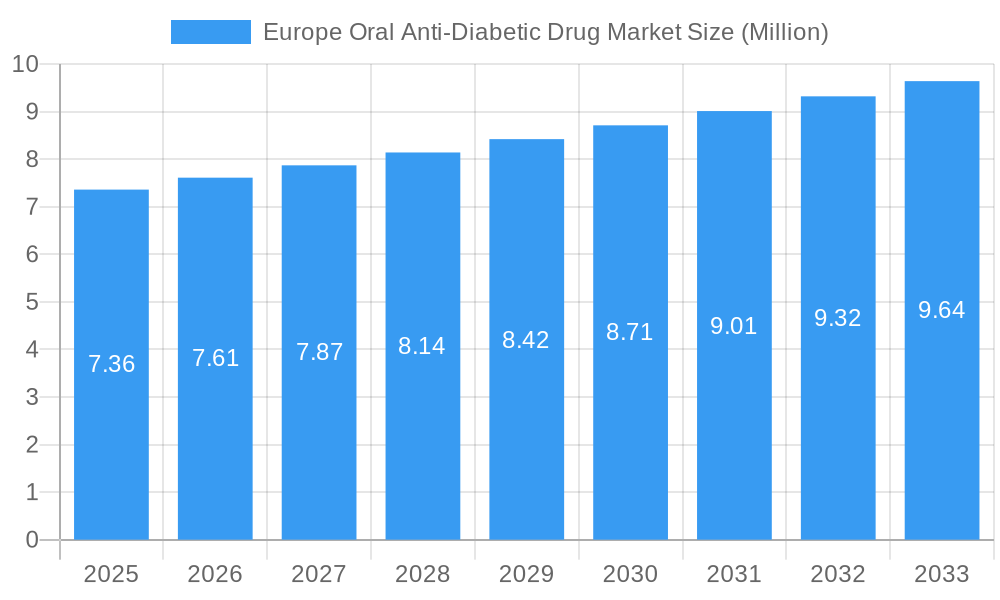

The European Oral Anti-Diabetic Drug Market is poised for steady expansion, projected to reach USD 7.36 million by 2025 with a Compound Annual Growth Rate (CAGR) of 3.40% through 2033. This growth trajectory is fueled by the escalating prevalence of diabetes across Europe, particularly Type 2 diabetes, driven by aging populations, sedentary lifestyles, and rising obesity rates. Key market drivers include the increasing demand for convenient and cost-effective treatment options, favorable reimbursement policies for oral anti-diabetic medications, and continuous innovation in drug development leading to more efficacious and safer therapies. The market is segmented by drug type, with Biguanides and DPP-4 inhibitors currently holding significant market share due to their established efficacy and broad patient acceptance. However, newer classes like SGLT2 inhibitors and GLP-1 agonists are experiencing robust growth, driven by their improved cardiovascular and renal benefits, offering new avenues for market expansion. The oral route of administration remains dominant due to its ease of use and patient preference, although injectable formulations are gaining traction for specific therapeutic needs.

Europe Oral Anti-Diabetic Drug Market Market Size (In Million)

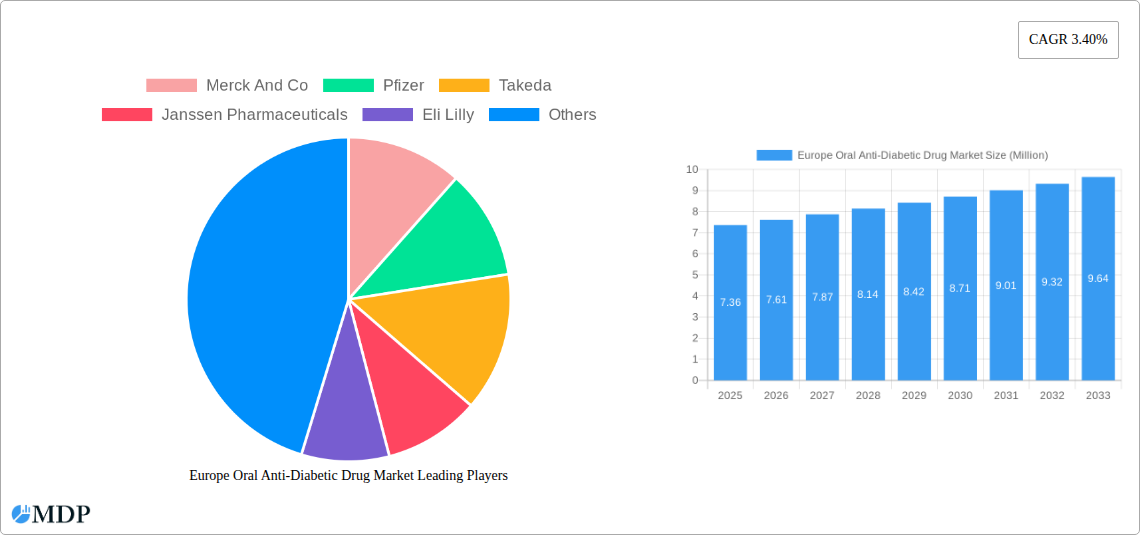

The European market is characterized by intense competition among major pharmaceutical players such as Merck & Co., Pfizer, Takeda, and Novartis, who are actively engaged in research and development to introduce novel oral anti-diabetic drugs and expand their product portfolios. Strategic collaborations, mergers, and acquisitions are also shaping the market landscape as companies strive to strengthen their positions and capture a larger share. While the market is experiencing positive growth, certain restraints include stringent regulatory approvals, the high cost of newer drug classes, and the emergence of biosimilars impacting pricing dynamics. Geographically, Western European countries like Germany, France, and the UK represent substantial markets due to higher healthcare spending and greater awareness of diabetes management. The "Rest of Europe" segment also presents significant untapped potential. The focus on patient-centric care and the development of combination therapies to improve glycemic control and reduce treatment complexity will continue to be key trends shaping the future of the European oral anti-diabetic drug market.

Europe Oral Anti-Diabetic Drug Market Company Market Share

This comprehensive report offers an in-depth analysis of the Europe Oral Anti-Diabetic Drug Market, providing critical insights into market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, opportunities, and the competitive landscape. Spanning the study period of 2019–2033, with a base year of 2025, this report is an indispensable resource for pharmaceutical manufacturers, investors, researchers, and policymakers seeking to understand and capitalize on the burgeoning European market for oral anti-diabetic medications.

Europe Oral Anti-Diabetic Drug Market Market Dynamics & Concentration

The Europe Oral Anti-Diabetic Drug Market is characterized by moderate to high market concentration, with a few key players holding significant market share. Innovation drivers are primarily focused on developing novel drug formulations with improved efficacy, reduced side effects, and enhanced patient convenience, such as oral insulin and advanced GLP-1 receptor agonists. Regulatory frameworks, overseen by agencies like the European Medicines Agency (EMA), play a crucial role in drug approval processes and market access, influencing the pace of innovation and product launches. Product substitutes, including injectable anti-diabetic drugs and lifestyle interventions, exert competitive pressure, necessitating continuous advancements in oral therapies. End-user trends are shifting towards personalized medicine and patient-centric treatment approaches, with a growing demand for drugs that offer better adherence and quality of life. Mergers and acquisition (M&A) activities, while not always high in volume, are strategic maneuvers by larger pharmaceutical companies to acquire innovative pipelines or expand their market presence. For instance, anticipated M&A deals in the coming years will likely consolidate the market further, aiming to leverage combined R&D capabilities and market reach. The market share distribution is influenced by patent expiries of blockbuster drugs and the successful launch of new generics and innovative molecules.

Europe Oral Anti-Diabetic Drug Market Industry Trends & Analysis

The Europe Oral Anti-Diabetic Drug Market is experiencing robust growth, driven by a confluence of factors including the escalating prevalence of diabetes across the continent and advancements in pharmaceutical research and development. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This growth trajectory is further bolstered by increasing awareness campaigns about diabetes management and the availability of sophisticated diagnostic tools, leading to earlier and more accurate diagnoses. Technological disruptions, particularly in the development of novel drug delivery systems and combination therapies, are reshaping the competitive landscape. The introduction of oral formulations for previously injectable medications, such as the potential first oral insulin capsule, represents a significant paradigm shift, promising improved patient compliance and a more convenient therapeutic experience. Consumer preferences are increasingly leaning towards oral anti-diabetic drugs due to their ease of administration and reduced invasiveness compared to injections. This preference fuels the demand for drugs belonging to newer classes like SGLT2 inhibitors and GLP-1 agonists, which offer superior glycemic control and cardiovascular benefits. Competitive dynamics are intensifying as established players and emerging biopharmaceutical companies vie for market dominance through strategic product launches, pipeline development, and lucrative partnerships. Market penetration of advanced oral anti-diabetic drugs is expected to rise significantly as healthcare providers and patients recognize their therapeutic advantages. The increasing burden of type 2 diabetes, which accounts for the vast majority of diabetes cases in Europe, remains a primary market driver, necessitating effective and accessible treatment options. The development of drugs targeting specific patient subgroups with co-morbidities, such as cardiovascular diseases and renal impairment, is also a key trend influencing market growth. The sustained investment in R&D by leading pharmaceutical giants is pivotal in bringing forth next-generation oral anti-diabetic agents with enhanced safety profiles and therapeutic efficacy.

Leading Markets & Segments in Europe Oral Anti-Diabetic Drug Market

The Europe Oral Anti-Diabetic Drug Market is segmented by Type of Drug, Route of Administration, and Indication. Among the types of drugs, DPP-4 inhibitors and SGLT2 inhibitors currently hold substantial market share due to their efficacy in glycemic control and beneficial cardiovascular and renal outcomes. GLP-1 agonists are also witnessing rapid market penetration, driven by their weight-loss benefits and potential for diabetes remission. Biguanides, particularly metformin, remain a cornerstone of first-line therapy due to their established safety profile and affordability. However, the growth potential for Sulfonylureas and Meglitinides is relatively lower, given the advent of newer drug classes. Thiazolidinediones are also facing increased scrutiny due to potential side effects.

The Route of Administration is predominantly Oral, reflecting the inherent preference for non-invasive treatments. While Injectable routes are crucial for certain therapies like insulin and some GLP-1 agonists, the focus for oral anti-diabetic drugs remains on oral formulations. Transdermal routes, though nascent, represent an area of potential future innovation for drug delivery.

In terms of Indication, Type 2 diabetes unequivocally dominates the market, accounting for over 90% of all diabetes cases in Europe. The rising prevalence of obesity and sedentary lifestyles are primary drivers for this segment. Type 1 diabetes management primarily relies on insulin therapy, with oral anti-diabetic drugs playing a limited, adjunctive role. Gestational diabetes, while a critical area, represents a smaller but growing market segment, particularly with increased awareness and screening initiatives.

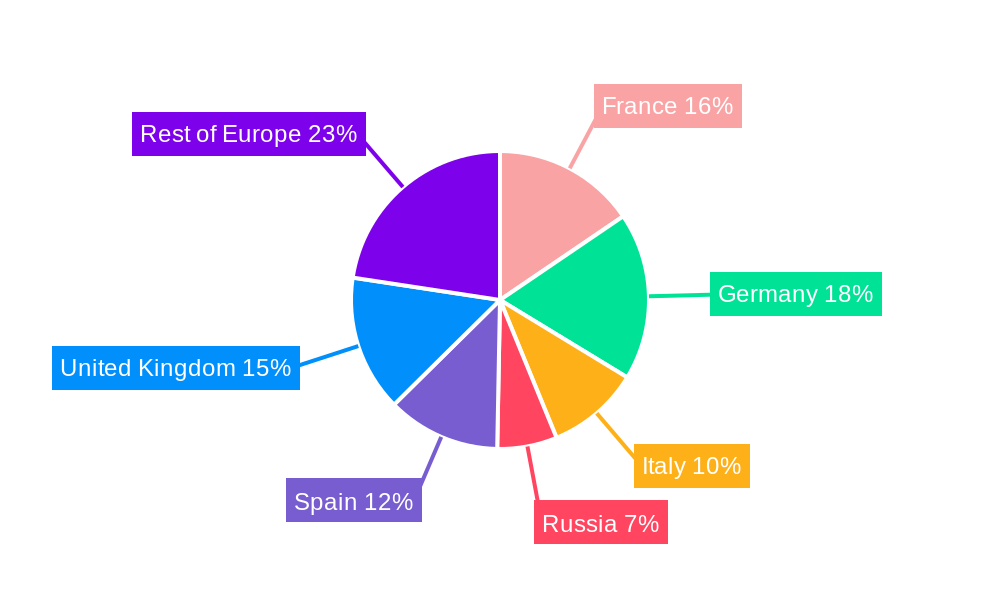

Geographically, Germany, the UK, France, and Italy represent the largest markets within Europe, owing to their large populations, developed healthcare infrastructures, and higher per capita healthcare spending. Economic policies that favor robust public healthcare systems and reimbursement frameworks for innovative diabetes treatments contribute significantly to the dominance of these countries. Investments in research and development by pharmaceutical companies, coupled with strong regulatory support, further propel these markets. Infrastructure development in terms of patient access to specialists and advanced diagnostic facilities also plays a crucial role. The increasing adoption of personalized medicine approaches and the focus on proactive diabetes management are key drivers for segment growth across these leading markets.

Europe Oral Anti-Diabetic Drug Market Product Developments

Product innovation in the Europe Oral Anti-Diabetic Drug Market is largely centered on enhancing drug efficacy, safety, and patient convenience. Key developments include the ongoing research into novel oral insulin formulations aiming to mimic natural insulin delivery, offering a less invasive alternative to injections. The market is also witnessing the development of fixed-dose combination therapies that combine multiple oral anti-diabetic agents to improve patient adherence and achieve better glycemic control with fewer pills. Furthermore, a significant trend is the development of oral GLP-1 receptor agonists, providing the benefits of this drug class without the need for injection. These advancements are driven by a deeper understanding of diabetes pathophysiology and the pursuit of therapies that not only manage blood glucose but also offer cardiovascular and renal protection.

Key Drivers of Europe Oral Anti-Diabetic Drug Market Growth

The Europe Oral Anti-Diabetic Drug Market's growth is propelled by several key factors. Foremost is the alarming rise in the prevalence of diabetes across the continent, particularly Type 2 diabetes, driven by aging populations, unhealthy lifestyles, and increasing obesity rates. Technological advancements in drug discovery and development are leading to the introduction of more effective and safer oral anti-diabetic medications, including novel mechanisms of action and improved drug delivery systems. Favorable regulatory environments and reimbursement policies in many European countries facilitate market access and adoption of new therapies. Increased patient awareness and demand for convenient treatment options further fuel the market. Economic factors, such as rising healthcare expenditures and a growing middle class with better access to healthcare services, also contribute significantly to market expansion.

Challenges in the Europe Oral Anti-Diabetic Drug Market Market

Despite its growth, the Europe Oral Anti-Diabetic Drug Market faces several challenges. The high cost of novel oral anti-diabetic drugs can pose a significant barrier to accessibility for some patient populations, leading to reimbursement hurdles and pricing pressures from healthcare payers. Stringent regulatory approval processes, while ensuring safety and efficacy, can also prolong the time-to-market for new drugs. Intense competition from generic drug manufacturers and the continuous threat of product substitutes, including injectable therapies and emerging alternative treatments, necessitate ongoing innovation and cost-effectiveness. Furthermore, the complexity of diabetes management, often involving multiple comorbidities, requires comprehensive treatment strategies that oral anti-diabetic drugs alone may not always address, leading to a need for combination therapies or integrated care approaches. Supply chain disruptions and manufacturing complexities for certain advanced oral formulations can also impact market availability.

Emerging Opportunities in Europe Oral Anti-Diabetic Drug Market

Emerging opportunities in the Europe Oral Anti-Diabetic Drug Market are diverse and promising. The development of oral insulin and other oral biologics represents a significant breakthrough, potentially revolutionizing diabetes management by offering a highly convenient alternative to injections. The increasing focus on personalized medicine, leveraging genetic and biomarker data, opens avenues for targeted therapies that improve treatment outcomes for specific patient subgroups. Strategic partnerships and collaborations between pharmaceutical companies, research institutions, and technology providers are crucial for accelerating R&D and bringing innovative solutions to market. Market expansion into under-penetrated regions within Europe and exploring new therapeutic applications for existing oral anti-diabetic drugs, such as their role in preventing cardiovascular events, are also significant opportunities. The growing emphasis on digital health solutions and remote patient monitoring can also enhance the effectiveness of oral anti-diabetic drug therapies by improving patient engagement and adherence.

Leading Players in the Europe Oral Anti-Diabetic Drug Market Sector

- Merck And Co

- Pfizer

- Takeda

- Janssen Pharmaceuticals

- Eli Lilly

- Novartis

- Sanofi

- AstraZeneca

- Bristol Myers Squibb

- Novo Nordisk

- Boehringer Ingelheim

- Astellas

Key Milestones in Europe Oral Anti-Diabetic Drug Market Industry

- March 2022: Oramed announced that ORMD-0801 (a new molecule) is being evaluated in two pivotal Phase 3 trials and can be the first oral insulin capsule that has the most convenient and safest way to deliver insulin therapy. This drug is expected to be a game-changer in the insulin and oral anti-diabetes drugs markets. Oramed is also developing an oral GLP-1 (Glucagon-like peptide-1) analog capsule (ORMD-0901).

- May 2021: The Committee for Medicinal Products for Human Use (CHMP) recommended a change to the terms of the marketing authorization for the medicinal product Jalra by Novartis Europharm Limited. Detailed recommendations for the use of this product will be described in the updated summary of product characteristics (SmPC).

Strategic Outlook for Europe Oral Anti-Diabetic Drug Market Market

The strategic outlook for the Europe Oral Anti-Diabetic Drug Market is exceptionally positive, driven by sustained innovation and unmet medical needs. The market is poised for continued growth, with a strong emphasis on developing therapies that not only manage blood glucose levels effectively but also offer cardioprotective and nephroprotective benefits. The anticipated approval and commercialization of novel oral formulations, particularly oral insulin and oral GLP-1 receptor agonists, represent significant growth accelerators. Pharmaceutical companies are expected to focus on pipeline expansion through internal R&D, strategic licensing agreements, and targeted acquisitions of promising technologies. Furthermore, increasing patient awareness and healthcare provider adoption of evidence-based treatment guidelines will continue to drive demand for advanced oral anti-diabetic drugs. The long-term potential lies in the development of combination therapies and personalized treatment approaches that cater to the diverse needs of the diabetic population, ultimately leading to improved patient outcomes and a more sustainable healthcare system.

Europe Oral Anti-Diabetic Drug Market Segmentation

-

1. Type of drug

- 1.1. Biguanides

- 1.2. Sulfonylureas

- 1.3. Meglitinides

- 1.4. Thiazolidinediones

- 1.5. DPP-4 inhibitors

- 1.6. GLP-1 agonists

- 1.7. SGLT2 inhibitors

-

2. Route of administration

- 2.1. Oral

- 2.2. Injectable

- 2.3. Transdermal

-

3. Indication

- 3.1. Type 1 diabetes

- 3.2. Type 2 diabetes

- 3.3. Gestational diabetes

Europe Oral Anti-Diabetic Drug Market Segmentation By Geography

- 1. France

- 2. Germany

- 3. Italy

- 4. Russia

- 5. Spain

- 6. United Kingdom

- 7. Rest of Europe

Europe Oral Anti-Diabetic Drug Market Regional Market Share

Geographic Coverage of Europe Oral Anti-Diabetic Drug Market

Europe Oral Anti-Diabetic Drug Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures

- 3.3. Market Restrains

- 3.3.1. Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs

- 3.4. Market Trends

- 3.4.1. Biguanide Segment Occupied the Highest Market Share in the Europe Oral Anti-Diabetic Drugs Market in 2022

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of drug

- 5.1.1. Biguanides

- 5.1.2. Sulfonylureas

- 5.1.3. Meglitinides

- 5.1.4. Thiazolidinediones

- 5.1.5. DPP-4 inhibitors

- 5.1.6. GLP-1 agonists

- 5.1.7. SGLT2 inhibitors

- 5.2. Market Analysis, Insights and Forecast - by Route of administration

- 5.2.1. Oral

- 5.2.2. Injectable

- 5.2.3. Transdermal

- 5.3. Market Analysis, Insights and Forecast - by Indication

- 5.3.1. Type 1 diabetes

- 5.3.2. Type 2 diabetes

- 5.3.3. Gestational diabetes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.4.2. Germany

- 5.4.3. Italy

- 5.4.4. Russia

- 5.4.5. Spain

- 5.4.6. United Kingdom

- 5.4.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of drug

- 6. France Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of drug

- 6.1.1. Biguanides

- 6.1.2. Sulfonylureas

- 6.1.3. Meglitinides

- 6.1.4. Thiazolidinediones

- 6.1.5. DPP-4 inhibitors

- 6.1.6. GLP-1 agonists

- 6.1.7. SGLT2 inhibitors

- 6.2. Market Analysis, Insights and Forecast - by Route of administration

- 6.2.1. Oral

- 6.2.2. Injectable

- 6.2.3. Transdermal

- 6.3. Market Analysis, Insights and Forecast - by Indication

- 6.3.1. Type 1 diabetes

- 6.3.2. Type 2 diabetes

- 6.3.3. Gestational diabetes

- 6.1. Market Analysis, Insights and Forecast - by Type of drug

- 7. Germany Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of drug

- 7.1.1. Biguanides

- 7.1.2. Sulfonylureas

- 7.1.3. Meglitinides

- 7.1.4. Thiazolidinediones

- 7.1.5. DPP-4 inhibitors

- 7.1.6. GLP-1 agonists

- 7.1.7. SGLT2 inhibitors

- 7.2. Market Analysis, Insights and Forecast - by Route of administration

- 7.2.1. Oral

- 7.2.2. Injectable

- 7.2.3. Transdermal

- 7.3. Market Analysis, Insights and Forecast - by Indication

- 7.3.1. Type 1 diabetes

- 7.3.2. Type 2 diabetes

- 7.3.3. Gestational diabetes

- 7.1. Market Analysis, Insights and Forecast - by Type of drug

- 8. Italy Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of drug

- 8.1.1. Biguanides

- 8.1.2. Sulfonylureas

- 8.1.3. Meglitinides

- 8.1.4. Thiazolidinediones

- 8.1.5. DPP-4 inhibitors

- 8.1.6. GLP-1 agonists

- 8.1.7. SGLT2 inhibitors

- 8.2. Market Analysis, Insights and Forecast - by Route of administration

- 8.2.1. Oral

- 8.2.2. Injectable

- 8.2.3. Transdermal

- 8.3. Market Analysis, Insights and Forecast - by Indication

- 8.3.1. Type 1 diabetes

- 8.3.2. Type 2 diabetes

- 8.3.3. Gestational diabetes

- 8.1. Market Analysis, Insights and Forecast - by Type of drug

- 9. Russia Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of drug

- 9.1.1. Biguanides

- 9.1.2. Sulfonylureas

- 9.1.3. Meglitinides

- 9.1.4. Thiazolidinediones

- 9.1.5. DPP-4 inhibitors

- 9.1.6. GLP-1 agonists

- 9.1.7. SGLT2 inhibitors

- 9.2. Market Analysis, Insights and Forecast - by Route of administration

- 9.2.1. Oral

- 9.2.2. Injectable

- 9.2.3. Transdermal

- 9.3. Market Analysis, Insights and Forecast - by Indication

- 9.3.1. Type 1 diabetes

- 9.3.2. Type 2 diabetes

- 9.3.3. Gestational diabetes

- 9.1. Market Analysis, Insights and Forecast - by Type of drug

- 10. Spain Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of drug

- 10.1.1. Biguanides

- 10.1.2. Sulfonylureas

- 10.1.3. Meglitinides

- 10.1.4. Thiazolidinediones

- 10.1.5. DPP-4 inhibitors

- 10.1.6. GLP-1 agonists

- 10.1.7. SGLT2 inhibitors

- 10.2. Market Analysis, Insights and Forecast - by Route of administration

- 10.2.1. Oral

- 10.2.2. Injectable

- 10.2.3. Transdermal

- 10.3. Market Analysis, Insights and Forecast - by Indication

- 10.3.1. Type 1 diabetes

- 10.3.2. Type 2 diabetes

- 10.3.3. Gestational diabetes

- 10.1. Market Analysis, Insights and Forecast - by Type of drug

- 11. United Kingdom Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type of drug

- 11.1.1. Biguanides

- 11.1.2. Sulfonylureas

- 11.1.3. Meglitinides

- 11.1.4. Thiazolidinediones

- 11.1.5. DPP-4 inhibitors

- 11.1.6. GLP-1 agonists

- 11.1.7. SGLT2 inhibitors

- 11.2. Market Analysis, Insights and Forecast - by Route of administration

- 11.2.1. Oral

- 11.2.2. Injectable

- 11.2.3. Transdermal

- 11.3. Market Analysis, Insights and Forecast - by Indication

- 11.3.1. Type 1 diabetes

- 11.3.2. Type 2 diabetes

- 11.3.3. Gestational diabetes

- 11.1. Market Analysis, Insights and Forecast - by Type of drug

- 12. Rest of Europe Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type of drug

- 12.1.1. Biguanides

- 12.1.2. Sulfonylureas

- 12.1.3. Meglitinides

- 12.1.4. Thiazolidinediones

- 12.1.5. DPP-4 inhibitors

- 12.1.6. GLP-1 agonists

- 12.1.7. SGLT2 inhibitors

- 12.2. Market Analysis, Insights and Forecast - by Route of administration

- 12.2.1. Oral

- 12.2.2. Injectable

- 12.2.3. Transdermal

- 12.3. Market Analysis, Insights and Forecast - by Indication

- 12.3.1. Type 1 diabetes

- 12.3.2. Type 2 diabetes

- 12.3.3. Gestational diabetes

- 12.1. Market Analysis, Insights and Forecast - by Type of drug

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Merck And Co

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Pfizer

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Takeda

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Janssen Pharmaceuticals

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Eli Lilly

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Novartis

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Sanofi

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 AstraZeneca

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Bristol Myers Squibb

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Novo Nordisk

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Boehringer Ingelheim

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Astellas

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Merck And Co

List of Figures

- Figure 1: Europe Oral Anti-Diabetic Drug Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Oral Anti-Diabetic Drug Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 2: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 3: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 4: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 5: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 6: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 7: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 10: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 11: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 12: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 13: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 14: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 15: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 18: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 19: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 20: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 21: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 22: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 23: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 26: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 27: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 28: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 29: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 30: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 31: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 34: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 35: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 36: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 37: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 38: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 39: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 42: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 43: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 44: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 45: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 46: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 47: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 50: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 51: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 52: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 53: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 54: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 55: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 57: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 58: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 59: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 60: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 61: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 62: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 63: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Oral Anti-Diabetic Drug Market?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the Europe Oral Anti-Diabetic Drug Market?

Key companies in the market include Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, Astellas.

3. What are the main segments of the Europe Oral Anti-Diabetic Drug Market?

The market segments include Type of drug, Route of administration, Indication.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures.

6. What are the notable trends driving market growth?

Biguanide Segment Occupied the Highest Market Share in the Europe Oral Anti-Diabetic Drugs Market in 2022.

7. Are there any restraints impacting market growth?

Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs.

8. Can you provide examples of recent developments in the market?

March 2022: Oramed announced that ORMD-0801 (a new molecule) is being evaluated in two pivotal Phase 3 trials and can be the first oral insulin capsule that has the most convenient and safest way to deliver insulin therapy. This drug is expected to be a game-changer in the insulin and oral anti-diabetes drugs markets. Oramed is also developing an oral GLP-1 (Glucagon-like peptide-1) analog capsule (ORMD-0901).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Oral Anti-Diabetic Drug Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Oral Anti-Diabetic Drug Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Oral Anti-Diabetic Drug Market?

To stay informed about further developments, trends, and reports in the Europe Oral Anti-Diabetic Drug Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence